The insurance landscape for home and auto coverage is a complex tapestry woven with competitive pressures, technological innovation, and ever-evolving consumer needs. Understanding this market requires navigating a range of factors, from the major players and their market strategies to the intricacies of policy options and the ever-present influence of regulatory oversight. This exploration delves into the key aspects of the home and auto insurance industry, providing insights into its current state and future trajectory.

From the diverse product offerings available to consumers to the innovative technological advancements transforming the industry, this overview aims to provide a comprehensive understanding of the challenges and opportunities facing both insurers and policyholders. We will examine how companies attract and retain customers, the role of technology in streamlining operations and enhancing customer experience, and the regulatory environment that shapes industry practices.

Customer Acquisition and Retention Strategies

Securing and maintaining a strong customer base is paramount for the success of any home and auto insurance company. Effective strategies blend targeted marketing with personalized customer experiences, leveraging data analytics to optimize both acquisition and retention efforts. This involves understanding customer needs, preferences, and behaviors to create compelling offers and foster long-term loyalty.

Marketing and Sales Strategies for Customer Acquisition

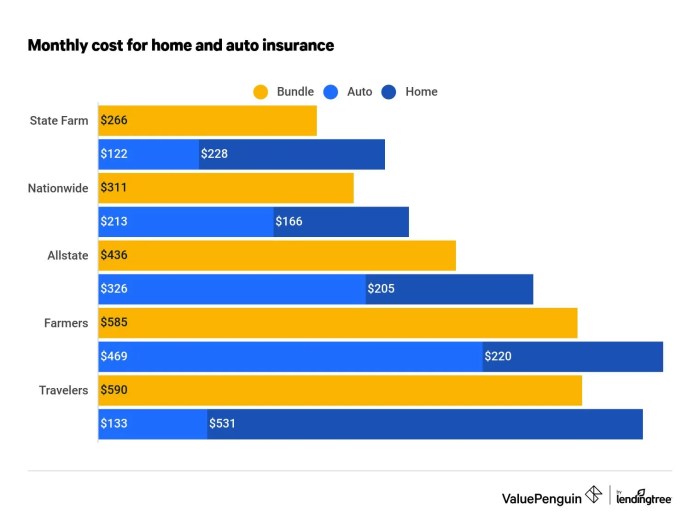

Home and auto insurance companies employ a diverse range of marketing and sales strategies to attract new customers. These strategies often combine traditional methods with innovative digital approaches. Common tactics include targeted online advertising campaigns (utilizing platforms like Google Ads and social media), strategic partnerships with auto dealerships or real estate agencies, and direct mail marketing to specific demographic groups. Furthermore, many companies utilize sophisticated lead generation techniques, employing online forms and interactive tools to capture potential customer information. Competitive pricing, bundled packages offering discounts for combining home and auto insurance, and clear, concise communication about policy benefits are also crucial components of a successful acquisition strategy. For example, a company might offer a significant discount to new customers who switch from a competitor, incentivizing them to make the change.

Customer Loyalty Programs and Retention Initiatives

Retaining existing customers is often more cost-effective than acquiring new ones. Insurance companies employ various loyalty programs and initiatives to encourage customer retention. These may include discounts for long-term policy holders, reward programs offering points redeemable for merchandise or discounts on other services, personalized communication acknowledging policy anniversaries or milestones, and proactive customer service that anticipates and addresses potential issues before they escalate. A successful example would be an insurance company offering a free home security system upgrade to loyal customers, thereby reinforcing their commitment and highlighting the value of their continued business. Another example could be providing exclusive access to financial planning resources or other value-added services.

Data Analytics and Personalized Offerings

Data analytics plays a crucial role in understanding customer behavior and personalizing insurance offerings. Companies collect vast amounts of data on customer demographics, driving history, claims history, and online interactions. This data is then analyzed to identify patterns and trends, allowing companies to tailor their marketing messages, pricing strategies, and product offerings to specific customer segments. For instance, a company might use data to identify customers who are likely to renew their policies and offer them customized discounts or additional coverage options. Conversely, data might reveal segments of customers at risk of churning, prompting proactive outreach to address their concerns and prevent cancellations.

Best Practices for Customer Relationship Management (CRM) in the Insurance Sector

Effective customer relationship management is vital for both acquisition and retention. Best practices include:

- Proactive Communication: Regularly communicate with customers about policy updates, important deadlines, and relevant information, not just when there’s a problem.

- Personalized Service: Tailor communication and service to individual customer needs and preferences.

- Easy Access to Information: Provide customers with convenient access to their policy information, billing details, and claims status through online portals and mobile apps.

- Efficient Claims Processing: Streamline the claims process to minimize customer frustration and ensure prompt resolution.

- Responsive Customer Support: Offer multiple channels for customer support (phone, email, chat) and ensure timely responses to inquiries.

- Feedback Mechanisms: Actively solicit and respond to customer feedback to identify areas for improvement.

- Data-Driven Decision Making: Utilize data analytics to understand customer behavior and personalize interactions.

Claims Process and Customer Service

A smooth and efficient claims process is crucial for maintaining customer loyalty and building a positive brand reputation in the competitive insurance market. Positive customer experiences during claims handling significantly impact retention rates and referrals. Understanding the typical steps, comparing company approaches, and implementing strategies for improvement are key to success.

Typical Steps in Filing a Home or Auto Insurance Claim

The claims process, while varying slightly between companies and claim types, generally follows a structured sequence. Initially, the policyholder reports the incident to their insurer, providing details of the event, date, time, and location. Next, the insurer assigns a claims adjuster who investigates the incident, gathers evidence, and assesses the damages. Following the assessment, the insurer provides a settlement offer to the policyholder, outlining the coverage and the amount they will pay. Finally, the insurer processes the payment and closes the claim once all documentation is received and reviewed. This process may involve multiple communications between the policyholder and the insurance company.

Comparison of Claims Handling Processes Across Insurance Companies

Insurance companies vary in their claims handling approaches, impacting customer experience. Some companies utilize a centralized claims processing system, while others employ a decentralized model. This affects the speed and efficiency of claim resolution. Some insurers prioritize speed and automation, offering online portals and streamlined processes. Others may prefer a more personalized approach, involving greater direct interaction with adjusters. Differences also exist in the level of communication provided to policyholders throughout the claims process. For example, some companies provide regular updates via email or phone, while others rely primarily on the policyholder to initiate contact. The availability of different communication channels (phone, email, online portal) also differs across insurers. Furthermore, the speed of claim settlement can significantly vary, with some companies resolving claims much faster than others.

Strategies for Improving Customer Satisfaction During the Claims Process

Improving customer satisfaction requires a multi-pronged approach. Proactive communication is key; regular updates, clear explanations, and empathetic responses build trust. Streamlining the claims process through technology, such as online portals and mobile apps, can reduce processing time and frustration. Providing multiple communication channels (phone, email, text) caters to diverse customer preferences. Empowering claims adjusters to make decisions and resolve issues promptly minimizes delays and improves customer experience. Finally, a robust customer service team, trained in conflict resolution and empathy, is essential to handle complaints effectively and build positive relationships with policyholders.

Auto Insurance Claim Process Flowchart

The following description illustrates a typical auto insurance claim process:

Imagine a flowchart with several boxes connected by arrows.

Box 1: Accident Occurs (This is the starting point of the flowchart).

Box 2: Report Accident to Insurance Company (Arrow from Box 1). This involves contacting the insurer via phone, app, or online portal. Information such as the date, time, location, and involved parties is collected.

Box 3: Claim Assigned to Adjuster (Arrow from Box 2). The insurer assigns a claims adjuster to handle the claim.

Box 4: Investigation and Damage Assessment (Arrow from Box 3). The adjuster investigates the accident, gathers evidence (police reports, photos, witness statements), and assesses the damage to the vehicle(s).

Box 5: Settlement Offer (Arrow from Box 4). The insurer provides a settlement offer to the policyholder, outlining the coverage and payment amount.

Box 6: Payment and Claim Closure (Arrow from Box 5). Once the policyholder accepts the offer and provides necessary documentation, the insurer processes the payment and closes the claim.

(Arrows indicate the flow from one step to the next.)

End of Discussion

The home and auto insurance market is dynamic and constantly evolving, driven by technological advancements, shifting consumer preferences, and a complex regulatory landscape. While competition among major players is fierce, the focus remains on providing comprehensive coverage, efficient claims processing, and superior customer service. Understanding the key trends and strategies within this industry is crucial for both consumers seeking the best value and companies striving for sustainable growth and market leadership. By staying informed about industry innovations and regulatory changes, both parties can navigate this complex market effectively.

User Queries

What is the difference between liability and collision coverage on auto insurance?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for repairs to your own vehicle, regardless of fault.

How often can I expect my home insurance premiums to change?

Home insurance premiums typically adjust annually, often based on factors like claims history, market conditions, and changes to your property.

What factors affect my auto insurance rates?

Many factors influence your auto insurance rates, including your driving record, age, location, vehicle type, and the coverage you select.

Can I bundle my home and auto insurance with different companies?

While many companies offer bundled discounts, you’re not obligated to use the same company for both. You can compare prices and coverage from different insurers independently.

What should I do if I’m unhappy with my insurance company’s service?

Contact your insurer’s customer service department first to express your concerns. If the issue remains unresolved, you can file a complaint with your state’s insurance department.