Securing your home is a fundamental aspect of financial well-being, and choosing the right home insurance provider is crucial. This guide delves into the world of Grange home insurance, offering a detailed exploration of its policies, pricing structures, and customer experiences. We’ll navigate the complexities of coverage options, claims processes, and financial stability, empowering you to make an informed decision about protecting your most valuable asset.

From understanding the core features of Grange’s policies and comparing them to competitors, to navigating the claims process and evaluating customer feedback, we aim to provide a clear and comprehensive overview. This analysis will equip you with the knowledge to assess whether Grange home insurance aligns with your specific needs and budget.

Defining Grange Home Insurance

Grange Insurance, a regional provider, offers home insurance policies primarily in the Midwest and the East Coast of the United States. Understanding its offerings requires examining its core features, coverage types, pricing comparisons, and common exclusions. This will provide a clear picture of what Grange provides to its policyholders.

Core Features of Grange Home Insurance Policies

Grange home insurance policies typically include standard features such as dwelling coverage (protecting the structure of your home), personal property coverage (protecting your belongings), liability coverage (protecting you from lawsuits), and additional living expenses coverage (covering temporary housing if your home becomes uninhabitable due to a covered event). These core features are often customizable to fit individual needs and risk profiles, allowing policyholders to tailor their coverage. The specific details and limits will vary depending on the chosen policy and the insured property’s characteristics.

Types of Coverage Offered by Grange

Grange offers a range of coverage options beyond the basic features. These can include: flood insurance (often purchased separately through the National Flood Insurance Program), earthquake insurance (also often a separate purchase), personal liability umbrella policies (extending liability coverage beyond the limits of the home insurance policy), and valuable items coverage (providing additional protection for high-value possessions like jewelry or art). The availability of these additional coverages will depend on location and individual policy specifics. It’s crucial to discuss your needs with a Grange representative to determine the appropriate level of coverage.

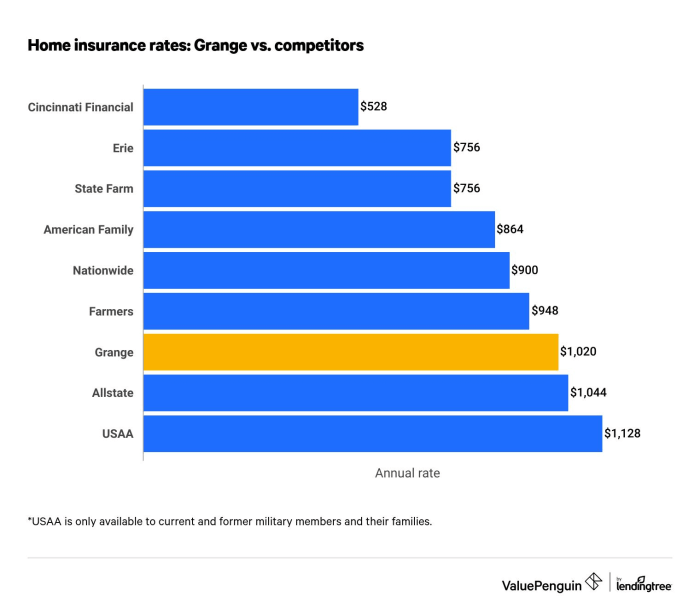

Comparison of Grange Home Insurance with Other Major Providers

Comparing Grange to national providers like State Farm or Allstate is challenging without specific policy details and location. Generally, regional insurers like Grange may offer competitive pricing in their primary service areas, potentially due to lower overhead compared to nationwide companies. However, coverage limits and specific included features can vary significantly. A direct comparison requires obtaining quotes from multiple insurers for the same property and coverage requirements. Factors such as claims history and credit score will also impact pricing from all providers. For example, a homeowner with excellent credit and a history of no claims might find Grange’s rates highly competitive compared to a national provider. Conversely, a homeowner with a less favorable profile might find the opposite to be true.

Common Exclusions in Grange Home Insurance Policies

Like most home insurance providers, Grange typically excludes certain events and damages from coverage. Common exclusions often include damage caused by normal wear and tear, intentional acts by the policyholder, floods (unless specifically added), earthquakes (unless specifically added), and certain types of insect infestations. Specific exclusions are clearly defined in the policy documents, and reviewing these details carefully before purchasing a policy is essential. For instance, damage from a termite infestation might not be covered, while damage from a sudden and accidental water leak would likely be included in a standard policy.

Grange Home Insurance Pricing and Factors

Understanding the cost of your Grange home insurance policy requires considering several key factors. The price you pay isn’t arbitrary; it’s a reflection of your individual risk profile as assessed by Grange. This assessment considers various aspects of your property and your circumstances.

Grange Home Insurance Premium Determinants

Several factors significantly influence the premium Grange calculates for your home insurance. These factors are carefully weighed to provide a fair and accurate reflection of the risk involved in insuring your property. Understanding these factors can help you better understand your premium and potentially take steps to lower it in the future.

Location

Your home’s location plays a crucial role in determining your insurance premium. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, generally command higher premiums due to the increased risk of damage. For example, a home situated in a coastal area susceptible to hurricanes will likely have a higher premium than a similar home located inland. Similarly, a home in a high-crime area might also attract a higher premium due to the increased risk of theft or vandalism.

Home Features

The characteristics of your home itself significantly influence your premium. Larger homes, with more valuable contents, generally cost more to insure. The age of your home, its construction materials (e.g., brick is generally considered more fire-resistant than wood), and the presence of safety features like smoke detectors and security systems also impact the premium. A home with modern fire-resistant roofing and updated electrical systems may qualify for a lower premium compared to one lacking these features.

Coverage Amount

The amount of coverage you choose directly affects your premium. Higher coverage amounts mean higher premiums because Grange is assuming a greater financial responsibility in the event of a claim. Choosing the appropriate coverage level is crucial – you want enough to adequately rebuild or repair your home and replace your belongings, but overinsuring can unnecessarily increase your costs.

Deductible

Your deductible – the amount you pay out-of-pocket before your insurance coverage kicks in – also impacts your premium. Choosing a higher deductible typically lowers your premium because you are assuming more of the financial risk. However, it’s important to select a deductible you can comfortably afford in case of a claim.

Hypothetical Premium Calculation

Let’s consider a hypothetical scenario. Imagine two homeowners, both seeking Grange home insurance.

Homeowner A: Lives in a low-risk area, owns a modest 1,500 sq ft brick home built in 2010 with a $250,000 coverage amount and a $1,000 deductible.

Homeowner B: Lives in a high-risk hurricane zone, owns a large 3,000 sq ft wood-frame home built in 1980 with a $500,000 coverage amount and a $500 deductible.

Homeowner A would likely receive a significantly lower premium than Homeowner B due to the differences in location, home size, construction materials, coverage amount, and deductible. The exact figures would depend on Grange’s specific rate calculations.

Premium Comparison with Competitors

The following table provides a hypothetical comparison of Grange premiums with those of two competitors (Company X and Company Y) for similar coverage:

| Feature | Grange | Company X | Company Y |

|---|---|---|---|

| Annual Premium (1,500 sq ft home, $250,000 coverage, $1000 deductible) | $1200 | $1350 | $1100 |

| Annual Premium (3,000 sq ft home, $500,000 coverage, $1000 deductible) | $2800 | $3200 | $2500 |

| Customer Service Rating | 4.5/5 | 4.0/5 | 4.2/5 |

| Claims Processing Speed | Average 7 days | Average 10 days | Average 5 days |

*Note: These are hypothetical figures for illustrative purposes only and do not reflect actual Grange premiums.*

Grange Home Insurance Policy Options and Add-ons

Choosing the right Grange home insurance policy involves understanding the various options available and selecting the coverage that best suits your needs and budget. Grange offers a range of policy options, from basic coverage to comprehensive protection, allowing you to tailor your insurance to your specific home and lifestyle. In addition to the core policy, several add-ons or endorsements can enhance your coverage and provide additional peace of mind.

Grange Home insurance offers several policy options, categorized by the level of coverage provided. These options generally include differing levels of liability coverage, dwelling coverage, and personal property coverage. The cost of each option will vary based on several factors including location, home value, and coverage limits. It’s crucial to carefully consider your individual circumstances to determine the appropriate level of protection.

Policy Options: Coverage Levels

Grange typically offers several levels of coverage, often described as basic, standard, and comprehensive. Basic policies provide fundamental protection, while comprehensive policies offer broader coverage for a higher premium. The standard option usually falls somewhere in between. Each level offers different limits for dwelling coverage (the structure of your home), personal property coverage (your belongings), and liability coverage (protecting you from lawsuits). For example, a basic policy might offer $100,000 in dwelling coverage, while a comprehensive policy might offer $500,000 or more. It’s important to compare these coverage limits to the actual replacement cost of your home and the value of your possessions.

Optional Add-ons and Endorsements

Adding endorsements to your Grange home insurance policy can significantly enhance your protection. These optional add-ons provide coverage for specific risks or situations not included in the standard policy. While they increase the overall premium, the added protection can be invaluable in the event of a covered loss.

- Earthquake Coverage: Protects against damage caused by earthquakes. This is often a separate policy and is crucial in earthquake-prone areas. The cost depends on your location and the assessed risk.

- Flood Insurance: Covers losses due to flooding, which is typically excluded from standard home insurance policies. The cost is influenced by your home’s location and flood risk assessment. It’s especially important in areas with a history of flooding.

- Personal Liability Umbrella Policy: Provides additional liability coverage beyond the limits of your standard home insurance policy. This is beneficial for high-net-worth individuals or those who may face a higher risk of liability claims. The cost is relatively low compared to the substantial added liability protection.

- Scheduled Personal Property Coverage: Provides specific coverage for high-value items such as jewelry, artwork, or antiques. This allows you to insure these items for their full replacement value, regardless of the overall personal property coverage limit. The cost is determined by the value and type of items insured.

- Identity Theft Protection: Covers expenses related to identity theft recovery, such as credit monitoring and legal assistance. The cost is relatively modest, offering significant peace of mind in the face of a growing threat of identity theft.

Comparing Costs and Benefits

The decision of which policy options and add-ons to select involves a careful balancing act between cost and coverage. While a comprehensive policy with numerous add-ons offers the most extensive protection, it will also carry a higher premium. A basic policy is less expensive but offers limited coverage. Consider the value of your home, your personal belongings, and your risk tolerance when making your selection. For instance, someone living in a high-risk flood zone should strongly consider flood insurance, even if it increases their premium. Similarly, those with valuable collections should explore scheduled personal property coverage. It’s advisable to discuss your specific needs with a Grange insurance agent to determine the optimal balance between cost and protection.

Grange’s Financial Stability and Reputation

Grange Insurance is a well-established regional insurer with a long history, and understanding its financial strength is crucial for potential customers. Its financial stability directly impacts its ability to meet its obligations to policyholders, providing confidence in the security of their coverage. A strong financial standing is indicative of a company’s ability to withstand economic downturns and continue providing reliable insurance services.

Assessing an insurance company’s financial health often involves examining its ratings from independent agencies and analyzing its performance over time. These assessments provide an objective view of the company’s solvency and its capacity to pay claims. For Grange, a detailed examination of its history, market position, and any significant financial events helps paint a complete picture of its reliability.

Grange’s Financial Ratings and Stability

Grange’s financial strength is regularly evaluated by independent rating agencies such as A.M. Best, Demotech, and Standard & Poor’s. These agencies assess a company’s financial strength based on various factors, including its reserves, underwriting performance, and investment portfolio. While specific ratings fluctuate and are subject to change, consistently high ratings from these reputable agencies suggest a robust financial position. Access to these ratings is readily available through the agencies’ websites and financial news sources. It is important to note that ratings are snapshots in time and reflect the company’s financial condition at a specific point.

Grange’s History and Market Presence

Founded in 1911, Grange Insurance has a significant presence in the Midwest, operating for over a century. This longevity suggests a history of successful adaptation to changing market conditions and sustained profitability. Its long-standing presence and established customer base demonstrate a level of trust and confidence built over decades of service. The company’s expansion and adaptation to modern insurance needs also demonstrate its ability to remain competitive and relevant within the industry.

Significant Events and News Related to Grange’s Financial Health

While specific, detailed financial news about Grange may require access to financial databases and industry publications, it’s generally advisable to look for press releases from Grange itself or news articles discussing the company’s financial performance. Major events, such as significant acquisitions, mergers, or changes in leadership, can influence the company’s financial standing and should be considered when assessing its stability. Regular monitoring of financial news and industry publications allows for staying informed on significant developments.

Key Facts about Grange’s Financial Standing

Understanding Grange’s financial standing is simplified by reviewing key facts. These facts offer a summary of its financial health, providing a clearer picture of its reliability and stability.

- A long operational history exceeding a century indicates sustained success and adaptability.

- Regularly assessed by independent rating agencies, providing external validation of financial strength.

- A strong regional presence, indicating a significant market share and established customer base.

- Transparency in financial reporting is generally considered a positive indicator of stability and accountability.

Final Wrap-Up

Ultimately, the decision of whether Grange home insurance is the right choice for you hinges on a careful consideration of your individual circumstances and priorities. By weighing the factors discussed – coverage options, pricing, customer service experiences, and financial stability – you can confidently evaluate Grange against other providers and select a policy that provides the protection and peace of mind you deserve. Remember to thoroughly review policy details and compare quotes before making a final decision.

FAQ

What discounts does Grange offer on home insurance?

Grange may offer discounts for various factors, including home security systems, multiple policy bundling (auto and home), and claims-free history. Specific discounts vary by location and policy details. Contact Grange directly for current discount information.

How long does it take Grange to process a claim?

Claim processing times vary depending on the complexity of the claim and the availability of necessary documentation. While Grange aims for efficient processing, it’s advisable to anticipate some delay, particularly for significant damage claims.

Does Grange cover flood damage?

Standard Grange home insurance policies typically do *not* cover flood damage. Flood insurance is usually purchased separately through the National Flood Insurance Program (NFIP) or a private insurer.

What is Grange’s customer service reputation like?

Customer reviews on Grange’s customer service are mixed. Some praise their responsiveness and helpfulness, while others report difficulties reaching representatives or slow response times. It’s advisable to review independent customer feedback sources before making a decision.