Securing adequate home insurance in Florida presents unique challenges, far beyond the typical concerns of other states. The vulnerability to hurricanes, the fluctuating real estate market, and the specific regulatory environment all contribute to a complex landscape for homeowners. This guide unravels the intricacies of FL home insurance, offering a clear understanding of coverage options, cost factors, and the process of securing the right policy for your needs.

From understanding the impact of location and building materials on premiums to navigating the claims process and selecting appropriate hurricane and flood coverage, we aim to empower Florida homeowners with the knowledge necessary to make informed decisions about protecting their most valuable asset. We’ll explore the various types of policies available, highlighting key differences and helping you determine the best fit for your individual circumstances and risk profile.

Understanding Florida Home Insurance

Securing adequate home insurance in Florida presents unique challenges due to the state’s vulnerability to hurricanes, severe weather events, and rising construction costs. Understanding the complexities of Florida’s insurance market is crucial for homeowners to make informed decisions and protect their investments.

The Unique Challenges of Florida Home Insurance

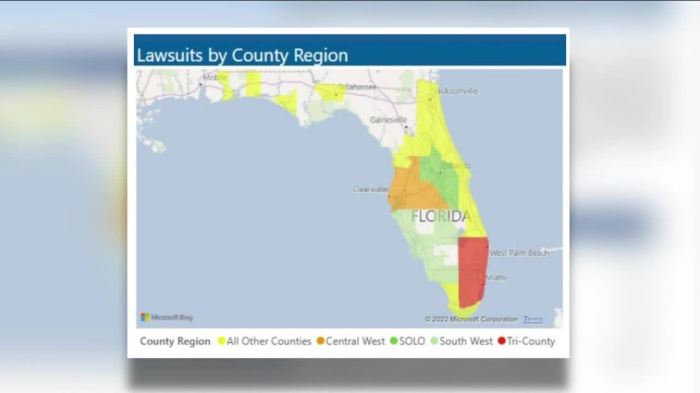

Florida’s geographical location and susceptibility to hurricanes significantly impact the home insurance market. The frequency and intensity of hurricanes lead to substantial losses for insurance companies, resulting in higher premiums and a more restrictive insurance market. Additionally, the state’s aging infrastructure, particularly in coastal areas, contributes to increased risk and higher repair costs following a catastrophic event. The increasing cost of building materials and labor further exacerbates the challenges faced by insurers, leading to higher premiums and a greater likelihood of insurers limiting or restricting coverage. This often results in a difficult market for homeowners to find affordable and comprehensive coverage.

Factors Influencing Florida Home Insurance Premiums

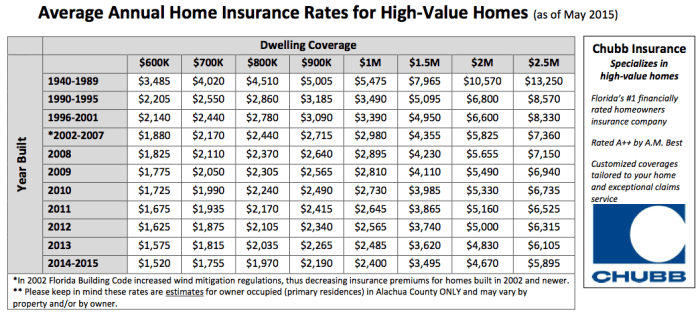

Several factors contribute to the determination of Florida home insurance premiums. These include the age and condition of the home, its location (coastal properties generally command higher premiums), the value of the property, the coverage amount selected, the deductible chosen, and the insurer’s risk assessment. The presence of hurricane mitigation features, such as impact-resistant windows and reinforced roofing, can positively influence premiums by demonstrating a reduced risk profile. The claims history of the homeowner and the insurer’s overall financial stability also play a role. Furthermore, the increasing frequency and severity of natural disasters directly impacts premium calculations. For example, a home located in a high-risk hurricane zone will likely face significantly higher premiums than a similar home located inland.

Types of Florida Home Insurance Coverage

Florida homeowners can choose from various types of home insurance coverage to tailor their protection to their specific needs and budget. The most common types include homeowners insurance (HO-3), which provides broad coverage for dwelling, personal property, and liability; condo insurance, which covers the interior of a condo unit and personal belongings; and renters insurance, which protects renters’ personal belongings and provides liability coverage. Each type offers varying levels of coverage and deductibles, and it is important to carefully compare policies to determine the best fit. Specialized policies may also be available to address unique risks, such as flood insurance (typically purchased separately from homeowners insurance) and windstorm insurance (often a separate policy in high-risk areas).

Comparison of Florida Home Insurance Coverage Options

The following table compares common coverage options, highlighting key differences in deductibles, coverage limits, and exclusions. Note that specific coverage amounts and exclusions can vary significantly between insurers and policies.

| Coverage Type | Deductible (Example) | Coverage Limit (Example) | Common Exclusions |

|---|---|---|---|

| HO-3 (Homeowners) | $1,000 - $5,000 | $250,000 - $1,000,000 | Flood, earthquake, intentional damage |

| Condo Insurance | $500 - $2,500 | $100,000 - $500,000 | Building exterior, common areas |

| Renters Insurance | $250 - $1,000 | $10,000 - $50,000 | Landlord's property, building structure |

| Flood Insurance | Varies | Varies | Generally covers flood damage only |

Factors Affecting Insurance Costs

Understanding the factors that influence your Florida home insurance premium is crucial for making informed decisions and potentially saving money. Several interconnected elements contribute to the final cost, ranging from your home’s characteristics to its location and the overall risk profile assessed by the insurer.

Location’s Impact on Premiums

The location of your home significantly impacts your insurance costs. Coastal properties, particularly those in high-risk hurricane zones, face substantially higher premiums than inland homes. This is due to the increased likelihood of damage from hurricanes, storm surges, and flooding. Insurers consider proximity to the coast, elevation, and the historical frequency and severity of storms in the area when calculating premiums. For example, a home in a designated high-velocity hurricane zone (HVHZ) will likely command a much higher premium than an equivalent home situated several miles inland. The increased risk translates directly into a higher cost to insure the property against potential losses.

Building Materials and Construction Quality

The materials used in your home’s construction and the overall quality of the build play a substantial role in determining insurance costs. Homes constructed with hurricane-resistant materials, such as impact-resistant windows and reinforced roofing, are considered lower risk and therefore attract lower premiums. Conversely, older homes with outdated building codes and vulnerable construction may command higher premiums due to their increased susceptibility to damage from wind, rain, and other perils. For example, a home built with concrete block and impact-resistant roofing will typically have lower insurance costs compared to a similarly sized home constructed with wood framing and standard roofing materials. The insurer’s assessment of the building’s resilience to various risks directly influences the premium.

Risk Mitigation Strategies to Lower Premiums

Several strategies can help mitigate risk and lower your insurance premiums. These proactive measures demonstrate to the insurer your commitment to protecting your property and reducing the potential for claims.

- Installing hurricane shutters or impact-resistant windows significantly reduces the risk of wind damage, leading to lower premiums.

- Elevating your home above the base flood elevation reduces the risk of flood damage and may qualify you for lower flood insurance rates.

- Regular home maintenance, including roof inspections and repairs, demonstrates responsible homeownership and can lead to favorable insurance rates.

- Installing a monitored fire alarm system can significantly reduce the risk of fire damage, potentially resulting in lower premiums.

Implementing these risk mitigation strategies can not only lower your insurance premiums but also protect your home and family from potential damage and losses. The cost savings often outweigh the initial investment in these protective measures.

Hurricane and Windstorm Coverage

Living in Florida means understanding the very real threat of hurricanes and windstorms. Protecting your home from these powerful weather events requires comprehensive insurance coverage, going beyond basic homeowner’s policies. This section will clarify the importance of hurricane and windstorm coverage and the options available to Florida homeowners.

Hurricane and windstorm coverage is not optional for Florida residents; it’s a necessity. Unlike many other states, Florida’s vulnerability to hurricanes necessitates specific and robust insurance policies designed to address the unique challenges posed by these powerful storms. The financial implications of a hurricane’s impact on a home can be devastating, potentially leading to significant out-of-pocket expenses for repairs or even total rebuilding costs. Comprehensive coverage helps mitigate these risks and provides financial security during a crisis.

Levels of Hurricane and Windstorm Coverage

Florida home insurance policies offer varying levels of coverage for hurricane and windstorm damage. The extent of coverage depends on the specific policy and chosen deductibles. Generally, policies offer coverage for damage to the structure of the home, as well as its contents. However, it is crucial to understand the differences between named storm coverage and all-perils coverage, as some policies may offer separate deductibles for wind and other perils. For example, some policies may have a separate deductible for hurricane damage that is higher than the deductible for other types of damage. It’s essential to review your policy documents carefully to understand the specifics of your coverage.

Scenarios Highlighting the Importance of Hurricane Coverage

Consider these examples to understand the crucial role of hurricane coverage:

- A homeowner experiences roof damage from high winds during a hurricane. The cost to repair or replace the roof could easily reach tens of thousands of dollars. Comprehensive hurricane coverage would help cover these significant expenses.

- A family’s home is severely damaged by a hurricane’s storm surge, rendering it uninhabitable. The cost of temporary housing, repairs, and replacement of damaged belongings can quickly add up. Hurricane coverage provides crucial financial assistance during this difficult time.

- A homeowner sustains damage to their property from flying debris during a hurricane. This could include broken windows, damaged siding, or destroyed landscaping. These seemingly smaller damages can accumulate to a substantial repair bill, highlighting the need for adequate coverage.

Windstorm Mitigation Options and Their Impact on Premiums

Implementing windstorm mitigation measures can significantly reduce the risk of damage and, consequently, lower insurance premiums. These measures strengthen a home’s ability to withstand hurricane-force winds.

| Mitigation Option | Description | Impact on Premiums |

|---|---|---|

| Hurricane Shutters | Impact-resistant shutters that protect windows and doors from damage. | Significant reduction (can be 20-40% or more, depending on insurer and other factors) |

| Roof Reinforcements | Strengthening the roof structure to withstand high winds. This might include using stronger materials or improved fastening techniques. | Moderate reduction (typically 5-15%, depending on the extent of the reinforcements) |

| Reinforced Garage Doors | Replacing standard garage doors with impact-resistant models. | Moderate reduction (similar to roof reinforcements) |

| Improved Building Codes Compliance | Ensuring the home meets or exceeds current building codes for wind resistance. | Potential reduction, varying depending on the specific improvements made. |

Illustrative Examples of Insurance Scenarios

Understanding the nuances of Florida home insurance is best achieved through examining real-world scenarios. The following examples highlight the importance of adequate coverage, proactive risk management, and the impact of various factors on insurance premiums.

Comprehensive Coverage Benefits

Imagine Sarah, a homeowner in St. Augustine, Florida, who opted for comprehensive coverage including windstorm, flood, and liability protection. Her home, a beautifully restored Victorian built in 1900, is valued at $750,000. During a severe thunderstorm, a large oak tree fell, damaging her roof and causing significant water damage to the interior. While the damage was extensive, Sarah’s comprehensive policy covered the entire cost of repairs, exceeding $100,000, including temporary housing while the repairs were underway. Without this coverage, Sarah would have faced substantial financial hardship. This example showcases how comprehensive coverage can protect against unforeseen and potentially devastating events.

Underinsurance and Significant Losses

Consider Michael, who owns a modest ranch-style home in Orlando, valued at $300,000. He chose a policy with a lower premium, significantly underinsuring his property. A major hurricane struck Central Florida, causing extensive damage to his roof and requiring complete replacement of his windows. The actual cost of repairs was $150,000. However, his policy only covered $100,000, leaving him with a $50,000 out-of-pocket expense. This scenario underscores the financial burden of underinsurance, even in cases of partial damage. The cost of rebuilding could have been far greater if the damage had been more extensive.

Proactive Risk Mitigation and Reduced Costs

John, a homeowner in Tampa, invested in significant hurricane mitigation measures. He installed impact-resistant windows, reinforced his roof, and had his home inspected for structural vulnerabilities. He documented these improvements and provided the information to his insurance provider. As a result, his insurance company offered a substantial discount on his premium, recognizing the reduced risk associated with his proactive approach. This demonstrates how investing in home improvements can lead to significant long-term savings on insurance costs. The reduction in his premium more than offset the initial cost of the improvements over time.

Hypothetical Home Insurance Costs

Below are examples illustrating how different factors influence insurance premiums. These are hypothetical examples and actual costs will vary based on many factors.

| Homeowner | Location | Home Type | Features | Estimated Annual Premium |

|---|---|---|---|---|

| Anna | Gainesville (low risk area) | 2000 sq ft, single-story, brick | Standard roof, no hurricane mitigation | $1,500 |

| Bob | Miami Beach (high risk area) | 3500 sq ft, two-story, wood frame | Standard roof, no hurricane mitigation | $4,000 |

| Carol | Naples (high risk area) | 3000 sq ft, two-story, concrete block | Impact-resistant windows, reinforced roof | $3,000 |

Ultimate Conclusion

Protecting your Florida home requires careful consideration of various factors and a thorough understanding of the available insurance options. By diligently researching, comparing policies, and implementing risk mitigation strategies, you can secure comprehensive coverage at a manageable cost. Remember, proactive planning and informed decision-making are key to safeguarding your investment and peace of mind in the face of Florida’s unique challenges. This guide serves as a starting point – always consult with insurance professionals for personalized advice tailored to your specific situation.

FAQ Compilation

What is Citizens Property Insurance?

Citizens Property Insurance Corporation is Florida’s insurer of last resort. It provides coverage when private insurers won’t, but policies may have higher premiums and stricter terms.

How does my credit score affect my FL home insurance premium?

In many states, including Florida, your credit score is a factor in determining your insurance premium. A higher credit score generally leads to lower premiums.

What is a wind mitigation inspection?

A wind mitigation inspection assesses your home’s features that reduce wind damage. Passing this inspection can lead to lower premiums on your windstorm coverage.

Can I bundle my home and auto insurance in Florida?

Yes, many insurance companies offer discounts for bundling home and auto insurance policies.

What is the difference between Actual Cash Value (ACV) and Replacement Cost (RC)?

ACV covers the replacement cost minus depreciation, while RC covers the full cost of replacing damaged property without accounting for depreciation.