Securing the right home insurance policy can feel overwhelming, with a vast landscape of providers and coverage options. Understanding the nuances of home insurance quotes is crucial for making informed decisions and protecting your most valuable asset. This guide navigates the complexities, empowering you to compare quotes effectively and choose a policy that perfectly aligns with your needs and budget.

We’ll explore the key components of a home insurance quote, from coverage types and influencing factors to the process of comparing quotes from different providers. We’ll also delve into the importance of scrutinizing policy details, understanding deductibles and coverage limits, and identifying potential hidden costs. By the end, you’ll be equipped to confidently navigate the world of home insurance and secure the best possible protection for your home.

Understanding Home Insurance Quotes

Receiving multiple home insurance quotes can feel overwhelming. Understanding the components of these quotes is crucial to making an informed decision that best protects your property and financial well-being. This section will break down the key elements of a typical quote, helping you compare apples to apples.

Components of a Home Insurance Quote

A home insurance quote details the cost and coverage offered for your specific property. Key components include the premium (the amount you pay periodically), the deductible (the amount you pay out-of-pocket before your insurance coverage kicks in), and the coverage limits (the maximum amount your insurer will pay for a covered loss). The quote will also specify the policy’s effective date and duration. Additionally, it will Artikel the specific perils covered (e.g., fire, wind, theft) and any exclusions (events or situations not covered by the policy). Finally, it will often include details about any discounts you qualify for, such as those for security systems or bundling with other insurance policies.

Common Coverage Options

Home insurance policies typically offer several coverage options. Dwelling coverage protects the physical structure of your home, while personal property coverage protects your belongings inside. Liability coverage protects you financially if someone is injured on your property or you cause damage to someone else’s property. Additional living expenses coverage helps cover temporary housing and living costs if your home becomes uninhabitable due to a covered event. Many policies also offer optional coverages, such as flood insurance or earthquake insurance, which are usually purchased separately. The specific coverage options and limits will vary depending on the insurer and your individual needs.

Factors Influencing Home Insurance Prices

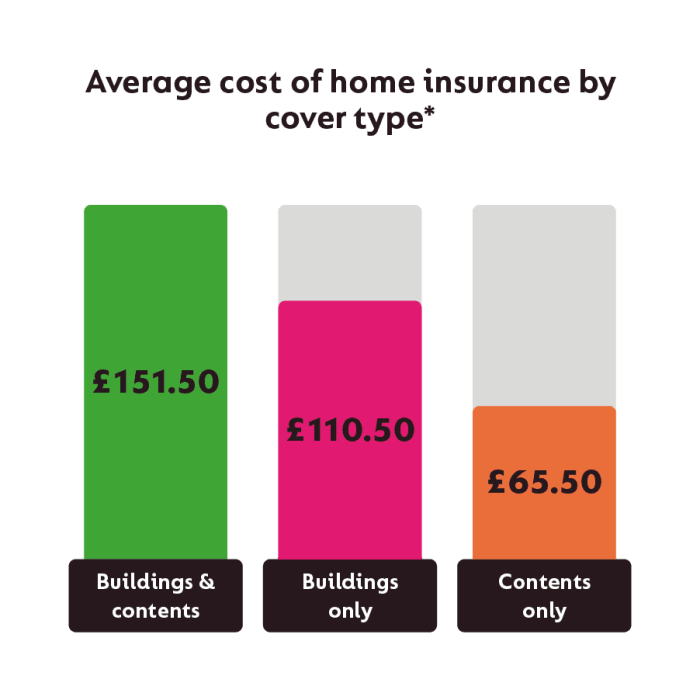

Several factors significantly influence the cost of home insurance. These include the location of your home (areas prone to natural disasters generally have higher premiums), the age and condition of your home (older homes may require more maintenance and thus have higher premiums), the value of your home and belongings (higher values mean higher premiums), your credit score (a good credit score often qualifies you for discounts), and the type of coverage you select (more comprehensive coverage usually costs more). Your claims history also plays a significant role; a history of claims can lead to higher premiums. Finally, the type of policy you choose (e.g., actual cash value vs. replacement cost) also affects the price.

Comparison of Home Insurance Policy Types

The following table compares key features of different types of home insurance policies. Note that specific coverage and pricing will vary based on individual circumstances and the insurer.

| Policy Type | Coverage | Premium Cost | Deductible Options |

|---|---|---|---|

| Basic/Named Peril | Covers only specific named perils (e.g., fire, wind, hail) | Generally lower | Typically higher |

| Broad Form | Covers a wider range of perils than named peril policies | Moderate | Moderate |

| Comprehensive/Open Peril | Covers all perils except those specifically excluded in the policy | Generally higher | Lower to Moderate |

| High-Value Home | Designed for homes with a high value and often includes specialized coverage | Significantly higher | Variable, often higher |

Finding and Comparing Quotes

Securing the best home insurance requires diligent comparison shopping. Several methods exist for obtaining quotes, each with its own advantages and disadvantages. Understanding these differences is crucial to making an informed decision and finding the policy that best suits your needs and budget.

Finding suitable home insurance involves navigating a landscape of online tools and direct insurer contact. This section will Artikel the most common methods, compare their benefits and drawbacks, and provide guidance on selecting reputable providers. Remember that the best approach often involves a combination of these strategies.

Online Comparison Tools

Online comparison websites aggregate quotes from multiple insurers, allowing you to see various options side-by-side. This streamlines the process, saving you time and effort spent contacting individual companies. However, these sites may not include every insurer in your area, and the displayed quotes might not represent the final price after individual underwriting assessments. Some comparison websites may also prioritize insurers who pay them referral fees, potentially influencing the order of results.

Contacting Individual Insurers Directly

Contacting insurers directly provides a more personalized experience. You can discuss your specific needs with an agent, ask detailed questions, and potentially negotiate terms. This method allows for a deeper understanding of the policy details and offers greater flexibility. However, it is more time-consuming than using comparison websites, requiring individual contact with each insurer. Furthermore, you might miss out on offers from insurers not contacted.

Reputable Home Insurance Providers (Example: [Region: California])

The following is a list of examples of reputable home insurance providers commonly found in California. This list is not exhaustive, and the suitability of a provider depends on individual needs and circumstances. Always verify licensing and financial stability before selecting an insurer.

- State Farm

- Allstate

- Farmers Insurance

- USAA (membership required)

- Nationwide

It is crucial to remember that this list is illustrative, and many other reputable companies operate in California and other regions. Thorough research is always recommended.

The Importance of Reading the Fine Print

Insurance quotes often contain complex terminology and exclusions. Failing to thoroughly review the fine print can lead to unexpected costs or inadequate coverage. Pay close attention to deductibles, coverage limits, exclusions (what is *not* covered), and any additional fees or riders. If anything is unclear, contact the insurer directly for clarification before accepting a quote. Understanding the policy’s details ensures you are fully aware of what is and isn’t covered under the policy. For example, a seemingly low premium might come with a high deductible, meaning you pay more out-of-pocket in the event of a claim. Similarly, certain types of damage, like flood damage, may require separate coverage.

Illustrating Policy Features

Understanding the specifics of your home insurance policy is crucial. Different policies offer varying levels of coverage and protection, and it’s important to carefully consider your needs before selecting a plan. This section will delve into the key features commonly found in home insurance policies, providing examples to clarify how they function in real-world scenarios.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if your actions cause damage to someone else’s property. For example, if a guest slips and falls on your icy walkway and suffers a broken leg, your liability coverage would help pay for their medical bills and any legal costs associated with the accident. The amount of coverage you choose determines the maximum amount the insurance company will pay out for such claims. A higher liability limit provides greater protection against significant financial losses. Consider a scenario where a tree on your property falls onto your neighbor’s car, causing $10,000 in damage. If your liability coverage is $100,000, the insurance company will cover the repair costs. However, if your coverage is only $50,000, you might be responsible for the remaining $5,000.

Dwelling Coverage

Dwelling coverage protects the physical structure of your home. This includes the walls, roof, foundation, and attached structures like garages. Imagine a scenario where a fire damages your home, requiring extensive repairs. Your dwelling coverage would help pay for the costs of rebuilding or repairing the damaged parts of your home, up to your policy’s coverage limit. The coverage limit is the maximum amount your insurer will pay for dwelling repairs or replacement. For example, if your dwelling coverage is $300,000 and a fire causes $250,000 in damage, the insurance company will cover the full cost of repairs. However, if the damage exceeds $300,000, you would be responsible for the difference. This highlights the importance of ensuring your dwelling coverage adequately reflects the current market value of your home.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. Suppose a burglary occurs, and your valuable electronics are stolen. Your personal property coverage would help replace these items, up to the policy’s coverage limit and considering your deductible. It’s important to note that some policies offer additional coverage for specific items, such as jewelry or artwork, which may require separate endorsements and increased premiums. Let’s say your personal property coverage is $50,000 and your deductible is $1,000. If a theft results in $10,000 worth of stolen belongings, you would receive $9,000 from your insurer after paying your deductible.

Deductibles and Coverage Limits: A Visual Representation

Consider this textual representation of how deductibles and coverage limits affect out-of-pocket expenses:

Scenario: $15,000 damage to your home.

| Coverage Limit | Deductible | Insurance Pays | You Pay |

|---|---|---|---|

| $200,000 | $1,000 | $14,000 | $1,000 |

| $100,000 | $2,000 | $98,000 | $2,000 |

| $100,000 | $0 | $100,000 | $5,000 |

The table shows that a higher deductible results in lower insurance payments but lower out-of-pocket expenses for the insured in cases of damage that is covered by the policy. A lower coverage limit, even with a low deductible, can lead to significant out-of-pocket expenses if the damage exceeds the limit. Choosing the right balance between coverage limits and deductibles is key to finding a policy that suits your budget and risk tolerance.

Concluding Remarks

Successfully comparing home insurance quotes requires careful consideration of numerous factors, from coverage levels and deductibles to customer service reputation and potential hidden fees. By diligently researching providers, analyzing quote details, and understanding your individual needs, you can confidently select a policy that provides comprehensive protection at a competitive price. Remember, the right home insurance policy offers peace of mind, knowing you’re adequately protected against unforeseen circumstances. Take control of your insurance decisions and secure the best possible coverage for your home.

Clarifying Questions

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

How often should I review my home insurance policy?

It’s advisable to review your home insurance policy annually, or whenever significant changes occur, such as renovations, additions, or changes in your personal circumstances.

What factors influence my home insurance premium?

Several factors influence premiums, including your home’s location, age and construction, coverage amount, deductible, and your claims history.

Can I bundle my home and auto insurance?

Yes, many insurers offer discounts for bundling home and auto insurance policies.

What is liability coverage?

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property.