Finding the cheapest homeowners insurance isn’t just about saving money; it’s about securing your most valuable asset while maintaining financial stability. The process, however, can feel overwhelming with the myriad of factors influencing premiums. This guide unravels the complexities, empowering you to navigate the insurance landscape confidently and find the best coverage at the most affordable price.

We’ll explore key factors impacting your insurance costs, from your home’s location and age to the level of coverage you choose. We’ll also equip you with practical strategies for securing lower premiums, including comparing quotes from multiple insurers and considering home improvements that can reduce your risk profile. Understanding these elements allows you to make informed decisions, ensuring both adequate protection and budget-friendly premiums.

Finding Affordable Home Insurance Options

Securing affordable home insurance is crucial for protecting your most valuable asset. Several strategies can significantly reduce your premiums without compromising coverage. Understanding these options and actively comparing quotes is key to finding the best value.

Finding the right home insurance policy involves careful consideration of several factors and proactive steps to minimize costs. This includes understanding your coverage needs, exploring different insurance providers, and leveraging available discounts.

Strategies for Lower-Cost Home Insurance

Lowering your home insurance premiums often involves a combination of strategies. These strategies focus on reducing risk, improving your home’s security, and making informed choices about your policy.

For example, installing security systems, such as alarms and smoke detectors, can often qualify you for discounts. Similarly, upgrading your home’s roofing materials to more fire-resistant options can also lead to lower premiums. Maintaining a good credit score is another significant factor; insurers often associate good credit with responsible behavior and lower risk.

Furthermore, increasing your deductible can result in lower premiums. However, it’s crucial to weigh the potential savings against your ability to afford a higher out-of-pocket expense in the event of a claim. Consider carefully how much you can comfortably pay should you need to file a claim.

Bundling Home and Auto Insurance

Bundling home and auto insurance with the same provider is a common strategy for saving money.

The benefits include potential discounts for combining policies, simplified billing, and often a more streamlined claims process should you need to file a claim for either your home or your vehicle. However, the drawbacks include potential limitations in choice of providers and the possibility that you might not get the most competitive rate for either policy individually if you bundle.

For example, if one insurer offers exceptionally low rates for auto insurance but higher rates for home insurance, bundling might not be the most cost-effective option. It is essential to compare the bundled price against the individual policy costs from multiple providers to ensure that bundling is genuinely beneficial.

Comparing Quotes from Multiple Insurers

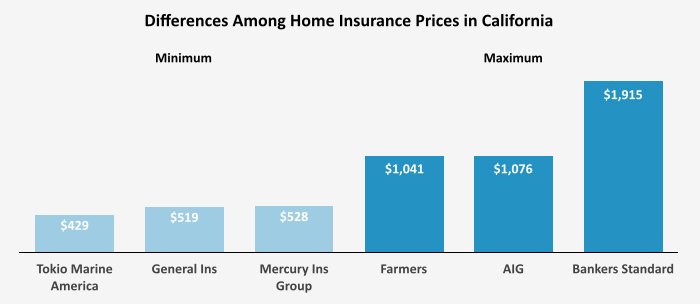

Comparing quotes from several insurance companies is vital for securing the most affordable home insurance.

Different insurers utilize varying risk assessment models and pricing structures, leading to significant differences in premiums for the same level of coverage. By comparing quotes, you can identify the insurer offering the best value for your specific needs and risk profile. This ensures you are not overpaying for your insurance.

Obtaining and Comparing Insurance Quotes

A systematic approach to obtaining and comparing quotes can streamline the process and ensure you are making informed decisions.

- Gather necessary information: Compile details about your home, such as its age, square footage, location, and any security features. Also, have information readily available about your mortgage, if applicable.

- Use online comparison tools: Many websites allow you to enter your information and receive multiple quotes simultaneously, simplifying the comparison process.

- Contact insurers directly: Supplement online comparisons by contacting insurers directly to discuss specific policy details and ask questions. This allows for a more personalized approach.

- Carefully review policy details: Before making a decision, thoroughly review the coverage details, deductibles, and exclusions of each quote. Ensure the policy adequately protects your home and belongings.

- Compare apples to apples: Ensure you are comparing similar coverage levels across different insurers to avoid making an uninformed decision based on price alone.

Impact of Location and Risk Factors

Your home’s location significantly influences your homeowner’s insurance premium. Insurers assess risk based on geographical data and various environmental factors, leading to considerable variations in costs across different regions. Understanding these factors can help you make informed decisions about home purchasing and insurance planning.

Geographical location is a primary determinant of insurance rates. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, naturally command higher premiums due to the increased likelihood of claims. Conversely, locations with lower risk profiles, typically those in less geographically volatile areas, tend to enjoy lower insurance costs. This is because insurers factor in the statistical probability of events occurring in specific areas, influencing the pricing of policies.

Geographic Location and Insurance Premiums

Insurance companies utilize sophisticated models that incorporate historical data on natural disasters, crime rates, and other relevant factors to calculate risk scores for specific locations. These scores directly translate into the premiums homeowners pay. For example, a home situated in a coastal area susceptible to hurricanes will likely have a higher premium than an equivalent home located inland, far from any major disaster-prone zones. Similarly, a home in a region with a high frequency of wildfires will also face higher premiums compared to a home in a less fire-prone area. This risk-based pricing ensures that premiums reflect the actual likelihood of claims arising from various perils.

Specific Risk Factors and Their Impact on Insurance Costs

Proximity to fire hazards, flood zones, and fault lines significantly increases insurance costs. Homes located near forests or dry brush are at a higher risk of wildfire damage, resulting in elevated premiums. Similarly, homes within floodplains or coastal areas face increased risk of flooding, leading to higher insurance costs. The distance from a fire station or the availability of adequate fire hydrants can also impact premiums; homes further from emergency services often face higher rates. Homes built on fault lines or in earthquake-prone areas will also see higher premiums reflecting the risk of seismic damage.

Regional Comparison of Insurance Costs Based on Risk Factors

Consider the following hypothetical example: A home identical in size, age, and construction quality located in a low-risk area like the Midwest might have an annual premium of $1,000. However, a similar home situated in a hurricane-prone coastal region of Florida could see an annual premium exceeding $3,000. This difference reflects the significantly higher risk of hurricane damage in Florida compared to the Midwest. Similarly, a home in California’s wildfire zone could have a premium significantly higher than a comparable home in a less fire-prone state. These variations highlight the substantial impact of location and risk factors on insurance costs.

Natural Disaster Frequency and Premium Impacts

The frequency of natural disasters directly impacts insurance premiums. Regions experiencing frequent hurricanes, earthquakes, or wildfires will see higher premiums than areas with less frequent occurrences. For instance, after a particularly devastating hurricane season, insurance companies often re-evaluate risk assessments and adjust premiums upwards in affected areas. This reflects the increased likelihood of future claims based on recent events. The impact of each disaster varies. Hurricanes cause widespread wind and flood damage, earthquakes lead to structural damage, and wildfires cause extensive property destruction. Each disaster type contributes differently to premium increases depending on the extent and frequency of such events in a particular region. A region experiencing several major hurricanes within a short timeframe will likely see a more significant premium increase compared to a region experiencing infrequent, smaller-scale events.

Final Review

Ultimately, securing the cheapest homeowners insurance requires a balanced approach: prioritizing adequate coverage while strategically minimizing costs. By understanding the factors influencing premiums, comparing quotes diligently, and making informed choices about coverage levels and home improvements, you can achieve both financial prudence and peace of mind. Remember, the lowest premium isn’t always the best deal; it’s about finding the optimal balance between cost and comprehensive protection for your home.

Detailed FAQs

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you’re accepting more financial responsibility.

Can I get homeowners insurance if I have a poor credit score?

Yes, but insurers often use credit scores to assess risk. A poor credit score might lead to higher premiums or difficulty securing coverage. It’s crucial to shop around and compare offers from different providers.

What is the difference between an insurance agent and a broker?

An agent represents a single insurance company, while a broker works with multiple companies to find you the best coverage options. Brokers can often offer broader choices and potentially better rates.

How often should I review my homeowners insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant change in your circumstances (e.g., home improvements, changes in your financial situation).

What is the impact of claims history on future premiums?

Filing a claim can increase your premiums, as it indicates a higher risk to the insurer. However, the impact depends on the nature and frequency of claims.