The search for the cheapest home insurance quote often feels like navigating a maze. Numerous providers, varying coverage options, and a complex jargon landscape can leave homeowners feeling overwhelmed. This guide aims to demystify the process, providing a clear path to finding affordable and adequate protection for your most valuable asset – your home. We’ll explore the key factors influencing cost, offer practical tips for comparison shopping, and empower you to make informed decisions that balance price with comprehensive coverage.

Understanding your needs is the first step. Are you looking for basic liability coverage or a comprehensive policy that includes protection against natural disasters? Your home’s value, location, and your credit score all significantly impact the final premium. This guide will delve into these factors and more, equipping you with the knowledge to confidently secure the best possible home insurance quote.

Understanding “Cheapest Home Insurance Quote” Search Intent

Understanding the search intent behind “cheapest home insurance quote” reveals a user prioritizing affordability above all else. This doesn’t necessarily mean they’re willing to compromise on quality, but rather, they’re actively seeking the best value for their money. They are likely comparing multiple options and are driven by a desire to minimize their insurance expenditure.

The primary need is to find a policy that adequately protects their home and belongings at the lowest possible price. This involves balancing coverage needs with premium costs.

Types of Home Insurance Policies Considered

Users searching for the cheapest home insurance quote may be considering various policy types, each offering different levels of coverage. Understanding these options is crucial for making an informed decision. A homeowner might be considering basic policies, offering liability and dwelling coverage, or more comprehensive options including additional coverages for personal belongings, liability, and potential events like flooding or earthquakes. The choice often depends on the value of the home, location, and the homeowner’s risk tolerance.

Factors Influencing Perception of “Cheapest”

The perception of “cheapest” is subjective and influenced by several factors beyond just the premium amount. While the initial premium quote is a key factor, users also consider the deductible amount. A lower premium might be offset by a high deductible, meaning the homeowner pays more out-of-pocket in case of a claim. The level of coverage provided is another significant factor. A policy with seemingly low premiums might offer limited coverage, leaving the homeowner vulnerable to significant financial losses in the event of a major incident. Finally, the reputation and financial stability of the insurance company play a role. A very cheap policy from an unreliable insurer might ultimately prove more expensive if claims are difficult or impossible to process. For example, a homeowner might find a policy for $500 a year cheaper than another at $700, but the $500 policy might have a $5000 deductible while the $700 policy has a $1000 deductible. The seemingly “cheaper” option could result in significantly higher out-of-pocket expenses in the event of a claim.

Factors Affecting Home Insurance Costs

Securing the cheapest home insurance quote involves understanding the various factors that influence premiums. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions and potentially save money. This section will explore these critical factors in detail.

Factors Influencing Home Insurance Premiums

Several interconnected factors significantly impact your home insurance premium. Understanding these allows for a more accurate comparison of quotes and helps in making informed decisions. The following table summarizes these key influences:

| Factor | Impact on Premium | Explanation | Example |

|---|---|---|---|

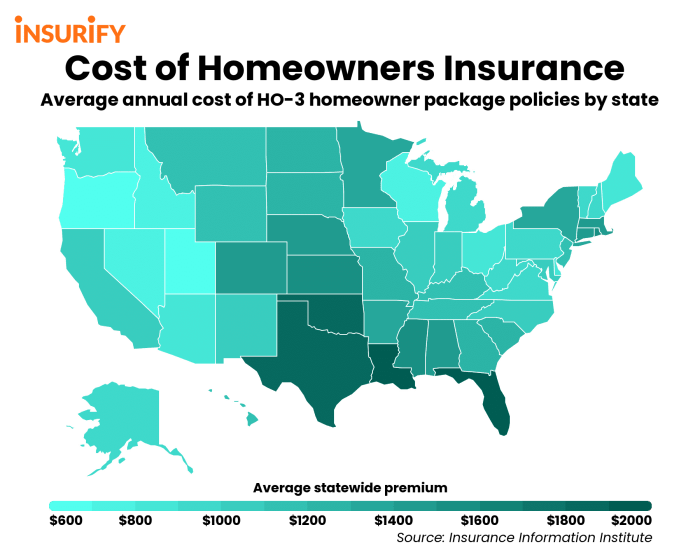

| Location | High risk areas = higher premiums | Areas prone to natural disasters (hurricanes, earthquakes, wildfires) or high crime rates command higher premiums due to increased risk. | A home in a coastal hurricane zone will generally cost more to insure than a similar home in an inland area. |

| Home Value | Higher value = higher premiums | The replacement cost of your home directly correlates with the insurance premium. A more expensive home requires a larger payout in case of damage or loss. | A $500,000 home will typically have a higher premium than a $250,000 home, all other factors being equal. |

| Coverage Level | Higher coverage = higher premiums | Choosing higher coverage limits (e.g., dwelling coverage, personal property coverage) results in higher premiums, but offers greater financial protection. | Opting for a higher deductible will lower your premium, but you’ll pay more out-of-pocket in the event of a claim. |

| Credit Score | Good credit = lower premiums | Insurance companies often use credit scores as an indicator of risk. A higher credit score generally translates to lower premiums, reflecting a lower perceived risk of non-payment. | Individuals with excellent credit scores often qualify for discounts and lower premiums compared to those with poor credit. |

Impact of Deductibles on Overall Cost

The deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible means lower premiums, as you’re assuming more of the risk. Conversely, a lower deductible leads to higher premiums but lower out-of-pocket expenses in the event of a claim. Choosing the right deductible involves balancing affordability with the potential financial burden of a claim. For example, a $1,000 deductible will generally result in a lower premium than a $500 deductible. However, you’ll need to be prepared to pay $1,000 before your insurance coverage begins.

Differences in Pricing Between Insurance Providers

Insurance companies use different underwriting models and risk assessments, resulting in varied pricing. Factors like company size, financial stability, and specific coverage options influence the final cost. Comparing quotes from multiple providers is crucial to find the most competitive rates. For instance, one insurer might specialize in certain types of homes or geographic areas, leading to more favorable pricing for specific customers. Another might offer discounts for bundling home and auto insurance. Therefore, obtaining multiple quotes allows for a thorough comparison and identification of the most suitable and cost-effective option.

Finding and Comparing Quotes

Securing the cheapest home insurance quote involves a proactive approach to comparing offers from multiple providers. This process requires careful attention to detail and a strategic understanding of how insurance companies assess risk. By following a structured approach, you can significantly increase your chances of finding the best value for your needs.

Obtaining Home Insurance Quotes

Gathering quotes from various insurers is the cornerstone of finding the best deal. A systematic approach ensures you don’t miss any potentially advantageous options.

- Identify Potential Insurers: Begin by researching different home insurance providers in your area. This can involve online searches, recommendations from friends and family, or checking with your existing insurance providers for bundled options.

- Use Online Comparison Tools: Many websites offer comparison tools that allow you to input your details and receive quotes from multiple insurers simultaneously. This streamlines the process and saves time.

- Contact Insurers Directly: While online tools are helpful, contacting insurers directly can provide more personalized service and allow you to ask specific questions about policy details.

- Provide Accurate Information: Accuracy is paramount. Ensure all information provided, such as your address, property details, and coverage requirements, is completely accurate to avoid discrepancies and inaccurate quotes.

- Request Multiple Quotes: Aim to obtain at least three to five quotes from different insurers to ensure a broad comparison and identify the most competitive offers. Consider a mix of both online and direct contact methods.

Comparing Quotes Effectively

A crucial step is ensuring a fair comparison. Simply looking at the premium price isn’t sufficient; you need to compare the coverage provided.

This checklist ensures you are comparing “apples to apples”:

- Coverage Amounts: Verify that the coverage amounts for dwelling, personal property, liability, and other relevant aspects are consistent across all quotes. For example, ensure that the dwelling coverage matches the actual replacement cost of your home.

- Deductibles: Compare the deductible amounts for different types of claims. Higher deductibles usually result in lower premiums, but you’ll pay more out-of-pocket in the event of a claim.

- Policy Exclusions: Carefully review the policy exclusions to understand what is not covered. Some policies may exclude specific types of damage or events.

- Discounts: Check for available discounts such as those for security systems, multiple policy bundling (home and auto), or claims-free history.

- Customer Service Ratings: Research the insurers’ customer service ratings and reviews to get an idea of their responsiveness and claims handling processes. A quick online search can often reveal valuable insights.

Understanding Insurance Jargon and Policy Details

Insurance policies often contain complex terminology. Understanding key terms is vital for making informed decisions.

Here are some tips to help navigate the complexities:

- Use Online Resources: Numerous websites and articles explain common insurance terms in plain language. Use these resources to clarify any unfamiliar words or phrases.

- Ask for Clarification: Don’t hesitate to contact insurers directly to clarify any aspects of the policy that you don’t understand. They should be happy to explain the details in a way that is easy to grasp.

- Review Policy Documents Carefully: Thoroughly read the entire policy document before making a decision. Pay close attention to the fine print and ensure you understand all the terms and conditions.

- Compare Policy Summaries: Many insurers provide concise policy summaries alongside the full policy documents. These summaries can help you quickly compare key features across different quotes.

Beyond Price

Finding the cheapest home insurance quote is only the first step. A thorough evaluation of the policy’s coverage and the insurer’s stability is crucial to ensuring you’re adequately protected. Focusing solely on price without considering these other factors could leave you financially vulnerable in the event of a claim.

Choosing a home insurance policy involves more than just comparing prices. Understanding the nuances of different coverage options and the financial health of the insurance provider is essential for making an informed decision. This section will help you navigate these crucial aspects.

Types of Home Insurance Coverage

Different insurers offer varying levels and types of coverage. Understanding these differences is key to selecting a policy that meets your specific needs. For example, some policies offer broader coverage for personal belongings, while others might have higher limits for liability protection. Similarly, coverage for specific events, such as floods or earthquakes, may be offered as add-ons or might be excluded entirely depending on the policy and your location. Carefully review the policy documents to understand exactly what is and isn’t covered.

Assessing Insurer Financial Stability and Reputation

The financial strength and reputation of an insurance company are critical considerations. A financially unstable company might struggle to pay out claims, leaving you with significant losses. You can assess an insurer’s financial stability by checking independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These agencies provide ratings that reflect the insurer’s ability to meet its financial obligations. Furthermore, researching customer reviews and complaints filed with state insurance departments can provide insights into an insurer’s reputation for fair claims handling and customer service. Look for companies with consistently high ratings and positive customer feedback.

Key Aspects of a Home Insurance Policy

Before finalizing your decision, it’s helpful to organize the key features of each policy for easy comparison. This allows you to objectively weigh the pros and cons of different options, ensuring you select the policy that best aligns with your needs and budget.

- Coverage Amounts: Dwelling coverage (the structure of your home), personal property coverage (your belongings), liability coverage (protection against lawsuits), and additional living expenses (coverage for temporary housing if your home is uninhabitable).

- Deductibles: The amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums.

- Premium Costs: The amount you pay regularly for your insurance coverage. Consider the total cost over the policy term.

- Policy Exclusions: Specific events or circumstances not covered by the policy. Common exclusions include floods, earthquakes, and intentional acts.

- Claims Process: Understand the insurer’s claims process, including how to file a claim, what documentation is required, and the typical timeframe for claim settlement.

- Discounts: Many insurers offer discounts for various factors, such as security systems, smoke detectors, or bundling home and auto insurance.

Final Review

Finding the cheapest home insurance quote isn’t just about the lowest price; it’s about finding the right balance between cost and comprehensive coverage. By understanding the factors that influence premiums, diligently comparing quotes, and considering the financial stability of insurers, you can make an informed decision that protects your home and your financial well-being. Remember, a thorough understanding of your policy and its implications is crucial for long-term peace of mind. Take your time, compare carefully, and secure the coverage that best fits your needs and budget.

FAQs

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you’re taking on more of the risk.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever significant changes occur, such as home renovations or improvements, or changes in your financial situation.

Can I bundle my home and auto insurance for a discount?

Yes, many insurers offer discounts for bundling home and auto insurance policies. This is a common way to save money.

What should I do if I disagree with my insurance company’s assessment of a claim?

Carefully review your policy, gather all relevant documentation, and contact your insurer to discuss your concerns. If the issue remains unresolved, you may need to consult with an insurance professional or consider mediation.