Finding affordable home insurance in Florida can feel like navigating a hurricane—challenging, unpredictable, and potentially costly. The Sunshine State’s unique climate and susceptibility to severe weather events significantly impact insurance premiums, leaving many homeowners searching for the best balance of coverage and cost. This guide cuts through the complexity, offering practical strategies and valuable insights to help you secure the cheapest Florida home insurance without compromising essential protection.

We’ll explore the key factors influencing insurance costs, including location, property features, and your personal risk profile. We’ll also delve into the various types of policies available, comparing coverage options and outlining the steps to effectively compare quotes from multiple insurers. Ultimately, our goal is to empower you with the knowledge and tools necessary to make informed decisions and secure the most affordable, yet comprehensive, home insurance policy for your needs.

Finding the Cheapest Options

Securing affordable home insurance in Florida requires a proactive and informed approach. The state’s unique vulnerability to hurricanes and other natural disasters significantly impacts insurance costs, making careful planning crucial for homeowners. By employing effective strategies and understanding the nuances of the insurance market, you can significantly reduce your premiums.

Finding the lowest home insurance rates in Florida often involves a multi-faceted strategy. This includes leveraging online comparison tools, actively shopping around with multiple insurers, and carefully understanding your policy options to ensure you’re getting the best coverage for your needs at the most competitive price.

Utilizing Online Insurance Comparison Tools

Online insurance comparison websites offer a convenient way to quickly obtain quotes from multiple insurers simultaneously. These platforms allow you to input your information once and receive several quotes, simplifying the comparison process. However, it’s essential to understand the limitations. These tools often present only a limited selection of insurers, and the quotes provided might not reflect the complete picture of available coverage options. Furthermore, the displayed premiums may be introductory rates, which can increase after the initial policy period. Therefore, while helpful for initial research, it’s crucial to independently verify the information and explore options beyond those initially presented by the comparison tool.

The Importance of Comparing Quotes from Multiple Insurers

Shopping around and comparing quotes from a diverse range of insurers is paramount to securing the cheapest home insurance. Different companies utilize varying underwriting models and risk assessment methodologies, leading to significant price discrepancies for the same coverage. For example, a company specializing in coastal properties might offer competitive rates for homes in hurricane-prone areas, while another might prioritize inland properties. By comparing quotes from at least three to five insurers, you greatly increase your chances of discovering the most favorable option. This proactive approach ensures you’re not inadvertently overpaying for your home insurance.

A Step-by-Step Guide to Obtaining and Evaluating Home Insurance Quotes

- Gather Necessary Information: Compile essential details about your property, including its address, square footage, age, construction materials, and any security features. You’ll also need information about your mortgage lender (if applicable) and personal details for the policy application.

- Contact Multiple Insurers Directly: Don’t rely solely on online comparison tools. Contact insurers directly to obtain quotes, ensuring you’re considering a broader range of options. This allows for a more detailed discussion of your specific needs and potential coverage customizations.

- Compare Coverage Options: Carefully analyze the policy details beyond just the premium. Compare coverage limits, deductibles, and specific exclusions to understand the true value and scope of each policy. A lower premium might not be worthwhile if it significantly compromises your coverage in case of a claim.

- Verify Insurer’s Financial Stability: Before committing to a policy, research the financial strength and stability of the insurer. You can use resources like A.M. Best or Standard & Poor’s to assess their rating. A financially sound insurer is less likely to face insolvency, protecting your claim payouts.

- Read the Fine Print: Thoroughly review the policy documents before signing. Understand the terms and conditions, including any exclusions, limitations, and cancellation policies. Don’t hesitate to ask clarifying questions to the insurer.

Insurance Policy Features and Coverage

Understanding the features and coverage of your Florida home insurance policy is crucial for protecting your investment. A standard policy typically bundles several types of coverage, each designed to address specific risks. However, the specifics can vary significantly between insurers, highlighting the importance of careful comparison.

Standard Coverage Components

Standard Florida home insurance policies generally include dwelling coverage (covering the physical structure of your home), personal property coverage (protecting your belongings), liability coverage (protecting you from lawsuits), and additional living expenses coverage (covering temporary housing costs if your home becomes uninhabitable due to a covered event). The precise limits and conditions for each coverage type are Artikeld in your policy documents. For example, dwelling coverage might have a specific limit, say $250,000, meaning that’s the maximum the insurer will pay for damage to your home. Personal property coverage typically has a lower limit, often a percentage of the dwelling coverage.

Coverage Variations Among Insurers

Insurers may offer different levels of coverage for specific perils. For instance, windstorm coverage is particularly crucial in Florida due to hurricane risk. Some insurers may offer higher windstorm coverage limits than others, or they might impose stricter deductibles. Similarly, flood insurance is usually purchased separately from a standard homeowner’s policy, as it’s often offered through the National Flood Insurance Program (NFIP) or private insurers. Comparing the coverage limits and deductibles for windstorm, flood, fire, and other perils offered by different insurers is essential to finding the best policy for your needs and budget. For example, one insurer might offer a $500,000 windstorm limit with a $5,000 deductible, while another might offer only $300,000 with a $10,000 deductible.

Policy Exclusions and Limitations

It’s equally important to understand what your policy *doesn’t* cover. All policies contain exclusions, specifying events or damages not covered. Common exclusions might include damage caused by normal wear and tear, acts of war, or intentional damage. Limitations might specify the maximum payout for certain types of losses or the conditions under which a claim will be considered. For example, a policy might exclude coverage for flood damage unless you have purchased a separate flood insurance policy. Carefully reviewing the policy documents, including the exclusions and limitations section, is critical to avoid surprises when you need to file a claim.

Filing a Claim and the Claims Process

Filing a claim typically involves contacting your insurer immediately after an incident. You’ll need to provide details about the event, the extent of the damage, and any supporting documentation, such as photographs. The insurer will then assign an adjuster to assess the damage and determine the amount of coverage. The claims process can vary in length depending on the complexity of the claim and the insurer’s efficiency. You should expect communication from your insurer throughout the process, and you may need to provide additional information or documentation as requested. The insurer will eventually provide a settlement offer, which you can accept or negotiate. Understanding the steps involved and what documentation you’ll need will streamline the process. For example, a prompt submission of photos and police reports (if applicable) can significantly speed up the process.

Illustrative Examples

Understanding how various factors influence Florida home insurance costs can be challenging. The following examples illustrate how different situations and choices can significantly impact your premiums.

Homeowner’s Insurance Cost Calculation

Let’s consider Maria, a homeowner in Tampa, Florida, with a 2,000 square foot home valued at $300,000. She has a good credit score (750), no prior claims in the past five years, and chooses a standard coverage policy with a $1,000 deductible. Her home is located in a relatively low-risk area for hurricanes and flooding. Based on these factors, a typical insurance quote might range from $2,500 to $3,500 annually. This range reflects the variability in pricing among different insurance providers and policy options. Factors like the specific coverage details and the chosen insurer can affect the final price. The higher end of the range might account for additional coverage options like windstorm or flood insurance, which are often necessary in Florida due to its vulnerability to these perils.

Cost-Saving Measures Reducing Premiums

Consider John, also in Tampa, with a similar home and value. Initially, his premiums were high, around $4,000 annually, due to several factors: a lower credit score (620), a recent claim for minor wind damage, and an older roof. By improving his credit score to 720, installing a new impact-resistant roof (reducing wind damage risk), and opting for a slightly higher deductible ($2,000), John reduced his annual premium to approximately $2,800. This represents a significant saving of $1,200 per year. The new roof alone likely resulted in a substantial discount because of the reduced risk of wind damage, demonstrating the importance of home maintenance in lowering insurance costs.

Fictional Insurance Policy: “Sunshine State Shield”

The “Sunshine State Shield” policy offered by “Coastal Calm Insurance” provides comprehensive coverage for dwelling, personal property, and liability. It includes standard features like fire, theft, and vandalism coverage. However, it has limitations. While it covers wind damage, it excludes flood damage unless a separate flood insurance policy is purchased. The policy also has a specific cap on coverage for certain types of jewelry and electronics. The deductible options range from $500 to $2,000, with the premium decreasing as the deductible increases. The policy explicitly Artikels exclusions for pre-existing conditions and requires prompt reporting of any incidents to maintain coverage. The policy’s annual cost is highly dependent on the homeowner’s location, property value, and chosen coverage levels and deductible. The “Sunshine State Shield” policy is an example of a typical policy with both benefits and limitations that a homeowner needs to carefully consider before purchasing.

Ultimate Conclusion

Securing the cheapest Florida home insurance requires careful planning and a proactive approach. By understanding the factors that influence premiums, diligently comparing quotes, and implementing cost-saving measures, you can significantly reduce your insurance expenses without sacrificing the vital protection your home deserves. Remember, thorough research and a strategic approach are your best allies in this process, ensuring you find a policy that provides peace of mind and fits comfortably within your budget. Don’t hesitate to utilize the resources and strategies Artikeld in this guide to navigate the complexities of Florida’s home insurance market successfully.

Key Questions Answered

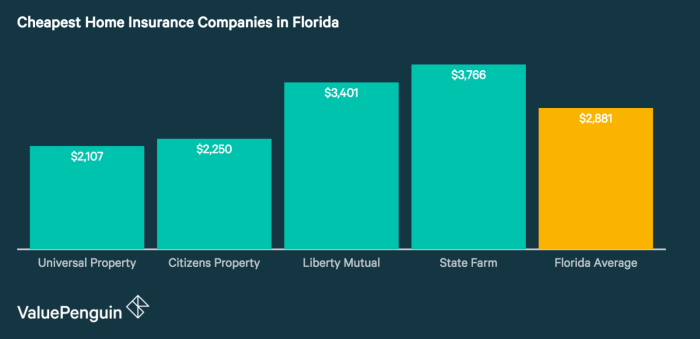

What is the average cost of home insurance in Florida?

The average cost varies significantly based on location, coverage, and property characteristics. However, expect to pay more than in many other states due to the higher risk of hurricanes and other severe weather.

Can I get home insurance if I live in a high-risk hurricane zone?

Yes, but it will likely be more expensive. Insurers assess risk based on location, and areas prone to hurricanes will have higher premiums. Consider mitigation measures to potentially lower your rates.

What is the difference between HO-3 and HO-A policies?

HO-3 (Special Form) is the most common, providing open-peril coverage for your dwelling and personal property (excluding specifically excluded perils). HO-A (Basic Form) offers named-peril coverage, meaning only specific events are covered.

How often should I review my home insurance policy?

Annually, at minimum. Your needs and risk profile may change, and reviewing your policy ensures you have the right coverage at the best price.