The pursuit of financial security often leads us down the path of seeking the best value for our money. Insurance, a critical component of that security, is no exception. Finding the cheapest car and home insurance isn’t simply about pinching pennies; it’s about strategically navigating a complex market to secure adequate coverage without unnecessary expense. This guide unravels the intricacies of securing affordable yet comprehensive insurance for your vehicle and home, empowering you to make informed decisions.

This exploration delves into the multifaceted factors influencing insurance costs, from your driving record and location to the features of your home and your chosen coverage levels. We’ll equip you with practical strategies to locate the most competitive premiums, including leveraging online comparison tools and understanding the nuances of different policy options. The goal is to help you find the optimal balance between cost and comprehensive protection, providing peace of mind without breaking the bank.

Defining “Cheapest”

Finding the cheapest car and home insurance often feels like navigating a maze. The term “cheapest” itself is relative, as the lowest premium isn’t always the best value. Several interconnected factors influence the final cost, and understanding these is crucial for making informed decisions. This section will detail the key elements that determine your insurance premiums for both your car and your home.

Factors Influencing Car Insurance Costs

Understanding the components of your car insurance premium allows for more effective cost management. Various factors significantly impact the final price, and some are more influential than others. The following table Artikels these key factors, their impact, and illustrative examples.

| Factor | Impact on Cost | Explanation | Example |

|---|---|---|---|

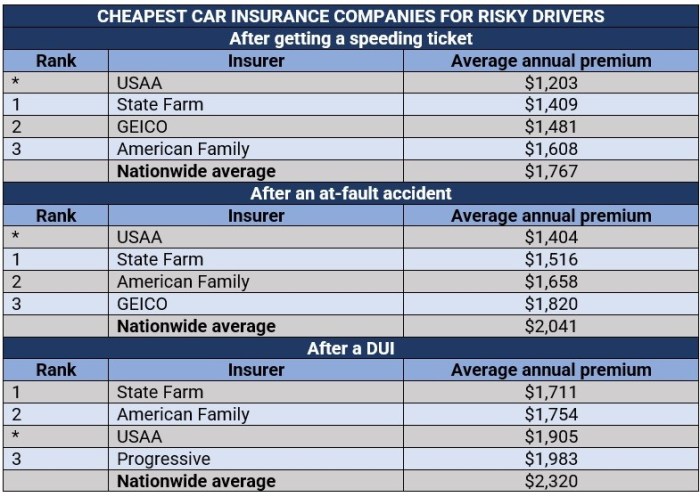

| Driving Record | High | Accidents and traffic violations significantly increase premiums due to higher risk assessment. | A driver with three accidents in the past three years will pay substantially more than a driver with a clean record. |

| Age and Gender | Medium | Statistically, younger drivers and males tend to have higher accident rates, resulting in higher premiums. | A 18-year-old male driver will typically pay more than a 45-year-old female driver. |

| Vehicle Type and Value | Medium | The type of car you drive and its value directly impact repair costs and insurance payouts. Expensive, high-performance vehicles generally cost more to insure. | Insuring a new luxury sports car will be far more expensive than insuring a used, economical sedan. |

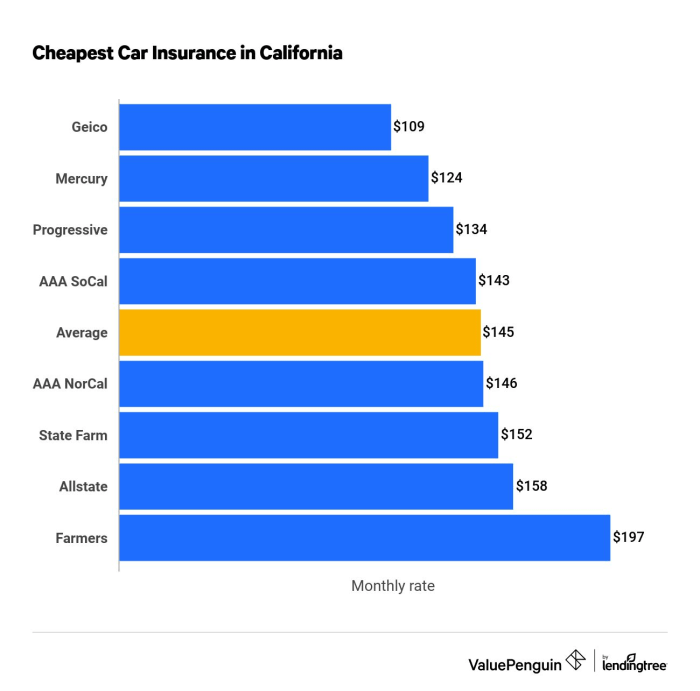

| Location | Medium | Insurance companies consider the risk of theft and accidents in your area. High-crime areas generally have higher premiums. | Living in a densely populated urban area with a high crime rate will typically result in higher premiums than living in a rural area. |

Factors Influencing Home Insurance Costs

Several elements determine the cost of your homeowner’s insurance. These factors are assessed by insurance companies to evaluate the risk associated with insuring your property.

The following points detail the primary factors influencing home insurance costs:

- Location: Similar to car insurance, your home’s location significantly impacts premiums. Areas prone to natural disasters (hurricanes, earthquakes, wildfires) or high crime rates will have higher premiums.

- Home Value: The higher the value of your home, the more expensive it is to insure. This is because the potential payout in case of damage or loss is higher.

- Home Age and Condition: Older homes may require more extensive repairs and have a higher risk of damage, leading to higher premiums. The overall condition of the home, including the roof and plumbing, also plays a role.

- Coverage Amount: The level of coverage you choose directly affects your premium. Higher coverage amounts result in higher premiums.

- Deductible: A higher deductible (the amount you pay out-of-pocket before insurance kicks in) will generally result in a lower premium.

- Security Features: Homes with security systems (alarm systems, fire sprinklers) often qualify for lower premiums due to reduced risk.

Comparison of Factors Influencing Car and Home Insurance Costs

While distinct, both car and home insurance premiums share some common influencing factors. Location, for example, plays a significant role in both, reflecting the risk assessment based on geographic factors. The value of the asset (car or home) also directly correlates with the premium; higher value translates to higher insurance costs. However, factors like driving record and vehicle type are unique to car insurance, while home age and condition are specific to home insurance. The level of coverage selected impacts both, but the specific coverage options differ significantly between the two.

Impact of Location and Lifestyle

Your location and lifestyle significantly influence the cost of both car and home insurance. Insurance companies assess risk based on a variety of factors, and these two categories are among the most impactful. Understanding how these factors affect your premiums can help you make informed decisions and potentially save money.

Geographic location plays a crucial role in determining insurance premiums due to variations in crime rates, accident frequency, and the prevalence of natural disasters. Lifestyle choices, such as driving habits and home security measures, also contribute significantly to risk assessment and subsequent premium calculations.

Geographic Location’s Influence on Insurance Premiums

Insurance companies utilize extensive data to analyze risk in different areas. Areas with high crime rates, for example, typically have higher home insurance premiums due to the increased likelihood of burglaries and vandalism. Similarly, regions prone to natural disasters, such as hurricanes, earthquakes, or wildfires, will command higher premiums for both home and auto insurance because of the elevated risk of damage or loss. Conversely, areas with lower crime rates and a lower frequency of natural disasters generally have lower insurance premiums. For example, a home in a rural area with a low crime rate might enjoy lower premiums compared to an identical home in a densely populated urban area with a higher crime rate. Similarly, a driver in a state with low accident rates might receive lower car insurance premiums than a driver in a state with a high number of accidents.

Lifestyle Choices and Their Impact on Insurance Costs

Lifestyle choices directly affect the risk assessment made by insurance companies. For car insurance, factors such as driving history (accidents, speeding tickets), annual mileage, and the type of vehicle driven all play a significant role in determining premiums. Drivers with a history of accidents or traffic violations typically pay higher premiums to reflect the increased risk they pose. Similarly, those who drive high-performance vehicles or frequently drive long distances are likely to pay more. For home insurance, security measures such as alarm systems, security cameras, and strong locks can significantly lower premiums. This is because these measures reduce the risk of burglary and other home-related incidents. Furthermore, maintaining a well-maintained home and regularly checking for potential hazards can also contribute to lower premiums. For instance, a homeowner who installs a sophisticated security system and regularly maintains their property might qualify for a discount on their home insurance premium. Conversely, a driver with multiple speeding tickets and a history of at-fault accidents can expect higher car insurance premiums.

Illustrative Examples of Location and Lifestyle Interactions

Consider two individuals: Sarah lives in a coastal city prone to hurricanes and drives a sports car, while John lives in a rural area with low crime rates and drives a fuel-efficient sedan. Sarah is likely to pay higher premiums for both her home and car insurance due to her location’s vulnerability to hurricanes and her choice of vehicle. John, on the other hand, is likely to enjoy lower premiums because of his location and his choice of a safer, more fuel-efficient vehicle. Another example involves two homeowners: Maria lives in a high-crime neighborhood and has no home security system, while David lives in a safe neighborhood and has a comprehensive security system. Maria will likely pay higher home insurance premiums than David due to the higher risk associated with her location and lack of security measures.

Long-Term Cost Management

Securing the lowest initial premiums is only half the battle. Maintaining affordable car and home insurance requires proactive strategies and consistent effort. By focusing on preventative measures and responsible habits, you can significantly reduce your long-term costs and avoid unexpected premium increases. This section Artikels practical steps to achieve this goal.

Maintaining a Good Driving Record

A clean driving record is the single most impactful factor in determining your car insurance premiums. Minor infractions can lead to significant increases, while accidents can result in substantially higher costs for years to come. Companies assess risk based on your driving history, rewarding safe drivers with lower rates.

- Defensive Driving Techniques: Regularly practicing defensive driving techniques, such as maintaining a safe following distance, obeying traffic laws, and avoiding distractions like cell phones, minimizes the risk of accidents and traffic violations.

- Driver’s Education/Advanced Training: Consider taking a defensive driving course or advanced driving training. Many insurers offer discounts for completing these programs, demonstrating your commitment to safe driving practices. These courses often provide valuable insights into accident prevention and hazard awareness.

- Vehicle Maintenance: Proper vehicle maintenance is crucial for preventing accidents. Regularly checking tire pressure, ensuring proper braking function, and addressing any mechanical issues promptly reduces the likelihood of breakdowns or accidents caused by vehicle malfunctions.

- Monitoring Your Driving Habits: Some insurance companies offer telematics programs that track your driving behavior. By consistently demonstrating safe driving habits, you may qualify for discounts and lower premiums. These programs often provide feedback on your driving style, allowing you to identify areas for improvement.

Improving Home Security

Home insurance premiums are directly influenced by the perceived risk of theft or damage to your property. Implementing robust security measures can significantly reduce your premiums by demonstrating to insurers that you’re taking proactive steps to protect your home.

- Security System Installation: Installing a monitored security system is one of the most effective ways to lower your premiums. Many insurers offer significant discounts for homes equipped with alarm systems, especially those that are professionally monitored and connected to emergency services.

- Exterior Lighting: Adequate exterior lighting deters potential intruders and improves visibility around your property. Motion-sensor lights are particularly effective in deterring crime and increasing security. Well-lit areas around entrances and walkways can significantly reduce the risk of burglaries.

- Strong Locks and Doors: Ensure all exterior doors and windows are fitted with high-quality locks and reinforced frames. Regularly inspect and maintain these security features to prevent vulnerabilities. Consider upgrading to more secure locks, such as deadbolt locks or smart locks, for enhanced protection.

- Regular Home Maintenance: Preventative maintenance, such as addressing roof leaks or plumbing issues promptly, reduces the risk of costly repairs and potential claims. Regular inspections and maintenance can significantly minimize the likelihood of incidents that could lead to insurance claims.

Closing Notes

Ultimately, securing the cheapest car and home insurance is a journey of informed decision-making. By understanding the key factors influencing premiums, utilizing available resources effectively, and proactively managing your risk profile, you can significantly reduce your insurance costs without compromising on necessary coverage. Remember, the cheapest option isn’t always the best; however, with careful planning and the strategies Artikeld above, you can achieve a balance of affordability and comprehensive protection for your valuable assets.

FAQ

What is the difference between liability and collision coverage for car insurance?

Liability coverage pays for damages you cause to others, while collision coverage covers damage to your own vehicle regardless of fault.

How does my credit score affect my insurance premiums?

In many states, your credit score is a factor in determining your insurance premiums. A higher credit score generally leads to lower premiums.

Can I get home insurance without a mortgage?

Yes, even if you own your home outright, you should still have homeowners insurance to protect your investment from unforeseen events.

What is an umbrella insurance policy?

An umbrella policy provides additional liability coverage beyond your car and home insurance policies, offering broader protection against significant lawsuits.

What are some ways to lower my home insurance premiums besides bundling?

Installing security systems, upgrading your home’s safety features, and taking preventative measures against damage (e.g., proper roof maintenance) can all lead to lower premiums.