Securing comprehensive coverage for your home and vehicle can often feel like navigating a complex maze. Understanding car home insurance quotes is key to finding the right balance between protection and affordability. This guide delves into the intricacies of bundled and separate policies, exploring the factors influencing premiums and providing actionable strategies to secure the best possible rates.

We’ll examine how various factors—from your credit score and driving history to your home’s location and features—impact the cost of your insurance. Learn how to effectively compare quotes from different providers, understand policy details, and ultimately, save money on your premiums. By the end, you’ll be equipped to confidently navigate the world of car and home insurance, securing the peace of mind you deserve.

Understanding Policy Details and Coverage

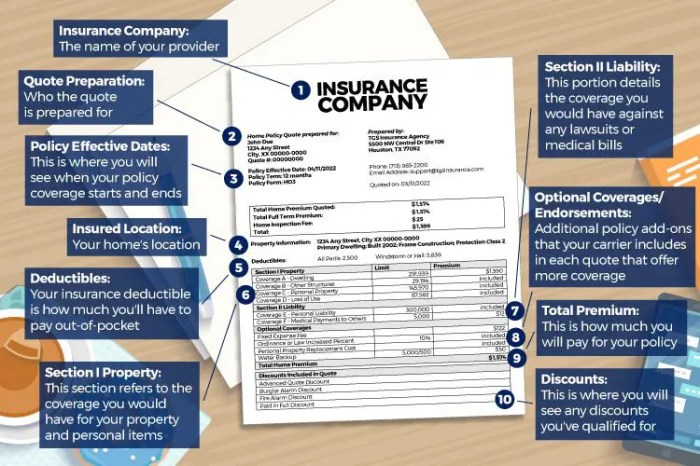

Choosing the right car and home insurance policy requires a clear understanding of its terms, conditions, and coverage options. This section will Artikel key aspects to consider, enabling you to make informed decisions about your protection.

Key Terms and Conditions in Car and Home Insurance Policies

Insurance policies often include complex legal jargon. Understanding key terms is crucial for knowing your rights and responsibilities. For example, in car insurance, “liability coverage” protects you against financial losses if you cause an accident. “Collision coverage” covers damage to your vehicle regardless of fault. “Comprehensive coverage” extends to non-collision events like theft or vandalism. Similarly, home insurance policies feature terms like “actual cash value” (ACV), which pays for the replacement cost minus depreciation, and “replacement cost,” which covers the full cost of replacing damaged items. “Deductible” refers to the amount you pay out-of-pocket before your insurance coverage kicks in. “Premium” is the amount you pay for your insurance policy. Understanding these terms allows for a more informed assessment of your policy’s scope and limitations.

Coverage Options for Car and Home Insurance

Car insurance offers various coverage levels, from basic liability to comprehensive packages. Liability coverage is legally mandated in most jurisdictions and covers damages to other people’s property or injuries sustained by others in an accident you cause. Collision coverage repairs or replaces your vehicle after an accident, regardless of fault. Comprehensive coverage protects against damage from events not involving a collision, such as theft, vandalism, or weather damage. Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who lacks sufficient insurance. Medical payments coverage helps pay for medical bills for you and your passengers regardless of fault.

Home insurance similarly offers varying levels of protection. Basic coverage typically protects against fire, theft, and vandalism. Additional coverage can be added for flood, earthquake, or other specific perils. Liability coverage protects you financially if someone is injured on your property or if you damage someone else’s property. Personal liability coverage protects you from claims of negligence. Optional endorsements can cover valuable items such as jewelry or art. Choosing the right coverage depends on your individual needs and risk assessment.

Filing a Claim for Car and Home Insurance

The claims process varies slightly between car and home insurance, but generally involves these steps: Report the incident to your insurance company as soon as possible. Provide all necessary information, including details of the accident or damage, police reports (if applicable), and contact information of any involved parties. Your insurer will then investigate the claim, potentially requesting additional information or documentation. Once the investigation is complete, your insurer will determine your coverage and the amount they will pay. You may be required to pay your deductible before receiving reimbursement. For car accidents, this might involve appraisals and repair estimates. For home damage, it might involve contractors’ estimates for repairs or replacement.

Hypothetical Scenario: Car Accident and Home Damage

Imagine a scenario where you’re involved in a car accident caused by another driver, resulting in damage to your vehicle and your neighbor’s fence. Simultaneously, a tree falls on your house during a storm. For the car accident, you would first report the incident to your insurance company and provide details including the other driver’s information and police report. Your insurer would investigate, assess damages to your vehicle and the neighbor’s fence, and determine liability. If the other driver is at fault, their insurance would likely cover the damages. If you have collision coverage, your insurer would cover repairs to your car, minus your deductible. For the home damage, you’d report the incident to your home insurer, providing photos and a contractor’s estimate for repairs. Your insurer would investigate, and if covered under your policy, would cover the cost of repairs, minus your deductible. Both claims would follow a similar process: reporting, investigation, assessment, and reimbursement, potentially involving multiple parties and various documentation.

Illustrative Examples

Understanding the cost of car and home insurance can be simplified through visual representations. These examples illustrate how various factors influence premiums and help you make informed decisions.

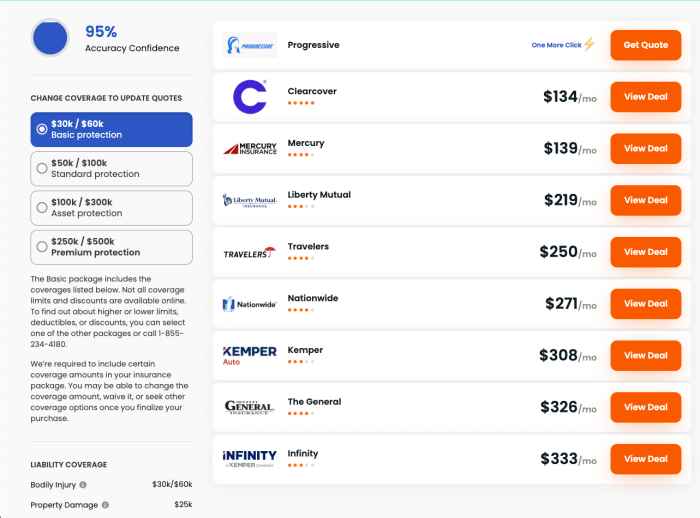

Let’s consider how different coverage levels impact car insurance costs.

Car Insurance Coverage Levels and Costs

Imagine a bar graph. The horizontal axis represents different coverage levels: Liability Only, Liability with Collision, and Comprehensive. The vertical axis represents the annual premium. Liability Only shows the lowest bar, representing the base cost. The bar for Liability with Collision is significantly taller, reflecting the added cost of collision coverage. The tallest bar represents Comprehensive coverage, including collision, theft, and other comprehensive perils, showcasing the highest premium. Now, let’s introduce deductibles. For each coverage level, we can add another bar representing the same coverage but with a higher deductible (e.g., $500 vs. $1000). These bars would be slightly shorter than their lower-deductible counterparts, demonstrating how a higher deductible lowers the premium. For instance, a Liability with Collision policy with a $1000 deductible might cost 15% less annually than the same policy with a $500 deductible. This illustrates the trade-off between upfront cost and out-of-pocket expenses in the event of a claim.

Factors Influencing Home Insurance Premiums

Consider a pie chart illustrating the various factors influencing home insurance premiums. The largest slice of the pie could represent the location of the home. High-risk areas prone to natural disasters (earthquakes, hurricanes, wildfires) will command a larger portion of the premium than a low-risk area. Another significant slice would represent the age and condition of the house. Older homes, requiring more maintenance and potentially having outdated safety features, will typically have higher premiums than newer, well-maintained homes. Smaller slices would represent factors like the home’s security features (alarms, security systems), the value of the home’s contents, and the homeowner’s claims history. A home with advanced security systems and a clean claims history will have a smaller premium than one lacking these features. For example, a home in a high-risk coastal area with an older structure might have a premium 30% higher than a similar-sized home in a low-risk inland area with modern safety features and a good claims history. The pie chart visually represents the relative weight of each factor in determining the overall premium.

Conclusive Thoughts

Finding the perfect car home insurance coverage doesn’t have to be an overwhelming experience. By understanding the key factors influencing premiums, employing smart comparison strategies, and leveraging available discounts, you can secure comprehensive protection while optimizing your budget. Remember to regularly review your policies and shop around to ensure you’re always getting the best value for your money. Take control of your insurance costs and protect what matters most.

FAQ Guide

What is the difference between liability and comprehensive car insurance?

Liability coverage pays for damages you cause to others, while comprehensive coverage protects your own vehicle from damage caused by events like theft or hail.

How does my credit score affect my insurance premiums?

Many insurers consider credit scores as an indicator of risk. A higher credit score often translates to lower premiums.

Can I bundle my renters insurance with my car insurance?

Yes, many insurers offer bundled discounts for renters and car insurance, leading to potential savings.

What is a deductible, and how does it affect my premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually mean lower premiums.

How often should I review my insurance policies?

It’s recommended to review your policies at least annually, or whenever there’s a significant life change (e.g., moving, new car).