Understanding the cost of business general liability insurance is crucial for protecting your enterprise. Many factors influence the final premium, creating a complex equation that balances risk assessment, coverage needs, and market dynamics. This exploration delves into the key elements determining your insurance cost, empowering you to make informed decisions and secure optimal coverage for your business.

From the size and nature of your business to your claim history and chosen coverage level, numerous variables play a significant role. This guide will unravel the intricacies of business liability insurance pricing, providing a clear path to understanding and managing your insurance expenses effectively. We will examine how different insurers approach pricing, the impact of various coverage options, and strategies for obtaining the most competitive quotes.

Factors Influencing Business General Liability Insurance Cost

Several key factors significantly influence the cost of business general liability insurance. Understanding these factors allows businesses to better predict their insurance premiums and make informed decisions about risk management. This understanding can also help businesses negotiate favorable rates with insurers.

Business Size and Insurance Premiums

The size of a business directly correlates with its insurance premiums. Larger businesses, with more employees and greater revenue, typically face higher premiums. This is because larger operations often have a greater potential for liability claims, due to increased activity and a larger potential pool of individuals who could be involved in incidents. A small bakery, for example, is statistically less likely to face a significant liability claim compared to a large construction company. Insurers assess risk based on the scale of operations, considering the potential for accidents and the financial implications of those accidents. Therefore, larger businesses generally pay more for the same level of coverage.

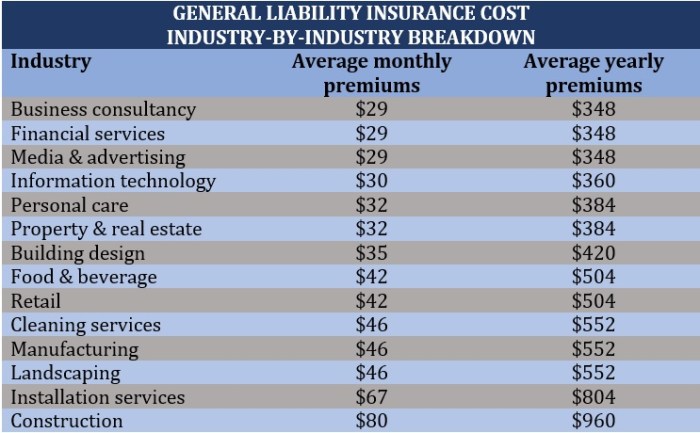

Industry Type and Insurance Cost

Different industries inherently carry different levels of risk. High-risk industries, such as construction, manufacturing, and healthcare, typically pay significantly higher premiums than low-risk industries like retail or office administration. This is because the nature of their work increases the likelihood of accidents, injuries, or property damage. Construction sites, for instance, present a higher risk of workplace accidents than a quiet office setting. The frequency and severity of potential claims directly influence the cost of insurance for each sector.

High-Risk versus Low-Risk Businesses

The distinction between high-risk and low-risk businesses is crucial in determining insurance costs. High-risk businesses, as mentioned, often involve hazardous materials, complex machinery, or activities with a higher probability of accidents. This leads to substantially higher premiums to compensate for the increased likelihood of claims. Low-risk businesses, on the other hand, operate in safer environments with fewer potential liabilities, resulting in lower premiums. A software development company, for example, generally faces lower risk than a chemical manufacturing plant.

Business Activities Increasing Premiums

Certain business activities significantly increase insurance premiums. These activities often involve a higher risk of accidents or liability. For example, businesses that handle hazardous materials, operate heavy machinery, or frequently interact with the public face higher premiums. A landscaping company using heavy equipment, for example, will likely pay more than a consulting firm. Similarly, a restaurant with a history of customer slip-and-fall incidents will face increased premiums compared to a restaurant with a spotless safety record. Any activity that increases the potential for claims directly impacts the cost of insurance.

Insurance Costs by Business Location

The location of a business also plays a significant role in determining insurance premiums. Urban areas often have higher rates due to factors such as higher property values, increased foot traffic, and a greater density of potential claims. Rural areas typically have lower rates because of lower property values and fewer potential incidents.

| Location Type | Average Annual Premium (Example) | Factors Influencing Cost | Example Business |

|---|---|---|---|

| Urban (Large City) | $1,500 – $3,000 | High property values, dense population, increased risk of accidents | Retail store in a busy city center |

| Suburban | $1,000 – $2,000 | Moderate property values, moderate population density, moderate risk | Small office in a suburban business park |

| Rural | $750 – $1,500 | Lower property values, sparse population, lower risk of accidents | Farm supply store in a rural area |

Coverage Options and Their Impact on Cost

Choosing the right general liability insurance coverage involves understanding the various options and how they influence your premium. The level of protection you select directly impacts the cost, so careful consideration is crucial. Balancing the need for comprehensive coverage with budget constraints is key to finding the right policy.

Coverage Limits and Premium Costs

Higher coverage limits generally result in higher premiums. Coverage limits define the maximum amount your insurer will pay for a single claim or over the policy period. For example, a policy with a $1 million per occurrence limit will cost more than a policy with a $300,000 limit. This is because the insurer assumes a greater potential financial risk with higher limits. The increase in premium isn’t always linear; the jump from $1 million to $2 million might be proportionally smaller than the jump from $300,000 to $1 million. Businesses with higher risk profiles, such as those in construction or manufacturing, will typically pay more for the same coverage limits compared to lower-risk businesses, like consulting firms.

Deductible Options and Their Cost Implications

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually leads to lower premiums. This is because you’re accepting more of the financial responsibility for smaller claims. For instance, a $1,000 deductible will likely result in a lower premium than a $500 deductible. However, choosing a very high deductible might not be advisable, as it could leave you vulnerable to significant financial losses if a substantial claim arises. The optimal deductible amount depends on your business’s financial capacity to absorb potential losses. A larger, more established business might comfortably choose a higher deductible, while a smaller startup might prefer a lower one.

Endorsements and Their Cost Impact

Endorsements add specific coverages or modify existing ones. Some endorsements increase costs, while others might decrease them, depending on the risk they address. For example, an endorsement for hired and non-owned auto coverage (covering accidents involving vehicles your employees use for business but that you don’t own) will generally increase your premium. Conversely, an endorsement that excludes certain high-risk activities might lower your premium, as it reduces the insurer’s potential liability. Other examples include product recall coverage (increases cost), professional liability coverage for consultants (increases cost), or pollution cleanup and removal (significantly increases cost). The specific cost impact of endorsements varies greatly depending on the insurer, the type of endorsement, and the business’s risk profile.

Cost Comparison: Basic vs. Comprehensive Coverage

The following table illustrates a simplified comparison of the cost differences between basic and comprehensive general liability insurance coverage for a hypothetical small business. Actual costs will vary significantly depending on factors such as location, industry, and specific coverage details.

| Coverage Feature | Basic Coverage | Comprehensive Coverage | Cost Difference |

|---|---|---|---|

| Coverage Limit (per occurrence) | $300,000 | $1,000,000 | +$300 – $500 (annual premium) |

| Deductible | $1,000 | $500 | +$50 – $100 (annual premium) |

| Additional Insured | Not Included | Included | +$100 – $200 (annual premium) |

| Total Annual Premium (Estimate) | $800 | $1200 – $1400 | +$400 – $600 |

The Role of the Insurance Provider

The insurance provider plays a pivotal role in determining the final cost of your business general liability insurance. Their pricing strategies, financial stability, and the specific coverage options they offer all significantly impact the premium you’ll pay. Understanding these factors is crucial for securing the best possible coverage at a competitive price.

Insurance providers utilize various pricing models, often incorporating sophisticated algorithms that analyze numerous risk factors. This results in a wide range of premiums offered across the industry, even for businesses with similar profiles.

Pricing Strategies of Different Insurance Providers

Different insurers employ distinct pricing strategies. Some focus on competitive pricing to attract a large customer base, while others may prioritize profitability, resulting in higher premiums but potentially better service. Some insurers might specialize in specific industries, allowing them to offer more tailored and potentially less expensive policies to businesses within their niche. Others might use a tiered system, offering discounts for risk mitigation measures implemented by the insured. The pricing approach adopted by an insurer directly affects the cost of coverage for the business owner.

Factors Contributing to Variations in Insurer Pricing

Several factors contribute to the variation in pricing among insurers. These include the insurer’s assessment of the business’s risk profile (industry, location, claims history), the insurer’s operating costs and profit margins, the level of coverage offered, and the specific terms and conditions of the policy. For example, a business located in a high-risk area might face higher premiums than a similar business in a lower-risk location, regardless of the insurer. Similarly, a business with a history of claims will likely pay more than a business with a clean record. The insurer’s financial strength also plays a role; more financially stable companies might offer slightly higher premiums due to their greater capacity to handle large claims.

Cost Effectiveness of Using a Broker Versus Dealing Directly with an Insurer

Using an insurance broker can offer cost-effectiveness in several ways. Brokers often have access to a wider range of insurers and policies, allowing them to compare prices and coverage options more efficiently. Their expertise in navigating the insurance market can also help businesses secure better deals. However, brokers typically charge a commission, which needs to be factored into the overall cost. Dealing directly with an insurer can eliminate the broker’s commission, but might limit access to diverse options and specialized knowledge. The most cost-effective approach depends on the individual business’s needs and resources.

Impact of an Insurer’s Financial Stability on Pricing

An insurer’s financial stability significantly influences pricing. Insurers with strong financial ratings and a proven track record of paying claims tend to charge slightly higher premiums. This is because they have the financial capacity to handle large and unexpected claims, offering greater security to policyholders. Conversely, insurers with weaker financial stability might offer lower premiums to attract business, but this comes with a higher risk that they might not be able to meet their obligations in the event of a significant claim. A business should carefully consider the insurer’s financial health before purchasing a policy, balancing cost savings with the risk of potential insolvency.

Comparison of Three Different Insurers

The following table compares three hypothetical insurers, highlighting their pricing structures and coverage options. Note that these are illustrative examples and actual insurer offerings may vary significantly.

| Insurer | Pricing Structure | Coverage Options | Financial Rating (Hypothetical) |

|---|---|---|---|

| Insurer A | Tiered pricing based on risk assessment; discounts for safety programs. | Comprehensive general liability, product liability, professional liability (add-ons available). | A+ |

| Insurer B | Competitive pricing; focuses on attracting a large customer base. | Basic general liability coverage; limited add-on options. | A- |

| Insurer C | Higher premiums; emphasizes personalized service and high claim payouts. | Highly customizable general liability coverage; extensive add-on options. | AA |

Claim History and Its Effect on Premiums

Your company’s claim history is a significant factor determining your general liability insurance premiums. Insurers meticulously track claims, analyzing both the frequency and severity of incidents to assess risk. A history of many or large claims will likely lead to higher premiums, while a clean record can result in significant savings.

Your past claims directly influence how insurers perceive your risk profile. This assessment isn’t simply about assigning blame; it’s about understanding the likelihood of future claims. Insurers use sophisticated actuarial models to predict future losses based on historical data, and your claim history forms a crucial component of these models.

Impact of Claim Frequency and Severity

The number of claims filed and the size of payouts significantly impact your premiums. Frequent claims, even if individually small, signal a potentially higher risk of future incidents. Conversely, a few large claims indicate a potential for substantial future losses. Insurers often use a points-based system or a formula to calculate premium increases based on both frequency and severity. For example, three small claims might result in a smaller premium increase than a single large claim, even though the total payout might be less in the case of the three smaller claims. The severity of a single claim carries more weight due to its potential to dramatically increase future payouts.

Loss Control Measures and Their Impact on Premiums

Implementing robust loss control measures can demonstrably reduce your premiums. These measures proactively mitigate risks and demonstrate to insurers your commitment to safety. Examples include improved safety training for employees, regular equipment maintenance, and implementing better security systems. By showing a proactive approach to risk management, you provide insurers with evidence of a reduced likelihood of future claims. Many insurers offer discounts for implementing specific loss control measures, such as safety training programs certified by recognized organizations. These discounts can be substantial, significantly offsetting the cost of implementing the safety measures.

Interpreting Policy Terms Related to Claim History

Your insurance policy will likely contain clauses addressing claim history and its impact on your premiums. These clauses may Artikel how claims are reported, the timeframe considered for assessing past claims, and the potential for premium adjustments based on your claim history. Carefully review these clauses to understand the specific criteria your insurer uses. Look for terms such as “experience modification factor” (EMR) or “loss control rating,” which often reflect your claim history’s influence on your premium. Understanding these terms will enable you to better predict your future premiums and manage your risk profile effectively.

Scenario: Impact of a Single Significant Claim

Consider a small bakery with a spotless claim history for five years. Then, a customer slips and falls, resulting in a $50,000 medical claim. This single incident, even though unusual, could significantly impact future premiums. The insurer, considering the previous clean record but recognizing the substantial payout, might increase the premium by 20-30% the following year. The bakery might also face stricter underwriting criteria for renewal, potentially resulting in less favorable terms. This scenario highlights the disproportionate effect a single, severe claim can have on your insurance costs.

Obtaining Quotes and Comparing Costs

Securing the best general liability insurance involves a strategic approach to obtaining and comparing quotes from multiple providers. This process allows you to identify the policy that best balances cost and coverage for your specific business needs. Careful comparison is crucial to avoid overpaying or settling for inadequate protection.

The Process of Obtaining Quotes

Gathering quotes involves contacting several insurance providers, either directly or through online comparison platforms. Start by identifying at least three to five reputable companies with a proven track record in your industry. Provide each provider with consistent and accurate information about your business, including its size, location, industry, and operations. Be prepared to answer questions about your business’s risk profile, such as the number of employees, types of services offered, and any prior claims. Remember to clearly state your coverage requirements to ensure you receive accurate quotes. You can obtain quotes via phone, email, or through their online portals, making sure to keep detailed records of each contact and quote received.

Tips for Effectively Comparing Insurance Quotes

Comparing quotes requires a systematic approach beyond simply focusing on the premium amount. Directly comparing premiums without considering the scope of coverage offered is misleading. Pay close attention to policy limits, deductibles, exclusions, and the specific perils covered. For example, one policy might offer higher liability limits for a slightly higher premium, offering better protection in the event of a significant claim. Another policy might have a lower premium but a higher deductible, meaning you’ll pay more out-of-pocket before the insurance kicks in. Consider using a spreadsheet to organize the information from each quote, facilitating a clear comparison of key features and costs.

Understanding Policy Terms Before Accepting a Quote

Before committing to a policy, meticulously review the policy document in its entirety. Don’t hesitate to seek clarification from the provider on any unclear terms or conditions. Pay particular attention to exclusions, which detail situations or events not covered by the policy. For instance, some policies may exclude coverage for specific types of activities or locations. Understanding these limitations is vital to ensuring the policy adequately protects your business. Consider seeking advice from an independent insurance broker who can help you navigate the complexities of different policy terms.

Key Factors to Consider When Choosing an Insurance Provider

Selecting an insurance provider involves more than just price. Consider the provider’s financial stability, reputation, and customer service. Research the insurer’s ratings from independent agencies like A.M. Best to gauge their financial strength. Read online reviews and testimonials to assess their customer service responsiveness and claims handling process. A financially stable provider with a history of fair claims handling will provide peace of mind in case you need to file a claim. Choose a provider that offers clear communication and readily available support.

Checklist for Evaluating and Comparing Insurance Quotes

It is essential to have a structured approach when evaluating quotes. The following checklist will help ensure you don’t overlook crucial details.

- Premium Amount: The total annual cost of the policy.

- Liability Limits: The maximum amount the insurer will pay for a covered claim.

- Deductible: The amount you pay out-of-pocket before the insurance coverage begins.

- Coverage Exclusions: Specific events or situations not covered by the policy.

- Policy Period: The duration of the insurance coverage.

- Insurer’s Financial Strength Rating: A rating from an independent agency reflecting the insurer’s financial stability.

- Customer Service Reputation: Reviews and testimonials reflecting the insurer’s responsiveness and claims handling.

- Policy Renewal Terms: Conditions for renewing the policy at the end of the term.

- Additional Coverage Options: Available add-ons, such as professional liability or equipment coverage.

- Payment Options: Available methods for paying premiums.

Illustrative Examples of Insurance Costs

Understanding the cost of general liability insurance requires considering several factors. The examples below illustrate how these factors influence the final premium, showcasing the variability across different business types and risk profiles. Note that these are illustrative examples and actual costs can vary significantly depending on specific circumstances and the insurer.

General Liability Insurance Cost for a Small Retail Business

Let’s consider a small bookstore with three employees located in a low-crime area. This business has a good safety record with no prior claims. Their annual revenue is approximately $100,000. A general liability policy with a $1 million liability limit might cost them between $300 and $700 annually. The lower end reflects a strong safety record and a low-risk location, while the higher end accounts for potential unforeseen incidents. Factors such as the specific coverage options chosen (e.g., higher limits) and the insurer’s pricing model would also affect the final cost.

General Liability Insurance Cost for a Large Manufacturing Company

A large manufacturing company with 200 employees, operating complex machinery, and handling hazardous materials will face significantly higher insurance costs. This company, located in an industrial park, has had some past claims related to minor workplace injuries. Their annual revenue is $10 million. Their general liability insurance premium could range from $10,000 to $30,000 or more annually. The higher cost reflects the increased risk associated with the nature of their operations, the number of employees, and their claim history. The specific coverage limits chosen, and the complexity of their operations, will significantly impact the premium.

Cost Difference: Strong vs. Poor Safety Record

Consider two identical restaurants, both with similar annual revenues and locations. Restaurant A maintains a robust safety program, has implemented comprehensive training, and has had no claims in the past five years. Restaurant B, on the other hand, has had several claims due to slips, trips, and falls, resulting from a lack of preventative measures. Restaurant A might pay an annual premium of $500-$800, while Restaurant B could face premiums of $1,500-$2,500 or more due to their poor safety record and increased risk profile. This example highlights the significant impact of a strong safety culture on insurance costs.

Factors Combining to Determine Final Cost

The final cost of general liability insurance is a complex calculation. For example, a small bakery with annual revenue of $50,000, located in a high-traffic area, with one employee and a clean safety record, might pay around $400-$600 annually. However, if this bakery were to increase its revenue to $200,000, expand its operations, hire additional employees, or experience a claim, the premium would likely increase substantially. The final cost is a dynamic interplay of factors, including revenue, number of employees, location, industry type, claim history, and the specific coverage limits selected. Each factor contributes to the overall risk assessment, ultimately determining the premium.

Final Summary

Securing adequate business general liability insurance is a strategic investment, safeguarding your business against potential financial losses. By carefully considering the factors influencing premium costs, comparing quotes from multiple providers, and understanding your coverage needs, you can achieve cost-effective protection tailored to your specific circumstances. Remember, proactive risk management and a clear understanding of your policy terms are essential for minimizing your insurance costs and maximizing your business’s resilience.

FAQ Insights

What is the average cost of business general liability insurance?

There’s no single average cost. Premiums vary significantly based on factors like business type, location, revenue, and risk profile. Expect a range from a few hundred to several thousand dollars annually.

Can I get liability insurance if my business has a history of claims?

Yes, but your premiums will likely be higher. Insurers consider claim history a key indicator of risk. Implementing loss control measures can help mitigate this impact.

How often should I review my business liability insurance policy?

Annually, at minimum. Your business needs and risk profile can change, requiring adjustments to your coverage and potentially impacting your premium.

What happens if I don’t have general liability insurance and a claim is filed against my business?

You could face significant legal fees and financial liabilities. The costs of defending yourself and paying settlements or judgments could severely impact your business’s financial health.