Planning for the inevitable can be daunting, but understanding the differences between burial insurance and life insurance is crucial for securing your family’s financial future. Both offer crucial protection, yet they serve distinct purposes and operate under different principles. This comparison will illuminate the key distinctions, enabling you to make informed decisions based on your specific needs and circumstances.

We’ll explore the core features of each type of insurance, comparing coverage, costs, application processes, and tax implications. Through real-world scenarios, we aim to clarify how these policies can provide financial relief and security during difficult times. By the end, you’ll have a clearer understanding of which policy—or perhaps even a combination—best suits your individual requirements.

Defining Burial Insurance and Life Insurance

Burial insurance and life insurance, while both designed to provide financial assistance after death, differ significantly in their scope and purpose. Understanding these differences is crucial for making informed decisions about financial planning for the future. This section will clarify the key distinctions between these two types of insurance.

Burial Insurance Coverage Details

Burial insurance, also known as final expense insurance, is a specific type of life insurance policy designed to cover the costs associated with a funeral and burial. Its core purpose is to alleviate the financial burden on surviving family members during a difficult time. Typical coverage includes funeral home services, embalming, cremation costs (if applicable), casket, burial plot, and sometimes even headstone costs. The policy payout is typically a fixed amount, directly addressing the expenses related to the final arrangements.

Common Exclusions in Burial Insurance Plans

While burial insurance aims to cover funeral expenses, several items are often excluded from coverage. These exclusions can vary between insurers and policies but commonly include things like outstanding debts, medical bills unrelated to the terminal illness, and other expenses not directly tied to funeral arrangements. For example, a policy might not cover the cost of a large memorial gathering or a lavish headstone that exceeds the policy’s limit. It’s essential to review the specific policy document to understand its limitations.

Burial Insurance versus Life Insurance Death Benefit Payout

Burial insurance policies usually offer a relatively small, fixed death benefit, directly tied to the anticipated costs of burial. This payout is typically paid out as a lump sum to the designated beneficiary. In contrast, life insurance policies, depending on the type, can offer significantly larger death benefits, payable as a lump sum or in installments. The death benefit in life insurance is not limited to funeral expenses; it can be used to cover any financial obligations left behind, such as mortgages, debts, or to provide ongoing financial support for dependents.

Life Insurance Definition and Types

Life insurance is a contract between an individual (the policyholder) and an insurance company, providing a death benefit to designated beneficiaries upon the policyholder’s death. Various types of life insurance exist, each with its own features and benefits. Term life insurance, for example, provides coverage for a specific period (the term), while whole life insurance offers lifelong coverage and often includes a cash value component that grows over time. Other types include universal life insurance and variable life insurance, each with varying degrees of flexibility and investment options. The choice of policy depends on individual needs and financial goals.

Cost Comparison

Understanding the financial implications is crucial when choosing between burial insurance and life insurance. Both offer financial protection, but their costs and benefits differ significantly, influenced by several factors. This section will delve into a detailed cost comparison, examining average premiums and highlighting the key elements that affect pricing for each type of policy.

Average Monthly Premiums

The cost of burial insurance and life insurance varies widely depending on factors such as age, health, coverage amount, and the type of policy. The following table provides estimated average monthly premiums. Note that these are illustrative examples and actual premiums will vary significantly depending on the insurer and individual circumstances. It’s crucial to obtain personalized quotes from multiple insurance providers.

| Age Group | Burial Insurance Premium | Life Insurance Premium (Term) | Life Insurance Premium (Whole) |

|---|---|---|---|

| 30-35 | $20 – $50 | $15 – $40 | $75 – $150 |

| 40-45 | $30 – $75 | $25 – $60 | $100 – $200 |

| 50-55 | $50 – $120 | $40 – $100 | $150 – $300 |

| 60-65 | $80 – $180 | $75 – $150+ | $250 – $450+ |

Factors Influencing Burial Insurance Costs

Several factors contribute to the cost of burial insurance policies. The most significant is the amount of coverage desired. Higher coverage amounts naturally lead to higher premiums. The age of the applicant is another critical factor; older applicants typically pay more due to a higher likelihood of needing the benefits sooner. Health status also plays a role; individuals with pre-existing conditions may face higher premiums or even be denied coverage. Finally, the insurer’s specific underwriting practices and the policy’s terms and conditions will impact the final cost. For instance, some policies may offer additional benefits, such as grief counseling or pre-need arrangements, which may increase the premium.

Factors Determining Life Insurance Costs

The cost of life insurance policies is determined by a more complex interplay of factors. Similar to burial insurance, the coverage amount is a primary determinant. Larger death benefits necessitate higher premiums. Age and health are also significant factors, with older and less healthy individuals generally paying more. However, the type of policy significantly impacts the cost. Term life insurance, which provides coverage for a specific period, is typically much more affordable than whole life insurance, which offers lifelong coverage and a cash value component. Lifestyle factors, such as smoking and occupation, can also influence premiums. For example, individuals with high-risk occupations may pay more. Finally, the insurer’s risk assessment and the policy’s specific features contribute to the overall cost.

Potential Cost Savings and Drawbacks

Burial insurance offers a lower premium compared to life insurance, making it accessible to those with limited budgets. However, the coverage is limited solely to funeral expenses. Life insurance, especially term life, can provide substantial financial protection for dependents, but the premiums are generally higher. Whole life insurance offers lifelong coverage and a cash value component, but comes with significantly higher premiums. The cost savings of burial insurance might be offset by the limited benefits, while the higher cost of life insurance provides broader financial security for loved ones. Careful consideration of individual needs and financial resources is crucial when choosing between these two options.

Coverage and Benefits

Understanding the coverage and benefits offered by burial insurance and life insurance is crucial for making an informed decision. Both types of policies offer a death benefit, but the nature and use of that benefit differ significantly, impacting how they address the financial burden of end-of-life expenses. This section clarifies these differences.

Burial Insurance Coverage

A typical burial insurance policy provides a predetermined, relatively modest sum of money specifically designed to cover funeral and burial expenses. This amount is usually sufficient to cover the costs of a basic funeral service, including embalming, cremation or casket, a viewing or memorial service, and transportation of the remains. Some policies may also include a small amount to cover other immediate expenses like grief counseling or administrative fees. However, more elaborate funeral arrangements or significant outstanding debts are typically not covered by these policies. The death benefit is explicitly intended for final expense coverage, not broader financial security for the beneficiaries.

Term Life Insurance Coverage

Term life insurance provides a death benefit for a specified period (the term), usually ranging from 10 to 30 years. Unlike burial insurance, the death benefit is considerably larger and can be tailored to meet the insured’s financial needs. This coverage is not specifically designated for funeral expenses; instead, the benefit is payable to the named beneficiaries and can be used for any purpose they deem appropriate, including funeral costs, outstanding debts, mortgage payments, children’s education, or other financial obligations. The flexibility of using the funds is a key differentiator. For example, a $250,000 term life insurance policy could easily cover funeral expenses and leave a substantial sum for the family’s financial security.

Whole Life Insurance Coverage

Whole life insurance, unlike term life, provides lifelong coverage and accumulates a cash value component that grows over time. The death benefit is typically larger than that of a burial insurance policy or even a comparable term life policy. The death benefit can be used for any purpose, similar to term life insurance. Furthermore, the cash value component can be accessed during the policyholder’s lifetime, although this will reduce the eventual death benefit. This feature adds an element of living benefits that are absent in burial and term life insurance. For instance, a family could borrow against the cash value to cover unexpected medical expenses, without having to surrender the entire policy.

Death Benefit Usage

The primary difference lies in the intended use of the death benefit. Burial insurance payouts are almost exclusively used to cover funeral and burial costs. In contrast, the death benefits from term and whole life insurance policies offer far greater flexibility. Beneficiaries can utilize the funds to settle outstanding debts, provide for dependents, fund education, or address any other financial need, with funeral expenses being just one possible application. The substantial difference in benefit amount between these policy types directly reflects this difference in intended usage.

Eligibility and Application Process

Securing a burial insurance or life insurance policy involves understanding the eligibility requirements and navigating the application process. Both processes share similarities, but also have key differences depending on the insurer and the type of policy sought. Generally, eligibility hinges on factors like age, health, and financial stability. The application process, however, varies in complexity and required documentation.

Eligibility criteria for burial insurance are generally less stringent than for traditional life insurance. This is because burial insurance policies typically offer lower coverage amounts. Applicants are usually required to complete a short application form, which may involve providing basic health information. While pre-existing conditions might not automatically disqualify an applicant, they could influence the policy’s terms or premium. Life insurance, on the other hand, often involves a more rigorous medical underwriting process, including medical examinations and extensive health history reviews, to assess risk and determine premiums. The higher the coverage amount, the more thorough the underwriting process tends to be.

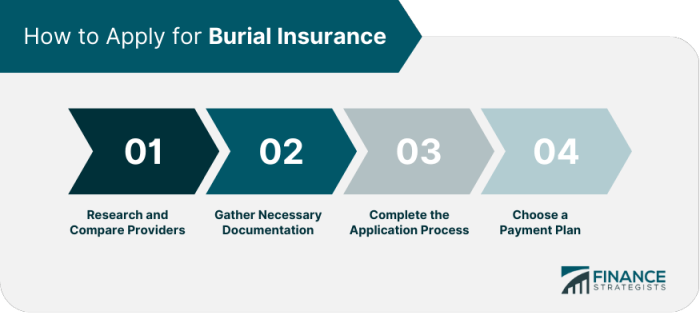

Burial Insurance Application Process

The steps involved in obtaining a burial insurance policy are typically straightforward and can be completed relatively quickly. This makes it an accessible option for individuals seeking basic coverage for funeral expenses.

- Complete an Application: This usually involves providing basic personal information, such as name, address, date of birth, and health status (often a simple questionnaire).

- Provide Necessary Documentation: This might include a copy of your driver’s license or other government-issued identification.

- Pay the First Premium: Once the application is approved, the first premium payment secures the policy.

- Receive Policy Documents: The insurance company will then send the official policy documents outlining the terms and conditions.

Life Insurance Application Process

The application process for life insurance is generally more involved than for burial insurance, due to the higher coverage amounts and associated risks. The process can vary significantly depending on the type of life insurance policy (term, whole, universal, etc.) and the insurer.

- Complete a Detailed Application: This application will request extensive personal and medical information, including a comprehensive health history.

- Undergo a Medical Examination: Depending on the policy amount and applicant’s health, a medical examination may be required. This usually involves blood and urine tests, as well as a physical examination by a physician.

- Provide Additional Documentation: This might include medical records, financial information, and employment details.

- Underwriting Review: The insurance company will review the application and medical information to assess the risk and determine eligibility and premium rates.

- Policy Issuance: Once the underwriting process is complete, and the application is approved, the policy will be issued.

Tax Implications and Estate Planning

Understanding the tax implications of both burial and life insurance is crucial for effective estate planning. Both types of insurance can impact how your assets are distributed after your death, and choosing the right type can significantly influence your beneficiaries’ financial burden. This section will Artikel the tax treatment of death benefits and how each insurance type can be integrated into a comprehensive estate plan.

Tax Implications of Burial Insurance Death Benefits

Death benefits from burial insurance policies are generally not subject to federal income tax. This is because the primary purpose of burial insurance is to cover funeral and burial expenses, which are considered personal expenses rather than taxable income. However, it’s important to note that state laws may vary, and some states might impose inheritance or estate taxes on the death benefit, depending on the size of the estate and the beneficiary’s relationship to the deceased. For example, a large death benefit paid to a non-spouse beneficiary might be subject to state estate tax in some jurisdictions. Always consult with a tax professional and review your state’s specific laws.

Tax Implications of Life Insurance Death Benefits

The tax implications of life insurance death benefits are more complex and depend largely on how the policy is structured and owned. Generally, death benefits paid to a named beneficiary are tax-free. This applies to both term and whole life insurance. However, if the policy was purchased as part of a business arrangement or if the policy’s cash value has exceeded the premiums paid (in whole life policies), certain tax implications might arise. For instance, if the policy owner was also the insured and the death benefit is paid to their estate, it may be included in the gross estate for estate tax purposes. Conversely, if the policy is owned by someone other than the insured, the death benefit may be excluded from the insured’s estate. This highlights the importance of proper ownership structuring.

Impact of Burial and Life Insurance on Estate Planning

Burial insurance primarily serves to cover funeral and burial costs, thereby reducing the financial burden on surviving family members. This is a straightforward way to ensure final expenses are taken care of without impacting other estate assets. In contrast, life insurance offers a much broader range of estate planning possibilities. A life insurance policy can provide a significant sum of money to beneficiaries, which can be used to pay off debts, cover estate taxes, fund education, or provide ongoing financial support. The death benefit can also be used to fund a trust, ensuring that assets are distributed according to the policy owner’s wishes.

Examples of Insurance in Estate Planning

Consider a scenario where an individual has significant debts and wants to ensure their family is not left with financial burdens. A life insurance policy with a substantial death benefit can be included in their estate plan to pay off these debts upon their death. This protects the family’s assets and allows them to move forward without the added stress of debt repayment. Another example involves a couple with young children. A life insurance policy can be used to create a trust fund that will provide for the children’s education and living expenses until they reach adulthood. This guarantees the children’s financial security, regardless of the parents’ circumstances. In contrast, a burial insurance policy might be used to cover funeral costs in a situation where a person has limited assets but wants to ensure their final arrangements are taken care of without burdening their family. The combination of both types of insurance provides a comprehensive approach to estate planning.

Illustrative Scenarios

Understanding the practical applications of burial insurance and life insurance is crucial. The following scenarios illustrate how these products can provide financial security and peace of mind in different life circumstances.

Burial Insurance Benefits for a Low-Income Individual

Maria, a 65-year-old retired waitress living on a fixed income, worries about the financial burden of her funeral expenses on her family. She has limited savings and relies on Social Security. A burial insurance policy, with its relatively low premiums, offers her a way to pre-plan and pre-pay for her funeral arrangements. This policy ensures her family won’t face unexpected costs at a time of grief. The financial relief provided is significant, as it prevents her family from having to deplete their own meager savings or incur debt to cover her funeral. The policy covers basic funeral services, such as embalming, cremation or burial, and a simple casket, alleviating a substantial financial stressor for her loved ones.

Life Insurance Benefits for a Family with Young Children

John and Sarah, a young couple with two small children, understand the importance of financial security for their family’s future. John is the primary breadwinner, and Sarah stays home to care for their children. A life insurance policy, in this case, provides a crucial safety net. If John were to pass away unexpectedly, the policy’s death benefit would provide a substantial sum to Sarah. This money would cover immediate expenses like funeral costs, but more importantly, it would provide financial support for their children’s education, living expenses, and other long-term needs until Sarah is able to re-enter the workforce or find alternative financial support. The financial security provided by the life insurance policy ensures the children’s well-being and prevents the family from facing financial hardship during a difficult time.

Comparing Burial Insurance and Life Insurance Outcomes in Unexpected Death

Consider two individuals, both unexpectedly passing away: David had a burial insurance policy, and Robert had a life insurance policy. David’s burial insurance policy covered the costs of his funeral and burial. His family was relieved of this immediate financial burden. However, they still faced the challenge of covering ongoing living expenses and other potential debts. Robert, on the other hand, had a substantial life insurance policy. His family received a large death benefit that not only covered funeral expenses but also provided a significant financial cushion to cover mortgage payments, living expenses, children’s education, and other long-term financial needs. This illustrates the difference in scope of coverage: burial insurance addresses end-of-life expenses, while life insurance provides broader financial protection for the surviving family members. The financial implications are stark; David’s family faced immediate and ongoing financial strain, while Robert’s family received substantial long-term financial security.

Concluding Remarks

Choosing between burial insurance and life insurance, or even utilizing both, ultimately hinges on individual financial situations and long-term goals. While burial insurance offers a focused approach to covering funeral expenses, life insurance provides broader financial protection for dependents. Careful consideration of your needs, family structure, and financial resources is paramount in making the most suitable choice. This comprehensive comparison has aimed to equip you with the necessary knowledge to navigate this important decision with confidence.

General Inquiries

What is the difference in the payout structure between burial and life insurance?

Burial insurance typically pays a fixed amount directly to a funeral home, while life insurance provides a lump sum death benefit to the designated beneficiary, which can be used for any purpose.

Can I have both burial and life insurance?

Yes, many people choose to have both types of insurance to ensure comprehensive financial protection for their families.

What happens if I cancel my burial insurance policy?

The policy’s terms will dictate the outcome. You may receive a refund of premiums paid, minus any fees, or you may receive no refund. Check your policy documents for specifics.

Are there age limits for burial insurance?

Yes, there are typically age limits, and premiums may increase with age. Eligibility criteria vary by insurer.

How does my health affect my ability to get burial or life insurance?

Your health status can impact your eligibility and premium rates for both types of insurance. Pre-existing conditions may lead to higher premiums or denial of coverage.