Securing your family’s financial future is paramount, and understanding whole life insurance is a crucial step in that process. This guide delves into the complexities of choosing the best whole life insurance policy, navigating the various types, features, and providers to help you make an informed decision that aligns perfectly with your individual needs and long-term goals. We’ll explore the nuances of policy selection, emphasizing the importance of careful consideration and comparison before committing to a plan.

From understanding the factors that define a “best” policy based on individual circumstances to comparing different policy types like traditional, variable, and universal whole life insurance, we’ll equip you with the knowledge to confidently select a policy that offers optimal protection and financial growth. We’ll also discuss crucial factors like age, health, financial goals, and risk tolerance, highlighting their influence on policy suitability. By the end, you’ll possess a clear understanding of the costs, benefits, and long-term implications of your choice.

Defining “Best” Whole Life Insurance

Finding the “best” whole life insurance policy isn’t about selecting a single, universally superior product. Instead, it’s about identifying the policy that most effectively aligns with an individual’s unique financial goals, risk tolerance, and life circumstances. The ideal policy for a young family will differ significantly from the optimal choice for a retiree nearing the end of their working life.

Defining the “best” policy hinges on understanding the interplay between individual needs and the features offered by different policies. A needs-based definition prioritizes the policy’s ability to meet specific financial objectives, such as providing a guaranteed death benefit to cover outstanding debts or ensuring a legacy for heirs. Conversely, a feature-based definition emphasizes specific policy characteristics, such as high cash value growth or flexible premium payment options. Both approaches are valid, but a truly “best” policy successfully integrates both needs and desired features.

Factors Contributing to a “Best” Policy

Several key factors determine whether a whole life insurance policy is considered “best” for a particular individual. These include the level of death benefit required, the affordability of premiums, the rate of cash value accumulation, the policy’s flexibility, and the financial strength and reputation of the issuing insurance company. For example, a young professional might prioritize a policy with lower premiums and a higher cash value growth potential to build wealth over time. In contrast, an older individual might prioritize a policy with a larger guaranteed death benefit to ensure adequate financial security for their family.

Needs-Based vs. Feature-Based Definitions

The distinction between needs-based and feature-based approaches is crucial. A needs-based approach focuses on the fundamental purpose of life insurance: providing financial protection for dependents in the event of the policyholder’s death. The “best” policy in this context is the one that provides sufficient coverage at a manageable cost. A feature-based approach, however, might prioritize aspects like the ability to borrow against the cash value or the inclusion of riders offering additional benefits. The “best” policy in this case is the one that offers the most attractive combination of features, even if it means a slightly higher premium or lower death benefit.

Policy Features and Life Stages

The relative importance of different policy features often shifts across various life stages.

| Policy Feature | Young Adult (20s-30s) | Established Adult (40s-50s) | Retirement (60s+) |

|---|---|---|---|

| Death Benefit | Moderate; focus on building wealth | Higher; protect family and legacy | Potentially lower; estate planning considerations |

| Premium Payments | Lower premiums preferred; flexibility valued | More stable income; higher premiums potentially acceptable | Lower premiums preferred; potential for reduced payments |

| Cash Value Accumulation | High growth potential prioritized | Moderate growth; potential for withdrawals | Access to funds for retirement income; lower growth acceptable |

Types of Whole Life Insurance Policies

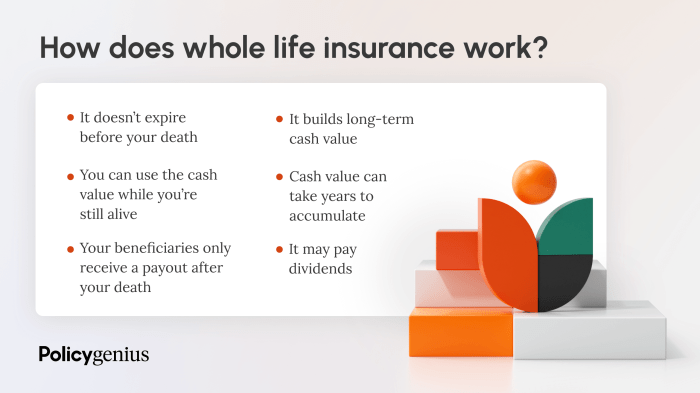

Whole life insurance offers lifelong coverage, but the specific type of policy you choose significantly impacts your premiums, investment potential, and overall benefits. Understanding the differences between the main types is crucial for making an informed decision that aligns with your financial goals and risk tolerance. This section will explore the key characteristics of three common whole life policy variations: traditional whole life, variable whole life, and universal whole life.

Traditional Whole Life Insurance

Traditional whole life insurance is a straightforward, fixed-premium policy. Your premiums remain constant throughout your life, guaranteeing lifelong coverage and a fixed death benefit. The cash value grows at a predetermined rate, usually a modest, stable interest rate set by the insurance company. This predictable nature makes it a reliable choice for those prioritizing financial stability and long-term security.

- Advantages: Fixed premiums, guaranteed death benefit, predictable cash value growth, lifelong coverage.

- Disadvantages: Higher premiums compared to term life insurance, lower potential for cash value growth compared to variable whole life.

Variable Whole Life Insurance

Variable whole life insurance offers a higher potential for cash value growth, but with greater risk. Instead of a fixed interest rate, your cash value is invested in sub-accounts similar to mutual funds, offering a range of investment options with varying degrees of risk. This means your death benefit and cash value can fluctuate depending on the performance of your chosen investments. It requires a more active role in managing your investment portfolio.

- Advantages: Potential for higher cash value growth, investment flexibility.

- Disadvantages: Higher risk due to market fluctuations, more complex to manage, potential for lower returns than expected.

Universal Whole Life Insurance

Universal whole life insurance provides more flexibility in premium payments and death benefit adjustments. You can adjust your premium payments within certain limits, and the cash value grows at a current interest rate that is typically adjusted periodically, reflecting market conditions. This allows for greater control over your policy, but it also requires careful monitoring and management to ensure consistent coverage.

- Advantages: Flexible premium payments, potential for higher cash value growth than traditional whole life (depending on interest rates), ability to adjust death benefit within policy limits.

- Disadvantages: Requires careful monitoring to ensure adequate coverage, interest rate fluctuations can affect cash value growth, potential for policy lapse if premiums are not maintained.

Factors to Consider When Choosing a Policy

Selecting the right whole life insurance policy is a significant financial decision requiring careful consideration of several interacting factors. The optimal policy will depend on your unique circumstances and priorities. Prioritizing these factors correctly ensures you secure the most appropriate and beneficial coverage.

Choosing a whole life insurance policy involves a careful assessment of your personal circumstances and long-term goals. Several key factors must be weighed to determine the most suitable policy. The interplay between these factors can significantly impact the type and amount of coverage you need.

Age and Health

Your age and current health status are paramount in determining eligibility and premium costs. Insurers assess risk based on these factors. Younger individuals, generally in good health, qualify for lower premiums than older individuals or those with pre-existing health conditions. For example, a 30-year-old with no health issues will likely receive a much more favorable rate than a 60-year-old with a history of heart problems. This is because the insurer’s risk of having to pay out a death benefit is lower for the younger, healthier individual. The underwriting process will thoroughly examine medical history and potentially require medical examinations to accurately assess risk.

Financial Goals and Resources

Your financial goals directly influence the type and amount of coverage you need. Consider your long-term objectives, such as leaving a legacy for your heirs, funding your children’s education, or ensuring your spouse’s financial security. The policy’s death benefit should align with these goals. Simultaneously, assess your current financial resources and ability to consistently pay premiums. A policy with a higher death benefit will naturally command higher premiums. Therefore, it’s crucial to find a balance between adequate coverage and affordability. For instance, someone planning for a substantial inheritance might opt for a higher death benefit, even if it means paying a larger premium.

Risk Tolerance

Your risk tolerance plays a crucial role in selecting a policy’s features. Some whole life policies offer features beyond the death benefit, such as cash value accumulation. If you are risk-averse, you might prioritize a policy with guaranteed cash value growth, even if the rate of return is modest. Conversely, someone with a higher risk tolerance might consider policies with higher potential returns, even if they carry a degree of investment risk. The cash value component, while providing a degree of security, should be considered in the context of your overall investment strategy and risk tolerance. It’s important to understand the potential trade-offs between guaranteed growth and higher potential returns.

Understanding Policy Costs and Benefits

Whole life insurance premiums, unlike term life insurance, are designed to cover the death benefit and build cash value over the policyholder’s lifetime. Understanding the components and how they interact is crucial for making an informed decision. This section will detail the factors that influence premium calculations and illustrate how policy features affect the overall cost and cash value growth.

The components of a whole life insurance premium are multifaceted. A significant portion covers the cost of the death benefit, which is the guaranteed payout to your beneficiaries upon your death. This cost is influenced by factors such as your age, health, gender, and the amount of coverage you select. A larger death benefit naturally leads to a higher premium. Another crucial component is the cost of building cash value. This cash value grows tax-deferred and can be accessed through loans or withdrawals, though this impacts the death benefit. Finally, administrative and operating expenses of the insurance company are factored into the premium. These costs cover the company’s overhead, marketing, and investment management. The specific allocation of these components varies between insurers and policy types.

Premium Determination Factors

Several factors intricately influence the calculation of your whole life insurance premiums. Your age at the time of application is a primary driver, with younger applicants typically receiving lower premiums due to their longer life expectancy. Your health status, as assessed through a medical examination and questionnaire, significantly impacts the risk assessment and thus the premium. Pre-existing conditions or high-risk lifestyle choices can lead to higher premiums. The amount of coverage you choose directly correlates with the premium; a higher death benefit necessitates a higher premium. The type of whole life policy also plays a role. Participating whole life policies, which offer dividends, may have slightly higher premiums initially, but dividends can offset some of the cost over time. Finally, the insurer’s own financial strength and operating costs influence the premium they charge.

Impact of Policy Features on Cost

Different policy features can significantly impact the overall cost of a whole life insurance policy. For instance, adding riders, such as a waiver of premium rider (which waives premiums if you become disabled) or a long-term care rider, will increase the premium. These riders provide additional benefits but come at an added cost. Similarly, choosing a policy with a higher cash value growth rate, often achieved through higher premiums, will result in a greater accumulation of cash value but also higher overall costs. Conversely, selecting a policy with a lower death benefit will lead to lower premiums, but also reduce the financial protection for your beneficiaries.

Cash Value Accumulation Example

Let’s consider a hypothetical example to illustrate cash value accumulation. Assume a 35-year-old male purchases a $250,000 whole life policy with an annual premium of $2,000. Under a conservative growth assumption of 4% annual interest on the cash value, the cash value might accumulate to approximately $50,000 after 10 years and $150,000 after 25 years. However, if the growth rate is higher, say 6%, the cash value could reach approximately $70,000 after 10 years and over $250,000 after 25 years. These are simplified illustrations; actual cash value growth depends on the policy’s specifics and the insurer’s investment performance. It’s important to remember that these are estimates, and actual results may vary. A policy illustration provided by the insurer will provide a more accurate projection based on their specific assumptions.

Comparing Policy Providers and Features

Choosing the “best” whole life insurance policy isn’t solely about the features offered; it’s also critically dependent on the provider offering those features. Different companies have varying financial strengths, customer service reputations, and approaches to policy design. A thorough comparison across multiple providers is essential to ensure you’re getting the most suitable and cost-effective policy for your needs.

Comparing policies from different insurance providers allows you to identify the best combination of features, benefits, and cost. This comparative analysis empowers you to make an informed decision, ensuring you select a policy that aligns with your financial goals and risk tolerance. Ignoring this step can lead to overpaying for coverage or settling for a policy lacking essential features.

A Method for Objective Policy Comparison

An objective comparison requires a structured approach. Begin by identifying your key priorities – death benefit amount, cash value growth potential, premium affordability, and riders (additional benefits). Then, obtain quotes from at least three different insurers, ensuring you’re comparing apples to apples (i.e., similar policy types and coverage amounts). Create a spreadsheet or use a comparison tool to organize the information. Focus on key metrics such as the annual premium, projected cash value growth over time (using illustrative examples provided by the insurer), the surrender charges (penalties for early withdrawal), and the availability of desired riders. Finally, consider the insurer’s financial rating from agencies like A.M. Best or Moody’s – a higher rating indicates greater financial stability.

Illustrative Comparison of Insurer Policies and Costs

The following table illustrates how different insurers might structure their whole life policies and associated costs. Remember, these are illustrative examples and actual figures will vary based on individual factors like age, health, and policy specifics. Always obtain personalized quotes from each insurer.

| Insurer | Annual Premium (Example: $50,000 Death Benefit) | Projected Cash Value Growth (Year 10, Example) | Surrender Charges (Example: Year 5) | Available Riders (Examples) |

|---|---|---|---|---|

| Insurer A | $1,500 | $10,000 | 10% | Accidental Death Benefit, Long-Term Care Rider |

| Insurer B | $1,700 | $12,000 | 8% | Waiver of Premium, Guaranteed Insurability |

| Insurer C | $1,300 | $8,000 | 12% | Accidental Death Benefit |

Illustrating Policy Performance with Visuals

Understanding the long-term growth potential of a whole life insurance policy’s cash value is crucial for assessing its value. Visual representations, like graphs, can effectively demonstrate this growth over time and help individuals understand the financial implications of their investment.

A graph illustrating cash value growth would typically show the policy’s cash value on the vertical (Y) axis and the time elapsed (in years) on the horizontal (X) axis. Data points would represent the cash value at the end of each year, reflecting the accumulation of premiums, interest earned, and any dividends paid. The trend line would generally show an upward curve, indicating the compounding effect of interest and dividends over time. The steepness of the curve would depend on factors such as the premium amount, the policy’s interest rate, and the dividend payout schedule. For example, a graph might show a starting cash value of $0 at year 0, increasing to $5,000 after 5 years, $12,000 after 10 years, and so on, illustrating exponential growth. This visual representation helps to easily compare different policy options and understand the potential long-term returns.

Cash Value Growth Over Time: A Sample Whole Life Policy

Let’s consider a hypothetical 30-year-old purchasing a $100,000 whole life policy with an annual premium of $2,000. Assume a guaranteed interest rate of 3% and an average annual dividend of 2%. The graph would depict the cash value accumulating over time. The X-axis would represent the years (0 to 30), and the Y-axis would represent the cash value in dollars. The data points would plot the cash value at the end of each year, reflecting the accumulated premiums, interest, and dividends. The line connecting these points would demonstrate an upward, slightly accelerating curve, showing the power of compounding. The graph would clearly illustrate how the cash value grows steadily, providing a significant nest egg by retirement. The visual representation makes it easier to grasp the long-term financial benefits compared to simply looking at numerical data.

Hypothetical Scenario Illustrating Whole Life Policy Benefits

Consider Sarah, a 35-year-old entrepreneur starting her own business. She purchases a $500,000 whole life policy with a yearly premium of $5,000. After 15 years, she experiences a period of financial hardship due to unforeseen business setbacks. However, she can access the accumulated cash value in her policy – let’s say $75,000 – as a loan or withdrawal, providing crucial financial relief without surrendering the policy. This loan can help her cover operating expenses or personal needs. Meanwhile, her policy continues to build cash value and maintain its death benefit, ensuring her family’s financial security even if she faces unexpected challenges. This scenario illustrates how a whole life policy acts as both a long-term investment and a safety net, offering financial flexibility during unexpected life events. Furthermore, upon her retirement, the policy’s cash value could provide a significant supplementary income stream, offering a source of funds to supplement her retirement savings.

Epilogue

Choosing the right whole life insurance policy is a significant financial decision that requires careful planning and consideration. This guide has provided a framework for understanding the key aspects of policy selection, from defining your needs and comparing policy features to understanding costs and long-term growth potential. Remember, comparing policies from multiple providers is essential to finding the best fit for your unique circumstances. By taking a proactive approach and engaging in thorough research, you can confidently secure a policy that offers peace of mind and lasting financial security for yourself and your loved ones.

Common Queries

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How is the cash value in a whole life policy taxed?

Cash value growth is generally tax-deferred, meaning you don’t pay taxes on the growth until you withdraw it. Withdrawals may be subject to taxes and penalties depending on the policy and your age.

Can I borrow against my whole life insurance policy’s cash value?

Yes, most whole life policies allow you to borrow against the accumulated cash value. Interest may accrue on the loan, and failing to repay could impact your death benefit.

What happens if I miss premium payments on my whole life insurance policy?

Missing payments can lead to policy lapse, meaning your coverage ends. However, grace periods and reinstatement options are often available depending on the policy.