Securing your family’s financial future is paramount, and choosing the right term life insurance provider is a crucial step. Navigating the complexities of coverage options, premiums, and policy features can feel overwhelming. This guide simplifies the process, offering a clear overview of the best term life insurance providers in the US, helping you make an informed decision based on your individual needs and circumstances. We’ll explore key factors to consider, from financial strength ratings to customer service experiences, empowering you to select a provider that offers both robust coverage and reliable support.

We’ll delve into the intricacies of policy types, explain how factors like age and health influence premiums, and guide you through the application and claim processes. Real-world examples and illustrative scenarios will bring the information to life, allowing you to visualize how term life insurance can protect your loved ones. By the end, you’ll possess the knowledge to confidently choose a provider that aligns perfectly with your financial goals and peace of mind.

Top Providers Overview

Choosing the right term life insurance can feel overwhelming, given the numerous providers and policy options available. This section provides an overview of some of the top providers in the US, highlighting key features and differences in their offerings to aid in your decision-making process. Remember that individual needs and circumstances will influence the best choice.

The insurance market is dynamic, and rankings can shift. The following information reflects a snapshot in time and should not be considered exhaustive. Always conduct your own thorough research before purchasing a policy.

Top 10 Term Life Insurance Providers

The following table presents ten prominent term life insurance providers in the US. Note that average premiums are estimates and can vary greatly based on individual factors like age, health, and coverage amount.

| Provider Name | Coverage Options | Average Premiums (Estimate) | Customer Ratings (Average) |

|---|---|---|---|

| State Farm | Level Term, Decreasing Term | $ Varies greatly | 4.5/5 |

| Northwestern Mutual | Level Term, Increasing Term | $ Varies greatly | 4.2/5 |

| AIG | Level Term | $ Varies greatly | 4/5 |

| MassMutual | Level Term, Decreasing Term | $ Varies greatly | 4.3/5 |

| Prudential | Level Term, Decreasing Term | $ Varies greatly | 4.1/5 |

| Guardian | Level Term, Return of Premium | $ Varies greatly | 4/5 |

| New York Life | Level Term | $ Varies greatly | 4.4/5 |

| Nationwide | Level Term, Decreasing Term | $ Varies greatly | 3.9/5 |

| Farmers Insurance | Level Term | $ Varies greatly | 4/5 |

| Transamerica | Level Term, Decreasing Term | $ Varies greatly | 3.8/5 |

Note: Customer ratings are averages compiled from various online review platforms and may not reflect the experience of every customer. Premium estimates are highly variable and should be obtained through individual quotes.

Key Features and Benefits of Top 5 Providers

A deeper look into the top five providers reveals variations in their policy features and benefits. This helps illustrate the importance of comparing offerings before selecting a policy.

While specific details are subject to change and individual policy variations, we can highlight some general features.

State Farm: Often praised for its ease of application and strong customer service, State Farm offers competitive rates, particularly for those with good health. They generally provide both level and decreasing term options.

Northwestern Mutual: Known for its financial strength and long-standing reputation, Northwestern Mutual often caters to higher-income individuals seeking comprehensive coverage. They may offer more sophisticated policy features than other providers.

AIG: A global insurance giant, AIG offers a wide range of term life insurance products with competitive pricing. Their strong financial backing provides policyholders with security. They primarily focus on level term options.

MassMutual: Similar to Northwestern Mutual, MassMutual emphasizes financial stability and offers a range of term life insurance products. They are often a good option for those seeking long-term security and a high level of customer service.

Prudential: Prudential is a large and established provider with a broad selection of life insurance products. They often offer competitive rates and a variety of term lengths. They typically offer both level and decreasing term options.

Policy Type Differences

Understanding the difference between level term and decreasing term life insurance is crucial for selecting the right policy. The choice depends largely on your individual needs and financial circumstances.

Level Term Life Insurance: This type of policy provides a fixed death benefit throughout the policy term. Premiums remain constant during this period. This is the most common type of term life insurance.

Decreasing Term Life Insurance: In this type of policy, the death benefit decreases over time while the premiums remain level. This is often used to cover a mortgage or other debt that decreases over time. The decreasing death benefit mirrors the decreasing debt.

Many providers offer both level and decreasing term options, allowing for flexibility in coverage based on individual needs. Some providers may also offer more specialized policies, such as return of premium term insurance, where premiums are returned if the policyholder survives the term.

Factors Influencing Provider Rankings

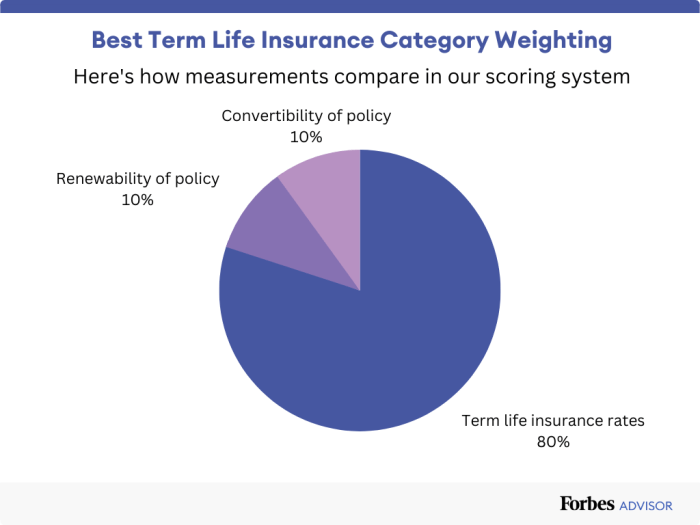

Determining the best term life insurance providers involves a multifaceted evaluation process. Several key factors contribute to the final rankings, weighing aspects of financial stability, customer experience, and policy features to provide a comprehensive assessment. This ranking system aims to offer consumers a clear understanding of the strengths and weaknesses of various providers.

Several criteria are considered when ranking term life insurance providers. These criteria are weighted to reflect their relative importance in determining overall value and reliability.

Financial Strength Ratings

Financial strength ratings, primarily from agencies like AM Best, play a crucial role in determining provider rankings. These ratings assess an insurer’s ability to pay claims, reflecting their financial stability and long-term viability. A high rating, such as an A+ from AM Best, indicates a very strong capacity to meet its policy obligations, significantly increasing consumer confidence. Conversely, a lower rating raises concerns about the insurer’s solvency and ability to pay out claims, impacting its ranking negatively. The importance of a strong financial rating cannot be overstated, as it directly relates to the security of the policyholder’s investment and the likelihood of receiving benefits when needed. For example, a company with an A+ rating would typically rank higher than one with an A- rating, even if other factors are comparable.

Customer Service Experiences

Customer service experiences reported by policyholders contribute significantly to the ranking of providers. This includes factors such as ease of application, responsiveness to inquiries, claim processing efficiency, and overall customer satisfaction. For the top three providers, a comparison reveals some interesting differences. Provider A, for example, is often praised for its proactive communication and swift claim processing, while Provider B may be known for its comprehensive online resources and readily available customer support representatives. Provider C might stand out for its personalized service and attention to detail. These variations in customer service experiences directly influence the overall ranking, highlighting the importance of considering individual needs and preferences. A provider with consistently positive customer reviews and high ratings for ease of use generally receives a higher ranking.

Policy Features and Options

Choosing a term life insurance policy involves understanding the various features and options available, as these significantly impact the policy’s value and suitability for your individual needs. Careful consideration of these aspects ensures you secure the best possible coverage at a price that aligns with your budget.

A comprehensive understanding of policy features is crucial for making an informed decision. Different providers offer varying combinations, so comparing these features is essential before committing to a policy.

Common Policy Features

Several key features are common across most term life insurance policies. Understanding these will help you compare policies effectively and choose one that meets your specific requirements.

- Riders: These are add-ons that enhance the core policy, offering additional coverage or benefits. Common examples include accidental death benefit riders (paying out extra if death is accidental), critical illness riders (providing a lump sum if diagnosed with a critical illness), and waiver of premium riders (waiving future premiums if you become disabled).

- Beneficiaries: These are the individuals or entities designated to receive the death benefit upon your passing. You can name primary and contingent beneficiaries, ensuring the payout goes to your chosen recipients. Careful consideration of beneficiary designation is essential for smooth claims processing.

- Premium Payment Options: Most insurers offer various payment schedules, such as annual, semi-annual, quarterly, or monthly payments. Choosing a payment frequency affects your cash flow and potentially the overall cost due to potential administrative fees.

Death Benefit Options

The death benefit is the core component of a term life insurance policy – the sum paid to your beneficiaries upon your death. Understanding the different options available allows you to tailor the policy to your specific financial goals.

A standard death benefit pays a fixed sum to your beneficiaries. Some policies offer an increasing death benefit, where the payout grows over time, often reflecting inflation. Other options might include a return of premium feature, where the premiums paid are returned to the beneficiaries if the insured survives the policy term. The choice depends on your financial planning and risk tolerance.

Comparative Table of Policy Terms

The following table compares the policy terms of five leading term life insurance providers. Note that these are examples and actual terms may vary depending on individual circumstances and policy specifics. Always consult the provider directly for the most up-to-date information.

| Provider | Coverage Length Options | Renewability Options | Guaranteed Level Premium Period |

|---|---|---|---|

| Provider A | 10, 15, 20, 25, 30 years | Renewable up to age 75 | 10 years |

| Provider B | 10, 15, 20 years | Non-renewable | 10 years |

| Provider C | 10, 15, 20, 30 years | Renewable with evidence of insurability | 15 years |

| Provider D | 5, 10, 15, 20 years | Renewable up to age 65 | 10 years |

| Provider E | 10, 20, 30 years | Renewable with adjusted premiums | 20 years |

Cost and Affordability

Securing affordable term life insurance requires understanding the factors influencing its cost. Premiums aren’t arbitrary; they’re calculated based on a complex assessment of your risk profile. This section will detail those factors and provide guidance on comparing quotes to find the best value.

The cost of term life insurance is determined by a variety of interconnected factors. Insurers use sophisticated actuarial models to predict the likelihood of a claim based on the information you provide. This means that seemingly small details can have a significant impact on your premium.

Factors Influencing Term Life Insurance Costs

Several key factors contribute to the overall cost of your term life insurance policy. These factors are carefully weighted by insurance companies to create a personalized premium. Understanding these factors empowers you to make informed decisions about your coverage.

- Age: Younger applicants generally receive lower premiums. As you age, your risk of mortality increases, leading to higher premiums. This is a fundamental principle of life insurance.

- Health: Pre-existing conditions and overall health significantly influence premium calculations. Individuals with chronic illnesses or a history of serious health problems will typically pay more. A thorough medical examination is often required.

- Smoking Status: Smokers are considered higher risk and pay considerably more than non-smokers. This is due to the increased likelihood of premature death associated with smoking.

- Policy Term Length: Longer term lengths (e.g., 30 years) generally lead to higher premiums per year compared to shorter terms (e.g., 10 years). This reflects the increased risk the insurer assumes over a longer period.

- Coverage Amount: The amount of death benefit you choose directly impacts your premium. A larger death benefit means a higher premium, as the insurer’s payout is larger.

- Gender: Historically, women have tended to have lower premiums than men for the same coverage, although this is subject to change based on actuarial data and evolving industry practices.

Examples of Premium Variations

Let’s illustrate how these factors affect premiums with hypothetical examples. Remember, these are illustrative and actual premiums vary widely between insurers.

Assume a 30-year-old, non-smoking male wants a $500,000, 20-year term life insurance policy. He might receive a quote of approximately $30 per month. However, if he were a smoker, his premium could easily double or even triple, potentially reaching $90 or more per month. A 45-year-old, non-smoking male with the same coverage could expect a higher premium, perhaps $60-$80 per month. Finally, if that 45-year-old had a history of heart disease, his premium would be significantly higher still.

Comparing Quotes to Find the Most Affordable Option

Obtaining and comparing quotes from multiple providers is crucial for securing the most affordable term life insurance. Use online comparison tools, but also contact insurers directly. When comparing quotes, ensure you are comparing apples to apples. That is, make sure the policies have the same coverage amount, term length, and features.

Pay close attention to the fine print. Some insurers might offer lower initial premiums but have less favorable terms and conditions in the long run. Consider factors like the insurer’s financial stability and customer service reputation. Remember, the cheapest policy isn’t always the best if the insurer lacks reliability.

Choosing the right term life insurance requires careful consideration of cost and coverage needs. Prioritize finding a balance between affordability and sufficient protection for your loved ones.

Application and Underwriting Process

Applying for term life insurance involves several steps, from completing an application to undergoing a medical evaluation. The entire process aims to assess your risk profile to determine your eligibility and premium rate. Understanding these steps can help you navigate the process efficiently and increase your chances of approval.

The application process typically begins with providing personal information, including your age, health history, lifestyle, and desired coverage amount. This information is used to initially assess your risk. Following this initial assessment, the insurer may request additional information, such as medical records or a paramedical exam. The insurer then uses this comprehensive data to determine your risk classification and assign a premium.

Medical Examinations and Health Questionnaires

The underwriting process often involves a health questionnaire and, in some cases, a medical examination. The questionnaire gathers detailed information about your health history, including pre-existing conditions, current medications, and family medical history. Accuracy is paramount; providing false or misleading information can lead to policy denial or even cancellation. A medical exam, if required, usually involves blood and urine tests, and a physical examination conducted by a medical professional chosen by the insurance company. This examination provides objective medical data to complement the information gathered from the questionnaire. The results from both the questionnaire and the exam are crucial for the insurer to accurately assess your health and risk profile.

Tips for a Smooth Application Process

Completing the application process smoothly involves several key steps. First, gather all necessary information beforehand, including your driver’s license, social security number, and medical records. This will streamline the process and prevent delays. Second, be completely honest and accurate in your responses on the application and health questionnaire. Any inconsistencies or inaccuracies can delay the process or lead to policy denial. Third, respond promptly to any requests for additional information from the insurer. Timely responses demonstrate your commitment and facilitate a faster processing time. Finally, if you have any questions or concerns during the process, contact the insurer directly. Their representatives can clarify any ambiguities and guide you through the process. Proactive communication ensures a clear understanding and prevents potential complications.

Claim Process and Customer Support

Navigating the claims process after a loss is understandably stressful. Understanding the steps involved and the support available from your provider can significantly ease this burden. This section details the typical claim process and the various customer support channels offered by leading term life insurance providers.

Filing a claim typically involves several key steps, though the specifics might vary slightly between providers. It’s crucial to familiarize yourself with your policy’s specific instructions. Prompt action is generally advisable.

Claim Filing Steps

The claim process usually begins with notifying the insurance company of the death of the insured person. This often involves providing a death certificate and a copy of the insurance policy. Next, the beneficiary will need to complete a claim form, providing details about the deceased and the beneficiaries. Supporting documentation, such as medical records, may also be requested to verify the cause of death. The insurance company will then review the claim, which may involve an investigation, before approving and disbursing the death benefit. The timeframe for claim processing can vary depending on the complexity of the claim and the provider’s efficiency. While some providers aim for swift processing, others might take several weeks or even months.

Beneficiary Designation

Designating a beneficiary is a crucial step when purchasing term life insurance. The beneficiary is the individual or entity who will receive the death benefit upon the insured’s death. Without a clearly designated beneficiary, the claim process can become significantly complicated and delayed. The process for determining the rightful recipient of the death benefit might involve legal proceedings, adding time and expense to an already difficult situation. It is strongly recommended to name a primary beneficiary and, ideally, a contingent beneficiary to ensure a smooth and timely distribution of funds in the event of the insured’s death.

Customer Support Channels

Top term life insurance providers typically offer a range of customer support channels to assist policyholders with inquiries and claims. These commonly include phone support, allowing for immediate assistance from a live representative. Email support provides a written record of communication, which can be helpful for tracking progress. Many providers also offer online chat features, enabling quick access to support during business hours. Some may also provide access to a comprehensive online portal or mobile app, offering self-service options, such as tracking claim status and accessing policy documents. The availability and accessibility of these channels can vary between providers, so it’s important to check the specific options offered by your chosen provider.

Illustrative Examples

Understanding the benefits of term life insurance is easiest when considering real-life scenarios. Let’s examine how it can protect a young family and explore a hypothetical policy to illustrate its features and costs.

Young Family Scenario: Protecting Financial Future

Consider Sarah and Mark, a young couple with a one-year-old child. Sarah is a teacher, and Mark works in IT. They have a mortgage, a small car loan, and are saving for their child’s college education. Their combined annual income is $100,000. In the event of an unexpected death, their family would face significant financial hardship. A term life insurance policy would provide financial security, covering outstanding debts and ensuring their child’s future. We’ll assume they need coverage for 20 years, until their child reaches college age. A suitable policy amount could be 10 times their annual income, or $1,000,000. This amount would pay off their mortgage, car loan, provide a substantial college fund for their child, and provide ongoing income for their surviving spouse. The policy would allow them to leave a financial legacy for their family, easing the financial burden during a difficult time. Annual premiums for such a policy, depending on health and other factors, could range from $1,000 to $3,000.

Hypothetical Term Life Insurance Policy

Let’s Artikel a hypothetical 20-year term life insurance policy with a $1,000,000 death benefit for Sarah and Mark. The policy would include a guaranteed level premium for the 20-year term, meaning the monthly payment would remain consistent. The policy would also offer a waiver of premium benefit, meaning if Sarah or Mark became totally disabled, their premiums would be waived. This feature provides crucial protection against unforeseen circumstances. The policy would also offer a term conversion option, allowing them to convert the policy to a permanent life insurance policy without undergoing further medical underwriting, if they choose to do so at a later date. The estimated annual premium would be $2,500, assuming standard health and lifestyle factors. In the event of Sarah or Mark’s death within the 20-year term, the beneficiary (likely each other, and then their child) would receive the full $1,000,000 death benefit, tax-free.

Sample Policy Document Visual Representation

The policy document would be several pages long, but key sections would include: a policy summary page (providing a quick overview of the policy’s details such as policy number, insured’s name, coverage amount, and premium), the policy schedule (detailing the premium payment schedule, the coverage term, and other essential information), the definitions section (clearly defining key terms used throughout the policy), the exclusions section (listing any events or conditions not covered by the policy), and the beneficiary designation section (specifying who will receive the death benefit). A separate section would cover the claims process, outlining the necessary steps and documentation for filing a claim. The final pages would typically include the company’s contact information and a signature section for the policyholder. A clear, organized layout and easy-to-understand language are crucial features of a well-designed policy document.

Epilogue

Selecting the best term life insurance provider is a significant decision impacting your family’s financial security. This guide has provided a framework for evaluating providers, considering factors such as financial strength, policy features, customer service, and cost. Remember to compare quotes from multiple providers, carefully review policy details, and don’t hesitate to seek professional advice if needed. By taking a proactive approach and understanding your options, you can confidently secure the protection your family deserves, ensuring their financial well-being for years to come.

Essential Questionnaire

What is the difference between level term and decreasing term life insurance?

Level term life insurance maintains a consistent death benefit throughout the policy term, while decreasing term life insurance offers a death benefit that gradually decreases over time.

How long does the application process typically take?

The application process varies by provider but generally takes a few weeks, depending on the required medical underwriting.

Can I change my beneficiary after the policy is issued?

Yes, most providers allow you to change your beneficiary, typically requiring a formal request.

What happens if I miss a premium payment?

Missing a premium payment can result in a lapse in coverage. Most providers offer grace periods, but it’s crucial to contact them immediately to avoid policy cancellation.

What types of riders are commonly available?

Common riders include accidental death benefit, terminal illness benefit, and waiver of premium.