Securing your family’s financial future is paramount, and choosing the right life insurance policy is a crucial step. However, understanding which companies reliably and efficiently process claims is equally important. This exploration delves into the world of life insurance, examining top-rated providers known for their prompt payouts, and outlining the factors that contribute to a smooth claims process. We’ll navigate the complexities of different policy types, payout structures, and crucial policy terms, empowering you to make informed decisions that protect your loved ones.

We’ll analyze key metrics such as financial strength ratings and claim settlement ratios, providing you with the tools to assess a company’s ability to fulfill its obligations. Furthermore, we’ll address potential claim disputes and offer strategies for resolving them effectively, ensuring you are well-equipped to navigate any challenges that may arise.

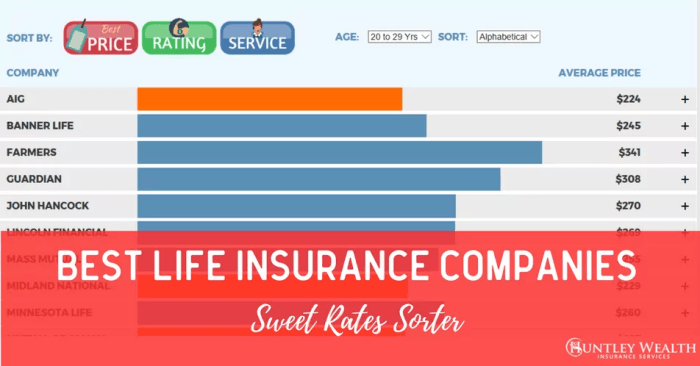

Top-Rated Life Insurance Providers

Choosing the right life insurance provider is a crucial decision, impacting your family’s financial security. This section Artikels ten highly-rated companies, considering factors beyond simple price comparisons. Understanding the criteria used for ranking allows for a more informed selection process.

Determining the “highest-rated” status involves a multifaceted evaluation. We weigh several key factors, including financial strength ratings from reputable agencies like A.M. Best and Moody’s, customer satisfaction scores from independent review sites, and the company’s history of timely and fair claim payouts. While financial stability is paramount, ensuring positive customer experiences and efficient claim processing are equally important for a holistic assessment.

Top Ten Life Insurance Companies

The following table lists ten companies consistently receiving high marks across these criteria. Note that rankings can fluctuate based on updated data and evolving market conditions. This list represents a snapshot in time and should be considered a starting point for further research.

| Company Name | Rating (Illustrative – replace with actual ratings) | Strengths |

|---|---|---|

| Company A | A++ | Exceptional financial strength, strong customer service, competitive pricing. |

| Company B | A+ | Wide range of policy options, quick claim processing, high customer satisfaction ratings. |

| Company C | A+ | Excellent financial stability, transparent processes, strong online resources. |

| Company D | A | Competitive premiums, robust policy features, responsive customer support. |

| Company E | A- | Strong reputation, long history of reliable payouts, diverse product offerings. |

| Company F | A+ | Excellent customer reviews, streamlined claims process, personalized service. |

| Company G | A | Competitive pricing, comprehensive coverage options, strong financial backing. |

| Company H | A- | Known for efficient claims handling, clear policy terms, strong online platform. |

| Company I | A+ | High customer satisfaction scores, wide network of agents, various policy types. |

| Company J | A | Strong financial stability, reliable payouts, comprehensive customer support. |

Average Death Claim Payout Times

Timely claim payouts are crucial during a difficult period. The following chart provides an illustrative comparison of average payout times for death claims across the top ten companies. Actual processing times can vary depending on individual circumstances and the complexity of each claim.

Note: The data presented below is illustrative and should not be considered definitive. Actual payout times can vary significantly depending on factors such as the type of policy, the cause of death, and the completeness of the claim documentation. Always consult the specific company’s claim processing information for accurate expectations.

| Company Name | Average Payout Time (Illustrative – in days) |

|---|---|

| Company A | 30 |

| Company B | 35 |

| Company C | 25 |

| Company D | 40 |

| Company E | 38 |

| Company F | 28 |

| Company G | 32 |

| Company H | 45 |

| Company I | 30 |

| Company J | 35 |

Factors Influencing Payout Speed and Efficiency

The speed and efficiency of a life insurance payout are crucial for beneficiaries during a difficult time. Several factors contribute to the processing time, ranging from the specifics of the insurance policy itself to the completeness of the documentation provided. Understanding these factors can help both policyholders and beneficiaries navigate the claims process more smoothly.

The time it takes to process a life insurance death claim varies significantly depending on a number of interconnected elements. These elements can interact in complex ways, sometimes leading to unforeseen delays. A clear understanding of these elements can assist in mitigating potential problems and ensuring a more timely payout.

Policy Type and Coverage Details

Different types of life insurance policies have varying claim processes. For example, term life insurance policies generally have simpler claims procedures compared to whole life or universal life policies, which may involve more complex calculations of cash value or accumulated benefits. The specific coverage details Artikeld in the policy, such as riders or additional benefits, can also influence the review and processing time. A policy with multiple beneficiaries, or complex beneficiary designations, may also increase processing time.

Documentation Requirements

Complete and accurate documentation is paramount for a swift claim settlement. Required documents typically include the death certificate, the original insurance policy, and completed claim forms. Missing or incomplete documentation is a major cause of delays. For example, if the death certificate is not properly completed or certified, the claim process will be delayed until this issue is resolved. Similarly, discrepancies between the information provided on the claim forms and the policy details can cause significant delays as the insurance company verifies the information.

Internal Company Procedures and Capacity

Each insurance company has its own internal procedures and claim processing workflows. Some companies may have more streamlined processes than others, leading to faster payouts. The company’s current workload and staffing levels also play a significant role. During periods of high claim volume, processing times may naturally increase. Furthermore, the complexity of the claim itself, such as cases involving potential disputes or ambiguous policy terms, may require additional internal review and investigation, inevitably lengthening the processing time.

Examples of Situations Leading to Delays and Mitigation Strategies

Delays can arise from various unforeseen circumstances. For instance, a beneficiary might unintentionally submit an incomplete claim form, omitting crucial information or documentation. This can be mitigated by carefully reviewing all required documents and ensuring their completeness before submission. Another example is a dispute regarding the beneficiary designation, where multiple individuals claim entitlement to the death benefit. In such cases, a clear and unambiguous beneficiary designation in the policy, along with proper legal documentation, is essential for avoiding delays. Finally, a death occurring in a foreign country may involve additional complexities in obtaining necessary documentation, potentially leading to delays. Proactive communication with the insurance company and obtaining all necessary legalizations and translations can help mitigate these delays.

Best Practices for Policyholders

To ensure a smooth and efficient claim process, policyholders should take several proactive steps.

- Keep the policy and all related documents in a safe and accessible place. This ensures easy access when needed.

- Regularly review the policy to understand the coverage, benefits, and claim procedures. This prevents misunderstandings later on.

- Keep the insurance company updated with any changes in contact information or beneficiary designations. This avoids potential delays due to outdated information.

- Designate a reliable person to act as a point of contact for the insurance company during the claims process. This simplifies communication and ensures a coordinated approach.

- Gather all necessary documentation promptly after a death occurs. This streamlines the claims process and minimizes delays.

- Communicate promptly and transparently with the insurance company throughout the claims process. This facilitates a smoother resolution.

Types of Life Insurance Policies and Payout Structures

Understanding the different types of life insurance policies and their payout structures is crucial for making an informed decision that aligns with your financial goals and family’s needs. The payout structure, whether a lump sum or structured settlement, significantly impacts how your beneficiaries receive the death benefit. This section will clarify the distinctions between various policy types and their payout mechanisms.

Life Insurance Policy Types and Payout Methods

The payout method for life insurance depends heavily on the type of policy chosen. Each policy offers a unique balance of coverage, cost, and flexibility. The following table compares three common types: term life, whole life, and universal life insurance.

| Policy Type | Payout Method | Typical Benefit Amounts |

|---|---|---|

| Term Life Insurance | Lump-sum payment upon death of the insured during the policy term. | Varies widely based on age, health, policy length, and coverage amount; typically ranges from $100,000 to $5 million or more. |

| Whole Life Insurance | Lump-sum payment upon death of the insured, anytime. May also offer cash value accumulation that can be accessed during the policyholder’s lifetime. | Varies widely; typically ranges from $25,000 to several million dollars, depending on premium payments and policy features. |

| Universal Life Insurance | Lump-sum payment upon death of the insured. Offers flexible premium payments and adjustable death benefit amounts. Cash value accumulation is also possible. | Varies widely, depending on premium payments and policy features; similar range to whole life insurance. |

Lump-Sum Payouts versus Structured Settlements

A lump-sum payout provides the full death benefit to the beneficiary(ies) as a single payment. A structured settlement, conversely, distributes the death benefit in installments over a predetermined period.

Lump-Sum Payouts: Advantages include immediate access to funds for significant expenses like debt repayment, education costs, or home purchase. Disadvantages include the potential for mismanagement of funds, especially if the beneficiary lacks financial expertise, leading to rapid depletion of the benefit. For example, a beneficiary might make impulsive large purchases, leaving them with little to nothing after a short period.

Structured Settlements: Advantages include providing a steady income stream, preventing the risk of rapid depletion, and potentially offering tax advantages. Disadvantages include limited access to the full amount immediately and potentially lower overall payout due to interest accrual and administrative fees. For instance, a structured settlement might provide a smaller monthly income compared to the total value of a lump sum, especially over a longer period.

Beneficiary Nomination and Payout Distribution

Carefully designating beneficiaries is crucial for ensuring the smooth and intended distribution of the death benefit. Different beneficiary designations influence how the payout is handled. Common designations include primary and contingent beneficiaries. A primary beneficiary receives the payout upon the insured’s death. If the primary beneficiary predeceases the insured, the contingent beneficiary receives the payout. Joint beneficiaries receive the payout equally. Failing to name beneficiaries could result in lengthy legal battles and delays in distributing the funds to rightful heirs. The process often involves completing a beneficiary designation form provided by the insurance company, and updating it as life circumstances change, such as marriage, divorce, or the birth of children. This ensures that the intended recipients receive the benefit as planned.

Understanding Policy Terms and Conditions

A life insurance policy is a legally binding contract, and understanding its terms and conditions is crucial to ensuring you receive the benefits you expect. Failing to comprehend the details can lead to unexpected limitations or even denial of claims. This section Artikels key elements to carefully review before purchasing any policy.

Thorough review of your policy document is paramount. It protects your financial interests and those of your beneficiaries. Don’t hesitate to seek clarification from your insurance agent or company if any aspect of the policy remains unclear. Remember, this is a significant financial commitment, so a clear understanding is essential.

Key Policy Terms Impacting Payouts

Several terms directly affect whether a claim is paid and the amount received. Carefully examining these aspects is vital to ensuring your policy meets your needs.

- Death Benefit: This is the amount your beneficiaries will receive upon your death. It’s usually a fixed sum, but some policies offer increasing benefits based on factors like investment performance.

- Beneficiary Designation: Clearly naming your beneficiary(ies) is critical. Ambiguity can lead to delays or disputes. The policy should specify how the benefit will be distributed among multiple beneficiaries (e.g., equal shares, percentages).

- Waiting Period (for certain benefits): Some policies may have a waiting period before certain benefits become payable. For instance, there might be a waiting period before coverage begins for accidental death or specific illnesses. Understand the duration of any waiting periods.

- Exclusions and Limitations: Policies often exclude coverage for certain causes of death or circumstances. These exclusions are clearly Artikeld in the policy document and can significantly affect the payout.

- Contestable Period: This is a period (typically two years) during which the insurance company can investigate the accuracy of information provided in the application. If they find material misrepresentations, they may deny the claim.

- Policy Lapse: Understand the circumstances under which your policy may lapse (e.g., non-payment of premiums). A lapsed policy may offer reduced benefits or no benefits at all.

Examples of Policy Exclusions and Limitations

Understanding common exclusions is essential for making an informed decision. These limitations can significantly reduce or eliminate payout amounts in specific situations.

- Suicide Clause: Many policies exclude payouts if death occurs by suicide within a specified period (usually one or two years) after the policy’s inception. This clause protects the insurance company from potential fraud.

- Pre-existing Conditions: Certain health conditions present before the policy’s effective date may not be covered. Policies might have specific exclusions or limitations regarding pre-existing conditions, particularly in health-related policies.

- Hazardous Activities: Policies may exclude or limit coverage for death resulting from participation in high-risk activities such as skydiving, mountain climbing, or other dangerous sports, unless explicitly covered under a rider.

- War or Military Service: Death occurring while engaged in active military service or war may be excluded or subject to limitations, depending on the specific policy terms.

- Illegal Activities: Death resulting from participation in illegal activities is usually excluded from coverage.

Financial Strength and Claim Settlement Ratios

Understanding a life insurance company’s financial strength and claim settlement ratio is crucial for ensuring your beneficiaries receive their payout reliably. These metrics provide insights into a company’s ability to meet its financial obligations and its efficiency in processing claims. Choosing a financially stable company with a high claim settlement ratio significantly reduces the risk of delays or denials.

Financial strength ratings and claim settlement ratios are two key indicators of a life insurance company’s reliability. A company’s financial strength reflects its ability to pay out claims even during economic downturns or unexpected events. The claim settlement ratio, on the other hand, reveals the efficiency and speed with which the company processes and approves claims. Analyzing both aspects provides a comprehensive view of a company’s trustworthiness.

Resources for Researching Financial Strength and Claim Settlement Ratios

Consumers can access information on a life insurance company’s financial strength and claim settlement ratios from several reputable sources. These resources offer independent assessments and data to aid in informed decision-making.

- A.M. Best: A.M. Best is a leading credit rating agency specializing in the insurance industry. They provide detailed financial strength ratings for life insurance companies, reflecting their ability to meet long-term obligations.

- Moody’s Investors Service: Moody’s also provides financial strength ratings for insurance companies, using a letter-based system to indicate creditworthiness and financial stability.

- Standard & Poor’s (S&P): S&P is another major credit rating agency offering financial strength ratings for insurance companies, with ratings influencing investor confidence and company stability.

- Weiss Ratings: Weiss Ratings offers independent ratings and analysis of insurance companies, focusing on financial strength and other relevant metrics. Their ratings provide an alternative perspective to the major credit rating agencies.

- State Insurance Departments: Each state’s insurance department maintains records on the financial condition and claim settlement practices of insurers operating within its jurisdiction. These records can often be accessed online.

Significance of Financial Strength Ratings and Claim Settlement Ratios

Financial strength ratings, typically expressed as letter grades or numerical scores, reflect the insurer’s ability to meet its long-term obligations. A high rating suggests a low risk of insolvency, ensuring the company can pay out claims even during challenging economic times. For example, an A++ rating from A.M. Best generally indicates superior financial strength and a very low risk of default. Conversely, a lower rating signifies a higher risk.

The claim settlement ratio represents the percentage of claims approved and paid out by the insurer. A high claim settlement ratio (ideally close to 100%) indicates efficiency and a commitment to fulfilling its obligations to policyholders. A low ratio might suggest difficulties in processing claims or a propensity to deny legitimate claims. For instance, a company with a 98% claim settlement ratio suggests that it successfully processes and pays out the vast majority of legitimate claims.

Interpreting Financial Ratings and Claim Settlement Data

Interpreting financial ratings requires understanding the rating scales used by different agencies. Each agency has its own rating system, with higher ratings indicating better financial strength. For example, an “A+” rating from one agency might be equivalent to an “AA-” rating from another. It’s essential to compare ratings from multiple agencies to gain a holistic perspective.

Claim settlement ratios should be considered in conjunction with the company’s financial strength. A high claim settlement ratio is meaningless if the company is financially unstable. Ideally, look for companies with both high financial strength ratings and high claim settlement ratios, indicating both the ability and willingness to pay out claims promptly and efficiently. A thorough examination of these metrics minimizes the risk of delays or denials when you need the payout most.

Addressing Potential Claim Disputes

Disputes in the life insurance claims process, while not always common, can be incredibly stressful for beneficiaries. Understanding the potential causes of these disputes and the available dispute resolution methods is crucial for a smoother claims experience. This section Artikels common reasons for disputes and provides strategies for effective resolution.

Common reasons for disputes often stem from discrepancies in policy information, incomplete documentation, or disagreements over the cause of death. For instance, a dispute might arise if the policyholder had undisclosed pre-existing conditions that the insurer argues should affect the payout. Another common issue is the failure to provide all necessary documentation within the specified timeframe, leading to delays or denials. Ambiguity in policy wording can also contribute to disputes, particularly regarding specific exclusions or definitions.

Causes of Life Insurance Claim Disputes

Several factors frequently contribute to disputes during the life insurance claims process. These include, but are not limited to, discrepancies between the application information and the actual health status of the insured at the time of policy inception, failure to provide all required documentation promptly and completely, and disagreements over the interpretation of policy terms and conditions, particularly concerning exclusions or specific definitions. The death itself may be subject to dispute, particularly in cases of ambiguous circumstances. For example, a dispute could arise if the cause of death is contested, leading to delays or even denials of the claim. Similarly, disputes may arise from fraudulent claims or attempts to manipulate the policy for financial gain.

Dispute Resolution Strategies

When a dispute arises, several methods exist for resolving the issue. Internal review by the insurance company should be the first step. This involves submitting additional documentation or clarifying any misunderstandings with the insurer. If the internal review is unsuccessful, mediation offers a less formal and less expensive alternative to litigation. A neutral third party mediator helps both parties reach a mutually agreeable settlement. Arbitration is a more formal process where a neutral arbitrator hears evidence and makes a binding decision. While less common, litigation, or taking the case to court, remains a final option if all other methods fail.

Steps to Take if a Claim is Denied or Delayed

If a claim is denied or significantly delayed, policyholders or beneficiaries should first review the denial letter carefully, noting the specific reasons provided. They should then gather all relevant documentation, including the policy, application, medical records, and any other supporting evidence. Contacting the insurer to discuss the reasons for the denial and explore options for appeal is crucial. If the insurer remains unyielding, exploring alternative dispute resolution methods like mediation or arbitration should be considered. Finally, if all other avenues are exhausted, legal counsel can be sought to explore the possibility of litigation. It’s essential to act promptly and document all communication with the insurance company throughout the process.

Wrap-Up

Selecting a life insurance company is a significant decision with long-term consequences. By understanding the factors influencing payout speed, the nuances of different policy types, and the importance of financial strength ratings, you can make a confident choice that aligns with your family’s needs. Remember, proactive research and a thorough understanding of your policy are key to ensuring a smooth and efficient claims process should the unexpected occur. Prioritize companies with a proven track record of timely payouts and strong financial stability to secure your loved ones’ financial well-being.

Essential FAQs

What is a claim settlement ratio?

A claim settlement ratio indicates the percentage of claims approved by an insurance company. A higher ratio generally suggests a more efficient and reliable claims process.

How long does it typically take to receive a life insurance payout?

Payout times vary depending on the company, policy type, and claim complexity. However, many companies aim for processing times within weeks or a few months.

Can I change my beneficiaries after purchasing a policy?

Yes, most policies allow for beneficiary changes, although the process may vary depending on the insurer. It’s important to update your beneficiary information as your circumstances change.

What happens if my claim is denied?

If your claim is denied, you typically have the right to appeal the decision. Review your policy carefully, gather supporting documentation, and contact the insurance company to understand the reasons for denial and explore your appeal options.