Securing the best insurance rate is a crucial financial decision, impacting your budget and peace of mind. This comprehensive guide unravels the complexities of insurance pricing, empowering you to navigate the market effectively and achieve significant savings. We’ll explore the numerous factors influencing your premiums, from demographics and driving history to coverage choices and credit score, providing actionable strategies to optimize your insurance costs.

From comparing online tools and understanding policy details to negotiating lower premiums and leveraging preventative measures, we offer a practical roadmap to finding the most affordable yet comprehensive insurance coverage tailored to your specific needs. Understanding the nuances of insurance pricing is key to securing the best possible deal.

Understanding “Best Insurance Rate”

Finding the best insurance rate isn’t about finding the single lowest price; it’s about finding the policy that offers the best value for your specific needs and risk profile. Numerous factors influence the cost of insurance, making a simple “lowest price” comparison often misleading. Understanding these factors is crucial to securing optimal coverage at a reasonable price.

Factors Influencing Insurance Costs

Several key factors determine insurance premiums. These include your age, location, credit score, driving history (for auto insurance), claims history, the type and amount of coverage you choose, and the deductible you select. For example, a driver with multiple speeding tickets will likely pay more for car insurance than a driver with a clean record. Similarly, a home in a high-crime area will command a higher homeowner’s insurance premium than one in a safer neighborhood. Insurance companies use sophisticated algorithms and statistical models to assess risk and price policies accordingly.

Types of Insurance Policies and Rate Variations

Different types of insurance policies come with varying rate structures. Auto insurance, for instance, typically includes liability coverage (paying for damages to others), collision coverage (paying for damage to your vehicle), and comprehensive coverage (covering non-collision damage). Higher coverage limits naturally lead to higher premiums. Homeowner’s insurance covers damage to your property and liability for injuries or damages on your property. Factors such as the age and condition of your home, its location, and the coverage amount significantly impact premiums. Health insurance rates vary widely based on plan type (e.g., HMO, PPO), coverage level, and individual health status. Pre-existing conditions and age are significant factors.

Pricing Models of Insurance Providers

Insurance providers employ various pricing models, often using a combination of actuarial analysis and competitive market pricing. Some insurers might emphasize risk-based pricing, heavily weighting factors like claims history and credit score. Others may offer more competitive rates for certain demographics or risk profiles, aiming to attract a broader customer base. These differences can lead to significant variations in premiums for seemingly similar policies across different providers. It’s essential to compare quotes from multiple insurers to identify the best value.

Individual Circumstances Affecting Insurance Premiums

Individual circumstances significantly impact insurance premiums. For example, a young driver with a new license will generally pay more for car insurance than an older driver with a long, clean driving record. Similarly, someone with a history of health issues will likely pay higher health insurance premiums than someone with a clean bill of health. Homeowners in high-risk areas (e.g., areas prone to wildfires or hurricanes) will typically face higher premiums than those in lower-risk areas. These factors highlight the importance of personalized insurance comparisons.

Average Insurance Rates Across Age Groups

The following table presents estimated average annual premiums for different insurance types across various age groups. These figures are for illustrative purposes only and may vary based on location, coverage level, and individual circumstances. It’s crucial to obtain personalized quotes from insurance providers for accurate pricing.

| Age Group | Auto Insurance (Annual) | Home Insurance (Annual) | Health Insurance (Annual) |

|---|---|---|---|

| 18-25 | $1800 | $1200 | $4500 |

| 26-35 | $1500 | $1000 | $3800 |

| 36-45 | $1200 | $900 | $3200 |

| 46-55 | $1000 | $800 | $2800 |

Finding the Best Rates

Securing the best insurance rates requires a proactive and informed approach. This involves leveraging available tools, carefully scrutinizing policy details, and understanding potential hidden costs. By employing effective strategies, you can significantly reduce your premiums and find the most suitable coverage for your needs.

Online insurance comparison tools offer a convenient way to quickly obtain quotes from multiple insurers. These platforms aggregate data from various providers, allowing you to compare prices and coverage options side-by-side. However, it’s crucial to remember that these tools only provide a snapshot; the actual policy details may vary.

Effectiveness of Online Comparison Tools

Online comparison tools significantly streamline the process of obtaining insurance quotes. They save time and effort by eliminating the need to contact each insurer individually. Many platforms allow you to filter results based on specific criteria, such as coverage levels and deductibles, enabling you to quickly identify policies that meet your requirements. While convenient, it’s vital to understand that these tools present a simplified overview and should not be the sole basis for your decision. Always verify the details directly with the insurer before committing to a policy.

Importance of Careful Policy Review

Reading the fine print is paramount. Policies often contain clauses that impact your coverage and costs. Pay close attention to deductibles, co-pays, exclusions, and limitations. Understanding these aspects will help you make an informed decision and avoid unexpected expenses. For instance, a seemingly low premium might come with a high deductible, meaning you’ll pay a substantial amount out-of-pocket before the insurance coverage kicks in. Similarly, certain exclusions might limit the types of claims your policy covers.

Potential Hidden Costs and Fees

Insurance policies may involve various hidden costs beyond the advertised premium. These can include administrative fees, processing fees, or additional charges for optional add-ons. Some insurers might also charge higher premiums based on your credit score or driving history. Carefully review the policy document for any such charges and compare them across different providers to ensure you are getting the best value. For example, a policy might advertise a low premium but include a significant annual administrative fee, negating the initial cost savings.

Strategies for Negotiating Lower Premiums

Several strategies can help negotiate lower insurance premiums. Maintaining a good driving record is crucial, as insurers often reward safe drivers with discounted rates. Bundling multiple insurance policies (like home and auto) with the same provider can also lead to significant savings. Furthermore, consider increasing your deductible; a higher deductible generally translates to lower premiums, although it increases your out-of-pocket expense in case of a claim. Finally, exploring discounts offered by professional organizations or affiliations can further reduce your costs.

Step-by-Step Guide for Obtaining Quotes

1. Gather necessary information: Compile details such as your age, address, driving history, and the type of coverage you need.

2. Use online comparison tools: Utilize multiple online comparison websites to get a broad range of quotes.

3. Contact insurers directly: Once you’ve identified a few potential providers, contact them directly to verify the details and ask any clarifying questions.

4. Compare policy details: Carefully review the policy documents from each insurer, paying close attention to coverage, exclusions, and fees.

5. Negotiate: Don’t hesitate to negotiate with insurers to try and secure a lower premium, especially if you’ve received lower quotes from competitors.

6. Select the best policy: Choose the policy that offers the best combination of coverage, price, and overall value.

Factors Affecting Insurance Rates

Securing the best insurance rate involves understanding the numerous factors influencing the final premium. These factors often interact, creating a complex calculation that determines your individual cost. This section breaks down the key elements, allowing you to better understand your own rate and potentially identify areas for improvement.

Demographics

Demographic information plays a significant role in determining insurance premiums. Age, gender, and marital status are commonly considered. Younger drivers, for example, statistically have higher accident rates, leading to higher premiums. Similarly, gender can influence rates in some jurisdictions, though this is becoming increasingly regulated. Marital status can sometimes reflect lifestyle choices and driving habits, also impacting risk assessment. Insurance companies use statistical data to correlate these factors with risk, leading to differentiated pricing.

Driving History

Your driving record is a critical factor. A clean driving history, free of accidents and traffic violations, will generally result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions significantly increase your risk profile, leading to higher rates. The severity of the offense and the frequency of incidents are both taken into account. For instance, a single minor accident might result in a moderate premium increase, while multiple serious accidents or DUI convictions could lead to substantially higher costs or even policy denial.

Credit Score

In many regions, your credit score is a factor in determining your insurance rate. A higher credit score often correlates with responsible financial behavior, which insurers interpret as a lower risk. Insurers believe that individuals with good credit are more likely to pay their premiums on time and less likely to file fraudulent claims. Conversely, a poor credit score can lead to significantly higher premiums. This practice is subject to regulations and varies by location.

Claims History

Your claims history directly impacts your premiums. Filing a claim, even for a minor incident, will typically lead to a premium increase. The frequency and severity of claims are key considerations. Multiple claims within a short period suggest a higher risk profile, resulting in substantial rate increases. Conversely, maintaining a clean claims history is crucial for keeping premiums low. It’s important to weigh the cost of repairs against the potential long-term impact on your insurance rates before filing a claim.

Location

Geographic location significantly influences insurance costs. Areas with higher crime rates, more frequent accidents, or severe weather conditions generally have higher insurance premiums. Urban areas often have higher rates than rural areas due to increased traffic congestion and the higher probability of accidents. The cost of repairs and the availability of repair services in a given area can also influence rates. For example, living in an area prone to hurricanes or earthquakes will result in higher premiums due to the increased risk of property damage.

Coverage Options

The type and amount of coverage you choose directly impact your premium. Comprehensive coverage, which protects against a wider range of incidents, will generally be more expensive than liability-only coverage. Similarly, increasing your coverage limits (e.g., higher liability limits) will increase your premium. Choosing higher deductibles, however, can often lower your premium, as you are accepting more financial responsibility in the event of a claim. Carefully evaluating your needs and risk tolerance is crucial in selecting the optimal coverage and deductible levels.

Lifestyle Choices

Lifestyle choices can influence insurance rates, particularly for auto insurance. Factors such as the type of vehicle driven (sports cars generally have higher premiums than sedans), the number of miles driven annually (higher mileage increases risk), and even where you park your car (street parking versus a garage) can all affect your premiums. For example, commuting long distances daily increases the risk of an accident, leading to a higher premium. Similarly, modifications to a vehicle, such as performance upgrades, can also increase premiums.

Saving Money on Insurance

Securing the best insurance rate isn’t just about finding the lowest initial premium; it’s about implementing strategies to keep your costs down over the long term. This involves proactive measures, financial planning, and understanding how various factors influence your premiums. By taking control of these aspects, you can significantly reduce your insurance expenses and allocate your budget more effectively.

Preventative Measures to Reduce Insurance Costs

Implementing preventative measures can substantially lower your insurance premiums. Insurance companies recognize that individuals who actively mitigate risk are less likely to file claims. This translates to lower payouts for the insurer, which they pass on to you in the form of reduced premiums. For example, installing a security system in your home can significantly reduce your homeowner’s insurance costs, as it demonstrates a commitment to protecting your property. Similarly, regular car maintenance and safe driving habits can lower your auto insurance premiums by reducing the likelihood of accidents. Investing in preventative measures is a cost-effective strategy that pays dividends in the long run, both in terms of reduced insurance costs and overall peace of mind.

Improving Credit Score for Better Insurance Rates

Your credit score is a significant factor in determining your insurance premiums. Insurers often use credit-based insurance scores to assess your risk profile. A higher credit score generally indicates greater financial responsibility, leading to lower premiums. Improving your credit score involves paying bills on time, keeping your credit utilization low (the amount of credit you use compared to your total available credit), and avoiding opening multiple new accounts in a short period. Strategies like paying down existing debt and monitoring your credit report for errors can significantly boost your score, leading to substantial savings on your insurance premiums. For instance, a study by the Insurance Information Institute showed that individuals with excellent credit scores often receive significantly lower rates compared to those with poor credit.

Benefits of Bundling Insurance Policies

Bundling your insurance policies, such as combining your auto and homeowner’s insurance with the same company, often results in significant discounts. Insurers incentivize bundling because it simplifies their administration and reduces the risk of losing a customer. This consolidation typically leads to lower premiums compared to purchasing individual policies from separate providers. The exact savings vary by insurer and policy, but bundling can represent a considerable reduction in your overall insurance costs. For example, many companies offer discounts of 10-15% or more for bundling multiple policies.

Impact of Higher Deductibles on Premiums

Choosing a higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, directly impacts your premiums. A higher deductible translates to lower monthly or annual premiums because you’re accepting more financial responsibility in the event of a claim. While a higher deductible might seem risky, it’s a cost-effective strategy for those who can comfortably afford a larger upfront payment in case of an incident. This is particularly relevant for individuals with a strong emergency fund or those with a low risk profile. For example, increasing your deductible from $500 to $1000 could result in a substantial reduction in your premium, potentially saving hundreds of dollars annually.

Ways to Reduce Risk and Improve Insurance Profile

Reducing risk and improving your insurance profile involves a multifaceted approach. Here are some key strategies:

- Maintain a good driving record (avoiding accidents and traffic violations).

- Install security systems in your home and/or vehicle.

- Regularly maintain your vehicle and home (preventative maintenance).

- Complete safety courses relevant to your insurance (e.g., defensive driving).

- Review your coverage annually and adjust as needed (to avoid over- or under-insurance).

- Shop around and compare quotes from multiple insurers.

- Consider increasing your deductible if financially feasible.

- Maintain a good credit score.

Understanding Policy Details

Securing the best insurance rate is only half the battle; understanding your policy’s intricacies is crucial to maximizing its benefits. A thorough grasp of your policy’s terms, conditions, and coverage ensures you’re adequately protected and can navigate the claims process smoothly.

Key Terms and Conditions

Insurance policies employ specific terminology. Familiarizing yourself with these terms prevents misunderstandings and ensures you know exactly what your coverage entails. For instance, “deductible” refers to the amount you pay out-of-pocket before your insurance coverage kicks in. “Premium” is the regular payment you make to maintain your insurance coverage. “Policy period” specifies the duration of your insurance coverage. “Exclusions” detail situations or events not covered by your policy. Understanding these and other key terms, such as “liability limits,” “coverage limits,” and “endorsements,” is paramount.

Types of Coverage

Insurance providers offer a variety of coverage options, tailored to different needs and risks. For example, auto insurance commonly includes liability coverage (protecting you against claims from others), collision coverage (covering damage to your vehicle in an accident), and comprehensive coverage (covering damage from events other than collisions, such as theft or hail). Homeowners insurance typically covers dwelling damage, personal property, liability, and additional living expenses in case of a covered event. Life insurance policies provide financial security to beneficiaries upon the insured’s death, with various types such as term life, whole life, and universal life insurance, each offering different features and benefits. Health insurance policies cover medical expenses, with various plans offering differing levels of coverage and cost-sharing.

The Claims Process

Filing a claim involves reporting the incident to your insurance provider, usually via phone or online portal. You’ll need to provide detailed information about the incident, including date, time, location, and any witnesses. The insurer will then investigate the claim, which may involve inspections, assessments, and gathering further evidence. Following the investigation, the insurer will determine the extent of coverage and the amount payable, considering your policy’s terms and conditions and the deductible. Expect some processing time, and keep accurate records of all communication and documentation throughout the process.

Policy Renewal Options

At the end of your policy period, you’ll have the option to renew. Many insurers offer automatic renewal, continuing coverage at the current rate or a potentially adjusted rate. You may also choose to shop around for a better rate from a different provider or negotiate a lower premium with your existing insurer. Consider factors like your risk profile, coverage needs, and market conditions when deciding on renewal options. Be aware of any deadlines for renewal or cancellation to avoid lapses in coverage.

Essential Elements of a Comprehensive Insurance Policy

A well-structured insurance policy should clearly Artikel several key elements:

- Policyholder Information: Name, address, contact details.

- Policy Number and Effective Dates: Unique identifier and coverage period.

- Covered Perils: Specific events or situations covered by the policy.

- Coverage Limits: Maximum amounts payable for covered losses.

- Deductibles: Amount paid out-of-pocket before coverage begins.

- Exclusions: Events or situations specifically not covered.

- Premium Amount and Payment Schedule: Cost of coverage and payment terms.

- Claims Procedure: Steps to follow in case of a covered incident.

- Cancellation and Renewal Provisions: Terms for ending or extending coverage.

Illustrative Examples of Insurance Rate Variations

Insurance premiums are not a one-size-fits-all proposition. Many factors influence the final cost, resulting in significant variations between individuals and policies. Understanding these factors can empower you to make informed decisions and potentially save money. The following examples illustrate the impact of several key variables on insurance rates.

Good Driving Record’s Impact on Insurance Costs

A clean driving record significantly reduces insurance premiums. Consider two drivers, both 30 years old, with similar cars and living in the same area. Driver A has a spotless record for the past five years, with no accidents or traffic violations. Driver B, however, has been involved in two at-fault accidents and received three speeding tickets during the same period. Driver A’s insurer will likely reward this safe driving history with a lower premium, perhaps 20-30% lower than Driver B’s, reflecting the reduced risk associated with Driver A. This difference can amount to hundreds of dollars annually.

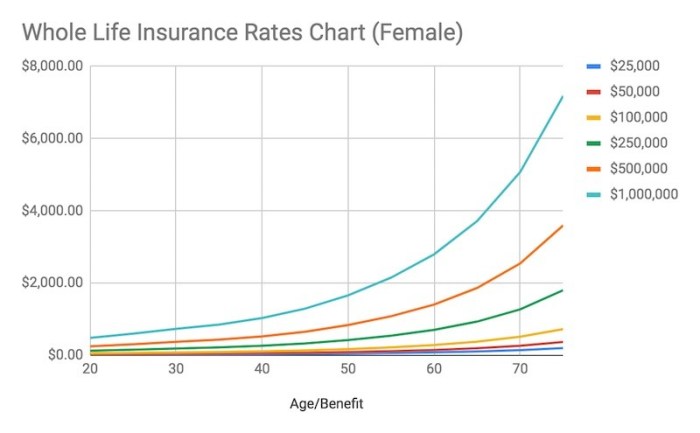

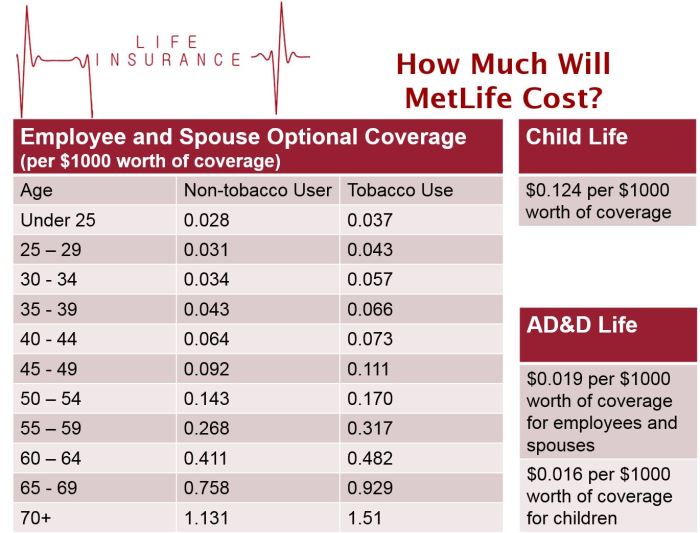

Age’s Influence on Insurance Premiums for Different Policy Types

Age is a major factor influencing insurance costs across various policy types. Let’s examine auto and health insurance. A 20-year-old driver will typically pay significantly more for car insurance than a 50-year-old driver with a similar driving record. This is because younger drivers are statistically involved in more accidents. Conversely, health insurance premiums generally increase with age, reflecting the higher likelihood of needing medical care as we age. A 25-year-old purchasing a basic health plan might pay considerably less than a 65-year-old purchasing a comparable plan, due to the increased risk associated with aging. The difference could range from a few hundred dollars to thousands annually, depending on the specific plan and individual health status.

Location’s Significant Impact on Insurance Rates

Geographic location plays a crucial role in determining insurance costs, especially for auto and homeowners insurance. Consider two identical homes, one located in a rural area with low crime rates and infrequent severe weather, and the other in a densely populated urban area with high crime and a history of natural disasters. The home in the urban area will likely have a much higher homeowners insurance premium due to increased risk of theft, vandalism, and property damage from storms or other events. Similarly, auto insurance rates in high-traffic, accident-prone urban areas tend to be significantly higher than in quieter, rural areas. This difference can be substantial, sometimes doubling or tripling the annual premium.

Premium Difference Between Minimum and Comprehensive Coverage

The level of coverage significantly impacts premiums. Minimum coverage, typically mandated by state law, only covers the bare minimum requirements, such as liability for injuries or damages caused to others. Comprehensive coverage, on the other hand, offers broader protection, including collision coverage, comprehensive coverage for damage from events such as theft or hail, and often higher liability limits. A driver with minimum coverage might pay $500 annually, while the same driver with comprehensive coverage could pay $1500 or more. The increased cost reflects the significantly higher level of protection offered.

Significant Credit Score Improvement’s Impact on Insurance Rates

In many states, insurance companies use credit scores as a factor in determining premiums. A significant improvement in credit score can lead to noticeable savings. Imagine someone with a poor credit score who pays $1200 annually for car insurance. After diligently improving their credit score by 100 points, they may see their premium reduced to $900, reflecting the reduced perceived risk to the insurer. This $300 annual savings demonstrates the potential financial benefit of maintaining a good credit history.

Ending Remarks

Ultimately, securing the best insurance rate involves a proactive and informed approach. By understanding the factors that influence premiums, utilizing comparison tools effectively, and negotiating strategically, you can significantly reduce your insurance costs without compromising on essential coverage. Remember, diligent research and a keen eye for detail are your greatest allies in this process. Take control of your insurance spending and secure the best possible protection for your future.

Quick FAQs

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

How often can I get my insurance rate reviewed?

You can typically request a review of your insurance rate annually, or even more frequently if your circumstances change significantly (e.g., marriage, new home, improved credit score).

Can I bundle different types of insurance?

Yes, bundling home, auto, and other insurance policies with the same provider often results in significant discounts.

What is the impact of a lapse in coverage?

A lapse in coverage can negatively impact your future insurance rates, as insurers may view it as a higher risk.

How does my credit score affect my insurance rates?

In many states, your credit score is a factor in determining your insurance premiums. A higher credit score generally leads to lower rates.