Securing affordable and comprehensive auto insurance can be a significant challenge for high-risk drivers. Factors like past accidents, traffic violations, and even age can dramatically impact premiums. This guide navigates the complexities of finding the best insurance coverage, offering insights into understanding risk profiles, comparing policy options, and implementing strategies to lower costs. We’ll explore various insurance types, premium influencers, and practical steps to improve your driving record and ultimately, your insurance rates.

Understanding your risk profile is the first step. Insurance companies analyze various factors, including your driving history, age, location, and even credit score. This assessment determines your eligibility for standard or non-standard policies, impacting the types of coverage and premiums you’ll encounter. By understanding these factors, you can make informed decisions and potentially secure more favorable insurance rates.

Understanding High-Risk Driver Profiles

Insurers categorize drivers as “high-risk” based on a comprehensive assessment of their driving history and other relevant factors. This classification directly impacts the premiums they pay, reflecting the increased likelihood of accidents or claims. Understanding this process is crucial for drivers to manage their insurance costs effectively.

Insurance companies utilize sophisticated algorithms and statistical models to predict the likelihood of future claims. This involves analyzing a wide range of data points, not just driving records, to build a comprehensive risk profile for each individual. The goal is to accurately price insurance policies to reflect the inherent risk associated with each driver.

Common Characteristics of High-Risk Drivers

Several factors contribute to a driver being classified as high-risk. These often include a history of accidents, traffic violations, and other indicators of poor driving habits. Age, location, and the type of vehicle driven also play a significant role in determining risk. A young driver with a history of speeding tickets, for example, will likely be considered a higher risk than an older driver with a clean driving record.

Factors Considered in Risk Assessment

Insurance companies consider a multitude of factors when assessing risk. These include the driver’s age, driving history (number of accidents and violations), the type of vehicle driven (sports cars are often considered higher risk), location (urban areas with high traffic density often have higher accident rates), driving experience (new drivers are statistically more likely to be involved in accidents), and even credit history (in some states). The weighting given to each factor can vary significantly between insurance providers.

Examples of High-Risk Driving Behaviors

Several driving behaviors consistently lead to higher insurance premiums. These include speeding tickets, reckless driving citations, DUI convictions, at-fault accidents, and multiple violations within a short period. Even minor infractions, when accumulated, can significantly impact a driver’s insurance rating. For instance, consistently receiving parking tickets might not seem significant individually, but collectively they suggest a disregard for traffic rules. Similarly, a history of minor fender benders, while individually not catastrophic, could indicate a pattern of inattentive driving.

Differences in Risk Assessment Between Providers

While all insurance companies assess risk, their methods and the weight they assign to various factors can differ significantly. Some insurers might place greater emphasis on recent driving history, while others might give more weight to the overall driving record. This variation is why it’s crucial to compare quotes from multiple providers to find the most competitive rates, even for high-risk drivers. For instance, one company might offer more lenient terms for young drivers with clean records than another. Similarly, some insurers may offer specialized programs or discounts for drivers who complete defensive driving courses, mitigating some of the risk associated with their profile.

Types of Insurance for High-Risk Drivers

Finding affordable and comprehensive car insurance can be a challenge for high-risk drivers. This often stems from a history of accidents, traffic violations, or other factors that increase the likelihood of claims. However, several insurance options cater specifically to this demographic, offering varying levels of coverage and cost. Understanding these options is crucial for high-risk drivers to secure appropriate protection while managing their budget effectively.

High-risk drivers generally face higher premiums compared to those with clean driving records. This is because insurance companies assess the risk associated with insuring each driver and adjust premiums accordingly. Several factors influence the classification of a driver as high-risk, including the number of accidents, traffic violations, age, driving history, and the type of vehicle driven. The options available are often categorized into standard and non-standard insurance policies.

Non-Standard Auto Insurance

Non-standard auto insurance is specifically designed for drivers who don’t qualify for standard policies due to their high-risk profile. These policies typically offer less comprehensive coverage than standard policies, but they are more accessible to those with poor driving records. Non-standard insurers often have more flexible underwriting guidelines, considering factors beyond just driving history, such as credit score and employment status. This broader consideration allows them to offer coverage to a wider range of drivers. However, premiums tend to be higher, and deductibles might also be more substantial.

Specialized Insurers for High-Risk Drivers

Several insurance companies specialize in providing coverage for high-risk drivers. These insurers often utilize more sophisticated risk assessment models that take into account a broader range of factors than standard insurers. They may offer tailored policies with varying coverage levels and premium structures designed to accommodate the specific needs and risk profiles of high-risk drivers. These specialized insurers might also provide driver safety programs or other resources aimed at reducing risk and improving driving habits, potentially leading to lower premiums over time.

Comparison of Policy Types

The following table compares three common types of insurance policies available to high-risk drivers: Non-Standard Auto Insurance, State-Minimum Coverage, and Specialized High-Risk Insurer Policies. Keep in mind that premiums and deductibles are highly variable and depend on individual circumstances.

| Policy Type | Coverage | Premiums | Deductibles |

|---|---|---|---|

| Non-Standard Auto Insurance | Liability coverage is usually required, but comprehensive and collision coverage may be limited or optional. | Significantly higher than standard policies. | Higher than standard policies. |

| State-Minimum Coverage | Meets the minimum liability requirements set by the state. Often lacks comprehensive and collision coverage. | Generally the lowest premium option, but offers minimal protection. | Varies by state and insurer. |

| Specialized High-Risk Insurer Policies | Offers a range of coverage options, from state minimum to more comprehensive plans, tailored to the individual’s risk profile. | Higher than standard policies, but potentially lower than some non-standard options depending on the driver’s profile and the chosen coverage level. | Varies depending on coverage and risk assessment. |

Factors Influencing Insurance Premiums

Securing affordable car insurance as a high-risk driver hinges on understanding the factors that influence premium calculations. Insurance companies use a complex algorithm considering various aspects of your profile to determine your risk level and, consequently, your premium. This section will detail the key factors, categorizing them by their level of impact on your final cost.

Age

Age is a significant factor in determining insurance premiums. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this demographic. Inexperience and a tendency towards risk-taking are contributing factors. Conversely, drivers in their mid-to-late 50s and 60s often see lower premiums, reflecting a statistically lower accident involvement in these age groups. This trend is due to a combination of increased driving experience and a more cautious driving style. The specific age brackets and associated premium differences vary between insurance providers, but the general trend remains consistent.

Driving History

Your driving history significantly impacts your insurance premiums. A clean driving record, characterized by an absence of accidents and traffic violations, leads to lower premiums. Conversely, a history of accidents, speeding tickets, or other moving violations substantially increases your risk profile and, therefore, your premium. The severity of accidents and the number of violations play a significant role. Multiple accidents or serious offenses like DUIs can result in significantly higher premiums or even policy cancellations. Insurance companies often use a points system to quantify the severity of infractions.

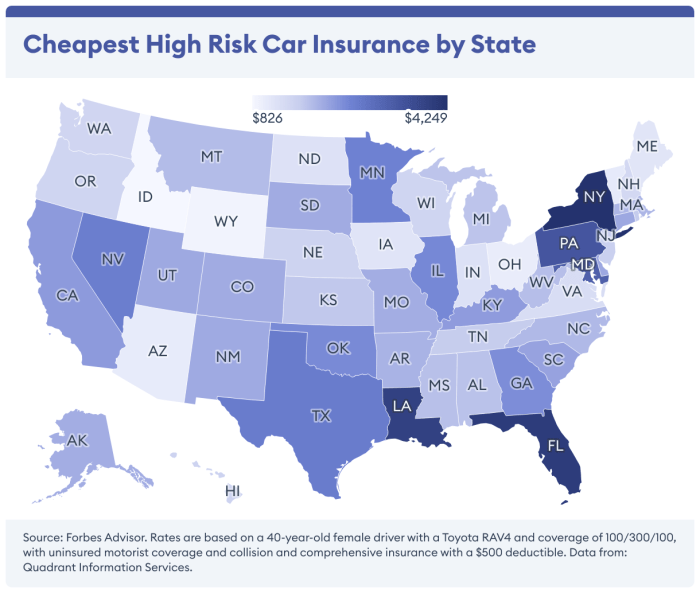

Location

Geographic location plays a crucial role in determining insurance premiums. Areas with high rates of accidents, theft, or vandalism will typically have higher insurance costs. This is because insurers face a greater risk of paying out claims in these high-risk areas. Urban areas, for instance, often have higher premiums than rural areas due to increased traffic density and higher chances of collisions. Similarly, areas with higher crime rates may see increased premiums due to the elevated risk of vehicle theft. The specific location’s influence can be substantial, sometimes surpassing the impact of other factors.

Prior Accidents and Traffic Violations

The impact of prior accidents and traffic violations is directly proportional to their severity and frequency. A single minor fender bender will generally have a less significant impact on your premiums compared to a major accident involving injuries or significant property damage. Similarly, multiple speeding tickets or other moving violations accumulate negatively, increasing your risk score and premiums. DUIs carry the most severe consequences, often resulting in significant premium increases or even policy non-renewal. Insurance companies maintain detailed records of driving infractions, and these records directly influence premium calculations.

Other Factors Influencing Premiums

Several other factors exert a moderate to minor influence on insurance premiums. These include:

- Vehicle Type: The type of vehicle you drive significantly affects your insurance costs. Sports cars and high-performance vehicles generally have higher premiums due to their higher repair costs and greater potential for accidents. Conversely, smaller, less expensive vehicles typically result in lower premiums.

- Credit Score: Surprisingly, your credit score can also impact your insurance premiums. Insurers often use credit scores as an indicator of overall risk. A good credit score can result in lower premiums, while a poor credit score can lead to higher premiums. This practice is not universal, and the extent of its influence varies by state and insurer.

- Driving Habits: While not always directly tracked, insurers increasingly utilize telematics data to monitor driving habits. Data from usage-based insurance (UBI) programs can assess factors like speeding, hard braking, and nighttime driving, influencing premium calculations. This is becoming increasingly common and could affect premiums in the future.

Categorization of Influence

To summarize, the factors influencing insurance premiums can be categorized as follows:

| Factor | Category of Influence |

|---|---|

| Age (especially under 25) | Major |

| Driving History (accidents, violations) | Major |

| Location (accident rates, crime rates) | Major |

| Vehicle Type (cost, performance) | Moderate |

| Credit Score | Moderate |

| Driving Habits (telematics data) | Minor (increasing influence) |

Finding Affordable Insurance

Securing affordable car insurance as a high-risk driver can feel like a daunting task, but it’s achievable with the right strategies. By understanding your options and taking proactive steps, you can significantly reduce your premiums and find a policy that fits your budget. This section Artikels practical approaches to finding affordable insurance and emphasizes the importance of responsible driving habits.

Finding affordable car insurance as a high-risk driver requires a multi-pronged approach. It involves carefully comparing quotes, improving your driving record, and exploring different insurance options. Remember, while premiums might be higher initially, proactive steps can lead to significant savings over time.

Strategies for Finding Affordable Insurance

Several strategies can help high-risk drivers find more affordable insurance. These involve careful shopping, exploring different policy types, and leveraging discounts wherever possible.

- Shop around and compare quotes: Obtaining quotes from multiple insurance providers is crucial. Don’t settle for the first offer you receive. Different companies use varying algorithms to assess risk, leading to significant price differences.

- Consider different policy types: Explore options like liability-only coverage (if legally permissible in your area) to reduce premiums. While offering less protection, this can be a cost-effective solution for some drivers.

- Look for discounts: Many insurers offer discounts for things like good student status, completing a defensive driving course, or bundling insurance policies (home and auto).

- Increase your deductible: A higher deductible means you pay more out-of-pocket in the event of an accident, but it will typically lower your premium.

- Maintain a good payment history: Consistently paying your premiums on time demonstrates financial responsibility, which can positively influence your insurance rate.

Improving Driving Habits and Reducing Risk

Safe driving is paramount, not only for personal safety but also for significantly impacting your insurance premiums. Consistent safe driving habits demonstrate lower risk to insurers, leading to potential discounts and lower rates in the long run.

- Avoid traffic violations: Moving violations, such as speeding tickets or accidents, directly increase your insurance risk profile and premiums. Driving cautiously and obeying traffic laws is essential.

- Maintain a clean driving record: A history of accidents or violations significantly impacts your insurance rates. Strive for a clean driving record to minimize your risk profile.

- Install a telematics device: Some insurers offer discounts based on your driving behavior, tracked via a telematics device installed in your vehicle. This can incentivize safe driving and potentially lower premiums.

Benefits of Defensive Driving Courses

Completing a defensive driving course demonstrates a commitment to safer driving practices. Insurance companies often recognize this commitment by offering discounts or reduced premiums.

Many insurers offer discounts for completing state-approved defensive driving courses. These courses teach safe driving techniques and strategies for avoiding accidents, ultimately reducing your risk profile. The completion certificate serves as proof of your commitment to safer driving and can lead to considerable savings on your insurance premiums. The exact discount offered varies by insurer and state.

Step-by-Step Guide for Comparing Insurance Quotes

Comparing insurance quotes effectively requires a structured approach. The following steps will help you find the best policy at the most affordable price.

- Gather your information: Before starting, collect necessary information, such as your driver’s license, vehicle information (year, make, model), and driving history.

- Use online comparison tools: Several websites allow you to compare quotes from multiple insurers simultaneously. Input your information and compare the results.

- Contact insurers directly: After using comparison tools, contact insurers directly to confirm details and discuss any specific questions you may have.

- Review policy details carefully: Before committing to a policy, thoroughly review the coverage details, deductibles, and premiums to ensure it meets your needs and budget.

- Compare apples to apples: Ensure that you’re comparing similar coverage levels across different insurers to get a fair comparison.

Understanding Policy Exclusions and Limitations

High-risk driver insurance policies, while necessary, often come with specific exclusions and limitations that significantly impact coverage. Understanding these nuances is crucial for avoiding unexpected financial burdens in the event of an accident or claim. Failing to grasp these limitations can lead to significant disappointment and potential legal complications.

Common Exclusions and Limitations

Many exclusions and limitations are standard across most high-risk driver insurance policies. These restrictions are designed to manage risk and mitigate potential losses for the insurance company. Common exclusions can include specific types of accidents, such as those involving racing or driving under the influence of alcohol or drugs. Policies might also limit coverage for certain types of vehicles or exclude coverage for damages caused by specific actions of the insured driver. Furthermore, there are often limitations on the amount of coverage available for liability, medical payments, or property damage. For example, a policy might cap liability coverage at a lower amount than a standard policy for a lower-risk driver. The policy documents will clearly Artikel these limitations.

Implications of Non-Disclosure

Failing to disclose relevant information to your insurer, such as prior accidents, driving violations, or DUI convictions, can have serious consequences. Insurance companies rely on accurate information to assess risk and determine premiums. If you withhold critical information, your insurer could void your policy, leaving you without coverage in the event of an accident. This could result in significant financial liability for any damages caused. In addition to policy voidance, insurers might also pursue legal action to recover any payouts made under a fraudulent claim. Complete honesty and transparency are essential when applying for high-risk insurance.

Filing a Claim and Potential Challenges

Filing a claim as a high-risk driver involves the same general process as for any other driver: contacting your insurer promptly, providing all necessary documentation, and cooperating with their investigation. However, high-risk drivers might face unique challenges. The claims process might be more rigorous, with a greater level of scrutiny applied to the circumstances surrounding the accident. Insurers might require more extensive documentation or additional investigations to verify the details of the claim. This process can be more time-consuming and potentially lead to delays in receiving compensation. Furthermore, the insurer may be more likely to deny or partially deny the claim due to pre-existing risk factors associated with the driver’s profile.

Claim Scenario and Potential Outcomes

Consider a scenario where a high-risk driver, with a history of speeding tickets, is involved in a minor collision. They file a claim with their insurer. The insurer, aware of the driver’s history, conducts a thorough investigation. If the investigation reveals that the accident was partially or fully the driver’s fault, the claim might be partially denied or the payout significantly reduced. The insurer might also increase the driver’s premium significantly for the following policy year, reflecting the increased risk. In a worst-case scenario, if the insurer finds evidence of non-disclosure or fraud, the policy could be voided, leaving the driver responsible for all damages and legal costs. Conversely, if the accident was determined to be the fault of the other driver, the claim would likely be processed normally, but the driver’s high-risk status might still influence future premiums.

Improving Driving Record and Reducing Risk

Improving your driving record and reducing your risk on the road is crucial for lowering insurance premiums and ensuring your safety. By actively working to become a safer driver, you can significantly impact your insurance costs and overall driving experience. This involves a combination of behavioral changes, vehicle upgrades, and a commitment to consistent safe driving practices.

Adopting safer driving habits and investing in vehicle safety features are key steps towards achieving a clean driving record. The long-term benefits of this proactive approach extend far beyond lower insurance costs; they contribute to personal safety and peace of mind.

Actionable Steps to Improve Driving Behavior

Several actionable steps can be taken to improve driving behavior and reduce the likelihood of accidents. These actions contribute to a safer driving experience and can significantly influence insurance premiums.

- Defensive Driving Techniques: Practice anticipating potential hazards, maintaining a safe following distance, and scanning the road ahead for potential risks. This proactive approach minimizes the chance of accidents.

- Speed Limit Adherence: Strictly adhering to posted speed limits is essential for safety and can drastically reduce the risk of accidents. Speeding significantly increases the severity of any collision.

- Avoiding Distracted Driving: Minimize distractions while driving, such as cell phone use, eating, or adjusting the radio. Focus solely on driving to ensure safe operation of the vehicle.

- Driver Education Courses: Consider taking a defensive driving course or a refresher course to learn updated driving techniques and strategies for accident avoidance. Many insurance companies offer discounts for completing such courses.

- Regular Vehicle Maintenance: Ensure your vehicle is in good working order through regular maintenance checks. Properly functioning brakes, tires, and lights contribute significantly to safety.

Benefits of Installing Vehicle Safety Features

Modern vehicles are equipped with a range of safety features that can significantly reduce the risk of accidents and their severity. Investing in these features can lead to substantial long-term savings.

- Anti-lock Braking Systems (ABS): ABS helps prevent wheel lockup during braking, allowing for better steering control in emergency situations.

- Electronic Stability Control (ESC): ESC helps maintain vehicle control during slippery conditions or sudden maneuvers, reducing the risk of skidding or loss of control.

- Airbags: Airbags provide crucial protection in the event of a collision, minimizing the risk of serious injury.

- Backup Cameras: Backup cameras improve visibility when reversing, reducing the risk of collisions in parking lots and other low-speed situations.

- Advanced Driver-Assistance Systems (ADAS): Features like lane departure warnings, adaptive cruise control, and automatic emergency braking can significantly reduce the risk of accidents.

Impact of a Clean Driving Record on Future Insurance Costs

Maintaining a clean driving record is paramount for securing lower insurance premiums. Insurance companies heavily weigh driving history when determining rates, rewarding safe drivers with lower costs.

A clean driving record demonstrates responsible driving behavior, reducing the perceived risk associated with insuring the driver. This directly translates to lower premiums over time. Conversely, accidents and traffic violations significantly increase insurance costs.

Long-Term Cost Savings of Safe Driving

The long-term cost savings associated with safe driving practices can be substantial. Consider this example:

Let’s assume a high-risk driver with a history of accidents pays an annual premium of $3000. By consistently practicing safe driving and maintaining a clean record for five years, they might see their premium reduced by 40% to $1800 annually. Over five years, this represents a saving of $6000 ($3000 x 5 – $1800 x 5 = $6000). This doesn’t account for potential savings from avoiding accident-related expenses such as repairs, medical bills, and legal fees, which can be significantly higher.

Summary

Finding the best insurance for high-risk drivers requires proactive research and a strategic approach. By understanding the factors that influence premiums, comparing policy options, and actively working to improve your driving record, you can significantly improve your chances of securing affordable and adequate coverage. Remember that responsible driving habits and continuous efforts to reduce risk are key to long-term cost savings and peace of mind.

General Inquiries

What constitutes a “high-risk” driver?

High-risk drivers typically have a history of accidents, traffic violations, DUIs, or other factors that suggest a higher likelihood of future claims.

Can I get insurance if I’ve had multiple accidents?

Yes, but it will likely be more expensive. Non-standard insurers specialize in covering high-risk drivers.

How can I lower my insurance premiums?

Improve your driving record, take defensive driving courses, consider safety features in your vehicle, and shop around for quotes.

What is SR-22 insurance?

SR-22 insurance is a certificate of insurance that proves you maintain the minimum required auto liability coverage, often mandated after serious driving offenses.