Securing your home with the right homeowners insurance is crucial, offering peace of mind against unforeseen events. However, navigating the world of insurance providers and policies can feel overwhelming. This guide aims to demystify the process, helping you understand the factors influencing costs, compare top companies, and choose a policy that best suits your needs and budget. We’ll explore coverage options, claims procedures, and provide practical tips to ensure you’re adequately protected.

From understanding the impact of your location and home features on premiums to comparing the strengths and weaknesses of leading insurance providers, we’ll cover everything you need to make an informed decision. We’ll also delve into the intricacies of policy coverage, highlighting the importance of adequate liability protection and exploring optional add-ons. Ultimately, this guide empowers you to confidently select the best homeowners insurance company for your unique circumstances.

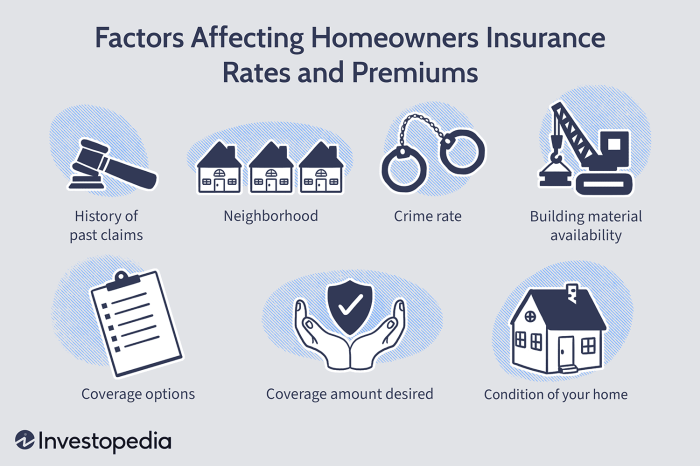

Factors Influencing Homeowners Insurance Costs

Securing homeowners insurance is a crucial step in protecting your most valuable asset. However, the cost of this protection can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Location’s Impact on Premiums

Your home’s location is a primary determinant of your insurance cost. Insurers assess risk based on factors like crime rates, the frequency of natural disasters (hurricanes, earthquakes, wildfires), and the proximity to fire hydrants or other emergency services. Homes in high-risk areas, such as those prone to flooding or wildfires, will generally command higher premiums due to the increased likelihood of claims. For example, a coastal property in a hurricane-prone region will likely have significantly higher premiums than a similar property located inland in a less disaster-prone area. Similarly, a home situated in a neighborhood with a high crime rate might face higher premiums due to the increased risk of theft or vandalism.

The Role of Home Features

The characteristics of your home itself play a substantial role in determining your insurance cost. Older homes, for instance, may require more expensive repairs or renovations following damage, leading to higher premiums. Larger homes typically cost more to insure due to the increased replacement cost of the structure and its contents. Conversely, homes equipped with security systems, such as alarms and fire sprinklers, often qualify for discounts as these features reduce the risk of loss. The materials used in construction also influence premiums; homes built with fire-resistant materials might receive a discount. Proper maintenance and regular inspections also influence the insurer’s assessment of risk.

Coverage Levels and Premium Costs

The amount of coverage you choose directly impacts your premium. Higher liability coverage, which protects you financially if someone is injured on your property, will result in a higher premium. Similarly, choosing higher dwelling coverage, which covers the cost of rebuilding or repairing your home in case of damage, will also increase your premium. Comprehensive coverage that includes additional perils, such as flood or earthquake insurance (often purchased separately), will naturally increase the overall cost. It’s crucial to find a balance between adequate coverage and affordability.

Discounts Offered by Insurance Companies

Insurance companies offer various discounts to incentivize homeowners to mitigate risks and demonstrate responsible homeownership. Common discounts include those for security systems, multiple policy bundling (home and auto insurance), claims-free history, and even for being a long-term customer. Some insurers may also offer discounts for energy-efficient upgrades or for completing home safety courses. It’s always advisable to inquire about available discounts when obtaining quotes.

Cost Impact of Different Risk Factors

| Risk Factor | Impact on Premium | Example | Potential Mitigation |

|---|---|---|---|

| Location (High Crime) | Increased | Home in a high-crime neighborhood | Improve home security |

| Home Age (Older Home) | Increased | 50-year-old home with outdated plumbing | Regular maintenance and upgrades |

| Home Size (Large Home) | Increased | 5,000 sq ft home | (Limited mitigation options) |

| Coverage Level (High Liability) | Increased | $500,000 liability coverage | Evaluate need for high coverage |

Top Homeowners Insurance Companies

Choosing the right homeowners insurance provider is a crucial decision, impacting your financial security and peace of mind. This section will examine three leading companies in the US market, comparing their offerings to help you make an informed choice. We will focus on coverage options, customer service, and claims processing efficiency. Remember that individual experiences can vary, and it’s always advisable to obtain personalized quotes and reviews before making a decision.

Leading Homeowners Insurance Providers

Three prominent homeowners insurance providers in the United States are State Farm, Allstate, and Nationwide. These companies consistently rank highly in terms of market share and customer satisfaction, though their specific strengths and weaknesses may vary. This comparison focuses on general trends and should not be considered exhaustive. Specific policy details and pricing will vary based on location, coverage needs, and individual risk profiles.

Coverage Options and Policy Features

State Farm, Allstate, and Nationwide offer a range of standard homeowners insurance coverage options, including dwelling protection, personal liability, and additional living expenses. However, the specifics of these coverages and the availability of optional add-ons (like flood or earthquake insurance) may differ. For example, State Farm is known for its extensive network of agents providing personalized service and tailored policy recommendations. Allstate offers various bundled insurance options, potentially leading to cost savings for customers with multiple insurance needs. Nationwide, on the other hand, is recognized for its strong financial stability and wide range of specialized coverage options catering to unique property types or circumstances.

Customer Service Reputation

Each company has a distinct customer service reputation. State Farm often receives positive feedback for its accessible agent network and personalized support. Allstate’s customer service has been subject to more varied reviews, with some customers praising their responsiveness while others reporting difficulties in reaching representatives or resolving issues. Nationwide generally receives positive reviews for its customer service, though similar to Allstate, experiences can be varied. Overall, consistent and efficient communication is a key factor in choosing a provider.

Claims Processing Speed and Efficiency

Claims processing speed and efficiency can vary significantly among these providers and depend heavily on the specific circumstances of the claim. Generally, all three companies aim for efficient claim handling, though individual experiences can vary greatly. Factors like the complexity of the claim, the availability of supporting documentation, and the company’s current workload can all impact processing times. Customer reviews often highlight the importance of clear communication and proactive updates from the insurance provider during the claims process.

Pros and Cons of Each Company

Understanding the pros and cons of each company can help you make an informed decision.

State Farm:

- Pros: Extensive agent network, personalized service, strong financial stability.

- Cons: Potentially higher premiums compared to some competitors in certain areas.

Allstate:

- Pros: Bundled insurance options, wide range of coverage choices.

- Cons: Customer service experiences can be inconsistent; claims processing speed may vary.

Nationwide:

- Pros: Strong financial stability, specialized coverage options, generally positive customer service reviews.

- Cons: May not offer the lowest premiums in all markets.

Policy Coverage and Features

Understanding the different types of coverage and features offered in a homeowners insurance policy is crucial for protecting your most valuable asset. Choosing the right policy involves careful consideration of your specific needs and risk factors. This section will detail the key components of a standard policy and highlight important additional coverage options.

Types of Homeowners Insurance Coverage

Homeowners insurance policies typically offer several types of coverage, broadly categorized to protect your property and your liability. These categories work together to provide comprehensive protection. A standard policy often includes dwelling coverage (protecting the physical structure of your home), other structures coverage (for detached garages or sheds), personal property coverage (for your belongings), loss of use coverage (for temporary living expenses if your home becomes uninhabitable), and liability coverage (protecting you from lawsuits). The specific amounts of coverage for each category are determined based on factors like the home’s value, location, and the contents within.

The Importance of Adequate Liability Coverage

Liability coverage is a critical component of homeowners insurance, offering financial protection if someone is injured on your property or if you accidentally damage someone else’s property. This coverage pays for medical bills, legal fees, and any judgments awarded against you. It’s important to have sufficient liability coverage to protect your assets from potentially devastating lawsuits. For example, if a guest slips and falls on your icy driveway, resulting in significant medical expenses and legal action, adequate liability coverage can prevent you from facing substantial financial losses. The recommended amount of liability coverage often exceeds the minimum requirements and should be considered based on your individual circumstances and risk profile. Consult with an insurance professional to determine the appropriate level for your needs.

Additional Coverage Options

Standard homeowners insurance policies may not cover all potential risks. Many insurers offer additional coverage options to address specific concerns. Flood insurance, for instance, is essential in flood-prone areas, as standard policies typically exclude flood damage. Similarly, earthquake insurance is crucial in seismically active regions. Other examples of additional coverage include personal liability umbrella policies (which extend liability coverage beyond the limits of your standard policy), identity theft protection, and coverage for valuable items such as jewelry or artwork. These supplemental policies provide enhanced protection tailored to specific risks and circumstances.

Determining the Appropriate Coverage Amount for Your Home

Determining the correct coverage amount requires a careful assessment of your home’s replacement cost, the value of your personal belongings, and your liability exposure. Several methods exist for estimating replacement costs, including professional appraisals and online calculators. It’s crucial to account for inflation and potential increases in construction costs when determining coverage amounts. Underinsuring your home can leave you financially vulnerable in the event of a significant loss. Regularly reviewing and adjusting your coverage amounts as needed ensures you maintain adequate protection. For personal belongings, creating a detailed inventory with photos or videos is recommended to facilitate claims processing.

Key Features of Standard Homeowners Insurance Policies

A standard homeowners insurance policy typically includes several key features designed to provide comprehensive protection. These features, while varying slightly by insurer and policy type, generally encompass the following:

- Dwelling Coverage: Protects the physical structure of your home against covered perils.

- Other Structures Coverage: Covers detached structures like garages, sheds, and fences.

- Personal Property Coverage: Protects your belongings inside and outside your home.

- Loss of Use Coverage: Provides funds for temporary living expenses if your home is uninhabitable.

- Liability Coverage: Protects you against lawsuits resulting from accidents or injuries on your property.

- Medical Payments Coverage: Pays for medical expenses of others injured on your property, regardless of fault.

Filing a Claim

Filing a homeowners insurance claim can feel daunting, but understanding the process can significantly ease the stress. A timely and well-documented claim is crucial for a smooth resolution and receiving the compensation you’re entitled to. This section details the steps involved, necessary documentation, common claim scenarios, and helpful tips for a successful claim process.

The Claim Filing Process

The process generally begins by contacting your insurance company immediately after an incident. This is typically done through a phone call to their claims department, followed by a detailed report of the incident. The insurer will then assign a claims adjuster to investigate the damage. The adjuster will assess the extent of the damage, verify the coverage, and determine the payout amount. Once the assessment is complete, the insurer will issue a settlement offer, which you can then accept or negotiate. Finally, the insurance company will process the payment and complete the claim.

Required Documentation

Supporting your claim with comprehensive documentation is vital. This includes, but is not limited to, your insurance policy, photographs and videos of the damage, police reports (if applicable, such as in cases of theft or vandalism), repair estimates from qualified contractors, receipts for any temporary repairs or expenses incurred, and any other relevant documentation that proves the extent of the loss and its connection to the insured property. Accurate and detailed documentation helps expedite the claims process and minimizes potential disputes.

Common Claim Scenarios and Handling

Several common scenarios frequently trigger homeowners insurance claims. For example, damage from severe weather (hail, wind, fire) often involves extensive photographic documentation of the damage to the property and its contents. Water damage claims, stemming from burst pipes or flooding, require documentation of the source of the damage and the extent of the water penetration. Theft claims necessitate a police report and detailed inventory of stolen items, including purchase receipts or appraisals where possible. Vandalism claims, similarly, need a police report and photographic evidence of the damage. Each scenario requires a tailored approach to documentation and evidence presentation to ensure a comprehensive claim.

Tips for a Smooth Claims Process

Several steps can streamline the claims process. Firstly, report the incident promptly. Secondly, take detailed photos and videos of the damage before making any repairs. Thirdly, keep accurate records of all communication with your insurer. Fourthly, cooperate fully with the claims adjuster during their investigation. Fifthly, obtain multiple repair estimates to ensure you receive fair compensation. Finally, review your policy carefully to understand your coverage limits and any applicable deductibles.

Filing a Claim: A Flowchart

A visual representation of the claims process can be helpful. Imagine a flowchart:

* Start: Incident occurs.

* Step 1: Contact your insurance company immediately.

* Step 2: Provide initial details of the incident.

* Step 3: Claims adjuster assigned.

* Step 4: Adjuster investigates and assesses damage.

* Step 5: Documentation submitted (photos, receipts, police reports).

* Step 6: Adjuster prepares damage estimate.

* Step 7: Insurance company issues settlement offer.

* Step 8: Review and accept or negotiate offer.

* Step 9: Payment processed.

* Step 10: Claim closed.

* End:

Conclusive Thoughts

Choosing the best homeowners insurance company requires careful consideration of numerous factors. By understanding the influence of location, home features, and coverage levels on premiums, and by comparing the offerings of leading providers, you can make an informed decision that aligns with your budget and risk tolerance. Remember to compare quotes, read policy details carefully, and don’t hesitate to ask questions. Protecting your most valuable asset deserves thorough planning and research – this guide provides the tools you need to do just that.

User Queries

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current market value of damaged property, minus depreciation. Replacement cost coverage pays for the cost of replacing the damaged property with new, similar items, without deducting for depreciation.

How often should I review my homeowners insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes in your life or property, such as renovations, additions, or increases in your possessions’ value.

What factors can affect my insurance deductible?

Your deductible is usually determined by you when you select your policy, but some insurers may offer discounts for higher deductibles. A higher deductible typically means lower premiums.

Can I get homeowners insurance if I have a previous claim?

Yes, but the cost of your premiums may be higher depending on the nature and severity of the previous claim. Be transparent with your insurer about your history.