Securing comprehensive insurance coverage is a crucial step in protecting your most valuable assets – your home and your vehicle. Navigating the world of insurance bundles, however, can feel overwhelming. This guide aims to demystify the process, helping you understand the key factors to consider when selecting the best home and auto insurance bundle to fit your individual needs and budget. From understanding coverage options and comparing quotes to navigating policy documents and understanding claims processes, we’ll equip you with the knowledge to make an informed decision.

We’ll explore the diverse range of features and coverage levels available, highlighting the advantages and disadvantages of different options. We’ll also discuss how individual circumstances, such as family size, location, and driving history, significantly impact the ideal bundle choice. By the end, you’ll be well-prepared to confidently compare bundles and choose the one that provides the optimal balance of protection and affordability.

Defining “Best” in Home and Auto Insurance Bundles

Finding the “best” home and auto insurance bundle is a highly personal endeavor, dependent on a complex interplay of individual needs and priorities. There’s no single “best” bundle for everyone; the optimal choice varies significantly based on individual circumstances and risk profiles.

Consumer priorities when selecting a home and auto insurance bundle are diverse and often conflicting. Understanding these priorities is crucial for making an informed decision.

Factors Influencing the Definition of “Best”

Several key factors influence how consumers define the “best” insurance bundle. These factors often interact, making the decision-making process challenging but ultimately rewarding when the right fit is found. Understanding these elements allows for a more strategic approach to finding the perfect bundle.

Consumer Priorities in Bundle Selection

Consumers typically prioritize a combination of factors when choosing a home and auto insurance bundle. These priorities are not mutually exclusive and often involve trade-offs.

- Price: Affordability is a primary concern for most consumers. The lowest premium is often the initial deciding factor, particularly for those on a tight budget. However, solely focusing on price can lead to inadequate coverage.

- Coverage: The extent of coverage offered is paramount. Consumers need sufficient protection against potential losses, considering factors like the value of their home and vehicle, personal belongings, and liability risks. Comprehensive coverage, while more expensive, provides greater peace of mind.

- Customer Service: Easy access to responsive and helpful customer service is critical, particularly during claims processing. Positive experiences with claims handling significantly influence customer satisfaction and loyalty.

Impact of Individual Circumstances on Bundle Selection

Individual circumstances significantly shape the selection process. What constitutes the “best” bundle for one person might be entirely unsuitable for another.

- Family Size: Larger families may require higher liability limits and more comprehensive coverage for their belongings. A family with young children might need additional coverage for specific risks.

- Location: Location significantly influences both home and auto insurance premiums. Areas prone to natural disasters (hurricanes, earthquakes, wildfires) will command higher premiums. Similarly, high-crime areas can lead to increased auto insurance costs.

- Driving History: Clean driving records typically result in lower auto insurance premiums. Individuals with multiple accidents or traffic violations will face higher premiums. This directly impacts the overall cost of the bundle.

Bundle Features and Coverage Options

Choosing the right home and auto insurance bundle involves understanding the features and coverage options available. Different bundles offer varying levels of protection, impacting both your premiums and the extent of financial coverage in the event of an accident or damage to your property. Carefully comparing these options is crucial to securing adequate insurance at a competitive price.

Home and auto insurance bundles typically include standard features designed to protect your assets and liability. Common features often bundled together include liability coverage for both your home and vehicle, property damage coverage for your home and personal belongings, and collision and comprehensive coverage for your vehicle. However, the specific inclusions and limits can vary significantly between providers and policy packages.

Coverage Levels for Home and Auto Insurance

Home insurance bundles usually offer several levels of coverage for dwelling, personal property, and liability. For example, a basic policy might cover the dwelling’s replacement cost up to a specific limit, while a more comprehensive policy may offer extended replacement cost coverage, which covers rebuilding costs even if they exceed the policy’s limit. Similarly, personal property coverage can vary, with higher limits available for valuable items. Auto insurance bundles also offer different levels of liability coverage, collision coverage, and comprehensive coverage. Liability coverage protects you against financial responsibility for injuries or damages caused to others. Collision coverage covers damage to your vehicle in an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle from events like theft, vandalism, or weather-related incidents.

Benefits and Drawbacks of Coverage Options

Liability coverage is essential for both home and auto insurance. It protects you from significant financial losses if you are held responsible for an accident or injury. However, the liability limits you choose should reflect your assets and potential exposure to risk. Higher limits provide greater protection but come with higher premiums. Collision coverage for your vehicle offers peace of mind in case of accidents, but it is often optional and can be expensive. Comprehensive coverage provides broad protection against various risks but can also be costly. Weighing the potential costs of incidents against the premium cost is vital when deciding on coverage levels. For instance, a driver in a high-risk area might prioritize comprehensive coverage to protect against theft, while someone in a low-risk area might find it less necessary. Similarly, homeowners in areas prone to natural disasters might prioritize higher dwelling coverage.

Comparison of Three Bundle Packages

| Feature | Basic Bundle | Standard Bundle | Premium Bundle |

|---|---|---|---|

| Home Dwelling Coverage | $200,000 | $300,000 | $400,000 |

| Home Liability Coverage | $100,000 | $300,000 | $500,000 |

| Auto Liability Coverage | $50,000/$100,000 | $100,000/$300,000 | $250,000/$500,000 |

| Collision Coverage (Auto) | Optional | Included | Included with higher deductible options |

| Comprehensive Coverage (Auto) | Optional | Optional | Included |

| Annual Premium (Example) | $1200 | $1500 | $2000 |

Finding and Comparing Bundles

Securing the best home and auto insurance bundle involves a thorough comparison of various providers and their offerings. This process requires understanding the different avenues available for finding suitable bundles and effectively evaluating the quotes received. The goal is to find a balance between comprehensive coverage and affordability.

Finding suitable home and auto insurance bundles can be approached in several ways, each with its own set of advantages and disadvantages. Consumers have access to a range of resources to facilitate this comparison process, leading to informed decision-making.

Methods for Finding Home and Auto Insurance Bundles

Consumers can utilize several methods to find home and auto insurance bundles. These methods offer varying degrees of convenience and control over the search process. Choosing the right method depends on individual preferences and the level of involvement desired.

- Online Comparison Websites: These websites allow users to input their information and receive quotes from multiple insurers simultaneously. This streamlines the comparison process, saving time and effort. Examples include sites like NerdWallet, Policygenius, and The Zebra.

- Directly Contacting Insurance Agents: Working with an independent insurance agent provides personalized guidance and access to a broader range of insurers, potentially including those not listed on comparison websites. Agents can help navigate policy options and explain complex terms.

- Individual Insurer Websites: Consumers can visit the websites of individual insurance companies to obtain quotes. This approach offers a deeper understanding of each insurer’s specific offerings but requires visiting multiple websites for a comprehensive comparison.

Advantages and Disadvantages of Comparison Tools vs. Insurance Agents

Online comparison tools and direct contact with insurance agents each present unique advantages and disadvantages that consumers should consider before choosing their preferred method.

| Feature | Online Comparison Tools | Insurance Agents |

|---|---|---|

| Convenience | High: Quick and easy access to multiple quotes. | Moderate: Requires scheduling appointments or phone calls. |

| Personalization | Low: Limited personalized advice; relies on user input. | High: Personalized guidance and tailored recommendations. |

| Coverage Options | Moderate: May not display all available options from each insurer. | High: Access to a wider range of insurers and coverage options. |

| Cost | Generally free to use. | May involve commissions, but often offset by personalized service. |

Step-by-Step Guide to Comparing Quotes

A systematic approach to comparing quotes ensures a thorough evaluation of different insurance providers and their offerings. This process allows for a well-informed decision based on individual needs and preferences.

- Gather Necessary Information: Compile details about your home (address, value, features) and vehicles (make, model, year). Accurate information is crucial for accurate quotes.

- Obtain Quotes from Multiple Providers: Utilize online comparison tools, contact insurance agents, or visit individual insurer websites to gather quotes. Aim for at least three to five quotes for a comprehensive comparison.

- Compare Coverage Options: Carefully review the coverage details of each quote, paying close attention to deductibles, premiums, and policy limits. Consider factors like liability limits, comprehensive coverage, and collision coverage.

- Analyze Premiums and Deductibles: Evaluate the total cost of each policy, considering both the premium and the deductible. A higher deductible typically results in a lower premium, and vice-versa. Determine the balance that best suits your budget and risk tolerance.

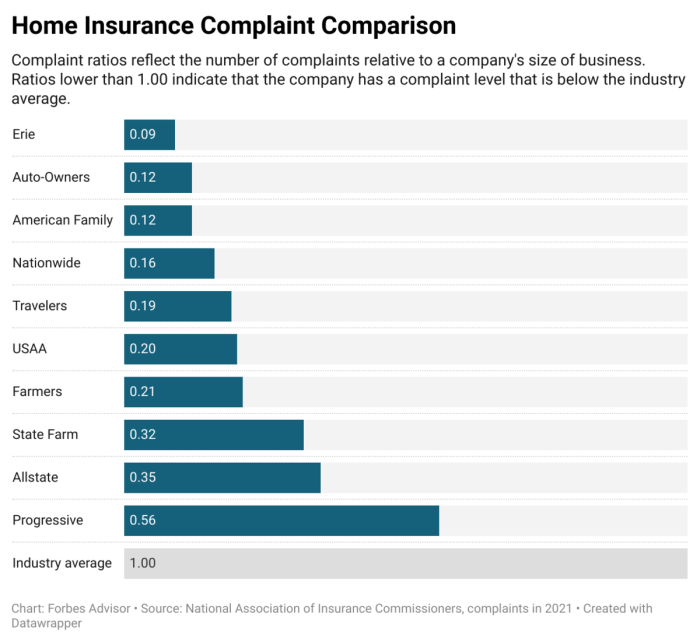

- Review Customer Reviews and Ratings: Research the reputation of each insurer by checking online reviews and ratings from independent sources. This helps assess the insurer’s customer service and claims handling process.

- Select the Best Bundle: Based on your analysis, choose the home and auto insurance bundle that best meets your needs in terms of coverage, cost, and insurer reputation. Remember that the cheapest option isn’t always the best if it lacks adequate coverage.

Understanding Policy Documents and Fine Print

Scrutinizing your home and auto insurance policy documents is crucial before committing to a bundled package. Failing to do so could leave you vulnerable to unexpected costs and insufficient coverage in the event of a claim. Understanding the fine print ensures you’re getting the protection you need and paid for.

Policy documents, while dense, are designed to clearly Artikel your coverage, limitations, and responsibilities. A thorough review helps you avoid unpleasant surprises down the line and empowers you to make informed decisions about your insurance needs.

Key Clauses and Exclusions

Many policies contain clauses that limit coverage under specific circumstances or exclude certain types of events altogether. For example, flood damage is often excluded from standard homeowners’ insurance policies and requires separate flood insurance. Similarly, auto policies may exclude coverage for damage caused by driving under the influence of alcohol or drugs. Consumers should pay close attention to these exclusions to ensure they have adequate supplemental coverage if needed. Other examples include clauses related to liability limits, the definition of a covered accident, and specific exclusions related to wear and tear versus accidental damage. Reviewing these details will ensure you are aware of what is, and isn’t, covered under your policy.

Understanding Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurer will pay for a covered claim. For instance, a homeowners’ policy might have a $250,000 liability limit for property damage caused by an accident on your property. If damages exceed this amount, you would be responsible for the difference. Similarly, auto insurance policies have liability limits for bodily injury and property damage. Understanding these limits is vital in determining if your coverage is sufficient for your assets and potential liabilities.

Deductibles represent the amount you must pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. For example, a $500 deductible on your auto insurance means you’ll pay the first $500 of any repair costs before your insurance coverage begins. Choosing the right deductible balance involves weighing the cost of premiums against your risk tolerance and financial capacity to cover potential out-of-pocket expenses. Carefully consider your financial situation and potential risk factors when determining the optimal deductible amount for your needs.

Customer Service and Claims Processes

Choosing the “best” home and auto insurance bundle isn’t solely about price and coverage; exceptional customer service and a streamlined claims process are equally crucial. A responsive and helpful insurer can significantly ease the stress associated with unexpected events, transforming a potentially negative experience into a manageable one. Conversely, poor customer service can amplify the difficulties of dealing with a claim, leaving you feeling frustrated and unsupported.

A responsive and helpful customer service team is invaluable. Imagine experiencing a house fire or a car accident – stressful situations demanding immediate attention. Having access to knowledgeable, empathetic representatives who can guide you through the complexities of filing a claim and addressing your concerns is paramount. Efficient communication, prompt responses, and clear explanations are hallmarks of excellent customer service.

Positive and Negative Customer Service Examples

Positive experiences often involve quick response times, clear communication, and proactive assistance. For instance, one insurer might immediately dispatch an adjuster after a car accident, providing temporary transportation while the vehicle is repaired. Conversely, negative experiences can include long wait times on hold, unhelpful representatives providing conflicting information, and a general lack of responsiveness to inquiries. A delayed response to a claim following a major home incident, leaving the homeowner in a vulnerable position without sufficient support, exemplifies poor customer service.

The Typical Claims Process for Home and Auto Insurance

The claims process typically begins with reporting the incident to your insurer. For auto insurance, this often involves providing details of the accident, including the date, time, location, and parties involved. For home insurance, reporting might involve describing the damage, its cause, and any immediate safety concerns. Following the initial report, an adjuster will likely be assigned to assess the damage and determine the extent of coverage. This assessment may involve an on-site inspection. Once the assessment is complete, the insurer will determine the payout based on the policy’s terms and conditions. The final stage involves receiving the payment or having repairs completed.

Questions to Ask Potential Insurers Regarding Their Claims Process

Before selecting an insurer, it’s crucial to understand their claims process. The following points represent key areas to clarify with potential insurers:

- The average processing time for claims of various types (e.g., minor auto damage, major home repairs).

- The methods for reporting claims (e.g., phone, online portal, mobile app).

- The availability of 24/7 claims support.

- The process for selecting and working with repair contractors (if applicable).

- The insurer’s policy on rental car reimbursement (for auto claims).

- The insurer’s process for handling disputes or disagreements about claim settlements.

- Whether the insurer utilizes independent adjusters or employs its own staff.

- The availability of a dedicated claims specialist to assist throughout the process.

End of Discussion

Choosing the right home and auto insurance bundle is a significant financial decision that requires careful consideration. By understanding your individual needs, comparing different options, and thoroughly reviewing policy documents, you can secure the best possible protection for your home and vehicle. Remember to prioritize clear communication with your insurer and ask clarifying questions regarding coverage, claims processes, and customer service responsiveness. Making an informed choice empowers you to secure the peace of mind that comes with knowing your assets are adequately protected.

FAQs

What is a deductible, and how does it affect my insurance costs?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums (monthly payments), while lower deductibles result in higher premiums.

Can I bundle insurance for multiple vehicles or properties?

Yes, many insurers offer discounts for bundling multiple vehicles or properties under a single policy. This can lead to significant savings.

How often can I review and adjust my insurance policy?

Most insurance policies allow for annual reviews and adjustments. Life changes, such as a new car or a home renovation, may necessitate policy modifications. Contact your insurer to discuss your options.

What happens if I switch insurance providers mid-term?

Switching providers mid-term is usually possible, but you may incur penalties or early termination fees depending on your existing policy terms. Check your policy for details.