Navigating the Texas car insurance market can feel like driving through a maze. Numerous providers, varying coverage options, and a complex interplay of factors influence the final cost. This guide unravels the intricacies of securing the best car insurance rates in Texas, empowering you to make informed decisions and potentially save significant money.

We’ll explore key factors affecting your premiums, from your driving history and credit score to the type of vehicle you drive and the coverage you choose. We’ll also provide practical strategies for comparing quotes, negotiating lower rates, and taking advantage of available discounts. Understanding these elements is crucial for obtaining the most competitive insurance rates tailored to your specific needs.

Understanding Texas Car Insurance Market

Navigating the Texas car insurance market can feel overwhelming, given the numerous providers and varying coverage options. Understanding the factors that influence your premiums and the types of coverage available is crucial for securing the best and most affordable policy. This section will provide a clear overview of the Texas car insurance landscape.

Factors Influencing Car Insurance Rates in Texas

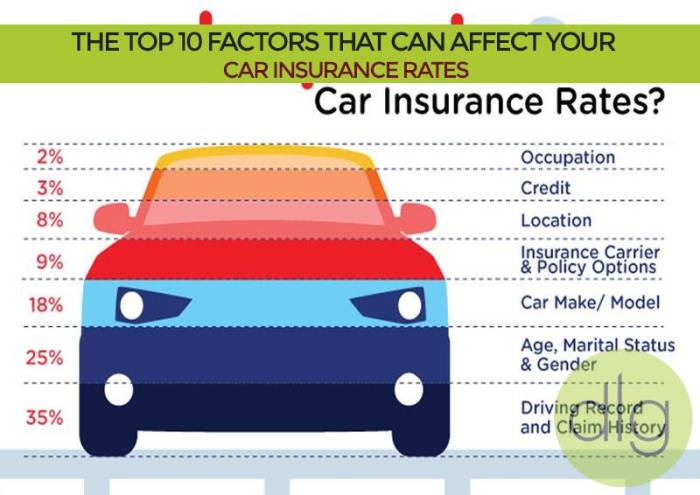

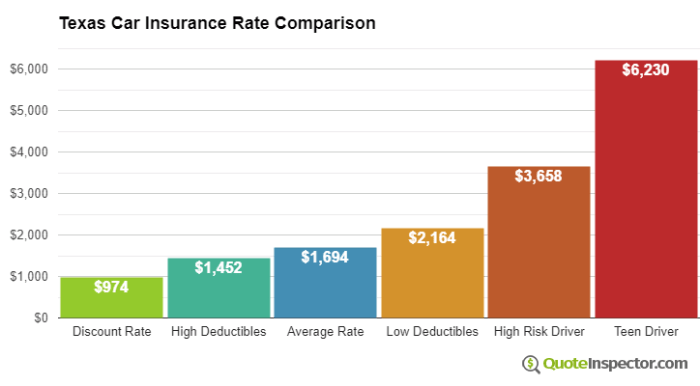

Several key factors determine your car insurance rates in Texas. These include your driving history (accidents, tickets, and DUI convictions), your age and gender, the type of vehicle you drive (make, model, and year), your location (urban areas generally have higher rates due to increased risk), and your credit score (insurers often use credit scores as an indicator of risk). Your chosen coverage levels also significantly impact your premium; higher coverage limits generally mean higher premiums. Finally, your driving habits, such as mileage and commuting distance, can also play a role in determining your rates.

Types of Car Insurance Coverage Available in Texas

Texas law mandates minimum liability coverage, which protects others in the event you cause an accident. This minimum typically includes bodily injury liability and property damage liability. However, drivers can and should consider purchasing additional coverage for more comprehensive protection. Comprehensive coverage protects your vehicle against non-collision damage (e.g., theft, vandalism, weather damage), while collision coverage protects against damage from accidents. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance. Personal injury protection (PIP) covers your medical expenses and lost wages regardless of fault. Medical payments coverage (Med-Pay) is similar to PIP but often has lower limits.

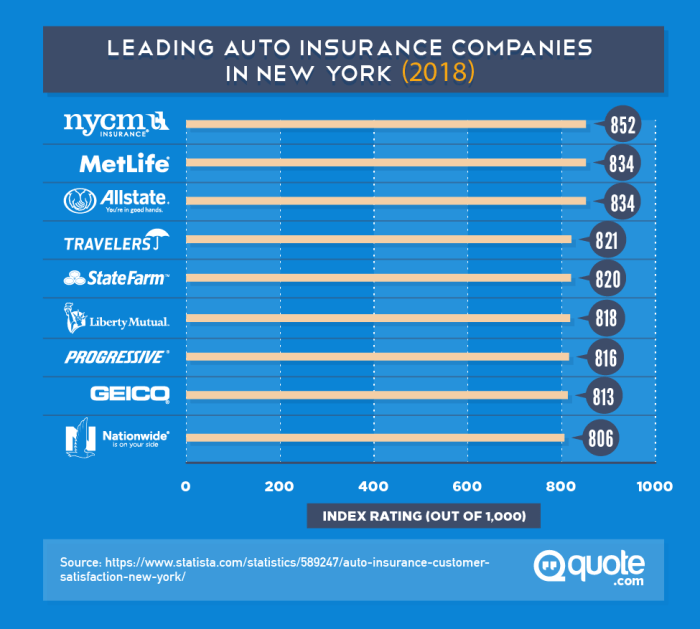

Comparison of Major Car Insurance Providers in Texas

The Texas car insurance market is highly competitive, with many major national and regional providers. While specific rates vary based on individual factors, a general comparison can illustrate the differences in pricing and coverage options. Note that these are average rates and may not reflect your specific situation. It’s crucial to obtain personalized quotes from multiple providers to find the best deal for your needs.

Comparison Table of Texas Car Insurance Providers

| Provider | Liability Coverage (Average Annual Rate) | Comprehensive Coverage (Average Annual Rate) | Collision Coverage (Average Annual Rate) |

|---|---|---|---|

| State Farm | $500 – $800 | $200 – $400 | $300 – $600 |

| Geico | $450 – $750 | $180 – $350 | $250 – $500 |

| Progressive | $550 – $900 | $220 – $450 | $350 – $700 |

| USAA | $400 – $650 | $150 – $300 | $200 – $400 |

Factors Affecting Individual Rates

Securing the best car insurance rates in Texas involves understanding the numerous factors influencing your premium. Insurance companies use a complex algorithm considering your individual characteristics and driving history to determine your risk profile. This risk assessment directly impacts the final cost of your policy. A deeper understanding of these factors can empower you to make informed decisions and potentially lower your premiums.

Several key individual factors significantly impact your Texas car insurance premiums. These factors are analyzed and weighted differently by each insurance company, resulting in variations in quotes. However, understanding the general impact of each allows for better comparison shopping and informed decision-making.

Age and Driving Experience

Age is a significant factor in determining car insurance rates. Younger drivers, particularly those under 25, statistically have higher accident rates, leading to higher premiums. This is because inexperience and risk-taking behaviors are more common in this age group. As drivers gain experience and reach their mid-twenties and beyond, their premiums generally decrease, reflecting a lower risk profile. For example, a 16-year-old driver will typically pay significantly more than a 35-year-old driver with a clean driving record, even with identical vehicles and coverage. This difference reflects the increased likelihood of accidents among younger, less experienced drivers.

Driving History

Your driving history is arguably the most significant factor influencing your car insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, DUIs, and other moving violations will substantially increase your rates. The severity of the violation and the frequency of incidents directly correlate with higher premiums. For instance, a single speeding ticket might lead to a modest increase, while a DUI conviction could result in a significant premium hike, or even policy cancellation in some cases. Multiple accidents or serious violations within a short period could dramatically impact your rates.

Credit Score

In Texas, as in many states, your credit score can influence your car insurance rates. Insurers use credit-based insurance scores to assess your risk profile. A higher credit score generally correlates with lower premiums, while a lower credit score suggests a higher risk of claims. The rationale behind this is that individuals with good credit history are often perceived as more responsible and less likely to file fraudulent claims. This practice is controversial, and some states are actively working to eliminate it, but it currently remains a factor in many Texas insurance rate calculations.

Type of Vehicle

The type of vehicle you drive plays a crucial role in determining your insurance rates. Factors considered include the vehicle’s make, model, year, safety features, and repair costs. Sports cars and luxury vehicles typically command higher premiums due to their higher repair costs and potential for more severe accidents. Conversely, smaller, more fuel-efficient vehicles often have lower premiums. Vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

Location

Your location in Texas also influences your insurance rates. Areas with higher crime rates and a greater frequency of accidents generally have higher insurance premiums. Urban areas often have higher rates compared to rural areas due to increased traffic congestion and the higher likelihood of accidents. The specific zip code where your vehicle is garaged is a key factor in determining your risk profile.

Coverage Level

The level of coverage you choose directly affects your premiums. Higher coverage limits, such as liability and collision, will result in higher premiums. While higher coverage provides greater financial protection, it comes at a higher cost. Choosing the minimum required coverage will generally result in lower premiums but leaves you with less financial protection in the event of an accident.

Factors Contributing to Higher or Lower Rates

The following bulleted list summarizes how various factors contribute to higher or lower insurance rates:

- Higher Rates: Younger age, poor driving history (accidents, tickets, DUIs), low credit score, expensive or high-performance vehicle, urban location, high coverage limits.

- Lower Rates: Older age (with clean driving record), clean driving history, good credit score, fuel-efficient vehicle, rural location, minimum required coverage.

Finding the Best Rates

Securing the most affordable car insurance in Texas requires a proactive approach. By employing effective comparison strategies and understanding the factors influencing your premiums, you can significantly reduce your annual costs. This section Artikels practical steps to achieve the best possible rates.

Effective Strategies for Comparing Car Insurance Quotes in Texas involve more than just checking a few websites. A comprehensive approach considers various factors and insurers to ensure you’re getting the best deal. This includes understanding your needs and comparing apples to apples, not just focusing on the lowest initial price.

Comparing Quotes from Multiple Insurers

Obtaining multiple quotes is crucial for finding the best car insurance rate. A step-by-step guide simplifies this process:

- Gather Your Information: Before starting, collect necessary information, including your driver’s license, vehicle identification number (VIN), and driving history. Accurate information ensures accurate quotes.

- Use Online Comparison Tools: Many websites allow you to compare quotes from multiple insurers simultaneously. Input your information once and receive multiple offers. These tools save significant time and effort.

- Contact Insurers Directly: While online tools are convenient, contacting insurers directly can provide additional insights and personalized options. Some discounts or specialized programs may not be available through online comparison tools.

- Review the Details: Carefully compare the coverage details, not just the price. Ensure the coverage limits and deductibles align with your needs and budget. A lower premium with insufficient coverage is ultimately a poor choice.

- Consider Different Coverage Levels: Experiment with different coverage levels (liability, collision, comprehensive) to see how they impact the premium. You may find a slightly higher premium for more comprehensive coverage is worthwhile in the long run.

Negotiating Lower Insurance Premiums

Once you have several quotes, you can leverage this information to negotiate lower premiums. This involves presenting competitive offers and highlighting your positive driving record.

Negotiating effectively requires a confident approach. Start by pointing out lower quotes from other insurers. Mention any safety features in your vehicle, such as anti-theft devices or advanced driver-assistance systems (ADAS). A clean driving record is a significant bargaining chip. Inquire about discounts for bundling policies (home and auto) or for completing defensive driving courses.

Using Online Comparison Tools Effectively

Online comparison tools are valuable resources, but effective use requires understanding their limitations. Ensure the tool includes a broad range of insurers operating in Texas. Be wary of tools that prioritize certain insurers; the best tool presents unbiased results from a wide selection of providers. Remember to review the fine print of any quote obtained through these tools. A seemingly low price may come with limitations on coverage. For example, a tool might only display minimum liability coverage, which may not be sufficient for your needs.

Discounts and Savings

Securing the best car insurance rates in Texas often involves leveraging available discounts. Many insurers offer a variety of discounts to incentivize safe driving habits and responsible behavior. Understanding these discounts and how to qualify can significantly reduce your premiums. This section details common discounts, eligibility requirements, and strategies to maximize your savings.

Common Car Insurance Discounts in Texas

Texas car insurance companies offer a range of discounts to reward safe driving and responsible behavior. These discounts can significantly lower your premiums, making insurance more affordable. Understanding the eligibility criteria for each discount is crucial to maximizing your savings.

| Discount Type | Eligibility Criteria | Potential Savings Example |

|---|---|---|

| Safe Driver Discount | Clean driving record with no accidents or traffic violations within a specified period (typically 3-5 years). Some insurers may consider points on your driving record. This often involves providing your driving history report. | A driver with a clean record might save 10-20% or more on their premium compared to a driver with accidents or violations. For example, a $100 monthly premium could be reduced to $80-$90. |

| Good Student Discount | Maintaining a high grade point average (GPA) in school. Specific GPA requirements vary by insurer, but generally, a GPA of 3.0 or higher is needed. Proof of enrollment and academic standing is usually required. | This discount can range from 5-25%, depending on the insurer and the student’s GPA. A student with a 3.8 GPA might save $15-$20 per month on a $100 premium. |

| Multi-Car Discount | Insuring multiple vehicles under the same policy with the same insurer. | Insuring two cars instead of one can often result in a 10-15% discount on the overall premium. If your individual premiums were $100 each, you might pay a total of $170 instead of $200. |

| Multi-Policy Discount (Bundling) | Bundling car insurance with other types of insurance, such as homeowners or renters insurance, from the same company. | Bundling policies can save 5-15% or more depending on the insurer and the types of policies bundled. For example, combining home and auto insurance could reduce your overall monthly cost by $20-$30. |

| Defensive Driving Course Discount | Completion of an approved defensive driving course. Proof of course completion is required. | Discounts vary by insurer but often range from 5-10%. A $100 monthly premium could decrease by $5-$10. |

| Vehicle Safety Features Discount | Driving a vehicle equipped with safety features like anti-lock brakes (ABS), airbags, and electronic stability control (ESC). | This discount can range from 5-10% and reflects the reduced risk associated with safer vehicles. A $100 premium could be reduced by $5-$10. |

| Payment Plan Discount | Paying your insurance premium in full upfront instead of opting for monthly installments. | Insurers often offer a small discount (around 2-5%) for paying in full, avoiding the administrative costs associated with payment plans. This could save you $2-$5 on a $100 premium. |

Maximizing Savings Through Discounts

To maximize savings, actively pursue all applicable discounts. Compare quotes from multiple insurers, providing accurate and complete information to ensure eligibility for all potential discounts. Maintain a clean driving record, achieve and maintain a high GPA (if applicable), and consider bundling your insurance policies. Regularly review your policy and explore new discounts as your circumstances change. For example, if you complete a defensive driving course or purchase a new car with advanced safety features, update your insurer immediately.

Understanding Policy Details

Choosing the right car insurance policy in Texas involves more than just finding the lowest price. A thorough understanding of your policy’s details is crucial to ensure you have the appropriate coverage in case of an accident or other unforeseen events. This section will break down the key components of a standard Texas car insurance policy to help you make an informed decision.

Understanding the various parts of your policy is essential for protecting yourself financially. Failing to grasp the nuances of your coverage could leave you vulnerable to significant out-of-pocket expenses in the event of a claim. Let’s delve into the key elements that define your policy and its implications.

Policy Limits and Deductibles

Policy limits define the maximum amount your insurance company will pay for covered losses in a single accident or over a policy period. These limits are typically expressed as per-person and per-accident amounts for bodily injury liability and property damage liability. For example, a 100/300/100 policy means the insurer will pay up to $100,000 for injuries to one person, up to $300,000 for injuries to multiple people in a single accident, and up to $100,000 for property damage. Deductibles, on the other hand, represent the amount you must pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but also means a larger upfront cost in the event of a claim. Choosing the right balance between deductible and premium is a personal decision based on your risk tolerance and financial situation.

Common Policy Exclusions

It’s important to understand what your policy *doesn’t* cover. Common exclusions may include damage caused by wear and tear, intentional acts, driving under the influence of alcohol or drugs, or using your vehicle for unauthorized purposes (e.g., using a personal vehicle for commercial deliveries). Additionally, many policies exclude coverage for certain types of vehicles, such as motorcycles or off-road vehicles, unless specifically added as endorsements. Reviewing the policy document carefully to identify these exclusions is vital to avoid surprises later. For example, a policy might exclude coverage for damage caused by flooding if you live in a flood-prone area, requiring separate flood insurance.

Important Questions to Ask Insurance Providers

Before committing to a policy, it’s crucial to ask clarifying questions. This proactive approach ensures you fully understand your coverage and avoid potential misunderstandings.

- What are the specific limits for bodily injury and property damage liability?

- What is the deductible for collision and comprehensive coverage?

- Are there any exclusions or limitations on coverage for specific situations or types of damage?

- What is the process for filing a claim, and what documentation will be required?

- What discounts are available, and am I eligible for any of them?

- What is the process for making payments and how can I manage my policy online?

- What are the options for increasing or decreasing coverage in the future?

Dealing with Claims

Filing a car insurance claim in Texas can seem daunting, but understanding the process can significantly ease the stress involved after an accident. This section Artikels the steps involved, provides examples of common claim scenarios, and offers a visual representation of the claim process. Remember, prompt action and accurate documentation are key to a smooth claim resolution.

The Car Insurance Claim Process in Texas

After a car accident in Texas, promptly notify your insurance company. This typically involves contacting them by phone or through their online portal. You’ll need to provide details of the accident, including the date, time, location, and a description of the events. Your insurance company will then guide you through the next steps, which may include filing a police report (especially in accidents involving injuries or significant property damage), gathering evidence (photos, witness statements), and potentially undergoing an appraisal of vehicle damage. The insurer will investigate the claim to determine liability and the extent of damages. Once the investigation is complete, your claim will be processed, and you will receive payment or other settlement according to your policy coverage.

Steps Involved in Dealing with an Accident

Dealing with a car accident requires a systematic approach. First, ensure everyone involved is safe and seek medical attention if necessary. Then, call the police to report the accident and obtain a police report. Next, gather information from all parties involved, including driver’s license numbers, insurance information, and contact details. Take photographs of the damage to all vehicles involved, the accident scene, and any visible injuries. Finally, notify your insurance company as soon as possible, providing them with all the information you’ve collected. Keep detailed records of all communications and documentation related to the accident and claim.

Common Claim Scenarios and Handling

Several common claim scenarios can arise after a car accident. For instance, a minor fender bender with minimal damage might only require a simple claim process involving exchanging information and providing photos of the damage. In contrast, a more serious accident involving injuries or significant property damage will require a more thorough investigation, possibly including medical evaluations and detailed damage assessments. A hit-and-run accident necessitates reporting the incident to the police immediately and filing a claim with your insurer, providing as much detail as possible about the other vehicle and driver. If you are involved in an accident with an uninsured driver, your Uninsured/Underinsured Motorist (UM/UIM) coverage will likely be utilized, and the claim process will involve your insurer pursuing recovery from the at-fault driver.

Claim Process Flowchart

Imagine a flowchart. It would begin with a box labeled “Accident Occurs”. This would branch to two boxes: “Injuries?” (Yes/No). If “Yes”, it would lead to “Seek Medical Attention” and then to “Report to Police”. If “No”, it would directly lead to “Report to Police”. Both paths then converge into “Notify Insurance Company”. This leads to “Gather Evidence (Photos, Witness Statements)”. Then, “Insurance Investigation” occurs, followed by “Liability Determination”. Finally, the flowchart concludes with “Claim Settlement (Payment/Repair)”. This illustrates the general process, but the specifics can vary based on individual circumstances.

State Regulations and Consumer Protection

Navigating the Texas car insurance market requires understanding the regulatory framework and the protections afforded to consumers. The Texas Department of Insurance (TDI) plays a crucial role in ensuring fair practices and protecting policyholders’ rights. This section Artikels the TDI’s responsibilities, details consumer protections under Texas law, and provides resources for resolving disputes.

The Texas Department of Insurance’s Role in Regulating Car Insurance

The TDI is the state agency responsible for overseeing the insurance industry in Texas. Its primary function regarding car insurance is to ensure that companies comply with state laws, maintain financial solvency, and treat consumers fairly. This involves setting minimum coverage requirements, approving insurance rates, and investigating consumer complaints. The TDI also educates consumers about their rights and responsibilities, helping them make informed decisions about their car insurance. They actively monitor insurance companies’ business practices to prevent unfair or deceptive acts and practices. This regulatory oversight is vital in maintaining a stable and consumer-friendly insurance market.

Consumer Rights and Protections Under Texas Law

Texas law provides several protections for car insurance consumers. These rights ensure fair treatment and access to necessary information. Policyholders have the right to clear and understandable policy documents, the right to receive prompt claim settlements, and the right to appeal decisions made by their insurance companies. The TDI actively works to enforce these rights and investigate complaints of unfair practices. Furthermore, the state mandates certain disclosures from insurance companies, providing consumers with transparency regarding their policy terms and conditions. This includes details about coverage limits, exclusions, and premium calculations.

Resources for Filing Complaints or Resolving Disputes

Consumers who have disputes with their insurance companies have several avenues for recourse. The TDI provides a comprehensive online complaint system, allowing policyholders to easily file complaints and track their progress. The TDI also offers mediation services to help resolve disputes between consumers and insurers without resorting to lengthy and costly litigation. In cases where mediation is unsuccessful, consumers can pursue legal action, but the TDI’s resources often facilitate quicker and more efficient resolutions. Consumers can also seek assistance from consumer advocacy groups and legal professionals specializing in insurance law. The TDI website provides detailed information on the complaint process and other resources available to consumers.

Important Consumer Protection Laws in Texas

Understanding key Texas laws protecting car insurance consumers is crucial for effective advocacy.

- Texas Insurance Code: This comprehensive code Artikels the regulations governing the insurance industry in Texas, including provisions related to consumer protection, fair claims practices, and rate regulation.

- Prompt Payment of Claims: Texas law requires insurers to pay valid claims promptly. Delays beyond reasonable timeframes may result in penalties for the insurer.

- Unfair Claims Settlement Practices Act: This act prohibits insurers from engaging in unfair or deceptive practices when handling claims, such as failing to conduct a thorough investigation or denying claims without sufficient justification.

- Right to Sue: Policyholders have the right to sue their insurance companies for breach of contract or bad faith claims handling if they believe their rights have been violated.

- Consumer Information Disclosure Requirements: Insurers are required to provide clear and concise information about their policies, including coverage details, exclusions, and premium calculations.

Ultimate Conclusion

Securing the best car insurance rates in Texas requires proactive research and a strategic approach. By understanding the factors influencing premiums, effectively comparing quotes, and leveraging available discounts, you can significantly reduce your insurance costs. Remember, the right policy is more than just a low price; it’s about finding the right balance of coverage and affordability to protect yourself and your vehicle on Texas roads. This guide provides the tools you need to confidently navigate this process.

Essential Questionnaire

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the state after certain driving offenses (like DUI). You only need it if mandated by the court or Texas Department of Public Safety.

Can I bundle my car insurance with other types of insurance?

Yes, many insurers offer discounts for bundling car insurance with home, renters, or other types of insurance. Check with providers to see what bundles are available.

How often can I get my car insurance rates reviewed?

You can request a rate review whenever you want, especially if significant life changes occur (marriage, new car, improved driving record). Most insurers allow for annual reviews as well.

What happens if I get into an accident and don’t have enough coverage?

Insufficient coverage could leave you responsible for paying out-of-pocket for damages exceeding your policy limits. This could lead to significant financial hardship.