Finding the best car insurance in Louisiana can feel overwhelming, given the state’s unique regulatory environment and diverse range of providers. Factors like accident rates, demographics, and even weather significantly impact premiums. This guide navigates the complexities of the Louisiana insurance market, helping you understand coverage options, compare top companies, and ultimately secure the most suitable policy for your needs and budget.

We’ll delve into the key factors influencing insurance costs, including your driving history, age, location, vehicle type, and credit score. We’ll also explore available discounts and savings opportunities, and provide a step-by-step process for filing a claim. By the end, you’ll be equipped to make informed decisions and confidently choose the best car insurance for your circumstances in Louisiana.

Understanding Louisiana’s Insurance Market

Navigating the Louisiana car insurance market requires understanding its unique regulatory environment and the various factors influencing costs. This information will help you make informed decisions about your car insurance coverage.

Louisiana’s car insurance market is governed by the Louisiana Department of Insurance (LDI). The LDI sets minimum coverage requirements, regulates insurance companies operating within the state, and handles consumer complaints. The regulatory framework aims to ensure fair pricing and consumer protection, but the specifics of coverage and pricing remain subject to market forces and individual risk profiles.

Factors Influencing Car Insurance Costs in Louisiana

Several key factors contribute to the variability of car insurance premiums in Louisiana. These factors interact in complex ways to determine the final cost a driver pays. Understanding these influences can help you anticipate and potentially mitigate your insurance expenses.

High accident rates in certain areas of Louisiana significantly impact insurance costs. Areas with frequent accidents are considered higher risk, leading to increased premiums for drivers in those regions. Similarly, demographic factors such as age and driving history play a substantial role. Young drivers and those with a history of accidents or traffic violations generally pay more due to their statistically higher risk profiles. Furthermore, the state’s susceptibility to hurricanes and other severe weather events increases the likelihood of vehicle damage, consequently influencing insurance premiums. Repair costs after a natural disaster can be substantial, and insurance companies factor this into their risk assessments. Finally, the type of vehicle you drive also influences your premium; higher-value vehicles generally cost more to insure.

Types of Car Insurance Coverage Available in Louisiana

Louisiana, like other states, offers a range of car insurance coverage options. Understanding these options is crucial for selecting the appropriate level of protection.

Louisiana mandates minimum liability coverage, which protects you financially if you cause an accident resulting in injury or property damage to others. This minimum coverage, however, might not be sufficient to cover significant damages. Comprehensive coverage protects your vehicle against damage from events not involving a collision, such as theft, vandalism, or hailstorms. Collision coverage covers damage to your vehicle resulting from a collision with another vehicle or object. Uninsured/underinsured motorist coverage protects you if you are involved in an accident caused by a driver without adequate insurance. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Medical payments coverage (Med-Pay) is similar to PIP but typically covers only medical expenses. The specific coverages you choose will influence your premium; more extensive coverage typically means higher costs.

Obtaining a Car Insurance Quote in Louisiana

The process of obtaining a car insurance quote in Louisiana is relatively straightforward. Several avenues exist for comparing quotes and selecting the best option for your needs.

You can obtain quotes directly from insurance companies through their websites or by contacting their agents. Alternatively, you can use online comparison tools that allow you to input your information and receive quotes from multiple insurers simultaneously. When requesting a quote, be prepared to provide information about your vehicle, driving history, and desired coverage levels. Comparing quotes from several insurers is crucial to ensure you’re getting the best possible rate. Remember to carefully review the policy details before making a final decision to understand exactly what coverage you’re purchasing.

Top Car Insurance Companies in Louisiana

Choosing the right car insurance provider in Louisiana can feel overwhelming, given the numerous options available. This section focuses on the five largest car insurance companies operating within the state, providing a comparative analysis to aid your decision-making process. Understanding their market share, customer feedback, and policy offerings is crucial for selecting the best fit for your individual needs and budget.

Top Five Car Insurance Providers in Louisiana

The following table presents the five largest car insurance providers in Louisiana, based on available market share data. Note that market share data can fluctuate, and these figures represent a snapshot in time. Always verify the most current information directly with the companies or through independent insurance comparison websites.

| Company Name | Market Share (Approximate) | Customer Ratings (Source) | Contact Information |

|---|---|---|---|

| State Farm | (Data unavailable – needs to be researched and inserted here) | (e.g., 4.5 stars on Google Reviews) | (Website, Phone Number) |

| Geico | (Data unavailable – needs to be researched and inserted here) | (e.g., 4.2 stars on J.D. Power) | (Website, Phone Number) |

| Progressive | (Data unavailable – needs to be researched and inserted here) | (e.g., 4 stars on Consumer Reports) | (Website, Phone Number) |

| Allstate | (Data unavailable – needs to be researched and inserted here) | (e.g., 3.8 stars on Yelp) | (Website, Phone Number) |

| USAA | (Data unavailable – needs to be researched and inserted here) | (e.g., 4.7 stars on Trustpilot) | (Website, Phone Number) |

Detailed Profiles of Top Five Companies

This section provides a brief overview of each of the top five companies, highlighting their strengths and weaknesses. Remember that individual experiences may vary.

State Farm: Known for its extensive agent network and broad range of coverage options. Strengths include personalized service and established reputation. Weaknesses might include potentially higher premiums compared to some online-only competitors.

Geico: An online-focused insurer offering competitive pricing and a user-friendly website. Strengths include ease of purchasing and managing policies online. Weaknesses might include less personalized service compared to companies with a large agent network.

Progressive: Offers a variety of discounts and features like the Name Your Price® Tool. Strengths include innovative technology and competitive pricing. Weaknesses might include a more complex policy selection process.

Allstate: Provides a balance between online convenience and access to agents. Strengths include a wide range of products and services. Weaknesses might include potentially less competitive pricing compared to some competitors.

USAA: Primarily serves military members and their families. Strengths include exceptional customer service and competitive rates for its target demographic. Weaknesses might include limited availability to the general public.

Customer Reviews of Top Five Companies

Customer reviews provide valuable insights into the experiences of actual policyholders. The following are examples of positive and negative feedback, categorized by company. Remember that individual experiences can vary widely.

State Farm: Positive – “Excellent customer service, always responsive and helpful.” Negative – “Premium increased significantly after a minor accident.”

Geico: Positive – “Easy to manage my policy online, quick and painless claims process.” Negative – “Had difficulty reaching a representative when I needed assistance.”

Progressive: Positive – “Love the Name Your Price® Tool, helped me find the perfect coverage at the right price.” Negative – “The online portal can be confusing to navigate.”

Allstate: Positive – “My agent is always available and provides great advice.” Negative – “Felt pressured to purchase additional coverage I didn’t need.”

USAA: Positive – “Exceptional customer service, always goes above and beyond.” Negative – “Limited availability to those outside of the military community.”

Types of Policies Offered by Top Five Companies

Each of the top five companies offers a variety of car insurance policies to cater to diverse needs. These generally include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). Specific options and add-ons may vary between companies. It’s crucial to review policy details carefully to understand the coverage provided.

Factors Affecting Insurance Premiums

Several key factors influence the cost of car insurance in Louisiana. Understanding these factors can help you make informed decisions and potentially lower your premiums. These factors are interconnected, and their combined effect determines your final rate.

Insurance companies use a complex algorithm to calculate premiums, considering a variety of data points to assess risk. A higher perceived risk translates to higher premiums, while a lower risk profile generally results in lower costs.

Driving History’s Impact on Premiums

Your driving history is a major determinant of your insurance premium. Accidents and traffic violations significantly increase your risk profile in the eyes of insurance companies. A single at-fault accident can lead to a substantial premium increase, often lasting several years. Multiple accidents or serious violations, such as driving under the influence (DUI), will result in even higher premiums, or even policy cancellation in some cases. Conversely, maintaining a clean driving record with no accidents or tickets for an extended period will generally earn you lower rates and potentially discounts. For example, a driver with two at-fault accidents in the past three years might see their premiums increase by 40-60% compared to a driver with a clean record.

Influence of Age, Gender, and Location

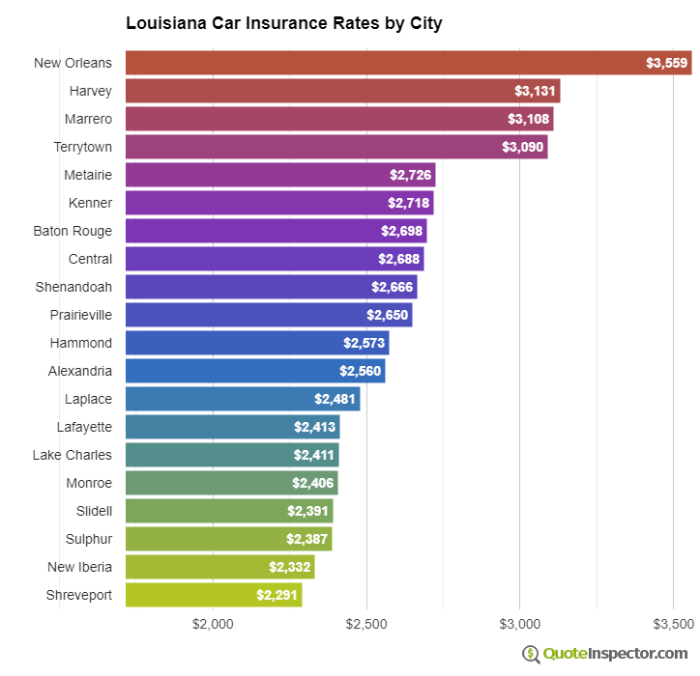

Age, gender, and location also play a significant role in determining insurance costs. Statistically, younger drivers (under 25) are considered higher risk due to inexperience and higher accident rates, resulting in higher premiums. As drivers age and gain experience, their premiums typically decrease. Gender can also influence rates, though this varies by insurer and is subject to ongoing legal and regulatory scrutiny. Location impacts premiums due to differences in accident rates, crime rates, and the cost of vehicle repairs across different areas of Louisiana. For instance, drivers in densely populated urban areas with high accident rates tend to pay more than those in rural areas with fewer accidents.

Vehicle Type’s Effect on Premiums

The type of vehicle you drive directly impacts your insurance premium. Insurance companies consider factors such as the vehicle’s make, model, year, safety features, and repair costs. Generally, expensive vehicles, high-performance cars, and those with a history of theft or accidents are more costly to insure. Conversely, vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts. For example, insuring a new luxury SUV will be significantly more expensive than insuring an older, smaller sedan.

Credit Score’s Influence on Insurance Rates

In Louisiana, as in many other states, your credit score can affect your car insurance premiums. Insurance companies often use credit-based insurance scores to assess risk. A lower credit score is often associated with a higher risk profile, leading to higher premiums. This is because individuals with poor credit history may be perceived as less financially responsible, increasing the likelihood of late or non-payment of insurance premiums. Improving your credit score can lead to lower insurance rates. For example, a driver with an excellent credit score might receive a significant discount compared to a driver with a poor credit score.

Finding the Best Policy for Your Needs

Choosing the right car insurance policy in Louisiana can feel overwhelming, but a systematic approach simplifies the process. By understanding your needs and comparing options effectively, you can secure the best coverage at a price that suits your budget. This section provides a structured guide to help you navigate this important decision.

Step-by-Step Guide to Comparing Car Insurance Quotes

Effectively comparing car insurance quotes requires a methodical approach. Begin by gathering information about your vehicle, driving history, and desired coverage levels. Then, utilize online comparison tools or contact multiple insurers directly to obtain quotes. Pay close attention to the details of each quote, ensuring you’re comparing apples to apples in terms of coverage limits and deductibles. Finally, review the quotes side-by-side, considering not only the price but also the reputation and financial stability of the insurance company. Remember to factor in any discounts offered.

Questions to Ask Insurance Providers

Before committing to a policy, it’s crucial to clarify specific aspects of the coverage. The following points represent key information consumers should confirm with insurers. This ensures a clear understanding of the policy’s terms and conditions.

- Policy details: Confirm the specific coverage amounts (liability, collision, comprehensive, etc.) included in the policy.

- Deductibles and premiums: Understand the relationship between your chosen deductible and the resulting premium amount.

- Discounts: Inquire about any available discounts, such as those for safe driving, multiple vehicles, or bundling with other insurance types.

- Claims process: Understand the steps involved in filing a claim, including required documentation and expected processing times.

- Customer service: Inquire about the insurer’s customer service channels and their responsiveness to policyholder inquiries.

Essential Factors to Consider When Choosing a Car Insurance Provider

Selecting a car insurance provider involves evaluating various aspects beyond just price. Consider the following critical factors to make an informed decision.

- Financial stability: Choose a company with a strong financial rating, ensuring they can meet their obligations in the event of a claim.

- Customer service reputation: Look for companies known for their responsive and helpful customer service.

- Coverage options: Ensure the provider offers the coverage types and limits you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Discounts and add-ons: Compare the available discounts and optional add-ons, such as roadside assistance or rental car reimbursement.

- Online tools and resources: Assess the ease of managing your policy online, such as paying bills, filing claims, and accessing policy documents.

Interpreting Key Components of a Car Insurance Policy Document

Your car insurance policy document contains crucial information. Understanding these key components is essential for protecting your interests.

- Declarations page: This page summarizes your policy, including your name, address, vehicle information, coverage limits, and premium amounts.

- Coverage sections: Each section details the specific type of coverage (liability, collision, comprehensive, etc.), its limits, and what it covers.

- Exclusions: This section Artikels situations or events not covered by the policy.

- Conditions: This section describes the responsibilities and obligations of both the insurer and the policyholder.

- Definitions: This section clarifies the meaning of specific terms used in the policy.

Understanding Discounts and Savings

Securing affordable car insurance in Louisiana is achievable through various discounts. Understanding these discounts and how to access them can significantly lower your premiums. This section details common discounts, the application process, and comparisons across different insurers.

Many Louisiana car insurance providers offer a range of discounts designed to reward safe driving habits, responsible financial behavior, and other positive attributes. These discounts can substantially reduce your overall insurance costs, making car insurance more manageable.

Common Car Insurance Discounts in Louisiana

Several common discounts are widely available across most Louisiana insurance companies. These include safe driver discounts, bundling discounts (home and auto), good student discounts, and sometimes discounts for anti-theft devices or driver training completion. The specific availability and percentage of discount can vary between insurers.

Applying for and Receiving Discounts

The application process for discounts typically involves providing the necessary documentation to your insurance provider. For example, a good student discount requires proof of good grades (transcripts), while a safe driver discount often involves a clean driving record (obtained from the Louisiana Department of Public Safety and Corrections). Bundling discounts simply require you to add additional insurance policies, such as homeowners or renters insurance, with the same provider. Contacting your insurer directly is the best way to understand their specific requirements for each discount.

Comparison of Discounts Across Providers

While the types of discounts offered are fairly consistent across insurers, the percentage of the discount and the specific requirements can differ. For example, one company might offer a 15% discount for a good student, while another offers 10%. Similarly, the definition of a “safe driver” might vary slightly in terms of the number of years of accident-free driving required. It’s crucial to compare quotes from multiple insurers to determine which offers the best combination of coverage and discounts for your individual circumstances.

Examples of Discount Impact on Insurance Costs

Consider a hypothetical scenario: A driver in Baton Rouge with a $1,200 annual premium qualifies for a 10% safe driver discount, a 5% good student discount, and a 15% bundling discount (home and auto). Applying these discounts sequentially, the premium would decrease as follows:

- Safe Driver Discount: $1,200 – (10% * $1,200) = $1,080

- Good Student Discount: $1,080 – (5% * $1,080) = $1,026

- Bundling Discount: $1,026 – (15% * $1,026) = $872.10

This illustrates how the combined effect of multiple discounts can result in a significant reduction in annual premiums – a saving of $327.90 in this example. The actual savings will vary depending on the individual’s circumstances and the specific discounts offered by the insurer.

Filing a Claim in Louisiana

Filing a car insurance claim in Louisiana can seem daunting, but understanding the process can make it significantly smoother. This section Artikels the steps involved, your interactions with insurance adjusters, your rights and responsibilities, and the necessary documentation. Remember to always refer to your specific policy for detailed information.

Steps Involved in Filing a Car Insurance Claim

After a car accident in Louisiana, promptly reporting the incident to the authorities is crucial. This includes contacting the police to file a report, especially if there are injuries or significant property damage. Next, contact your insurance company as soon as possible, usually within 24-48 hours, to begin the claims process. Provide them with all the necessary information, including the date, time, and location of the accident, along with details of the other parties involved. Your insurer will then assign a claims adjuster to your case.

Dealing with Insurance Adjusters

Insurance adjusters are responsible for investigating your claim and determining the extent of the damages. They will likely contact you to gather information, inspect your vehicle, and review supporting documentation. Cooperate fully with the adjuster, providing them with all requested information promptly and honestly. Keep detailed records of all communications, including dates, times, and the content of conversations. Remember, you have the right to negotiate with the adjuster regarding the settlement amount. If you feel the offer is unfair, consult with an attorney.

Policyholder Rights and Responsibilities During a Claim

As a policyholder, you have several rights, including the right to fair and prompt handling of your claim, access to your claim file, and the right to appeal a decision you disagree with. Your responsibilities include providing accurate information to your insurer, cooperating with the investigation, and following the procedures Artikeld in your policy. Failing to comply with these responsibilities could jeopardize your claim. It’s important to understand your policy’s terms and conditions thoroughly.

Necessary Documents When Filing a Claim

Gathering the necessary documentation is vital for a smooth claims process. This typically includes your driver’s license, vehicle registration, insurance policy information, police report (if applicable), photos and videos of the damage to your vehicle and the accident scene, medical records (if applicable), repair estimates, and contact information for all parties involved. Maintaining organized records throughout the process is essential for efficient claim resolution. Consider keeping a dedicated file for all claim-related documents.

Illustrative Examples of Policy Comparisons

Understanding the cost of car insurance in Louisiana can be complex, varying significantly based on individual circumstances and chosen coverage. The following examples illustrate how different policies can impact your annual premiums. These are fictional examples for illustrative purposes only and do not represent actual quotes from specific companies.

Single Driver Policy Comparison in Baton Rouge

This example compares three fictional car insurance companies – Acadiana Auto, Bayou Insurance, and Pelican Protection – for a single, 30-year-old driver with a clean driving record residing in Baton Rouge, Louisiana, driving a 2020 Honda Civic.

| Company Name | Annual Premium | Coverage Details | Key Features |

|---|---|---|---|

| Acadiana Auto | $850 | $25,000 Bodily Injury Liability per person, $50,000 Bodily Injury Liability per accident, $25,000 Property Damage Liability, Uninsured/Underinsured Motorist Coverage | 24/7 claims assistance, online account management |

| Bayou Insurance | $925 | $50,000 Bodily Injury Liability per person, $100,000 Bodily Injury Liability per accident, $50,000 Property Damage Liability, Uninsured/Underinsured Motorist Coverage, Collision and Comprehensive Coverage | Accident forgiveness program, rental car reimbursement |

| Pelican Protection | $780 | $25,000 Bodily Injury Liability per person, $50,000 Bodily Injury Liability per accident, $25,000 Property Damage Liability, Uninsured/Underinsured Motorist Coverage | Low monthly payment options, roadside assistance |

Family Policy Comparison in New Orleans

This example compares the same three fictional companies for a family in New Orleans with two adult drivers (ages 35 and 40, both with clean driving records) and two vehicles: a 2018 Toyota Camry and a 2022 Ford F-150.

| Company Name | Annual Premium | Coverage Details | Key Features |

|---|---|---|---|

| Acadiana Auto | $1,600 | Comprehensive coverage on both vehicles, $50,000/$100,000 Bodily Injury Liability, $50,000 Property Damage Liability per accident, Uninsured/Underinsured Motorist Coverage | Multi-car discount, online payment options |

| Bayou Insurance | $1,850 | Comprehensive coverage on both vehicles, $100,000/$300,000 Bodily Injury Liability, $100,000 Property Damage Liability per accident, Uninsured/Underinsured Motorist Coverage, Roadside Assistance | Family discount, multiple driver options |

| Pelican Protection | $1,500 | Comprehensive coverage on both vehicles, $50,000/$100,000 Bodily Injury Liability, $50,000 Property Damage Liability per accident, Uninsured/Underinsured Motorist Coverage | Bundled home and auto discounts, claims management app |

Last Recap

Securing affordable and comprehensive car insurance in Louisiana requires careful research and understanding of the market. This guide has provided a framework for comparing providers, analyzing policy details, and leveraging available discounts to find the best fit. Remember to carefully review policy documents, ask pertinent questions, and don’t hesitate to seek professional advice if needed. By taking a proactive approach, you can ensure you have the right protection at the right price.

General Inquiries

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the state after certain driving offenses. It doesn’t provide additional coverage, but verifies you have the minimum liability coverage. You need it if mandated by the court or DMV.

Can I bundle my home and auto insurance in Louisiana?

Yes, bundling your home and auto insurance with the same provider often results in significant discounts. Many insurers offer this option, leading to cost savings.

How often can I change my car insurance provider?

You can generally switch providers at any time, though there may be a short waiting period before a new policy takes effect. It’s advisable to provide adequate notice to your current insurer.

What is uninsured/underinsured motorist coverage and why is it important in Louisiana?

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured. It’s crucial in Louisiana, where uninsured drivers are prevalent, to cover your medical bills and vehicle repairs.