Navigating the world of car insurance can feel overwhelming, especially in a diverse market like Alabama. Finding the best policy requires understanding the state’s regulatory landscape, comparing numerous providers and coverage options, and carefully considering your individual needs. This guide cuts through the complexity, providing a clear path to securing the most suitable and affordable car insurance for your situation in Alabama.

From liability and collision coverage to comprehensive options and the factors affecting premiums (driving record, age, location, vehicle type), we’ll explore the key elements to consider. We’ll also equip you with strategies for comparing quotes, negotiating premiums, and understanding the often-confusing policy details. By the end, you’ll be well-prepared to make an informed decision about your Alabama car insurance.

Understanding Alabama’s Insurance Market

Navigating the Alabama car insurance market requires understanding its regulatory framework, available providers, coverage options, and the factors influencing premium costs. This information empowers consumers to make informed decisions about their auto insurance protection.

Alabama’s insurance market is governed by the Alabama Department of Insurance, which sets regulations for insurers, approves rates, and handles consumer complaints. This regulatory body ensures fair practices and consumer protection within the state’s insurance industry. Insurers must adhere to these regulations, including minimum coverage requirements, to operate legally in Alabama.

Major Car Insurance Providers in Alabama

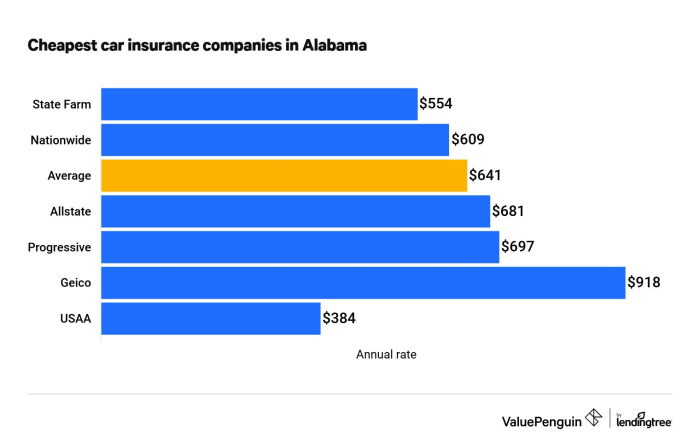

Several major national and regional insurance companies operate extensively in Alabama. These companies offer a range of coverage options and price points, providing consumers with choices to suit their individual needs and budgets. Examples of prominent providers include State Farm, GEICO, Allstate, Progressive, and Nationwide, among others. Smaller, regional companies also compete within the market, often offering specialized services or focusing on particular customer demographics.

Types of Car Insurance Coverage in Alabama

Alabama law mandates minimum liability coverage, protecting drivers against financial responsibility for injuries or damages caused to others in an accident. However, drivers can opt for additional coverage to enhance their protection. Liability coverage typically includes bodily injury liability and property damage liability. Collision coverage pays for repairs or replacement of your vehicle regardless of fault, while comprehensive coverage protects against damage from events like theft, vandalism, or weather-related incidents. Uninsured/underinsured motorist coverage is also available, providing protection if you’re involved in an accident with a driver who lacks sufficient insurance.

Factors Influencing Car Insurance Premiums in Alabama

Several factors contribute to the calculation of car insurance premiums in Alabama. These factors are used by insurance companies to assess risk and determine the appropriate cost of coverage. A driver’s driving record, including accidents and traffic violations, significantly impacts premiums; a clean record generally leads to lower rates. Age is another key factor, with younger drivers often facing higher premiums due to statistically higher accident rates. Location also plays a role, as areas with higher accident rates or crime rates may command higher premiums. Finally, the type of vehicle driven is a significant factor; more expensive vehicles or those with higher repair costs generally result in higher premiums. For instance, a high-performance sports car will typically have higher premiums than a smaller, economical vehicle.

Key Features to Consider When Choosing Car Insurance

Choosing the right car insurance in Alabama involves careful consideration of several key factors beyond just the price. A comprehensive approach ensures you secure adequate protection while optimizing your budget. Understanding the nuances of different policies and insurer offerings is crucial for making an informed decision.

Essential Features to Consider

Selecting car insurance requires careful evaluation of several essential features. These features significantly impact your overall experience and the level of protection you receive. Prioritizing these aspects will help you find a policy that best suits your needs and financial situation.

- Customer Service: A responsive and helpful customer service team is invaluable. Consider insurers with readily available phone support, online chat options, and positive customer reviews regarding their responsiveness to inquiries and issue resolution.

- Claims Process: Understanding the claims process is crucial. Look for insurers with clear, straightforward procedures, readily available claims representatives, and a history of efficient and fair claim settlements. A streamlined process can significantly ease the stress of dealing with an accident.

- Policy Flexibility: Your insurance needs may change over time. Choose an insurer offering flexible policy options, allowing adjustments to coverage limits, deductibles, and add-ons as your circumstances evolve. This adaptability ensures your policy remains relevant and suitable.

Coverage Limits and Deductibles

Coverage limits and deductibles are fundamental aspects of your car insurance policy that directly impact your out-of-pocket expenses in the event of an accident. Understanding their implications is essential for choosing a policy that aligns with your risk tolerance and financial capabilities.

Coverage limits define the maximum amount your insurer will pay for specific types of damages (e.g., bodily injury, property damage). Higher limits provide greater protection but typically come with higher premiums. Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, but you bear a greater financial burden in case of a claim. The optimal balance between coverage limits and deductibles depends on your individual risk assessment and financial situation. For example, a higher deductible might be suitable for someone with a strong emergency fund, while someone with limited savings might prefer a lower deductible despite higher premiums.

Types of Car Insurance Policies

Different types of car insurance policies offer varying levels of coverage and protection. Understanding the benefits and drawbacks of each type is crucial for making an informed choice.

- Liability Coverage: This covers damages you cause to others’ property or injuries you inflict on others in an accident you are at fault for. It’s typically required by law in Alabama.

- Collision Coverage: This covers damages to your vehicle, regardless of fault, in an accident. It’s optional but highly recommended.

- Comprehensive Coverage: This covers damages to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. This is also optional.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It’s crucial in Alabama, given the prevalence of uninsured drivers.

Comparison of Major Insurers

The following table compares five major car insurance providers in Alabama based on price, coverage options, and customer reviews. Note that prices and specific coverage options can vary based on individual circumstances and location. Customer reviews represent a general sentiment and may not reflect every individual’s experience.

| Insurer | Price (Estimated Annual Premium) | Coverage Options | Customer Reviews (Summary) |

|---|---|---|---|

| State Farm | $1000 – $1500 | Comprehensive, Liability, Collision, Uninsured/Underinsured Motorist | Generally positive, known for strong customer service. |

| GEICO | $800 – $1200 | Comprehensive, Liability, Collision, Uninsured/Underinsured Motorist | Mixed reviews, some praise for low prices, others cite difficulties with claims. |

| Progressive | $900 – $1400 | Comprehensive, Liability, Collision, Uninsured/Underinsured Motorist, various add-ons | Positive reviews for their Name Your Price tool and online accessibility. |

| Allstate | $1100 – $1600 | Comprehensive, Liability, Collision, Uninsured/Underinsured Motorist | Generally positive, known for strong claims handling. |

| USAA | $800 – $1300 (Military members only) | Comprehensive, Liability, Collision, Uninsured/Underinsured Motorist | Excellent reviews, known for exceptional customer service and benefits for military members. |

Finding the Best Deal

Securing the most affordable car insurance in Alabama requires a strategic approach. This involves diligent comparison shopping, leveraging online tools, and understanding the nuances of quote generation and negotiation. By employing the techniques Artikeld below, you can significantly reduce your annual premiums while ensuring adequate coverage.

Finding the lowest car insurance rate involves more than just clicking a few buttons. It requires understanding your needs, comparing multiple quotes side-by-side, and knowing how to negotiate effectively. This section will guide you through each step of the process.

Comparing Car Insurance Quotes

Comparing quotes from different providers is crucial for finding the best deal. Don’t rely on just one quote; instead, obtain at least three to five quotes from various insurance companies operating in Alabama. This allows you to see a range of prices and coverage options. Remember to ensure that you are comparing apples to apples – the same coverage limits and deductibles across all quotes. Differences in coverage levels will significantly impact the final price.

Utilizing Online Comparison Tools

Online comparison websites simplify the quote-gathering process. These platforms allow you to input your information once and receive multiple quotes simultaneously. While convenient, it’s important to critically evaluate the results. Not all comparison websites include every insurance provider, and the displayed quotes might not represent the final price after individual risk assessments. Use these tools as a starting point, but always verify the information directly with the insurance company.

Obtaining and Reviewing Car Insurance Quotes

The process of obtaining a quote usually involves providing personal information, driving history, and details about your vehicle. Be prepared to answer questions about your age, driving record (including accidents and violations), and the type of vehicle you drive. Carefully review each quote, paying close attention to the coverage details, premiums, and deductibles. Understand what each coverage option provides before making a decision. Don’t hesitate to contact the insurance company directly if you have any questions about the quote details.

Negotiating Car Insurance Premiums

Negotiating your car insurance premium is often possible, especially if you have a clean driving record and have been with your current provider for a considerable time. Start by highlighting your positive driving history and any safety features in your vehicle. Inquire about discounts, such as those for bundling home and auto insurance, maintaining a good credit score, or completing defensive driving courses. Don’t be afraid to politely express your intention to switch providers if a better offer isn’t presented. Sometimes, the threat of losing a customer is enough to incentivize a better deal. Remember to be respectful and professional throughout the negotiation process.

Understanding Policy Details and Fine Print

Choosing the right car insurance policy in Alabama involves more than just comparing prices. A thorough understanding of the policy’s details and fine print is crucial to ensure you’re adequately protected and avoid unexpected costs or coverage gaps. This section will highlight important aspects to consider before signing on the dotted line.

Common Exclusions and Limitations

Alabama car insurance policies, like those in other states, often contain exclusions and limitations. These are specific situations or types of damages that are not covered by your policy. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Limitations might include caps on the amount of coverage for specific types of losses, such as medical payments or property damage. For example, a policy might have a $50,000 limit for bodily injury liability per accident, meaning the insurance company would only pay up to that amount for injuries sustained by others in an accident you caused. Carefully reviewing the policy’s declaration page and the detailed coverage descriptions will reveal these specific limitations and exclusions applicable to your chosen plan. Understanding these limitations is key to making informed decisions about your coverage needs.

Importance of Thorough Policy Review

Reading and understanding your car insurance policy is paramount. It’s a legally binding contract outlining your rights and responsibilities. Failing to understand the terms could lead to disputes with your insurance company during a claim. Take the time to review every section, including the definitions of terms, coverage details, and exclusions. If anything is unclear, don’t hesitate to contact your insurance agent or company for clarification. Consider using a highlighter to mark important sections and make notes in the margins. This proactive approach can save you considerable stress and potential financial loss down the line. Remember, it’s your responsibility to understand the terms of your policy.

Filing a Claim and Expectations

The process of filing a car insurance claim generally involves reporting the incident to your insurance company as soon as possible. This usually involves providing details about the accident, including the date, time, location, and the parties involved. You’ll likely need to provide police reports, photos of the damage, and witness statements. The insurance company will then investigate the claim to determine liability and the extent of damages. Expect a thorough assessment of your claim, which may include inspections of your vehicle and medical records. Be prepared to provide all necessary documentation promptly and cooperate fully with the adjuster. The timeframe for claim settlement can vary depending on the complexity of the claim and the amount of damages involved. While the process can be stressful, staying organized and communicative with your insurer will expedite the process.

Frequently Asked Questions

Understanding the specifics of your Alabama car insurance policy can be challenging. Here are some frequently asked questions and their corresponding answers:

- What is Uninsured/Underinsured Motorist coverage? This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical bills and vehicle repairs.

- What is the difference between liability and collision coverage? Liability coverage pays for damages you cause to others, while collision coverage pays for damages to your own vehicle, regardless of fault.

- What is comprehensive coverage? Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or hail.

- How do I choose the right deductible? A higher deductible will lower your premium, but you’ll pay more out-of-pocket if you file a claim. Consider your financial situation when choosing a deductible.

- What is the process for renewing my policy? Your insurance company will typically notify you before your policy expires, providing options to renew or make changes.

Illustrative Examples of Policy Scenarios

Understanding hypothetical scenarios can help clarify the complexities of car insurance in Alabama. Let’s examine a few examples to illustrate how different coverage levels and claims processes work in practice.

Minor Car Accident Claims Process

Imagine a scenario where you are involved in a minor fender bender. Your vehicle sustains $2,000 in damages, and the other driver’s vehicle has $1,500 in damages. You are both at fault, equally responsible for the accident. The claims process would begin with reporting the accident to your insurance company and the other driver’s insurance company. You would file a claim, providing details of the accident, police report (if applicable), photos of the damage, and repair estimates. Your insurer will then investigate the claim, potentially contacting the other driver and reviewing all submitted documentation. Depending on your policy’s liability coverage, your insurer might cover your damages and/or pursue reimbursement from the other driver’s insurance. If both parties have collision coverage, each insurer will handle their own insured’s repairs, potentially leading to subrogation (recovery of costs) between the insurance companies. The process might involve multiple phone calls, emails, and potentially appraisals of the damage. The timeline for resolution can vary depending on the complexity of the case and the responsiveness of all parties involved.

Impact of Different Coverage Levels on Financial Outcome

In the previous scenario, the financial outcome would significantly differ based on your coverage levels. If you only carried liability coverage (minimum required in Alabama), your insurer would only cover damages to the other driver’s vehicle, up to your policy’s limit. You would be responsible for the $2,000 in repairs to your own vehicle. However, if you had collision coverage, your insurer would cover your vehicle’s repairs, less your deductible. Comprehensive coverage would also protect against other non-collision damages, such as hail damage or vandalism. Uninsured/underinsured motorist coverage would protect you if the other driver was at fault and either uninsured or underinsured, covering your damages and medical expenses. Higher liability limits would protect you from significant financial responsibility if your negligence caused substantial damage or injury to others.

Hypothetical Car Insurance Policy: Key Features and Limitations

Let’s consider a hypothetical policy from a fictional Alabama insurer, “Alabama AutoSafe.” This policy includes liability coverage of $100,000/$300,000 (bodily injury per person/per accident), uninsured/underinsured motorist coverage of $50,000/$100,000, collision coverage with a $500 deductible, and comprehensive coverage with a $250 deductible. It also includes roadside assistance and rental car reimbursement. However, this policy might exclude coverage for damages caused by driving under the influence of alcohol or drugs, or for modifications to your vehicle that are not factory-approved. The policy might also have specific limitations on rental car coverage duration and the types of roadside assistance offered. It’s crucial to carefully review the policy document for a complete understanding of its terms and conditions.

Sample Insurance Policy Document: Key Sections

Imagine a policy document. The first page would display the policyholder’s information, policy number, effective dates, and coverage summary. Subsequent sections would detail liability coverage limits, collision and comprehensive coverage details (including deductibles), uninsured/underinsured motorist coverage, and optional add-ons. A section would describe exclusions and limitations, outlining situations where coverage might not apply. Another section would Artikel the claims process, explaining how to report an accident and file a claim. Finally, the policy would include information on premium payments, cancellation policies, and contact information for customer service. An important section would define the policyholder’s responsibilities, such as notifying the insurer promptly after an accident. A separate section would list definitions of key terms used in the policy.

Epilogue

Securing the best car insurance in Alabama is a multifaceted process requiring careful consideration of various factors. By understanding the state’s regulatory environment, comparing different providers and their offerings, and actively engaging in the quote comparison and negotiation process, you can achieve significant savings while ensuring adequate protection. Remember to thoroughly review policy documents and understand coverage limits and exclusions to make a truly informed choice. This guide empowers you to navigate this process confidently and find the optimal car insurance solution for your specific needs in Alabama.

FAQ Insights

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the state after certain driving offenses. It’s not a type of insurance itself, but a certificate filed by your insurer with the state. You’ll need it if mandated by the court or DMV.

Can I bundle my home and auto insurance?

Yes, many insurers offer discounts for bundling home and auto insurance. This can lead to significant savings compared to purchasing separate policies.

How often can I change my car insurance policy?

You can usually change your policy at any time, although there might be penalties for canceling early depending on your contract. Most policies renew annually.

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle damage even if the other driver is at fault and lacks sufficient insurance.