Securing adequate insurance for your car and home is a crucial step in responsible ownership. This guide delves into the complexities of finding the “best” policy, acknowledging that “best” is subjective and depends heavily on individual needs and circumstances. We’ll explore the various types of coverage, factors influencing costs, and the features offered by different insurance providers, ultimately empowering you to make informed decisions.

From understanding liability and collision coverage to navigating the claims process and comparing quotes, we’ll provide a clear and concise overview to help you navigate the often-confusing world of car and home insurance. We aim to equip you with the knowledge to select a policy that offers comprehensive protection at a price that fits your budget.

Factors Influencing Insurance Costs

Securing affordable car insurance involves understanding the key factors that influence premiums. Insurance companies employ a complex system of risk assessment to determine how much you’ll pay. This assessment considers a variety of factors, some within your control and others not. Understanding these factors empowers you to make informed decisions and potentially lower your insurance costs.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premiums. A clean driving record, free of accidents and traffic violations, generally results in lower premiums. Conversely, accidents and tickets, especially those involving significant damage or injury, can dramatically increase your premiums. The severity of the incident, such as a minor fender bender versus a major collision, directly correlates with the premium increase. Multiple incidents within a short period further exacerbate the impact. For example, two speeding tickets in one year might lead to a more substantial increase than a single ticket. Insurance companies view a consistent pattern of unsafe driving as a higher risk, leading to higher premiums.

Vehicle Type, Location, and Driver Age Influence

The type of vehicle you insure plays a crucial role in determining your premium. Sports cars and high-performance vehicles generally cost more to insure due to their higher repair costs and greater potential for accidents. Conversely, smaller, less powerful vehicles often command lower premiums. Your location also influences your insurance rates. Areas with high crime rates or a higher frequency of accidents typically have higher insurance premiums due to the increased risk of theft or collisions. Finally, your age significantly impacts your premiums. Younger drivers, particularly those under 25, generally pay more because statistically they are involved in more accidents. As drivers age and gain experience, their premiums usually decrease. For example, a 16-year-old driver will likely pay significantly more than a 40-year-old driver with a clean driving record, even if they drive the same vehicle.

Strategies for Reducing Insurance Premiums

Understanding the factors that affect your premiums allows you to implement strategies for reducing them. Here are several key approaches:

- Maintain a clean driving record: Avoid accidents and traffic violations to demonstrate responsible driving habits.

- Choose a safer vehicle: Opt for vehicles with good safety ratings and lower repair costs.

- Consider your location: If possible, living in a lower-risk area can reduce premiums.

- Bundle your insurance: Combining auto and home insurance with the same provider often leads to discounts.

- Increase your deductible: A higher deductible means lower premiums, but you’ll pay more out-of-pocket in the event of a claim.

- Explore discounts: Many insurers offer discounts for good students, safe drivers, and those who install anti-theft devices.

- Shop around: Compare quotes from multiple insurance providers to find the best rates.

- Maintain a good credit score: In many states, credit history is a factor in determining insurance rates.

Policy Selection and Comparison

Choosing the right car insurance policy can feel overwhelming given the sheer number of options available. A systematic approach to comparing quotes and understanding policy details is crucial to securing the best coverage at a competitive price. This section provides a step-by-step guide to navigating this process effectively.

Comparing Insurance Quotes Effectively

A methodical comparison of insurance quotes is essential to finding the best value. This involves more than just looking at the premium; a comprehensive review of coverage details and policy terms is necessary. The following steps will help you make an informed decision.

- Gather Multiple Quotes: Obtain at least three to five quotes from different insurance providers. Use online comparison tools or contact insurers directly. Ensure you provide consistent information across all applications to enable accurate comparison.

- Standardize Your Information: Use the same details (vehicle information, driving history, coverage needs) for every quote request. This ensures a fair and accurate comparison of pricing and coverage.

- Analyze Coverage Details: Don’t focus solely on the premium. Compare the types and amounts of coverage offered by each insurer. Pay close attention to liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and roadside assistance.

- Consider Deductibles: Higher deductibles generally lead to lower premiums. Evaluate your financial situation to determine the deductible you can comfortably afford in case of an accident.

- Review Policy Exclusions and Limitations: Carefully read the policy documents to understand what is and isn’t covered. Some policies might exclude certain types of damage or driving situations.

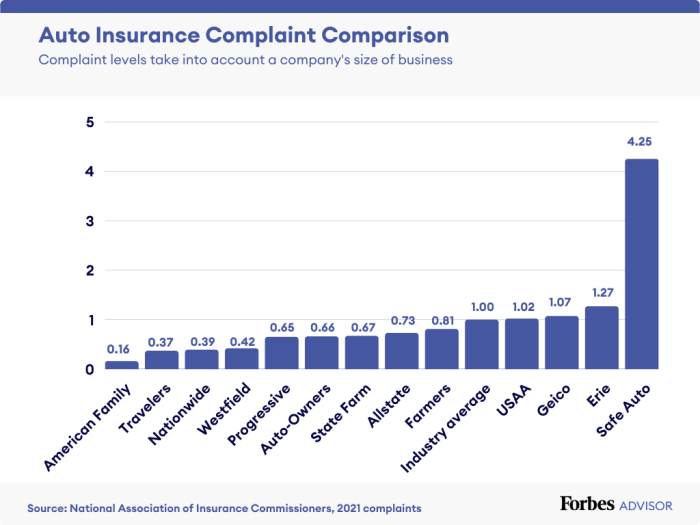

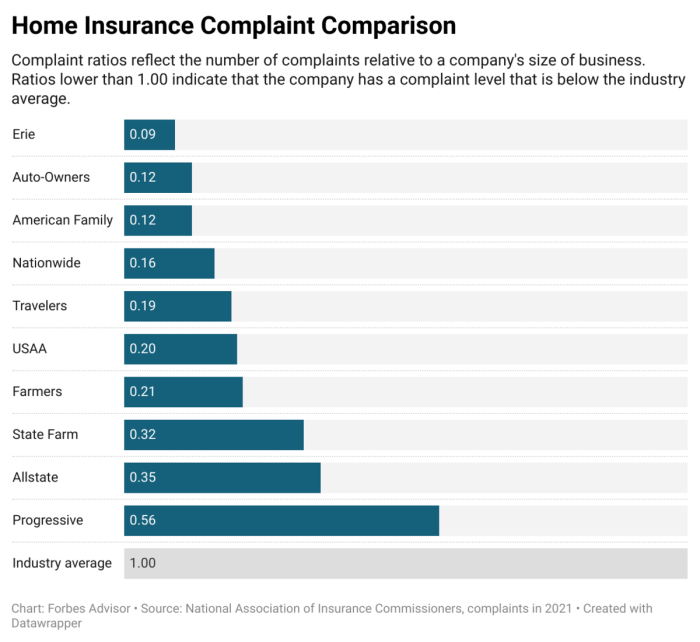

- Check Customer Reviews and Ratings: Research the insurers’ reputations for claims handling and customer service. Online reviews and ratings can provide valuable insights.

- Compare the Overall Value: Consider the total cost, including premiums and deductibles, against the level of coverage provided. The lowest premium isn’t always the best deal if the coverage is insufficient.

Understanding Policy Terms and Conditions

Understanding the terms and conditions of your car insurance policy is vital. Failure to do so could result in unexpected costs or insufficient coverage in the event of a claim. Key aspects to focus on include:

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: This covers damage to your vehicle resulting from an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premium: The amount you pay regularly for your insurance coverage.

Sample Insurance Policy Comparison Sheet

Using a comparison sheet helps organize the information gathered from different insurers.

| Insurer | Premium Cost (Annual) | Coverage Details (Liability Limits, etc.) | Deductible Amount |

|---|---|---|---|

| Insurer A | $1200 | $100,000/$300,000 Bodily Injury, $50,000 Property Damage, Collision, Comprehensive, Uninsured Motorist | $500 |

| Insurer B | $1000 | $50,000/$100,000 Bodily Injury, $25,000 Property Damage, Collision, Comprehensive | $1000 |

| Insurer C | $1300 | $100,000/$300,000 Bodily Injury, $50,000 Property Damage, Collision, Comprehensive, Uninsured Motorist, Roadside Assistance | $250 |

Understanding Claims Processes

Filing a car insurance claim can seem daunting, but understanding the process can significantly ease the experience. A smooth claim process hinges on prompt action, accurate documentation, and a clear understanding of your policy. This section details the typical steps, required documentation, and common reasons for claim denials.

Typical Steps Involved in Filing a Car Insurance Claim

After an accident, promptly report the incident to your insurer. This initial notification initiates the claims process. The insurer will then assign a claims adjuster who will investigate the incident, gathering information from all parties involved. This may include reviewing police reports, medical records, and damage assessments. Once the investigation is complete, the adjuster will determine liability and the extent of the damages. Finally, the insurer will process the claim payment, either directly to you or to the repair facility, depending on your policy and the specifics of the claim.

Required Documentation for a Successful Claim

Comprehensive documentation is crucial for a successful claim. This typically includes a completed claim form, a copy of your driver’s license and insurance policy, police report (if applicable), photos and videos of the damage to your vehicle and the accident scene, and any medical records or bills related to injuries sustained in the accident. If you were not at fault, documentation supporting this, such as witness statements or dashcam footage, is highly beneficial. Detailed repair estimates from reputable mechanics are also essential for claims involving vehicle damage.

Common Causes for Claim Denials and How to Avoid Them

Claim denials often stem from incomplete or inaccurate information, failure to meet policy requirements, or discrepancies in the reported details. For example, failing to report the accident promptly, providing inaccurate information on the claim form, or not having the necessary coverage (e.g., uninsured/underinsured motorist coverage when dealing with an at-fault driver without adequate insurance) can lead to a denial. Similarly, claims involving events excluded by your policy, such as driving under the influence of alcohol or drugs, will likely be denied. To avoid denials, ensure prompt reporting, accurate documentation, and a thorough understanding of your policy’s terms and conditions. Maintain open communication with your insurer and cooperate fully throughout the investigation.

Claims Process Flowchart

1. Accident Occurs

2. Report Accident to Insurer

3. Insurer Assigns Claims Adjuster

4. Adjuster Investigates (Gathers Information, Reviews Documentation)

5. Liability and Damages Determined

6. Claim Processed and Payment Made

Illustrative Examples of Insurance Scenarios

Understanding insurance scenarios through real-world examples helps clarify the importance of different coverage types and how they impact your financial responsibility in case of an accident or incident. The following examples illustrate key aspects of car insurance policies.

Comprehensive Coverage: A Crucial Scenario

Imagine Sarah, a young professional, recently purchased a brand new electric vehicle. She lives in a city known for frequent hailstorms. One afternoon, a severe hailstorm pummels her car, causing significant damage to the roof, hood, and windshield. Comprehensive coverage steps in here. Without it, Sarah would be responsible for the entire cost of repairs, potentially amounting to thousands of dollars. With comprehensive coverage, her insurance company covers the repairs, minus her deductible, protecting her from a substantial financial burden. This scenario highlights the importance of comprehensive coverage, especially for newer vehicles or those in areas prone to weather-related damage or vandalism.

Liability Coverage Insufficiency: Consequences of Inadequate Protection

Consider John, who carries only the minimum liability coverage required by his state. While driving, he accidentally runs a red light and collides with another car, seriously injuring the other driver. The medical bills for the injured driver, along with damages to their vehicle, exceed John’s liability coverage limit. As a result, John faces significant financial repercussions. He is personally liable for the difference between the accident costs and his insurance payout, potentially leading to substantial debt, legal action, and damage to his credit score. This scenario emphasizes the importance of carrying adequate liability coverage to protect oneself from potentially catastrophic financial losses resulting from accidents.

Deductibles and Out-of-Pocket Expenses

Let’s say Maria has collision coverage with a $500 deductible. She’s involved in a fender bender, causing $2,000 worth of damage to her car. Her insurance company will cover $1,500 (the total damage minus her deductible). Maria is responsible for paying the remaining $500, representing her out-of-pocket expense. If her deductible were $1,000, her out-of-pocket cost would increase to $1,000. This illustrates how the deductible directly impacts the amount an insured individual pays in a claim. A higher deductible means lower premiums but higher out-of-pocket costs in the event of an accident. Conversely, a lower deductible means higher premiums but lower out-of-pocket costs.

Roadside Assistance: A Valuable Benefit

Picture David, traveling on a remote highway late at night when his car suddenly breaks down. He’s stranded, alone, and in the dark. However, David has roadside assistance coverage as part of his car insurance policy. He makes a call, and within an hour, a tow truck arrives, safely transporting his car to a nearby repair shop. The roadside assistance also covers the cost of the tow and potentially other services like jump starts or tire changes. This scenario showcases the convenience and peace of mind that roadside assistance provides, particularly in emergency situations where being stranded could be dangerous or inconvenient.

Final Review

Choosing the right car and home insurance policy is a significant financial decision. By carefully considering the factors Artikeld in this guide – from coverage types and cost influences to company features and claims procedures – you can confidently select a policy that aligns with your specific needs and provides peace of mind. Remember to regularly review your coverage and adjust as your circumstances change. Proactive insurance planning is a key element of responsible home and vehicle ownership.

Expert Answers

Can I bundle my car and home insurance for a discount?

Yes, many insurance companies offer discounts for bundling car and home insurance policies. This is often a significant cost savings.

What is a deductible, and how does it affect my claim?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you’ll pay more if you file a claim.

How often should I review my insurance policy?

It’s advisable to review your insurance policy at least annually, or whenever there’s a significant life change (e.g., new car, moving, marriage).

What factors affect my home insurance premiums?

Home insurance premiums are influenced by factors such as your home’s location, age and condition, coverage amount, and your claims history.

What happens if I’m involved in an accident and it’s not my fault?

Even if the accident wasn’t your fault, you should still report it to your insurance company. They will investigate and work with the other party’s insurance to resolve the claim.