Navigating the world of auto insurance in Michigan can feel like driving through a blizzard – confusing and potentially costly. Michigan’s unique no-fault system adds a layer of complexity, making it crucial to understand your options and find the best coverage for your needs. This guide cuts through the confusion, offering a clear path to securing affordable and comprehensive auto insurance in the Great Lakes State.

We’ll explore the factors influencing premium costs, from your driving history and vehicle type to your location and age. We’ll also compare leading insurance providers, helping you make an informed decision. Learn how to compare quotes, understand policy details, and even discover strategies to lower your premiums. By the end, you’ll be equipped to confidently navigate the Michigan auto insurance landscape and secure the best protection for yourself and your vehicle.

Understanding Michigan’s Auto Insurance Market

Michigan’s auto insurance market is unique due to its no-fault system, a characteristic that significantly impacts coverage options, costs, and claims processes. Understanding the intricacies of this system is crucial for Michigan residents to secure appropriate and affordable auto insurance.

Michigan’s No-Fault Insurance System

Michigan operates under a no-fault auto insurance system, meaning that regardless of who caused an accident, your own insurance company will cover your medical expenses and lost wages up to certain limits. This differs from many other states where fault is determined, and the at-fault driver’s insurance covers the injured party’s expenses. The system aims to expedite the claims process and reduce litigation, although it has faced criticism regarding costs and complexities. This system includes Personal Injury Protection (PIP) coverage, which is mandatory in Michigan. It covers medical bills, lost wages, and other related expenses for you and your passengers, regardless of fault.

Types of Auto Insurance Coverage in Michigan

Several types of auto insurance coverage are available in Michigan beyond the mandatory PIP. These include Property Damage Liability, which covers damage to another person’s vehicle or property in an accident you caused; Bodily Injury Liability, which covers medical expenses and other damages to others injured in an accident you caused; Uninsured/Underinsured Motorist coverage, which protects you if you’re involved in an accident with an uninsured or underinsured driver; and Collision coverage, which covers damage to your vehicle in an accident regardless of fault. Comprehensive coverage protects against damage to your vehicle from events other than collisions, such as theft, fire, or vandalism.

Cost of Auto Insurance in Michigan Compared to Other States

Michigan consistently ranks among the states with the highest auto insurance premiums. Several factors contribute to this, including the no-fault system’s high medical costs, high rates of fraud, and the state’s relatively high number of uninsured drivers. For example, a 2023 study might show that the average annual premium in Michigan is significantly higher than the national average and substantially more expensive than premiums in states with different insurance systems, such as those that primarily use a tort system. Direct comparisons require referencing specific data from insurance comparison websites or state regulatory agencies at the time of inquiry, as rates fluctuate.

Common Auto Insurance Claims in Michigan

Common auto insurance claims in Michigan reflect the state’s unique characteristics and driving conditions. These frequently include claims for PIP benefits following accidents, regardless of fault. Claims for property damage, particularly after collisions, are also prevalent. Claims involving uninsured motorists are another common occurrence, highlighting the challenges posed by a high number of uninsured drivers. Finally, claims related to severe weather damage, such as hailstorms or winter accidents, frequently occur due to Michigan’s variable climate.

Factors Affecting Auto Insurance Premiums in Michigan

Several key factors influence the cost of auto insurance in Michigan, a state known for its unique no-fault system. Insurance companies use a complex algorithm to assess risk and determine premiums, balancing the potential for claims with the need for profitable business. Understanding these factors can help drivers make informed choices and potentially save money.

Driving History

A driver’s driving history is arguably the most significant factor affecting insurance premiums. This includes details like accidents, traffic violations, and even the number of years a driver has held a license. A clean driving record, characterized by no accidents or tickets, will typically result in lower premiums. Conversely, multiple accidents or serious violations, such as DUI convictions, significantly increase premiums. Insurance companies view these events as indicators of higher risk, leading to a higher probability of future claims. For example, a driver with a DUI on their record might see their premiums increase by 50% or more compared to a driver with a clean record. The severity and frequency of incidents heavily influence the premium increase.

Age and Gender

Age and gender also play a role in determining insurance rates. Statistically, younger drivers (typically under 25) are considered higher risk due to inexperience and a higher propensity for accidents. Insurance companies therefore tend to charge them higher premiums. Older drivers, particularly those over 65, may see lower premiums, reflecting the general trend of decreased accident rates with age and increased driving experience. Regarding gender, while the impact varies by insurer and state regulations, historically, male drivers have been statistically associated with a higher accident rate than female drivers, leading to potentially higher premiums for males in some cases. This is constantly evolving, however, and data analysis is crucial for insurance companies in determining appropriate rates.

Vehicle Type and Location

The type of vehicle insured also impacts premiums. Sports cars and other high-performance vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Location is another crucial factor. Insurance companies consider the crime rate, accident frequency, and even the density of traffic in a given area when setting premiums. Areas with high crime rates or a history of many accidents will generally have higher insurance rates than safer, less congested areas. For instance, a driver living in a high-crime urban area might pay significantly more than a driver in a rural area with low crime rates.

Typical Premium Ranges

| Driver Profile | Age | Driving History | Approximate Annual Premium Range |

|---|---|---|---|

| Young Driver (under 25) | 18-24 | Clean Record | $1,500 – $3,000 |

| Young Driver (under 25) | 18-24 | At-fault Accident | $2,500 – $4,500 |

| Experienced Driver (35-50) | 35-50 | Clean Record | $800 – $1,800 |

| Experienced Driver (35-50) | 35-50 | Multiple Violations | $1,500 – $3,000 |

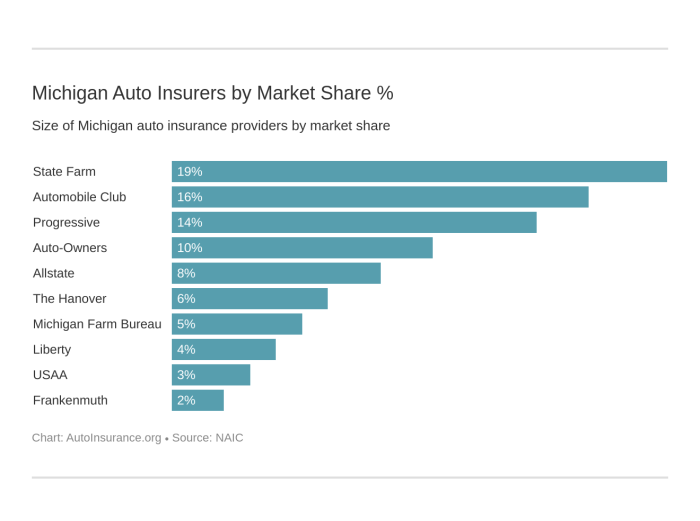

Finding the Best Auto Insurance Provider in Michigan

Choosing the right auto insurance provider in Michigan can significantly impact your finances and peace of mind. The market offers a wide range of options, each with varying coverage, premiums, and customer service levels. Careful consideration of several factors is crucial to securing the best policy for your individual needs.

Criteria for Evaluating Auto Insurance Providers

Selecting an auto insurance provider requires a thorough evaluation process. The following checklist Artikels key criteria to consider, enabling a comprehensive comparison of different providers.

- Coverage Options: Assess the types of coverage offered (liability, collision, comprehensive, uninsured/underinsured motorist, etc.) and their limits. Ensure the coverage adequately protects your assets and liabilities.

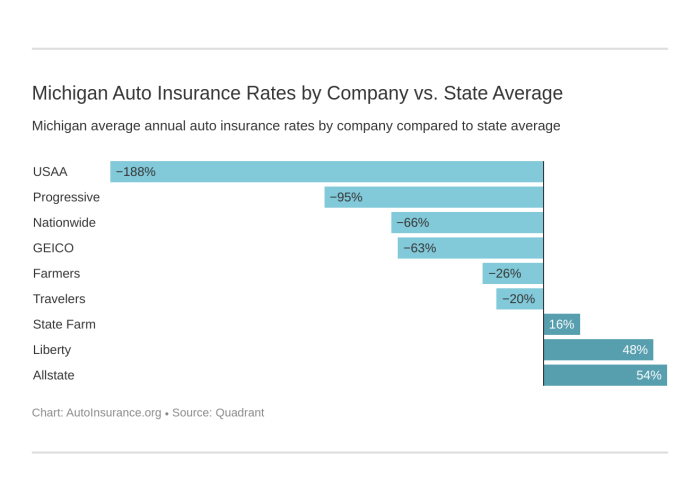

- Premium Costs: Compare quotes from multiple providers to find the most competitive pricing. Consider factors such as deductibles and coverage limits, as these directly impact the premium.

- Customer Service: Research the provider’s reputation for customer service. Look for reviews and ratings that highlight responsiveness, helpfulness, and ease of communication.

- Financial Stability: Check the insurer’s financial strength rating from independent agencies like A.M. Best. A high rating indicates a lower risk of the company’s inability to pay claims.

- Discounts: Inquire about available discounts, such as those for safe driving, bundling policies, or being a good student. These can significantly reduce your overall premium.

- Claims Process: Investigate the provider’s claims process, including how easily claims are filed, processed, and settled. Read reviews to understand customer experiences with claims handling.

Comparison of Top 5 Auto Insurance Companies in Michigan (Based on Hypothetical Data)

Note: The following comparison uses hypothetical data for illustrative purposes only. Actual rankings and ratings vary depending on the source and methodology. Always conduct your own research using independent rating agencies and customer review sites.

| Company | Average Customer Rating | Average Premium (Annual) | Financial Strength Rating | Notable Features |

|---|---|---|---|---|

| Company A | 4.5 stars | $1200 | A+ | Excellent claims service, multiple discounts |

| Company B | 4.2 stars | $1100 | A | Strong online tools, competitive pricing |

| Company C | 4.0 stars | $1300 | A- | Wide range of coverage options |

| Company D | 3.8 stars | $1050 | B+ | Good value for basic coverage |

| Company E | 4.3 stars | $1250 | A | Strong customer support, many discounts |

Resources for Finding and Comparing Insurance Quotes

Several online resources facilitate the comparison of auto insurance quotes from multiple providers. These platforms often provide tools to filter options based on specific criteria, streamlining the selection process. Examples include independent comparison websites and the individual websites of insurance companies.

Step-by-Step Guide to Obtaining Auto Insurance Quotes

Obtaining auto insurance quotes involves a straightforward process. Following these steps will ensure you receive accurate and comprehensive quotes.

- Gather Information: Collect necessary information, including your driver’s license, vehicle information (make, model, year), and driving history.

- Use Online Comparison Tools: Utilize online comparison websites to receive quotes from multiple insurers simultaneously.

- Contact Insurers Directly: Contact insurers directly to obtain quotes and clarify any questions regarding coverage options or premiums.

- Compare Quotes: Carefully compare quotes based on coverage, price, and customer service ratings.

- Select a Provider: Choose the provider that best meets your needs and budget.

- Purchase Policy: Complete the application process and purchase your chosen policy.

Understanding Policy Details and Coverage Options

Choosing the right auto insurance policy in Michigan requires a thorough understanding of the various coverage options and their implications. This section will clarify the different types of coverage available, the significance of deductibles, and how to calculate the overall cost of your policy. Understanding these details empowers you to make informed decisions that best protect your financial interests.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing damaged vehicles or other property. The limits of your liability coverage are expressed as numbers, such as 25/50/10, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury in an accident, and $10,000 for property damage. Higher limits provide greater protection but also increase premiums.

Collision and Comprehensive Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or hitting an animal. Both collision and comprehensive coverage typically have deductibles, which are the amounts you pay out-of-pocket before your insurance company covers the remaining costs.

Personal Injury Protection (PIP) and Med-Pay

Michigan is a no-fault state, meaning your own insurance company covers your medical bills and lost wages regardless of who caused the accident. This is primarily handled through PIP coverage. Med-Pay, on the other hand, covers medical expenses for you and your passengers, regardless of fault, but it typically has lower coverage limits than PIP. Understanding the nuances of PIP and Med-Pay is crucial for navigating Michigan’s unique auto insurance landscape. For example, PIP coverage might cover medical expenses, lost wages, and rehabilitation costs, while Med-Pay might only cover medical bills up to a specified limit.

Deductible Amounts

The deductible is the amount you pay out-of-pocket before your insurance company starts paying for covered repairs or medical expenses. Higher deductibles generally lead to lower premiums, as you are accepting more financial responsibility in the event of a claim. Conversely, lower deductibles result in higher premiums but offer greater protection against out-of-pocket costs. Choosing the right deductible involves balancing your risk tolerance with your budget. For example, a $500 deductible on collision coverage means you’ll pay the first $500 of repair costs after an accident, while your insurer covers the rest (up to the policy limits).

Calculating Total Policy Cost

The total cost of your auto insurance policy depends on several factors, including your coverage levels, deductibles, driving history, vehicle type, location, and age. A basic formula for estimating your total annual cost is:

Premium = Base Rate + (Coverage Factors) + (Driver Factors)

Coverage factors include the types of coverage selected (liability, collision, comprehensive, PIP, Med-Pay) and the chosen coverage limits and deductibles. Driver factors include your age, driving history (accidents, tickets), and credit score (in some cases). Insurance companies use complex algorithms to determine your specific premium, and obtaining quotes from multiple insurers is essential for comparison.

Common Policy Exclusions and Limitations

Understanding what your policy *doesn’t* cover is just as important as understanding what it does.

- Damage caused intentionally by the policyholder.

- Damage caused while driving under the influence of alcohol or drugs.

- Damage to property owned by the policyholder.

- Damage from wear and tear or mechanical failure.

- Losses exceeding the policy’s coverage limits.

It is crucial to carefully review your policy documents to understand all exclusions and limitations. These can vary significantly between insurance providers and policy types.

Saving Money on Michigan Auto Insurance

Michigan’s auto insurance market can be complex, but understanding how to reduce your premiums is key to managing your budget. Several strategies can significantly lower your yearly costs, allowing you to keep more money in your pocket. This section will explore effective methods for achieving substantial savings on your Michigan auto insurance.

Strategies for Reducing Auto Insurance Premiums

Several actionable steps can help lower your auto insurance premiums. These strategies focus on reducing risk and demonstrating responsible behavior to insurers. Careful consideration of these points can lead to significant cost savings.

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal. Online comparison tools can streamline this process.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it typically results in lower premiums. Carefully weigh the trade-off between upfront costs and potential savings.

- Maintain a Good Driving Record: A clean driving record is a major factor in determining your insurance rates. Avoiding accidents and traffic violations is crucial for keeping premiums low.

- Consider Your Coverage Needs: Review your current coverage levels. Do you need all the add-ons? Opting for only necessary coverage can save money. For example, uninsured/underinsured motorist coverage is important, but consider your needs for roadside assistance or rental car reimbursement.

- Take a Defensive Driving Course: Completing a state-approved defensive driving course can often qualify you for a discount, demonstrating your commitment to safe driving practices.

- Pay Your Premiums on Time: Late payments can negatively impact your insurance rates. Setting up automatic payments can help avoid late fees and maintain a positive payment history.

Benefits of Maintaining a Good Driving Record

A clean driving record is arguably the most impactful factor in determining your auto insurance premiums. Accidents and traffic violations significantly increase your risk profile in the eyes of insurance companies, leading to substantially higher rates. Conversely, a spotless record demonstrates responsible driving habits, often resulting in significant discounts.

Potential Savings from Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as combining auto insurance with homeowners or renters insurance. This practice often leads to substantial savings compared to purchasing each policy separately. The discount percentage varies depending on the insurer and the specific policies bundled. For example, bundling your auto and home insurance could result in a 10-15% discount, saving hundreds of dollars annually.

Examples of Discounts Offered by Insurance Companies

Insurance companies offer a variety of discounts to incentivize safe driving and responsible behavior. These discounts can significantly reduce your premiums.

- Good Student Discount: Students with good grades often qualify for a discount.

- Multi-Car Discount: Insuring multiple vehicles with the same company usually provides a discount.

- Safe Driver Discount: Discounts are often offered for drivers with a history of safe driving and no accidents.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle may qualify you for a discount.

- Telematics Programs: Some insurers offer discounts based on your driving behavior tracked through a telematics device.

Impact of Different Savings Strategies on Overall Cost

Consider a hypothetical scenario: John’s initial annual premium is $1,500.

| Savings Strategy | Percentage Savings | Dollar Savings | New Annual Premium |

|---|---|---|---|

| Bundling Policies | 10% | $150 | $1350 |

| Good Driving Record (no accidents/tickets) | 15% | $225 | $1275 |

| Increased Deductible | 5% | $75 | $1425 |

| Defensive Driving Course | 3% | $45 | $1455 |

| All Strategies Combined (Hypothetical) | 30% | $450 | $1050 |

This table illustrates the potential cumulative effect of employing multiple savings strategies. Note that actual savings will vary depending on the insurer, your specific circumstances, and the available discounts.

Filing a Claim and Dealing with Insurance Companies

Navigating the process of filing an auto insurance claim in Michigan can be daunting, but understanding the steps involved and your rights can significantly ease the experience. This section Artikels the process, offers advice on negotiating with adjusters, and provides examples of common claim disputes.

Steps Involved in Filing an Auto Insurance Claim

Following an accident, promptly reporting the incident to your insurance company is crucial. This typically involves contacting your insurer’s claims department via phone or their online portal. Be prepared to provide details about the accident, including the date, time, location, and involved parties. You’ll also need to provide information about your vehicle and any injuries sustained. Many insurers require you to file a police report, especially in cases involving significant damage or injuries. Finally, gather all relevant documentation, including photos of the damage, police reports, and witness contact information. Thorough documentation significantly strengthens your claim.

Negotiating with Insurance Adjusters

Insurance adjusters are responsible for investigating claims and determining the amount of compensation. Negotiating with an adjuster requires a calm and professional approach. Clearly and concisely explain the extent of the damage and the impact on you. Support your claims with solid evidence, such as repair estimates, medical bills, and lost wage documentation. Remember, you are not obligated to accept the adjuster’s initial offer. If you disagree with their assessment, politely but firmly express your concerns and provide additional supporting evidence. Consider seeking legal counsel if the negotiation process becomes complex or if you feel the adjuster is not being fair.

Advice on Dealing with Insurance Companies After an Accident

Remain calm and organized throughout the process. Keep detailed records of all communication with the insurance company, including dates, times, and names of individuals you spoke with. Be honest and accurate in your reporting. Misrepresenting information can jeopardize your claim. Understand your policy coverage thoroughly. Know what your policy covers and what it doesn’t. This will help you to negotiate effectively with the adjuster. If you have questions or concerns, don’t hesitate to seek clarification from your insurer or a legal professional.

Common Claim Disputes and Their Resolution

Disputes often arise regarding the valuation of vehicle damage, the assessment of medical expenses, and the determination of fault in an accident. For example, a dispute might arise if the insurance adjuster offers a lower repair estimate than what a local mechanic provides. In such cases, provide the adjuster with multiple repair estimates from reputable sources. Similarly, disputes over medical expenses often involve disagreements on the necessity or reasonableness of certain treatments. Detailed medical records and doctor’s statements can help support your claim. Disputes over fault can be particularly challenging. Police reports, witness statements, and photos of the accident scene are vital in determining liability. If negotiations fail, mediation or arbitration can provide an alternative dispute resolution process before resorting to litigation. In some cases, involving a lawyer experienced in insurance claims might be necessary to protect your interests.

Final Summary

Securing the best auto insurance in Michigan requires careful consideration of several factors, from understanding the state’s unique no-fault system to comparing quotes from different providers. By leveraging the information provided in this guide, including understanding policy details and implementing cost-saving strategies, you can confidently choose a policy that offers comprehensive coverage at a price that fits your budget. Remember to regularly review your policy and adapt it to your changing needs. Safe driving and informed decision-making are key to managing your auto insurance effectively in Michigan.

Detailed FAQs

What is the minimum auto insurance coverage required in Michigan?

Michigan requires minimum coverage for personal injury protection (PIP) and property damage liability. Specific amounts vary; check the state’s Department of Insurance and Financial Services website for current requirements.

How does my credit score affect my auto insurance premiums?

In many states, including Michigan, your credit score can influence your insurance rates. A higher credit score generally leads to lower premiums.

Can I get auto insurance if I have a DUI on my record?

Yes, but it will likely be significantly more expensive. Companies will consider the severity and recency of the offense.

What is the difference between collision and comprehensive coverage?

Collision covers damage to your vehicle in an accident, regardless of fault. Comprehensive covers damage from events other than collisions, like theft or hail.