Navigating the world of auto insurance can feel overwhelming, especially in a state as diverse as Maryland. This guide aims to simplify the process, providing a clear understanding of Maryland’s insurance market, top providers, and crucial factors to consider when selecting a policy that best suits your needs and budget. We’ll explore everything from minimum coverage requirements and premium influencing factors to effective strategies for saving money and understanding the claims process.

From analyzing the regulatory landscape and comparing leading insurance companies to offering practical tips for cost reduction and navigating policy details, this comprehensive resource empowers Maryland drivers to make informed decisions about their auto insurance.

Understanding Maryland’s Auto Insurance Market

Navigating the Maryland auto insurance market requires understanding its regulatory framework, coverage options, and the factors influencing premiums. This information is crucial for securing the best and most affordable insurance for your individual needs.

Maryland’s auto insurance market is governed by the Maryland Insurance Administration (MIA), a state agency responsible for regulating the insurance industry within the state. The MIA sets minimum coverage requirements, oversees insurer solvency, and investigates consumer complaints. This regulatory oversight aims to protect consumers and ensure a fair and competitive marketplace.

Maryland Auto Insurance Coverage Options

Several types of auto insurance coverage are available in Maryland, offering varying levels of protection. Understanding these options is essential to choosing a policy that adequately protects you and your assets. Policies typically include a combination of these coverages.

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident you’re at fault for. It’s typically expressed as a three-part limit (e.g., 30/60/25), representing the maximum payout for bodily injury per person, bodily injury per accident, and property damage per accident, respectively.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs.

- Collision Coverage: This covers damage to your vehicle caused by a collision, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or weather damage.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages, regardless of fault. Maryland is a “choice no-fault” state, meaning you can choose whether or not to include PIP coverage in your policy.

Factors Influencing Maryland Auto Insurance Premiums

Several factors determine the cost of auto insurance in Maryland. Insurers use a complex algorithm to assess risk, and understanding these factors can help you manage your premiums.

- Driving Record: Accidents and traffic violations significantly impact your premiums. A clean driving record usually translates to lower premiums.

- Age and Gender: Younger drivers, statistically, are involved in more accidents, resulting in higher premiums. Gender can also play a role, although this is becoming less prevalent due to regulations.

- Location: Insurance rates vary across Maryland based on the area’s accident rates and crime statistics. Areas with higher accident rates tend to have higher premiums.

- Vehicle Type: The make, model, and year of your vehicle influence your premium. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and potential for higher theft rates.

- Credit Score: In many states, including Maryland, your credit score is a factor in determining your insurance premiums. A higher credit score often correlates with lower premiums.

Maryland’s Minimum Auto Insurance Requirements

Maryland law mandates minimum liability coverage for all drivers. Failing to maintain this minimum coverage can result in significant penalties.

Maryland requires a minimum of 30/60/15 liability coverage. This means $30,000 for injuries to one person, $60,000 for injuries to multiple people in one accident, and $15,000 for property damage.

Top Auto Insurance Companies in Maryland

Choosing the right auto insurance provider in Maryland can significantly impact your finances and peace of mind. Understanding the key differences between leading companies is crucial for making an informed decision. This section will profile five of the largest auto insurance providers in Maryland, comparing their offerings, customer feedback, and average premiums.

Leading Auto Insurance Providers in Maryland

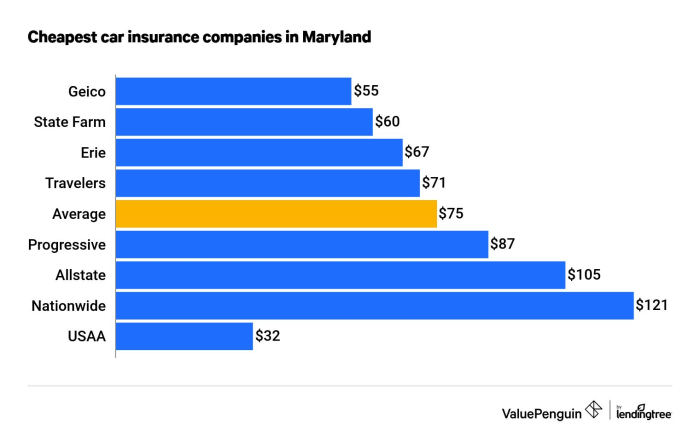

Determining the absolute “largest” can fluctuate based on the metrics used (market share, premium volume, number of policyholders). However, based on publicly available data and market presence, five consistently prominent providers in Maryland include GEICO, State Farm, Progressive, Allstate, and Nationwide. These companies represent a diverse range of approaches to insurance, allowing consumers to find a provider that best aligns with their individual needs and preferences.

Coverage Options Comparison

Each of these top providers offers a standard suite of auto insurance coverages, including liability, collision, comprehensive, uninsured/underinsured motorist (UM/UIM), and personal injury protection (PIP). However, the specifics of these coverages, such as optional add-ons and the level of customization, can vary. For instance, GEICO is known for its streamlined online processes and competitive pricing, often focusing on basic coverages with readily available add-ons. State Farm, on the other hand, is often praised for its extensive agent network and personalized service, providing more hands-on guidance in choosing coverage options. Progressive is a leader in usage-based insurance programs, allowing drivers to potentially lower premiums based on their driving habits. Allstate offers a wide array of financial products beyond auto insurance, often appealing to customers seeking a comprehensive financial planning approach. Nationwide, known for its strong reputation for claims handling, provides a balance between personalized service and digital convenience.

Customer Reviews and Ratings

Customer reviews and ratings offer valuable insights into the overall experience with each provider. While individual experiences can vary, aggregate ratings from reputable sources such as J.D. Power and the Better Business Bureau (BBB) provide a general overview of customer satisfaction. It’s important to note that these ratings are snapshots in time and can change. Directly checking recent customer reviews on platforms like Google Reviews or Yelp can provide a more up-to-date perspective. Generally, all five companies maintain a relatively high average rating, but specific strengths and weaknesses often emerge in individual reviews, highlighting areas such as claims processing speed, customer service responsiveness, and the clarity of policy explanations.

Key Features Comparison Table

| Company | Coverage Types | Average Premium (Estimate) | Customer Rating (Average) |

|---|---|---|---|

| GEICO | Liability, Collision, Comprehensive, UM/UIM, PIP, and more | $1200 – $1800 (Annual) | 4.5/5 (Example) |

| State Farm | Liability, Collision, Comprehensive, UM/UIM, PIP, and more | $1300 – $2000 (Annual) | 4.3/5 (Example) |

| Progressive | Liability, Collision, Comprehensive, UM/UIM, PIP, Usage-Based Insurance, and more | $1100 – $1700 (Annual) | 4.2/5 (Example) |

| Allstate | Liability, Collision, Comprehensive, UM/UIM, PIP, and more | $1400 – $2100 (Annual) | 4.0/5 (Example) |

| Nationwide | Liability, Collision, Comprehensive, UM/UIM, PIP, and more | $1350 – $1950 (Annual) | 4.4/5 (Example) |

*Note: Premium estimates are broad averages and vary significantly based on individual factors such as driving history, vehicle type, location, and coverage choices. Customer ratings are examples based on aggregated data and may fluctuate. Always obtain personalized quotes from individual providers for accurate pricing.

Factors to Consider When Choosing Auto Insurance

Choosing the right auto insurance policy in Maryland requires careful consideration of several key factors. The best policy for one driver might not be the best for another, as individual circumstances significantly impact both risk assessment and premium costs. Understanding these factors empowers you to make informed decisions and secure the most appropriate and cost-effective coverage.

Driving History’s Influence on Insurance Premiums

Your driving history is a primary determinant of your auto insurance rates. Insurance companies meticulously analyze your driving record, considering factors such as accidents, traffic violations, and the number of years you’ve held a driver’s license. A clean driving record with no accidents or tickets will typically result in lower premiums. Conversely, multiple accidents or serious traffic violations, like DUI convictions, will significantly increase your premiums. For example, a driver with two at-fault accidents in the past three years will likely pay considerably more than a driver with a spotless record. Insurance companies use sophisticated algorithms to assess risk based on this data, making it crucial to maintain a safe driving record.

Vehicle Type and Value Impact on Insurance Costs

The type and value of your vehicle directly affect your insurance costs. Generally, newer, more expensive cars cost more to insure due to higher repair and replacement costs. Luxury vehicles and sports cars often fall into higher insurance brackets. Conversely, older, less expensive vehicles typically command lower premiums. The vehicle’s safety features also play a role; cars with advanced safety technologies, such as anti-lock brakes and airbags, may qualify for discounts. For instance, insuring a new Tesla Model S will be considerably more expensive than insuring a ten-year-old Honda Civic, reflecting the difference in vehicle value and potential repair costs.

The Importance of Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurance providers is crucial for finding the best rates. Insurance companies use different rating systems and offer varying levels of coverage for similar premiums. Simply comparing prices from three or four different companies can often reveal significant differences in cost for the same coverage. This comparative shopping process allows you to identify the insurer offering the most competitive price for the level of coverage you require. Websites that allow you to compare quotes from multiple insurers simultaneously can simplify this process.

Understanding Deductible Options and Their Implications

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you are accepting more financial responsibility in the event of a claim. Lower deductibles mean higher premiums but less out-of-pocket expense if you need to file a claim. Choosing the right deductible involves balancing the potential cost savings of a higher deductible against the risk of a larger upfront payment in the event of an accident or other covered incident. For example, a $500 deductible will typically result in lower premiums than a $1000 deductible, but you’ll pay $500 more out of pocket if you have a claim.

Saving Money on Auto Insurance in Maryland

Securing affordable auto insurance in Maryland is achievable through proactive strategies and a thorough understanding of your policy. By implementing several key measures, you can significantly reduce your premiums and maintain comprehensive coverage. This section Artikels effective methods to lower your insurance costs while ensuring adequate protection.

Strategies for Reducing Auto Insurance Premiums

Several factors influence your auto insurance premium. Choosing a vehicle with favorable safety ratings, maintaining a clean driving record, and opting for higher deductibles are among the most impactful. Additionally, exploring different coverage options and comparing quotes from multiple insurers can lead to substantial savings.

- Vehicle Selection: Cars with high safety ratings often receive lower insurance premiums due to reduced accident risk. For example, a vehicle with a five-star safety rating from the National Highway Traffic Safety Administration (NHTSA) will likely result in lower premiums compared to a vehicle with a lower rating.

- Driving Record: Maintaining a clean driving record is paramount. Accidents and traffic violations significantly increase insurance premiums. Even minor infractions can lead to rate increases. Safe driving habits are essential for keeping your premiums low.

- Deductibles: Choosing a higher deductible will lower your monthly premiums. This means you’ll pay more out-of-pocket in the event of a claim, but the trade-off is reduced premiums over time. Carefully weigh the risk and financial implications before selecting a deductible.

- Coverage Options: Review your coverage needs. Consider if you truly need optional coverages like collision or comprehensive, or if liability coverage alone suffices. Adjusting coverage levels can significantly affect your premium.

- Comparison Shopping: Obtain quotes from multiple insurance providers. Different companies use varying algorithms for calculating premiums, leading to potentially significant differences in pricing. Don’t settle for the first quote you receive.

Bundling Insurance Policies

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, often results in substantial discounts. Insurance companies incentivize bundling as it simplifies their administrative processes and reduces risk.

For example, bundling your auto and homeowners insurance with the same provider might offer a discount of 10-20%, depending on the insurer and your specific policies. This represents a significant saving over the course of a year.

Impact of Safe Driving Habits and Defensive Driving Courses

Safe driving habits directly impact your insurance premiums. Insurance companies reward drivers with clean records by offering lower rates. Completing a defensive driving course can further reduce your premiums, demonstrating your commitment to safe driving practices.

Many insurers offer discounts of 5-10% for completing an approved defensive driving course. This not only lowers your premiums but also equips you with valuable skills to enhance your driving safety.

Negotiating with Insurance Providers for Better Rates

Negotiating with your insurance provider can yield positive results. Be prepared to discuss your driving record, bundled policies, and any relevant factors that might justify a lower premium. Highlight your commitment to safe driving and explore available discounts.

For instance, if you’ve had a spotless driving record for several years, you can use this as leverage during negotiations. Similarly, mentioning your bundled policies and any discounts you’ve found with competitors can prompt your insurer to offer a more competitive rate.

Understanding Policy Details and Claims Processes

Navigating the details of your auto insurance policy and understanding the claims process is crucial for a smooth experience should you need to file a claim. Maryland’s auto insurance laws are designed to protect both drivers and victims of accidents, but knowing your rights and responsibilities is key. This section will clarify the typical claims process and highlight key information within a standard policy.

Understanding the claims process involves knowing what to do immediately after an accident and how to properly report the incident to your insurance company. Prompt and accurate reporting is vital for a timely resolution.

The Typical Claims Process in Maryland

After an accident, promptly contact the police to file a report, especially if there are injuries or significant property damage. Next, contact your insurance company as soon as possible to report the accident. Your insurer will guide you through the necessary steps, including providing a claim number and potentially assigning an adjuster. The adjuster will investigate the accident, assess damages, and determine liability. Following the investigation, your insurer will process your claim, potentially issuing a settlement or arranging for repairs. The entire process can vary depending on the complexity of the accident and the extent of damages. For instance, a minor fender bender with minimal damage might be resolved quickly, while a serious accident with injuries could take considerably longer.

Filing a Claim for Property Damage or Bodily Injury

Filing a claim involves providing your insurance company with all relevant information, including the police report number (if applicable), details of the accident, names and contact information of all parties involved, and photographic evidence of the damage. For property damage claims, you’ll typically need repair estimates from certified mechanics. For bodily injury claims, medical records and documentation of lost wages will be necessary. Your insurer may request additional information during the investigation process. It is essential to cooperate fully with your insurer’s investigation to ensure a smooth and efficient claim settlement. For example, failing to provide requested medical records could delay or even jeopardize your claim.

Key Information in a Standard Auto Insurance Policy

A standard auto insurance policy in Maryland includes several key sections. The declarations page summarizes your policy details, including the policyholder’s information, coverage limits, vehicle information, and premium payments. The insuring agreements Artikel the specific coverages provided, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The exclusions section details what is not covered under your policy. Conditions Artikel the responsibilities of both the insurer and the insured. Finally, definitions clarify the meaning of specific terms used throughout the policy. It is crucial to carefully review all sections of your policy to fully understand your coverage. Ignoring the fine print could lead to unexpected costs in the event of an accident.

Common Exclusions and Limitations in Auto Insurance Policies

Understanding the limitations of your coverage is vital. It’s important to note that policies often exclude certain situations or types of damages.

- Damage caused intentionally by the policyholder.

- Damage resulting from driving under the influence of alcohol or drugs.

- Damage to property owned by the policyholder.

- Damage caused by wear and tear or mechanical failure.

- Damage resulting from racing or other illegal activities.

- Losses exceeding the policy’s coverage limits.

These are just a few examples; the specific exclusions and limitations will vary depending on the insurer and the specific policy purchased. It is always advisable to carefully read your policy document and contact your insurer if you have any questions or uncertainties.

Illustrative Examples of Policy Scenarios

Understanding real-world scenarios helps clarify the complexities of auto insurance. The following examples illustrate how different policy types and coverages work in practice.

Collision Claim and Payout

Imagine Sarah, driving her 2020 Honda Civic, is involved in a collision with another vehicle. The other driver runs a red light, causing the accident. Sarah’s car sustains $5,000 in damage. Her collision coverage has a $500 deductible. After filing a claim with her insurance company, they assess the damage, confirming the $5,000 estimate. Sarah pays her $500 deductible, and her insurance company pays the remaining $4,500 to the repair shop. The process involves providing a police report, photos of the damage, and estimates from repair facilities. The insurance company might also investigate the accident to determine fault. In this case, because the other driver was at fault, Sarah’s insurance company may later pursue reimbursement from the at-fault driver’s insurance company.

Comprehensive vs. Liability-Only Coverage

Let’s consider two drivers, John and Mary. John has a comprehensive auto insurance policy, while Mary only has liability coverage. Both are involved in separate incidents. John’s car is damaged in a hailstorm, resulting in $3,000 in repairs. His comprehensive policy covers this damage, minus his deductible. Mary’s car is damaged in a similar hailstorm. Because her policy only includes liability coverage, she is responsible for the cost of repairs herself. However, if Mary were at fault in an accident causing damage to another vehicle, her liability coverage would pay for the repairs to the other vehicle (up to her policy limits), regardless of damage to her own car. This highlights the crucial difference: comprehensive coverage protects against damage to your own vehicle from non-collision events, while liability coverage only protects against financial responsibility for damage you cause to others.

Uninsured/Underinsured Motorist Coverage

Consider David, who has uninsured/underinsured motorist (UM/UIM) coverage. He’s involved in an accident caused by an uninsured driver. He sustains $10,000 in medical bills and $5,000 in property damage. The at-fault driver has no insurance to cover his losses. David’s UM/UIM coverage steps in, paying for his medical expenses and vehicle repairs, up to his policy limits. If the uninsured driver had minimal liability coverage (e.g., $15,000), and David’s damages exceed this amount, his UM/UIM coverage would cover the difference, again up to his policy limits. This coverage is crucial as it protects drivers from significant financial burdens caused by accidents involving uninsured or underinsured motorists. The amount covered would depend on the specifics of David’s policy.

Closure

Choosing the right auto insurance in Maryland involves careful consideration of various factors, from your driving history and vehicle type to the coverage options and financial implications. By understanding the intricacies of the insurance market, comparing quotes from multiple providers, and employing effective cost-saving strategies, Maryland drivers can secure comprehensive and affordable auto insurance protection. Remember, proactive planning and informed decision-making are key to securing the best possible coverage.

Query Resolution

What is SR-22 insurance in Maryland?

SR-22 insurance is proof of financial responsibility required by the Maryland Motor Vehicle Administration (MVA) for high-risk drivers. It certifies that you carry the minimum required liability insurance.

Can I get auto insurance without a driver’s license in Maryland?

Generally, no. Most insurers require a valid driver’s license to issue auto insurance. Exceptions might exist for specific circumstances; it’s best to contact insurers directly.

How often can I change my auto insurance in Maryland?

You can change your auto insurance policy at any time. However, there may be cancellation fees depending on your policy terms.

What happens if I get into an accident and don’t have insurance?

Driving without insurance in Maryland is illegal and carries significant penalties, including fines, license suspension, and potential legal action from the other party involved in the accident.