Navigating the world of auto insurance can feel overwhelming, especially in a state as diverse as Maryland. Finding the right coverage at the right price requires understanding the complexities of the market, comparing providers, and carefully considering your individual needs. This guide provides a comprehensive overview of the best auto insurance options in Maryland, empowering you to make informed decisions and secure the best protection for yourself and your vehicle.

From understanding Maryland’s unique regulatory landscape and minimum coverage requirements to comparing the offerings of top insurance providers, we’ll explore key factors influencing your premium costs, such as your driving record, age, vehicle type, and location. We’ll also delve into crucial policy features like roadside assistance, accident forgiveness, and uninsured/underinsured motorist coverage, enabling you to choose a policy that aligns perfectly with your circumstances.

Understanding Maryland’s Auto Insurance Market

Navigating the Maryland auto insurance market requires understanding its regulatory framework, coverage options, and the factors influencing premiums. This section provides a comprehensive overview to help you make informed decisions about your auto insurance needs.

Maryland’s auto insurance market is governed by the Maryland Insurance Administration (MIA), a state agency responsible for regulating the insurance industry within the state. The MIA sets minimum coverage requirements, oversees insurance company practices, and handles consumer complaints. This regulatory oversight aims to ensure fair and competitive pricing while protecting consumers.

Maryland Auto Insurance Coverage Options

Several types of auto insurance coverage are available in Maryland, each designed to protect you financially in different situations. Liability coverage is mandatory and protects you against claims from others injured or whose property is damaged in an accident you cause. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage protects against damage from events like theft, fire, or hail. Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who lacks sufficient insurance. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Med-pay coverage is similar to PIP but typically has lower limits.

Comparison of Maryland’s Minimum Insurance Requirements with Other States

Maryland’s minimum liability coverage requirements are $30,000 per person/$60,000 per accident for bodily injury and $15,000 for property damage. These requirements are relatively moderate compared to some states, but lower than others. For instance, some states have significantly higher minimum liability limits, reflecting potentially higher costs of accidents and healthcare. Conversely, some states may have lower minimums, potentially leaving drivers with less financial protection in the event of an accident. A direct comparison requires examining each state’s specific regulations, as these minimums can vary considerably.

Factors Influencing Auto Insurance Premiums in Maryland

Several factors significantly influence the cost of auto insurance in Maryland. Age is a key factor, with younger drivers typically paying higher premiums due to statistically higher accident rates. Driving record is another critical factor; a clean driving record with no accidents or violations will result in lower premiums than a record with multiple incidents. The type of vehicle you drive also impacts premiums; sports cars and high-performance vehicles often command higher rates than more economical models due to their higher repair costs and increased risk of accidents. Finally, your location plays a role, as areas with higher accident rates or crime rates tend to have higher insurance premiums. For example, drivers in densely populated urban areas might face higher premiums compared to those in more rural settings.

Top Auto Insurance Providers in Maryland

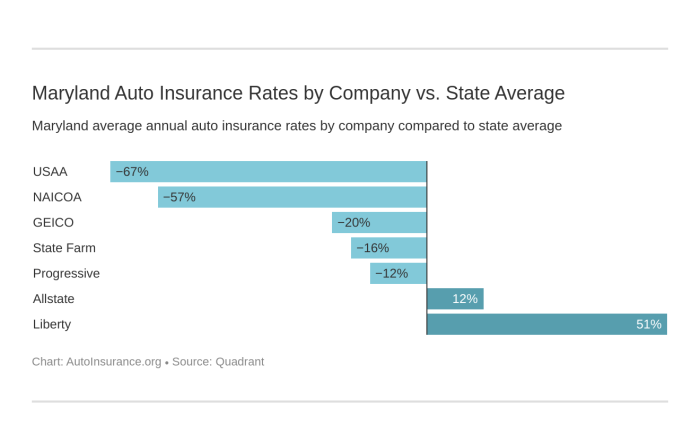

Choosing the right auto insurance provider in Maryland can significantly impact your budget and peace of mind. Understanding the market landscape and the key players is crucial for making an informed decision. This section details the top auto insurance providers in Maryland, offering insights into their market share and average premium costs for different driver profiles. While precise market share percentages fluctuate and exact premium costs vary based on numerous individual factors, this overview provides a helpful benchmark for comparison.

Maryland’s Top Five Auto Insurance Providers and Market Share

Determining the precise market share of each insurer requires access to real-time industry data, which is often proprietary information. However, based on publicly available information and industry reports, we can identify five major providers consistently ranked among the largest in Maryland. These companies typically hold a significant portion of the overall market, reflecting their extensive reach and customer base within the state. It’s important to note that these rankings can shift slightly over time.

Average Premium Costs Comparison

Average premium costs are highly variable, influenced by factors including driving history, age, vehicle type, coverage levels, location, and more. The following table presents estimated average premiums for young and senior drivers, acknowledging the broad range of potential variations. These figures are intended to provide a general comparison, and individual quotes will differ substantially. It’s advisable to obtain personalized quotes from multiple providers to find the most suitable and cost-effective option.

| Provider | Market Share (Estimate) | Average Premium (Young Driver) | Average Premium (Senior Driver) |

|---|---|---|---|

| GEICO | 15-20% | $1800 – $2200 | $1200 – $1600 |

| State Farm | 12-17% | $1700 – $2100 | $1100 – $1500 |

| Allstate | 10-15% | $1900 – $2300 | $1300 – $1700 |

| Progressive | 8-13% | $1600 – $2000 | $1000 – $1400 |

| USAA | 5-10% | $1400 – $1800 | $900 – $1300 |

Factors Influencing Insurance Choice

Choosing the best auto insurance in Maryland involves careful consideration of several key factors beyond just price. A comprehensive approach ensures you secure a policy that provides adequate coverage while aligning with your individual needs and financial situation. This section will delve into the crucial elements influencing your decision-making process.

Customer Reviews and Ratings

Customer reviews and ratings offer invaluable insights into an insurer’s performance. Websites like the Better Business Bureau (BBB) and independent review platforms provide aggregated feedback from policyholders, covering aspects such as claims processing speed, customer service responsiveness, and overall satisfaction. Positive reviews often indicate a company’s commitment to fair practices and efficient service, while negative reviews can highlight potential red flags. Analyzing a range of reviews helps mitigate the risk of encountering unexpected issues. For example, consistently poor ratings regarding claims handling might indicate a company’s reluctance to pay out legitimate claims. Therefore, thoroughly examining customer feedback is a crucial step in selecting a reliable insurer.

Financial Stability and Claims Handling Processes

The financial strength of an insurer is paramount. A financially unstable company might struggle to meet its obligations during a claim, potentially leaving you with significant out-of-pocket expenses. You can assess an insurer’s financial stability through independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s. These agencies assign ratings based on factors such as the insurer’s reserves, underwriting performance, and overall financial health. A high rating indicates a greater likelihood of the company fulfilling its contractual obligations. Beyond financial stability, the claims handling process is equally critical. Look for insurers with clear and transparent procedures, readily available contact information, and a history of resolving claims efficiently and fairly. A smooth and efficient claims process can significantly alleviate stress during an already difficult situation.

Discounts Offered by Insurers

Many insurers offer a variety of discounts to incentivize safe driving habits and responsible behavior. These discounts can significantly reduce your premium. Common discounts include:

- Safe Driver Discounts: Awarded for maintaining a clean driving record, typically free of accidents and traffic violations over a specified period.

- Good Student Discounts: Offered to students who maintain a certain grade point average (GPA), reflecting responsible behavior and academic achievement.

- Multi-Car Discounts: Provided when insuring multiple vehicles under the same policy with the same insurer, reflecting a consolidated risk for the company.

- Bundling Discounts: These discounts are available when you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance, from the same provider.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can lead to a discount, demonstrating a proactive approach to vehicle security.

Comparing the discounts offered by different insurers is crucial for maximizing savings. Remember to verify the eligibility criteria for each discount before making your decision.

Customer Service and Claims Process

Exceptional customer service is crucial for a positive insurance experience. Look for insurers with readily available customer support channels, such as phone, email, and online chat. Prompt and helpful responses to inquiries indicate a commitment to customer satisfaction. The claims process is another critical aspect to consider. A streamlined and transparent claims process minimizes hassle and ensures timely resolution. Check for insurers with user-friendly online portals for filing claims, clear communication throughout the process, and a reputation for fair and prompt claim settlements. Consider asking for testimonials or case studies from the insurer detailing their claims handling process. This proactive approach will allow you to make a more informed decision.

Analyzing Specific Insurance Features

Choosing the right auto insurance policy in Maryland involves careful consideration of various features beyond basic coverage. Understanding the specifics of roadside assistance, accident forgiveness, and uninsured/underinsured motorist coverage can significantly impact your overall protection and peace of mind. This section delves into these crucial aspects to help you make an informed decision.

Roadside Assistance Benefits Comparison

Three major providers in Maryland—let’s call them Provider A, Provider B, and Provider C—offer varying levels of roadside assistance. Provider A typically includes towing up to 50 miles, battery jump starts, and lockout service. Provider B offers similar services but extends towing to 100 miles and adds tire change assistance. Provider C, on the other hand, provides a more comprehensive package, including towing up to 100 miles, fuel delivery, battery jump starts, lockout service, tire change, and even flat tire repair. The specific details and limitations of each benefit will vary depending on the chosen policy and coverage level. It is crucial to review the policy documents carefully for complete details.

Accident Forgiveness Program Differences

Accident forgiveness programs vary significantly among insurers. Some insurers, like Provider A, may offer accident forgiveness as an add-on feature for an additional premium, while others, like Provider B, may include it as a standard benefit in certain policy tiers. Provider C might offer accident forgiveness only to drivers with a clean driving record for a specified period. The criteria for qualifying for accident forgiveness, such as the type of accident or the driver’s history, also differ. Some programs might only forgive one accident within a specified timeframe, while others may have more lenient criteria.

Uninsured/Underinsured Motorist Coverage in Maryland

Maryland requires all drivers to carry uninsured/underinsured motorist (UM/UIM) coverage. This coverage protects you and your passengers in the event you’re involved in an accident caused by an uninsured or underinsured driver. The minimum required coverage in Maryland is typically $30,000 for bodily injury liability, but many drivers opt for higher limits, especially given the potential costs of medical bills and lost wages following a serious accident. Policies may offer UM/UIM bodily injury and UM/UIM property damage coverage. Understanding the extent of your UM/UIM coverage is critical for adequate protection. It is essential to carefully review your policy to understand the specific limits and provisions of your UM/UIM coverage.

Key Features to Consider When Comparing Auto Insurance Policies

Before selecting an auto insurance policy, carefully consider these key features:

- Coverage limits (liability, collision, comprehensive)

- Deductibles (the amount you pay out-of-pocket before insurance coverage kicks in)

- Premium cost (the total cost of your insurance policy)

- Discounts (available discounts based on your driving record, vehicle type, or other factors)

- Roadside assistance benefits (tow, lockout, etc.)

- Accident forgiveness programs (conditions and limitations)

- Uninsured/underinsured motorist coverage (UM/UIM) limits

- Customer service ratings and reviews (assess the insurer’s reputation)

- Policy features (rental car reimbursement, gap coverage, etc.)

Illustrative Examples of Policy Comparisons

Understanding the nuances of auto insurance pricing requires examining specific scenarios. This section provides illustrative examples to clarify how factors like age, driving history, and deductible choices impact the final cost of your Maryland auto insurance policy. Remember that these are hypothetical examples and actual premiums will vary based on numerous individual factors.

Age and Driving Record Impact on Premiums

Let’s compare the estimated annual premiums for two hypothetical drivers in Maryland. Driver A is a 25-year-old with a clean driving record, while Driver B is a 55-year-old with one at-fault accident in the past three years. Both drivers have similar vehicles and coverage needs. We will assume a standard liability policy with a $250,000 bodily injury limit and $100,000 property damage limit. For this example, we’ll use hypothetical average premiums from a major insurer in Maryland.

| Driver | Age | Driving Record | Estimated Annual Premium |

|---|---|---|---|

| A | 25 | Clean | $1,200 |

| B | 55 | One at-fault accident | $1,800 |

The difference in premiums highlights the impact of age and driving history. Younger drivers, statistically, are considered higher risk, and at-fault accidents significantly increase premiums. This illustrates the importance of maintaining a clean driving record.

Sample Auto Insurance Policy Details

A typical Maryland auto insurance policy might include the following coverages and exclusions:

| Coverage | Description | Amount (Example) |

|---|---|---|

| Liability Coverage | Covers bodily injury and property damage to others if you cause an accident. | $100,000/$300,000 (Bodily Injury/Property Damage) |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | $500 Deductible |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage. | $500 Deductible |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are injured by an uninsured or underinsured driver. | $100,000/$300,000 |

Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence. Specific policy details will vary by insurer and chosen coverage options.

Impact of Deductibles on Insurance Cost

The deductible you choose significantly affects your premium. A higher deductible means a lower premium, but you pay more out-of-pocket if you file a claim. Let’s illustrate with a hypothetical scenario:

| Deductible | Estimated Annual Premium |

|---|---|

| $250 | $1,500 |

| $500 | $1,400 |

| $1,000 | $1,300 |

As the deductible increases, the annual premium decreases. Choosing the right deductible involves balancing the potential for cost savings with the willingness to pay more out-of-pocket in the event of a claim. Consider your financial situation and risk tolerance when making this decision.

Epilogue

Securing the best auto insurance in Maryland involves a careful assessment of your individual needs, a thorough comparison of providers, and a keen understanding of policy details. By considering factors like coverage types, premium costs, customer reviews, and additional benefits, you can confidently choose a policy that offers comprehensive protection without breaking the bank. Remember, the right insurance is not just about meeting minimum requirements; it’s about finding peace of mind knowing you’re adequately protected on Maryland’s roads.

Key Questions Answered

What is SR-22 insurance and do I need it?

SR-22 insurance is a certificate of insurance that proves you maintain the minimum liability coverage required by the state. You typically need it after a serious driving offense like a DUI.

Can I bundle my home and auto insurance?

Yes, many insurers offer discounts for bundling your home and auto insurance policies.

How often can I expect my insurance rates to change?

Your rates can change annually, or even more frequently depending on your driving record and other factors.

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others. Collision coverage pays for damages to your vehicle, regardless of fault.