Navigating the world of auto insurance in Illinois can feel overwhelming. With varying coverage options, factors influencing costs, and a multitude of providers, finding the best fit for your individual needs requires careful consideration. This guide aims to simplify the process, providing a comprehensive overview of Illinois auto insurance requirements, cost factors, and strategies for securing the most suitable and affordable coverage.

From understanding minimum liability requirements and the penalties for driving uninsured to exploring various coverage types and leveraging available discounts, we’ll equip you with the knowledge to make informed decisions. We’ll also compare prominent insurance providers, helping you choose a company that aligns with your priorities and budget. Ultimately, our goal is to empower you to confidently navigate the Illinois auto insurance landscape.

Understanding Illinois Auto Insurance Requirements

Driving in Illinois requires understanding the state’s auto insurance regulations to ensure legal compliance and financial protection. Failure to comply can result in significant penalties and leave you vulnerable in the event of an accident. This section details the minimum requirements, potential penalties, and various coverage options available to Illinois drivers.

Minimum Liability Coverage Requirements in Illinois

Illinois mandates minimum liability insurance coverage for all drivers. This means you must carry a policy that covers damages you cause to others in an accident. The minimum requirements are $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $20,000 property damage liability. This means your insurance company will pay a maximum of $25,000 for injuries to one person, $50,000 for injuries to multiple people in a single accident, and $20,000 for damage to another person’s property. It’s crucial to understand that these are minimums, and significantly higher coverage limits are strongly recommended to protect yourself financially in the event of a serious accident.

Penalties for Driving Without Insurance in Illinois

Driving without insurance in Illinois is illegal and carries substantial penalties. These penalties can include fines, license suspension, and even vehicle impoundment. The fines can be quite steep, varying depending on the number of offenses. In addition to the fines, your license may be suspended for a period of time, preventing you from legally driving. Furthermore, if you’re involved in an accident without insurance, you could face significant financial responsibility for damages, even if you weren’t at fault. Your ability to obtain insurance in the future may also be impacted.

Common Types of Auto Insurance Coverage

Beyond the mandated liability coverage, several other types of auto insurance are available to provide broader protection.

| Coverage Type | Description | Example of Benefit |

|---|---|---|

| Collision | Covers damage to your vehicle caused by a collision, regardless of fault. | Your car is damaged in an accident with another vehicle, even if you are at fault. Collision coverage will pay for repairs or replacement. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or hail. | Your car is damaged by a falling tree branch. Comprehensive coverage will cover the repairs. |

| Uninsured/Underinsured Motorist | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | You are injured in an accident caused by an uninsured driver. This coverage will help pay for your medical bills and other damages. |

Factors Affecting Auto Insurance Costs in Illinois

Several key factors influence the cost of auto insurance in Illinois. Insurance companies utilize a complex algorithm considering various aspects of the driver and vehicle to determine premiums. Understanding these factors can help you make informed decisions about your insurance coverage and potentially lower your costs.

Driving Record

Your driving history significantly impacts your insurance premium. A clean driving record, free of accidents and traffic violations, typically results in lower rates. Conversely, accidents, especially those resulting in injuries or significant property damage, and traffic violations such as speeding tickets or DUIs, will substantially increase your premiums. Insurance companies view these incidents as indicators of higher risk. The severity and frequency of incidents are key factors; multiple violations within a short period will generally lead to more significant rate increases than isolated incidents. Some companies may even refuse to insure drivers with particularly poor records.

Age

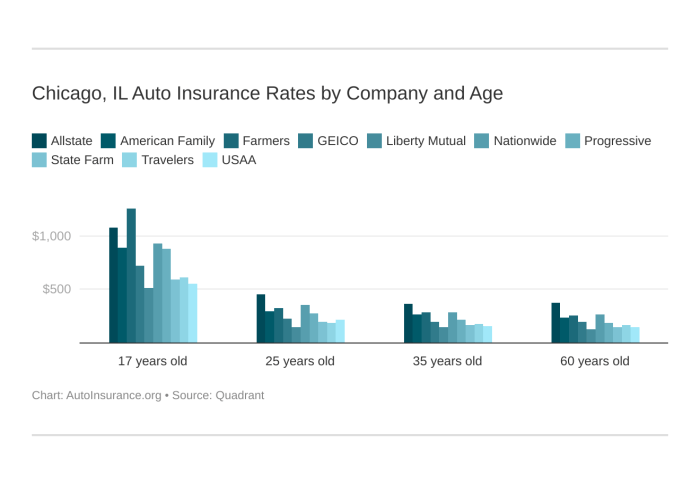

Age is another crucial factor. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, insurance companies often charge higher premiums for this demographic. As drivers age and gain experience, their premiums typically decrease, reflecting a lower risk profile. This trend continues until a certain age, after which premiums may again increase slightly due to factors such as declining eyesight and reflexes.

Location

Where you live in Illinois significantly affects your insurance rates. Insurance companies consider the accident rates, crime statistics, and the frequency of theft in different areas. Cities with higher crime rates and more frequent accidents will generally have higher insurance premiums compared to more rural areas with lower incident rates. The density of the population also plays a role; more densely populated areas often have higher insurance costs due to increased congestion and the likelihood of accidents.

Vehicle Type

The type of vehicle you drive is a major determinant of your insurance cost. Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to insure than smaller, more economical cars. This is because these vehicles are often more expensive to repair and replace, and they may be more likely to be involved in accidents or targeted for theft. The vehicle’s safety features also play a role; cars with advanced safety technology may qualify for discounts.

Credit Score

In Illinois, as in many other states, your credit score can influence your auto insurance premiums. Insurance companies often use credit-based insurance scores to assess risk. A lower credit score is often associated with a higher risk of filing claims. While this practice is controversial, it is legal in Illinois. Improving your credit score can potentially lead to lower insurance premiums. However, it’s important to note that credit scores are only one factor among many, and their influence varies among insurance companies.

Claims History

Your claims history, similar to your driving record, is a significant factor. Filing multiple claims, even for minor incidents, can lead to higher premiums. Insurance companies view frequent claims as indicators of higher risk. The type of claim also matters; claims involving significant damage or injuries will have a greater impact on your rates than smaller claims. Maintaining a clean claims history is crucial for keeping your insurance costs low.

Average Insurance Rates in Illinois Cities

The following table provides a comparison of average insurance rates across several Illinois cities. Note that these are estimates and actual rates will vary based on individual factors.

| City | Average Premium | Minimum Coverage Premium | Factors Influencing Cost |

|---|---|---|---|

| Chicago | $1,500 (estimated) | $600 (estimated) | High accident rates, theft, population density |

| Springfield | $1,200 (estimated) | $500 (estimated) | Moderate accident rates, lower population density than Chicago |

| Peoria | $1,100 (estimated) | $450 (estimated) | Relatively lower accident rates compared to larger cities |

| Champaign | $1,300 (estimated) | $550 (estimated) | University town, higher population density than smaller cities |

Finding the Best Auto Insurance Provider in Illinois

Choosing the right auto insurance provider in Illinois can significantly impact your financial well-being and peace of mind. Numerous companies operate within the state, each offering a unique range of services and coverage options. Careful consideration of factors like price, coverage, and customer service is crucial for making an informed decision.

Comparing Major Illinois Auto Insurance Companies

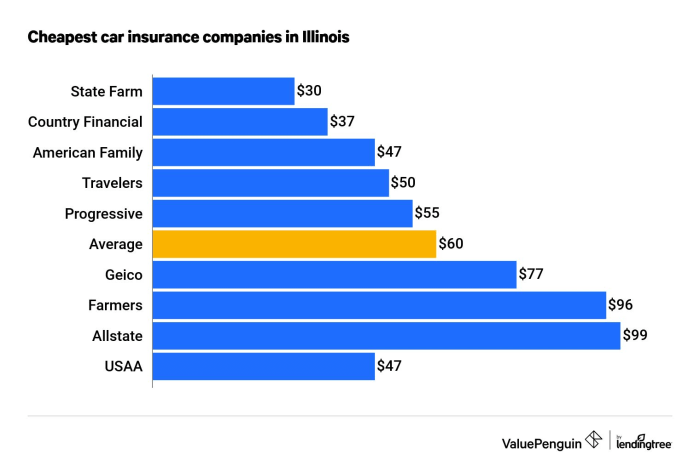

Several major insurance companies compete for customers in Illinois, each with its strengths and weaknesses. Direct comparison helps consumers identify the best fit for their individual needs and risk profiles. For example, State Farm, a prominent national insurer, often boasts a strong local presence and competitive rates, particularly for bundled home and auto insurance. Geico, known for its extensive advertising and online tools, may appeal to consumers who prioritize convenience and digital interaction. Allstate, another major player, often emphasizes personalized service and a wide array of coverage options. Progressive, frequently lauded for its innovative features like Snapshot telematics, attracts customers seeking potential discounts based on driving behavior. Finally, Nationwide offers a comprehensive suite of insurance products and is recognized for its financial stability. These are just a few examples; many other reputable insurers operate successfully within the state. The ideal provider depends heavily on individual circumstances.

Reputable Independent Insurance Agents in Illinois

Utilizing an independent insurance agent offers several advantages. These agents work with multiple insurance companies, allowing them to compare quotes and coverage options across a wider spectrum. This eliminates the need for consumers to contact numerous companies individually. Finding a reputable independent agent can simplify the process considerably. While a specific list of agents is beyond the scope of this text due to the dynamic nature of the industry and the need for ongoing verification, resources such as the Illinois Department of Insurance website and online directories can assist in locating licensed and highly-rated agents within specific Illinois communities. Look for agents with extensive experience and positive client testimonials.

Auto Insurance Provider Comparison Chart

The following table compares key features of five prominent Illinois auto insurance providers. Remember that rates and specific coverage options can vary based on individual factors like driving history, vehicle type, and location.

| Provider | Coverage Options | Customer Service Rating (Illustrative – Based on aggregated online reviews; actual ratings vary) | Claims Process (Illustrative – Based on reported experiences; actual processes may vary) |

|---|---|---|---|

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP), medical payments | 4.5 out of 5 stars | Generally efficient and straightforward, often with dedicated claims adjusters |

| Geico | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP) (varies by state) | 4.0 out of 5 stars | Primarily online and phone-based, known for relatively quick processing times for simpler claims |

| Allstate | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP), roadside assistance | 4.2 out of 5 stars | Offers various communication channels, with a focus on personalized service |

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP), various add-ons | 4.1 out of 5 stars | Known for its use of technology in claims processing, potentially offering faster resolution for certain types of claims |

| Nationwide | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP), many add-on options | 4.3 out of 5 stars | A relatively traditional claims process, often involving direct communication with adjusters |

Obtaining Quotes from Multiple Insurers

The process of obtaining quotes is straightforward. Most insurers offer online quote tools on their websites, requiring basic information about your vehicle, driving history, and desired coverage. Alternatively, you can contact insurers directly by phone or through an independent agent. It is recommended to obtain at least three to five quotes to ensure a comprehensive comparison. Remember to carefully review the policy details, including deductibles, coverage limits, and any exclusions, before making a final decision. Comparing apples to apples—ensuring you’re comparing similar coverage levels—is crucial for accurate price comparison.

Discounts and Savings on Illinois Auto Insurance

Securing affordable auto insurance in Illinois is achievable with a keen understanding of available discounts and strategic planning. Many insurance providers offer a range of discounts designed to reward safe driving habits and responsible financial choices. By taking advantage of these opportunities, Illinois drivers can significantly reduce their premiums.

Finding the best rate involves more than just comparing prices; it’s about identifying which discounts apply to your individual circumstances and maximizing their impact. This section will explore common discounts and offer practical tips for securing the lowest possible premium.

Common Auto Insurance Discounts in Illinois

Several discounts are commonly offered by Illinois auto insurers. These can significantly lower your premiums, sometimes by hundreds of dollars annually. Understanding these discounts is crucial to obtaining the best possible rate.

- Good Driver Discount: This is perhaps the most common discount. Maintaining a clean driving record, free of accidents and traffic violations for a specified period (typically three to five years), qualifies you for this substantial reduction. The specific percentage varies by insurer, but it can be considerable, often ranging from 10% to 25% or more.

- Bundling Discount: Many insurers offer discounts when you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance. Bundling your policies with the same provider simplifies billing and often leads to a significant discount, typically around 10-15% or more depending on the policies bundled.

- Safe Driver Discount: Some insurers utilize telematics programs, which involve installing a device in your car or using a smartphone app to monitor your driving habits. Safe driving behaviors, such as maintaining consistent speeds and avoiding hard braking, can earn you a discount. Discounts vary widely based on individual driving data.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can demonstrate your commitment to vehicle security and may result in a discount. The discount amount is determined by the insurer and the type of device installed.

- Good Student Discount: Students who maintain a high grade point average (GPA) often qualify for discounts, reflecting their responsible behavior. The required GPA and the discount percentage vary depending on the insurer and the student’s age.

- Multi-Car Discount: Insuring multiple vehicles under one policy with the same provider often results in a discount, reflecting the insurer’s reduced administrative costs.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can demonstrate your commitment to safe driving and often leads to a premium reduction. The discount amount will vary depending on the insurer and the specific course.

Tips for Securing the Best Auto Insurance Rate

Obtaining the lowest possible auto insurance rate requires proactive steps. By following these tips, you can significantly reduce your premiums.

- Shop Around: Obtain quotes from multiple insurance providers. Prices vary considerably between companies, so comparing quotes is essential.

- Review Your Coverage: Ensure you have adequate coverage but avoid unnecessary extras that inflate your premium. Carefully consider your needs and choose the appropriate coverage levels.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to qualify for good driver discounts. Safe driving is not only responsible but also financially rewarding.

- Bundle Your Insurance: Combine your auto insurance with other policies to take advantage of bundling discounts.

- Explore Telematics Programs: Consider participating in a telematics program to demonstrate your safe driving habits and potentially earn a discount.

- Increase Your Deductible: Increasing your deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can lower your premium, but carefully weigh this against your risk tolerance.

- Pay Annually: Paying your premium annually, rather than monthly, may result in a small discount from some insurers.

Calculating Potential Savings

Let’s illustrate potential savings. Assume a base premium of $1,200 annually.

- Good Driver Discount (20%): $1,200 x 0.20 = $240 savings

- Bundling Discount (15%): $1,200 x 0.15 = $180 savings

- Safe Driver Discount (10%): $1,200 x 0.10 = $120 savings

Total potential savings: $240 + $180 + $120 = $540

This example demonstrates how combining discounts can result in substantial savings. The actual savings will vary based on the specific discounts offered by your insurer and your individual circumstances.

Steps to Lower Your Insurance Premiums

Taking proactive steps can lead to lower premiums.

- Maintain a clean driving record.

- Shop around for the best rates.

- Bundle your insurance policies.

- Consider increasing your deductible (carefully weighing the risks).

- Explore and participate in telematics programs if offered.

- Maintain a high GPA if eligible for a good student discount.

- Install anti-theft devices.

- Complete a defensive driving course.

Filing a Claim with Your Illinois Auto Insurer

Filing an auto insurance claim in Illinois involves several key steps, ensuring a smooth process for resolving your situation after an accident. Prompt and accurate reporting is crucial for a successful claim. Understanding the process beforehand can significantly reduce stress and potential delays.

The initial steps involve contacting your insurance company as soon as possible after the accident. This notification typically initiates the claims process. You’ll provide basic details of the incident, including the date, time, location, and parties involved. Your insurer will then assign a claims adjuster who will be your primary contact throughout the process. The adjuster’s role is to investigate the accident, assess damages, and determine the appropriate compensation.

Dealing with Insurance Adjusters

Insurance adjusters play a vital role in evaluating your claim. They gather information, including police reports, witness statements, and photographic evidence of vehicle damage. Effective communication with your adjuster is key. Be prepared to provide all necessary documentation promptly and answer their questions thoroughly and honestly. Maintain detailed records of all communications, including dates, times, and the content of conversations. This documentation can prove invaluable should any disputes arise. Remember, adjusters work for the insurance company, so presenting your case clearly and factually is important.

Claim Denial and Appeals

Claims can be denied for various reasons, such as insufficient evidence, failure to meet policy requirements, or if the accident was determined to be the policyholder’s fault and they do not have adequate coverage. For example, a claim might be denied if the policyholder failed to report the accident within the stipulated timeframe Artikeld in their policy. Another example would be if the damages were deemed to be pre-existing and not directly related to the accident. If your claim is denied, your policy will likely Artikel the appeals process. This usually involves submitting a written appeal with additional supporting documentation to challenge the denial. You may also want to consult with an attorney to review the decision and advise on your next steps.

Necessary Documentation for Filing a Claim

Gathering the correct documentation is essential for a smooth claims process. This typically includes a completed accident report form provided by your insurer, a copy of your driver’s license and insurance policy, photographs of the damage to all vehicles involved, and a police report if one was filed. If there were any witnesses, obtain their contact information as well. Detailed records of medical treatment, including bills and doctor’s notes, are necessary if injuries are involved. The more comprehensive the documentation, the stronger your claim will be.

Understanding Uninsured/Underinsured Motorist Coverage in Illinois

Uninsured/Underinsured Motorist (UM/UIM) coverage is a crucial component of auto insurance in Illinois, offering vital protection in the event of an accident caused by a driver without adequate insurance or by a hit-and-run driver. While Illinois requires minimum liability coverage, it’s often insufficient to cover the full extent of injuries and damages in a serious accident. UM/UIM coverage bridges this gap, ensuring you and your passengers have the necessary financial protection.

UM/UIM coverage compensates you for your medical bills, lost wages, pain and suffering, and property damage if you’re injured by an uninsured or underinsured driver. It also protects you if you’re a passenger in a vehicle involved in an accident with an uninsured or underinsured driver. This coverage is separate from your collision and liability coverage, which addresses accidents involving your own vehicle or your responsibility for damages to others.

Scenarios Requiring Uninsured/Underinsured Motorist Coverage

Several situations highlight the critical importance of UM/UIM coverage. For instance, if you’re involved in an accident with a driver who is uninsured, your liability coverage will not compensate you for your injuries or vehicle damage. Similarly, if the other driver’s liability limits are lower than your actual damages, UM/UIM coverage compensates for the difference. Hit-and-run accidents, where the at-fault driver cannot be identified or located, are another critical scenario. Even with comprehensive coverage, you would need UM/UIM coverage to receive compensation for your damages in these instances. Finally, accidents involving drivers with inadequate insurance coverage, even if they carry insurance, could lead to a shortfall in compensation for significant injuries or property damage.

Filing a Claim Under Uninsured/Underinsured Motorist Coverage

Filing a UM/UIM claim involves reporting the accident to your insurance company promptly, usually within a specified timeframe. You’ll need to provide details of the accident, including the date, time, location, and any witness information. You’ll also need to provide documentation such as police reports, medical records, and repair estimates. Your insurance company will then investigate the accident and assess the damages. The claims process might involve negotiations with the other driver’s insurance company if applicable, or it may require litigation if a settlement cannot be reached. Be prepared to thoroughly document all expenses related to the accident, including medical bills, lost wages, and property damage.

Examples of Situations Necessitating Uninsured/Underinsured Motorist Coverage

Consider these examples: A driver with only the state-mandated minimum liability insurance causes a serious accident resulting in significant medical bills exceeding the other driver’s coverage. Or, a hit-and-run driver flees the scene after causing an accident, leaving the injured party with substantial medical expenses and vehicle damage. These situations underscore the value of UM/UIM coverage, which protects you from financial ruin in such circumstances. Another example might be a multi-vehicle accident where one driver is uninsured, and another driver’s liability coverage is insufficient to cover the combined damages. In such cases, UM/UIM coverage would act as a safety net.

Epilogue

Securing the best auto insurance in Illinois involves understanding your needs, researching available options, and actively seeking ways to minimize costs. By carefully considering factors like coverage types, discounts, and provider reputation, you can confidently choose a policy that provides adequate protection without breaking the bank. Remember to compare quotes from multiple insurers and don’t hesitate to ask questions to ensure you fully understand your policy’s terms and conditions. Driving safely and maintaining a clean driving record are also crucial steps in managing your insurance costs effectively.

FAQ Section

What happens if I get into an accident without insurance in Illinois?

Driving without insurance in Illinois results in significant penalties, including fines, license suspension, and potential legal repercussions. Your ability to file a claim against the at-fault driver may also be affected.

How often can I change my auto insurance provider?

You can typically switch auto insurance providers at any time, though there might be a short waiting period before your new policy takes effect. Be sure to provide your new insurer with adequate notice to avoid any coverage gaps.

Can I bundle my auto and home insurance for a discount?

Yes, many insurance companies offer discounts for bundling auto and homeowners or renters insurance. This is a common way to save money on your premiums.

What is SR-22 insurance?

SR-22 insurance is proof of financial responsibility required by the state in certain situations, such as after a DUI or serious accident. It certifies you carry the minimum required insurance coverage.