Navigating the world of Arizona car insurance can feel overwhelming, with a maze of coverage options, varying costs, and numerous providers. Understanding your state’s requirements, comparing different insurers, and identifying ways to save money are crucial steps in securing affordable and adequate car insurance. This guide provides a comprehensive overview, equipping you with the knowledge to make informed decisions about your AZ car insurance.

From deciphering mandatory coverage levels and penalties for driving uninsured to understanding the factors that influence your premiums (age, driving history, vehicle type, location, and credit score), we’ll break down the complexities. We’ll also compare major insurance providers, outlining their strengths and weaknesses to help you find the best fit for your needs and budget. Finally, we’ll offer practical strategies for lowering your costs, including tips for securing discounts and maintaining a clean driving record.

Understanding Arizona Car Insurance Requirements

Securing the right car insurance is crucial for all Arizona drivers. Failure to comply with the state’s minimum insurance requirements can lead to significant penalties. This section details Arizona’s mandatory insurance coverage, penalties for non-compliance, and a comparison of different coverage types available.

Arizona’s Mandatory Minimum Insurance Coverage

Arizona requires all drivers to carry a minimum level of liability insurance. This protects others in case you cause an accident. The minimum requirement is 15/30/10, which means $15,000 in bodily injury liability coverage per person, $30,000 in total bodily injury liability coverage per accident, and $10,000 in property damage liability coverage. It’s important to note that this minimum coverage may not be sufficient to cover the costs associated with a serious accident. Many drivers opt for higher liability limits to protect their assets.

Penalties for Driving Without Insurance in Arizona

Driving without insurance in Arizona is a serious offense. Penalties can include significant fines, license suspension, and even vehicle impoundment. The specific penalties vary depending on the circumstances and the number of offenses. For example, a first-time offense might result in a fine of several hundred dollars and a short suspension, while repeat offenses can lead to much steeper fines and longer suspensions. Additionally, if you’re involved in an accident without insurance, you could face civil lawsuits and be held personally liable for damages.

Comparison of Car Insurance Coverage Types in Arizona

Several types of car insurance coverage are available in Arizona, offering varying levels of protection. Understanding these options is essential to choosing the right policy for your needs and budget. Liability insurance covers damages to others, while collision and comprehensive coverages protect your vehicle.

| Coverage Type | What it Covers | Is it Mandatory? | Example |

|---|---|---|---|

| Liability | Damages to others’ property and injuries sustained by others in an accident you caused. | Yes (minimum limits required) | Covers medical bills and vehicle repair costs for the other driver if you cause an accident. |

| Collision | Damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. | No | Covers repairs to your car if you hit a tree, even if you are at fault. |

| Comprehensive | Damage to your vehicle caused by non-collision events, such as theft, vandalism, fire, or hail. | No | Covers damage to your car if it’s stolen or damaged by a hailstorm. |

Factors Affecting Car Insurance Quotes in Arizona

Securing affordable car insurance in Arizona involves understanding the various factors that influence your premium. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions to potentially lower your rates. This section details the most significant factors affecting your Arizona car insurance quote.

Several key factors significantly impact your car insurance premiums in Arizona. These factors are interconnected and often work in combination to determine your final rate. Understanding their influence is crucial for obtaining the best possible coverage at a competitive price.

Age and Driving Experience

Your age and driving history are primary determinants of your insurance premium. Younger drivers, particularly those with less than three years of driving experience, are statistically more likely to be involved in accidents. Insurance companies reflect this increased risk by charging higher premiums. Conversely, drivers with a long, clean driving record generally qualify for lower rates, demonstrating a lower risk profile to the insurance provider. For example, a 20-year-old with a clean record might pay significantly more than a 50-year-old with 30 years of accident-free driving. The accumulation of years of safe driving demonstrably reduces insurance costs.

Driving History

Your driving record is meticulously reviewed by insurance companies. Accidents, speeding tickets, and DUI convictions significantly increase your premiums. The severity of the infraction directly correlates with the premium increase. A single at-fault accident could lead to a substantial rate hike, while multiple violations can result in even higher costs or difficulty obtaining coverage altogether. Maintaining a clean driving record is the most effective way to keep your insurance costs low.

Type of Vehicle

The type of vehicle you drive plays a significant role in determining your insurance premium. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles typically result in lower insurance premiums. The vehicle’s safety features, such as anti-lock brakes and airbags, also influence the rate; vehicles with advanced safety features may receive discounts.

Location

Your address significantly influences your car insurance rate. Insurance companies consider the crime rate, accident frequency, and the overall risk associated with your area. Living in a high-risk area with a high incidence of car theft or accidents will typically result in higher premiums compared to residing in a safer, lower-risk neighborhood.

Credit Score

In Arizona, as in many other states, your credit score can influence your car insurance rates. Insurance companies use credit-based insurance scores to assess risk. A higher credit score generally correlates with lower insurance premiums, while a lower score often leads to higher premiums. This is because individuals with good credit history are statistically less likely to file fraudulent claims. It’s important to note that this is a controversial practice, and the impact of credit scores on insurance varies by company and state regulations.

Driving Habits

Your driving habits, even if not resulting in tickets, can influence your premiums. Many insurance companies offer usage-based insurance (UBI) programs that track your driving behavior through telematics devices or smartphone apps. These programs monitor factors like speeding, hard braking, and nighttime driving. Safer driving habits, as measured by these programs, can lead to discounts, while risky driving behaviors may result in higher premiums. For example, consistently driving under the speed limit and avoiding aggressive driving maneuvers can result in significant savings.

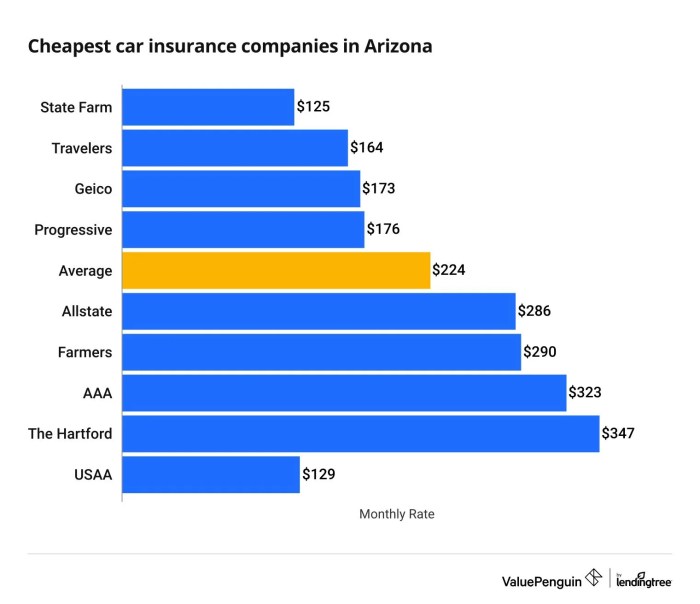

Comparing Car Insurance Providers in Arizona

Choosing the right car insurance provider in Arizona can significantly impact your budget and peace of mind. This section compares three major companies, highlighting their strengths and weaknesses to aid your decision-making process. Remember that rates vary based on individual factors, so it’s crucial to obtain personalized quotes.

Arizona Car Insurance Company Comparison

Several factors influence the choice of an auto insurance provider. These include price, coverage options, customer service reputation, and claims handling efficiency. Below, we analyze three prominent companies operating within Arizona.

| Company | Average Price (Estimated) | Customer Service Rating (J.D. Power, Example) | Claims Handling Process |

|---|---|---|---|

| Geico | $1200 – $1800 (Annual, varies greatly based on driver profile) | Above Average (Illustrative; check J.D. Power for current ratings) | Generally known for a streamlined online claims process and relatively quick payouts. However, individual experiences can vary. |

| State Farm | $1100 – $1700 (Annual, varies greatly based on driver profile) | Above Average (Illustrative; check J.D. Power for current ratings) | Offers a mix of online and in-person claims handling options, with a reputation for a strong agent network providing personalized support. Claim processing times can be influenced by the complexity of the claim. |

| Progressive | $1000 – $1600 (Annual, varies greatly based on driver profile) | Average (Illustrative; check J.D. Power for current ratings) | Known for its Name Your Price® tool, allowing customers to customize their coverage and premiums. Claims handling is generally efficient, often utilizing online portals and apps. |

Disclaimer: The price ranges provided are estimates and should not be considered definitive quotes. Actual premiums will vary based on several factors including driving history, age, location, vehicle type, and coverage selected. Customer service ratings are illustrative and may change; refer to independent rating agencies for the most up-to-date information. Claims handling processes can also vary depending on the specifics of each claim.

Obtaining and Understanding Car Insurance Quotes

Securing the best car insurance in Arizona involves understanding the process of obtaining and comparing quotes. This section will guide you through the steps, highlighting key information and common practices. Knowing how to navigate the quoting process will empower you to make informed decisions and find the most suitable coverage at the best price.

Obtaining Car Insurance Quotes Online and Offline

Arizona car insurance quotes can be obtained conveniently through online platforms or by contacting insurance providers directly. Online quote acquisition usually involves visiting an insurer’s website, filling out a brief form with pertinent information, and receiving an instant quote. Offline methods include contacting insurance agents via phone or visiting their offices in person. This allows for a more personalized interaction and the opportunity to ask detailed questions. Both methods ultimately serve the same purpose: to provide you with a potential cost estimate for your car insurance.

Information Requested When Applying for a Quote

Insurance providers require specific information to accurately assess your risk and generate a quote. This typically includes your driver’s license information, vehicle details (make, model, year), address, driving history (including accidents and violations), and the desired coverage levels. Some companies may also request information about your credit history, as this can be a factor in determining your premium. Providing accurate and complete information is crucial for receiving an accurate quote and avoiding potential complications later.

Common Discounts Offered by Arizona Car Insurance Providers

Many Arizona car insurance providers offer a range of discounts to incentivize safe driving practices and customer loyalty. These can significantly reduce your overall premium. Common discounts include good driver discounts (for drivers with clean driving records), multi-car discounts (for insuring multiple vehicles with the same provider), and safe driver discounts (often obtained through telematics programs that monitor driving habits). Other potential discounts include bundling home and auto insurance, completing defensive driving courses, and being a member of certain organizations. Always inquire about available discounts when obtaining quotes.

Interpreting and Comparing Different Insurance Quotes

Once you have several quotes, carefully compare the coverage offered, deductibles, and premiums. Focus not just on the price but also on the specific benefits and limitations of each policy. A lower premium may not always equate to better value if the coverage is inadequate. Consider factors such as liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and roadside assistance. A clear comparison chart can help organize this information and make informed decision-making easier. For example, comparing a policy with a $500 deductible and a $1000 premium against a policy with a $1000 deductible and a $800 premium requires careful consideration of your risk tolerance and financial capacity.

Saving Money on Arizona Car Insurance

Securing affordable car insurance in Arizona is achievable through proactive strategies and informed decision-making. By understanding the factors influencing your premiums and implementing cost-saving measures, you can significantly reduce your annual expenses without compromising necessary coverage. This section Artikels several effective methods to lower your car insurance costs.

Maintaining a Clean Driving Record

A clean driving record is arguably the most significant factor in determining your car insurance premiums. Insurance companies view drivers with a history of accidents, speeding tickets, or DUI convictions as higher risk. Consequently, they charge higher premiums to offset the increased likelihood of claims. Conversely, maintaining a spotless driving record demonstrates responsible driving behavior, leading to lower premiums and potentially significant savings over time. For example, a driver with multiple accidents might pay hundreds, even thousands, more annually compared to a driver with a perfect record. Consistent safe driving is the best investment in reducing your insurance costs.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple insurance policies, such as auto and homeowners or renters insurance. This practice often leads to substantial savings because the insurer consolidates your risk profile, streamlining administrative costs and fostering loyalty. For instance, bundling your car insurance with your homeowners insurance could result in a 10-20% discount, depending on the insurer and your specific policies. It’s always worthwhile to inquire about bundling options when obtaining quotes from different providers.

Tips for Finding Affordable Car Insurance in Arizona

Choosing the right car insurance can feel overwhelming, but these tips can simplify the process and help you secure the best possible rate:

- Shop Around: Obtain quotes from multiple insurance companies to compare prices and coverage options. Don’t settle for the first quote you receive.

- Consider Your Coverage Needs: Evaluate your specific needs and choose a coverage level that adequately protects you while minimizing unnecessary expenses. Higher coverage levels generally mean higher premiums.

- Increase Your Deductible: A higher deductible (the amount you pay out-of-pocket before your insurance kicks in) will typically result in lower premiums. Carefully weigh the financial implications before increasing your deductible.

- Maintain a Good Credit Score: In many states, including Arizona, your credit score is a factor in determining your insurance premiums. A higher credit score generally translates to lower premiums.

- Take Advantage of Discounts: Many insurance companies offer discounts for various factors, such as safe driving courses, anti-theft devices, and good student status. Inquire about all available discounts.

- Pay Annually: Paying your premium annually instead of monthly can often lead to a slight discount.

- Review Your Policy Regularly: Your insurance needs may change over time. Review your policy periodically to ensure it still meets your requirements and that you’re not overpaying.

Addressing Specific Scenarios

Understanding the nuances of Arizona car insurance becomes clearer when examining specific situations. This section will address the insurance implications of various driving scenarios, offering insight into coverage options and potential costs.

High-Performance Vehicle Insurance

Insuring a high-performance vehicle in Arizona typically results in higher premiums than insuring a standard car. This is due to several factors, including the increased risk of accidents, higher repair costs, and the potential for greater liability in the event of an accident. Factors such as the vehicle’s make, model, engine size, and performance capabilities all contribute to the premium calculation. Companies often categorize these vehicles as “high-risk,” leading to more stringent underwriting processes and higher premiums. Drivers should expect to pay significantly more for comprehensive and collision coverage, reflecting the higher potential for damage or loss. Additionally, some insurers may require additional safety features or driver training programs as a condition for coverage.

Multiple Vehicle Coverage

Many Arizonans own multiple vehicles. Insuring multiple vehicles with the same insurer can often lead to discounts. Bundling policies, including home or renters insurance, can further reduce costs. However, the total premium will still depend on the individual characteristics of each vehicle (age, make, model, etc.) and the driving history of each driver associated with those vehicles. It is advisable to compare quotes from multiple insurers to find the most cost-effective option for insuring multiple vehicles. Insurers may offer various discounts for insuring multiple cars under one policy, making it beneficial to explore this option thoroughly.

Insurance Requirements for Young Drivers

Young drivers in Arizona face higher insurance premiums due to their statistically higher accident rates. Insurers assess risk based on age and driving experience. Minimum liability coverage requirements remain the same, but obtaining comprehensive and collision coverage is highly recommended to protect against potential financial losses. Some insurers may offer discounts for young drivers who maintain good grades in school or complete defensive driving courses. Parents may be able to add their children to their existing policies, sometimes benefiting from family discounts, but this should be compared to independent policies to ensure the best value. It’s important for young drivers to maintain a clean driving record to reduce their insurance premiums over time.

Minor Accident Claims Process

Let’s consider a scenario: Sarah, a 25-year-old driver, is stopped at a red light when another car, driven by Mark, rear-ends her. The damage to Sarah’s car is minor—a small dent in the bumper. Mark admits fault and exchanges insurance information with Sarah. Sarah contacts her insurer to report the accident, providing all relevant details, including the date, time, location, and the other driver’s information. Her insurer initiates an investigation, possibly contacting Mark’s insurer and reviewing police reports if filed. If the damage is minor and within the deductible, Sarah may choose to forego filing a claim, as this could affect her premiums. If she decides to file a claim, her insurer will assess the damage, potentially arranging for repairs through a preferred body shop. The insurer will then negotiate with Mark’s insurer to settle the claim. The process can take several weeks, depending on the efficiency of the involved parties. If the damages exceed the deductible, Sarah would be responsible for the deductible amount, and her insurer would cover the remaining costs of repair.

Outcome Summary

Securing the right Arizona car insurance involves careful consideration of your individual needs and a thorough understanding of the market. By comparing quotes, understanding the factors influencing premiums, and implementing cost-saving strategies, you can find affordable coverage that provides adequate protection. Remember to regularly review your policy and adjust it as your circumstances change to ensure you maintain optimal coverage and cost-effectiveness.

Questions and Answers

What happens if I’m in an accident without insurance in Arizona?

Driving without insurance in Arizona results in significant penalties, including license suspension, fines, and potential legal liabilities if you cause an accident.

Can I get car insurance if I have a bad driving record?

Yes, but it will likely be more expensive. Insurers consider your driving history, so a clean record is crucial for lower premiums. You may need to explore high-risk insurance providers.

How often should I review my car insurance policy?

It’s advisable to review your policy at least annually, or whenever significant life changes occur (e.g., new car, change in address, marriage).

What types of discounts are commonly available?

Common discounts include those for good students, safe drivers, multiple-vehicle policies (bundling), and anti-theft devices.