Understanding your average monthly car insurance cost is crucial for responsible budgeting. Numerous factors influence this figure, from your driving history and the type of vehicle you own to your location and the level of coverage you choose. This guide delves into the complexities of car insurance pricing, providing insights into how these factors interact to determine your monthly premiums. We’ll explore various coverage options, strategies for lowering your costs, and answer common questions to help you navigate the world of auto insurance with confidence.

Navigating the car insurance landscape can feel overwhelming, with a multitude of factors influencing the final price. This guide aims to demystify the process by breaking down the key elements that contribute to your monthly premiums. From understanding the different types of coverage to learning strategies for securing lower rates, we provide a comprehensive overview to empower you with the knowledge to make informed decisions about your auto insurance.

Factors Influencing Average Monthly Car Insurance Costs

Several interconnected factors determine the average monthly cost of car insurance. Understanding these factors can help individuals make informed decisions about their coverage and potentially reduce their premiums. These factors are often assessed by insurance companies when calculating your individual risk profile.

Age and Driving Experience

Age is a significant factor in determining insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums. This is due to a combination of factors including less driving experience, higher risk-taking behaviors, and a higher propensity for speeding and other traffic violations. As drivers gain experience and reach their mid-twenties and beyond, their premiums generally decrease. This reflects a reduced risk profile based on improved driving skills and a better accident history.

Driving History

A clean driving record is crucial for obtaining lower insurance rates. Accidents, traffic violations (such as speeding tickets or DUIs), and at-fault accidents significantly impact premiums. Multiple incidents within a short period can lead to substantial increases, and some insurers may even refuse coverage. Conversely, drivers with a spotless record for several years often qualify for discounts and lower premiums. Maintaining a good driving history is therefore a key factor in managing insurance costs.

Vehicle Type

The type of vehicle you drive directly affects your insurance premiums. Sports cars, luxury vehicles, and high-performance cars generally have higher insurance costs due to their higher repair and replacement values, as well as the increased risk of theft. Conversely, smaller, less expensive vehicles typically result in lower premiums. Features like safety technology (anti-lock brakes, airbags, etc.) can also influence premiums, often leading to discounts for vehicles equipped with advanced safety features.

Location

Geographic location plays a crucial role in determining insurance costs. Areas with higher rates of accidents, theft, and vandalism generally have higher insurance premiums. Urban areas tend to have higher rates than rural areas due to increased traffic congestion and higher likelihood of accidents. Insurance companies use sophisticated actuarial models to assess risk based on location-specific data, influencing premiums accordingly.

Coverage Level

The level of coverage you choose significantly impacts your monthly premium. Liability coverage, which protects others in case you cause an accident, is typically the most affordable. Adding collision coverage (covering damage to your vehicle in an accident, regardless of fault) and comprehensive coverage (covering damage from events other than collisions, such as theft or vandalism) increases premiums. Higher coverage limits also lead to higher premiums, offering greater financial protection but at a higher cost.

| Age | Driving History | Vehicle Type | Average Monthly Cost (USD) |

|---|---|---|---|

| 20 | One at-fault accident, speeding ticket | Sports Car | $250 |

| 35 | Clean record for 5 years | Sedan | $100 |

| 50 | Clean record for 20 years | SUV | $80 |

| 23 | Two accidents, multiple speeding tickets | Pickup Truck | $300 |

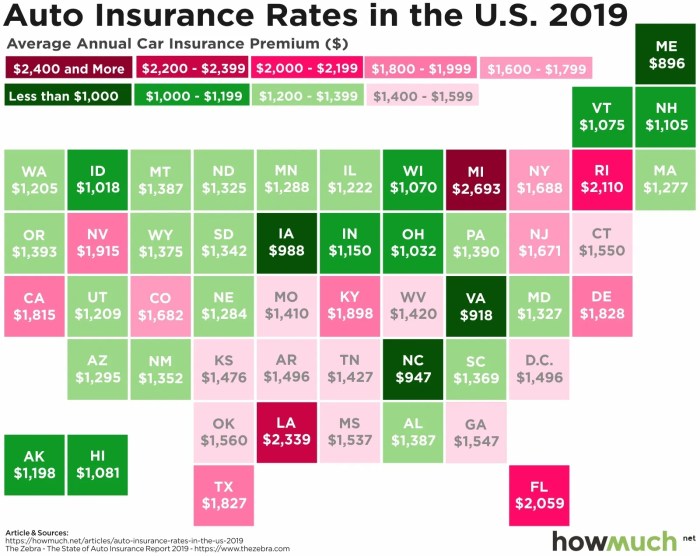

Geographic Variations in Car Insurance Costs

Geographic location significantly impacts the cost of car insurance. Several interconnected factors contribute to these variations, resulting in substantial differences in average monthly premiums across the country. Understanding these factors is crucial for consumers to make informed decisions about their insurance coverage.

Several key elements influence the cost of car insurance in different regions. Population density plays a role, as densely populated areas tend to have higher accident rates due to increased traffic congestion and driver interaction. Areas with higher accident rates naturally lead to increased insurance claims, driving up premiums for everyone in that region. Similarly, the cost of living, including the cost of vehicle repairs and medical care, directly affects insurance payouts and, consequently, premiums. States with higher costs of living often see higher insurance premiums to offset these expenses.

Factors Contributing to Regional Premium Differences

Higher population density in urban areas like New York City or Los Angeles correlates with a higher frequency of accidents and subsequently, higher insurance premiums. Conversely, rural areas with lower population density and less traffic often have lower accident rates, leading to lower premiums. The cost of auto repairs also varies geographically; states with higher labor costs and more expensive parts will typically reflect this in their insurance rates. Similarly, states with higher healthcare costs will see higher insurance premiums to account for increased medical expenses related to accidents.

Examples of Regional Premium Variations

For example, states like Michigan and Florida consistently rank among those with the highest average car insurance premiums. Michigan’s high premiums are often attributed to a combination of high medical costs, a high number of uninsured drivers, and a litigious environment leading to higher claim payouts. Florida, on the other hand, experiences a high volume of accidents due to its large population and significant number of tourists, contributing to higher premiums. In contrast, states like Maine and Idaho often have lower average premiums, partly due to their lower population densities, lower accident rates, and lower costs of living.

Illustrative Map of Regional Premiums

Imagine a map of the United States. The East Coast, particularly major metropolitan areas, is depicted in darker shades of red, indicating higher average monthly premiums. This gradually lightens to orange and yellow as you move towards the Midwest and the central plains. The western states, excluding major coastal cities, are represented in lighter yellows and greens, signifying lower average premiums. The deepest red areas would represent states like Michigan and Florida, while the palest green areas represent states like Maine and Idaho. This gradient visually represents the substantial variations in car insurance costs across the country.

Types of Car Insurance and Their Average Costs

Understanding the different types of car insurance coverage is crucial for making informed decisions about your financial protection. Choosing the right coverage depends on your individual needs, risk tolerance, and budget. While average costs vary significantly based on factors like location, driving history, and the vehicle itself, this section provides a general overview of common coverage types and their approximate monthly expenses. Remember to obtain personalized quotes from multiple insurers for accurate pricing.

Several types of car insurance coverage are available, each offering a different level of protection. These policies can be purchased individually or bundled together for comprehensive coverage. The average monthly cost for each type of coverage is presented below as a range, as precise figures depend on numerous individual factors.

Liability Coverage

Liability insurance covers damages or injuries you cause to others in an accident. It’s typically required by law and usually includes bodily injury and property damage liability. Bodily injury liability covers medical expenses and other losses for injured individuals, while property damage liability covers repairs or replacement costs for damaged vehicles or property. Failing to carry adequate liability insurance can result in severe financial consequences.

- Coverage: Bodily injury and property damage to others.

- Average Monthly Cost: $300 – $800 (This range reflects significant variations based on factors like state, driving record, and coverage limits. A driver with a clean record in a low-risk area might pay closer to the lower end, while someone with multiple accidents or traffic violations in a high-risk area could pay closer to the higher end.)

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This means even if you cause the accident, your insurance will help cover the costs. This is optional coverage, but it provides significant financial protection against potentially expensive repairs.

- Coverage: Repairs or replacement of your vehicle after a collision, regardless of fault.

- Average Monthly Cost: $150 – $400 (Again, this is a broad range. The cost will be influenced by the vehicle’s make, model, year, and value, as well as the deductible chosen. A newer, more expensive vehicle will generally have a higher collision insurance premium.)

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. While not legally required, it offers peace of mind and financial security against unforeseen events that could cause significant damage to your vehicle.

- Coverage: Damage to your vehicle from non-collision events (theft, vandalism, weather, etc.).

- Average Monthly Cost: $100 – $300 (This cost is highly dependent on the value of the vehicle and the risk factors associated with its location and the driver’s profile. A vehicle kept in a high-crime area might cost more to insure comprehensively.)

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. This coverage can pay for your medical bills, lost wages, and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance. It is vital in situations where the other driver’s insurance is insufficient to cover your damages.

- Coverage: Medical bills, lost wages, and vehicle repairs if involved in an accident with an uninsured or underinsured driver.

- Average Monthly Cost: $50 – $150 (This cost is often less than other coverages, but its value is immense in protecting you from significant financial loss in a worst-case scenario.)

Strategies for Lowering Car Insurance Premiums

Lowering your car insurance premiums can significantly impact your monthly budget. Several strategies can help you achieve this, focusing on responsible driving, smart policy choices, and leveraging available discounts. By implementing these techniques, you can potentially save a considerable amount over time.

Safe Driving Practices

Maintaining a clean driving record is paramount in securing lower insurance rates. Insurance companies heavily weigh your driving history when calculating premiums. Accidents and traffic violations lead to increased premiums, often for several years. Conversely, a spotless record demonstrates responsible driving, making you a lower-risk driver and resulting in lower costs. Defensive driving courses can also help, as many insurers offer discounts for completing them. These courses emphasize safe driving techniques and accident avoidance, leading to better driving habits and potentially lower premiums.

Bundling Policies

Many insurance companies offer discounts for bundling multiple policies, such as combining your car insurance with homeowners or renters insurance. This bundling strategy demonstrates loyalty and reduces administrative costs for the insurer, which they often pass on to the customer as a discount. The exact discount percentage varies by company and policy, but it can be substantial. It’s worthwhile to inquire about bundled policy discounts from your current insurer and compare them to offers from other companies.

Exploring Discounts

Insurance companies provide a range of discounts to incentivize safe driving and responsible behavior. These discounts often include those for good students, anti-theft devices, and safe driving technology like anti-lock brakes and electronic stability control. Furthermore, some insurers offer discounts for drivers who maintain a certain credit score, reflecting their financial responsibility. It’s crucial to thoroughly review the discounts offered by your insurer and explore those available from competitors.

Impact of Increased Deductibles

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, directly affects your monthly premium. A higher deductible typically translates to a lower monthly payment, as you are assuming more of the financial risk. However, it’s crucial to carefully consider your financial situation before opting for a significantly higher deductible. You should have sufficient savings to cover the deductible in case of an accident.

| Deductible Amount | Monthly Premium (Example) |

|---|---|

| $250 | $150 |

| $500 | $130 |

| $1000 | $110 |

*Note: These are example figures and actual costs will vary depending on the insurer, location, coverage, and other factors.*

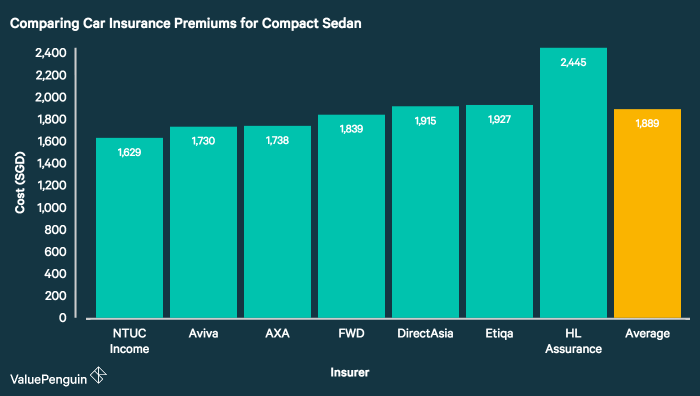

Comparing Insurance Quotes

Obtaining quotes from multiple insurance providers is essential for securing the best rates. Use online comparison tools or contact insurers directly to obtain personalized quotes. Be sure to provide accurate information to each insurer to ensure you receive accurate and comparable quotes. Remember to compare not just the monthly premium but also the coverage details and deductibles to find the policy that best suits your needs and budget. By comparing multiple quotes, you can identify the insurer that offers the most comprehensive coverage at the most competitive price.

The Role of Driving History in Determining Premiums

Your driving history is a significant factor in determining your car insurance premiums. Insurance companies use this information to assess your risk of being involved in an accident or making a claim. A clean driving record translates to lower premiums, while a history of accidents, tickets, or claims will likely result in higher costs. The more incidents you have, the higher the perceived risk, and therefore, the higher your premium.

Your driving history encompasses more than just the number of incidents; the severity of those incidents also plays a crucial role. A minor fender bender will have a less significant impact than a serious accident involving injuries or substantial property damage. Similarly, the type of violation also matters; a speeding ticket is generally less impactful than a DUI conviction.

Impact of Accidents, Tickets, and Claims on Premiums

The impact of accidents, tickets, and claims on your insurance premiums can be substantial. Each incident adds to your risk profile, leading to higher premiums. For example, a single at-fault accident could increase your premiums by 20-40% or more, depending on the severity of the accident and your insurance company’s rating system. Multiple incidents will result in even higher increases. Similarly, traffic violations, especially serious ones like DUI or reckless driving, can significantly elevate your premiums for several years. Insurance companies view these as indicators of risky driving behavior, and they adjust your premiums accordingly to reflect that increased risk.

Comparison: Clean Driving Record vs. Multiple Incidents

The difference in premiums between a clean driving record and one with multiple incidents can be dramatic.

- Clean Driving Record: Individuals with a clean driving record typically enjoy the lowest premiums. They are considered low-risk drivers, and insurance companies reward them with lower rates. This allows them to benefit from discounts and potentially lower monthly payments.

- Multiple Incidents: Conversely, drivers with multiple accidents, tickets, or claims face significantly higher premiums. Each incident increases the perceived risk, resulting in a substantial increase in the cost of insurance. This increase can persist for several years, even after the incidents have occurred, as insurance companies continue to assess risk based on past driving behavior. In some cases, drivers with poor driving records may even find it difficult to obtain insurance coverage at all, or may only qualify for high-risk insurance policies with significantly higher premiums.

Long-Term Consequences of Driving Violations

The consequences of driving violations on insurance premiums can extend far beyond the immediate aftermath of the incident. Many insurance companies maintain records of driving violations for several years, sometimes even longer. This means that even if you have a clean driving record for several years following a violation, the incident could still impact your premiums. For instance, a DUI conviction can lead to significantly higher premiums for five to ten years, or even longer, depending on your insurance provider and state regulations. The longer your record shows negative incidents, the longer the impact on your insurance costs. This underscores the importance of safe driving practices to maintain a clean record and keep insurance premiums affordable over the long term.

Closing Summary

Ultimately, understanding your average monthly car insurance cost involves a careful consideration of several interconnected factors. By understanding your individual risk profile, comparing quotes from multiple providers, and implementing cost-saving strategies, you can secure affordable and appropriate car insurance coverage. Remember, a proactive approach to managing your insurance can lead to significant savings over time, allowing you to budget effectively and drive with peace of mind.

Top FAQs

What is the average cost of car insurance for a teenager?

The average cost for a teenager is significantly higher than for adults due to higher risk. Expect premiums considerably above the national average.

How often can I expect my car insurance rates to change?

Rates can change annually, or even more frequently depending on your insurer and any changes in your driving record or risk profile.

Can I get car insurance without a driver’s license?

Generally, no. Most insurers require a valid driver’s license to issue a policy.

What happens if I don’t pay my car insurance?

Failure to pay can lead to policy cancellation and potential legal consequences, including fines and difficulty obtaining future insurance.