Securing your family’s financial future through life insurance is a crucial step, but understanding the associated costs can be daunting. The average price of life insurance per month varies significantly depending on several key factors. This exploration delves into the intricacies of premium calculations, helping you navigate the complexities and make informed decisions about your coverage.

From age and health status to policy type and coverage amount, numerous variables influence your monthly premiums. We’ll examine how term versus whole life insurance impacts costs, explore the relationship between coverage level and premium payments, and compare pricing across different insurance providers. Understanding these factors empowers you to choose a policy that aligns with your budget and financial goals.

Factors Influencing Monthly Life Insurance Premiums

Several key factors determine the monthly cost of life insurance. Understanding these factors allows individuals to make informed decisions when choosing a policy that best suits their needs and budget. These factors interact in complex ways, so it’s advisable to obtain personalized quotes from multiple insurers.

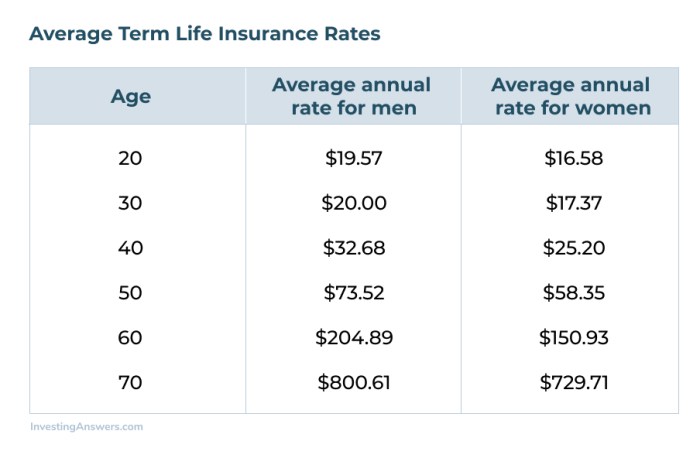

Age’s Impact on Life Insurance Costs

Age is a significant factor influencing life insurance premiums. Statistically, older individuals have a higher risk of mortality compared to younger individuals. Insurance companies reflect this increased risk by charging higher premiums to older applicants. A 30-year-old will generally pay significantly less than a 50-year-old for the same coverage amount, all other factors being equal. This is because the insurer anticipates paying out a claim sooner for the older individual.

Health Status and Premium Pricing

An applicant’s health status plays a crucial role in determining premium costs. Individuals with pre-existing health conditions, such as heart disease, diabetes, or cancer, typically face higher premiums than those in excellent health. Insurers assess the risk associated with each applicant’s medical history and current health to determine the likelihood of a claim. A thorough medical examination and review of medical records are usually part of the underwriting process.

Term Life Insurance vs. Whole Life Insurance Costs

Term life insurance and whole life insurance differ significantly in cost and coverage. Term life insurance provides coverage for a specific period (term), typically 10, 20, or 30 years. It’s generally less expensive than whole life insurance, which offers lifelong coverage. The lower cost of term life insurance reflects its limited coverage period. Whole life insurance, on the other hand, builds cash value over time, which increases the overall cost.

Lifestyle Choices and Premium Influence

Lifestyle choices, such as smoking and exercise habits, significantly impact life insurance premiums. Smokers are considered higher risk due to increased susceptibility to various health problems. Consequently, they usually pay substantially more for life insurance than non-smokers. Conversely, individuals who maintain a healthy lifestyle through regular exercise and a balanced diet may qualify for lower premiums as they present a lower risk profile to the insurer. Some insurers even offer discounts for participation in wellness programs.

Average Monthly Life Insurance Premiums

The following table presents estimated average monthly premiums for various age groups and policy types. These are illustrative examples and actual premiums may vary depending on the insurer, coverage amount, and individual circumstances.

| Age Group | Term Life (10-year, $250,000) | Term Life (20-year, $250,000) | Whole Life ($250,000) |

|---|---|---|---|

| 30-35 | $20-$30 | $30-$45 | $75-$125 |

| 40-45 | $35-$50 | $50-$75 | $100-$175 |

| 50-55 | $60-$90 | $80-$120 | $150-$250 |

| 60-65 | $100-$150+ | $130-$200+ | $200-$350+ |

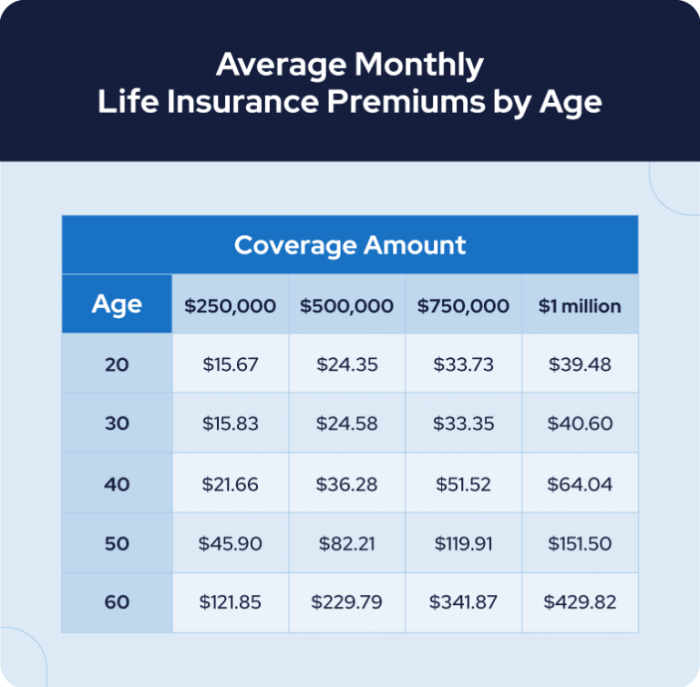

Coverage Amounts and Premium Costs

The cost of your life insurance policy is directly tied to the amount of coverage you choose and the length of the policy term. Higher coverage amounts naturally result in higher premiums, while shorter term lengths generally mean lower monthly payments. Understanding this relationship is crucial for selecting a policy that aligns with your financial needs and budget.

The amount of coverage you select significantly impacts your monthly premium. A larger death benefit means the insurance company assumes greater risk, leading to a higher premium. Conversely, a smaller death benefit translates to a lower premium. The length of the policy term also plays a vital role. Term life insurance, which covers a specific period, offers lower premiums than permanent life insurance, which provides lifelong coverage.

Relationship Between Coverage Amount and Monthly Premium

The relationship between coverage amount and monthly premium is generally linear; as the coverage amount increases, so does the premium. This is because a higher death benefit represents a greater financial obligation for the insurance company. Several factors beyond the coverage amount also influence the premium, including age, health, and lifestyle choices. However, the coverage amount remains the primary driver of premium costs.

Effect of Benefit Periods on Monthly Payments

Different benefit periods, or policy terms, affect monthly payments substantially. A 10-year term life insurance policy will have lower monthly premiums compared to a 20-year term policy with the same coverage amount. This is because the insurance company’s risk is spread over a shorter period for the shorter term policy. Permanent life insurance policies, offering lifelong coverage, will have the highest monthly premiums.

Examples of Premium Costs for Various Coverage Levels

The following are examples of average monthly premiums for various coverage levels. Remember that these are estimates and actual premiums will vary based on individual factors.

* $100,000 Coverage: Expect monthly premiums ranging from $10 to $30 for a 10-year term, and $20 to $60 for a 20-year term.

* $250,000 Coverage: Monthly premiums could range from $25 to $75 for a 10-year term, and $50 to $150 for a 20-year term.

* $500,000 Coverage: Expect monthly premiums ranging from $50 to $150 for a 10-year term, and $100 to $300 for a 20-year term.

Average Monthly Premium Costs

The following table illustrates average monthly costs for different coverage amounts and policy lengths. Note that these are sample figures and actual costs may vary significantly based on individual circumstances.

| Coverage Amount | 10-Year Term | 20-Year Term | Whole Life |

|---|---|---|---|

| $100,000 | $15 – $35 | $25 – $65 | $50 – $150 |

| $250,000 | $35 – $85 | $60 – $160 | $125 – $375 |

| $500,000 | $70 – $170 | $120 – $320 | $250 – $750 |

The Role of the Insurer and Policy Features

The cost of life insurance, expressed as a monthly premium, is significantly influenced by the insurer and the specific features included in the policy. Understanding these factors is crucial for consumers seeking the best value for their needs. Different insurers utilize varying actuarial models and risk assessments, leading to price discrepancies even for similar coverage amounts. Furthermore, policy add-ons and benefit structures significantly impact the final premium.

Choosing a life insurance policy involves navigating a complex landscape of insurers and policy options. The insurer’s financial stability, claims-paying history, and overall reputation are important considerations beyond the immediate cost. Policy features, meanwhile, can dramatically alter the premium’s monthly amount, sometimes justifying a higher cost for enhanced benefits or flexibility.

Premium Cost Comparisons Among Insurers

Life insurance premiums vary significantly among different companies. Several factors contribute to this variation, including the insurer’s operational costs, risk assessment methodologies, and investment strategies. For example, a company with a strong investment portfolio might offer lower premiums than one with higher operational expenses. Direct comparisons between insurers are often difficult due to the complexity of policy structures and the variety of riders available. However, using a standardized comparison tool or consulting with an independent insurance broker can help consumers identify competitive offerings.

Factors Influencing Premiums Beyond Coverage Amount

Beyond the basic coverage amount, several policy features significantly influence premium pricing. Riders, for example, are add-ons that enhance the policy’s benefits but increase the cost. Common riders include accidental death benefits, critical illness coverage, or long-term care benefits. The inclusion of these riders directly impacts the premium. Similarly, the type of policy itself – term life insurance versus whole life insurance – dramatically affects the premium cost. Term life insurance, offering coverage for a specific period, generally has lower premiums than whole life insurance, which provides lifelong coverage and often includes a cash value component. Furthermore, the insurer’s underwriting process, which assesses the applicant’s health and risk profile, plays a major role in determining the premium.

Impact of Policy Features on Monthly Premiums

Policy features like cash value options substantially influence monthly premiums. Whole life and universal life insurance policies typically offer cash value accumulation, allowing policyholders to build a savings component within their policy. This cash value component, however, increases the monthly premium compared to term life insurance policies that do not offer this feature. Other policy features, such as guaranteed insurability options (allowing the policyholder to increase coverage in the future without further medical underwriting) or waiver of premium riders (covering premiums in case of disability), also contribute to higher monthly premiums. The trade-off between premium cost and the added benefits offered by these features must be carefully evaluated.

Premium Comparison Table

The following table compares monthly premiums for a similar $500,000 term life insurance policy (10-year term, healthy 35-year-old male non-smoker) from three different insurers. Note that these are illustrative examples and actual premiums may vary based on individual circumstances and specific policy details.

| Insurer | Monthly Premium | Policy Features | Notes |

|---|---|---|---|

| Insurer A | $35 | Basic term life coverage | No riders included |

| Insurer B | $40 | Basic term life coverage + Accidental Death Benefit Rider | Additional rider included |

| Insurer C | $30 | Basic term life coverage | Potentially higher deductible or other cost-saving measures |

Understanding and Interpreting Average Premiums

Average monthly life insurance premiums can be misleading. While useful as a general benchmark, they fail to capture the significant variability in individual circumstances that dramatically affect the final cost. Relying solely on average figures can lead to inaccurate budgeting and unrealistic expectations regarding life insurance affordability.

Understanding that average premiums are just a starting point is crucial. Many factors, as discussed previously, contribute to the final price, rendering a simple average largely ineffective for personal financial planning.

Limitations of Average Premiums

Average premium data often masks the wide range of costs. For example, a reported average of $50 per month might encompass policies ranging from $20 to $150 monthly, depending on individual characteristics. This broad range makes the average a poor predictor of individual costs. The average doesn’t account for the unique health profile, age, lifestyle choices, coverage amount, policy type, and other factors of the insured. This means the average is essentially a meaningless number without considering the nuances of each individual’s situation.

The Importance of Personalized Quotes

Obtaining multiple personalized quotes from different insurers is essential. This allows for a direct comparison of costs based on your specific profile. Instead of relying on an average, a personalized quote reflects your individual risk assessment, providing a much more accurate representation of your monthly premium. Ignoring this crucial step can result in either overspending on unnecessary coverage or underinsuring due to the perceived affordability of an average figure.

Examples of Individual Circumstances Affecting Premiums

Consider two individuals, both 35 years old, seeking $500,000 in life insurance coverage. Individual A is a non-smoker with a healthy lifestyle and a family history free of major illnesses. Individual B is a smoker with a history of high blood pressure and a family history of heart disease. Individual A might receive a monthly premium significantly lower than the average, while Individual B’s premium could be substantially higher. Similarly, a 55-year-old applying for the same coverage will generally pay more than a 30-year-old, even if both are otherwise similar in health and lifestyle. The choice of policy type (term life, whole life, etc.) also plays a significant role.

Visual Representation of Premium Variability

The following text-based chart illustrates the variability in monthly premiums based on several key factors. Note that these are illustrative examples and actual premiums can vary widely depending on the specific insurer and policy details.

“`

Age Health Lifestyle Coverage Premium Range

——- ——- ——— ——— ————-

30 Excellent Healthy $250,000 $25 – $40

40 Good Moderate $500,000 $50 – $80

50 Fair Unhealthy $1,000,000 $100 – $200

35 Poor Unhealthy $500,000 $150 – $250

“`

Caption: This chart demonstrates the wide range of monthly life insurance premiums based on age, health status, lifestyle choices, and desired coverage amount. The premium range shown for each scenario highlights the significant variability and the limitations of relying on a single average premium figure.

Additional Costs and Fees Associated with Life Insurance

Beyond the monthly premium, several additional costs can significantly impact the overall price of life insurance. These fees, often overlooked, can add up over the policy’s lifespan, potentially altering the financial planning associated with securing life insurance. Understanding these additional charges is crucial for making informed decisions and budgeting accurately.

These additional costs vary depending on the type of policy, the insurer, and the individual’s circumstances. While some fees are upfront, others may arise during the policy’s duration. Failing to account for these extras can lead to unpleasant surprises and financial strain down the line.

Policy Fees

Policy fees are charges levied by the insurance company for administering and maintaining your life insurance policy. These can include application fees, which are typically paid upfront when applying for coverage. Some insurers also charge annual policy fees, a recurring charge for maintaining the policy each year. These fees can range significantly, from a nominal amount to a substantial sum, depending on the policy type and the insurer. For example, a term life insurance policy might have lower annual fees compared to a whole life or universal life policy due to the simpler structure and shorter term.

Medical Examinations and Tests

Many life insurance applications require a medical examination, including blood tests and other assessments, to determine the applicant’s health and risk profile. The cost of these medical examinations is usually borne by the applicant, and the price can vary based on the extent of the testing required. For instance, a high-risk applicant might require more extensive testing, leading to higher examination fees compared to a low-risk applicant. These costs are typically paid upfront before the policy is issued.

Rider Fees

Life insurance policies often offer riders, which are optional add-ons that provide additional coverage or benefits. These riders come with an additional cost, increasing the overall premium. For example, a long-term care rider provides coverage for nursing home care, but it will add to your monthly payment. Similarly, a disability rider, providing income protection in case of disability, will also add to the premium. The cost of these riders varies widely depending on the type of rider and the level of coverage.

Surrender Charges

If you choose to cancel your policy before its maturity date (cash value policies), you may incur surrender charges. These charges are designed to compensate the insurance company for administrative costs and potential losses incurred due to the early termination of the contract. The amount of the surrender charge typically decreases over time. For instance, a whole life policy might have a surrender charge that diminishes over the first ten years of the policy, after which no further surrender charges are applied.

Calculating Total Annual Cost

It’s crucial to calculate the total annual cost of your life insurance to get a complete picture of the financial commitment. This involves more than just the monthly premium.

Here’s how to calculate the total annual cost:

- Step 1: Determine the monthly premium. This is the base cost of your insurance.

- Step 2: Identify any annual policy fees. This is usually a fixed amount charged annually.

- Step 3: Add any rider fees. These are the additional costs for optional benefits.

- Step 4: Account for one-time fees. This could include application fees or medical examination costs.

- Step 5: Calculate the total annual cost. Multiply the monthly premium by 12 and add all other annual and one-time fees. For example: Monthly premium: $100, Annual policy fee: $50, Rider fee: $75/year, Application fee: $75. Total annual cost = ($100 x 12) + $50 + $75 + $75 = $1400.

Total Annual Cost = (Monthly Premium x 12) + Annual Policy Fees + Rider Fees + One-Time Fees

Conclusive Thoughts

Ultimately, determining the right life insurance policy requires careful consideration of individual circumstances and a personalized approach. While average monthly premiums offer a general benchmark, obtaining multiple quotes from reputable insurers is paramount. By understanding the factors that influence cost and engaging in thorough research, you can secure the appropriate level of coverage without unnecessary financial strain, providing peace of mind for yourself and your loved ones.

Quick FAQs

What is the cheapest type of life insurance?

Generally, term life insurance is the most affordable option, offering coverage for a specific period.

Can I lower my life insurance premiums?

Yes, maintaining a healthy lifestyle, choosing a shorter policy term, and opting for a lower coverage amount can all help reduce premiums.

How often are life insurance premiums paid?

Premiums are typically paid monthly, but some insurers offer annual or even semi-annual payment options.

What happens if I miss a life insurance premium payment?

Missing payments can lead to policy lapse, meaning your coverage is terminated. Most insurers offer grace periods, but it’s crucial to contact them immediately if you anticipate difficulty making a payment.