Understanding the average price for car insurance is crucial for responsible budgeting and financial planning. Many factors influence the cost, from your age and driving history to the type of car you drive and where you live. This guide delves into these factors, providing a clear picture of what influences your premiums and how to navigate the process of obtaining accurate quotes. We’ll explore reliable resources, potential biases in reported averages, and strategies for securing the best possible rates.

This comprehensive analysis will equip you with the knowledge to understand your individual insurance costs in the context of broader trends. We’ll move beyond simple averages to examine the nuances of pricing, helping you make informed decisions about your coverage and budget.

Factors Influencing Car Insurance Costs

Several interconnected factors determine the final cost of your car insurance premium. Understanding these elements can help you make informed decisions and potentially save money. This section will explore the key influences on your insurance rate.

Age and Car Insurance Premiums

Younger drivers generally pay significantly higher premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on actuarial data, and the higher accident rate for younger drivers translates to higher premiums. As drivers gain experience and a clean driving record, their premiums typically decrease. For example, a 16-year-old driver might pay double or even triple the rate of a 30-year-old driver with a similar vehicle and coverage. The decrease in premiums often plateaus in the mid-to-late 50s.

Driving History’s Impact on Insurance Rates

Your driving history is a crucial factor in determining your insurance cost. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions will significantly increase your premiums. The severity of the offense also plays a role; a major accident will have a more substantial impact than a minor fender bender. Many insurance companies use a points system to track driving infractions, with each point leading to a premium increase.

Vehicle Type and Insurance Costs

The type of vehicle you drive significantly impacts your insurance premium. Sports cars and high-performance vehicles are generally more expensive to insure than sedans or smaller vehicles. This is because these vehicles are often more expensive to repair and are statistically involved in more accidents. Features like advanced safety technology can sometimes mitigate this cost, but the inherent risk associated with high-performance vehicles usually results in higher premiums. For instance, insuring a luxury SUV will typically cost more than insuring a compact economy car.

Comparison of Insurance Coverage Levels

Insurance coverage levels directly influence the cost of your policy. Liability coverage pays for damages caused to others in an accident. Collision coverage pays for damage to your vehicle, regardless of fault. Comprehensive coverage protects against damage from non-collision events, such as theft or hail. Liability-only coverage is the cheapest, while a policy with collision and comprehensive coverage is significantly more expensive. Choosing the right coverage level depends on your individual risk tolerance and financial situation. A higher deductible will usually lower your premium, but you will pay more out-of-pocket in the event of a claim.

Location’s Influence on Insurance Premiums

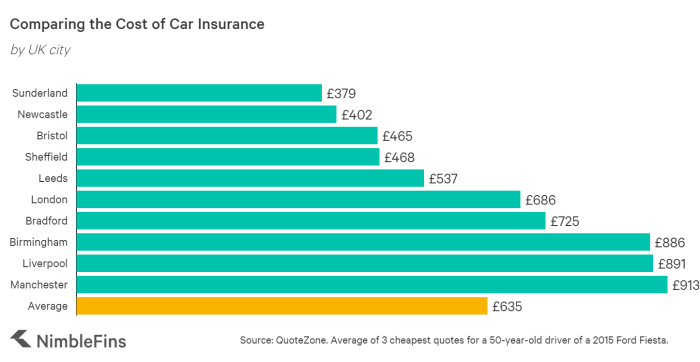

Your location plays a significant role in determining your car insurance premiums. Areas with high crime rates, more frequent accidents, or higher repair costs typically have higher insurance rates. Urban areas often have higher premiums than rural areas due to increased traffic density and the higher likelihood of accidents. Insurance companies carefully analyze accident statistics and claims data for specific geographic locations to assess risk.

Average Insurance Costs for Various Car Makes and Models

The table below shows estimated average annual insurance costs for selected car makes and models. These are averages and actual costs can vary depending on the factors mentioned above.

| Make & Model | Annual Premium (Liability Only) | Annual Premium (Liability + Collision) | Annual Premium (Full Coverage) |

|---|---|---|---|

| Honda Civic | $500 | $800 | $1000 |

| Toyota Camry | $550 | $850 | $1100 |

| Ford F-150 | $650 | $1000 | $1300 |

| BMW 3 Series | $750 | $1200 | $1500 |

Finding Average Car Insurance Prices

Determining the average cost of car insurance can be tricky, as prices vary significantly based on numerous individual factors. However, understanding how to find average prices and interpret them is crucial for making informed decisions about your own insurance coverage. This section will explore resources for finding average quotes, discuss the limitations of online tools, and highlight potential biases and discrepancies.

Resources for Obtaining Average Car Insurance Quotes

Several avenues exist for researching average car insurance costs. Online comparison websites aggregate quotes from multiple insurers, offering a snapshot of potential prices. These sites often provide average rates based on user data, though their accuracy and representativeness can be debated. Additionally, individual insurance company websites may display average rates for specific coverage types in certain geographic areas, but these are usually broad generalizations. Finally, independent insurance agents, due to their experience working with multiple insurers, can often provide insights into typical costs within a specific region and demographic.

Reliability of Online Car Insurance Comparison Tools

Online comparison tools can be helpful starting points, but it’s crucial to understand their limitations. The averages they display are often based on aggregated user data, which may not be fully representative of the entire population. The algorithms used by these tools can also influence the results, and the selection of insurers included in the comparison may be limited. Moreover, the quotes provided are typically estimates, not guaranteed prices, and the final cost may differ depending on individual factors not considered by the algorithm.

Potential Biases in Reported Average Insurance Prices

Reported average car insurance prices can be subject to various biases. For instance, averages might be skewed by the inclusion of drivers with exceptionally high or low risk profiles. Geographic location plays a significant role; averages for urban areas with high accident rates will differ considerably from those in rural areas. The type of coverage included in the average (liability only, comprehensive, etc.) also drastically affects the final figure. Finally, the time of year can influence reported averages, as certain factors like weather-related accidents may temporarily increase costs.

Factors Causing Discrepancies Between Reported Averages and Individual Experiences

Several factors can cause a significant gap between reported average car insurance prices and an individual’s actual cost. These include driving history (accidents, tickets), age and gender, credit score, vehicle type and value, location, and the specific coverage chosen. A driver with a history of accidents will naturally pay more than the average, while a young, inexperienced driver will also likely face higher premiums. Furthermore, the insurer chosen can dramatically impact the final cost, even for similar profiles.

Step-by-Step Guide to Obtaining Accurate Personalized Quotes

To obtain accurate personalized car insurance quotes, follow these steps:

- Gather your information: This includes your driving history, vehicle details, address, and desired coverage levels.

- Use multiple online comparison tools: Compare quotes from several different websites to get a broader picture.

- Contact individual insurers directly: Don’t rely solely on online comparisons. Contact insurers directly to verify quotes and discuss specific policy details.

- Compare quotes carefully: Pay close attention to the details of each policy, including deductibles, coverage limits, and exclusions.

- Consider your needs and budget: Choose a policy that offers the appropriate level of coverage at a price you can afford.

Interpreting Average Car Insurance Data

Average car insurance prices, while helpful for a general understanding of the market, possess significant limitations when applied to individual circumstances. Relying solely on averages can lead to inaccurate estimations of personal insurance costs and potentially inadequate coverage. Understanding these limitations is crucial for making informed decisions about your insurance needs.

Understanding the nuances of average car insurance data allows for a more realistic assessment of potential costs. While averages provide a benchmark, they don’t reflect the wide variability influenced by individual factors. Effectively utilizing average data involves recognizing its limitations and supplementing it with personalized information.

Limitations of Average Car Insurance Prices

Average car insurance costs represent a broad, generalized figure. They fail to account for the multitude of factors that significantly impact individual premiums. These factors, as discussed previously, include driving history, age, location, vehicle type, and the specific coverage selected. For example, a young driver with a history of accidents in a high-crime area driving a high-performance vehicle will pay considerably more than the average, even if they opt for minimum coverage. Conversely, an older, experienced driver with a clean record in a rural area driving a fuel-efficient car might pay significantly less. Using the average as a sole guide could lead to either underestimating or overestimating the actual cost, resulting in either insufficient coverage or unnecessary expense.

Estimating Potential Insurance Costs Using Average Data

While not a precise predictor, average data can serve as a starting point for estimating potential costs. Begin by researching average premiums for your state or region, considering your vehicle type (e.g., sedan, SUV, truck). Then, adjust this average based on your perceived risk profile. For instance, if you’re a young driver with a less-than-perfect driving record, anticipate a higher premium than the average. Conversely, a seasoned driver with a clean record can expect a lower premium. This adjusted figure provides a rough estimate, but remember that this is only a starting point and a more accurate quote requires contacting insurance providers directly. For example, if the average for your area is $1200 annually for a sedan, and you’re a young driver, you might reasonably expect to pay $1500-$1800, or even more, depending on other factors.

Individual Circumstances Deviating from the Average

Individual circumstances can dramatically alter insurance costs. Consider these examples: A driver with multiple speeding tickets will likely pay far more than the average. Someone living in an urban area with a high rate of car theft will pay more than someone in a rural area. The type of car significantly influences premiums; a sports car will typically be more expensive to insure than a compact car. The level of coverage chosen – comprehensive versus liability-only – also dramatically affects the final cost. These individual factors can easily double or even triple the average cost.

Importance of Specific Coverage Needs

Average car insurance costs often reflect basic liability coverage. However, individual needs vary. Someone with significant assets might require higher liability limits to protect their wealth. Others might need comprehensive coverage to protect against theft or damage. Adding features like roadside assistance or uninsured/underinsured motorist coverage further increases costs. Therefore, evaluating average costs without considering specific coverage requirements provides an incomplete and potentially misleading picture. Focusing solely on the average price without considering your specific needs can lead to insufficient protection or unnecessary expenses.

Average vs. Median Insurance Costs

Understanding the difference between average (mean) and median insurance costs is vital for interpreting data accurately. Here’s a breakdown:

- Average (Mean): The average is calculated by summing all insurance costs and dividing by the total number of policies. It’s susceptible to being skewed by extremely high or low values (outliers). A few very high premiums can significantly inflate the average, making it a less representative figure for the typical cost.

- Median: The median represents the middle value when all insurance costs are arranged in order. It’s less sensitive to outliers than the average. The median provides a more robust representation of the typical insurance cost because it is not influenced by extreme values.

The implication is that the median often provides a more realistic picture of the typical insurance cost than the average, especially when dealing with a dataset that includes a wide range of premiums. The average can be misleading, while the median offers a more accurate representation of the central tendency of insurance costs.

Visual Representation of Average Costs

Understanding average car insurance costs is significantly enhanced through visual representations. Graphs and charts effectively communicate complex data, making trends and patterns readily apparent. This section will illustrate how different visualization techniques can clarify the relationship between various factors and insurance premiums.

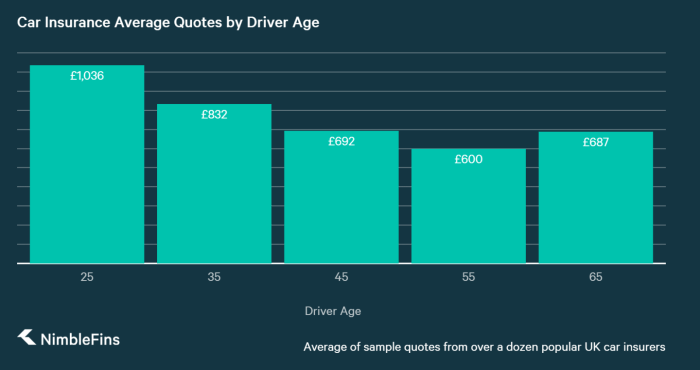

Bar Graph Illustrating Average Insurance Costs Across Different Age Groups

A bar graph provides a clear visual comparison of average car insurance costs across different age groups. The horizontal axis (x-axis) would represent the age groups, perhaps categorized in 5-year intervals (e.g., 16-20, 21-25, 26-30, etc.). The vertical axis (y-axis) would represent the average annual insurance premium in dollars. Each bar would represent a specific age group, with its height corresponding to the average premium for that group. For example, a bar representing the 16-20 age group might be significantly taller than a bar representing the 31-35 age group, reflecting the generally higher insurance costs for younger drivers. Data points could be derived from industry averages reported by insurance comparison websites or regulatory bodies. A key would clearly define what each bar represents.

Chart Illustrating the Relationship Between Vehicle Value and Insurance Premiums

A scatter plot is ideal for illustrating the relationship between vehicle value and insurance premiums. The horizontal axis (x-axis) would represent the vehicle’s value (in dollars), and the vertical axis (y-axis) would represent the annual insurance premium (in dollars). Each data point on the chart would represent a specific vehicle, with its x-coordinate representing the vehicle’s value and its y-coordinate representing its insurance premium. A trend line could be added to the scatter plot to show the general relationship between vehicle value and insurance cost. One would expect a positive correlation, meaning that as the vehicle’s value increases, the insurance premium tends to increase as well. For example, a luxury vehicle would likely have a data point far to the right and high up on the chart, while an older, less valuable vehicle would have a data point closer to the origin.

Box and Whisker Plot Representing the Range of Insurance Costs

A box and whisker plot is a useful tool for visually representing the distribution and range of insurance costs. This plot displays the median, quartiles, and potential outliers of the data. The “box” represents the interquartile range (IQR), which contains the middle 50% of the data. The line inside the box indicates the median (the middle value). The “whiskers” extend from the box to the minimum and maximum values within 1.5 times the IQR from the box edges. Data points outside this range are considered outliers and are plotted individually. For example, a box and whisker plot could be created for the insurance costs of a specific age group or vehicle type. The plot would show the median cost, the range of costs within the IQR, and any unusually high or low insurance premiums. This allows for a quick visual assessment of the typical cost and the extent of variation.

Discounts and Savings on Car Insurance

Lowering your car insurance premiums is a significant financial goal for many drivers. Fortunately, numerous discounts are available, potentially leading to substantial savings. Understanding these discounts and how to qualify for them can make a considerable difference in your overall insurance costs. This section explores common discounts, the benefits of bundling, and strategies for securing lower rates.

Common Car Insurance Discounts

Many insurance companies offer a variety of discounts to attract and retain customers. These discounts often target specific demographics, driving behaviors, or vehicle features. Understanding the availability and eligibility criteria for these discounts is crucial for maximizing savings.

- Good Student Discount: Offered to students maintaining a high GPA, typically above a 3.0 or equivalent. This reflects the lower risk associated with responsible students.

- Safe Driver Discount: Awarded to drivers with a clean driving record, free from accidents and traffic violations over a specified period. The length of the clean driving history required varies by insurer.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course demonstrates a commitment to safe driving practices and often results in a discount.

- Multi-Car Discount: Insuring multiple vehicles under the same policy with the same insurer usually qualifies for a discount due to the insurer’s reduced administrative costs and increased customer loyalty.

- Multi-Policy Discount (Bundling): Bundling home, auto, and other insurance policies with a single provider often provides significant savings due to the insurer’s economies of scale.

- Vehicle Safety Features Discount: Cars equipped with anti-theft devices, airbags, and other safety features are often associated with lower accident rates, leading to discounts.

- Senior Citizen Discount: Some insurers offer discounts to drivers over a certain age, often reflecting statistically lower accident rates in this demographic.

- Military Discount: Active-duty military personnel and veterans may qualify for discounts as a show of appreciation for their service.

Impact of Bundling Insurance Policies

Bundling your insurance policies, such as combining home and auto insurance, often results in significant cost savings. Insurance companies reward customers who consolidate their coverage, offering discounts as an incentive for loyalty and reduced administrative overhead. For example, a customer bundling their home and auto insurance might receive a 10-15% discount on their total premiums compared to purchasing each policy separately. This discount can amount to hundreds of dollars annually.

Securing Discounts for Safe Driving Habits

Maintaining a clean driving record is paramount for securing discounts. This involves avoiding accidents, traffic violations, and accumulating points on your driving record. Furthermore, actively participating in defensive driving courses demonstrates a commitment to safe driving practices, leading to potential discounts. Many insurers offer online or in-person courses, often leading to a discount upon completion. For instance, completing a certified defensive driving course could lead to a 5-10% reduction in premiums.

Leveraging Different Discounts to Lower Premiums

Many discounts can be combined to achieve substantial savings. A good student with a clean driving record who bundles their home and auto insurance and has a car with advanced safety features could potentially receive a significant discount. For example, combining a good student discount (10%), a safe driver discount (15%), a multi-policy discount (10%), and a vehicle safety features discount (5%) could result in a cumulative discount of 40%, significantly reducing premiums.

Comparison of Discounts Offered by Various Insurance Providers

Insurance providers vary in the types and amounts of discounts they offer. It’s essential to compare quotes from multiple insurers to identify the best deals. Some insurers might emphasize discounts for bundling, while others might offer more significant discounts for safe driving or specific vehicle features. A thorough comparison is crucial to finding the most cost-effective policy. For instance, one insurer might offer a 20% discount for bundling, while another offers a 15% discount but a higher discount for a vehicle with advanced safety features. The best choice depends on individual circumstances.

Final Thoughts

Securing affordable car insurance requires a nuanced understanding of the factors influencing premiums and the resources available for obtaining accurate quotes. By carefully considering your driving history, vehicle type, location, and coverage needs, you can effectively navigate the complexities of car insurance pricing. Remember to leverage available discounts and comparison tools to find the best value for your specific circumstances. Ultimately, informed decision-making is key to securing comprehensive and cost-effective car insurance.

Key Questions Answered

What is the difference between liability, collision, and comprehensive coverage?

Liability covers damage or injury you cause to others. Collision covers damage to your car in an accident, regardless of fault. Comprehensive covers damage from non-accidents (e.g., theft, vandalism).

How often can I expect my car insurance rates to change?

Rates can change annually, or even more frequently, based on factors like your driving record, claims history, and changes in the insurance market.

Can I get car insurance without a driving license?

Generally, no. Most insurers require a valid driver’s license to insure a vehicle.

What is a usage-based insurance program?

These programs use telematics devices or smartphone apps to track your driving habits, potentially offering discounts for safe driving.

How does credit score affect car insurance rates?

In many states, your credit score is a factor in determining your insurance premiums. A higher credit score often translates to lower rates.