Understanding the average insurance cost for small businesses is crucial for financial planning and operational success. Many factors contribute to these costs, creating a complex landscape for entrepreneurs. This exploration delves into the key elements influencing premiums, examining industry variations, location impacts, and the significance of claims history. We’ll also explore various types of insurance coverage essential for mitigating risks and securing affordable options.

Navigating the world of small business insurance can feel overwhelming, but armed with the right knowledge, owners can make informed decisions to protect their investments and future. This guide provides a comprehensive overview, helping you understand the intricacies of insurance costs and empowering you to find the best coverage at a reasonable price.

Factors Influencing Small Business Insurance Costs

Several key factors significantly impact the average cost of insurance for small businesses. Understanding these factors allows business owners to better budget for insurance expenses and potentially negotiate more favorable premiums. This section will delve into the specifics of these cost drivers.

Industry Type

The type of industry a small business operates in is a major determinant of its insurance costs. High-risk industries, such as construction or manufacturing, typically face higher premiums due to the increased likelihood of accidents and injuries. Conversely, businesses in lower-risk sectors, like retail or office administration, may enjoy lower insurance costs. This difference reflects the inherent risk profiles associated with different business activities. For example, a construction company needs comprehensive liability insurance to cover potential workplace accidents and property damage, resulting in higher premiums compared to a software development company with fewer physical risks.

Location

Geographic location plays a crucial role in insurance pricing. Areas with higher crime rates, natural disaster risks (earthquakes, hurricanes, floods), or a higher frequency of accidents will generally lead to higher insurance premiums. A business located in a high-crime area might face increased costs for property insurance, while a business in a flood-prone zone will likely pay more for flood insurance. Insurance companies base their risk assessments on statistical data for specific locations.

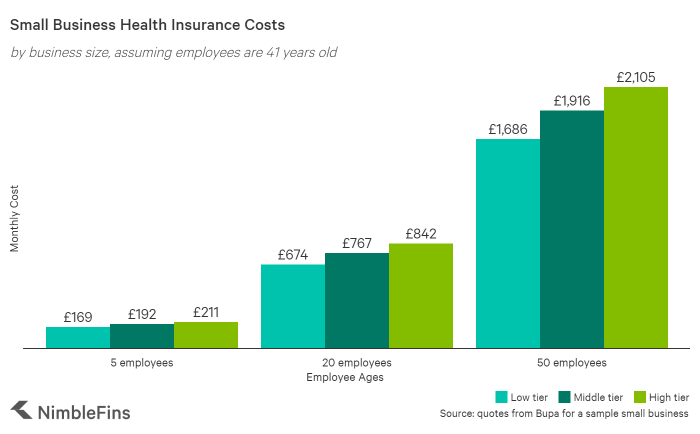

Number of Employees

The number of employees directly influences insurance costs, primarily through workers’ compensation insurance. More employees mean a greater potential for workplace accidents and thus higher premiums. Additionally, a larger workforce may necessitate broader liability coverage, further impacting overall insurance costs. A single-person business will have significantly lower workers’ compensation costs than a business with fifty employees.

Claims History

A business’s claims history is a critical factor in determining future insurance premiums. A history of frequent or high-value claims will lead to higher premiums, reflecting the increased risk associated with the business. Conversely, a clean claims history can result in lower premiums as insurers perceive the business as less risky. Insurance companies use actuarial data to assess the likelihood of future claims based on past performance. Maintaining a strong safety record and implementing risk mitigation strategies can significantly influence a business’s claims history and, consequently, its insurance costs.

Risk Assessment

Risk assessment is the cornerstone of insurance pricing. Insurers meticulously evaluate various aspects of a business to determine its risk profile. This assessment considers factors such as the industry, location, number of employees, safety procedures, and past claims history. A thorough risk assessment allows insurers to accurately price insurance policies to reflect the likelihood of claims. Businesses can proactively participate in risk assessment by implementing safety measures and maintaining detailed records of their operations. This demonstrates to insurers a commitment to risk mitigation and can potentially lead to lower premiums.

Insurance Cost Variations Across Sectors

The insurance costs vary substantially across different business sectors. For instance, construction companies typically face significantly higher premiums than technology firms due to the inherent risks associated with construction work, including potential injuries and property damage. Retail businesses might have moderate insurance costs, primarily focused on liability and property insurance. Technology firms, while potentially facing cybersecurity risks, usually have lower overall insurance costs compared to more physically demanding industries. This variation underscores the importance of understanding the specific risk profile of each industry when budgeting for insurance.

| Factor | Low Impact | Medium Impact | High Impact |

|---|---|---|---|

| Industry Type | Retail | Restaurant | Construction |

| Location | Rural Area, Low Crime | Suburban Area | Urban Area, High Crime |

| Number of Employees | 1-5 | 6-15 | 16+ |

| Claims History | No Claims in 3 Years | 1 Minor Claim in 3 Years | Multiple Claims in 3 Years |

Types of Insurance Coverage for Small Businesses

Securing the right insurance is vital for the financial health and longevity of any small business. Unexpected events, from property damage to lawsuits, can quickly cripple a company without adequate protection. Understanding the various types of insurance available and their specific applications is crucial for effective risk management. This section Artikels common insurance policies, detailing their coverage and the risks they mitigate.

Liability Insurance

Liability insurance protects your business from financial losses resulting from claims of bodily injury or property damage caused by your business operations or employees. This is a cornerstone of small business insurance, shielding you from potentially devastating legal and financial consequences.

- General Liability Insurance: Covers claims of bodily injury or property damage to third parties on your business premises or as a result of your business operations. For example, a customer slipping and falling in your store.

- Professional Liability Insurance (Errors and Omissions): Protects against claims of negligence or mistakes in professional services provided. This is crucial for consultants, designers, or any business offering professional advice or services. For instance, a consultant giving faulty financial advice that results in a client’s loss.

- Product Liability Insurance: Covers claims related to injuries or damages caused by defective products your business manufactures or sells. A food producer facing lawsuits due to contaminated food products is an example.

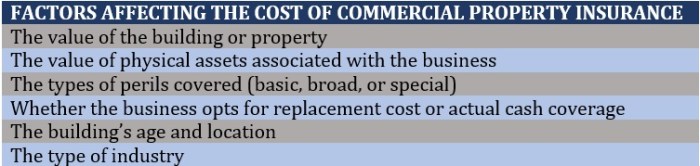

Property Insurance

Property insurance safeguards your business’s physical assets from various perils. This coverage ensures you can recover from events that could otherwise cause significant financial hardship.

- Commercial Property Insurance: Covers damage to or loss of your business building, equipment, inventory, and other physical assets due to fire, theft, vandalism, or natural disasters. A bakery whose building is damaged by a fire needs this coverage.

- Business Interruption Insurance: Provides financial support during periods when your business is unable to operate due to a covered event, such as a fire or natural disaster. This covers lost income and ongoing expenses while the business is closed.

Workers’ Compensation Insurance

Workers’ compensation insurance protects your employees in case of work-related injuries or illnesses. It’s a legal requirement in most jurisdictions and offers crucial protection for both your employees and your business.

- Workers’ Compensation: Covers medical expenses, lost wages, and rehabilitation costs for employees injured on the job. A construction worker injured on a building site would be covered under this policy.

Other Important Insurance Types

Beyond the core categories, several other insurance types are valuable for many small businesses.

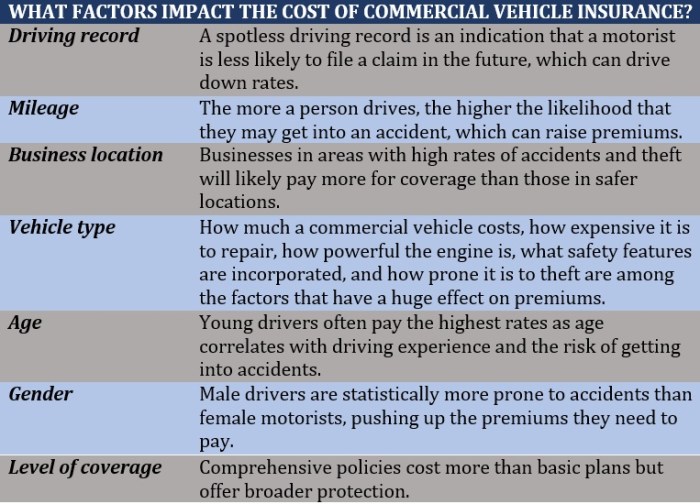

- Commercial Auto Insurance: Covers vehicles owned and operated by your business, protecting against accidents and liability. A delivery service company needs this to protect its fleet.

- Cyber Liability Insurance: Protects against financial losses from data breaches, cyberattacks, and other cybersecurity incidents. Any business that handles sensitive customer data should have this.

- Business Owner’s Policy (BOP): Often combines several coverages, including general liability and property insurance, into a single, convenient policy. This is a cost-effective option for many small businesses.

Finding Affordable Small Business Insurance

Securing affordable insurance is crucial for the financial health of any small business. High premiums can strain budgets and hinder growth, so understanding how to find cost-effective solutions is vital. This section explores strategies for obtaining competitive insurance rates and navigating the process of purchasing a policy.

Finding affordable small business insurance involves a multi-faceted approach. It’s not simply about finding the cheapest policy, but rather the most comprehensive and cost-effective coverage for your specific needs. This requires careful planning, research, and negotiation.

Strategies for Securing Cost-Effective Insurance Solutions

Several strategies can help small business owners reduce their insurance costs. These include improving risk management practices, bundling policies, and carefully selecting coverage.

- Improve Risk Management: Implementing robust safety measures and training programs can demonstrate a lower risk profile to insurers, leading to reduced premiums. For example, a retail store implementing a comprehensive security system and employee training on theft prevention might qualify for lower premiums compared to a store with lax security.

- Bundle Policies: Insurers often offer discounts for bundling multiple types of insurance, such as property, liability, and workers’ compensation, under a single policy. This can lead to significant savings compared to purchasing each policy individually.

- Carefully Select Coverage: Avoid unnecessary coverage. Analyze your business’s specific risks and needs to determine the minimum required coverage. Purchasing excess coverage can inflate premiums unnecessarily.

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurers is essential to finding the best rates. Different insurers have different rating systems and may offer varying premiums for the same coverage.

Resources for Comparing Insurance Quotes and Policies

Numerous resources are available to help small business owners compare insurance quotes and policies effectively. Utilizing these resources can streamline the process and ensure you’re getting the best possible value.

- Online Insurance Marketplaces: Websites like Insurify, Policygenius, and others allow you to compare quotes from multiple insurers simultaneously. These platforms often offer tools to customize your search based on your specific business needs.

- Independent Insurance Agents: Independent agents represent multiple insurance companies, allowing them to compare quotes across various providers on your behalf. They can provide expert advice and help navigate the complexities of insurance selection.

- Industry Associations: Many industry associations offer group insurance programs to their members, often providing discounted rates due to the collective bargaining power of the group.

Negotiating Insurance Premiums

Negotiating insurance premiums is a viable strategy to secure more affordable coverage. While not always successful, a well-prepared approach can yield positive results.

- Demonstrate a Low-Risk Profile: Highlight your business’s safety measures, employee training programs, and loss prevention strategies to showcase your commitment to risk mitigation.

- Leverage Multiple Quotes: Use quotes from competing insurers to negotiate lower premiums. This demonstrates your willingness to switch providers if a better offer isn’t presented.

- Consider Increasing Deductibles: Raising your deductible can significantly lower your premiums. This requires careful consideration of your financial capacity to cover a potential loss.

- Pay Annually: Some insurers offer discounts for annual payments instead of monthly installments.

Obtaining Small Business Insurance: A Step-by-Step Guide

The process of obtaining small business insurance involves several key steps. Following a structured approach can ensure a smooth and efficient process.

- Assess Your Needs: Identify the types of insurance coverage your business requires based on its size, industry, and risk profile.

- Gather Information: Collect relevant information about your business, such as its location, size, revenue, and number of employees.

- Obtain Quotes: Request quotes from multiple insurers using online marketplaces, independent agents, or directly contacting insurers.

- Compare Quotes and Policies: Carefully compare the quotes, considering coverage, premiums, and policy terms.

- Negotiate Premiums: Attempt to negotiate lower premiums based on your risk profile and comparison quotes.

- Select a Policy: Choose the policy that best meets your needs and budget.

- Complete the Application: Complete the insurance application accurately and thoroughly.

- Pay Premiums: Pay the initial premium to activate your policy.

Impact of Claims History on Insurance Costs

Your small business’s claims history significantly impacts the cost of your insurance premiums. Insurance companies view claims as direct indicators of risk. A history of frequent or costly claims suggests a higher likelihood of future claims, leading to increased premiums. Conversely, a clean claims history often translates to lower premiums.

Insurance companies employ sophisticated methods to assess risk based on past claims data. This involves analyzing the frequency, severity, and type of claims filed over a specific period, typically three to five years. They use statistical models and algorithms to predict the probability of future claims based on this historical data. Factors such as the nature of the business, industry trends, and location also play a role in this risk assessment, but claims history is a primary determinant.

Claims Frequency and Premium Increases

The relationship between claims frequency and insurance costs is directly proportional. More claims generally lead to higher premiums. Let’s consider a hypothetical scenario: Acme Widgets, a small manufacturing company, experiences two minor claims in the first year, resulting in a modest premium increase of 5% for the following year. However, in the second year, they experience three significant claims, leading to a 15% premium increase for the third year. This demonstrates the compounding effect of claims on premiums. Continued high claim frequency could lead to policy non-renewal or significantly higher premiums, potentially making insurance unaffordable. Conversely, a company with consistently low or no claims might see premium reductions over time, as insurers recognize the reduced risk.

Visual Representation of Claims and Insurance Costs

Imagine a line graph. The x-axis represents the number of claims filed over a five-year period, ranging from zero to ten claims. The y-axis represents the corresponding annual insurance premium, increasing from a base rate to a significantly higher rate. The graph would show a clear upward trend: as the number of claims increases, the insurance premium increases proportionally. The line would not be perfectly linear, as the severity of individual claims also influences the premium, but the overall trend would demonstrate a strong positive correlation. For example, a company with zero claims might have a premium of $1000, while a company with ten claims might have a premium exceeding $3000, highlighting the substantial impact of claims history.

Government Regulations and Small Business Insurance

Government regulations significantly influence the small business insurance market, impacting both the availability and cost of coverage. These regulations aim to protect consumers, ensure fair competition, and maintain the solvency of insurance companies. However, the resulting compliance requirements can add complexity and expense for small businesses.

Government regulations dictate various aspects of the insurance industry, from the types of coverage required to the pricing and underwriting practices allowed. Compliance with these regulations often translates to increased administrative burdens and costs for insurance providers, which are ultimately passed on to small business owners in the form of higher premiums. Furthermore, variations in regulations across different jurisdictions can lead to inconsistencies in coverage and pricing.

Compliance Requirements and Their Impact on Insurance Costs

Meeting regulatory requirements adds considerable expense for insurers. This includes costs associated with: maintaining accurate records, conducting regular audits, implementing sophisticated risk management systems, and employing legal and compliance personnel to ensure adherence to constantly evolving rules. These costs are factored into the premiums charged to businesses, directly affecting the overall cost of insurance. For example, the increased paperwork and verification processes associated with complying with the Affordable Care Act (ACA) led to higher administrative costs for insurers, which in turn increased premiums for small businesses offering employee health insurance.

State-by-State Variations in Insurance Regulations

Insurance regulations vary considerably across different states and regions. Some states have stricter regulations regarding minimum coverage requirements, leading to higher premiums. Others may have more lenient rules on pricing practices, resulting in potentially lower costs for some types of insurance. For example, workers’ compensation insurance regulations differ significantly between states. States with higher workers’ compensation benefits typically have higher premiums, reflecting the increased risk for insurers. Conversely, states with simpler claim processes might have lower premiums. This variability necessitates a thorough understanding of the specific regulatory landscape in each state where a small business operates.

Summary of Key Regulations and Their Effects on Insurance Costs

| Regulation Type | Specific Example | Impact on Insurance Costs | State/Regional Variation |

|---|---|---|---|

| Workers’ Compensation | State-mandated benefits and claim processes | Higher premiums in states with more generous benefits or complex claim systems. | Significant variation; some states have significantly higher premiums than others. |

| Environmental Regulations | Compliance with pollution control laws (e.g., CERCLA) | Increased premiums for businesses in high-risk industries or locations. | Variations based on state environmental laws and enforcement. |

| Employment Practices Liability Insurance (EPLI) | State laws regarding discrimination and harassment claims. | Higher premiums in states with stricter laws or higher litigation rates. | Significant variation; states with higher legal costs tend to have higher premiums. |

| Health Insurance (ACA) | Employer mandate (for businesses with over 50 employees) | Increased premiums due to administrative costs and compliance requirements. | Federal regulations, but state variations in enforcement and supplemental programs. |

Last Word

Securing adequate insurance is paramount for any small business, protecting against unforeseen circumstances and ensuring long-term viability. By understanding the factors affecting insurance costs, proactively managing risk, and utilizing available resources, small business owners can effectively manage their insurance expenses and gain peace of mind. This comprehensive analysis serves as a valuable tool, enabling informed decisions and fostering a strong foundation for sustainable growth.

FAQ

What is the average cost of general liability insurance for a small business?

The average cost varies greatly depending on factors like location, industry, and revenue. Expect to pay anywhere from $500 to $1,500 annually, but it’s best to obtain quotes for a precise estimate.

Can I bundle different types of insurance for a better rate?

Yes, many insurers offer discounts for bundling policies, such as general liability and property insurance. This is a common strategy to reduce overall costs.

How often should I review my insurance policy?

It’s advisable to review your insurance policy annually, or whenever your business experiences significant changes (e.g., expansion, new employees, increased revenue).

What happens if I make a claim and my premiums increase?

Insurers assess risk based on claims history. Filing a claim may result in a premium increase, but the extent depends on the nature and frequency of claims.