Navigating the world of home insurance can feel overwhelming, especially when confronted with the often-misunderstood concept of the deductible. This guide aims to demystify the average home insurance deductible, exploring its meaning, influencing factors, and the crucial role it plays in your overall insurance costs and claim process. We’ll delve into the relationship between deductibles and premiums, providing practical advice to help you choose the right deductible for your individual financial circumstances and risk tolerance.

From defining what a deductible actually is and how it impacts your out-of-pocket expenses during a claim, to exploring the various factors influencing its amount – including location, coverage type, and policy specifics – this guide provides a clear and concise understanding of this important aspect of homeownership.

Factors Influencing Deductible Amounts

Home insurance deductibles, the amount you pay out-of-pocket before your insurance coverage kicks in, aren’t arbitrarily chosen. Several factors play a crucial role in determining the deductible amount you’ll face. Understanding these factors can help you make informed decisions when purchasing or adjusting your home insurance policy.

Location’s Influence on Deductibles

Geographic location significantly impacts home insurance deductibles. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, typically command higher deductibles. Insurance companies assess the risk associated with each location, factoring in historical claims data, proximity to hazardous areas, and the likelihood of future events. For example, a home in a coastal region susceptible to hurricanes might have a substantially higher deductible than a similar home located inland. This reflects the increased probability of costly claims in high-risk areas. Conversely, homes in areas with lower risk profiles may qualify for lower deductibles.

Coverage Type and Deductible Levels

The type of coverage you choose directly affects your deductible. Comprehensive policies offering broader protection against a wider range of perils generally come with higher deductibles. Conversely, more limited policies with fewer coverage options may have lower deductibles. This is because the insurer is assuming less risk with a more limited policy. For instance, a policy covering only fire damage might have a lower deductible than a policy covering fire, wind, hail, and theft. Choosing the right balance between coverage breadth and deductible amount is crucial.

Deductibles for Different Home Insurance Policies

Homeowner’s and renter’s insurance policies differ significantly in their deductible structures. Homeowner’s insurance, which covers the structure of the home and its contents, usually involves higher deductibles than renter’s insurance. This is due to the substantially higher potential cost of repairing or replacing a home compared to replacing personal belongings. Renter’s insurance, focusing solely on personal possessions, generally features lower deductibles because the insured value is typically much lower. The specific deductible amount will, however, still vary based on the factors discussed above.

Factors Affecting Deductible Amounts: A Summary

The following table summarizes the key factors and their influence on deductible amounts. Note that these are examples and actual amounts will vary widely based on the specific insurer and individual circumstances.

| Factor | Influence on Deductible | Example |

|---|---|---|

| Location | Higher deductibles in high-risk areas | Coastal home: $2,000 deductible; Inland home: $500 deductible |

| Coverage Type | Higher deductibles for broader coverage | Comprehensive policy: $1,000 deductible; Basic policy: $500 deductible |

| Policy Type (Homeowner’s vs. Renter’s) | Homeowner’s policies typically have higher deductibles | Homeowner’s: $1,500 deductible; Renter’s: $500 deductible |

| Claims History | Higher deductibles for individuals with frequent claims | No claims in 5 years: $750 deductible; Multiple claims: $1500 deductible |

Choosing the Right Deductible

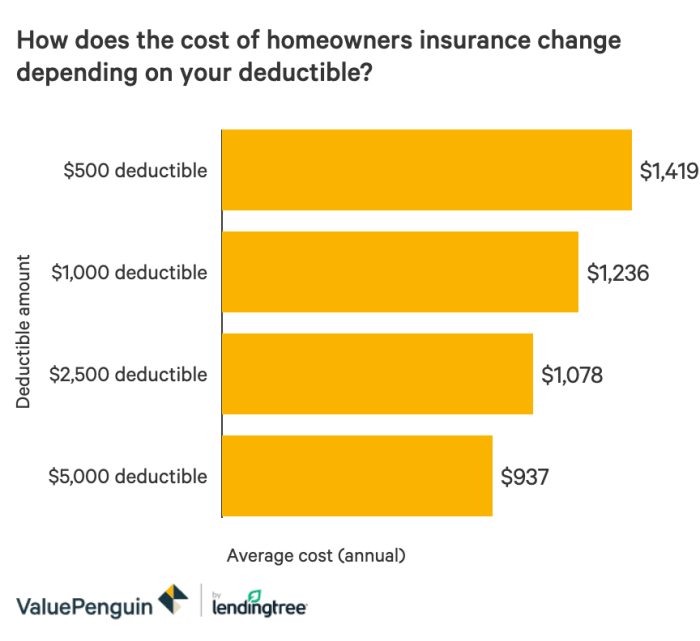

Selecting the right home insurance deductible is a crucial decision impacting your premiums and out-of-pocket expenses in case of a claim. Finding the balance between affordability and financial protection requires careful consideration of your personal financial situation and risk tolerance. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums but lower out-of-pocket costs when you need to file a claim.

Deductible Selection and Financial Circumstances

Your financial stability plays a significant role in determining the appropriate deductible amount. Individuals with substantial emergency savings can comfortably afford a higher deductible, knowing they can cover the cost should an incident occur. Conversely, those with limited savings might prefer a lower deductible to mitigate the financial burden of a potential claim. Consider your monthly budget, existing savings, and ability to absorb unexpected expenses. For example, a homeowner with $20,000 in savings might comfortably choose a $2,000 deductible, whereas someone with limited savings might opt for a $500 deductible.

The Importance of Emergency Funds in Deductible Selection

Emergency funds act as a crucial buffer against unexpected expenses, including the deductible on your home insurance. Before choosing a deductible, assess the size of your emergency fund. A well-funded emergency account provides the financial security to handle a higher deductible without jeopardizing your financial stability. Ideally, your emergency fund should cover at least three to six months of living expenses, plus the amount of your chosen deductible. For instance, if your monthly expenses are $3,000 and you’re considering a $1,000 deductible, a minimum emergency fund of $10,000-$20,000 would be advisable.

A Step-by-Step Guide to Determining Your Ideal Deductible

- Assess your emergency fund: Determine the total amount of money you have readily available in savings for unexpected expenses.

- Calculate your monthly expenses: Estimate your essential monthly expenses (housing, food, transportation, etc.).

- Determine your comfort level: Consider how much you can comfortably afford to pay out-of-pocket in the event of a claim. This will help define your acceptable deductible range.

- Compare insurance quotes: Obtain quotes from multiple insurance providers with varying deductible options within your comfort range. Observe the impact of different deductible amounts on your premium.

- Choose the deductible: Select the deductible that balances affordability with your financial capacity to cover potential out-of-pocket expenses. Consider the likelihood of filing a claim in your area.

Risks Associated with High and Low Deductibles

Choosing a very high deductible, while lowering premiums, exposes you to significant financial risk if a claim arises. You would need to cover a substantial amount out-of-pocket, potentially straining your finances. Conversely, opting for a very low deductible offers greater protection but comes with higher premiums. This could mean paying more over time even if you never file a claim. The ideal deductible is a personalized choice reflecting your individual financial situation and risk tolerance. For example, someone living in a high-risk area for natural disasters might choose a lower deductible despite the higher premium, prioritizing financial security over cost savings.

Resources for Finding Average Deductible Information

Finding reliable data on average home insurance deductibles can be challenging, as the amount varies significantly based on numerous factors. While a precise average for your specific location and circumstances is difficult to pinpoint, several resources can provide valuable insights into typical ranges. Understanding these ranges is crucial for making informed decisions about your own coverage, although it’s vital to remember that these averages shouldn’t be the sole determinant of your deductible choice.

Understanding the limitations of average deductible information is key. Average data masks the wide range of factors influencing individual premiums and deductibles. Averages may be skewed by outliers, providing a misleading picture of what a typical homeowner might expect. Using average data alone risks choosing a deductible that is either too high (leading to significant out-of-pocket expenses in case of a claim) or too low (resulting in higher premiums). Therefore, averages should serve as a general guideline, not a definitive decision-making tool.

Sources of Home Insurance Information

Several reputable websites and organizations offer valuable information about home insurance, including data on average premiums and deductibles, though rarely specific averages for a particular location. These resources often provide comparative tools, allowing you to input your specific circumstances (location, home value, coverage needs) to receive personalized estimates. This is a more effective approach than relying solely on generalized average data.

Reputable Resources for Home Insurance Information

The following list provides examples of organizations and websites known for their reliable information on home insurance:

- The Insurance Information Institute (III): The III is a non-profit organization that provides consumer information on various insurance topics, including home insurance. They offer educational materials and resources to help consumers understand insurance concepts and make informed decisions.

- State Insurance Departments: Each state has its own insurance department that regulates the insurance industry within that state. These departments often publish consumer guides and provide resources to help consumers compare insurance policies and file complaints.

- Consumer Reports: Consumer Reports is a well-respected consumer advocacy organization that conducts independent testing and research on various products and services, including insurance. They may provide ratings and comparisons of home insurance providers.

- NAIC (National Association of Insurance Commissioners): The NAIC is an organization that works to standardize and improve insurance regulation across the United States. Their website may offer resources and information on home insurance.

- Independent Insurance Agents: Local, independent insurance agents can offer personalized guidance and access to multiple insurance providers, helping you compare quotes and find the best coverage for your needs. They can provide insight into typical deductibles in your area, based on their experience.

Closure

Ultimately, selecting the appropriate home insurance deductible involves a careful balancing act between affordability and financial preparedness. By understanding the interplay between deductibles and premiums, considering your personal financial situation, and acknowledging potential risks, you can make an informed decision that protects your home and your financial well-being. Remember to leverage the resources available to research average deductibles in your area, but always prioritize personalized assessment over generic averages.

Top FAQs

What happens if I don’t have enough money to pay my deductible after a claim?

Your insurance company will likely still cover the remaining costs of the claim after your deductible is paid. However, you will be responsible for paying your deductible in full, and failure to do so could impact your future coverage.

Can I change my deductible after I’ve purchased a policy?

Generally, you can adjust your deductible, but it usually involves contacting your insurance provider and may result in a premium adjustment. The specifics depend on your policy and insurer.

Does my deductible change every year?

Not automatically. Your deductible remains the same unless you actively change it when renewing your policy or making other adjustments.

What’s the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after a claim.