Securing your home with adequate insurance is a crucial financial decision. However, navigating the complexities of home insurance costs can feel overwhelming. This guide demystifies the process, exploring the various factors influencing the average cost of home insurance and offering practical strategies to find affordable coverage that meets your needs. We’ll delve into the nuances of policy types, coverage levels, and individual risk factors, providing you with the knowledge to make informed choices.

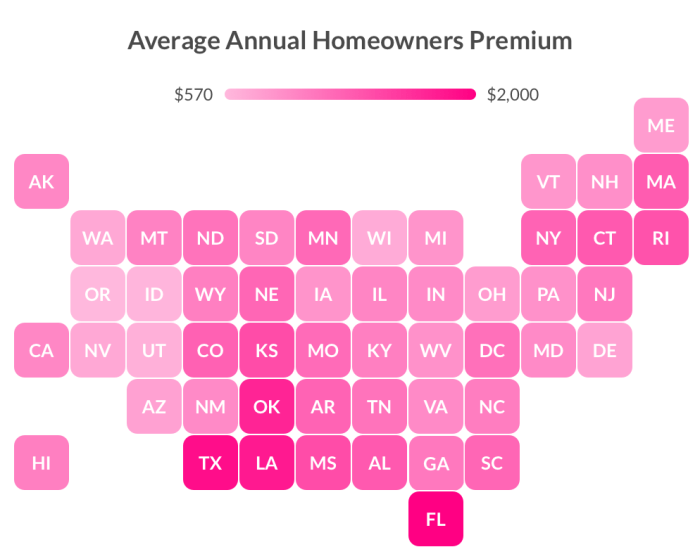

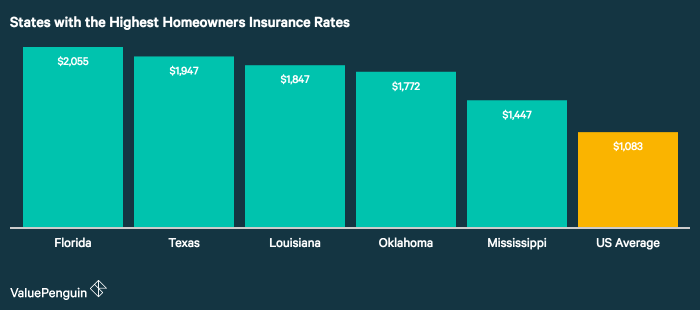

From geographical location and home features to your credit score and claims history, numerous variables play a significant role in determining your premium. Understanding these factors allows you to assess your risk profile and proactively manage your insurance expenses. This guide aims to empower you with the information necessary to secure the best possible coverage at a price that aligns with your budget.

Types of Home Insurance Policies and Their Costs

Choosing the right home insurance policy can significantly impact your financial protection and overall cost. Understanding the different types of policies available and their associated costs is crucial for making an informed decision. This section will Artikel the key differences between common home insurance policies, their coverage details, and typical cost variations.

Home Insurance Policy Types: HO-3, HO-4, and HO-6

Several standard home insurance policies cater to different needs and property types. The most common are HO-3, HO-4, and HO-6. These policies offer varying levels of coverage and, consequently, different price points.

- HO-3 (Special Form): This is the most common type of homeowners insurance. It provides open-peril coverage for the dwelling and other structures, meaning it covers damage from almost any cause except those specifically excluded in the policy. Personal property is covered on a named-peril basis, meaning it only covers damage from specifically listed events. Examples of covered perils include fire, wind, hail, and theft. Examples of exclusions often include floods, earthquakes, and acts of war.

- HO-4 (Contents Broad Form): Also known as renters insurance, this policy covers personal property against named perils. It does not cover the dwelling itself, as renters do not own the building. Coverage typically includes personal belongings, liability protection, and additional living expenses if the renter is displaced due to a covered event. For example, fire damage to furniture would be covered, but damage to the building’s structure would not be.

- HO-6 (Condominium Owner’s Coverage): This policy is designed for condominium owners. It covers personal property and improvements and alterations made to the unit (things beyond the basic structure). It typically does not cover the building’s common areas or the building structure itself. For example, damage to your custom cabinets would be covered, while damage to the building’s exterior wall would not be.

Coverage Inclusions and Exclusions

Understanding what is and isn’t covered is vital. Each policy type has specific inclusions and exclusions that impact the overall cost and protection offered.

- HO-3 (Special Form): Inclusions typically include dwelling coverage, other structures coverage, personal property coverage, loss of use coverage (additional living expenses), and liability coverage. Exclusions commonly include floods, earthquakes, and intentional acts.

- HO-4 (Contents Broad Form): Inclusions typically include personal property coverage, liability coverage, and additional living expenses. Exclusions commonly include damage to the building structure, floods, earthquakes, and intentional acts.

- HO-6 (Condominium Owner’s Coverage): Inclusions typically include personal property coverage, improvements and alterations coverage, and liability coverage. Exclusions commonly include damage to the building structure, common areas, floods, earthquakes, and intentional acts.

Average Cost Variations and Coverage Limits

The cost of home insurance varies significantly based on several factors, including the policy type, coverage limits, location, and the homeowner’s risk profile. The following table provides a general estimate of average annual costs. Note that these are illustrative examples and actual costs may vary considerably.

| Policy Type | Coverage Limit (Dwelling) | Average Annual Cost (Estimate) | Notes |

|---|---|---|---|

| HO-3 | $300,000 | $1,200 – $1,800 | Costs vary widely based on location and risk factors. |

| HO-4 | N/A (Renters Insurance) | $200 – $500 | Primarily covers personal property. |

| HO-6 | $100,000 (Improvements/Alterations) | $500 – $1,000 | Covers personal property and improvements to the condo unit. |

Illustrative Examples of Average Costs

Understanding the average cost of home insurance is crucial, but it’s important to remember that this is just a starting point. Numerous factors influence the final premium, making a broad average less informative than a personalized assessment based on your specific circumstances. The following examples illustrate how these factors impact the cost.

Scenario Variations and Their Impact on Home Insurance Costs

This section presents three hypothetical scenarios to demonstrate how different factors affect home insurance premiums. Each scenario highlights specific characteristics and their resulting cost implications.

Scenario 1: The Suburban Family Home

Imagine a family living in a suburban neighborhood in a relatively low-risk area for natural disasters. Their home is a 2,500 square foot, single-family dwelling, 15 years old, with a market value of $400,000. They have a good credit score and have never filed a home insurance claim. Their chosen policy includes standard coverage with a $1,000 deductible. In this scenario, their estimated annual premium might be around $1,200. The low-risk location, good credit, and lack of claims history contribute to a lower premium.

Scenario 2: The Coastal Condo

Consider a condo owner living in a coastal area prone to hurricanes and flooding. Their 1,200 square foot condo is valued at $300,000 and is located in a high-risk zone. They have an average credit score and have filed one minor claim in the past five years. They opt for a comprehensive policy with higher coverage limits and a $500 deductible to better protect against potential losses from natural disasters. In this case, their annual premium could be significantly higher, perhaps around $2,500. The higher risk location, the past claim, and the comprehensive coverage all contribute to the increased cost.

Scenario 3: The Older Victorian Home

Let’s examine a homeowner with a 3,000 square foot Victorian home, 80 years old, valued at $600,000, located in a moderate-risk area. This home requires more extensive repairs and maintenance due to its age. The homeowner has excellent credit but has filed two claims in the past ten years, one for a minor incident and one for a more significant roof repair. They choose a policy with high coverage and a $1,000 deductible. Their annual premium might fall around $1,800. The age of the home, previous claims, and the higher value contribute to a premium higher than the suburban home, despite the moderate-risk location and good credit.

Visual Representation of Cost Differences

A bar graph could effectively illustrate these cost differences. The horizontal axis would represent the three scenarios (Suburban Home, Coastal Condo, Older Victorian Home), and the vertical axis would represent the annual premium. Three bars would be displayed, each corresponding to a scenario, with their heights proportional to the estimated premiums ($1,200, $2,500, and $1,800, respectively). This visual would clearly demonstrate how location, home characteristics, and claim history significantly impact the final cost. A second graph could show how the premium changes with varying coverage levels (e.g., basic, standard, comprehensive) for a single scenario, demonstrating the cost-benefit trade-off between coverage and premium. This second graph would display a line graph where the x-axis shows coverage levels and the y-axis represents the premium. The line would show an upward trend, indicating increasing premiums with higher coverage levels.

Last Point

Ultimately, finding the right home insurance policy involves a careful balance between adequate coverage and affordability. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and negotiating effectively, you can secure comprehensive protection without breaking the bank. Remember, proactive planning and informed decision-making are key to obtaining the best value for your home insurance investment. This guide provides the tools and knowledge you need to navigate this crucial financial decision with confidence.

Q&A

What is the average cost of home insurance in the US?

The average cost varies significantly depending on location, home value, coverage, and individual risk factors. It’s impossible to give a single national average, but expect to pay anywhere from a few hundred to over a thousand dollars annually.

How often can I expect my home insurance premiums to change?

Premiums are typically reviewed and adjusted annually. Changes can reflect factors like claims history, changes in your property, or shifts in the overall insurance market.

Can I get home insurance if I have a poor credit score?

Yes, but a poor credit score will likely result in higher premiums. Insurers consider credit history as an indicator of risk. However, you can still find coverage, though it may be more expensive.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacing damaged property, regardless of depreciation.