Navigating the world of car insurance can feel like driving through a dense fog. Understanding the average monthly cost is crucial, but the price varies wildly depending on numerous factors. This guide illuminates the key elements that influence your premium, helping you become a more informed and savvy consumer.

From age and driving history to the type of car you drive and where you live, numerous variables impact your monthly insurance bill. We’ll explore these factors in detail, providing clear explanations and insightful comparisons to empower you with the knowledge to make smart choices about your car insurance.

Factors Influencing Monthly Car Insurance Costs

Several factors significantly influence the monthly cost of car insurance. Understanding these factors can help you make informed decisions and potentially save money on your premiums. These factors interact in complex ways, so it’s not always a simple case of adding or subtracting individual impacts.

Age and Car Insurance Premiums

Younger drivers typically pay higher premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on historical data, and this data shows a higher accident rate among inexperienced drivers. As drivers gain experience and reach a certain age (usually around 25), their premiums tend to decrease significantly. This reflects the reduced risk associated with more mature and experienced drivers. For example, a 18-year-old might pay double what a 35-year-old pays for the same coverage on a similar vehicle.

Driving History’s Impact on Insurance Costs

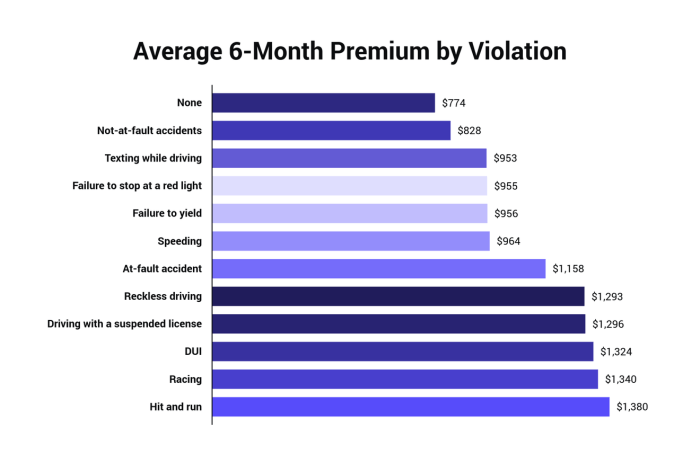

A clean driving record is crucial for keeping insurance costs low. Accidents and traffic violations significantly increase premiums. The severity of the accident and the number of infractions directly impact the increase. For instance, a single at-fault accident could lead to a premium increase of 20-40%, while multiple speeding tickets might result in even higher increases. Maintaining a clean driving record is the most effective way to keep insurance costs manageable.

Insurance Rates for Different Car Makes and Models

The make and model of your car significantly impact your insurance premiums. Insurance companies consider factors such as the car’s safety features, repair costs, theft rate, and its overall value. Luxury cars and sports cars, generally, are more expensive to insure due to higher repair costs and a greater likelihood of theft. Conversely, smaller, more fuel-efficient cars often have lower insurance rates. For example, insuring a high-performance sports car might cost significantly more than insuring a compact sedan.

Location’s Influence on Insurance Premiums

Your location plays a significant role in determining your car insurance rates. Areas with high crime rates, a higher frequency of accidents, or a greater likelihood of natural disasters typically have higher insurance premiums. Urban areas often have higher rates than rural areas due to increased traffic congestion and the higher probability of accidents and theft. This reflects the increased risk that insurance companies perceive in certain geographical locations.

Effect of Coverage Levels on Monthly Payments

The level of coverage you choose directly affects your monthly premiums. Liability coverage, which protects others in case you cause an accident, is typically the most basic and least expensive. Collision and comprehensive coverage, which protect your vehicle in accidents and against other damage (respectively), are optional but significantly increase your monthly payments. Higher coverage limits also lead to higher premiums. Choosing the right balance between coverage and affordability is crucial.

Average Monthly Cost for Different Coverage Levels

| Coverage Level | Liability Only | Liability + Collision | Liability + Collision + Comprehensive |

|---|---|---|---|

| Average Monthly Cost (Estimate) | $50-$100 | $100-$175 | $150-$250 |

*Note: These are estimates and actual costs can vary significantly based on the factors discussed above. These figures are based on averages from various insurance comparison websites and are intended to illustrate general trends, not provide exact pricing.

Average Costs by Driver Profile

Car insurance premiums are rarely uniform; they vary significantly depending on the driver’s profile. Several factors contribute to this variation, leading to a wide range of monthly costs. Understanding these variations can help drivers better anticipate and manage their insurance expenses.

Average Monthly Cost for Young Drivers (Under 25)

Young drivers typically face significantly higher insurance premiums than older drivers. This is primarily due to their statistically higher accident rates and lack of driving experience. Insurance companies perceive them as higher risk, resulting in increased premiums. The average monthly cost for drivers under 25 can range from $150 to $300 or even more, depending on factors such as location, vehicle type, and driving record. In some cases, high-risk young drivers might pay significantly more. For example, a young driver with a sports car in a large city could easily exceed $300 per month.

Average Monthly Cost for Experienced Drivers (Over 55)

Experienced drivers, those over 55, generally benefit from lower insurance premiums. Years of safe driving and a proven track record contribute to this lower cost. Insurance companies view them as lower-risk drivers, leading to reduced premiums. The average monthly cost for this group can range from $80 to $150, but this varies depending on other factors like the type of vehicle insured and the driver’s location. A driver with a long history of accident-free driving in a rural area might pay significantly less than the average.

Average Monthly Cost for Male vs. Female Drivers

Historically, male drivers have faced higher insurance premiums than female drivers. This disparity is often attributed to statistical differences in accident rates and claims. While the gap is narrowing in some regions, it’s still a factor in many insurance calculations. The exact difference varies by location and other factors, but generally, men might pay slightly more than women for comparable coverage. It is important to note that this is a broad generalization, and individual rates depend on numerous other factors.

Average Monthly Cost for Drivers with Good Credit vs. Poor Credit

Credit history is increasingly used by insurance companies to assess risk. Drivers with good credit scores often qualify for lower premiums, reflecting the idea that responsible financial behavior correlates with responsible driving. Conversely, those with poor credit scores may face significantly higher premiums. The difference can be substantial; a driver with excellent credit might pay hundreds of dollars less annually than a driver with poor credit, even if all other factors are identical.

Additional Factors Influencing Average Monthly Cost Based on Driver Profile

Several additional factors, beyond age and gender, significantly influence car insurance costs based on individual driver profiles:

- Driving Record: Accidents, tickets, and DUI convictions substantially increase premiums.

- Type of Vehicle: Expensive or high-performance vehicles generally lead to higher premiums.

- Location: Insurance rates vary widely by state, city, and even neighborhood due to differences in accident rates and crime.

- Coverage Level: Choosing higher coverage limits (liability, collision, comprehensive) results in higher premiums.

- Driving Habits: Telematics programs that track driving behavior can influence premiums; safer driving habits can lead to discounts.

- Marital Status: In some cases, married individuals might receive slightly lower rates.

- Occupation: Certain high-risk occupations may lead to higher premiums.

Understanding Insurance Quotes and Policies

Choosing the right car insurance policy can feel overwhelming, but understanding the different types of coverage, policy terms, and how to compare quotes empowers you to make informed decisions and find the best protection for your needs and budget. This section will guide you through the process of navigating insurance quotes and policies.

Types of Car Insurance Policies

Car insurance policies offer various levels of coverage, each designed to protect you in different scenarios. Common types include liability coverage (which covers damages you cause to others), collision coverage (which covers damage to your car in an accident, regardless of fault), comprehensive coverage (which covers damage to your car from events other than collisions, such as theft or vandalism), and uninsured/underinsured motorist coverage (which protects you if you’re involved in an accident with a driver who lacks or has insufficient insurance). The specific types and levels of coverage available will vary depending on your location and insurance provider.

Common Terms and Conditions in Car Insurance Policies

Car insurance policies contain numerous terms and conditions that define the scope of coverage, your responsibilities, and the insurer’s obligations. Key terms often include deductibles (the amount you pay out-of-pocket before your insurance coverage kicks in), premiums (the regular payments you make for your insurance), policy limits (the maximum amount your insurance will pay for a claim), and exclusions (specific events or circumstances not covered by the policy). Carefully reviewing these terms ensures you understand your rights and responsibilities. For example, a policy might exclude coverage for damage caused while driving under the influence of alcohol or drugs.

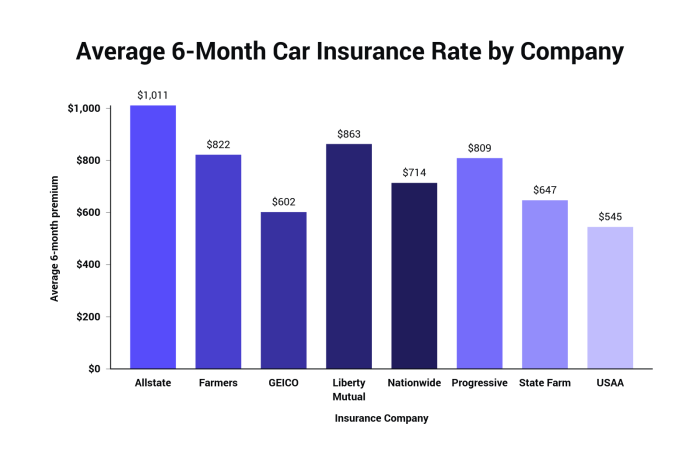

Comparing Insurance Quotes from Different Providers

Obtaining quotes from multiple insurance providers is crucial for finding the best value. Many online comparison tools allow you to enter your information once and receive quotes from various insurers simultaneously. When comparing quotes, focus on the total cost, considering deductibles and premiums, as well as the level of coverage offered. Don’t solely focus on the lowest price; ensure the coverage adequately meets your needs. For instance, a cheaper policy with a high deductible might ultimately cost more if you have an accident.

Key Factors to Consider When Choosing a Car Insurance Policy

Selecting the right policy involves considering several factors. Your driving history (including accidents and violations), the type of car you drive, your location (some areas have higher accident rates), and your coverage needs all influence the cost and suitability of different policies. Your age and credit score can also play a role in determining your premium. For example, drivers with clean driving records typically receive lower premiums than those with multiple accidents or violations.

Comparison of Key Policy Features

| Policy Type | Coverage | Typical Cost (Monthly Estimate) | Deductible Options |

|---|---|---|---|

| Liability Only | Covers injuries and damages to others | $30 – $80 | Not applicable |

| Liability + Collision | Covers damages to your car and others | $80 – $150 | $250, $500, $1000+ |

| Full Coverage (Liability + Collision + Comprehensive) | Covers damages to your car from accidents, theft, vandalism, etc., and damages to others | $150 – $300+ | $250, $500, $1000+ |

| Liability + Uninsured/Underinsured Motorist | Covers damages caused by uninsured or underinsured drivers | $50 – $120 | Not applicable (usually) |

Saving Money on Car Insurance

Reducing your monthly car insurance premiums can significantly impact your budget. Several strategies can help you lower your costs, from making lifestyle changes to leveraging available discounts. Understanding these strategies empowers you to make informed decisions and potentially save hundreds of dollars annually.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, is a common and effective way to save money. Insurance companies often offer discounts for bundling because it simplifies their administration and reduces the risk of multiple claims from the same customer. These discounts can vary significantly depending on the insurer and the specific policies bundled, but they frequently represent a substantial percentage reduction in your overall premium. For example, a customer might receive a 10-15% discount by bundling their car and home insurance.

Defensive Driving Courses

Completing a defensive driving course can lead to lower insurance premiums. These courses teach safe driving techniques and accident avoidance strategies, demonstrating to insurers your commitment to safe driving practices. Many insurance companies offer discounts to drivers who complete an approved course, recognizing the reduced risk associated with better-trained drivers. The specific discount amount will vary by insurer and the course taken, but it often represents a meaningful reduction in your annual cost.

Discounts for Good Drivers and Students

Many insurance companies offer discounts based on your driving record and academic achievements. Good student discounts are typically available to students maintaining a certain GPA, reflecting the lower risk associated with responsible students. Similarly, safe driver discounts reward drivers with clean driving records, free from accidents and traffic violations, over a specified period. These discounts can be substantial, sometimes reaching 15-20% or more off your premium. Eligibility criteria vary by insurance provider, so it’s essential to check with your insurer about specific requirements.

Calculating Potential Savings

The following table illustrates potential savings using various strategies. These are examples and actual savings will vary depending on your individual circumstances and insurance provider.

| Strategy | Potential Savings (%) | Example Premium (Annual) | Savings (Annual) |

|---|---|---|---|

| Bundling (Home & Auto) | 15% | $1200 | $180 |

| Defensive Driving Course | 10% | $1080 (after bundling) | $108 |

| Good Student Discount | 10% | $972 (after bundling & course) | $97.20 |

| Total Potential Savings | 35% | $1200 | $485.20 |

Illustrative Examples of Monthly Costs

Understanding the factors influencing car insurance costs is crucial, but seeing real-world examples helps solidify this understanding. The following scenarios illustrate how different driver profiles and circumstances can significantly impact monthly premiums. Remember that these are examples, and actual costs will vary based on numerous factors and specific insurer policies.

Young Driver with a Speeding Ticket

Consider a 20-year-old driver with a newly acquired license and a recent speeding ticket. Insurance companies view young drivers as higher risk due to inexperience. Adding a speeding ticket further increases this perceived risk. This driver might expect to pay significantly more than an older, experienced driver with a clean record. For instance, their monthly premium could be $150-$250 higher than a comparable driver with a clean record, potentially reaching $200-$350 per month depending on the severity of the speeding ticket, the car’s value, and the coverage chosen. This substantial increase reflects the higher likelihood of accidents associated with young drivers and the added risk associated with traffic violations.

Older Driver with a Clean Driving Record

Conversely, a 55-year-old driver with a spotless driving record for over 20 years will likely enjoy much lower monthly premiums. Insurance companies view older drivers with clean records as statistically less likely to be involved in accidents. This driver might pay between $75 and $150 per month for comprehensive coverage, depending on the car’s value and location. This lower cost reflects the lower risk profile associated with this demographic.

Comparison of Monthly Costs Across Different Scenarios

Imagine a bar graph visualizing monthly car insurance costs. The horizontal axis represents the scenarios, and the vertical axis represents the monthly premium in dollars. One bar represents a young driver (20 years old) in a city driving a high-performance sports car. This bar would be the tallest, representing the highest cost, perhaps around $300-$400 per month. Another bar represents an older driver (55 years old) in a rural area driving a compact, fuel-efficient car. This bar would be significantly shorter, representing a much lower cost, possibly around $80-$120 per month. A third bar could compare the cost of insuring a low-cost sedan versus a luxury SUV for a similar driver profile (e.g., a 35-year-old with a clean record in a suburban area). The luxury SUV would have a taller bar reflecting the higher cost of insuring a more expensive vehicle, potentially a difference of $50-$100 per month compared to the sedan. Finally, a fourth bar would illustrate the difference in cost for the same driver and car, but comparing city driving to rural driving. The city driving bar would be taller, reflecting the increased risk associated with higher traffic density and more frequent accidents. This visual representation clearly illustrates how various factors interact to influence the final cost.

Final Thoughts

Ultimately, the average cost for car insurance per month is a highly personalized figure. By understanding the factors discussed—your driving record, vehicle type, location, and coverage choices—you can gain a clearer picture of what to expect and take proactive steps to manage your premiums effectively. Armed with this information, you can confidently shop for the best car insurance policy to fit your needs and budget.

FAQ

What is the cheapest type of car insurance?

Liability-only insurance is typically the cheapest, but it offers the least coverage. Consider your risk tolerance before opting for minimal coverage.

How often are car insurance rates reviewed?

This varies by insurer and location, but many companies review rates annually or even more frequently, depending on factors like claims history and driving record changes.

Can I get car insurance without a credit check?

Some insurers offer policies that don’t explicitly use credit scores, but your driving history and other factors will still heavily influence your rate.

What happens if I miss a car insurance payment?

Missing payments can lead to policy cancellation, penalties, and difficulty obtaining future insurance. Contact your insurer immediately if you anticipate payment problems.