Navigating the world of auto insurance can feel like driving through a dense fog. Understanding average monthly costs is crucial for budgeting and making informed decisions. This guide delves into the key factors influencing your premiums, helping you decipher the complexities and find the best coverage for your needs. We’ll explore everything from age and driving history to vehicle type and location, equipping you with the knowledge to secure affordable and comprehensive auto insurance.

From comparing different coverage types and deductibles to leveraging discounts and negotiating rates, we aim to empower you to take control of your auto insurance expenses. We’ll examine various strategies for finding the best deals and understanding your policy, ultimately helping you save money and drive with confidence.

Factors Influencing Monthly Auto Insurance Costs

Several key factors contribute to the variation in monthly auto insurance premiums. Understanding these factors can help drivers make informed decisions and potentially save money on their insurance costs. These factors interact in complex ways, so it’s impossible to predict your exact premium without a specific quote from an insurer. However, understanding the general impact of each factor provides valuable insight.

Age and Insurance Premiums

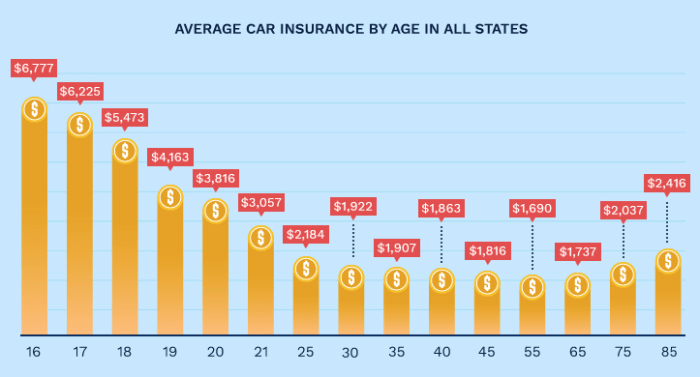

Younger drivers generally pay higher insurance premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on this data, and higher risk translates to higher premiums. As drivers age and gain experience, their accident rates tend to decrease, leading to lower premiums. The sweet spot for lower premiums is often in the mid-30s to mid-50s, after which premiums may start to increase slightly again due to factors like potential health concerns affecting driving ability.

Driving History’s Impact on Costs

A clean driving record is crucial for maintaining low insurance premiums. Accidents and traffic violations significantly increase your risk profile in the eyes of insurance companies. Each accident or ticket results in a higher premium, and multiple incidents can lead to substantially increased costs or even policy cancellation. The severity of the accident or violation also matters; a major accident will have a more significant impact than a minor fender bender or a speeding ticket. Maintaining a spotless driving record is the best way to keep insurance costs down.

Insurance Rates for Different Car Types

The type of vehicle you drive significantly impacts your insurance premiums. Generally, sedans tend to have lower insurance rates than SUVs or sports cars. This is because sports cars are often more expensive to repair and are statistically involved in more accidents due to their higher performance capabilities. SUVs, while safer in some respects, are also more expensive to repair than sedans. The cost of parts and the likelihood of higher repair bills directly influence insurance premiums.

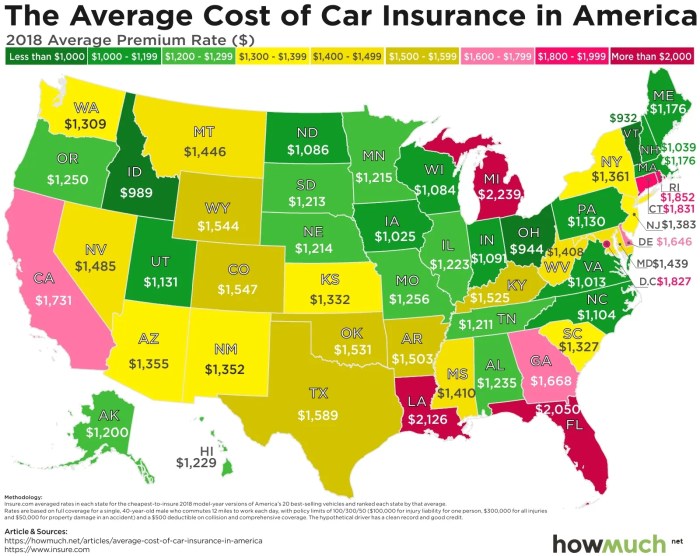

Location and Insurance Premiums

Your location plays a significant role in determining your insurance rates. Urban areas generally have higher premiums than rural areas. This is due to a higher concentration of vehicles, increased traffic congestion, and a greater likelihood of accidents and theft in densely populated areas. Rural areas typically have lower accident rates and lower vehicle theft rates, resulting in lower insurance premiums.

Credit Score’s Influence on Insurance Costs

In many states, your credit score is a factor in determining your auto insurance premium. Insurers use credit scores as an indicator of risk, with those who have good credit often receiving lower premiums. This is because individuals with good credit are statistically more likely to pay their bills on time, which is viewed as a positive indicator of responsible behavior, including responsible driving. Improving your credit score can lead to lower insurance premiums.

Average Monthly Premiums Based on Driver Profiles

| Driver Profile | Age | Driving History | Vehicle Type | Average Monthly Premium |

|---|---|---|---|---|

| Young Driver | 20 | One accident, one speeding ticket | Sports Car | $250 |

| Experienced Driver | 45 | Clean record | Sedan | $80 |

| Mature Driver | 60 | One minor accident 5 years ago | SUV | $120 |

| New Driver | 18 | Clean record | Sedan | $150 |

Types of Auto Insurance Coverage and Their Costs

Understanding the different types of auto insurance coverage and their associated costs is crucial for making informed decisions about your policy. Choosing the right coverage depends on your individual needs, risk tolerance, and budget. This section will break down common coverage types, explore how deductibles influence premiums, and compare the monthly costs of various coverage levels.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or property damage to others. It typically covers bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s vehicle or property. The amount of liability coverage you carry is usually expressed as a three-number set (e.g., 25/50/25), representing the maximum amounts paid out for bodily injury per person ($25,000), bodily injury per accident ($50,000), and property damage per accident ($25,000). Higher liability limits generally result in higher premiums. For example, increasing your liability coverage from 25/50/25 to 100/300/100 significantly increases protection but will also increase your monthly premium.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This means that even if you cause the accident, your insurance will cover the damage to your own car. The deductible you choose significantly impacts your premium. A higher deductible (the amount you pay out-of-pocket before your insurance kicks in) will result in a lower monthly premium. For example, choosing a $1,000 deductible instead of a $500 deductible might save you $10-$20 per month, but you’ll pay more if you need to file a claim.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or weather-related damage. Similar to collision coverage, your deductible influences the premium. A higher deductible lowers your monthly premium, but increases your out-of-pocket expense in the event of a claim. For instance, a $500 deductible on comprehensive coverage might be $15-$25 per month cheaper than a $250 deductible, but you’ll have to pay more in case of a covered incident.

Deductible Amounts and Monthly Premiums

The amount you choose for your deductible directly impacts your monthly premium. A higher deductible means a lower premium, and vice versa. This is because you are accepting more financial responsibility in the event of a claim. The relationship isn’t always linear; the savings from increasing your deductible often diminish at higher levels.

Monthly Costs of Different Coverage Levels

Minimum coverage typically includes only the state-mandated liability insurance, providing minimal protection. Full coverage includes liability, collision, and comprehensive coverage, offering maximum protection. The difference in monthly costs can be substantial. For example, minimum coverage might cost $50-$75 per month, while full coverage could cost $150-$300 or more, depending on factors like your driving record, vehicle, and location.

Average Monthly Costs for Various Coverage Combinations

| Coverage | Deductible (Collision/Comprehensive) | Average Monthly Cost (Estimate) | Notes |

|---|---|---|---|

| Liability Only (Minimum) | N/A | $50 – $75 | State minimum requirements vary |

| Liability + Collision | $500/$500 | $100 – $150 | Cost increases with lower deductibles |

| Liability + Collision + Comprehensive | $500/$500 | $150 – $250 | Full coverage, higher cost, greater protection |

| Liability + Collision + Comprehensive | $1000/$1000 | $120 – $200 | Full coverage, lower cost due to higher deductible |

*Note: These are average estimates and actual costs can vary significantly based on individual circumstances.

Finding the Best Auto Insurance Rates

Securing the most affordable auto insurance requires a proactive approach. By employing effective comparison strategies, carefully considering various factors, and understanding policy details, you can significantly reduce your annual premiums. This section Artikels key steps to achieving optimal insurance rates.

Comparing Insurance Quotes

To obtain the best rates, it’s crucial to compare quotes from multiple insurance providers. Avoid relying on a single quote, as rates vary considerably depending on the company’s risk assessment and pricing models. Utilize online comparison tools that allow you to input your information once and receive quotes from several insurers simultaneously. This saves time and effort. Remember to check the fine print of each quote, as advertised rates may not reflect all applicable fees or discounts. Contacting insurers directly may also reveal additional discounts or promotions not readily available online.

Factors to Consider When Choosing an Insurance Company

Selecting an insurance company involves more than just the price. Several crucial factors should be weighed before committing to a policy. These include the company’s financial stability (rated by agencies like A.M. Best), customer service reputation (check online reviews and ratings), claims handling process (how efficiently and fairly they resolve claims), and the breadth and depth of coverage options offered. Consider the availability of additional services, such as roadside assistance or accident forgiveness programs, which can add value beyond the basic coverage. A financially sound company with a strong track record of customer satisfaction and efficient claims processing is a safer and more reliable choice in the long run.

Negotiating Lower Insurance Premiums

Negotiating lower premiums is often possible, particularly if you have a clean driving record and maintain good credit. Begin by obtaining quotes from multiple insurers and use these as leverage during negotiations. Highlight any safety features in your vehicle, such as anti-theft devices or advanced safety systems, as these can qualify you for discounts. Consider increasing your deductible; a higher deductible generally results in lower premiums. Bundle your auto insurance with other policies, such as homeowners or renters insurance, to take advantage of potential discounts. Finally, inquire about any available discounts based on your occupation, education, or affiliations with specific organizations.

Understanding and Interpreting Insurance Policy Documents

Insurance policies can be complex, but understanding the key provisions is vital. Pay close attention to the declarations page, which summarizes your coverage details, including the policy period, covered vehicles, and premiums. Carefully review the policy’s definitions of coverage, especially for liability, collision, and comprehensive coverage. Understand the limits of liability, which determine the maximum amount the insurer will pay for damages caused by an accident. Familiarize yourself with the claims process Artikeld in the policy, including steps to take in case of an accident. If anything is unclear, don’t hesitate to contact your insurer for clarification.

Benefits of Bundling Insurance Policies

Bundling your auto and home insurance policies with the same insurer often leads to significant savings. Many insurers offer discounts for bundling, recognizing that a multi-policy customer presents less risk and is more likely to remain a loyal customer. The convenience of managing both policies under one provider is an added benefit. This simplifies billing and communication, and it can also streamline the claims process if you experience damage to both your vehicle and your home in a single incident. The discount amount varies depending on the insurer and your specific policies, but it’s often a substantial percentage, making bundling a financially sound decision for many.

Understanding Insurance Discounts and Savings

Securing affordable auto insurance often involves more than just choosing the right coverage; it’s about strategically leveraging available discounts and savings opportunities. Many insurers offer a range of discounts designed to reward safe driving habits, academic achievement, and responsible vehicle ownership. Understanding these discounts and how they impact your premium is crucial for minimizing your monthly costs.

Common Insurance Discounts

Several common discounts can significantly reduce your auto insurance premiums. These discounts are typically offered by most major insurance providers and can combine to create substantial savings. For example, a safe driver discount rewards drivers with clean driving records, often offering a percentage reduction based on years without accidents or moving violations. Good student discounts are available to students maintaining a certain GPA, recognizing their responsible behavior. Multi-car discounts incentivize insuring multiple vehicles under the same policy, streamlining administration and reducing risk for the insurer.

Impact of Usage-Based Insurance Programs

Usage-based insurance (UBI) programs, also known as pay-per-mile or telematics programs, are increasingly popular. These programs utilize technology, often through a smartphone app or a device plugged into your car, to track your driving habits. Factors like mileage driven, speed, braking habits, and time of day driving are monitored. Drivers with safer driving patterns typically receive lower premiums, reflecting their reduced risk profile. Conversely, those with less-safe driving habits may see higher premiums. For instance, a driver who consistently drives at high speeds or brakes harshly might see a higher premium compared to a driver with a smoother driving style. The specific savings vary greatly depending on the insurer and the individual’s driving behavior.

Savings from Defensive Driving Courses

Completing a state-approved defensive driving course can lead to notable savings on your auto insurance. Many insurers offer discounts to drivers who demonstrate a commitment to improving their driving skills and knowledge of traffic laws. These courses often cover topics such as safe driving techniques, hazard recognition, and defensive driving strategies. The discount amount varies depending on the insurer and the specific course. For example, a driver who completes a course and provides proof of completion might receive a 10% discount on their premium for a year.

Impact of Anti-theft Devices

Installing anti-theft devices in your vehicle can significantly reduce your insurance premiums. Insurers recognize that vehicles equipped with these devices are less likely to be stolen, leading to lower claim payouts. The types of anti-theft devices that qualify for discounts vary by insurer, but common examples include alarm systems, immobilizers, and GPS tracking systems. The discount offered often depends on the type and quality of the anti-theft device installed. A sophisticated GPS tracking system might result in a larger discount than a basic alarm system.

Ways to Reduce Monthly Insurance Expenses

Several strategies can help lower your monthly auto insurance costs.

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Bundle insurance policies: Combine auto insurance with home or renters insurance.

- Increase your deductible: A higher deductible typically results in lower premiums.

- Shop around and compare rates: Obtain quotes from multiple insurers.

- Consider a less expensive vehicle: Certain car models are cheaper to insure than others.

- Pay your premiums on time: Avoid late payment fees and potential increases in premiums.

- Explore different coverage options: Adjust your coverage levels to match your needs and budget.

- Maintain good credit: Credit history often impacts insurance rates.

Visual Representation of Average Monthly Costs

Understanding the average cost of auto insurance requires visualizing the data. Visual representations, such as charts and graphs, offer a clear and concise way to comprehend how various factors influence monthly premiums. Below, we explore two key visual representations illustrating average monthly insurance costs.

Average Monthly Insurance Costs by Age Group

This bar graph illustrates how average monthly auto insurance premiums change across different age groups. The horizontal axis represents the age groups, categorized in five-year intervals (e.g., 16-20, 21-25, 26-30, etc., extending to 65+). The vertical axis represents the average monthly premium cost, measured in US dollars. Each bar represents a specific age group, with its height corresponding to the average monthly premium for that group. For example, the bar representing the 16-20 age group would likely be significantly taller than the bar for the 31-35 age group, reflecting the higher risk associated with younger drivers. Data points would be clearly labeled above each bar, showing the precise average cost for each age range. The graph would visually demonstrate the general trend of higher premiums for younger drivers, gradually decreasing as drivers age and gain experience, before potentially leveling off or slightly increasing in the older age brackets.

Average Monthly Premiums by Vehicle Type

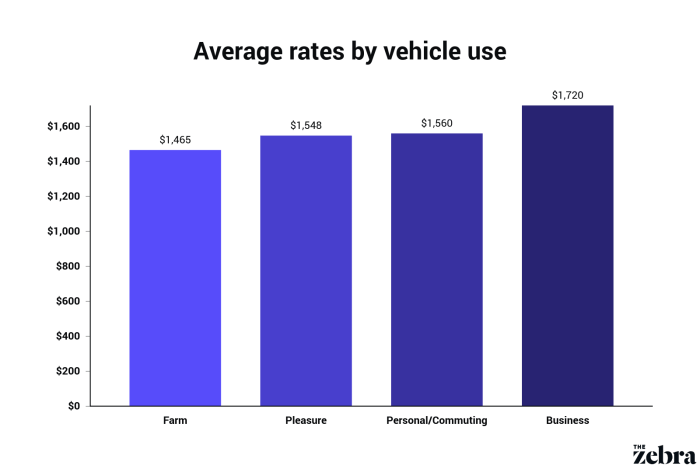

A column chart effectively compares average monthly premiums for different vehicle types. The horizontal axis displays various vehicle categories (e.g., Sedan, SUV, Truck, Sports Car, Minivan). The vertical axis, again, represents the average monthly premium in US dollars. Each column represents a vehicle type, its height corresponding to the average monthly premium for that category. For instance, a sports car would likely have a taller column than a sedan, indicating higher insurance costs due to factors like higher repair costs and increased risk of accidents. Data points would be displayed atop each column, providing exact average premium values. The chart would clearly showcase the differences in insurance costs based on vehicle type, highlighting the impact of vehicle characteristics on premiums. This visual comparison allows for a quick understanding of how vehicle type influences the cost of insurance. For example, a hypothetical chart might show an average monthly premium of $100 for a sedan, $150 for an SUV, $200 for a sports car, and $120 for a minivan. These figures are illustrative and would vary depending on numerous other factors.

Wrap-Up

Securing affordable and suitable auto insurance requires careful consideration of numerous factors. By understanding the influence of your driving history, vehicle type, location, and credit score, you can proactively manage your premiums. Remember to actively compare quotes from different providers, explore available discounts, and choose coverage that aligns with your individual risk tolerance and financial capabilities. Armed with this knowledge, you can confidently navigate the insurance landscape and find the best auto insurance plan for your needs.

Key Questions Answered

What is the average cost of liability-only insurance?

The average cost of liability-only insurance varies greatly depending on location, driver profile, and coverage limits, but it’s generally significantly lower than full coverage.

How often can I expect my insurance rates to change?

Insurance rates can change annually, or even more frequently depending on your insurer and any changes in your driving record or risk profile.

Can I get insurance if I have a poor driving record?

Yes, but it will likely be more expensive. Companies specializing in high-risk drivers exist, though you’ll pay a premium for the coverage.

What is the difference between collision and comprehensive coverage?

Collision covers damage to your car in an accident, regardless of fault. Comprehensive covers damage from non-accident events like theft or weather.