Auto theft insurance is a crucial aspect of vehicle ownership, offering financial protection against the significant losses associated with vehicle theft. Understanding the nuances of this coverage, from policy details to preventative measures, empowers car owners to make informed decisions and safeguard their investment. This guide delves into the complexities of auto theft insurance, providing a clear and concise overview of its various facets.

We’ll explore the differences between comprehensive and collision coverage, examine the factors influencing premium costs (including vehicle type, driver history, and credit score), and Artikel the claims process step-by-step. Furthermore, we will discuss proactive strategies for theft prevention, including technological advancements and safe driving habits, to help you minimize your risk and protect your vehicle.

Defining Auto Theft Insurance

Auto theft insurance is a crucial component of a comprehensive auto insurance policy, offering financial protection against the loss or damage of your vehicle due to theft. It helps cover the costs associated with replacing or repairing your vehicle, potentially minimizing significant financial burdens in the event of theft. Understanding the nuances of this coverage is key to ensuring you have adequate protection.

Auto theft insurance typically covers the actual cash value (ACV) of your vehicle at the time of the theft. This means the insurer will compensate you for the value of your car, minus depreciation, to replace it with a similar vehicle. Some policies might offer additional coverage for things like towing, storage fees, or even a rental car while your vehicle is being replaced.

Comprehensive Versus Collision Coverage and Theft

Comprehensive coverage and collision coverage are two distinct types of auto insurance that address different scenarios. While both can play a role in a theft claim, their scope differs significantly. Comprehensive coverage protects against losses due to events outside of a collision, including theft, vandalism, fire, and natural disasters. Collision coverage, on the other hand, only applies to damage caused by an accident involving another vehicle or object. Therefore, if your car is stolen, your comprehensive coverage will likely cover the loss, whereas your collision coverage would not be applicable. If your car is damaged during a theft (e.g., broken window), both comprehensive and collision coverage might be relevant depending on your policy and the specific circumstances.

Comparison of Auto Theft Insurance Policies Across Providers

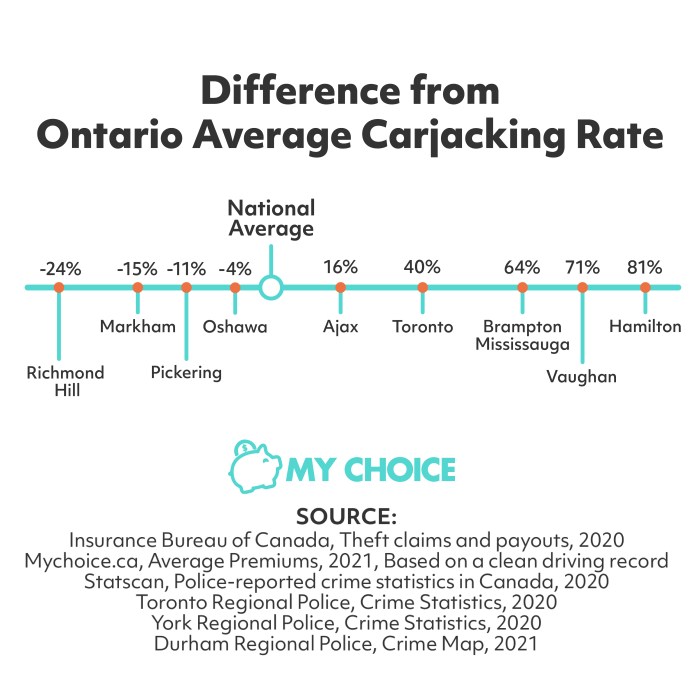

Different insurance providers offer varying levels of coverage and pricing for auto theft insurance. Factors influencing premiums include your vehicle’s make, model, year, and location, as well as your driving history and credit score. For example, a high-value luxury car parked in a high-crime area will likely command a higher premium compared to an older, less valuable vehicle in a low-crime area. Direct comparison of specific providers is beyond the scope of this content; however, it’s advisable to obtain quotes from multiple insurers to find the most suitable and cost-effective policy. You can typically use online comparison tools to streamline this process.

Common Exclusions in Auto Theft Insurance Policies

While auto theft insurance provides substantial protection, it’s crucial to be aware of common exclusions. These exclusions often vary depending on the specific policy and provider, but some frequent examples include:

- Theft of items from within the vehicle: Unless you have separate coverage for personal belongings, the insurer generally won’t reimburse you for stolen items from inside your car.

- Theft due to negligence: If your vehicle is stolen because you left the keys in the ignition, the claim might be denied or partially denied.

- Theft by someone with access to the vehicle: If a family member or someone you authorized to use your vehicle steals it, the claim might be rejected.

- Lack of proper reporting: Failing to report the theft promptly to both the police and your insurance company can impact your claim.

It is essential to carefully review your policy documents to understand the specific terms, conditions, and exclusions applicable to your auto theft insurance coverage.

Factors Affecting Auto Theft Insurance Premiums

Several interconnected factors influence the cost of your auto theft insurance premium. Understanding these factors can help you make informed decisions and potentially secure more favorable rates. Insurance companies use sophisticated algorithms that weigh these elements to assess your risk and determine the appropriate premium.

The price you pay for auto theft insurance is not arbitrary; it’s a calculated reflection of the perceived risk you present to the insurer. This risk is determined by a combination of your vehicle’s characteristics, your driving history, and your personal financial profile. Let’s delve into the key elements.

Vehicle Characteristics

The make, model, and year of your vehicle significantly impact your auto theft insurance premium. Vehicles with a history of high theft rates will generally command higher premiums. This is because insurance companies face a greater likelihood of having to pay out claims for these vehicles. Conversely, vehicles less prone to theft attract lower premiums. The age of the vehicle also plays a role; older vehicles, especially those with less advanced security systems, are often considered higher risk.

Driver Demographics and History

Your age, driving history, and credit score are crucial factors in determining your auto theft insurance premium. Insurance companies consider these elements to assess your overall risk profile. Younger drivers, statistically, tend to have higher accident rates, leading to higher premiums. A clean driving record, on the other hand, typically results in lower premiums. Similarly, a good credit score often correlates with responsible behavior, which insurers view favorably.

Factor Impact Table

| Factor | Impact on Premium | Explanation | Example |

|---|---|---|---|

| Vehicle Make and Model | Higher for high-theft vehicles, lower for less desirable targets | Insurance companies track theft rates for specific car models. Popular, easily stolen models incur higher premiums. | A 2023 Honda Civic (high theft rate) will likely have a higher premium than a 2010 Toyota Camry (lower theft rate). |

| Vehicle Year | Higher for newer vehicles, lower for older vehicles (but potentially higher if older and high-theft) | Newer vehicles are more valuable and thus more attractive to thieves. Older vehicles, while less valuable, may have less sophisticated security features. | A 2023 SUV will likely cost more to insure than a 1998 sedan, but a 1998 sports car might cost more than a 2005 minivan due to theft risk. |

| Driver Age | Generally higher for younger drivers, lower for older drivers (with experience) | Younger drivers statistically have higher accident rates, increasing the insurer’s risk. | A 16-year-old driver will typically pay significantly more than a 40-year-old driver with a clean record. |

| Driving History | Higher for drivers with accidents or violations, lower for drivers with clean records | A history of accidents or traffic violations indicates a higher risk of future claims. | A driver with three speeding tickets will likely pay more than a driver with a spotless record. |

| Credit Score | Higher for low credit scores, lower for high credit scores | Credit score is used as an indicator of financial responsibility, influencing the insurer’s assessment of risk. | Individuals with excellent credit scores often qualify for discounts, while those with poor credit may face higher premiums. |

Filing a Claim for Auto Theft

Filing a claim for a stolen vehicle can be a stressful experience, but a methodical approach will help expedite the process and maximize your chances of receiving compensation. Remember to remain calm and follow the steps Artikeld below to ensure a smooth claim process. Accurate and timely reporting is crucial.

The process generally involves reporting the theft to the authorities, then contacting your insurance provider, and finally providing necessary documentation to support your claim. Each step is critical for a successful outcome.

Reporting the Stolen Vehicle to Authorities

Promptly reporting the theft to the police is the first and most crucial step. A police report serves as official documentation of the incident and is essential for your insurance claim. The police will take a statement, record details about your vehicle (make, model, VIN, license plate number), and may conduct an investigation. You’ll receive a case number, which you’ll need for your insurance claim. Be prepared to provide as much detail as possible, including the time and location of the theft, any witnesses, and any unusual circumstances surrounding the event. Keep a copy of the police report for your records.

Contacting Your Insurance Company

Once you have the police report, contact your insurance company immediately. They will have specific procedures for reporting a stolen vehicle. Be prepared to provide the police report number, your policy details, and a detailed description of your vehicle. The insurance company will guide you through the next steps in the claims process, which may include providing additional information or documentation. They may also assign a claims adjuster to your case.

Documentation Required for an Auto Theft Claim

To support your claim, you will need to provide comprehensive documentation. This typically includes:

- The police report detailing the theft.

- Your insurance policy details and contact information.

- Vehicle registration and title.

- Proof of ownership, such as purchase receipts or loan documents.

- Photos of your vehicle prior to the theft (if available).

- Any additional information that might help substantiate your claim, such as security camera footage or witness statements.

Gathering this documentation as soon as possible will expedite the claims process. The more complete your documentation, the smoother the process will be.

Receiving Compensation After a Successful Claim

After your claim is approved, the process of receiving compensation typically involves the following steps:

- Claim Assessment: The insurance company will assess the value of your stolen vehicle based on its make, model, year, mileage, condition, and market value at the time of the theft. They may use various valuation tools and resources to determine a fair market value.

- Settlement Offer: The insurance company will make a settlement offer based on their assessment. This offer may include the actual cash value (ACV) of the vehicle, minus any deductible you have.

- Negotiation (if necessary): If you disagree with the settlement offer, you can negotiate with the insurance company to reach a mutually acceptable amount. This may involve providing additional documentation or evidence to support your valuation.

- Payment: Once a settlement is agreed upon, the insurance company will issue a payment. This payment might be directly deposited into your bank account or issued as a check. The payment method will depend on your insurance company’s procedures.

The timeline for receiving compensation can vary depending on the complexity of the claim and the insurance company’s processing time. However, it is important to keep in regular contact with your insurance adjuster to track the progress of your claim.

Preventing Auto Theft

Auto theft is a significant concern for vehicle owners, resulting in financial losses and emotional distress. Proactive measures, however, can significantly reduce the risk of becoming a victim. By combining smart parking habits, effective security devices, and vehicle tracking systems, you can greatly enhance your vehicle’s protection.

Preventative Measures to Reduce Auto Theft Risk

Implementing simple yet effective preventative measures can dramatically decrease your chances of experiencing vehicle theft. These measures are often overlooked but contribute significantly to overall vehicle security. For example, always locking your car doors, even when briefly leaving the vehicle, is a fundamental step. Similarly, never leaving your keys in the ignition, even for a moment, is crucial. Furthermore, parking in well-lit, populated areas, especially at night, significantly reduces the opportunity for thieves. Finally, removing valuables from plain sight prevents opportunistic thefts; thieves are less likely to target a vehicle that appears to contain nothing of value.

Security Devices and Their Effectiveness

A range of security devices offers varying levels of protection against theft. The effectiveness of each device depends on factors such as the sophistication of the device itself and the determination of the thief.

- Steering Wheel Locks: These visible deterrents make it more difficult to steal the vehicle, discouraging opportunistic thieves. Their effectiveness, however, is limited against determined thieves with specialized tools.

- Alarm Systems: These systems trigger a loud alarm when unauthorized entry is detected, alerting nearby individuals and potentially deterring thieves. Modern alarm systems often incorporate sensors for both the interior and exterior of the vehicle.

- Immobilizers: These electronic devices prevent the engine from starting unless the correct key is used. They are often integrated into the vehicle’s ignition system and are highly effective in preventing theft.

- GPS Tracking Systems: While not a direct theft deterrent, these systems aid in vehicle recovery after theft. Their effectiveness depends on the system’s accuracy and the authorities’ ability to locate the vehicle.

Safe Parking Practices and Habits

Safe parking practices are crucial in preventing auto theft. Choosing well-lit and populated areas minimizes the risk of becoming a target. Parking in garages or secured parking lots whenever possible offers additional protection. Avoid parking in isolated areas or areas with poor visibility, as these locations are more attractive to thieves. Furthermore, being aware of your surroundings and avoiding parking near known high-crime areas can also significantly reduce the risk.

Vehicle Tracking Systems and Their Benefits

Vehicle tracking systems provide a valuable tool for recovering stolen vehicles. These systems use GPS technology to monitor the vehicle’s location in real-time.

- GPS Tracking Devices: These devices are often small and discreet, easily hidden within the vehicle. They transmit location data to a monitoring service, allowing authorities to track the stolen vehicle’s movements.

- Cellular Tracking Systems: These systems use cellular networks to transmit location data, providing broader coverage than GPS-only systems. This allows for tracking even in areas with weak GPS signals.

- Integrated Tracking Systems: Some modern vehicles come equipped with built-in tracking systems, providing seamless integration with the vehicle’s electronics. These systems often offer additional features, such as remote vehicle location and immobilization.

The benefits of vehicle tracking systems include increased chances of vehicle recovery and the potential to assist law enforcement in apprehending thieves. The data provided by these systems can be crucial in investigations and prosecutions.

Understanding Policy Exclusions and Limitations

Auto theft insurance, while offering crucial protection, isn’t a blanket guarantee against all losses. Policies contain exclusions and limitations that define what isn’t covered, or where coverage is capped. Understanding these specifics is vital to avoid disappointment during a claim. Failing to grasp these nuances can lead to significant financial burdens in the event of a theft.

While your policy aims to cover the financial impact of a stolen vehicle, certain circumstances may reduce or eliminate your compensation. These restrictions are typically Artikeld in the policy’s fine print, so careful review is essential before purchasing a policy. This section clarifies common exclusions and limitations to better inform you of your coverage.

Common Exclusions and Limitations

Several factors can limit or eliminate coverage for a stolen vehicle. For instance, many policies exclude theft from certain locations, such as unsecured areas or locations explicitly prohibited in the policy documents. Similarly, if the theft resulted from your negligence, such as leaving the keys in the ignition, coverage might be significantly reduced or denied entirely. Policies also often have limitations on the amount of compensation provided, particularly for older vehicles where depreciation significantly reduces the vehicle’s value. This means the payout might not fully cover the replacement cost. Furthermore, certain modifications or aftermarket additions might not be covered, even if they were professionally installed.

Scenarios Where Coverage Might Be Denied or Limited

Let’s consider some specific examples. Suppose your car is stolen from an unlocked garage that is clearly visible from the street. The insurer might argue that this represents negligence on your part, potentially leading to reduced coverage or a claim denial. Alternatively, if you fail to report the theft promptly as stipulated in your policy, this could also impact your claim. Another scenario is if your vehicle is stolen while parked in a high-crime area known for vehicle thefts, and you were aware of the risk. This knowledge of the risk could be used to argue that you failed to take reasonable precautions. Finally, if the theft investigation reveals evidence of fraud or misrepresentation on your part, your claim would likely be denied.

Scenarios Where Auto Theft Insurance Might Not Cover the Full Value of the Vehicle

Depreciation is a major factor. The insurance company will typically assess the vehicle’s value at the time of the theft, considering factors like age, mileage, condition, and market value. This means that an older vehicle will likely receive a lower payout than a newer one, even if both are stolen. Furthermore, if the vehicle was heavily modified, the insurer may only cover the value of the original vehicle, excluding the cost of the aftermarket additions. Similarly, if the theft occurred due to your negligence, the insurer may only partially cover the losses. For example, if the theft resulted from leaving the keys in the ignition, the payout might be significantly reduced or even denied.

Common Reasons for Claim Denials Related to Auto Theft

Understanding the reasons for claim denials is crucial for preventing such outcomes. Below are common reasons why your auto theft insurance claim might be denied:

- Failure to report the theft promptly.

- Negligence leading to the theft (e.g., leaving keys in the ignition).

- Providing false or misleading information during the claim process.

- Violation of policy terms and conditions.

- The theft occurring in a location explicitly excluded by the policy.

- Lack of sufficient evidence to support the claim.

- The vehicle being stolen under circumstances not covered by the policy.

Comparing Different Auto Theft Insurance Providers

Choosing the right auto theft insurance can significantly impact your financial well-being in the event of a theft. A thorough comparison of different providers is crucial to ensure you secure adequate coverage at a competitive price. This involves examining not only the premium but also the breadth and depth of coverage offered, alongside customer service experiences.

This section will compare three major auto insurance providers – State Farm, Geico, and Progressive – highlighting their coverage options, pricing structures, and customer reviews. Remember that specific pricing and coverage details will vary depending on your location, driving history, and the vehicle being insured. It’s always recommended to obtain personalized quotes from each provider.

Provider Comparison Table

The following table summarizes key aspects of auto theft insurance from three major providers. Note that this is a simplified comparison, and individual policy details may vary.

| Provider | Coverage Highlights | Pricing Structure | Customer Reviews Summary |

|---|---|---|---|

| State Farm | Comprehensive coverage including theft, collision, and liability; various deductible options; roadside assistance often included in packages; potential discounts for bundling with other insurance types. | Premiums generally considered competitive; discounts offered for safe driving, good grades (for young drivers), and bundling insurance policies; pricing varies significantly based on location and risk factors. | Generally positive reviews regarding claims processing and customer service; some complaints regarding pricing increases in certain areas. |

| Geico | Offers comprehensive coverage including theft; various deductible and coverage limit options; known for competitive pricing; online tools for managing policies and filing claims. | Known for highly competitive pricing, especially for online purchases; discounts available for safe driving, bundling policies, and military service; pricing varies based on location and risk profile. | Mostly positive reviews emphasizing ease of online policy management and quick claims processing; some complaints regarding customer service responsiveness for complex claims. |

| Progressive | Comprehensive coverage options, including theft; offers Name Your Price® tool allowing customers to specify a desired premium and see coverage options; various deductible choices; provides accident forgiveness programs. | Pricing structure can vary widely depending on the Name Your Price® tool selection; discounts available for various factors including safe driving, good student discounts, and multiple vehicle coverage. | Reviews are mixed; many praise the Name Your Price® tool’s flexibility; some criticism regarding claims processing speed and customer service in certain situations. |

Evaluating Different Policies

When comparing auto theft insurance policies, several key factors should be considered to determine the best fit for your individual needs and budget. This involves a careful assessment of deductibles, premiums, and coverage limits.

Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean lower out-of-pocket costs but higher premiums. Higher deductibles mean lower premiums but higher out-of-pocket costs if a claim is filed. Consider your financial capacity and risk tolerance when choosing a deductible.

Premiums: This is the amount you pay regularly to maintain your insurance coverage. Premiums are influenced by factors such as your driving history, location, vehicle type, and chosen coverage level. Compare premiums from different providers while keeping coverage levels consistent for a fair comparison.

Coverage Limits: This refers to the maximum amount your insurance company will pay for a covered loss. Ensure the coverage limits are sufficient to cover the potential cost of replacing your vehicle in the event of theft. Higher coverage limits generally result in higher premiums.

The Role of Technology in Auto Theft Prevention and Insurance

Technology has revolutionized the fight against auto theft, impacting both prevention strategies and the insurance industry’s approach to risk assessment and premium pricing. Advancements in vehicle security systems, coupled with data analytics capabilities, have significantly altered the landscape of auto theft insurance.

Technological advancements are fundamentally reshaping auto theft prevention and the insurance industry’s response. This includes the development of sophisticated anti-theft devices, the use of telematics for risk assessment, and the application of data analytics to better understand and mitigate risk.

GPS Tracking and Immobilizers

GPS tracking systems allow for the real-time location of a stolen vehicle, aiding in swift recovery. Immobilizers, on the other hand, prevent the vehicle from starting unless authorized, acting as a significant deterrent. The widespread adoption of these technologies has led to a demonstrable decrease in successful auto thefts, particularly for vehicles equipped with both systems. For example, a study conducted by the National Insurance Crime Bureau (NICB) showed a significant reduction in theft rates for vehicles equipped with both GPS tracking and immobilizer systems compared to vehicles without these technologies. The effectiveness of these technologies is further enhanced by their integration with law enforcement databases, enabling faster response times and increased recovery rates.

Technological Advancements’ Influence on Insurance Costs and Availability

The increased security afforded by advanced anti-theft technologies directly influences the cost and availability of auto theft insurance. Vehicles equipped with sophisticated security features are considered lower risk, resulting in lower premiums. Conversely, vehicles lacking such features may face higher premiums or even difficulty obtaining coverage, reflecting the increased risk they present to insurers. Insurance companies often offer discounts for vehicles with features like GPS tracking, alarm systems, and immobilizers, incentivizing vehicle owners to invest in these technologies. For instance, many major insurers provide significant premium reductions (up to 20% in some cases) for vehicles equipped with factory-installed anti-theft systems.

Telematics in Risk Assessment and Premium Determination

Telematics, the use of technology to collect and transmit data from vehicles, plays a crucial role in modern risk assessment. Insurance companies utilize telematics devices installed in vehicles to monitor driving behavior, such as speed, acceleration, braking, and mileage. This data allows insurers to create more accurate risk profiles, leading to personalized premiums that reflect individual driving habits. Drivers with safer driving patterns, as evidenced by telematics data, may qualify for lower premiums, while those exhibiting riskier behaviors may face higher rates. This usage of data fosters a more equitable and accurate system for premium determination. For example, a driver with consistently low speeds and smooth braking might receive a 10-15% discount compared to a driver with frequent hard braking and speeding incidents.

Data Analytics in Identifying High-Risk Areas and Vehicles

Insurance companies leverage data analytics to identify geographic areas with higher rates of auto theft and specific vehicle models that are more prone to theft. This allows for targeted risk mitigation strategies, such as increased patrols in high-risk areas and enhanced security measures for vulnerable vehicles. By analyzing vast datasets encompassing vehicle specifications, location data, and theft reports, insurers can create sophisticated predictive models to anticipate future theft trends. This proactive approach enables them to adjust premiums accordingly and develop targeted prevention programs. For instance, an insurer might identify a specific model of SUV as being particularly susceptible to theft in a certain city, leading to adjusted premiums for that model within that geographic area.

Ultimate Conclusion

Securing adequate auto theft insurance is a vital step in responsible vehicle ownership. By understanding the intricacies of coverage, claims procedures, and preventative measures, car owners can significantly mitigate the financial and emotional burden associated with vehicle theft. Remember to carefully compare policies from different providers, considering factors like deductibles, premiums, and coverage limits, to find the best fit for your needs and budget. Proactive theft prevention is equally important, so incorporate the safety tips discussed to further reduce your risk.

Popular Questions

What is the difference between comprehensive and collision coverage regarding theft?

Comprehensive coverage typically covers theft, while collision coverage only covers damage resulting from a collision. Theft is a separate event.

How long does it take to get a payout after a successful auto theft claim?

The processing time varies depending on the insurance company and the complexity of the claim, but it usually takes several weeks.

Does my insurance cover a stolen car if I left the keys in the ignition?

Many policies may deny or reduce coverage if the theft was due to negligence, such as leaving the keys in the ignition. Always check your policy’s specific exclusions.

What if my stolen car is recovered damaged?

Your comprehensive coverage should cover the repair costs or the actual cash value of the damage, depending on your policy.