Navigating the world of auto insurance can feel overwhelming, but understanding the process of obtaining a quote is the first step towards securing the right coverage. This guide delves into Progressive’s auto insurance quote process, exploring the factors that influence premiums, comparing it to competitors, and examining customer experiences. We’ll unpack the various coverage options, highlight key features, and illustrate how a quote is generated through a practical example. Whether you prefer online quotes, phone calls, or in-person consultations, we’ll equip you with the knowledge to make informed decisions.

From understanding the information needed to obtain a quote to analyzing the impact of your driving history and credit score, this guide offers a comprehensive overview of Progressive’s approach. We’ll compare Progressive’s offerings to those of other major insurers, providing a clear picture of the advantages and disadvantages of each. Ultimately, our goal is to empower you to confidently navigate the auto insurance landscape and secure the best possible coverage for your needs.

Progressive’s Auto Insurance Quote Process

Obtaining an auto insurance quote from Progressive is a relatively straightforward process, designed to be completed quickly and easily online or over the phone. The company emphasizes a user-friendly experience, aiming to provide customers with a clear understanding of their coverage options and pricing.

Progressive’s quote process involves several key steps, each designed to gather the necessary information to accurately assess risk and provide a personalized quote.

Steps in Obtaining a Progressive Auto Insurance Quote

The process generally begins with providing basic information about yourself and your vehicle(s). This includes details such as your name, address, driver’s license number, and vehicle information (year, make, model, VIN). Next, you’ll be asked about your driving history, including accidents and traffic violations. This information is crucial in determining your risk profile. Finally, you’ll select your desired coverage levels and any additional options, such as roadside assistance or rental car reimbursement. After submitting this information, Progressive’s system calculates your quote, which is then presented to you for review. You can then choose to purchase the policy or explore alternative options.

Information Required from the User

To generate an accurate quote, Progressive requires a comprehensive range of information. This includes personal details such as your name, address, date of birth, and driver’s license information. Vehicle details, such as the year, make, model, and VIN of each vehicle to be insured, are also essential. Your driving history, including any accidents, traffic violations, and prior insurance claims, plays a significant role in determining your premium. Finally, you’ll need to specify your desired coverage levels, such as liability, collision, and comprehensive coverage. Providing accurate and complete information ensures a precise quote.

Comparison of Progressive’s Quote Process with Competitors

While Progressive strives for a streamlined process, it’s useful to compare its approach to that of competitors like Geico and State Farm. Each company has its strengths and weaknesses, and the best choice depends on individual preferences and needs.

| Feature | Progressive | Geico | State Farm |

|---|---|---|---|

| Speed of Quote Generation | Generally very fast, often within minutes online. | Known for its fast online quote process. | Slightly slower than Progressive and Geico, often requiring more detailed information upfront. |

| Ease of Use | User-friendly website and mobile app; clear navigation. | Simple and intuitive website and app; minimal steps. | Website and app are functional, but may feel slightly less streamlined than competitors. |

| Information Required | Comprehensive but clearly presented; asks for information in a logical sequence. | Requires similar information to Progressive, with a focus on efficiency. | May require more detailed information upfront, potentially leading to a longer quote process. |

Factors Influencing Progressive Auto Insurance Quotes

Progressive, like other insurance providers, uses a multifaceted approach to determine your auto insurance premium. Several key factors contribute to the final quote, ensuring that premiums reflect individual risk profiles. Understanding these factors can help you better understand your insurance costs and potentially find ways to lower them.

Driving History

Your driving history is a significant factor in determining your Progressive auto insurance quote. This includes your past accidents, traffic violations, and even the number of years you’ve been driving. A clean driving record with no accidents or tickets will generally result in a lower premium. Conversely, multiple accidents or serious traffic violations, such as DUIs, will significantly increase your premiums. Progressive’s algorithms analyze the severity and frequency of incidents to assess risk. For instance, a single minor fender bender might result in a moderate increase, while a DUI conviction could lead to a substantial premium hike or even policy denial. The further back an incident is, the less impact it typically has, as it’s assumed your driving habits may have improved over time.

Vehicle Type

The type of vehicle you drive heavily influences your insurance quote. Factors considered include the vehicle’s make, model, year, safety features, and repair costs. Sports cars and luxury vehicles, often associated with higher repair costs and a higher risk of theft, tend to command higher premiums than more economical and safer models. Vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts, reflecting their lower accident risk. The age of your vehicle also plays a role; older cars are generally cheaper to insure due to their lower value, while newer vehicles command higher premiums due to their higher replacement costs.

Location

Your location plays a crucial role in determining your insurance rates. Progressive considers factors such as the crime rate, accident frequency, and the cost of repairs in your area. Areas with high crime rates or a high frequency of accidents will generally have higher insurance premiums due to the increased risk of theft or collisions. The cost of car repairs also varies geographically; areas with higher labor and parts costs will typically reflect higher premiums. For example, someone living in a densely populated urban area with high traffic congestion might pay more than someone residing in a rural area with fewer vehicles on the road.

Credit Score

In many states, Progressive (and other insurers) uses your credit score as a factor in determining your auto insurance rates. While the specific impact varies by state and individual circumstances, a higher credit score generally correlates with lower premiums. This is because a good credit score is often associated with responsible financial behavior, which insurers interpret as a lower risk. Conversely, a poor credit score might indicate a higher risk profile and lead to higher premiums. It’s important to note that this practice is controversial and not allowed in all states.

Impact of Credit Score on Progressive Auto Insurance Quotes

| Credit Score Range | Potential Premium Impact | Example |

|---|---|---|

| 750-850 (Excellent) | Lowest premiums | A driver with this score might pay $100 per month. |

| 650-749 (Good) | Moderate premiums | The same driver with this score might pay $120 per month. |

| Below 650 (Fair/Poor) | Highest premiums | The same driver with this score might pay $150 per month. |

Progressive’s Coverage Options and Features

Progressive offers a comprehensive range of auto insurance coverage options designed to meet diverse needs and budgets. Understanding these options is crucial for securing adequate protection and avoiding financial hardship in the event of an accident or unforeseen circumstances. This section will detail Progressive’s key coverage types and highlight some of their valuable add-on features, comparing them to a competitor to provide a clearer picture of the market landscape.

Progressive’s core coverage options fall into several categories: liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage protects against damage from events like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage helps cover your losses if you’re involved in an accident with an uninsured or underinsured driver. The specific amounts of coverage are customizable, allowing policyholders to tailor their protection to their individual risk assessments and financial situations.

Liability Coverage

Liability coverage is a crucial aspect of any auto insurance policy. It compensates others for injuries or property damage you cause in an accident. Progressive offers various liability coverage limits, allowing you to choose the level of protection that best suits your needs. For example, a policy might offer $100,000/$300,000 limits, meaning $100,000 per person and $300,000 per accident for bodily injury. Property damage liability covers the cost of repairing or replacing damaged property belonging to others. Higher limits provide greater financial protection in the event of a serious accident. Failing to carry sufficient liability insurance can lead to significant financial repercussions, including lawsuits and legal fees.

Collision and Comprehensive Coverage

Collision coverage is designed to pay for repairs or replacement of your vehicle following a collision, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against damage caused by non-collision events such as theft, vandalism, hail, fire, or weather-related incidents. Choosing the right deductible amount is a key decision here. A higher deductible means lower premiums but higher out-of-pocket expenses in case of a claim. Progressive allows you to customize these deductibles to balance cost and risk. For example, a $500 deductible on collision coverage would mean you pay the first $500 of repair costs, while Progressive covers the rest.

Uninsured/Underinsured Motorist Coverage

This coverage is vital in protecting you from drivers who lack sufficient insurance. Uninsured motorist coverage protects you if you are injured by an uninsured driver, while underinsured motorist coverage helps if you are injured by a driver with insufficient insurance to cover your damages. In states with a high percentage of uninsured drivers, this coverage is particularly important. Consider the potential costs of medical bills and lost wages if you are involved in an accident with an uninsured driver; this coverage helps mitigate those risks.

Progressive’s Add-on Features

Progressive offers a range of add-on features to enhance your policy. Roadside assistance provides help with things like flat tires, lockouts, and jump starts. Rental car reimbursement can cover the cost of a rental car while your vehicle is being repaired after an accident. Other add-ons may include accident forgiveness, which can prevent your premiums from increasing after your first at-fault accident, and gap insurance, which covers the difference between what your car is worth and what you owe on your loan if it’s totaled.

Comparison with a Competitor: State Farm

To illustrate the differences in coverage options, let’s compare Progressive with State Farm, a major competitor.

- Roadside Assistance: Both Progressive and State Farm offer roadside assistance, but the specific services and coverage may differ. For example, Progressive might offer towing up to a certain distance, while State Farm might have a broader range of services included.

- Rental Car Reimbursement: Both companies offer this, but the daily allowance and total coverage amount can vary significantly. State Farm may have a higher daily limit, while Progressive might offer a longer rental period.

- Accident Forgiveness: Both insurers often include accident forgiveness programs, but the eligibility criteria and specifics of the program can vary. For instance, one insurer might offer forgiveness only after a certain number of years of accident-free driving.

Progressive and State Farm offer similar core coverages, but the specifics of their add-on features and pricing can differ. It’s essential to compare quotes from multiple insurers to find the best fit for your individual needs and budget. The advantages and disadvantages are often subjective and depend heavily on individual circumstances and preferences.

Customer Reviews and Experiences with Progressive Quotes

Understanding customer experiences is crucial for assessing the effectiveness and overall satisfaction associated with Progressive’s auto insurance quote process. Analyzing feedback from various platforms provides valuable insights into both the strengths and weaknesses of their service. This analysis considers both the quote acquisition process itself and the subsequent policy experience.

Customer reviews across numerous online platforms, including independent review sites, social media, and customer forums, reveal a mixed bag of experiences with Progressive auto insurance quotes. While many praise the ease and speed of obtaining a quote, others express frustration with the accuracy of pricing or the overall customer service.

Summary of Customer Feedback

The following table summarizes the common themes found in customer reviews, categorized as positive, negative, or neutral. This categorization helps to provide a balanced perspective on the overall customer experience.

| Positive Feedback | Negative Feedback |

|---|---|

| Easy-to-use online quote tool; quick and efficient quote generation; competitive pricing compared to competitors; helpful and responsive customer service representatives (in some cases); clear and concise policy explanations. | Inaccurate quote estimations leading to higher final premiums; difficulty reaching customer service; confusing policy details; aggressive sales tactics reported by some users; lengthy claim processing times reported in some instances. |

| Many customers appreciate the convenience of obtaining a quote online, often highlighting the straightforward and user-friendly nature of the Progressive website and mobile app. The speed of the quote generation process is frequently praised. | Several reviews cite instances where the initial online quote was significantly lower than the final premium, leading to disappointment and a feeling of being misled. Problems contacting customer service, including long wait times and unhelpful representatives, are also common complaints. |

| Positive comments often focus on the perceived value for money, with many customers reporting that Progressive’s rates were competitive or even lower than those offered by other insurers. | Negative experiences frequently revolve around the complexity of the policy documentation, with some customers expressing difficulty understanding the terms and conditions. Reports of high-pressure sales tactics during the quote process also appear in some reviews. |

Common Complaints Regarding the Quote Process

A significant portion of negative feedback centers around the accuracy of the initial online quotes. Many customers report receiving a seemingly low quote online, only to find the final premium significantly higher after providing more detailed information. This discrepancy often stems from the initial quote relying on limited information, leading to underestimation of risk factors. This lack of transparency in the quote process can lead to customer dissatisfaction. Another recurring complaint involves difficulty contacting customer service representatives for clarification or assistance. Long wait times and unhelpful representatives are frequently mentioned.

Common Praises Regarding the Quote Process

Conversely, positive reviews consistently highlight the ease and speed of obtaining a quote through Progressive’s online platform. The user-friendly interface and quick quote generation are frequently praised as major advantages. Many customers appreciate the convenience of comparing coverage options and obtaining a personalized quote within minutes. The availability of multiple channels for obtaining a quote (online, phone, agent) is also frequently mentioned as a positive aspect.

Illustrative Example of a Progressive Auto Insurance Quote

This example illustrates a fictional scenario to demonstrate how Progressive’s online quote system works and the factors influencing the final price. It’s important to remember that actual quotes will vary based on individual circumstances.

Sarah, a 28-year-old resident of Austin, Texas, is looking to get car insurance for her 2018 Honda Civic. She has a clean driving record with no accidents or tickets in the past five years. She uses her car for commuting to work and occasional weekend errands, classifying her usage as “pleasure” rather than “business” or “high mileage.”

Sarah’s Progressive Auto Insurance Quote Breakdown

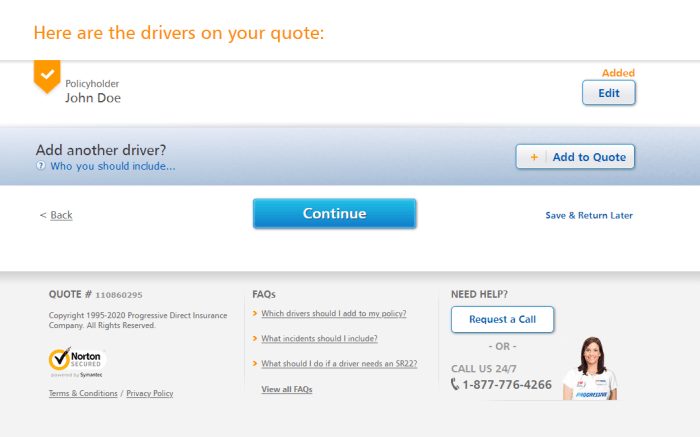

The Progressive website’s user-friendly interface guided Sarah through a series of simple questions. She inputted her personal information, vehicle details, and driving history. The system then calculated her quote, breaking down the various factors influencing the final cost.

The quote provided a base rate reflecting the general risk associated with insuring a 2018 Honda Civic in Austin, Texas. This base rate considers factors like the vehicle’s make, model, and year, as well as the statistical likelihood of accidents and claims in that specific geographic area. Austin’s higher population density and traffic volume likely contribute to a higher base rate compared to more rural areas.

Sarah’s clean driving record significantly lowered her premium. Progressive rewards drivers with good driving histories through lower rates, reflecting the reduced risk they present. Conversely, accidents or traffic violations would have increased her premium.

Her vehicle usage (“pleasure”) also impacted the quote. Had Sarah used her car for business purposes or logged significantly higher mileage, the quote would likely have been higher to account for increased exposure to potential accidents.

Finally, Sarah explored different coverage options. She chose liability coverage, comprehensive coverage, and collision coverage, each adding to the total premium. However, she opted for a higher deductible, which in turn lowered her monthly payment. This illustrates how selecting different coverage levels and deductible amounts directly affects the final cost of insurance.

The entire process took Sarah less than 10 minutes to complete. She found the website easy to navigate and appreciated the clear explanations provided for each factor affecting her quote. The final quote provided a detailed breakdown of all costs, allowing her to easily understand how the price was determined. She was able to compare different coverage options and adjust her selections to find the best balance between coverage and affordability. Overall, Sarah found the experience positive and efficient.

Comparison of Progressive’s Online and Offline Quote Methods

Obtaining an auto insurance quote from Progressive can be done through several avenues, each offering a unique set of advantages and disadvantages. Understanding these differences is crucial for choosing the method best suited to individual needs and preferences. This section will compare and contrast the online and offline quote processes, highlighting the pros and cons of each.

Progressive offers a streamlined online quote process, allowing customers to quickly receive a quote from the comfort of their own homes. Conversely, offline methods, such as phone calls and in-person visits, provide opportunities for more personalized interactions with agents. However, they may require more time commitment. The potential for variations in quotes across these methods will also be examined.

Online Quote Method Advantages and Disadvantages

The online quote process offers several benefits. It’s convenient, readily available 24/7, and allows for quick comparisons of different coverage options. However, it may lack the personalized touch of human interaction.

- Advantages: Convenience, speed, 24/7 availability, easy comparison of options, potential for lower costs due to reduced overhead.

- Disadvantages: Limited personalized assistance, potential for misunderstanding of complex coverage details, reliance on accurate information input.

Offline Quote Method Advantages and Disadvantages

The offline methods, encompassing phone calls and in-person visits, provide a different experience. These methods allow for direct interaction with a Progressive agent, who can answer questions and provide tailored advice. However, they require more time and effort.

- Advantages: Personalized service, opportunity for clarification of complex issues, potential for negotiating coverage options, ability to address individual circumstances more effectively.

- Disadvantages: Time-consuming, requires scheduling appointments (for in-person visits), potential for longer wait times, potentially higher costs due to increased agent involvement.

Potential Differences in Quotes Obtained Through Different Methods

While Progressive strives for consistency, minor variations in quotes obtained through different methods are possible. These discrepancies are typically not significant but can stem from subtle differences in the information gathering process. For instance, an agent might uncover additional discounts or identify specific risks during a phone or in-person conversation that the online system might miss. Conversely, the online system might offer promotions or discounts not immediately apparent during offline interactions. These differences are usually small and should not significantly alter the overall cost comparison. It is important to note that any discrepancies should be clarified with a Progressive representative to ensure complete understanding.

Conclusion

Securing the right auto insurance is a crucial step in protecting yourself and your vehicle. This guide has provided a detailed exploration of Progressive’s auto insurance quote process, from initial steps to final quote calculation, encompassing factors like driving history, vehicle type, and location. By understanding the nuances of the quote process and comparing Progressive’s offerings with those of competitors, you are better equipped to make an informed decision that aligns with your individual circumstances and budget. Remember to thoroughly review your options and compare quotes from multiple providers to ensure you find the best coverage at the most competitive price.

Frequently Asked Questions

What types of vehicles does Progressive insure?

Progressive insures a wide variety of vehicles, including cars, trucks, motorcycles, RVs, and boats. Specific coverage options may vary depending on the vehicle type.

Can I bundle my home and auto insurance with Progressive?

Yes, Progressive offers bundled home and auto insurance policies, often resulting in discounts.

How often can I get a new quote from Progressive?

You can request a new quote from Progressive as often as needed, particularly if your circumstances change (e.g., new vehicle, change of address, improved driving record).

What happens if I have a lapse in my insurance coverage?

A lapse in coverage can significantly impact your insurance rates. It’s best to maintain continuous coverage to avoid higher premiums.