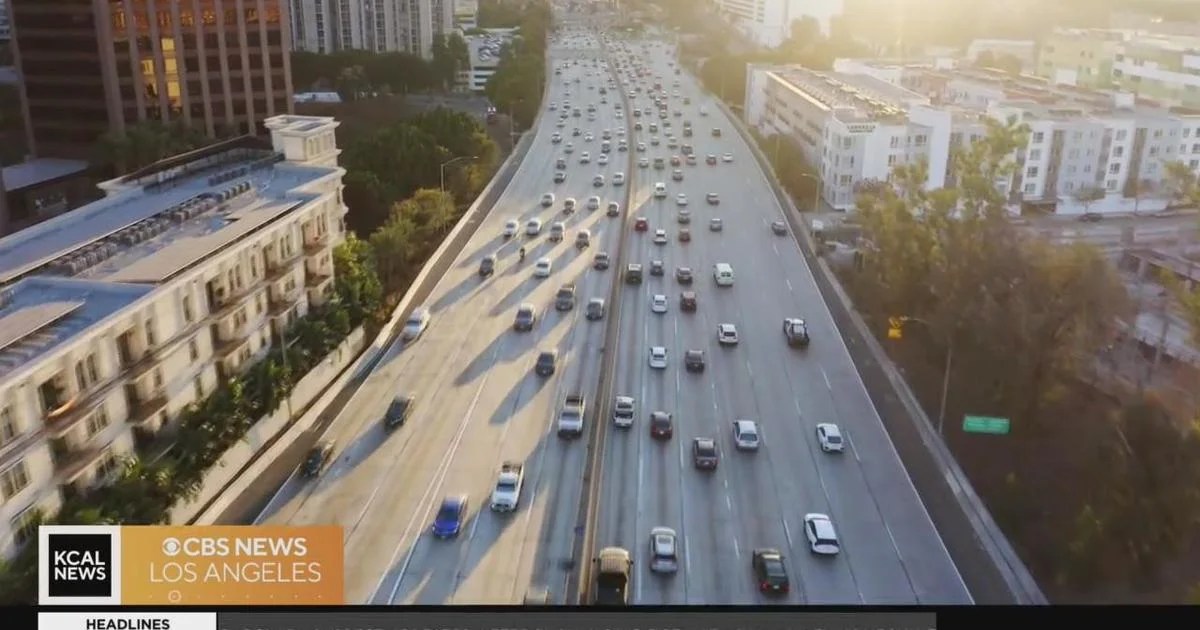

Navigating the Los Angeles auto insurance market can feel like driving through rush hour traffic – challenging but ultimately manageable with the right guidance. This guide unravels the complexities of finding the best auto insurance in the City of Angels, considering factors like location, driving history, and the unique characteristics of the Los Angeles driving environment. We’ll explore various coverage options, help you compare providers, and empower you to make informed decisions to protect yourself and your vehicle.

From understanding minimum insurance requirements to navigating the claim process, we’ll provide a clear and concise overview of everything you need to know to secure affordable and comprehensive auto insurance in Los Angeles. We’ll delve into the specifics of different coverage types, explain how various factors impact your premiums, and offer practical tips for finding the best policy to fit your individual needs and budget.

Understanding the Los Angeles Auto Insurance Market

Los Angeles, a sprawling metropolis with diverse demographics and a high volume of vehicles, presents a unique and complex auto insurance market. Understanding its characteristics is crucial for securing the best coverage at a competitive price. Factors such as traffic congestion, accident rates, and the cost of vehicle repairs significantly impact insurance premiums.

Factors Influencing Los Angeles Auto Insurance Premiums

Several key factors contribute to the cost of auto insurance in Los Angeles. These include the driver’s age and driving history (younger drivers and those with accidents or violations generally pay more), the type and value of the vehicle (luxury cars and newer models are more expensive to insure), the driver’s location within Los Angeles (higher crime rates and accident-prone areas lead to higher premiums), and the chosen coverage level (more comprehensive coverage naturally costs more). Additionally, credit scores can influence premiums in many cases, with higher scores often leading to lower rates. The competition among insurance providers also plays a role in shaping premium costs.

Comparison of Los Angeles Auto Insurance Options

Los Angeles offers a wide range of auto insurance options, from large national providers to smaller regional companies. Consumers can choose between full-coverage policies, which offer comprehensive protection, and liability-only policies, which provide minimal coverage. The best option depends on individual needs and financial situations. Those with older vehicles or limited budgets might opt for liability-only coverage, while those with newer, more valuable cars might prefer comprehensive protection. Direct-to-consumer online insurers often offer competitive rates, while traditional brick-and-mortar agencies can provide personalized service and guidance.

Common Types of Auto Insurance Coverage in Los Angeles

Standard auto insurance coverage in Los Angeles typically includes liability coverage (bodily injury and property damage), collision coverage (damage to your vehicle from an accident), comprehensive coverage (damage to your vehicle from non-accident events like theft or vandalism), uninsured/underinsured motorist coverage (protection if you’re involved in an accident with an uninsured or underinsured driver), and medical payments coverage (medical expenses for you and your passengers). Uninsured/underinsured motorist coverage is particularly important in a densely populated city like Los Angeles where accidents involving uninsured drivers are more common. Optional add-ons such as roadside assistance and rental car reimbursement are also frequently available.

Comparison of Auto Insurance Providers in Los Angeles

The following table provides a simplified comparison of several auto insurance providers in Los Angeles. Note that average premiums can vary greatly depending on individual circumstances. Customer ratings are based on publicly available information and may differ depending on the source.

| Provider Name | Average Premium (Estimate) | Coverage Options | Customer Ratings (Example) |

|---|---|---|---|

| Geico | $1200 – $1800 annually (Estimate) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | 4.5 out of 5 stars |

| State Farm | $1300 – $2000 annually (Estimate) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Roadside Assistance | 4.2 out of 5 stars |

| Progressive | $1100 – $1700 annually (Estimate) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Rental Car Reimbursement | 4.0 out of 5 stars |

| Farmers Insurance | $1400 – $2200 annually (Estimate) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | 4.3 out of 5 stars |

Factors Affecting Insurance Costs in Los Angeles

Securing affordable auto insurance in Los Angeles can feel like navigating a complex maze. Numerous factors influence the premiums you’ll pay, and understanding these elements is crucial for making informed decisions and potentially saving money. This section will explore the key variables that determine your Los Angeles auto insurance costs.

Demographic Factors

Your age, driving history, and residential location significantly impact your insurance premium. Younger drivers, statistically, are involved in more accidents and therefore present a higher risk to insurance companies, leading to higher premiums. Conversely, drivers with a long, clean driving record typically enjoy lower rates due to their demonstrated safety. Location plays a crucial role as well; areas with higher crime rates and more frequent accidents will generally have higher insurance premiums than safer neighborhoods. For example, living in a high-crime area like South Central Los Angeles might result in a higher premium compared to living in a more affluent and safer area like Beverly Hills. Insurance companies use sophisticated algorithms that consider these factors to assess risk and set premiums accordingly.

Vehicle Type and Value

The type and value of your vehicle are major determinants of your insurance cost. Luxury vehicles and high-performance cars are more expensive to repair and replace, resulting in higher premiums. Conversely, insuring a smaller, less expensive car will generally be cheaper. The vehicle’s safety features also play a role; cars equipped with advanced safety technologies, such as anti-lock brakes and airbags, may qualify for discounts. For instance, insuring a Tesla Model S will likely be more expensive than insuring a Honda Civic, due to the higher repair costs and replacement value of the Tesla.

Traffic Patterns and Accident Rates

Los Angeles is notorious for its congested traffic and high accident rates. These factors directly influence insurance premiums. Areas with frequent accidents and heavy traffic congestion are considered higher-risk zones, leading to higher insurance premiums for drivers residing in or frequently driving through these areas. Insurance companies analyze accident data and traffic patterns to assess risk levels in different parts of the city, impacting pricing accordingly. The sheer volume of vehicles on the road in Los Angeles contributes to a higher likelihood of accidents, impacting the overall cost of insurance.

Driving History

Your driving history is perhaps the most significant factor affecting your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions will significantly increase your premiums, reflecting the increased risk you pose to the insurance company. The severity of the incident also plays a role; a minor fender bender will have less of an impact than a serious accident resulting in injury or significant property damage. For example, a driver with multiple speeding tickets and a DUI conviction will likely face significantly higher premiums than a driver with a spotless record.

Reducing Insurance Premiums

Several strategies can help drivers reduce their auto insurance premiums.

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Shop around for insurance: Compare quotes from multiple insurance providers.

- Consider increasing your deductible: A higher deductible lowers your premium but increases your out-of-pocket expenses in case of an accident.

- Bundle your insurance: Combine your auto and home insurance policies for potential discounts.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for a discount.

- Choose a less expensive vehicle: Insuring a smaller, less expensive car typically costs less.

- Install anti-theft devices: Installing anti-theft devices can reduce your premium.

Finding the Right Auto Insurance in Los Angeles

Navigating the Los Angeles auto insurance market can feel overwhelming, but with a strategic approach, finding the right policy for your needs is achievable. This section will guide you through the process of comparing quotes, understanding policy details, and ultimately selecting the best coverage for your circumstances. Remember, the right policy isn’t just about the lowest price; it’s about finding the appropriate balance of coverage and cost.

Comparing Auto Insurance Quotes

To effectively compare auto insurance quotes, it’s crucial to obtain quotes from multiple providers. This allows for a comprehensive overview of available options and pricing structures. Don’t limit yourself to just online comparison websites; contact insurance companies directly as well. This ensures you capture all potential offers. When comparing, pay close attention not only to the premium but also to the deductibles, coverage limits, and any additional features offered.

Obtaining an Auto Insurance Quote

The process of obtaining an auto insurance quote is generally straightforward. Most providers offer online quote tools where you input your information (vehicle details, driving history, address, etc.). Others prefer phone calls or in-person consultations. Be prepared to provide accurate and complete information; inaccuracies can lead to inaccurate quotes or even policy cancellations later. Request quotes from at least three to five different insurers to ensure a broad comparison.

Understanding Policy Details Before Purchasing

Before committing to a policy, meticulously review all its details. Understand the different coverage types (liability, collision, comprehensive, uninsured/underinsured motorist) and their limits. Pay close attention to the deductible, which is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but also mean a greater financial burden in case of an accident. Clarify any ambiguities with the insurance provider before signing. A sample policy might show a $500 deductible for collision and comprehensive, and $25,000/$50,000 liability coverage.

Evaluating Different Insurance Policy Options

Evaluating policy options involves comparing premiums, deductibles, coverage limits, and additional features. Consider your driving habits, the value of your vehicle, and your risk tolerance. A younger driver with a less valuable car might opt for a higher deductible to lower their premium, while an older driver with a luxury vehicle might prefer a lower deductible for greater protection. Remember to factor in any discounts offered, such as those for good driving records, multiple vehicle insurance, or bundling with other insurance types.

A Step-by-Step Guide to Finding the Best Auto Insurance

- Gather Information: Collect details about your vehicle, driving history, and desired coverage levels.

- Obtain Quotes: Request quotes from at least three to five different insurance providers using online tools, phone calls, or in-person visits.

- Compare Quotes: Carefully compare premiums, deductibles, coverage limits, and any additional features or discounts offered.

- Review Policy Details: Thoroughly review the policy documents of the top contenders before making a decision.

- Choose a Policy: Select the policy that best balances cost, coverage, and your personal risk tolerance.

- Make Payment: Complete the purchase and payment process according to the insurer’s instructions.

Specific Coverage Options and Their Implications

Choosing the right auto insurance coverage in Los Angeles is crucial, given the city’s high traffic density and potential for accidents. Understanding the different coverage options and their implications is key to securing adequate protection without overspending. This section will break down the essential coverages and help you make informed decisions.

Liability Coverage in Los Angeles

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. In Los Angeles, where accidents are relatively common, having sufficient liability coverage is paramount. California requires minimum liability coverage of 15/30/5, meaning $15,000 for injury per person, $30,000 for total injury per accident, and $5,000 for property damage. However, given the high cost of medical care and potential legal fees, it’s advisable to consider higher liability limits, such as 100/300/100 or even more, to safeguard yourself against significant financial repercussions. This higher coverage provides a greater safety net in the event of a serious accident.

Collision and Comprehensive Coverage Comparison

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage caused by non-collision events such as theft, vandalism, fire, or hail. In Los Angeles, with its dense traffic and potential for weather-related damage, both coverages offer valuable protection. The decision of whether to carry both often depends on the age and value of your vehicle and your personal risk tolerance. A newer, more expensive car might warrant both collision and comprehensive coverage, while an older car might only require liability coverage.

Uninsured/Underinsured Motorist Coverage Benefits and Drawbacks

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver without insurance or with insufficient insurance to cover your damages. Given the prevalence of uninsured drivers in Los Angeles, UM/UIM coverage is highly recommended. The benefit is clear: financial protection in a situation where the at-fault driver cannot compensate you for your losses. The drawback is the added cost to your premium, however, the potential financial burden of an accident with an uninsured driver significantly outweighs this cost.

Personal Injury Protection (PIP) in Los Angeles

Personal Injury Protection (PIP) coverage, also known as Med-Pay, covers medical expenses and lost wages for you and your passengers, regardless of fault. In Los Angeles, where medical costs are high, PIP coverage can be invaluable in helping to offset these expenses after an accident. It’s important to note that California is an at-fault state, meaning that your own insurance company will not typically cover your medical bills unless you have PIP coverage or were not at fault.

Deductible Levels and Premium Implications

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums. Choosing the right deductible involves balancing affordability with the financial burden of a potential out-of-pocket expense. For example, a $500 deductible might mean lower monthly premiums but a significant upfront cost if you need to file a claim, while a $1000 deductible would mean higher monthly premiums but less out-of-pocket expense in case of a claim. Consider your financial situation and risk tolerance when selecting your deductible.

Coverage Types and Their Relevance in Los Angeles

- Liability Coverage: Protects you financially if you cause an accident. Crucial in Los Angeles due to high traffic and accident rates. Higher limits are recommended.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault. Beneficial in Los Angeles’s congested traffic.

- Comprehensive Coverage: Covers damage from non-collision events (theft, vandalism, etc.). Useful in Los Angeles due to potential for theft and weather damage.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: Protects you if hit by an uninsured or underinsured driver. Highly recommended in Los Angeles due to a significant number of uninsured drivers.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and passengers, regardless of fault. Important in Los Angeles due to high medical costs.

Legal and Regulatory Aspects of Auto Insurance in Los Angeles

Navigating the legal landscape of auto insurance in Los Angeles is crucial for all drivers. Understanding minimum coverage requirements, the claims process, and the role of regulatory bodies ensures you’re protected and prepared in case of an accident. This section Artikels the key legal and regulatory aspects relevant to Los Angeles drivers.

Minimum Insurance Requirements in Los Angeles

California, and therefore Los Angeles, mandates minimum auto insurance coverage, commonly referred to as financial responsibility. Failing to maintain this minimum coverage can result in significant penalties. These requirements protect both drivers and victims of accidents. The minimum coverage includes bodily injury liability and property damage liability. Bodily injury liability covers injuries to others caused by your vehicle, while property damage liability covers damage to another person’s property. Specific amounts vary, but generally, the minimum requirements are $15,000 for injury or death to one person, $30,000 for injury or death to multiple people in a single accident, and $5,000 for property damage. It’s important to note that these minimums are often insufficient to cover significant damages, and purchasing higher coverage limits is strongly recommended.

The Auto Insurance Claim Process in Los Angeles

Filing an auto insurance claim involves several steps. First, report the accident to the police and obtain a police report. Next, contact your insurance company as soon as possible to report the accident and begin the claims process. Provide all necessary information, including details of the accident, the other driver’s information, and any witnesses. Your insurer will then investigate the claim and determine liability. If your claim is approved, you will receive compensation for covered damages, which may include vehicle repairs, medical expenses, lost wages, and other related costs. If you’re involved in a hit-and-run, you’ll need to report it immediately to the police and then file a claim with your own insurer, possibly using uninsured/underinsured motorist coverage. The claim process can vary depending on the circumstances of the accident and the specific policies involved. It is advisable to document everything meticulously, including photos and witness statements.

Role of the California Department of Insurance (CDI)

The California Department of Insurance (CDI) is the state agency responsible for regulating the insurance industry. The CDI licenses and oversees insurance companies operating in California, ensuring they comply with state laws and regulations. They investigate complaints against insurers, help consumers resolve disputes, and educate the public about insurance issues. The CDI plays a vital role in protecting consumers’ rights and ensuring a fair and competitive insurance market. If you have a dispute with your insurance company, you can file a complaint with the CDI. They offer resources and assistance to help resolve these disputes.

Common Legal Disputes Related to Auto Insurance in Los Angeles

Common legal disputes often involve disagreements over liability, the amount of damages, or coverage under a policy. Disputes regarding uninsured/underinsured motorist coverage are also frequent. Other disputes might arise from policy interpretation, claims denials, or bad faith claims handling. These disputes can be complex and often require legal counsel to navigate successfully. In some cases, litigation may be necessary to resolve these disagreements.

Legal Requirements and Claim Procedures

| Legal Requirements | Claim Procedures |

|---|---|

| Minimum Bodily Injury Liability: $15,000/$30,000 | Report accident to police; obtain police report. |

| Minimum Property Damage Liability: $5,000 | Contact your insurance company immediately. |

| Proof of insurance required to operate a vehicle. | Provide all necessary information to your insurer. |

| Compliance with California Vehicle Code. | Cooperate with your insurer’s investigation. |

| Potential penalties for driving without insurance. | If approved, receive compensation for covered damages. |

Illustrative Scenarios and Their Insurance Implications

Understanding real-world scenarios helps clarify the complexities of auto insurance in Los Angeles. The following examples illustrate how different accidents and situations impact insurance claims and coverage. Remember that specific outcomes depend on individual policy details and the specifics of each accident.

Minor Fender Bender

Imagine a minor fender bender on the 405 freeway during rush hour. Two cars lightly collide, resulting in minor scratches and a dented bumper on one vehicle. Both drivers exchange information, and no one is injured. In this scenario, the claim would likely be processed through the at-fault driver’s insurance company. The process typically involves filing a claim, providing documentation (photos of damage, police report if one was filed), and undergoing an assessment of the damages. The insurance company will then cover the cost of repairs, minus any deductible the policyholder has. If damages are minimal, the claim might be settled quickly and efficiently. However, even minor accidents can lead to unexpected delays if there are disputes over fault or the extent of the damage.

Major Accident

Consider a more serious accident involving a multi-vehicle collision on Sunset Boulevard. One driver runs a red light, causing a chain reaction that results in significant damage to multiple vehicles and injuries to several occupants. This scenario involves a more complex insurance claim process. Police would likely be involved, generating a detailed accident report. Each driver’s insurance company will investigate the accident to determine liability. Medical bills, vehicle repairs, and potential lost wages due to injuries need to be considered. The claim process will be lengthier, involving negotiations between insurance companies, medical professionals, and potentially legal representatives. The extent of coverage will depend on each driver’s policy limits and the determination of fault. In cases of severe injury or significant property damage, the claim could involve substantial financial settlements.

Uninsured Driver Accident

Suppose you’re involved in an accident with an uninsured driver in Los Angeles. The uninsured driver’s negligence caused the accident, resulting in damage to your vehicle and personal injury. In this situation, your uninsured/underinsured motorist (UM/UIM) coverage will be crucial. This coverage, which is optional in some policies but highly recommended in Los Angeles, protects you from financial losses caused by uninsured or underinsured drivers. You’ll file a claim with your own insurance company, and they will handle the process of covering your medical bills, vehicle repairs, and other related expenses. However, your recovery might be limited by your UM/UIM coverage limits. Pursuing legal action against the uninsured driver is also an option, but recovering damages can be challenging.

Hit-and-Run Accident

A hit-and-run accident leaves you with significant damage to your vehicle and potentially injuries. The absence of the at-fault driver complicates the insurance claim process considerably. You will need to report the accident to the police immediately to file a police report, which will be essential for your insurance claim. Your comprehensive coverage, if included in your policy, should cover the damages to your vehicle, minus your deductible. Medical expenses related to injuries would also be covered under your medical payments coverage or personal injury protection (PIP) if applicable. Recovering damages beyond these coverages can be difficult without identifying the at-fault driver. Depending on the circumstances, you may explore filing a claim with your insurance company and potentially seeking legal counsel.

Scenario Comparison Table

| Scenario | Resulting Damages | Applicable Insurance Coverage |

|---|---|---|

| Minor Fender Bender | Minor scratches, dented bumper; no injuries | Liability coverage (at-fault driver); Collision coverage (if applicable) |

| Major Accident (Multi-Vehicle) | Significant vehicle damage; multiple injuries; potential lawsuits | Liability coverage (at-fault driver); Collision coverage; Medical Payments/PIP; Uninsured/Underinsured Motorist (UM/UIM) if applicable |

| Accident with Uninsured Driver | Vehicle damage; personal injuries | Uninsured/Underinsured Motorist (UM/UIM) coverage; Medical Payments/PIP (if applicable) |

| Hit-and-Run Accident | Vehicle damage; potential injuries; no at-fault driver identified | Comprehensive coverage (vehicle damage); Medical Payments/PIP (injuries); Uninsured/Underinsured Motorist (UM/UIM) if applicable (depending on the policy and state law) |

Final Wrap-Up

Securing the right auto insurance in Los Angeles is a crucial step in responsible driving. By understanding the factors that influence premiums, comparing different providers and coverage options, and knowing your rights as a policyholder, you can confidently navigate the complexities of the Los Angeles auto insurance market. Remember, proactive planning and informed decision-making can lead to significant savings and peace of mind on the road. This guide serves as your roadmap to a smoother, safer, and more financially secure driving experience in the heart of Los Angeles.

Question Bank

What is the minimum car insurance coverage required in Los Angeles?

California requires minimum liability coverage of 15/30/5. This means $15,000 for injuries per person, $30,000 for injuries per accident, and $5,000 for property damage.

How do I file a car insurance claim in Los Angeles?

Contact your insurance company immediately after an accident. Provide them with all relevant information, including police reports if applicable. Follow their instructions for filing a claim and gathering necessary documentation.

Can my driving record affect my insurance rates in Los Angeles?

Yes, significantly. Accidents, speeding tickets, and DUI convictions will likely increase your premiums. Maintaining a clean driving record is crucial for keeping your insurance costs low.

What is Uninsured/Underinsured Motorist coverage and why is it important in Los Angeles?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Given the high traffic volume in Los Angeles, this coverage is highly recommended.