Navigating the world of auto insurance can be daunting, especially in a bustling city like Kansas City. Understanding your options, comparing providers, and finding the best coverage for your needs requires careful consideration. This guide provides a comprehensive overview of auto insurance in Kansas City, covering key factors influencing premiums, available coverage types, and strategies for securing affordable protection.

From identifying top insurance providers and their unique offerings to understanding the impact of local driving laws and common claim processes, we aim to equip you with the knowledge necessary to make informed decisions about your auto insurance. We’ll delve into the specifics of various coverage types, helping you understand which options best suit your individual circumstances and budget.

Top Insurance Providers in Kansas City

Choosing the right auto insurance provider is crucial for securing your financial well-being in case of an accident. Kansas City offers a diverse market with numerous options, each with varying coverage levels and pricing structures. Understanding the key differences between providers can help you make an informed decision that best suits your needs and budget.

Leading Auto Insurance Providers in Kansas City

Finding the best auto insurance provider often involves comparing several options. The following table lists five of the largest auto insurance providers serving the Kansas City area, providing a snapshot of their offerings. Note that average premium ranges can vary greatly depending on individual factors such as driving history, vehicle type, and coverage levels. Customer ratings are based on aggregated reviews from various reputable sources and represent a general sentiment, not a definitive measure of individual experiences.

| Company Name | Contact Information | Average Premium Range | Customer Ratings (Example – based on aggregated reviews) |

|---|---|---|---|

| State Farm | (Example) 1-800-STATEFARM, Website: statefarm.com | $800 – $1500 (Annual) | 4.2 out of 5 stars |

| Geico | (Example) 1-800-GEICO, Website: geico.com | $700 – $1400 (Annual) | 4.0 out of 5 stars |

| Progressive | (Example) 1-800-PROGRESSIVE, Website: progressive.com | $900 – $1600 (Annual) | 4.1 out of 5 stars |

| Allstate | (Example) 1-800-ALLSTATE, Website: allstate.com | $850 – $1550 (Annual) | 3.9 out of 5 stars |

| Farmers Insurance | (Example) Find a local agent via farmers.com | $950 – $1700 (Annual) | 4.0 out of 5 stars |

Comparison of Coverage Options

Liability, collision, and comprehensive coverage are fundamental aspects of any auto insurance policy. Significant differences exist between providers in the limits offered for each. For example, liability coverage, which protects you against claims from others involved in an accident you caused, can range from minimum state requirements (which vary by state) to much higher limits, offering greater protection. Collision coverage, which repairs or replaces your vehicle after an accident regardless of fault, may have deductibles ranging from a few hundred dollars to several thousand. Comprehensive coverage, which covers damage to your vehicle from non-collision events (e.g., theft, vandalism, hail), also has varying deductibles and coverage limits. Each provider’s policy details should be carefully reviewed to understand these differences.

Unique Selling Propositions of Each Provider

Each insurance provider highlights specific benefits to attract customers. State Farm, for example, often emphasizes its extensive agent network and personalized service. Geico focuses on its ease of online purchasing and competitive pricing. Progressive is known for its Name Your Price® Tool, allowing customers to set a budget and find coverage options accordingly. Allstate’s reputation is built on its long history and brand recognition. Farmers Insurance emphasizes its local agent network and personalized service, similar to State Farm. These are just examples, and the specific strengths of each provider may change over time. It is advisable to compare current offerings directly from each provider’s website or through an independent insurance comparison tool.

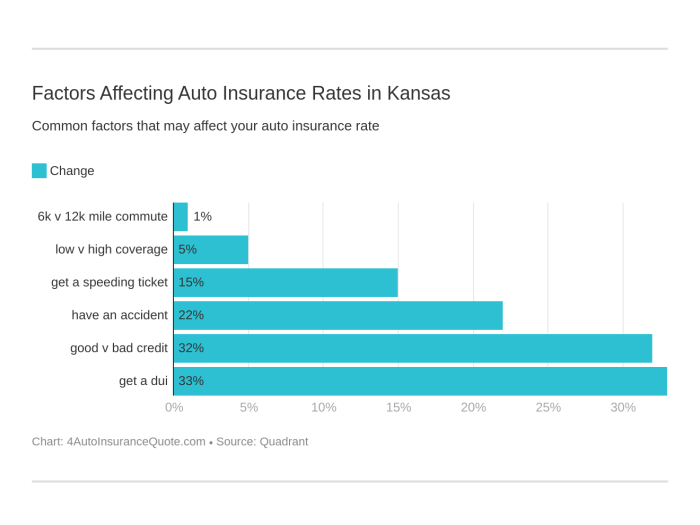

Factors Affecting Auto Insurance Rates in Kansas City

Securing affordable auto insurance in Kansas City involves understanding the various factors that influence premium costs. These factors are often interconnected and can significantly impact the final price you pay. This section will detail the key elements and illustrate their effects with hypothetical examples.

Several key factors determine your auto insurance rates in Kansas City. These include your driving history, age, the type of vehicle you drive, and your location within the city. Additionally, broader factors such as local traffic patterns and accident rates also play a significant role. Understanding these influences can empower you to make informed decisions and potentially lower your premiums.

Driving History

Your driving record is arguably the most significant factor affecting your insurance rates. Insurance companies meticulously review your history, considering factors like accidents, speeding tickets, and DUI convictions. A clean driving record typically results in lower premiums, while incidents like accidents or violations lead to higher costs. The severity of the incident also impacts the increase; a minor fender bender will have a less dramatic effect than a serious accident involving injuries or significant property damage.

| Driving History | Hypothetical Annual Premium |

|---|---|

| Clean driving record (3+ years without incidents) | $1,000 |

| One speeding ticket in the past three years | $1,200 |

| At-fault accident resulting in minor damage | $1,500 |

| DUI conviction | $2,500+ |

Age and Driving Experience

Insurance companies generally categorize drivers by age groups, reflecting the statistical likelihood of accidents within each group. Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents and therefore face higher premiums. As drivers age and gain experience, their premiums typically decrease, reflecting a reduced risk profile.

| Driver Age | Hypothetical Annual Premium |

|---|---|

| 16-20 years old | $1,800 |

| 21-25 years old | $1,400 |

| 26-35 years old | $1,200 |

| 36+ years old | $1,000 |

Vehicle Type

The type of vehicle you drive significantly influences your insurance rates. Factors such as the vehicle’s make, model, year, safety features, and repair costs all play a role. Sports cars and luxury vehicles, generally more expensive to repair, tend to command higher premiums compared to more economical and safer vehicles.

| Vehicle Type | Hypothetical Annual Premium |

|---|---|

| Economy Sedan | $1,000 |

| Mid-size SUV | $1,200 |

| High-Performance Sports Car | $1,800 |

Location

Your address in Kansas City influences your insurance rates. Areas with higher crime rates, more traffic congestion, and a greater frequency of accidents typically have higher insurance premiums. Insurance companies use detailed geographic data to assess risk levels within specific neighborhoods and zip codes.

| Location Type | Hypothetical Annual Premium |

|---|---|

| Low-risk area | $1,000 |

| Medium-risk area | $1,200 |

| High-risk area | $1,500 |

Impact of Local Traffic Patterns and Accident Rates

Kansas City’s traffic patterns and accident rates directly influence insurance premiums. Areas with heavy traffic congestion, frequent accidents, or a high incidence of theft increase the risk for insurance companies, leading to higher premiums for drivers in those areas. Conversely, areas with less traffic and fewer accidents typically have lower premiums. Insurance companies use statistical data on accident frequency and severity to determine risk profiles for different areas within the city.

Types of Auto Insurance Coverage Available

Choosing the right auto insurance coverage in Kansas City is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage and their benefits will help you make an informed decision that best suits your needs and budget. This section Artikels the common types of auto insurance coverage available, detailing their advantages and limitations.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. In Kansas, liability coverage is mandatory, and it typically comes in two parts: bodily injury liability and property damage liability. The limits are expressed as numbers, for example, 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury in an accident, and $25,000 for property damage. Higher limits offer greater protection, but also result in higher premiums.

- This coverage is essential, as it protects you from potentially devastating financial consequences if you are at fault in an accident.

- It’s beneficial to have higher liability limits than the minimum required by law, as serious accidents can easily exceed those limits.

- Liability coverage only pays for the other person’s damages; it does not cover your own injuries or vehicle repairs.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This includes collisions with another vehicle, an object (like a tree or a fence), or even rollovers. It’s important to note that this coverage usually has a deductible, meaning you pay a certain amount out-of-pocket before the insurance company starts paying.

- Collision coverage is highly beneficial if you want to ensure your vehicle is repaired or replaced after an accident, even if you are at fault.

- The deductible amount significantly impacts the cost of this coverage; a higher deductible means lower premiums, but a higher out-of-pocket expense in case of an accident.

- This coverage is optional, but it provides valuable peace of mind, especially if you have a newer or more expensive vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail, flood, and even damage from animals. Similar to collision coverage, comprehensive coverage typically has a deductible.

- Comprehensive coverage is valuable for protecting your vehicle from a wide range of unforeseen events.

- It’s particularly beneficial if you live in an area prone to severe weather or if your vehicle is a high-value asset.

- Like collision coverage, the deductible amount influences the premium cost.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills, lost wages, and vehicle repairs, even if the other driver is at fault and doesn’t have enough insurance to cover your damages. This coverage is crucial because not all drivers carry adequate insurance.

- This coverage is essential because it protects you from significant financial losses if you are involved in an accident with an uninsured or underinsured driver.

- It’s especially important in areas with a high percentage of uninsured drivers.

- UM/UIM coverage can cover medical bills, lost wages, and vehicle repairs for you and your passengers.

Finding Affordable Auto Insurance in Kansas City

Securing affordable auto insurance in Kansas City requires a proactive approach and a thorough understanding of the market. Many factors influence your premium, and by employing smart strategies, you can significantly reduce your costs without compromising necessary coverage. This section Artikels effective methods for finding and obtaining the best possible rates.

Finding the lowest premiums often involves a combination of careful planning and comparison shopping. Don’t settle for the first quote you receive; actively seek out multiple options and analyze them based on your individual needs and risk profile.

Comparison Shopping and Quote Acquisition

Comparing quotes from multiple insurance providers is paramount to finding affordable auto insurance. Use online comparison tools, which allow you to input your information once and receive quotes from several companies simultaneously. This saves time and effort. Remember to provide accurate information to ensure the quotes are truly reflective of your risk profile. Don’t be afraid to contact insurance companies directly as well; sometimes, speaking with an agent can uncover discounts or specialized programs not readily apparent online. For example, a company might offer a discount for bundling your home and auto insurance.

Negotiating Premiums and Exploring Discounts

Once you have several quotes, don’t hesitate to negotiate. Insurance companies often have some flexibility in their pricing. Highlight your clean driving record, safety features in your vehicle, and any other factors that mitigate your risk. Ask about available discounts. Many companies offer discounts for things like: good student discounts, driver’s education completion, multiple vehicle insurance, anti-theft devices, and safe driving programs. For example, demonstrating a consistently clean driving record over several years could lead to a significant reduction in your premium.

Utilizing Resources for Affordable Insurance

Several resources can assist in your search for affordable auto insurance in Kansas City. State-run programs or non-profit organizations often provide guidance and support for finding affordable coverage. These organizations can help connect consumers with insurers who offer programs specifically tailored to lower-income individuals or those with less-than-perfect driving records. Additionally, independent insurance agents can offer valuable assistance by comparing options from various companies and helping you navigate the selection process. They often have access to policies and discounts that aren’t always available through online comparison tools.

Common Auto Insurance Claims in Kansas City

Auto insurance claims in Kansas City, like other major metropolitan areas, reflect the typical risks associated with driving. Understanding the common types of claims and the claims process is crucial for navigating the aftermath of an accident and ensuring you receive the appropriate compensation. This section Artikels the most frequent claim types and the steps involved in filing a claim.

The most common types of auto insurance claims filed in Kansas City involve collisions, comprehensive claims (covering non-collision damage), and liability claims. Collision claims arise from accidents involving another vehicle or a stationary object, while comprehensive claims cover damage from events such as hailstorms, theft, or vandalism. Liability claims occur when a driver is at fault for an accident causing damage to another person’s property or injuries to another person.

The Auto Insurance Claims Process

The claims process typically begins with promptly reporting the accident to your insurance company. This usually involves providing details of the accident, including the date, time, location, and the involved parties. You’ll likely need to provide information about the other driver(s), any witnesses, and police report number (if applicable). Your insurer will then assign a claims adjuster who will investigate the accident, assess the damage, and determine liability. The adjuster will contact you to discuss the next steps, which may include providing additional documentation, undergoing a vehicle inspection, or attending a medical examination if injuries are involved. Once the investigation is complete, the insurance company will determine the amount of compensation to be paid, considering factors like policy coverage, liability, and the extent of damages. Payments are typically made after all assessments and reviews are complete.

Importance of Adequate Coverage

Having adequate auto insurance coverage is paramount in protecting yourself financially following an accident. Insufficient coverage can leave you responsible for significant out-of-pocket expenses.

Consider this scenario: A driver with only minimum liability coverage causes an accident resulting in $50,000 in property damage and $100,000 in medical bills for the other party. Their minimum liability coverage might only cover a fraction of these costs, leaving them personally liable for the remaining balance. This could lead to financial ruin, including lawsuits, wage garnishment, and potential bankruptcy. In contrast, a driver with higher liability limits would be better protected and less likely to face such severe financial consequences. Similarly, comprehensive and collision coverage protects your own vehicle from damage, regardless of fault, preventing significant repair costs from falling solely on you. Choosing the right coverage levels based on your individual circumstances and risk assessment is critical for financial security.

Common Types of Claims Data

While precise claim data specific to Kansas City requires access to proprietary insurance company databases, general trends can be observed. For example, a higher frequency of collision claims might be expected during periods of inclement weather or during peak commuting hours. Comprehensive claims might show seasonal variations, with hail damage claims peaking during summer months and theft claims potentially fluctuating based on socioeconomic factors and time of year. Liability claims often correlate with traffic congestion and driver behavior patterns. Understanding these general trends highlights the importance of proactive driving habits and appropriate insurance coverage.

Understanding Kansas City’s Driving Laws and Their Impact on Insurance

Kansas City, like all cities, has a set of driving laws and regulations that significantly influence auto insurance rates. Understanding these laws and their consequences is crucial for drivers to maintain affordable insurance premiums and avoid potential financial burdens. Insurance companies carefully assess driving records, and violations can lead to substantial increases in premiums.

Driving infractions in Kansas City directly affect your insurance rates. The severity of the violation and the frequency of offenses are key factors. Minor violations, like parking tickets, might have a minimal impact, while more serious offenses, such as driving under the influence (DUI) or reckless driving, can result in significant premium hikes or even policy cancellations. This is because these actions demonstrate a higher risk to the insurance company.

Consequences of Traffic Violations on Insurance Premiums

Insurance companies utilize a points system to track driving records. Each violation earns points, and the accumulation of points directly correlates with higher premiums. For instance, a speeding ticket might add two points, while a DUI could add several more. The more points accumulated, the higher the risk you are perceived to be, leading to a higher insurance premium. Furthermore, some violations, such as DUIs, can result in a significant increase in premiums for several years, even after the violation is resolved. This is because these offenses demonstrate a pattern of risky behavior. Imagine a graph where the x-axis represents the number of points accumulated and the y-axis represents the insurance premium. The line would show a clear upward trend, indicating that as the number of points increases, so does the cost of insurance. A DUI would be represented by a sharp spike in the line, reflecting the significant premium increase associated with such a violation. This visual representation clearly illustrates the direct relationship between driving violations and insurance costs.

Summary

Securing the right auto insurance in Kansas City involves understanding the interplay of various factors, from your driving history to the specific coverage options available. By carefully considering the information presented in this guide – from comparing providers and understanding rate influences to navigating the claims process – you can confidently choose a policy that offers both comprehensive protection and financial prudence. Remember, proactive planning and informed choices are key to securing the best possible auto insurance for your needs.

Essential Questionnaire

What is the minimum liability coverage required in Kansas City?

Kansas has minimum liability requirements; however, it’s crucial to check the specific state requirements as they can impact your insurance needs. Consult the Missouri Department of Insurance website for the most up-to-date information.

How can I dispute an insurance claim denial?

If your claim is denied, carefully review the denial reason. Gather all supporting documentation and contact your insurance provider to discuss the denial. If the issue remains unresolved, you may need to consider mediation or legal counsel.

Does my insurance cover rental cars?

Coverage for rental cars varies depending on your policy. Some policies automatically extend coverage, while others require additional rental car insurance. Review your policy details or contact your provider for clarification.

What is the impact of a speeding ticket on my insurance rates?

A speeding ticket will likely increase your insurance premiums. The extent of the increase depends on factors such as the severity of the violation and your insurance provider’s rating system. Multiple violations will significantly raise your rates.