Navigating the world of auto insurance can feel overwhelming, especially in a state like Minnesota with its unique regulations and coverage options. Understanding your minimum requirements, available coverages, and the factors influencing your premiums is crucial for securing affordable and adequate protection. This guide provides a clear and concise overview of auto insurance in Minnesota, empowering you to make informed decisions about your coverage.

From liability and collision to comprehensive and uninsured/underinsured motorist coverage, we’ll explore the various types of insurance available, highlighting their benefits and drawbacks. We’ll also delve into the key factors affecting your premium, such as your driving record, age, vehicle type, and location, offering practical strategies for finding affordable insurance and negotiating lower rates. Finally, we’ll guide you through the process of filing a claim and address specific situations like SR-22 requirements and high-risk insurance.

Minimum Insurance Requirements in Minnesota

Driving in Minnesota requires adhering to the state’s minimum auto insurance requirements to protect yourself and others on the road. These requirements ensure financial responsibility in case of accidents, covering potential damages and injuries. Failure to comply can result in significant penalties.

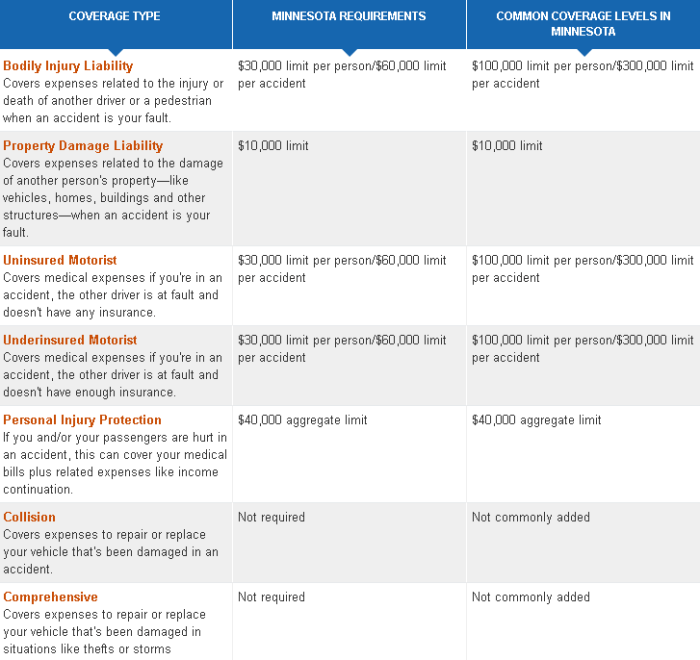

Mandatory Auto Insurance Coverage Types

Minnesota law mandates that all drivers carry at least two types of auto insurance coverage: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and other damages resulting from injuries you cause to others in an accident. Property damage liability covers the cost of repairing or replacing another person’s vehicle or property damaged in an accident caused by you. While not mandatory, additional coverages like uninsured/underinsured motorist and collision are highly recommended for comprehensive protection.

Minimum Financial Responsibility Limits

The minimum financial responsibility limits in Minnesota are set to ensure sufficient coverage for common accident scenarios. For bodily injury liability, the minimum limit is $30,000 per person and $60,000 per accident. This means that your insurance company will pay a maximum of $30,000 for injuries to one person and a maximum of $60,000 for injuries to multiple people in a single accident. For property damage liability, the minimum limit is $20,000. This amount covers the cost of repairing or replacing damaged property, such as another vehicle. It’s crucial to understand that these are minimums; higher limits are strongly advised to adequately protect yourself from significant financial liability in the event of a serious accident.

Comparison to Neighboring States

Minnesota’s minimum insurance requirements are comparable to those of some neighboring states but differ from others. For example, Iowa and Wisconsin have similar minimum liability limits, while states like North Dakota and South Dakota may have lower minimums. It’s important to research the specific requirements of each state if you frequently travel across state lines, as driving with insufficient coverage in another state can lead to severe consequences. For instance, a Minnesota driver involved in an accident in a state with higher minimums could face significant personal liability for exceeding the limits of their Minnesota policy.

Minimum Coverage Limits Comparison Table

| Coverage Type | Minnesota Minimum Limit | Example Scenario | Importance |

|---|---|---|---|

| Bodily Injury Liability (per person) | $30,000 | Covers medical bills, lost wages, and pain and suffering for one injured person. | Protects you from financial ruin if you seriously injure someone. |

| Bodily Injury Liability (per accident) | $60,000 | Covers injuries to multiple people involved in the same accident. | Crucial when multiple individuals are injured in a single accident. |

| Property Damage Liability | $20,000 | Covers repairs or replacement costs for damaged vehicles or property. | Essential for covering damages to other vehicles or property. |

Types of Auto Insurance Coverage Available in MN

Choosing the right auto insurance coverage in Minnesota is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage available and their benefits is key to making an informed decision that aligns with your individual needs and risk tolerance. This section details the common types of auto insurance coverage offered in Minnesota.

Liability Coverage

Liability insurance protects you financially if you cause an accident that results in injuries or damages to others. It covers the costs associated with the other party’s medical bills, property repairs, and legal fees. In Minnesota, carrying liability insurance is mandatory. The minimum requirements dictate the amount of coverage you must carry, but you can purchase higher limits for greater protection.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries you cause to others.

- Property Damage Liability: Covers the cost of repairing or replacing damaged property belonging to others, such as their vehicle or fence.

For example, if you rear-end another car and cause $10,000 in damages to their vehicle and $20,000 in medical bills for the injured driver, your liability coverage would help pay for these expenses. The amount covered depends on the limits you choose. Higher limits offer better protection but come with higher premiums. The drawback is that liability coverage does not cover your own vehicle’s repairs or your medical expenses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This means that even if you cause the accident, your insurance will help cover the cost of fixing your car.

- Covers damage to your vehicle in a collision with another vehicle or object.

- Pays for repairs or replacement, less your deductible.

Suppose you hit a deer and your car sustains $5,000 in damage. Your collision coverage would cover the cost of repairs after you pay your deductible. The drawback is the cost; collision coverage is usually more expensive than other types of coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or weather-related events.

- Covers damage caused by events not related to collisions.

- Pays for repairs or replacement, less your deductible.

Imagine a tree falls on your parked car causing $3,000 in damage. Your comprehensive coverage would help cover the repair costs. Like collision, the downside is the premium cost. However, it offers peace of mind against a wide range of unexpected events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver who is uninsured or whose insurance coverage is insufficient to cover your losses.

- Covers your medical bills and vehicle repairs if hit by an uninsured or underinsured driver.

- Can also cover lost wages and pain and suffering.

For instance, if you are seriously injured in an accident caused by an uninsured driver, your UM/UIM coverage would help cover your medical expenses and lost wages. This is particularly valuable in Minnesota, where uninsured drivers are a concern. The benefit is substantial protection, but the cost adds to your overall premium.

Factors Affecting Auto Insurance Premiums in MN

Understanding the factors that influence your auto insurance premiums in Minnesota is crucial for securing affordable coverage. Several key elements contribute to the final cost, and knowing these can help you make informed decisions about your policy. Insurance companies utilize complex algorithms, but understanding the underlying factors provides valuable insight into how your premium is determined.

Driving Record

Your driving history significantly impacts your premium. A clean record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, DUIs, or other moving violations will increase your premiums. The severity and frequency of incidents are also considered; a single minor accident will have less impact than multiple serious accidents. Insurance companies use a points system to assess risk, with each violation adding points that elevate your premium. For example, a DUI conviction might lead to a substantial premium increase for several years.

Age and Driving Experience

Age and driving experience are strongly correlated with risk. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As drivers gain experience and reach a certain age (typically around 25), their premiums generally decrease. This reflects the reduced risk associated with more experienced drivers. Conversely, drivers over 65 might face slightly higher premiums due to potential age-related driving limitations. Insurance companies use actuarial data to quantify these risks and adjust premiums accordingly.

Vehicle Type

The type of vehicle you drive directly influences your premium. Sports cars and high-performance vehicles are often associated with higher accident rates and repair costs, resulting in higher premiums. Conversely, smaller, less expensive vehicles generally have lower premiums. Factors such as the vehicle’s safety rating, repair costs, and theft rate also play a role. For example, a new luxury SUV will likely command a higher premium than a used compact car.

Location

Your location significantly impacts your premium. Insurance companies consider the accident rates and crime statistics in your area. Areas with high accident rates or a high incidence of vehicle theft will have higher premiums. This reflects the increased risk of claims in those locations. Living in a rural area might result in lower premiums than living in a densely populated urban center with higher traffic congestion.

Coverage Levels

The amount of coverage you choose affects your premium. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will result in higher premiums. This is because you are paying for greater protection in case of an accident or damage to your vehicle. Choosing minimum coverage will result in the lowest premium but also leaves you with less financial protection in the event of a significant accident.

Premium Calculation Methods

While the specific algorithms vary among insurance companies, they generally use a combination of statistical modeling and actuarial data to assess risk. Factors are weighted differently depending on the company’s risk assessment methodology and the data they use. Some companies may place more emphasis on driving records, while others may prioritize geographic location. This variation explains why premiums can differ significantly between insurers even for similar drivers and vehicles. The use of sophisticated algorithms ensures that premiums are actuarially sound and reflect the actual risk associated with each policy.

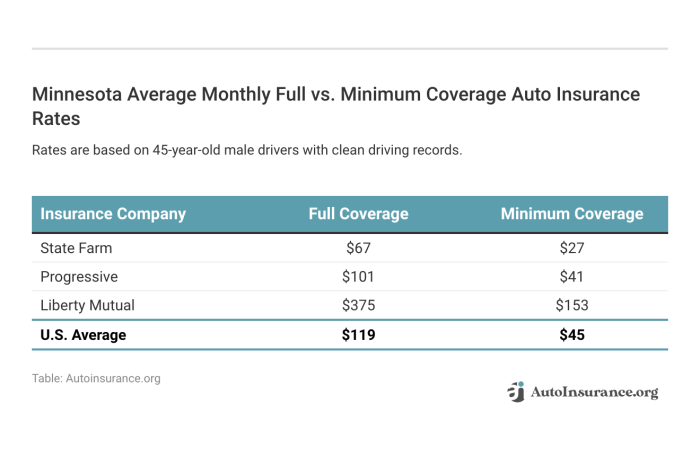

Finding Affordable Auto Insurance in Minnesota

Securing affordable auto insurance in Minnesota requires a proactive approach. By understanding your options and employing effective strategies, you can significantly reduce your premiums without compromising necessary coverage. This section Artikels several key methods to achieve this.

Strategies for Finding Affordable Auto Insurance

Several strategies can help Minnesotans find more affordable auto insurance. Careful consideration of these factors can lead to substantial savings.

- Shop Around and Compare: Obtaining quotes from multiple insurers is crucial. Different companies use varying algorithms to assess risk, leading to different premium calculations. Avoid sticking with the same insurer year after year without checking for better rates elsewhere.

- Bundle Your Policies: Many insurers offer discounts for bundling auto insurance with other types of insurance, such as homeowners or renters insurance. This can result in considerable savings compared to purchasing each policy separately.

- Maintain a Good Driving Record: A clean driving record is a significant factor in determining your premium. Avoiding accidents and traffic violations is the most effective way to keep your premiums low. Insurance companies view drivers with fewer incidents as lower-risk.

- Consider Your Vehicle: The type of vehicle you drive impacts your insurance costs. Safer, less expensive vehicles generally have lower insurance premiums. Features like anti-theft devices can also influence your rate.

- Adjust Your Coverage: Review your current coverage levels. While maintaining adequate coverage is essential, you might find you have higher limits than necessary. Reducing coverage levels slightly, while still meeting minimum requirements, can lower your premiums. However, carefully weigh the risks before reducing coverage.

- Increase Your Deductible: Raising your deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums. This strategy requires careful consideration of your financial capacity to cover a higher deductible in the event of an accident.

- Take Defensive Driving Courses: Completing a state-approved defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount on your premiums. Many insurers offer such discounts as an incentive for driver improvement.

Negotiating Lower Premiums

Don’t be afraid to negotiate your insurance premiums. Insurance companies are often willing to work with customers to find mutually beneficial arrangements.

- Contact Your Insurer Directly: Explain your situation and inquire about available discounts or adjustments. Be polite and prepared to discuss your driving record and any changes in your circumstances (e.g., new vehicle, moving to a safer neighborhood).

- Highlight Your Positive Attributes: Emphasize your clean driving record, years of insurance history with the company, and any other factors that demonstrate your low risk profile.

- Compare Quotes and Use Them as Leverage: If you have received lower quotes from other insurers, use this information to negotiate a better rate with your current provider. They may be willing to match or beat a competitor’s offer to retain your business.

Using Online Insurance Comparison Tools

Online comparison tools offer a convenient way to gather quotes from multiple insurers simultaneously.

- Advantages: Convenience, speed, and the ability to compare various options side-by-side. This allows for efficient decision-making.

- Disadvantages: The information provided may not be completely comprehensive, and some insurers may not be included in the comparison. It’s always recommended to verify information directly with the insurer.

Comparing Quotes from Multiple Insurers

To effectively compare quotes, create a spreadsheet listing key factors for each insurer. Include premium amounts, coverage levels, deductibles, and any discounts offered. This will facilitate a clear comparison to determine the best value for your needs. Remember to always review the policy details carefully before making a decision.

Filing an Auto Insurance Claim in MN

Filing an auto insurance claim in Minnesota can seem daunting, but understanding the process can make it significantly less stressful. This section Artikels the steps involved, from initial reporting to claim settlement. Remember, prompt and accurate reporting is crucial for a smooth claims process.

Reporting an Accident to Your Insurance Company

After a car accident in Minnesota, promptly contacting your insurance company is paramount. This initial report initiates the claims process and allows your insurer to begin investigating the incident. Typically, you’ll contact your insurer via phone, providing details of the accident, including the date, time, location, and individuals involved. Be prepared to answer questions about the circumstances of the accident, any injuries sustained, and the extent of vehicle damage. Accurate and detailed information provided at this stage significantly accelerates the claims process. Failure to report the accident promptly could impact your claim.

Documentation Needed to Support a Claim

Supporting your auto insurance claim with comprehensive documentation is essential for a successful outcome. This documentation helps your insurer verify the details of the accident and assess the extent of damages. Examples of necessary documents include:

- Police report: A police report, if one was filed, provides an official account of the accident, including details about the accident’s cause, involved parties, and witness statements.

- Photographs and videos: Visual evidence, such as photographs of vehicle damage, the accident scene, and any visible injuries, can be invaluable in supporting your claim.

- Medical records: If injuries resulted from the accident, providing medical records detailing treatment, diagnosis, and prognosis is crucial for substantiating any medical expense claims.

- Repair estimates: Obtain detailed estimates from reputable repair shops outlining the cost of vehicle repairs. These estimates should specify the necessary repairs and the cost of parts and labor.

- Witness statements: If there were any witnesses to the accident, obtain their contact information and written statements detailing what they observed.

- Insurance policy information: Have your insurance policy information readily available, including your policy number and coverage details.

Step-by-Step Guide for Handling an Auto Insurance Claim

Navigating the claims process can be simplified with a structured approach. Follow these steps for a smoother experience:

- Contact your insurer immediately: Report the accident as soon as possible, providing all relevant details.

- Gather necessary documentation: Collect all supporting documents, as Artikeld above.

- Cooperate with the investigation: Respond promptly to your insurer’s requests for information and cooperate fully with their investigation.

- File a claim: Follow your insurer’s instructions for formally filing your claim. This often involves completing specific forms and submitting the necessary documentation.

- Keep records: Maintain detailed records of all communication with your insurer, including dates, times, and the names of individuals you spoke with.

- Follow up: If you haven’t heard back from your insurer within a reasonable timeframe, follow up to check on the status of your claim.

SR-22 Insurance in Minnesota

SR-22 insurance is a certificate of financial responsibility required by the Minnesota Department of Public Safety (DPS) for certain drivers. It’s not a type of insurance itself, but rather proof to the state that you carry the minimum required auto insurance coverage. Essentially, it’s a way for the state to ensure you’re financially responsible for any accidents you might cause.

SR-22 insurance is mandated in Minnesota for drivers who have had their driving privileges revoked or suspended due to specific reasons, such as driving under the influence (DUI), serious moving violations, or multiple at-fault accidents. The state requires this proof of insurance to reinstate your driving privileges or to allow you to obtain a license in the first place if you’ve had prior serious driving infractions.

Obtaining SR-22 Insurance

The process of obtaining SR-22 insurance involves finding an insurance company that offers this service. Many major auto insurance providers offer SR-22 filings. Once you find a provider, you’ll need to provide them with the necessary documentation, which might include your driver’s license, proof of vehicle ownership, and information about your driving history. The insurance company will then file the SR-22 certificate electronically with the Minnesota Department of Public Safety. The certificate confirms to the state that you maintain the minimum required auto insurance coverage for a specified period. Failure to maintain continuous coverage can lead to license suspension or revocation.

Implications of Not Maintaining SR-22 Insurance

Failing to maintain SR-22 insurance in Minnesota has serious consequences. The state will be notified immediately if your coverage lapses. This could result in the immediate suspension or revocation of your driver’s license, making it illegal for you to drive. Furthermore, you may face additional fines and penalties. In some cases, you may be required to complete additional driving courses or undergo further evaluations before your license can be reinstated. The consequences can significantly impact your ability to commute to work, run errands, and participate in daily life. For instance, a person who relies on driving for their job could face job loss due to a license suspension.

Duration of SR-22 Requirement

The length of time you’re required to maintain SR-22 insurance in Minnesota varies depending on the reason for the requirement and the severity of the offense. It’s typically a period of one to three years, but in some cases, it can last longer. The Minnesota DPS will specify the duration of the requirement when issuing the order. After the specified period has passed, and you’ve maintained continuous coverage, the SR-22 requirement is removed. It’s crucial to understand the specific terms of your requirement and to maintain continuous coverage throughout the entire period to avoid further penalties.

High-Risk Auto Insurance in MN

Securing affordable auto insurance in Minnesota can be a significant challenge for drivers with less-than-perfect driving records. High-risk drivers often face higher premiums and limited choices due to their perceived increased likelihood of accidents or claims. Understanding the factors that contribute to high-risk designations and available resources is crucial for these individuals to navigate the insurance market effectively.

Factors Determining High-Risk Classification in Minnesota

Several factors contribute to a driver being classified as high-risk in Minnesota. These factors are primarily based on driving history and reflect the increased risk an insurance company assesses. Insurance companies use sophisticated algorithms and statistical models to analyze these factors and determine the appropriate premium.

- DUI/DWI Convictions: Driving under the influence significantly increases insurance premiums. Multiple DUI/DWI convictions can lead to extremely high premiums or even policy cancellations.

- Serious Accidents: Being at fault in accidents, especially those resulting in injuries or significant property damage, drastically impacts your insurance rating. The severity of the accident directly correlates with the premium increase.

- Multiple Traffic Violations: Accumulating numerous speeding tickets, reckless driving citations, or other moving violations within a short period demonstrates a pattern of risky driving behavior.

- License Suspension or Revocation: A history of license suspension or revocation strongly suggests a higher risk profile and makes obtaining insurance more difficult.

- Prior Insurance Lapses: Going without car insurance for extended periods can be viewed as a risk factor, as it indicates a lack of responsibility and financial stability.

- Age and Driving Experience: Younger drivers, especially those with limited driving experience, are generally considered higher-risk due to statistically higher accident rates.

Challenges Faced by High-Risk Drivers in Obtaining Auto Insurance

High-risk drivers frequently encounter difficulties finding affordable insurance. Many standard insurance companies may refuse to cover them entirely, or offer only limited coverage options at exorbitant rates. This situation often forces high-risk drivers to explore specialized insurance providers, which may still result in significantly higher premiums than those paid by drivers with clean records. The process can be frustrating and time-consuming, requiring extensive research and comparison shopping.

Finding Affordable High-Risk Auto Insurance Options in Minnesota

While securing affordable insurance is challenging, several strategies can help high-risk drivers find better options.

- Compare Quotes from Multiple Insurers: Shop around extensively. Don’t rely on just one quote. Use online comparison tools and contact multiple insurance companies directly, including those specializing in high-risk drivers.

- Consider Non-Standard Auto Insurance Companies: These companies specifically cater to high-risk drivers and offer coverage, although usually at higher rates than standard insurers. They understand the nuances of high-risk profiles and are more likely to approve applications.

- Improve Your Driving Record: Taking defensive driving courses and avoiding further traffic violations can demonstrate a commitment to safer driving and may lead to lower premiums over time. This is a long-term strategy, but a worthwhile one.

- Maintain a Good Payment History: Consistent and timely payments on your insurance premiums can positively impact your insurance score and potentially lead to better rates in the future.

- Increase Your Deductible: Choosing a higher deductible can lower your premium, but it means you’ll pay more out-of-pocket if you need to file a claim. Weigh the trade-off carefully.

Resources for High-Risk Drivers Seeking Insurance in Minnesota

Several resources can assist high-risk drivers in their search for insurance. Online comparison websites provide a convenient way to obtain multiple quotes simultaneously. Independent insurance agents can also be invaluable, as they have access to a wider range of insurers, including those specializing in high-risk drivers. The Minnesota Department of Commerce website offers general information about auto insurance regulations and consumer protection.

Auto Insurance and Minnesota’s No-Fault System

Minnesota operates under a modified no-fault auto insurance system, meaning that regardless of fault in an accident, your own insurance company will primarily cover your medical bills and lost wages. This differs from a pure no-fault system, where fault is completely irrelevant in the initial claim process. Understanding how this system functions is crucial for Minnesotans involved in car accidents.

Minnesota’s no-fault system dictates that your own insurance company covers your medical expenses and lost wages, regardless of who caused the accident. However, there are limitations. You can only recover damages from your own insurer up to the limits of your Personal Injury Protection (PIP) coverage. For example, if your PIP coverage is $20,000, your insurer will pay up to that amount for your medical bills and lost wages, regardless of the extent of your injuries or the duration of your lost work. This system aims to expedite the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage Under No-Fault

PIP coverage is the core of Minnesota’s no-fault system. It pays for medical expenses, lost wages, and other related expenses for you and your passengers, regardless of fault. This includes medical treatment, rehabilitation, and replacement services. It also covers lost wages, up to a certain limit, for time missed from work due to the accident. The amount of PIP coverage is determined by your insurance policy, and it’s important to choose a level of coverage that adequately protects you.

Benefits of Minnesota’s No-Fault System

The no-fault system offers several advantages. It ensures quicker access to medical care and financial compensation following an accident, as you don’t have to wait for fault to be determined before receiving benefits. It also reduces the number of lawsuits, leading to potentially lower insurance premiums in the long run. Finally, it offers protection for those injured in accidents caused by uninsured or underinsured drivers.

Drawbacks of Minnesota’s No-Fault System

Despite its benefits, the no-fault system has limitations. The system can lead to higher insurance premiums overall, as the cost of paying for everyone’s medical expenses is spread across all policyholders. The limitations on PIP coverage can leave accident victims with significant uncovered medical bills if their injuries are severe or their lost wages exceed their coverage. Furthermore, the system doesn’t cover pain and suffering unless the injuries meet a certain threshold of severity, which can be difficult to meet.

Claim Handling Under Minnesota’s No-Fault System

Filing a claim under Minnesota’s no-fault system generally involves contacting your own insurance company immediately after the accident. You’ll need to provide details about the accident, including the date, time, location, and the other driver’s information. Your insurer will then investigate the claim and begin processing your medical bills and lost wages. It’s important to keep accurate records of all medical treatments, bills, and lost wages to support your claim. If your injuries exceed your PIP coverage, you may need to pursue a claim against the at-fault driver’s insurance company, which would involve proving fault.

Comparison with Other States’ Systems

Minnesota’s system is a modified no-fault system, meaning that while your own insurance covers your initial medical expenses and lost wages, you can still sue the at-fault driver for damages exceeding your PIP coverage if the injuries meet certain thresholds. Other states have pure no-fault systems, where lawsuits are generally prohibited, or tort systems, where fault is determined and the at-fault driver’s insurance is responsible for all damages. Pure no-fault systems, like Michigan’s, prioritize quick payouts and reduce litigation, but limit the ability to recover for pain and suffering. Tort systems, like those in many other states, allow for full recovery of damages, but can lead to longer and more expensive legal battles.

Final Review

Securing the right auto insurance in Minnesota involves careful consideration of your individual needs and risk profile. By understanding the minimum requirements, available coverage options, and factors influencing premiums, you can effectively protect yourself and your assets while optimizing your insurance costs. Remember to compare quotes from multiple insurers, leverage negotiation strategies, and maintain a safe driving record to achieve the best possible coverage at the most affordable price. This guide serves as a valuable resource to help you navigate this process confidently.

FAQ Guide

What happens if I’m in an accident and don’t have insurance?

Driving without insurance in Minnesota is illegal and can result in significant fines, license suspension, and even vehicle impoundment. You’ll also be responsible for all accident-related costs.

Can I get insurance if I have a DUI on my record?

Yes, but it will likely be more expensive. You’ll be considered a high-risk driver, and insurers will charge higher premiums to compensate for the increased risk.

How often can I change my auto insurance provider?

You can typically switch providers at any time, but there may be penalties or fees depending on your policy terms. It’s best to check your policy for details.

What is the difference between collision and comprehensive coverage?

Collision covers damage to your vehicle caused by an accident, regardless of fault. Comprehensive covers damage from events outside of accidents, such as theft, vandalism, or weather-related damage.