Navigating the world of auto insurance can feel overwhelming, especially in a state as diverse as Missouri. Understanding your coverage needs, finding affordable rates, and knowing what to do in the event of an accident are crucial aspects of responsible driving. This guide provides a clear and concise overview of Missouri’s auto insurance landscape, empowering you to make informed decisions about your protection on the road.

From minimum coverage requirements and the various types of insurance available, to factors influencing premiums and strategies for finding affordable options, we’ll cover the essential aspects of securing the right auto insurance policy for your needs. We’ll also explore the claims process, available discounts, and helpful resources to assist you throughout your journey.

Minimum Coverage Requirements in Missouri

Driving in Missouri requires carrying a minimum amount of auto insurance to protect yourself and others. Failure to do so can result in significant penalties. This section details Missouri’s minimum coverage requirements, compares them to neighboring states, and illustrates the potential costs associated with different coverage levels.

Missouri’s Minimum Liability Coverage

Missouri mandates minimum liability insurance coverage to compensate others for injuries or damages you cause in an accident. This coverage is divided into bodily injury liability and property damage liability. The minimum requirement is 25/50/25. This means $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. It’s crucial to understand that this coverage protects the other party, not you. If your damages exceed these limits, you are personally responsible for the difference.

Penalties for Driving Without Minimum Insurance

Driving in Missouri without the minimum required insurance is a serious offense. Penalties can include substantial fines, license suspension, and even vehicle impoundment. The specific penalties can vary depending on the circumstances and the number of offenses. Furthermore, if you’re involved in an accident without insurance, you could face lawsuits and significant financial repercussions. It’s far more cost-effective to maintain the minimum required insurance than to risk these consequences.

Comparison with Neighboring States

Missouri’s minimum liability coverage requirements are relatively low compared to some neighboring states. For instance, Illinois has higher minimums, often requiring significantly more coverage for bodily injury and property damage. Similarly, states like Kansas may also have higher minimum liability requirements. This difference highlights the importance of understanding the specific insurance laws in each state you drive in. Always check the requirements of the state where you are operating a vehicle.

Coverage Levels and Associated Costs

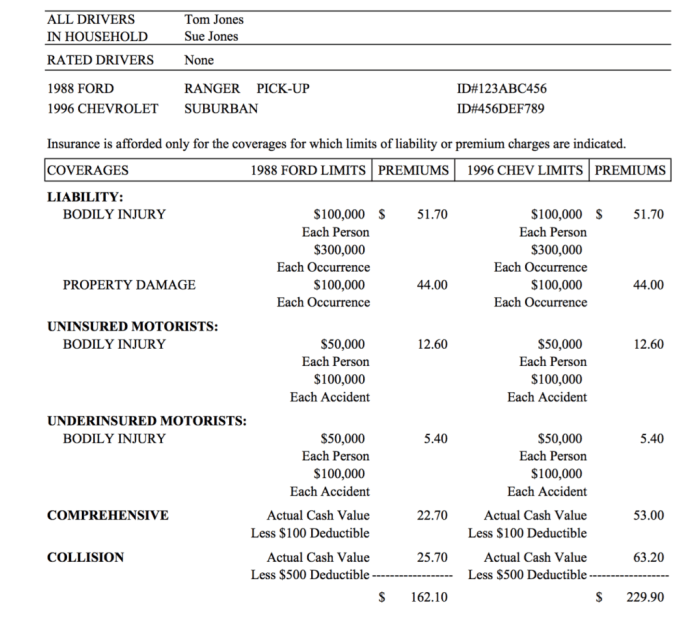

The cost of auto insurance in Missouri varies greatly depending on several factors, including your driving record, age, location, and the type of vehicle you drive. The following table provides a general idea of how different coverage levels might impact your premiums. These are illustrative examples and actual costs will vary.

| Coverage Level | Bodily Injury Liability | Property Damage Liability | Estimated Monthly Premium* |

|---|---|---|---|

| Minimum (25/50/25) | $25,000/$50,000 | $25,000 | $80 – $120 |

| Higher Liability (100/300/100) | $100,000/$300,000 | $100,000 | $120 – $180 |

| Comprehensive & Collision | (Included in Liability) | (Included in Liability) | +$50 – $100 |

| Uninsured Motorist | (Additional Coverage) | (Additional Coverage) | +$20 – $40 |

*Estimated monthly premiums are for illustrative purposes only and will vary depending on individual circumstances. Contact an insurance provider for an accurate quote.

Types of Auto Insurance Available in Missouri

Choosing the right auto insurance in Missouri involves understanding the different types of coverage available. This ensures you have the appropriate protection for yourself, your vehicle, and others involved in potential accidents. Failing to understand these options could leave you financially vulnerable in the event of an accident or other covered incident.

Missouri law requires minimum liability coverage, but purchasing additional coverage provides a more comprehensive safety net. The cost of insurance will vary depending on factors such as your driving record, the type of vehicle, your location, and the coverage levels you select. Let’s explore the various types of auto insurance you can purchase in Missouri.

Liability Coverage

Liability insurance protects you financially if you cause an accident that results in injuries or property damage to others. This is the minimum coverage required in Missouri, and it covers the costs of medical bills, property repairs, and legal fees for the other party involved. The state mandates minimum limits, but purchasing higher limits is strongly advised, as exceeding those limits could leave you personally liable for substantial costs.

Benefits include financial protection from lawsuits and significant medical expenses resulting from accidents you cause. Drawbacks include the lack of coverage for your own vehicle damage or injuries in an accident you caused.

- Beneficial when you cause an accident resulting in injuries or property damage to another person or their property.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is optional coverage, but it can be invaluable in protecting your investment in your vehicle. The insurance company will cover the cost of repairs or replacement, less your deductible.

Benefits include protection for your vehicle’s repair or replacement costs following an accident, regardless of fault. Drawbacks are the cost of the premium and the deductible you must pay before coverage begins.

- Most beneficial when your vehicle is damaged in a collision, regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or weather-related damage. Like collision coverage, this is optional but offers significant protection against unexpected events. It covers repairs or replacement, less your deductible.

Benefits include protection from a wide range of non-collision-related damage to your vehicle. Drawbacks are the added cost of the premium and the deductible.

- Most beneficial when your vehicle is damaged by events such as theft, vandalism, fire, hail, or other non-collision related incidents.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver who is uninsured or underinsured. This coverage helps pay for your medical bills, vehicle repairs, and other expenses, even if the other driver is at fault and lacks sufficient insurance.

Benefits include financial protection in accidents involving uninsured or underinsured drivers. Drawbacks are the added premium cost, but the peace of mind it offers significantly outweighs this cost in many situations.

- Beneficial when you are involved in an accident caused by an uninsured or underinsured driver.

Cost Comparison

The cost of auto insurance varies greatly depending on several factors. However, a hypothetical example illustrates the potential cost differences. For a standard sedan driven by a 30-year-old with a clean driving record in a medium-sized Missouri city, the annual premiums might look like this:

| Coverage Type | Estimated Annual Premium |

|---|---|

| Minimum Liability Only | $500 |

| Liability + Collision + Comprehensive | $1200 |

| Liability + Collision + Comprehensive + UM/UIM | $1500 |

Note: These are estimated costs and actual premiums will vary based on individual circumstances. It’s crucial to obtain quotes from multiple insurers to compare prices and coverage options.

Factors Affecting Auto Insurance Premiums in Missouri

Several factors influence the cost of auto insurance in Missouri, making it crucial for drivers to understand how these elements contribute to their premiums. These factors range from personal characteristics to vehicle details and even your creditworthiness. By understanding these influences, drivers can make informed decisions to potentially lower their insurance costs.

Driving Record

Your driving history significantly impacts your Missouri auto insurance premium. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents, especially those resulting in injuries or significant property damage, will lead to substantially higher premiums. Similarly, multiple speeding tickets or other moving violations can also increase your insurance costs. Insurance companies view a history of at-fault accidents as a higher risk, thus justifying the increased premium. For example, a driver with three speeding tickets in the past three years might pay significantly more than a driver with a spotless record.

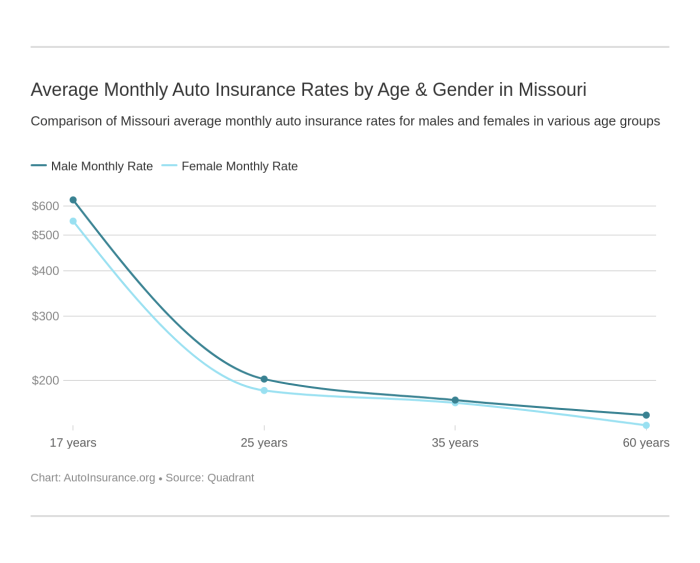

Age and Gender

Age and gender are statistically correlated with accident rates, influencing insurance premiums. Younger drivers, particularly those under 25, generally pay higher premiums due to their higher accident risk. Insurance companies consider this demographic statistically more prone to accidents and therefore a higher risk. Gender also plays a role, though its impact varies by insurer and is often subject to regulatory scrutiny. Historically, males in certain age groups have been statistically shown to have a higher accident rate than females, potentially leading to higher premiums for them.

Location

Where you live in Missouri directly impacts your insurance rates. Areas with higher crime rates, more traffic congestion, and a greater frequency of accidents typically have higher insurance premiums. This is because insurance companies assess the risk of claims based on geographical data. For example, a driver residing in a densely populated urban area might pay more than a driver in a rural area with lower accident rates.

Vehicle Type

The type of vehicle you drive significantly affects your insurance premium. High-performance vehicles, sports cars, and luxury cars are generally more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. The vehicle’s safety features, such as anti-lock brakes and airbags, also influence premiums; vehicles with advanced safety features may qualify for discounts.

Credit Score

In Missouri, as in many other states, your credit score can significantly impact your auto insurance premium. Insurance companies use credit-based insurance scores to assess risk. A higher credit score generally indicates a lower risk profile, leading to lower premiums. Conversely, a lower credit score suggests a higher risk, potentially resulting in higher premiums. This is because individuals with poor credit may be more likely to file fraudulent claims or have difficulty paying premiums.

Impact of Factors on Premiums: A Comparative Table

| Factor | Impact on Premium | Example | Relative Impact (High/Medium/Low) |

|---|---|---|---|

| Driving Record | Significant increase with accidents/violations; decrease with clean record | Multiple accidents: substantial premium increase; no accidents: lower premium | High |

| Age | Higher for younger drivers, decreases with age | 20-year-old: higher premium; 50-year-old: lower premium | Medium |

| Location | Higher in high-risk areas | Urban area: higher premium; rural area: lower premium | Medium |

| Vehicle Type | Higher for expensive/high-performance vehicles | Sports car: higher premium; economy car: lower premium | High |

| Credit Score | Higher for lower credit scores | Poor credit: higher premium; excellent credit: lower premium | Medium |

Finding Affordable Auto Insurance in Missouri

Securing affordable auto insurance in Missouri requires a strategic approach. Understanding your options, comparing quotes diligently, and carefully reviewing policy details are crucial steps in finding the best coverage at a price that fits your budget. This section provides practical strategies to help you navigate the process effectively.

Finding the right balance between cost and adequate coverage is a key concern for many Missouri drivers. Several factors influence the price of auto insurance, and understanding these can help you make informed choices. By actively comparing quotes and understanding your policy, you can significantly impact your overall cost.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is essential to securing the most affordable auto insurance. Different companies use varying calculation methods and offer different coverage options, resulting in a wide range of premiums. By obtaining at least three to five quotes, you can identify the best value for your needs. Websites that allow you to compare quotes from various providers can streamline this process. Remember to provide consistent information across all quotes for accurate comparisons.

Understanding Policy Details Before Purchasing

Before committing to an auto insurance policy, thoroughly review all the details. Pay close attention to the coverage limits, deductibles, and any exclusions. Understanding these aspects will ensure you’re getting the protection you need without paying for unnecessary coverage. If anything is unclear, contact the insurance provider directly for clarification before signing the contract. Don’t hesitate to ask questions; it’s your right to understand what you’re paying for.

Step-by-Step Guide to Obtaining and Comparing Insurance Quotes

Obtaining and comparing auto insurance quotes in Missouri involves several straightforward steps.

- Gather Necessary Information: Collect your driver’s license information, vehicle information (year, make, model, VIN), and driving history (including any accidents or violations). Having this information readily available will speed up the quote process.

- Use Online Comparison Tools: Many websites allow you to enter your information and receive multiple quotes simultaneously. This saves time and effort compared to contacting each insurer individually.

- Contact Insurers Directly: Supplement online quotes by contacting insurance companies directly. This allows you to ask specific questions and clarify any uncertainties about the policies.

- Compare Quotes Carefully: Don’t just focus on the price. Compare coverage limits, deductibles, and any additional features offered. Consider the overall value, not just the lowest price.

- Review Policy Documents: Before purchasing a policy, carefully review all the documents provided by the insurer to ensure you understand the terms and conditions.

Dealing with an Auto Insurance Claim in Missouri

Navigating the auto insurance claims process in Missouri can seem daunting, but understanding the steps involved can significantly ease the burden after an accident. This section Artikels the process, from initial reporting to claim resolution, providing clarity on your rights and responsibilities.

Filing an auto insurance claim in Missouri typically begins with promptly reporting the accident to your insurance company. The sooner you report, the faster the claims process can begin. Accurate and thorough reporting is crucial for a smooth and efficient resolution.

Reporting an Accident to Your Insurance Company

Following a car accident in Missouri, you should contact your insurance company as soon as possible, ideally within 24 hours. This initial report will initiate the claims process. During this call, you will need to provide specific details about the accident, including the date, time, location, and a description of the events leading up to and following the collision. Accurate information regarding the other driver(s) involved, including their contact information and insurance details, is also essential. You should also document any injuries sustained and the extent of vehicle damage. Be prepared to provide a police report number if one was filed. Failing to promptly report the accident could delay or even jeopardize your claim.

The Claims Process in Missouri

Once you report the accident, your insurance company will assign a claims adjuster to investigate the incident. The adjuster will gather information from various sources, including your report, police reports (if applicable), witness statements, and photographs of the damage. They will then assess the liability for the accident and determine the extent of the damages. This process can take time, depending on the complexity of the claim. You will likely need to provide additional documentation as requested by the adjuster, such as medical bills, repair estimates, and rental car receipts. Open communication with your adjuster throughout the process is key to ensuring a timely resolution. Expect regular updates on the progress of your claim. It’s important to keep detailed records of all communication and documentation related to your claim.

Rights and Responsibilities of Drivers Involved in an Accident

Missouri law requires drivers involved in accidents resulting in property damage or injury to stop at the scene, provide their information to the other party, and cooperate with law enforcement. Failure to do so can result in significant legal consequences. You are responsible for reporting the accident to your insurance company, cooperating with the claims adjuster, and providing accurate information. You have the right to seek compensation for your damages, including medical expenses, vehicle repairs, lost wages, and pain and suffering, if the accident was not your fault. If you are at fault, your insurance company will handle the claim, subject to the limits of your policy. However, you still have the right to dispute the adjuster’s findings if you believe them to be inaccurate. It is advisable to consult with an attorney if you have questions or concerns about your rights or responsibilities. Remember that you are required to carry minimum liability insurance in Missouri, and failing to do so can result in severe penalties.

Discounts and Savings on Auto Insurance in Missouri

Securing affordable auto insurance in Missouri is achievable through various discounts offered by insurance providers. Understanding these discounts and their eligibility requirements can significantly lower your premiums. This section details common discounts, their eligibility criteria, and potential savings examples.

Common Auto Insurance Discounts in Missouri

Many Missouri auto insurance companies offer a range of discounts to incentivize safe driving and responsible insurance practices. These discounts can substantially reduce the overall cost of your insurance policy. Taking advantage of these discounts can lead to considerable savings over the policy’s lifespan.

Good Driver Discounts

Good driver discounts reward drivers with clean driving records. Typically, this requires a minimum number of years without accidents or traffic violations. The specific requirements vary by insurer, but generally, a driver with three to five years of accident-free driving history qualifies. For instance, a driver with a spotless record for five years might receive a 15-20% discount on their premium compared to a driver with recent accidents or violations.

Bundling Discounts

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, often results in significant savings. Insurance companies offer these discounts because managing multiple policies for the same customer is more efficient. A typical bundling discount might range from 10% to 25% depending on the specific policies bundled and the insurance provider. For example, bundling home and auto insurance could reduce your annual premium by $200-$500.

Safe Driver Discounts

These discounts reward drivers who demonstrate safe driving habits. Some insurers use telematics programs, which involve installing a device in your car to monitor your driving behavior. Safe driving habits such as maintaining consistent speeds, avoiding harsh braking and acceleration, and not driving at night can lead to a discount. These discounts can vary significantly depending on your driving score, with potential savings reaching 10% to 30%. A driver with consistently good telematics data might see their premium reduced by $150 annually.

Comparison of Discounts and Potential Savings

| Discount Type | Eligibility Requirements | Potential Savings (Example) | Potential Percentage Savings |

|---|---|---|---|

| Good Driver | 3-5 years accident-free driving | $150 – $300 per year | 15% – 20% |

| Bundling (Home & Auto) | Purchasing both home and auto insurance from the same company | $200 – $500 per year | 10% – 25% |

| Safe Driver (Telematics) | Participation in a telematics program and safe driving habits | $100 – $300 per year | 10% – 30% |

Understanding Your Policy Documents

Your auto insurance policy is a legally binding contract. Understanding its terms is crucial to ensuring you have the appropriate coverage and know what to expect in the event of an accident or claim. Carefully reviewing your policy will prevent misunderstandings and potential disputes with your insurer.

Policy Terms and Conditions

Auto insurance policies contain various terms and conditions that define the agreement between you and your insurance company. These terms specify the coverage provided, your responsibilities as a policyholder, and the procedures for filing a claim. Common terms include definitions of covered perils (e.g., collision, comprehensive, liability), exclusions (situations not covered), and cancellation clauses (conditions under which the policy can be terminated). For instance, a policy might exclude coverage for damage caused by driving under the influence of alcohol or drugs. Understanding these specifics is essential to avoid unexpected costs or denied claims.

Coverage Limits and Deductibles

Coverage limits represent the maximum amount your insurer will pay for a covered loss. These limits are usually expressed in monetary values (e.g., $100,000 for bodily injury liability). Deductibles represent the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible on your collision coverage and incur $2,500 in damages, you would pay $500, and your insurer would pay the remaining $2,000. Understanding your coverage limits and deductibles allows you to make informed decisions about your insurance needs and budget accordingly. A higher deductible typically results in lower premiums, but also means a larger out-of-pocket expense in case of a claim.

Interpreting Key Sections of a Standard Auto Insurance Policy

A typical auto insurance policy includes several key sections. The declarations page summarizes your policy information, including your name, address, vehicle information, coverage types, and premium amounts. The definitions section clarifies the meaning of specific terms used throughout the policy. The coverage section details the types of coverage you have purchased, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The exclusions section Artikels situations or events that are not covered by your policy. The conditions section describes your responsibilities as a policyholder, such as notifying the insurer of an accident promptly and cooperating with investigations. Finally, the endorsements section details any modifications or additions to your standard policy, such as adding a driver or increasing coverage limits. Thorough review of each section ensures a complete understanding of your policy’s scope and limitations.

Resources for Missouri Drivers

Navigating the world of auto insurance can be challenging, but Missouri offers several resources to help drivers find the information and support they need. Understanding these resources can empower you to make informed decisions about your coverage and ensure you’re protected on the road. This section Artikels key organizations and websites that provide valuable assistance to Missouri drivers.

Finding the right auto insurance can feel overwhelming, but utilizing the available resources simplifies the process significantly. These resources provide access to crucial information, assistance with claims, and guidance on understanding your policy.

Missouri Department of Insurance

The Missouri Department of Insurance (DOI) serves as the primary regulatory body for the insurance industry in the state. Their website offers a wealth of information, including consumer guides on auto insurance, details on minimum coverage requirements, and a searchable database of licensed insurers. They also handle consumer complaints and investigate potential insurance fraud. Contact information for the Missouri DOI can be found on their website, and they offer various ways to contact them, including phone, email, and mail. The website typically includes frequently asked questions (FAQs) sections covering common concerns related to auto insurance.

Other Helpful Organizations and Websites

Several other organizations and websites offer valuable information and support to Missouri drivers seeking auto insurance. These resources often provide comparative tools, independent reviews, and advice on finding affordable coverage. Many offer educational materials explaining complex insurance concepts in simple terms. They may also provide links to consumer protection agencies and legal resources.

A list of helpful websites and organizations might include (but is not limited to):

- The Insurance Information Institute (III): This national organization provides objective information about insurance topics, including auto insurance.

- Consumer Reports: Offers reviews and ratings of auto insurance companies.

- National Association of Insurance Commissioners (NAIC): Provides information and resources on insurance regulations nationwide.

- Local consumer advocacy groups: Many states have non-profit organizations dedicated to consumer protection, which may offer assistance with insurance-related issues.

A Helpful Resource Guide for Missouri Drivers (Image Description)

Imagine a tri-fold brochure. The cover features a stylized image of the Missouri state flag subtly incorporated into a road scene. The title “Navigating Missouri Auto Insurance” is prominently displayed. Inside, the left panel provides a concise summary of minimum coverage requirements and key terms. The center panel offers a step-by-step guide to finding affordable insurance, including tips for comparison shopping and identifying potential discounts. The right panel lists contact information for the Missouri Department of Insurance, other helpful organizations, and frequently asked questions. The brochure is designed with clear headings, bullet points, and a visually appealing layout using the state’s colors. The overall tone is informative, reassuring, and easy to understand.

Ending Remarks

Securing adequate auto insurance in Missouri is not merely a legal requirement; it’s a vital step in protecting yourself, your passengers, and your vehicle. By understanding the intricacies of coverage options, premiums, and the claims process, you can navigate the complexities of auto insurance with confidence. Remember to regularly review your policy, compare quotes, and take advantage of available discounts to ensure you have the right coverage at the best possible price. Drive safely and be prepared.

FAQ Corner

What happens if I’m in an accident and don’t have insurance?

Driving without the minimum required insurance in Missouri can result in significant fines, license suspension, and even vehicle impoundment. You’ll also be personally liable for any damages or injuries you cause.

Can I get insurance if I have a poor driving record?

Yes, but your premiums will likely be higher. Many insurers offer coverage to drivers with less-than-perfect records, though they may assess higher risk and charge accordingly. Shopping around and comparing quotes is crucial in this situation.

How often can I change my auto insurance policy?

You can usually change your policy whenever you like, though there might be penalties for canceling early. Many insurers allow you to adjust coverage or switch providers at renewal time.

What is Uninsured/Underinsured Motorist coverage?

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It helps cover your medical bills and vehicle repairs, even if the at-fault driver lacks sufficient insurance.