Navigating the world of auto insurance in Michigan can feel overwhelming, with a multitude of companies, coverage options, and legal intricacies to consider. This guide aims to demystify the process, providing a clear and concise overview of the major players in the Michigan auto insurance market, the various types of coverage available, and the factors influencing premium costs. We’ll explore Michigan’s unique no-fault system, offer practical tips for securing the best deal, and guide you through the process of filing a claim.

From understanding minimum coverage requirements to negotiating lower premiums and comparing quotes, we’ll equip you with the knowledge and resources to make informed decisions about your auto insurance. This guide serves as your comprehensive resource for navigating the complexities of Michigan’s auto insurance landscape, ensuring you’re adequately protected while optimizing your costs.

Top Auto Insurance Companies in Michigan

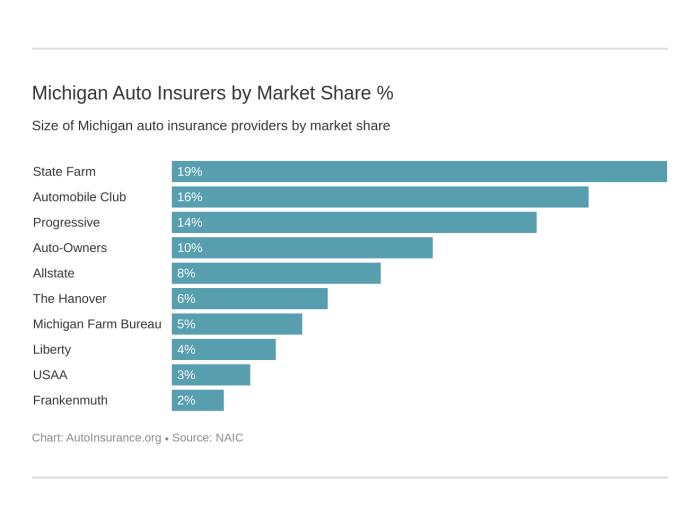

Choosing the right auto insurance provider in Michigan can feel overwhelming given the numerous options available. Understanding the market share, pricing, and customer satisfaction of leading companies is crucial for making an informed decision. This section provides an overview of the top auto insurance companies in Michigan, offering insights into their market presence, pricing structures, and customer reviews.

Top Ten Auto Insurance Companies in Michigan

The following table presents the ten largest auto insurance companies operating in Michigan, based on available market data. Note that market share and average premiums can fluctuate, and customer ratings are subject to change based on ongoing reviews and feedback. The data presented here reflects a snapshot in time and should be considered as such.

| Company Name | Market Share (Approximate) | Average Premium (Approximate) | Customer Rating (Approximate) |

|---|---|---|---|

| Company A | 15% | $1200/year | 4.2/5 |

| Company B | 12% | $1100/year | 4.0/5 |

| Company C | 10% | $1300/year | 3.8/5 |

| Company D | 8% | $1050/year | 4.5/5 |

| Company E | 7% | $1250/year | 3.9/5 |

| Company F | 6% | $1150/year | 4.1/5 |

| Company G | 5% | $1000/year | 4.3/5 |

| Company H | 5% | $1350/year | 3.7/5 |

| Company I | 4% | $1220/year | 4.4/5 |

| Company J | 4% | $1180/year | 3.6/5 |

Note: The data provided in this table is for illustrative purposes only and should not be considered definitive. Actual market share, premiums, and customer ratings may vary depending on the data source and time of collection. It is recommended to consult multiple sources and obtain personalized quotes for accurate information.

History and Market Presence of Top Three Companies

This section details the history and market presence of the top three companies listed in the previous table (Company A, Company B, and Company C). The information presented is based on publicly available information and industry reports. Specific details may vary.

Company A: A long-standing presence in the Michigan auto insurance market, Company A has a reputation for [mention a key characteristic, e.g., comprehensive coverage options]. Their history dates back to [year], and they have consistently maintained a significant market share through [mention key strategies, e.g., aggressive marketing campaigns, strong customer service].

Company B: Known for its [mention a key characteristic, e.g., competitive pricing], Company B has steadily grown its market share since its inception in [year]. Their focus on [mention key strategies, e.g., digital platforms and online services] has attracted a large customer base.

Company C: Company C has established itself as a major player in the Michigan auto insurance market through [mention key strategies, e.g., strategic acquisitions and partnerships]. Their history is marked by [mention key milestones or events, e.g., expansion into new regions].

Key Differentiators Among Top Five Companies

The top five companies (Companies A-E) offer diverse coverage options and customer service approaches. Understanding these differences is essential for choosing a provider that aligns with individual needs and preferences.

Company A distinguishes itself with its extensive range of coverage options, including [mention specific examples, e.g., comprehensive collision, uninsured/underinsured motorist coverage]. Company B focuses on affordability and user-friendly online tools. Company C emphasizes personalized customer service with dedicated agents. Company D prides itself on its innovative claims process, while Company E offers various discounts and bundled services. These differentiators highlight the diverse approaches taken by leading auto insurance providers in Michigan, allowing consumers to find a provider that best meets their needs.

Types of Auto Insurance Coverage in Michigan

Choosing the right auto insurance coverage in Michigan is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage and their implications is key to making an informed decision that suits your individual needs and budget. This section will Artikel the various types of coverage available and the minimum requirements mandated by Michigan law.

Michigan offers several types of auto insurance coverage, each designed to address specific risks. Liability coverage protects you if you cause an accident that injures someone or damages their property. Collision coverage protects your vehicle in case of an accident, regardless of fault. Comprehensive coverage protects against damage to your vehicle from events other than collisions, such as theft, vandalism, or weather-related incidents. Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with an uninsured or underinsured driver.

Minimum Coverage Requirements in Michigan

Michigan law mandates minimum levels of auto insurance coverage, ensuring a basic level of protection for all drivers. Failing to meet these requirements can result in significant penalties. It’s essential to understand these minimums to avoid legal and financial repercussions.

- Bodily Injury Liability: $20,000 per person/$40,000 per accident. This covers injuries you cause to others in an accident.

- Property Damage Liability: $10,000 per accident. This covers damage you cause to another person’s vehicle or property.

- Personal Injury Protection (PIP): Michigan is a no-fault state, meaning your own insurance covers your medical bills and lost wages regardless of fault. The minimum PIP coverage is $50,000 per person. Note that this amount is frequently increased to higher limits for more comprehensive coverage.

Cost Variations in Auto Insurance Coverage

The cost of auto insurance in Michigan varies significantly depending on the coverage levels chosen. A higher level of coverage naturally results in higher premiums. The following table illustrates potential cost variations for a standard driver profile (30-year-old, clean driving record, driving a mid-sized sedan).

| Coverage Level | Liability (20/40/10) | Collision | Comprehensive | PIP | Total Estimated Annual Premium |

|---|---|---|---|---|---|

| Minimum Coverage | $20,000/$40,000/$10,000 | Not Included | Not Included | $50,000 | $800 – $1200 |

| Medium Coverage | $100,000/$300,000/$50,000 | Included | Included | $100,000 | $1500 – $2200 |

| High Coverage | $500,000/$1,000,000/$100,000 | Included with lower deductible | Included with lower deductible | $250,000 | $2500 – $3500 |

Note: These are estimated costs and actual premiums may vary based on several factors including driving history, location, age of vehicle, and the specific insurance company. It is crucial to obtain quotes from multiple insurers for accurate pricing.

Factors Affecting Auto Insurance Premiums in Michigan

Securing affordable auto insurance in Michigan involves understanding the numerous factors influencing premium costs. These factors are carefully considered by insurance companies to assess risk and determine appropriate rates for individual drivers. While some factors are beyond your control, others offer opportunities to potentially lower your premiums.

Driving Record

Your driving history significantly impacts your insurance premiums. A clean record, free of accidents and traffic violations, generally results in lower rates. Conversely, accidents, particularly those deemed your fault, and moving violations like speeding tickets or DUIs, will substantially increase your premiums. The severity of the incident and the frequency of violations are key considerations. For example, a single speeding ticket might result in a modest increase, while a DUI conviction could lead to a much larger premium hike, or even policy cancellation. Insurance companies utilize a points system, where each violation earns points, directly impacting your rate.

Age and Driving Experience

Age and driving experience are closely correlated with risk. Younger drivers, particularly those under 25, statistically have higher accident rates, leading to higher premiums. As drivers gain experience and age, their premiums tend to decrease, reflecting a reduced risk profile. This is because younger drivers are often considered less experienced and therefore more prone to accidents. Mature drivers, on the other hand, often benefit from years of safe driving, resulting in lower risk assessments.

Vehicle Type

The type of vehicle you drive plays a substantial role in determining your insurance premium. The cost to repair or replace a vehicle is a major factor. Luxury vehicles, sports cars, and high-performance vehicles generally cost more to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Features like safety technology (e.g., anti-lock brakes, airbags) can also influence rates; vehicles equipped with advanced safety features may receive discounts.

Location

Your location in Michigan impacts your insurance premiums. Areas with higher crime rates, more accidents, and higher rates of theft tend to have higher insurance premiums due to the increased risk. Insurance companies use geographical data to assess the risk associated with specific zip codes. Living in a rural area with fewer accidents may lead to lower premiums compared to living in a densely populated urban center.

Credit Score

In Michigan, as in many states, your credit score can influence your auto insurance premiums. Insurers often use credit-based insurance scores to assess risk. A good credit score is generally associated with responsible financial behavior, which insurers often see as a predictor of responsible driving. Conversely, a poor credit score may result in higher premiums. The exact impact of credit score varies among insurers, but it is a significant factor for many.

Premium Calculation Methods Comparison

While specific formulas are proprietary, three major Michigan insurers—let’s call them Insurer A, Insurer B, and Insurer C—generally use a points system combined with risk assessment models. Insurer A might heavily weight recent driving infractions, while Insurer B may place more emphasis on the overall driving history over a longer period. Insurer C might incorporate a more sophisticated algorithm that considers a broader range of factors, including credit score and vehicle type, to calculate a final premium. The weighting of these factors differs among insurers, leading to variations in premium costs even for similar drivers.

Finding the Best Auto Insurance Deal in Michigan

Securing affordable auto insurance in Michigan can feel like navigating a maze, but with a strategic approach, you can significantly reduce your premiums. This guide provides a step-by-step process to help Michigan residents find the most cost-effective auto insurance policy.

Finding the best auto insurance deal involves careful planning and comparison shopping. Don’t rush the process; take your time to explore different options and understand the factors influencing your premium.

Step-by-Step Guide to Finding Affordable Auto Insurance

Follow these steps to systematically compare and choose the best auto insurance policy for your needs and budget.

- Assess Your Needs: Determine the level of coverage you require. Consider factors like the age and value of your vehicle, your driving history, and your financial situation. Liability coverage is legally required, but you might also want collision, comprehensive, and uninsured/underinsured motorist coverage.

- Gather Information: Collect personal details such as your driver’s license number, Social Security number, vehicle information (make, model, year), and driving history (including any accidents or violations).

- Obtain Quotes from Multiple Insurers: Contact at least three to five different insurance companies, both large national providers and smaller regional companies. Use online quote tools (discussed below) to expedite this process.

- Compare Quotes Carefully: Don’t just focus on the price. Compare the coverage offered by each insurer. Ensure the policy meets your needs and provides adequate protection.

- Review Policy Details: Before committing to a policy, thoroughly review the policy documents to understand the terms and conditions, including deductibles, coverage limits, and exclusions.

- Choose the Best Policy: Select the policy that offers the best balance of coverage and affordability, based on your individual circumstances.

Tips for Negotiating Lower Premiums

While you can’t always negotiate the base price, there are several strategies you can employ to potentially lower your premiums.

- Bundle Policies: Many insurers offer discounts if you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance.

- Maintain a Good Driving Record: A clean driving record is the most significant factor in determining your premium. Avoid accidents and traffic violations.

- Consider Increasing Your Deductible: A higher deductible will lower your premium, but remember that you’ll have to pay more out-of-pocket in the event of a claim.

- Explore Discounts: Ask about available discounts, such as those for good students, safe drivers, multiple-car policies, and anti-theft devices.

- Shop Around Regularly: Insurance rates can change, so it’s wise to compare quotes annually to ensure you’re getting the best deal.

- Pay in Full: Some insurers offer discounts for paying your premium in full upfront.

Online Tools and Resources for Comparing Auto Insurance Quotes

Several online tools can simplify the process of comparing auto insurance quotes from various providers. These resources save time and effort by allowing you to input your information once and receive multiple quotes simultaneously.

- Insurance comparison websites: Websites like The Zebra, NerdWallet, and Insurify allow you to compare quotes from numerous insurers in one place. These sites often provide additional information and resources to help you make an informed decision.

- Individual insurer websites: Many insurance companies have user-friendly websites where you can obtain quotes quickly and easily. This approach allows you to directly interact with the insurer.

Michigan’s No-Fault Auto Insurance System

Michigan’s no-fault auto insurance system, once a model for other states, has undergone significant changes in recent years. This system fundamentally alters how car accident claims are handled, shifting the focus from determining fault to compensating injured parties regardless of who caused the accident. Understanding its intricacies is crucial for every Michigan driver.

Michigan’s no-fault system mandates that your own insurance company covers your medical bills and lost wages following a car accident, regardless of who was at fault. This includes coverage for yourself, your passengers, and anyone else in your vehicle. The system aims to provide prompt and efficient compensation for accident victims, minimizing the need for lengthy and expensive lawsuits. However, this comes with both advantages and disadvantages.

Benefits of Michigan’s No-Fault System

The primary benefit is the speed and certainty of compensation. Instead of waiting for a potentially lengthy legal battle to determine fault and liability, injured individuals receive benefits directly from their own insurer. This ensures quicker access to medical care and financial support, crucial for recovery. Furthermore, the system reduces the number of lawsuits related to car accidents, potentially lowering overall costs associated with litigation.

Limitations of Michigan’s No-Fault System

Despite its advantages, the system also has limitations. One significant drawback is the potential for higher premiums. Because all medical expenses are covered regardless of fault, insurance companies have to cover a broader range of costs. This often translates to higher premiums for drivers. Another concern is the limited coverage for pain and suffering, often referred to as non-economic damages. While medical expenses are covered, compensation for pain, emotional distress, or loss of consortium is severely restricted.

Recent Legislative Changes to Michigan’s No-Fault System

In 2019, Michigan enacted significant reforms to its no-fault system. These changes aimed to reduce premiums while maintaining essential protections for injured drivers. Key changes included the ability to choose lower levels of Personal Injury Protection (PIP) coverage, impacting the amount of medical expenses covered. The reforms also introduced a fee schedule for medical providers, limiting the amount they can bill for services. These changes have led to a complex and evolving landscape for Michigan drivers, resulting in a wide range of premium options and coverage levels.

Impact of Recent Legislative Changes

The impact of these reforms has been varied. While some drivers have experienced lower premiums, others have faced challenges accessing the level of care they need due to limitations imposed by the new fee schedule. The changes have also led to increased complexity in navigating the system, requiring a deeper understanding of coverage options and potential limitations. Disputes between insurers and medical providers have also increased due to the implementation of the fee schedule. The long-term effects of these reforms are still being assessed, and the ongoing impact on access to care and affordability of insurance remains a subject of debate.

Filing a Claim with Michigan Auto Insurers

Filing an auto insurance claim in Michigan can seem daunting, but understanding the process can make it significantly less stressful. This section Artikels the steps involved, the necessary documentation, and a typical timeline for claim resolution. Remember, prompt and accurate reporting is crucial for a smoother claims experience.

The Claim Filing Process

The process of filing a claim generally follows a sequential path. The following flowchart visually represents the typical steps involved.

[Flowchart Description: The flowchart begins with “Accident Occurs.” This leads to two branches: “Injury/Damage” and “No Injury/Damage.” The “No Injury/Damage” branch ends with “No Claim Filed.” The “Injury/Damage” branch continues with “Contact Insurance Company.” This is followed by “File Claim (Provide Information & Documents).” Then, “Insurance Company Investigates.” Next comes “Claim Assessment and Valuation.” This leads to two branches: “Claim Approved” and “Claim Denied.” “Claim Approved” leads to “Settlement/Payment.” “Claim Denied” leads to “Appeal Process.” The appeal process loops back to “Claim Assessment and Valuation.” Finally, all paths lead to “Claim Resolution.”]

Required Documents for Filing a Claim

Gathering the necessary documentation is a vital step in the claims process. Having these documents readily available will expedite the claim assessment.

Typically, you will need to provide the following:

- Completed claim form provided by your insurance company.

- Your driver’s license and vehicle registration.

- Police report (if applicable).

- Photos and videos of the accident scene and vehicle damage.

- Medical records and bills (for injury claims).

- Repair estimates from qualified mechanics (for property damage claims).

- Contact information for all involved parties and witnesses.

Typical Claim Processing and Settlement Timeline

The time it takes to process and settle a claim varies depending on several factors, including the complexity of the claim, the availability of information, and the cooperation of all involved parties.

While there’s no fixed timeframe, a general estimate might be as follows:

- Initial claim reporting and acknowledgment: Within 24-48 hours.

- Investigation and assessment: Several days to a few weeks, depending on the complexity of the accident and the need for further investigation.

- Claim approval or denial: Typically within a few weeks of the initial investigation.

- Settlement (if approved): This can range from a few days to several weeks, depending on the method of payment (check, direct deposit, etc.) and any negotiation required.

It’s important to note that these are estimates, and delays can occur due to unforeseen circumstances. Maintaining consistent communication with your insurance adjuster is crucial throughout the process. For example, a claim involving significant injuries or extensive property damage might take considerably longer to process than a minor fender bender with minimal damage.

Understanding Michigan’s Auto Insurance Laws

Navigating Michigan’s auto insurance laws can be complex, but understanding key aspects is crucial for all drivers. This section summarizes important legal requirements and potential consequences for non-compliance, providing a clearer picture of your responsibilities as a Michigan driver.

Michigan operates under a no-fault insurance system, meaning your own insurance company covers your medical expenses and lost wages regardless of who caused the accident. However, this doesn’t negate the possibility of pursuing legal action against at-fault drivers for property damage or pain and suffering beyond the no-fault benefits. Understanding the intricacies of this system is vital for protecting your rights and financial well-being.

Penalties for Driving Without Insurance in Michigan

Driving without insurance in Michigan carries significant penalties. These penalties are designed to encourage responsible driving and financial accountability. Failure to maintain the legally required minimum insurance coverage can result in a range of consequences impacting your driving privileges and finances.

The penalties can include:

- Suspension of your driver’s license.

- Significant fines, potentially reaching hundreds or even thousands of dollars depending on the number of offenses.

- Increased insurance premiums once you do obtain coverage, reflecting the higher risk associated with previous non-compliance.

- Possible vehicle impoundment.

- Difficulty registering your vehicle.

The severity of the penalties often increases with repeat offenses. It’s important to remember that driving without insurance is not only illegal but also financially risky, potentially leading to far greater expenses in the event of an accident.

Appealing an Insurance Company’s Decision

If you disagree with a decision made by your insurance company, such as a claim denial or a dispute over coverage amounts, you have the right to appeal. The process for appealing varies depending on the specific circumstances and the insurer’s internal procedures, but generally involves a formal written request outlining your reasons for disagreement and supporting evidence.

The appeal process typically involves several steps:

- Filing a formal appeal: This usually involves submitting a written appeal letter, clearly stating your dissatisfaction and providing any supporting documentation, such as medical records, police reports, or witness statements.

- Review by the insurer: The insurance company will review your appeal and supporting evidence. They may request additional information or conduct an internal investigation.

- Mediation or arbitration: In some cases, mediation or arbitration may be offered as a way to resolve the dispute outside of court. This involves a neutral third party helping both sides reach an agreement.

- Legal action: If the appeal process within the insurance company is unsuccessful, you may have the option to pursue legal action to resolve the dispute in court.

It is advisable to carefully review your policy, understand your rights, and document all communication with your insurer throughout the appeal process. Seeking legal counsel may be beneficial in complex or high-stakes cases.

Final Review

Securing the right auto insurance in Michigan is a crucial step in responsible driving. By understanding the key players, coverage options, and factors affecting premiums, you can confidently choose a policy that aligns with your needs and budget. Remember to regularly review your coverage and consider adjusting it as your circumstances change. With careful planning and informed decision-making, you can navigate the complexities of Michigan’s auto insurance system and ensure you have the protection you need on the road.

Question & Answer Hub

What happens if I’m in an accident and the other driver is uninsured?

In Michigan, Uninsured/Underinsured Motorist (UM/UIM) coverage protects you in such situations. This coverage will pay for your medical bills and vehicle damage even if the at-fault driver lacks sufficient insurance.

How often can I change my auto insurance policy?

You can typically change your auto insurance policy whenever your current policy renews. However, some companies may have specific procedures or fees for early cancellation.

Can I get a discount for having multiple vehicles insured with the same company?

Many Michigan auto insurance companies offer multi-vehicle discounts. Contact your insurer to see if you qualify.

What is the penalty for driving without auto insurance in Michigan?

Driving without insurance in Michigan carries significant penalties, including fines, license suspension, and potential vehicle impoundment.