Navigating the world of auto insurance can feel overwhelming, especially in a vibrant city like Brownsville, Texas. Finding the right coverage at the best price requires understanding the local market, comparing various providers, and considering individual needs. This guide delves into the intricacies of Brownsville’s auto insurance landscape, offering insights into factors influencing rates, available coverage options, and strategies for securing affordable protection.

From understanding the competitive landscape dominated by major insurance providers to navigating the nuances of liability, collision, and comprehensive coverage, we’ll equip you with the knowledge to make informed decisions. We’ll explore how factors like driving history, vehicle type, and even your location within Brownsville impact your premiums. Ultimately, our aim is to empower you to find the best auto insurance policy tailored to your specific circumstances and budget.

Brownsville, TX Auto Insurance Market Overview

The Brownsville, TX auto insurance market is a competitive landscape shaped by a mix of national and regional providers. The city’s demographics, economic conditions, and accident rates all influence the types of policies offered and the associated premiums. Understanding this market is crucial for residents seeking the best coverage at the most affordable price.

The competitive nature of the market ensures consumers have a range of choices. However, this variety also necessitates careful comparison of policies and providers to find the best fit for individual needs and budgets. Factors such as driving history, vehicle type, and coverage preferences significantly impact the final cost of insurance.

Major Insurance Providers in Brownsville, TX

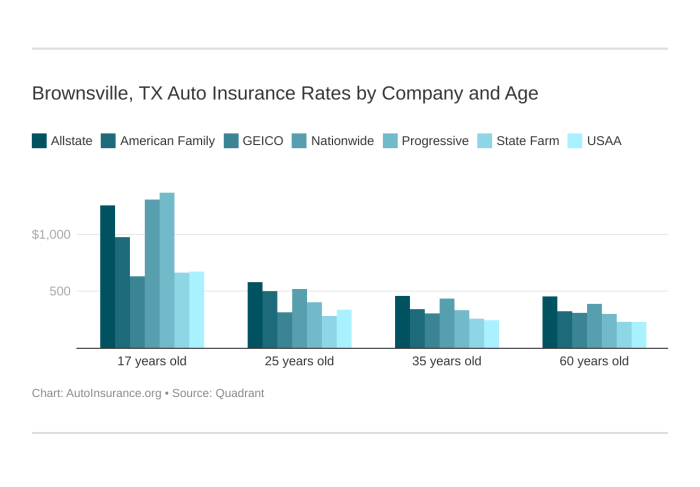

Several major insurance companies operate extensively in Brownsville, offering a variety of auto insurance products. These providers often compete on price, coverage options, and customer service, leading to a dynamic market environment. Some of the most prominent include State Farm, Geico, Progressive, and Allstate, although many smaller, regional companies also operate within the city. Consumers can leverage this competition to their advantage by comparing quotes and selecting the provider that best meets their requirements.

Comparison of Auto Insurance Policies in Brownsville, TX

The types of auto insurance policies available in Brownsville mirror those offered across the state of Texas. These include liability coverage (which covers injuries or damages to others), collision coverage (which covers damage to your vehicle in an accident), comprehensive coverage (which covers damage from non-collision events like theft or vandalism), uninsured/underinsured motorist coverage (which protects you if involved in an accident with an uninsured driver), and medical payments coverage (which covers medical expenses for you and your passengers). The specific coverage levels and premiums will vary based on individual risk factors.

Comparison of Four Major Insurers

The following table compares four major auto insurance providers in Brownsville, offering a snapshot of their average rates, coverage options, and customer reviews. Note that these are average rates and individual premiums may vary significantly. Customer reviews are summarized from publicly available sources and should be considered a general indication of customer satisfaction.

| Insurer | Average Annual Rate (Estimate) | Coverage Options | Customer Review Summary |

|---|---|---|---|

| State Farm | $1200 – $1800 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | Generally positive, known for strong customer service. |

| Geico | $1000 – $1500 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | Mixed reviews, often praised for competitive pricing but sometimes criticized for customer service. |

| Progressive | $1100 – $1700 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, various add-ons | Generally positive, known for a wide range of coverage options and customization. |

| Allstate | $1300 – $1900 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | Mixed reviews, some praise for claims handling, others cite higher premiums. |

Disclaimer: The rates and customer reviews presented are estimates based on publicly available information and may not reflect current pricing or individual experiences. It is crucial to obtain personalized quotes from multiple insurers to compare options accurately.

Factors Influencing Auto Insurance Rates in Brownsville, TX

Auto insurance premiums in Brownsville, Texas, are determined by a complex interplay of factors. Understanding these factors can help drivers make informed decisions and potentially save money on their insurance costs. This section will detail some key influences on your Brownsville auto insurance rate.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premiums. Insurance companies view a clean driving history – free of accidents, tickets, and DUI convictions – very favorably. Conversely, accidents, particularly those deemed your fault, will likely lead to higher premiums. The severity of the accident also matters; a minor fender bender will have less impact than a serious collision resulting in significant damage or injuries. Similarly, traffic violations, such as speeding tickets or running red lights, demonstrate a higher risk profile and will usually increase your rates. Multiple offenses within a short period will result in even steeper increases. For example, a driver with three speeding tickets in a year might face a premium increase of 20-30% or more compared to a driver with a clean record. A DUI conviction can lead to significantly higher premiums, sometimes doubling or even tripling the cost of insurance. Insurance companies use a points system to track these infractions, with more points translating to higher premiums.

Age and Gender Influence on Auto Insurance Costs

Statistically, age and gender are factors considered by insurance companies. Younger drivers, particularly those under 25, generally pay higher premiums due to their increased risk of accidents. This is because younger drivers have less experience behind the wheel and are more prone to risky driving behaviors. Once drivers reach a certain age (typically mid-20s to 30s), premiums tend to decrease. Gender also plays a role, with studies suggesting that, on average, men tend to pay slightly higher premiums than women. This disparity is often attributed to higher accident rates and insurance claims among men. However, this is a generalization, and individual driving records still significantly influence the final premium. It’s crucial to remember that these are statistical trends, and individual circumstances can vary greatly.

Vehicle Type and Value’s Role in Determining Rates

The type and value of your vehicle directly affect your insurance premiums. Generally, sports cars and high-performance vehicles are considered riskier and more expensive to insure than sedans or smaller cars due to their higher repair costs and greater potential for damage. The value of your car also matters; a more expensive car will typically result in higher premiums because the insurance company has to cover a larger potential payout in case of theft or damage. Features like anti-theft systems can help mitigate this cost, while older, less valuable vehicles often have lower insurance rates. For instance, insuring a new luxury SUV will be substantially more expensive than insuring a used economy car.

Location’s Influence on Brownsville Insurance Premiums

The specific location within Brownsville where you reside can influence your insurance rates. Areas with higher crime rates or a greater frequency of accidents will generally have higher premiums due to the increased risk of theft and collisions. Insurance companies use sophisticated geographic rating systems that consider factors like accident history, theft rates, and the density of traffic in different neighborhoods. A driver living in a high-risk area might pay more than a driver living in a quieter, less congested neighborhood, even if their driving records are identical. This is a key factor that drivers in Brownsville should be aware of when comparing quotes from different insurance providers.

Finding Affordable Auto Insurance in Brownsville, TX

Securing affordable auto insurance in Brownsville, Texas, requires a strategic approach. The cost of insurance can vary significantly depending on several factors, including your driving record, the type of vehicle you drive, and the coverage you choose. By understanding these factors and employing effective strategies, you can significantly reduce your premiums and find a policy that fits your budget. This section Artikels practical tips and resources to help you navigate the Brownsville auto insurance market and obtain the best possible rates.

Tips for Securing Lower Auto Insurance Rates in Brownsville

Several strategies can help you lower your auto insurance costs in Brownsville. Maintaining a clean driving record is paramount; accidents and traffic violations directly impact your premiums. Consider increasing your deductible; a higher deductible means lower premiums, but be prepared to pay more out-of-pocket in the event of a claim. Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, through the same provider often results in discounts. Choosing a vehicle with a lower insurance risk profile, such as a car with good safety ratings and a lower theft rate, can also help. Finally, maintaining good credit can positively influence your insurance rates, as insurers often consider credit scores as an indicator of risk.

Strategies for Comparing Auto Insurance Quotes Effectively

Effectively comparing auto insurance quotes is crucial for finding the best deal. Begin by obtaining quotes from multiple insurers; don’t settle for the first quote you receive. Ensure you’re comparing apples to apples; make sure each quote includes the same coverage levels and deductibles. Use online comparison tools, but be aware that these tools may not include all insurers operating in Brownsville. Contact insurers directly to obtain personalized quotes, as online tools may not accurately reflect your specific circumstances. Pay close attention to the details of each quote, including the coverage limits, deductibles, and any additional fees or charges. Don’t solely focus on the price; consider the reputation and financial stability of the insurer as well.

Resources for Finding Affordable Auto Insurance in Brownsville

Several resources can assist you in finding affordable auto insurance in Brownsville. Independent insurance agents can provide quotes from multiple insurers, saving you the time and effort of contacting each company individually. Online comparison websites can provide a starting point for comparing quotes, but remember to verify the information with the insurers directly. The Texas Department of Insurance website offers valuable information about auto insurance regulations and consumer protection in Texas. Local community organizations and financial literacy programs may also offer resources and guidance on finding affordable insurance options.

Step-by-Step Guide to Obtaining Car Insurance in Brownsville

Obtaining car insurance in Brownsville involves a straightforward process. First, gather necessary information, such as your driver’s license, vehicle identification number (VIN), and driving history. Next, obtain quotes from multiple insurers using a combination of online tools and direct contact. Carefully compare the quotes, paying attention to coverage, deductibles, and premiums. Once you’ve chosen a policy, provide the insurer with the required information and payment. Finally, ensure you receive confirmation of your coverage and keep your insurance card readily available. Remember to review your policy periodically and update your information as needed.

Specific Coverage Options and Their Importance

Choosing the right auto insurance coverage is crucial for protecting yourself and your finances in Brownsville, TX. Understanding the various options and their implications is key to securing adequate protection without overspending. This section details essential coverage types and their relevance to drivers in the Brownsville area.

Liability Coverage in Brownsville

Liability coverage is legally mandated in Texas and is arguably the most important type of auto insurance. It protects you financially if you cause an accident that injures someone or damages their property. In Brownsville, with its busy streets and potential for accidents, strong liability coverage is vital. A minimum of 30/60/25 liability coverage is required by Texas law, meaning $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 for property damage. However, given the potential for significant medical expenses and legal fees following an accident, many drivers opt for higher liability limits, such as 100/300/100 or even more, to provide greater financial security. Failing to carry sufficient liability coverage could leave you personally liable for substantial costs exceeding your assets.

Collision and Comprehensive Coverage Benefits

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or even animal strikes. While not legally required, these coverages are highly recommended, particularly in Brownsville where weather events like hailstorms can cause significant damage. Consider the cost of repairing or replacing your vehicle; if it exceeds your savings or your ability to quickly obtain a loan, the peace of mind offered by these coverages is invaluable. For example, a hail storm could easily cause thousands of dollars in damage to a vehicle, a cost easily covered by comprehensive insurance.

Uninsured/Underinsured Motorist Coverage in Brownsville

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver who lacks sufficient insurance or is uninsured altogether. Given the prevalence of uninsured drivers in many areas, including potentially Brownsville, UM/UIM coverage is essential. This coverage will help pay for your medical bills, lost wages, and vehicle repairs if you are injured by an uninsured or underinsured driver. Choosing adequate UM/UIM limits is crucial, ensuring you’re protected against substantial financial losses in such scenarios. It’s advisable to have UM/UIM coverage that matches or exceeds your liability limits.

Deductible Options and Premium Impact

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums. The choice depends on your risk tolerance and financial situation. A higher deductible means you’ll pay more upfront in the event of a claim, but your monthly premiums will be lower. Conversely, a lower deductible means lower out-of-pocket expenses in case of an accident, but your monthly premiums will be higher. Carefully weigh the trade-off between the monthly savings and the potential for higher out-of-pocket expenses when choosing a deductible. For instance, a $500 deductible might be more manageable than a $1000 deductible, but the premium difference should be considered.

Understanding Policy Details and Claims Process

Navigating the auto insurance claims process can feel overwhelming, but understanding your policy and the steps involved can significantly ease the burden. This section Artikels the typical claims process in Brownsville, TX, provides a step-by-step guide for handling accidents, and emphasizes the importance of thoroughly understanding your policy’s terms and conditions. Proper documentation is key to a smooth and successful claim.

Understanding your policy’s terms and conditions is paramount. This includes knowing your coverage limits (liability, collision, comprehensive), deductibles, and any exclusions. Familiarizing yourself with these details before an accident occurs will save you time and stress during a potentially difficult situation. Pay close attention to the specific definitions of covered events and circumstances, as well as any stipulations related to reporting claims within a specific timeframe. Ignoring these details could compromise your ability to file a successful claim.

Filing an Auto Insurance Claim in Brownsville

The process of filing an auto insurance claim typically begins with contacting your insurance provider as soon as possible after an accident. Most insurers have 24/7 claims hotlines. Following the initial contact, you’ll be guided through the necessary steps, which may include providing a detailed accident report, arranging for vehicle inspections or repairs, and submitting supporting documentation such as police reports and medical records. The claims adjuster will then evaluate the damages and determine the payout based on your policy and the specifics of the accident. The timeframe for claim resolution varies depending on the complexity of the claim and the availability of all necessary information. In some cases, a delay might be caused by disputes regarding fault or the extent of the damages. Patience and clear communication with your insurer are crucial throughout this process.

Handling an Accident and Contacting Your Insurer

After an accident, prioritize safety. Check for injuries and call emergency services if needed. If possible, move vehicles to a safe location to prevent further accidents. Then, gather information from all involved parties, including names, contact details, driver’s license numbers, insurance information, and license plate numbers. Take photographs of the accident scene, documenting vehicle damage, road conditions, and any visible injuries. Note the time, date, and location of the accident. Contact your insurer immediately to report the accident, following their specific instructions for reporting. Keep detailed records of all communication with your insurer, including dates, times, and names of individuals you spoke with.

Documenting Damages After a Car Accident

Thorough documentation is crucial for a successful insurance claim. Begin by taking clear and comprehensive photographs of all vehicle damage, from all angles. Document any damage to other property involved. If there are injuries, obtain medical documentation from the treating physician. Gather any witness statements or contact information. A detailed police report, if available, is essential. Remember to preserve any physical evidence, such as broken car parts or debris from the accident scene. The more thorough your documentation, the stronger your claim will be. Consider creating a detailed timeline of events, including the time of the accident, the steps taken immediately afterward, and all subsequent communications with your insurer and other relevant parties.

Brownsville’s Unique Auto Insurance Needs

Brownsville, Texas, presents a unique set of challenges and considerations for auto insurance, differing significantly from other parts of the state or country. These factors stem from a combination of geographic location, demographic characteristics, and specific local conditions that influence both the frequency and severity of accidents and the overall cost of insurance. Understanding these nuances is crucial for Brownsville drivers to secure appropriate and affordable coverage.

Brownsville’s specific risks and local regulations significantly impact auto insurance costs and policy choices. The city’s location near the US-Mexico border, its significant tourism, and its specific weather patterns all contribute to a higher-than-average risk profile for insurers.

Specific Risks and Challenges Faced by Brownsville Drivers

Several factors contribute to higher insurance premiums in Brownsville. The proximity to the border increases the likelihood of cross-border incidents and potential for undocumented drivers, which can complicate claims processes and increase the risk of uninsured motorist accidents. Furthermore, the city’s bustling tourism industry leads to increased traffic congestion and a higher density of vehicles on the road, raising the chance of collisions. Finally, the prevalence of older vehicles in some areas of Brownsville can contribute to a higher incidence of mechanical failures and resulting accidents. These factors combine to create a risk profile that necessitates higher premiums to compensate for the increased likelihood and potential severity of claims.

Local Regulations and Laws Impacting Auto Insurance

While Brownsville doesn’t have unique auto insurance laws separate from the state of Texas, the enforcement and interpretation of these laws can vary. For example, the enforcement of traffic laws and the speed at which claims are processed can influence insurance rates. Stricter enforcement might lead to fewer accidents and therefore lower premiums, while less stringent enforcement might have the opposite effect. Drivers should familiarize themselves with Texas state regulations concerning auto insurance and be aware of local enforcement practices.

Impact of Weather Conditions on Insurance Rates

Brownsville’s subtropical climate presents its own set of challenges. The high frequency of hurricanes and tropical storms increases the risk of significant vehicle damage, leading to higher insurance premiums. Furthermore, the intense summer heat can cause increased tire blowouts and other vehicle malfunctions, potentially contributing to accidents. The prolonged periods of high humidity can also affect the longevity of vehicle components, potentially leading to more frequent repairs. These weather-related risks are factored into insurance rate calculations.

Recommendations for Brownsville Drivers

Understanding the unique challenges faced by Brownsville drivers is crucial for securing appropriate coverage. Here are some recommendations to help protect themselves and their vehicles:

- Maintain a clean driving record: Avoiding accidents and traffic violations is the most effective way to keep insurance premiums low.

- Choose a comprehensive insurance policy: Given the risks of severe weather and other potential incidents, a comprehensive policy offering broader coverage is advisable.

- Shop around for insurance quotes: Comparing quotes from multiple insurers ensures you find the best rate for your needs.

- Consider additional coverage options: Uninsured/underinsured motorist coverage is particularly important given the potential for accidents involving drivers without sufficient insurance.

- Maintain your vehicle: Regular maintenance helps prevent breakdowns and accidents, potentially reducing your insurance risk.

- Be aware of your surroundings: Increased vigilance while driving, particularly during periods of inclement weather or heavy traffic, can help avoid accidents.

Epilogue

Securing affordable and comprehensive auto insurance in Brownsville, TX, involves careful planning and informed decision-making. By understanding the factors influencing rates, comparing quotes effectively, and selecting coverage options that align with your individual needs and risk profile, you can ensure adequate protection for yourself and your vehicle. Remember to regularly review your policy and consider adjusting your coverage as your circumstances change. Driving safely and maintaining a good driving record remain the best ways to keep your premiums low.

FAQs

What is SR-22 insurance and do I need it in Brownsville?

SR-22 insurance is a certificate of liability insurance that proves you have the minimum required auto insurance coverage. You might need it in Brownsville if you’ve had your license suspended or revoked. Check with the Texas Department of Public Safety to determine if you require an SR-22.

How often can I change my auto insurance policy?

You can usually change your auto insurance policy whenever you like, but there might be penalties depending on your policy terms. It’s best to check with your insurance provider for details on cancellation or modification fees.

What are the penalties for driving without car insurance in Brownsville?

Driving without insurance in Texas is illegal and carries significant penalties, including fines, license suspension, and even vehicle impoundment. The specific penalties can vary.

Can I bundle my home and auto insurance in Brownsville?

Yes, many insurance companies offer discounts for bundling home and auto insurance. Bundling can often lead to significant savings on your overall premiums.