Navigating the world of auto insurance can feel overwhelming, especially in a bustling city like Austin, Texas. Finding the right coverage at the best price requires understanding the various factors that influence premiums and the specific regulations in place. This guide provides a clear and concise overview of auto insurance in Austin, helping you make informed decisions to protect yourself and your vehicle.

From identifying top providers and understanding rate influences to mastering the claims process and complying with Texas law, we aim to demystify the complexities of auto insurance. We’ll explore the different coverage options available, offer strategies for securing affordable rates, and equip you with the knowledge to confidently navigate any insurance-related situation.

Top Austin Auto Insurance Providers

Choosing the right auto insurance provider in Austin can significantly impact your budget and peace of mind. Several factors influence the best choice, including coverage options, pricing, customer service, and financial stability. Understanding the strengths and weaknesses of the leading providers helps consumers make informed decisions.

Leading Auto Insurance Companies in Austin, TX

The following table provides an estimated ranking of the five largest auto insurance companies operating in Austin, based on market share and customer feedback. Note that precise market share data is often proprietary and not publicly released by insurance companies. These figures are estimates based on publicly available information and industry analysis. Customer ratings are averages collected from various reputable review platforms and may vary depending on the specific platform and time of data collection.

| Rank | Company Name | Market Share (Estimate) | Customer Rating (Source) |

|---|---|---|---|

| 1 | State Farm | ~20% | 4.5/5 (J.D. Power, Consumer Reports) |

| 2 | USAA | ~15% | 4.7/5 (J.D. Power, NerdWallet) |

| 3 | Progressive | ~12% | 4.2/5 (Consumer Reports, Google Reviews) |

| 4 | Geico | ~10% | 4.0/5 (J.D. Power, Yelp) |

| 5 | Allstate | ~8% | 4.3/5 (ConsumerAffairs, Trustpilot) |

Company Strengths and Weaknesses in the Austin Market

Each company possesses unique strengths and weaknesses. For example, State Farm benefits from its extensive agent network and brand recognition, providing widespread accessibility and personalized service. However, their pricing might not always be the most competitive. USAA, while highly rated, primarily serves military members and their families, limiting its overall market reach. Progressive excels in its online tools and customized pricing options, but customer service experiences can vary. Geico’s advertising is ubiquitous, attracting many customers with competitive rates, but their customer service may lack the personalized touch of other companies. Allstate maintains a strong national presence, providing a consistent experience, though it might not offer the most innovative digital tools. These are general observations; individual experiences may differ.

Types of Auto Insurance Policies Offered

All five companies offer a standard range of auto insurance policies. These typically include liability coverage (bodily injury and property damage), collision coverage (damage to your vehicle), comprehensive coverage (damage from non-collisions, such as theft or weather), uninsured/underinsured motorist coverage (protection against drivers without adequate insurance), and personal injury protection (PIP) coverage (medical expenses and lost wages). Many also offer additional options such as roadside assistance, rental car reimbursement, and gap insurance. The specific availability and pricing of these policies vary based on individual driver profiles and coverage choices.

Factors Affecting Auto Insurance Rates in Austin

Securing affordable auto insurance in Austin, Texas, depends on a variety of factors. Understanding these influences can empower you to make informed decisions and potentially lower your premiums. This section will delve into the key elements that insurance companies consider when calculating your rates.

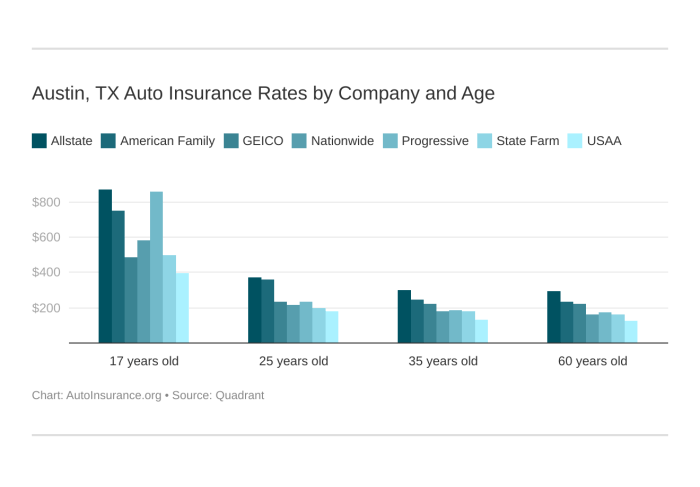

Several key factors significantly impact your Austin auto insurance premiums. Your driving history plays a crucial role, with a clean record leading to lower rates compared to those with accidents or traffic violations. Age is another important factor, as younger drivers, statistically, are involved in more accidents and therefore face higher premiums. The type of vehicle you drive also influences your rate; sports cars and luxury vehicles generally cost more to insure due to higher repair costs and a greater likelihood of theft. Finally, your location within Austin itself matters, as some neighborhoods have higher rates of accidents and theft than others, resulting in higher premiums for residents in those areas.

Driving History’s Influence on Insurance Premiums

A driver’s history is a primary determinant of their insurance rate. Accidents, traffic violations, and even the number of years of driving experience all contribute to the risk assessment. Multiple accidents or serious violations will substantially increase premiums, reflecting the higher risk associated with such drivers. Conversely, a clean driving record with several years of accident-free driving will result in lower premiums. For example, a driver with two at-fault accidents in the past three years would likely pay significantly more than a driver with a spotless record for the same period. Insurance companies use sophisticated algorithms that weigh the severity and frequency of incidents to calculate risk.

Vehicle Type and Insurance Costs

The type of vehicle significantly impacts insurance costs. Higher-value vehicles, such as luxury cars or sports cars, typically command higher premiums due to increased repair costs and higher theft rates. Conversely, insuring a smaller, less expensive vehicle usually results in lower premiums. For instance, insuring a high-performance sports car might cost several hundred dollars more annually than insuring a compact sedan, even if both vehicles are driven by the same individual with the same driving record. This difference reflects the inherent cost differences associated with repair and replacement.

Geographic Location within Austin and Insurance Rates

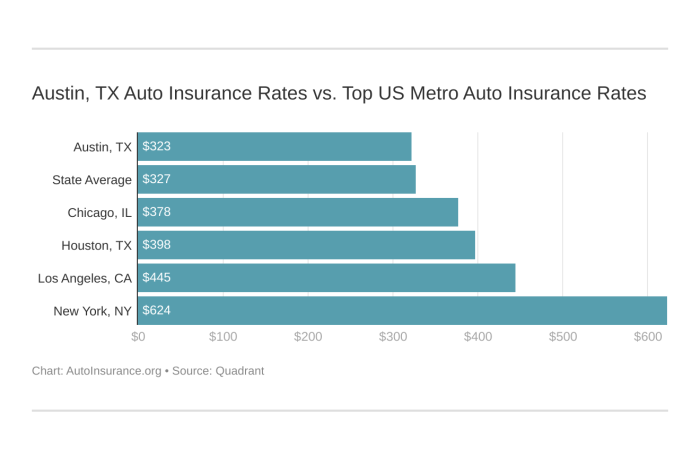

Insurance rates vary across different areas within Austin. Neighborhoods with higher crime rates or a greater frequency of accidents tend to have higher insurance premiums. This is because insurance companies assess the risk associated with each location, factoring in the statistical probability of claims originating from that area. A driver residing in a high-risk neighborhood may pay considerably more than a driver in a safer area, even if they have identical driving records and vehicles. This variation reflects the inherent risks associated with specific geographic locations.

Common Misconceptions about Austin Auto Insurance Rates

Several misconceptions exist regarding auto insurance rates in Austin.

Misconception 1: “My good driving record doesn’t matter.”

This is incorrect. A clean driving record is a significant factor in obtaining lower premiums. Insurance companies heavily reward drivers with a history of safe driving.

Misconception 2: “All insurance companies have the same rates.”

This is false. Insurance companies use different algorithms and risk assessments, leading to variations in rates. Comparing quotes from multiple insurers is crucial to find the best deal.

Misconception 3: “My age doesn’t affect my insurance rate.”

This is untrue. Younger drivers generally pay higher premiums due to higher accident statistics. As drivers age and gain experience, their rates typically decrease.

Finding Affordable Auto Insurance in Austin

Securing affordable auto insurance in Austin, a city with a diverse population and varying driving conditions, requires a strategic approach. Understanding the factors influencing your premiums and actively comparing options are key to finding the best coverage at a price that works for you. This guide provides a step-by-step process to help Austin residents navigate the complexities of auto insurance and secure the most cost-effective policy.

A Step-by-Step Guide to Finding Affordable Auto Insurance

Finding the right auto insurance policy involves careful planning and comparison. Follow these steps to ensure you’re getting the best possible deal.

- Assess Your Needs: Determine the minimum coverage required by Texas law and consider additional coverage like collision and comprehensive, based on your vehicle’s value and your risk tolerance. This initial assessment helps narrow your search to policies that meet your specific needs.

- Gather Information: Collect relevant personal information, including your driver’s license number, vehicle information (year, make, model, VIN), and your driving history (accident and violation records). Accurate information ensures accurate quotes.

- Obtain Multiple Quotes: Use online comparison tools or contact insurance providers directly to obtain at least three to five quotes. Note the coverage details and premium amounts for each quote.

- Compare Quotes Carefully: Don’t just focus on the price; compare the coverage offered by each provider. A slightly higher premium might offer better protection in the long run. Pay attention to deductibles, liability limits, and additional coverage options.

- Review Policy Details: Before committing to a policy, thoroughly review the policy documents to understand the terms and conditions, including exclusions and limitations.

- Choose the Best Policy: Select the policy that offers the best balance of coverage and affordability, aligning with your budget and risk assessment.

Benefits of Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is crucial for securing affordable auto insurance. This allows you to identify the best value for your money. Different companies use different rating factors and offer various discounts, resulting in significant price variations for similar coverage. By comparing, you avoid overpaying and can potentially save hundreds of dollars annually. For example, one insurer might offer a significant discount for bundling home and auto insurance, while another might provide a lower rate for drivers with good credit scores.

Strategies for Lowering Auto Insurance Premiums

Several strategies can help lower your Austin auto insurance premiums.

- Improve Driving Habits: Maintaining a clean driving record is the single most effective way to reduce premiums. Avoid speeding tickets, accidents, and traffic violations. Defensive driving courses can also lead to discounts.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in the event of a claim, but it typically results in lower premiums. Carefully weigh the financial implications of a higher deductible against the potential savings.

- Bundle Your Insurance: Combining your auto insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant discounts.

- Maintain a Good Credit Score: In many states, including Texas, insurance companies consider credit scores when determining premiums. A higher credit score can lead to lower rates.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits using a telematics device. Safe driving can earn you discounts.

- Explore Discounts: Inquire about available discounts, such as those for good students, military members, or those who have completed defensive driving courses.

Types of Auto Insurance Coverage in Texas

Choosing the right auto insurance coverage is crucial for protecting yourself and your finances in the event of an accident. Texas law mandates certain minimum coverages, but understanding the various options available allows you to tailor your policy to your specific needs and risk tolerance. This section details the common types of auto insurance coverage and their importance.

Texas Auto Insurance Coverage Options

The following table Artikels the different types of auto insurance coverage available in Texas, along with factors influencing their cost and their overall importance.

| Coverage Type | Description | Typical Cost Factors | Importance |

|---|---|---|---|

| Liability Coverage (Bodily Injury and Property Damage) | Pays for injuries and damages you cause to others in an accident. This is split into bodily injury liability (covering medical bills and lost wages of injured parties) and property damage liability (covering repairs to damaged vehicles or property). | Driving record, age, type of vehicle, location, claims history. | Legally required in Texas; protects you from potentially devastating financial losses if you cause an accident. |

| Collision Coverage | Covers damage to your vehicle resulting from a collision, regardless of fault. | Vehicle’s make, model, year, and value; deductible amount; claims history. | Essential for protecting your vehicle investment, especially for newer cars. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or weather damage. | Vehicle’s make, model, year, and value; deductible amount; location (areas prone to hail or theft will increase costs); claims history. | Protects against a wider range of risks that could significantly damage or destroy your vehicle. |

| Uninsured/Underinsured Motorist (UM/UIM) Coverage | Covers your medical bills and vehicle repairs if you’re injured in an accident caused by an uninsured or underinsured driver. This can also cover your passengers. | Your coverage limits; claims history; the state’s uninsured driver statistics (higher rates in areas with more uninsured drivers). | Crucial protection given the significant number of uninsured drivers on Texas roads; prevents you from bearing the financial burden alone. |

| Medical Payments Coverage (Med-Pay) | Covers medical expenses for you and your passengers, regardless of fault. | Coverage limits; claims history. | Provides immediate financial assistance for medical treatment following an accident, even if you are at fault. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other expenses for you and your passengers, regardless of fault. (Note: PIP is not mandatory in Texas, but some drivers may choose to add it.) | Coverage limits; claims history. | Offers broader coverage than Med-Pay, including lost wages and other expenses, but is not required by Texas law. |

Minimum Liability Insurance Requirements in Texas

Texas law requires drivers to carry a minimum of \$30,000 in bodily injury liability coverage per person, \$60,000 per accident, and \$25,000 in property damage liability coverage. This means that if you cause an accident resulting in injuries or property damage, your insurance company will only pay up to these limits.

Financial Implications of Inadequate Insurance Coverage

Carrying only the minimum liability insurance can leave you financially vulnerable. Consider a scenario where you cause an accident resulting in serious injuries to another person. Their medical bills could easily exceed the \$30,000 per person limit, leaving you personally responsible for the difference. This could result in significant debt, wage garnishment, and even bankruptcy. Similarly, if the damage to the other person’s vehicle exceeds the \$25,000 property damage limit, you’d be responsible for the remaining costs. Comprehensive and collision coverage protects your own vehicle, but insufficient liability coverage leaves you exposed to substantial financial liability for injuries and damages you cause to others. Therefore, carrying higher liability limits, beyond the state minimum, is highly recommended.

Filing an Auto Insurance Claim in Austin

Filing an auto insurance claim after an accident in Austin can feel overwhelming, but a methodical approach can significantly ease the process. Understanding the steps involved and documenting the accident properly are crucial for a smooth and successful claim. This section details the process and provides helpful tips for navigating this challenging situation.

Immediate Actions After an Accident

Following an accident, prioritize safety. If anyone is injured, call 911 immediately. Even if injuries appear minor, seek medical attention. Next, move vehicles to a safe location if possible, away from traffic. Then, exchange information with all involved parties. This includes names, addresses, phone numbers, driver’s license numbers, insurance information, and license plate numbers. Record the date, time, and location of the accident precisely. If there are witnesses, get their contact information as well.

Documenting the Accident Scene

Thorough documentation is critical for supporting your insurance claim. Take clear photographs from multiple angles. This should include pictures of vehicle damage (all sides), the accident location (showing road conditions, traffic signals, and any visible contributing factors), and any visible injuries. If possible, capture images of the vehicles’ positions relative to each other and any visible skid marks. A detailed written description of the accident, including the sequence of events from your perspective, should accompany the photos. Note the weather conditions and any contributing factors like poor visibility or road hazards.

Reporting the Accident to Your Insurance Company

Contact your insurance company as soon as possible after the accident, ideally within 24 hours. Provide them with the information you gathered at the scene, including the police report number if one was filed. Be prepared to answer questions about the accident and provide supporting documentation. Follow your insurer’s instructions carefully and keep records of all communications.

The Role of a Claims Adjuster

A claims adjuster will be assigned to your case. Their role is to investigate the accident, assess the damages, and determine the liability. They will likely contact you to request additional information or documentation. Cooperate fully with the adjuster and respond promptly to their requests. Be honest and accurate in your statements and provide all relevant information. The adjuster will evaluate the claim based on the evidence provided, including police reports, witness statements, and photographic evidence. They will then determine the amount your insurance company will pay for repairs or medical expenses.

Negotiating with the Claims Adjuster

If you disagree with the adjuster’s assessment of the claim, you have the right to negotiate. Keep detailed records of all communication and maintain a professional demeanor throughout the process. You may wish to consult with an attorney if you are having difficulty reaching a fair settlement. Remember to keep all documentation, including correspondence with the adjuster, estimates for repairs, and medical bills.

Understanding Texas Auto Insurance Laws

Texas law mandates minimum auto insurance coverage for all drivers, impacting every resident of Austin. Understanding these requirements is crucial to avoid legal repercussions and ensure financial protection in the event of an accident. This section Artikels key aspects of Texas auto insurance laws and provides resources for further information.

Minimum Required Auto Insurance Coverage in Texas

Texas requires drivers to carry a minimum of $30,000 in bodily injury liability coverage per person and $60,000 per accident. This means that if you cause an accident resulting in injuries, your insurance company will pay up to $30,000 for each injured person, with a total maximum payout of $60,000 for all injured parties in that single accident. Additionally, you are required to carry at least $25,000 in property damage liability coverage to cover damage to another person’s vehicle or property. Failing to meet these minimums is a violation of Texas law.

Resources for Learning More About Texas Auto Insurance Regulations

The Texas Department of Insurance (TDI) is the primary resource for information on Texas auto insurance laws. Their website provides comprehensive details on required coverages, policy options, and consumer rights. The TDI website offers downloadable brochures, frequently asked questions, and contact information for assistance. Additionally, independent consumer advocacy groups often publish guides and articles summarizing key aspects of Texas insurance regulations, providing another valuable source of information for Austin residents. Local Austin-based insurance agencies can also provide valuable insights and guidance, helping to navigate the complexities of Texas insurance law.

Penalties for Driving Without Insurance in Texas

Driving without the minimum required auto insurance in Texas carries significant consequences. These penalties can include hefty fines, license suspension, and even vehicle impoundment. The specific penalties can vary depending on the circumstances and the number of offenses. For example, a first-time offense might result in a fine and a temporary license suspension, while subsequent offenses could lead to more severe penalties, including a longer suspension or even criminal charges. Furthermore, being uninsured can leave you personally liable for significant costs associated with accidents you cause, including medical bills and property damage repairs, potentially leading to financial ruin. It’s imperative to maintain the minimum required insurance coverage to avoid these severe penalties and protect yourself financially.

Closing Summary

Securing adequate auto insurance in Austin is a crucial step in responsible driving. By understanding the factors influencing your rates, comparing quotes from multiple providers, and familiarizing yourself with Texas insurance laws, you can effectively manage your risk and protect your financial well-being. Remember, proactive planning and informed decision-making are key to finding the right coverage at a price that works for you. This guide serves as a starting point; further research and consultation with insurance professionals are always recommended.

Top FAQs

What is the minimum liability insurance required in Texas?

Texas requires a minimum of 30/60/25 liability coverage: $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

How often can I expect my auto insurance rates to change?

Rates can change periodically, often annually, based on factors like your driving record, claims history, and changes in the insurance market.

Can I get discounts on my auto insurance?

Yes, many insurers offer discounts for safe driving, bundling policies (home and auto), having a good credit score, and completing defensive driving courses.

What should I do immediately after a car accident?

Ensure everyone is safe, call emergency services if needed, exchange information with the other driver(s), take photos of the damage and the scene, and contact your insurance company.