The rise of mobile technology has revolutionized how we interact with various services, and insurance is no exception. Auto insurance apps are transforming the industry, offering convenience, efficiency, and innovative features that cater to the modern user’s needs. This exploration delves into the design, functionality, marketing, and legal aspects of developing a successful auto insurance application.

From user interface design and seamless claim submissions to data security and integration with other services, we’ll examine the critical elements that contribute to a positive user experience and a thriving mobile insurance platform. We’ll also discuss the challenges and opportunities presented by this rapidly evolving landscape.

App Features & Functionality

A successful auto insurance app needs to seamlessly integrate convenience, efficiency, and security to meet the diverse needs of its users. This requires a careful consideration of features, a user-friendly interface, robust security protocols, and a streamlined claims process. The following sections delve into these key aspects.

Five Essential Features of a Successful Auto Insurance App

Five key features contribute significantly to a positive user experience and overall app success. These include: policy management capabilities allowing for easy access to policy details, immediate digital ID cards, 24/7 claims reporting functionality, personalized recommendations and insights based on driving behavior (where applicable and with user consent), and secure communication channels for direct contact with customer service representatives. These features cater to the modern user’s demand for speed, convenience, and personalized service.

User Interface (UI) Comparison of Three Popular Auto Insurance Apps

A comparative analysis of the user interfaces of three popular auto insurance apps reveals distinct design philosophies. Let’s consider hypothetical examples, “InsureEasy,” “DriveSafe,” and “AutoGuard.” InsureEasy prioritizes simplicity with a clean, minimalist design using primarily light colors and large, easily accessible buttons. DriveSafe opts for a more modern, visually engaging interface incorporating dynamic animations and gradients, which might appeal to a younger demographic. AutoGuard presents a more traditional, somewhat formal design with a focus on clear, concise information display, possibly aiming for a more mature audience. While all three apps achieve functionality, their design approaches cater to different user preferences and expectations.

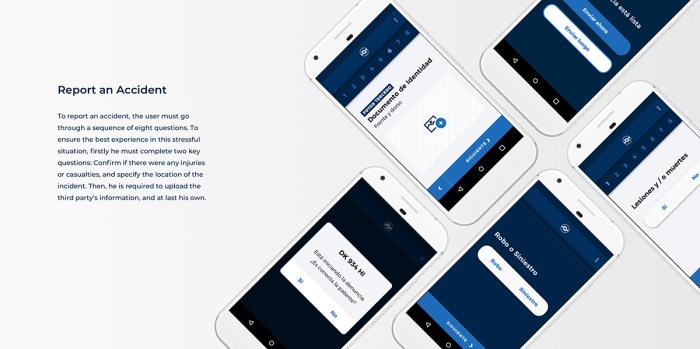

User Flow Diagram for Submitting a Claim

The user flow for submitting a claim should be straightforward and intuitive. A typical flow would begin with the user selecting “Report a Claim,” followed by providing details of the accident (date, time, location, involved parties). The app may then request photos of the damage and the accident scene. The user then confirms the information and submits the claim. The app might provide a claim reference number and estimated processing time. Finally, the user receives updates on the claim’s status through in-app notifications or email. This streamlined process minimizes friction and ensures a smooth claims experience.

Security Features for Protecting User Data

Protecting user data is paramount. Essential security features include end-to-end encryption for all data transmitted between the app and the server, multi-factor authentication for login, regular security audits to identify and address vulnerabilities, compliance with relevant data privacy regulations (e.g., GDPR, CCPA), and robust fraud detection mechanisms to prevent unauthorized access and fraudulent activities. These measures ensure user information remains confidential and secure.

Comparison of Features Across Three Auto Insurance Apps

| Feature | InsureEasy | DriveSafe | AutoGuard |

|---|---|---|---|

| Policy Management | Excellent | Good | Good |

| Claims Reporting | Good | Excellent | Good |

| Digital ID Card | Yes | Yes | Yes |

| Personalized Recommendations | No | Yes | No |

User Experience (UX) and Design

A positive user experience is paramount for the success of any mobile application, especially in a competitive market like auto insurance. A well-designed app can foster customer loyalty, increase engagement, and ultimately drive business growth. Conversely, a poorly designed app can lead to frustration, churn, and negative brand perception. This section will explore key aspects of UX and design crucial for a successful auto insurance app.

Intuitive Navigation in Auto Insurance Apps

Intuitive navigation is essential for a seamless user experience. Users should be able to easily find the information and features they need without confusion or frustration. Complex navigation flows can lead to users abandoning the app before completing their tasks. Clear labeling, logical grouping of features, and a consistent visual hierarchy are crucial elements for achieving intuitive navigation. For example, a clear path to file a claim, view policy details, or make a payment should be readily apparent. The app should prioritize the most common user tasks and make them easily accessible. A well-structured menu system, combined with effective search functionality, can significantly improve navigation.

Effective Use of Visual Design Elements

Visual design plays a significant role in enhancing user engagement and creating a positive brand experience. The use of color, typography, imagery, and spacing can significantly impact the overall look and feel of the app. A visually appealing app is more likely to capture and maintain user attention. For instance, using a consistent color palette that aligns with the brand identity can create a cohesive and professional look. High-quality imagery, such as relevant illustrations or photos, can enhance the visual appeal and make the app more engaging. Clear and legible typography ensures readability and improves the overall user experience. Careful consideration of white space can improve readability and reduce visual clutter. For example, Progressive uses bright, clean visuals, while Geico’s app might employ a more playful and cartoonish aesthetic.

Designing for Users with Varying Tech Proficiency

Auto insurance apps should be accessible and usable by individuals with varying levels of technological proficiency. This requires careful consideration of design elements and features. The app should be easy to understand and use, even for users who are not tech-savvy. Clear and concise language, simple instructions, and intuitive icons can significantly improve accessibility. The use of large fonts, high contrast, and sufficient spacing can improve readability for users with visual impairments. Consider offering alternative input methods, such as voice commands, to cater to users with dexterity challenges. Progressive rollout of new features, with clear explanations and tutorials, can help users gradually adapt to new functionalities.

Potential Usability Issues and Improvements in Existing Apps

Many existing auto insurance apps suffer from usability issues, such as slow loading times, confusing navigation, and lack of accessibility features. These issues can lead to user frustration and ultimately impact customer satisfaction. For example, some apps might require excessive scrolling to find specific information, while others might have cluttered interfaces that make it difficult to locate key features. Improvements could include optimizing app performance to reduce loading times, simplifying navigation flows, and incorporating accessibility features such as screen readers and voice commands. Implementing user testing and feedback mechanisms can help identify and address usability issues early in the development process. Regular updates and improvements based on user feedback are essential for maintaining a positive user experience.

Factors Contributing to a Positive User Experience

A positive user experience in a mobile insurance application is a multifaceted outcome. Several key factors contribute to this positive experience. These include:

- Intuitive Navigation: Easy-to-understand menus and clear pathways to key features.

- Fast Loading Times: Minimizing wait times for pages to load.

- Seamless Integration: Smooth connectivity with other platforms and services.

- Personalized Experience: Tailoring content and features to individual user needs.

- Excellent Customer Support: Providing easy access to help and support.

- Proactive Communication: Keeping users informed about policy updates and important information.

- Security and Privacy: Ensuring the security and privacy of user data.

- Accessibility Features: Catering to users with disabilities.

Integration with Other Services

Seamless integration with other services is crucial for a modern auto insurance app, enhancing user experience and providing added value beyond basic policy management. Effective integration streamlines processes, improves data accuracy, and ultimately increases customer satisfaction. This section details the key integrations and their implications.

Telematics Device Integration

Integrating with telematics devices allows the app to collect driving data such as speed, acceleration, braking, mileage, and location. This data is then used to assess driving behavior and offer personalized insurance premiums based on actual driving habits. For example, a driver with consistently safe driving habits might qualify for a significant discount, while risky driving behaviors could lead to a premium increase. This system promotes safer driving and provides a fairer pricing model. The integration typically involves the app connecting wirelessly to a telematics device installed in the vehicle, securely transmitting data to the insurance provider’s servers for analysis and premium adjustments.

Integration with User Financial Accounts

Linking the app to a user’s bank account or other financial accounts facilitates automated payments. This eliminates the need for manual payments, reducing the risk of missed payments and associated late fees. Furthermore, it allows for seamless claims processing, with payments for repairs or medical expenses directly deposited into the user’s account. Security protocols, such as multi-factor authentication and encryption, are vital to protect sensitive financial information. For example, a user could authorize the app to automatically deduct their premium payment from their linked checking account each month.

Roadside Assistance Service Integration

Integrating with roadside assistance services offers immediate access to help in case of emergencies such as flat tires, lockouts, or breakdowns. The app can locate the nearest roadside assistance provider, dispatch help, and provide real-time tracking of the assistance vehicle’s location. This enhances convenience and safety for users, providing peace of mind knowing assistance is readily available. The integration could involve a direct API connection between the app and the roadside assistance provider’s system, enabling seamless communication and service dispatch.

Social Media Platform Integration

Integrating with social media platforms presents both advantages and disadvantages. Advantages could include streamlined customer support channels, improved marketing and brand awareness through targeted advertising, and the ability to collect user feedback. However, disadvantages include potential privacy concerns regarding user data sharing, the risk of negative publicity from social media comments, and the complexities of managing multiple platforms. A careful risk-benefit analysis is essential before implementing this type of integration. For example, integrating with Facebook Messenger could provide a convenient customer service channel, but it also necessitates careful consideration of data privacy and user consent.

Data Flow Between Auto Insurance App and Third-Party Service Provider

A simple flowchart illustrates the data flow:

[Diagram Description: A rectangular box labeled “Auto Insurance App” is connected to a rectangular box labeled “Third-Party Service Provider” with an arrow indicating data flow in both directions. Within the “Auto Insurance App” box, smaller boxes represent functions such as “User Data,” “Policy Information,” and “Driving Data.” Within the “Third-Party Service Provider” box, smaller boxes represent functions such as “Payment Processing,” “Roadside Assistance Dispatch,” and “Telematics Data Analysis.” Arrows show data moving between the app and provider for specific services. For instance, an arrow points from “User Data” in the app to “Payment Processing” in the provider for premium payments, and an arrow points from “Driving Data” in the app to “Telematics Data Analysis” in the provider for risk assessment.]

Marketing and Monetization Strategies

A successful launch and sustained growth for a new auto insurance app require a robust marketing and monetization strategy. This plan Artikels key approaches to acquire users, retain them, and generate revenue, considering both the competitive landscape and the unique features of the app. The following sections detail the marketing campaign, monetization models, and address potential challenges.

Marketing Campaign Plan

The marketing campaign will leverage a multi-channel approach, combining digital marketing with traditional methods to reach a broad audience. Initial efforts will focus on building brand awareness and generating excitement around the app’s launch. This will involve a phased rollout, starting with targeted social media campaigns on platforms like Facebook, Instagram, and TikTok, showcasing the app’s key benefits and user-friendly interface. Simultaneously, search engine optimization () strategies will be implemented to improve organic search rankings. Paid advertising campaigns on Google Ads and other relevant platforms will complement organic efforts. Public relations activities, including press releases and partnerships with relevant influencers, will further amplify the message. Finally, a referral program will incentivize existing users to spread the word. The campaign’s success will be monitored through key performance indicators (KPIs) such as app downloads, user engagement, and customer acquisition cost (CAC).

Monetization Strategies

The app will employ a hybrid monetization model, combining freemium and paid options. The freemium model will offer basic features, such as policy comparison and quotes, for free. Users can upgrade to a premium subscription for advanced features, such as personalized risk assessments, accident reporting assistance, and roadside assistance. A paid model will involve direct partnerships with insurance providers, generating revenue through commissions on policies sold through the app. This diversified approach aims to maximize revenue streams and cater to a wider range of user needs and preferences. The pricing for premium subscriptions will be competitive and transparent, with different tiers offering varying levels of features and benefits.

Examples of Successful Marketing Campaigns

Several successful insurance apps have leveraged innovative marketing strategies. Lemonade, for instance, successfully employed a humorous and engaging brand voice across social media platforms, creating a memorable and relatable brand image. Their focus on transparency and a streamlined user experience also resonated with consumers. Other successful apps have partnered with popular automotive brands or influencers to reach a wider audience. These examples highlight the importance of crafting a unique brand identity and utilizing creative marketing channels to cut through the noise.

Challenges in User Acquisition and Retention

Acquiring and retaining users for an auto insurance app presents several challenges. The competitive landscape is saturated with established players and new entrants, making it difficult to stand out. Building trust and overcoming consumer skepticism about using a mobile app for insurance is crucial. Furthermore, maintaining user engagement and preventing churn requires a continuous effort to improve the app’s features, performance, and customer support. Data security and privacy concerns also need to be addressed proactively to build user confidence.

User Acquisition Methods

User acquisition will involve a mix of organic and paid strategies. Organic strategies will focus on optimizing the app store listing, leveraging social media marketing, and building a strong online presence through content marketing and public relations. Paid strategies will include targeted advertising campaigns on social media, search engines, and other relevant platforms. App store optimization (ASO) will be a key component of organic acquisition, ensuring the app is easily discoverable and ranks highly in search results. Paid campaigns will be meticulously tracked and optimized to maximize ROI. A referral program, offering incentives for users to invite friends, will further enhance user acquisition efforts.

Technological Aspects and Development

Building a robust and user-friendly auto insurance app requires careful consideration of various technological aspects, from the selection of appropriate programming languages and databases to the implementation of rigorous security measures. The development process itself involves multiple stages, from initial design and coding to thorough testing and deployment across different platforms. Data privacy and security are paramount, demanding a proactive and multi-layered approach.

Technology Stack Selection

The choice of technologies significantly impacts the app’s performance, scalability, and maintainability. A typical auto insurance app might utilize a combination of technologies. For the backend, a scalable language like Java, Python (with frameworks like Django or Flask), or Node.js might be employed, coupled with a robust database such as PostgreSQL or MySQL for storing policy information, user data, and claims details. The frontend, interacting directly with the user, would likely be developed using frameworks like React Native (for cross-platform development targeting both iOS and Android), Swift (for iOS), or Kotlin (for Android). Cloud services like AWS, Google Cloud Platform (GCP), or Azure would likely handle infrastructure needs, providing scalability and reliability.

Development and Deployment Process

Developing and deploying an auto insurance app involves several key phases. First, the design and planning phase establishes the app’s features, user interface, and overall architecture. Next, the development team writes the code, using the chosen technologies, and conducts unit testing to identify and fix bugs early in the process. Following this, integration testing ensures different components of the app work together seamlessly. User acceptance testing (UAT) involves real users testing the app to provide feedback on usability and functionality. Finally, the app is deployed to app stores (Apple App Store and Google Play Store) after passing rigorous quality assurance checks. This process often involves creating separate builds optimized for iOS and Android platforms, accounting for platform-specific requirements and guidelines.

App Security and Data Privacy

Security and data privacy are critical concerns for any application handling sensitive user information, especially an auto insurance app which deals with personal data, financial transactions, and driving records. Implementing robust security measures is essential to prevent data breaches and protect user privacy. This includes using secure coding practices to prevent vulnerabilities, employing encryption to protect data both in transit and at rest, implementing multi-factor authentication, and adhering to relevant data privacy regulations like GDPR and CCPA. Regular security audits and penetration testing are crucial for identifying and mitigating potential threats. Transparency regarding data collection and usage practices is also vital for building user trust.

Testing Strategies

Comprehensive testing is essential to ensure the app’s stability, functionality, and performance. This involves various testing methodologies, including unit testing (testing individual components), integration testing (testing interactions between components), system testing (testing the entire system), and user acceptance testing (UAT) with real users. Automated testing tools can significantly improve efficiency and coverage. Performance testing assesses the app’s response time and scalability under various load conditions. Security testing, including penetration testing, identifies potential vulnerabilities. Thorough testing across different devices and operating system versions is vital to ensure compatibility and a consistent user experience.

Potential Technical Challenges and Solutions

Developing an auto insurance app presents several potential challenges. One significant challenge is integrating with various third-party services, such as telematics providers, mapping services, and payment gateways. Robust APIs and secure integration methods are necessary to ensure seamless data exchange. Another challenge is maintaining data consistency and accuracy across different data sources. Implementing data validation and reconciliation processes is crucial. Scalability is another concern, as the app needs to handle a growing number of users and transactions efficiently. Utilizing cloud-based infrastructure and employing appropriate scaling strategies can address this challenge. Finally, complying with evolving security and privacy regulations requires ongoing effort and investment in security best practices and updates.

Legal and Regulatory Compliance

Developing an auto insurance app requires careful consideration of a complex web of legal and regulatory requirements. Failure to comply can result in significant financial penalties, reputational damage, and legal action. This section Artikels key legal and regulatory considerations for creating and launching such an application.

Data Privacy Regulations

Compliance with data privacy regulations is paramount. These regulations vary significantly across jurisdictions but generally focus on protecting personal information collected from users. Key regulations include the General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA) in California, and similar laws in other states and countries. These regulations stipulate how personal data must be collected, stored, processed, and protected, including requirements for user consent, data minimization, and data security. For example, GDPR mandates explicit user consent for data processing and provides individuals with rights to access, rectify, and erase their personal data. CCPA grants California residents similar rights and requires businesses to disclose the categories of personal information collected and the purposes for which it is used. Non-compliance can lead to hefty fines and legal challenges.

Transparency and User Consent in Data Collection

Transparency and user consent are cornerstones of ethical and legal data handling. Users must be clearly informed about what data is collected, why it’s collected, how it will be used, and with whom it may be shared. This information should be presented in a clear, concise, and accessible manner, avoiding legal jargon. Obtaining explicit, informed consent is crucial, especially for sensitive data such as driving history or location data. The consent process should be easily accessible and allow users to easily withdraw their consent at any time. Failure to be transparent and obtain proper consent can lead to legal issues and damage user trust.

Regulatory Landscape Comparison

The regulatory landscape for auto insurance apps differs significantly across countries. For instance, data privacy laws vary widely, as discussed above. Insurance regulations themselves also differ, impacting factors such as required disclosures, pricing practices, and the types of insurance products that can be offered. Some countries have more stringent regulations on the use of telematics data collected by the app, while others have more flexible frameworks. Before launching in a new market, thorough legal research is essential to understand and comply with all applicable laws and regulations. This may involve consulting with local legal counsel to ensure full compliance.

Legal and Regulatory Requirements Checklist (Example: California)

The following checklist provides a sample of legal and regulatory requirements for launching an auto insurance app in California. This is not exhaustive and should not be considered legal advice. Consult with legal counsel for specific guidance.

- Compliance with CCPA: Implement measures to ensure compliance with data collection, storage, and usage requirements.

- Insurance licensing and regulatory compliance: Obtain the necessary licenses and permits from the California Department of Insurance.

- Data security: Implement robust security measures to protect user data from unauthorized access, use, or disclosure.

- Transparency and consent: Clearly disclose data collection practices and obtain explicit user consent.

- Fair pricing practices: Adhere to California’s regulations on insurance pricing and avoid discriminatory practices.

- Terms of service and privacy policy: Create comprehensive terms of service and privacy policy that comply with all applicable laws.

- Dispute resolution mechanisms: Establish a clear process for resolving disputes with users.

- Accessibility compliance: Ensure the app is accessible to users with disabilities, in compliance with the Americans with Disabilities Act (ADA).

Last Word

Developing a successful auto insurance app requires a multifaceted approach, balancing user-centric design, robust security measures, strategic marketing, and strict legal compliance. By understanding the technological intricacies, user experience best practices, and the ever-changing regulatory environment, developers can create a truly impactful application that meets the evolving needs of the insurance market and improves the lives of policyholders.

Key Questions Answered

What data is typically collected by an auto insurance app?

Commonly collected data includes driving behavior (speed, acceleration, braking), location data (for usage-based insurance), vehicle information, and policy details. Privacy policies should clearly Artikel data collection practices.

How secure is my personal information in an auto insurance app?

Reputable auto insurance apps employ robust security measures, including encryption and multi-factor authentication, to protect user data. However, it’s crucial to download apps from official app stores and review the app’s privacy policy.

Can I use an auto insurance app if I don’t have a smartphone?

Many insurers offer alternative methods of accessing their services, such as online portals or phone support, for those without smartphones. However, app functionality might be limited or unavailable in these cases.

What happens if my app malfunctions during a claim submission?

Most apps have customer support options, often including phone numbers or email addresses, for assistance with technical issues. Insurers may also allow for claims to be submitted via alternative methods if the app is unavailable.