Navigating the world of auto insurance can be complex, especially in a city like Albuquerque, New Mexico. This guide provides a detailed overview of the Albuquerque auto insurance market, exploring factors influencing premiums, comparing providers, and outlining essential legal considerations. We’ll delve into the unique aspects of Albuquerque’s driving environment and offer practical tips to help you secure the best coverage at the most competitive price.

From understanding the demographics of Albuquerque drivers and their specific insurance needs to navigating the intricacies of New Mexico’s insurance regulations, this resource aims to empower you with the knowledge necessary to make informed decisions about your auto insurance. We will compare average premiums, discuss the impact of driving history and credit scores, and highlight the importance of choosing the right coverage for your individual circumstances.

Understanding the Albuquerque, NM Auto Insurance Market

Albuquerque’s auto insurance market is shaped by a unique blend of demographic factors, local conditions, and national trends. Understanding these elements is crucial for residents seeking the best coverage at the most competitive price. This section will explore the key aspects of the Albuquerque auto insurance landscape.

Albuquerque Driver Demographics and Insurance Needs

Albuquerque’s population is diverse, impacting insurance needs in several ways. A significant portion of the population falls within younger age brackets, often associated with higher risk driving and thus, higher premiums. The city also has a sizable Hispanic population, and cultural factors can influence driving habits and insurance choices. Furthermore, the city’s mix of urban and suburban areas leads to varying risk profiles, with more densely populated areas potentially experiencing higher accident rates. These factors contribute to a varied insurance market, with premiums reflecting the diverse risk levels within the community.

Major Auto Insurance Coverages in Albuquerque

The most common types of auto insurance coverage in Albuquerque align with national trends. Liability coverage, which protects drivers in case they cause an accident resulting in injury or property damage to others, is mandatory in New Mexico. Collision coverage, protecting against damage to one’s own vehicle in an accident, regardless of fault, is frequently purchased. Comprehensive coverage protects against damage from non-collision events such as theft, vandalism, or weather-related incidents. Uninsured/Underinsured motorist coverage is essential given the risk of accidents involving drivers without sufficient insurance. Personal injury protection (PIP) covers medical expenses and lost wages for the policyholder and passengers, regardless of fault.

Comparison of Albuquerque Auto Insurance Premiums

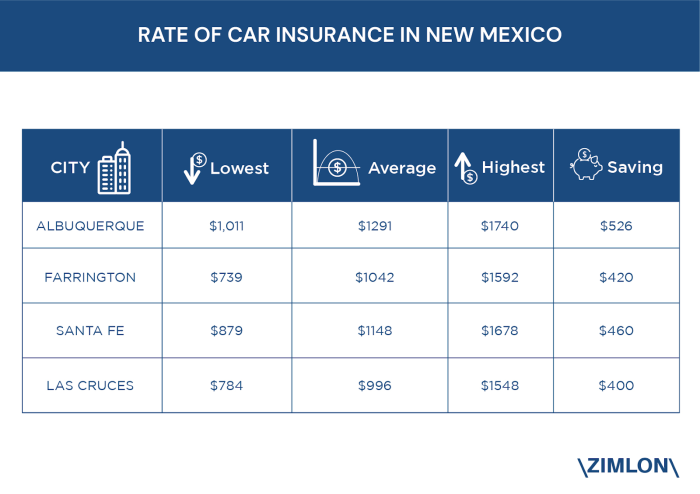

Precise average premiums for Albuquerque are difficult to state definitively without access to real-time insurance data from multiple providers. However, it’s generally accepted that premiums in Albuquerque are influenced by both state and national averages. New Mexico, as a state, may have slightly higher or lower average premiums than the national average, depending on factors such as the state’s regulatory environment and the prevalence of certain types of accidents. Albuquerque’s specific location within the state, along with its unique demographic and traffic patterns, can further influence the final cost of insurance. It’s advisable to obtain quotes from multiple insurers for a personalized assessment.

Impact of Local Factors on Insurance Costs

Traffic congestion and accident rates directly influence Albuquerque’s auto insurance costs. Areas with higher traffic density and more frequent accidents are generally considered higher-risk zones, resulting in higher premiums for drivers in those areas. The prevalence of certain types of accidents, such as rear-end collisions (often associated with congested traffic), can also affect insurance rates. Additionally, the availability of public transportation and the overall driving culture within Albuquerque may play a role in determining the overall risk profile and subsequent insurance costs.

Top 5 Most Common Car Insurance Claims in Albuquerque

The following table provides a hypothetical representation of the top 5 most common car insurance claims in Albuquerque. Actual data would require access to proprietary insurance company claims data. The information presented below is for illustrative purposes only.

| Claim Type | Frequency | Average Cost | Contributing Factors |

|---|---|---|---|

| Collision | High | $3,000 | Traffic congestion, driver inattention |

| Comprehensive (Theft) | Moderate | $2,500 | High vehicle theft rates in certain areas |

| Liability | High | Varies greatly | Driver negligence, traffic violations |

| Uninsured/Underinsured Motorist | Moderate | $4,000 | High percentage of uninsured drivers |

| Comprehensive (Weather Damage) | Moderate | $1,500 | Seasonal hailstorms, occasional flooding |

Key Factors Affecting Auto Insurance Rates in Albuquerque

Securing affordable auto insurance in Albuquerque depends on several interconnected factors. Understanding these factors allows drivers to make informed decisions and potentially lower their premiums. This section details the key elements influencing your insurance costs.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance rates. Insurance companies view a clean driving history as a low-risk profile, resulting in lower premiums. Conversely, accidents and traffic violations increase your risk profile, leading to higher premiums. The severity of the accident or violation further influences the increase. For example, a single minor fender bender might result in a smaller premium increase compared to a serious accident involving injuries or property damage. Similarly, multiple speeding tickets or more serious offenses like DUI convictions will substantially raise your rates. Many insurers utilize a points system to assess driving history, with each violation adding points that increase premiums.

Credit Score’s Influence on Auto Insurance Rates

In Albuquerque, as in many other states, your credit score plays a role in determining your auto insurance rates. Insurers often use credit-based insurance scores to assess your risk. The rationale is that individuals with good credit tend to demonstrate responsible financial behavior, which is correlated with responsible driving habits. A higher credit score typically translates to lower insurance premiums, while a lower credit score can lead to significantly higher premiums. It’s important to note that while credit scores are a factor, they are not the sole determinant of your insurance rate.

Vehicle Type and Age’s Effect on Insurance Costs

The type and age of your vehicle are crucial factors affecting insurance costs. Generally, newer, more expensive vehicles are more costly to insure due to higher repair costs and replacement values. Sports cars and high-performance vehicles also command higher premiums due to their increased risk of accidents and higher theft rates. Older vehicles, conversely, may have lower premiums due to their lower value, but may also lack modern safety features which can impact rates. The vehicle’s safety rating, as determined by organizations like the IIHS, also plays a role. Vehicles with high safety ratings may qualify for discounts.

Coverage Choices and Premium Costs

The type of coverage you choose directly affects your premium. Liability coverage, which is legally mandated in most states, protects you financially if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage caused by non-collision events, such as theft, vandalism, or weather-related damage. Choosing higher coverage limits for liability, collision, or comprehensive coverage will generally result in higher premiums, but offers greater financial protection. Conversely, selecting only the minimum required coverage will result in lower premiums but leaves you with less financial protection in the event of an accident.

Discounts Offered by Albuquerque Auto Insurance Providers

Many Albuquerque auto insurance providers offer various discounts to help lower your premiums. These discounts can significantly reduce your overall cost.

- Good Student Discount: Offered to students maintaining a certain GPA.

- Safe Driver Discount: Awarded for a period of accident-free driving.

- Multi-Vehicle Discount: For insuring multiple vehicles with the same company.

- Bundling Discount: Combining auto insurance with other insurance products, such as homeowners or renters insurance.

- Anti-theft Device Discount: For vehicles equipped with anti-theft devices.

Finding and Choosing an Auto Insurance Provider in Albuquerque

Choosing the right auto insurance provider in Albuquerque can significantly impact your financial well-being and peace of mind. Numerous factors influence your decision, including price, coverage options, and customer service. This section will guide you through the process of selecting the best provider for your needs.

Reputable Auto Insurance Companies in Albuquerque

Several reputable auto insurance companies operate in Albuquerque, offering a range of coverage options and price points. It’s crucial to compare several companies to find the best fit. This is not an exhaustive list, and the availability of specific companies may vary.

Examples of companies often found in Albuquerque include State Farm, Geico, Progressive, Allstate, Nationwide, and Farmers Insurance. Many smaller, regional providers also operate within the city, potentially offering more competitive rates or specialized services. Always check for licensing and customer reviews before selecting a provider.

Comparing Auto Insurance Providers

Comparing insurance providers involves analyzing customer reviews, ratings from independent organizations, and the specific coverage offered. Online resources like the Better Business Bureau (BBB) and independent review sites can provide valuable insights into customer experiences with different companies. Pay close attention to how quickly claims are processed and how effectively customer service resolves issues. A company with consistently high ratings and positive feedback generally indicates better service and reliability.

For example, one company might excel in claims processing speed, while another may offer more comprehensive coverage at a slightly higher premium. Understanding these trade-offs is essential in making an informed decision. Customer reviews often highlight specific strengths and weaknesses, such as the ease of online account management or the responsiveness of claims adjusters.

Obtaining an Auto Insurance Quote in Albuquerque

Obtaining an auto insurance quote is a straightforward process. Most companies offer online quote tools, allowing you to quickly receive an estimate based on your vehicle information, driving history, and coverage preferences. Alternatively, you can contact insurance agents directly by phone or in person. Be prepared to provide accurate information about your vehicle, driving record, and desired coverage levels.

The online quote process typically involves entering details like your vehicle’s year, make, and model; your driving history (including accidents and violations); your desired coverage levels (liability, collision, comprehensive, etc.); and your address. After submitting this information, the system generates a preliminary quote. Remember, this is an estimate, and the final premium may vary slightly after a full review of your application.

Checklist of Questions to Ask When Comparing Auto Insurance Quotes

Before committing to a policy, thoroughly compare quotes and ask pertinent questions. This ensures you understand the terms and conditions and choose the best fit for your needs.

A comprehensive checklist should include questions about coverage limits, deductibles, discounts offered, claims process, customer service availability, and any additional fees or surcharges.

Comparative Table of Auto Insurance Providers

| Company Name | Average Premium (Estimate) | Customer Rating (Example) | Key Features |

|---|---|---|---|

| State Farm | $1200 (Annual) | 4.5 stars | Wide coverage options, strong customer service reputation, various discounts |

| Geico | $1000 (Annual) | 4 stars | Competitive pricing, easy online quote process, strong digital presence |

| Progressive | $1100 (Annual) | 4.2 stars | Name Your Price® tool, various coverage options, robust online tools |

| Allstate | $1300 (Annual) | 4 stars | Strong brand recognition, extensive agent network, various bundled services |

Note: Premium estimates are illustrative and will vary based on individual factors. Customer ratings are examples and may fluctuate. Always check current ratings and quotes from individual providers.

Understanding Albuquerque’s Insurance Regulations and Laws

Navigating the legal landscape of auto insurance in Albuquerque, New Mexico, requires understanding the state’s minimum requirements, claims processes, and the rights and responsibilities of drivers involved in accidents. This section clarifies these crucial aspects to help ensure you’re adequately protected.

Minimum Auto Insurance Requirements in New Mexico

New Mexico mandates minimum liability coverage for all drivers. This means you must carry insurance that covers damages you cause to others in an accident. The minimum requirements are $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $10,000 for property damage. Failure to meet these minimums results in significant penalties. It’s important to note that these minimums may not be sufficient to cover all potential damages in a serious accident, and many drivers opt for higher coverage limits for added protection.

Filing an Auto Insurance Claim in Albuquerque

Filing an auto insurance claim involves reporting the accident to your insurer promptly, usually within 24-48 hours. You will need to provide detailed information about the accident, including the date, time, location, and involved parties. Supporting documentation such as police reports, photos of the damage, and witness statements will strengthen your claim. Your insurer will then investigate the claim and determine liability. The process can vary depending on the complexity of the accident and the insurer’s procedures. It is recommended to keep detailed records of all communication and documentation related to the claim.

Rights and Responsibilities of Drivers Involved in an Accident

In the event of an accident, New Mexico law requires drivers to stop at the scene, exchange information with other involved parties, and report the accident to the authorities if injuries or significant property damage occur. Drivers have the right to seek medical attention and legal counsel. Responsibilities include cooperating with law enforcement and providing accurate information to your insurer. Failure to comply with these requirements can lead to legal repercussions. It’s crucial to remain calm, document the scene, and avoid admitting fault at the scene of the accident.

Consequences of Driving Without Adequate Auto Insurance in Albuquerque

Driving without the minimum required auto insurance in New Mexico is illegal. Consequences include hefty fines, license suspension, and the possibility of vehicle impoundment. In the event of an accident, an uninsured driver is fully responsible for all damages, potentially facing significant financial liability. This can include medical bills, property repairs, and legal fees. The financial burden of an accident without insurance can be devastating.

Step-by-Step Guide for Handling an Accident

Handling an accident effectively involves a series of crucial steps.

- Ensure Safety: Check for injuries and call emergency services if needed. Move vehicles to a safe location if possible.

- Exchange Information: Obtain the other driver’s name, address, phone number, driver’s license number, insurance information, and license plate number. Note the make, model, and year of their vehicle.

- Document the Scene: Take photos and videos of the damage to all vehicles, the accident location, and any visible injuries. Note the weather conditions and any visible road hazards.

- Contact Law Enforcement: If there are injuries or significant property damage, call the police and file a report. Obtain a copy of the police report.

- Seek Medical Attention: If you or anyone else is injured, seek medical attention immediately, even if you feel fine initially. Document all medical treatments and expenses.

- Notify Your Insurer: Report the accident to your insurance company as soon as possible, usually within 24-48 hours. Provide them with all the information you gathered.

- Keep Records: Maintain a detailed record of all communications, documents, and expenses related to the accident and the claim process.

Specific Considerations for Albuquerque Drivers

Navigating the Albuquerque auto insurance landscape requires understanding factors unique to the city. Beyond the standard considerations of driving history and vehicle type, several elements specific to Albuquerque significantly influence insurance premiums and claims. These include the challenges of insuring specialty vehicles, the impact of the city’s climate, prevalent roadway hazards, and strategies for maintaining a favorable driving record.

Insuring Classic Cars and Specialty Vehicles

Insuring classic cars or other specialty vehicles in Albuquerque presents unique challenges. These vehicles often require specialized coverage that accounts for their higher value and potential for mechanical issues. Finding insurers familiar with the nuances of classic car restoration and maintenance is crucial. Premiums will typically be higher due to the increased risk of theft, vandalism, and the cost of repairs using specialized parts and expertise. Some insurers may offer agreed-value coverage, which ensures payment based on the vehicle’s appraised value rather than its depreciated market value in the event of a total loss. It’s essential to thoroughly research insurers specializing in classic and specialty vehicle insurance to find the most suitable and affordable coverage.

Albuquerque’s Climate and Auto Insurance Claims

Albuquerque’s climate, characterized by dramatic seasonal shifts and a distinct monsoon season, significantly impacts auto insurance claims. The intense summer heat can lead to tire blowouts and engine overheating, while the monsoon season brings heavy rainfall and flash flooding, increasing the likelihood of accidents due to hydroplaning and reduced visibility. Hailstorms are also a common occurrence, resulting in significant vehicle damage and a surge in comprehensive insurance claims. Drivers should be prepared for these weather-related events and consider purchasing comprehensive coverage to protect against these potential losses. The increased frequency of these weather-related incidents can contribute to higher average insurance premiums for Albuquerque drivers.

Common Driving Hazards in Albuquerque and Their Effect on Insurance Rates

Albuquerque’s roadways present specific hazards that influence insurance rates. Construction zones are frequent, causing traffic congestion and increasing the risk of rear-end collisions. The city’s diverse terrain, including mountainous areas and winding roads, contributes to an elevated risk of accidents involving rollovers or loss of control. Furthermore, pedestrian traffic in certain areas, particularly near the University of New Mexico and downtown, increases the risk of pedestrian accidents. These factors, coupled with the overall traffic volume, contribute to a higher frequency of accidents and subsequently, higher insurance premiums.

Maintaining a Good Driving Record and Lowering Insurance Premiums

Maintaining a clean driving record is crucial for securing lower insurance premiums in Albuquerque. Defensive driving techniques, such as maintaining a safe following distance, avoiding distractions (cell phone use, etc.), and adhering to speed limits, are essential for accident prevention. Regular vehicle maintenance, including tire rotations, brake checks, and oil changes, also helps minimize the risk of mechanical failures that could lead to accidents. Consider taking a defensive driving course; many insurers offer discounts for completing such courses. By consistently demonstrating safe driving habits and responsible vehicle maintenance, Albuquerque drivers can significantly reduce their insurance costs.

Visual Representation of Common Accident Locations and Types

Imagine a map of Albuquerque. High-accident areas would be visually represented by denser clusters of points. Along Interstate 25, particularly during rush hour, the points would be concentrated, representing primarily rear-end collisions and lane-change accidents. Near the University of New Mexico, more dispersed points would indicate a higher frequency of pedestrian accidents and collisions at intersections. In the mountainous areas surrounding the city, the points would show a higher concentration of accidents involving rollovers and single-vehicle crashes due to loss of control. The visual would show a correlation between accident density and specific roadway characteristics and traffic patterns.

Final Wrap-Up

Securing the right auto insurance in Albuquerque requires careful consideration of various factors. By understanding the local market dynamics, evaluating different providers, and being aware of your rights and responsibilities, you can effectively protect yourself and your vehicle. Remember to compare quotes, ask questions, and choose a policy that aligns with your budget and risk tolerance. Driving safely and maintaining a clean driving record are also crucial steps in managing your insurance costs effectively in Albuquerque.

FAQ Overview

What is the minimum liability coverage required in New Mexico?

New Mexico requires a minimum of $25,000 bodily injury liability coverage per person and $50,000 per accident, and $10,000 property damage liability coverage.

How do I file a claim after an accident in Albuquerque?

Contact your insurance company immediately after the accident. Gather information from all involved parties, including contact details, license plate numbers, and insurance information. File a police report if necessary.

What factors influence the cost of insuring a classic car in Albuquerque?

Factors include the vehicle’s age, condition, value, and usage. Specialized classic car insurance policies often have different premium calculations than standard auto insurance.

Can I get discounts on my Albuquerque auto insurance?

Yes, many insurers offer discounts for good driving records, bundling policies (home and auto), safety features in your vehicle, and completing defensive driving courses.