Securing affordable and comprehensive insurance for your home and vehicle is a crucial aspect of responsible financial planning. Understanding the intricacies of auto home insurance quotes can feel daunting, but this guide demystifies the process, empowering you to make informed decisions and potentially save significant money. We’ll explore the components of a quote, factors influencing its cost, and strategies for securing the best possible coverage at a price that fits your budget.

From navigating online quote generators to understanding the nuances of bundled policies, we’ll equip you with the knowledge needed to confidently compare offers from different insurers. This comprehensive overview will cover everything from obtaining accurate quotes to analyzing policy documents and filing claims, making the process significantly less stressful.

Understanding “Auto Home Insurance Quote”

An auto home insurance quote provides a prospective policyholder with an estimated cost for insuring their vehicle and home with the same insurance company. It’s essentially a snapshot of the potential premiums you’d pay, allowing you to compare options before committing to a policy. Understanding the quote’s components is crucial for making an informed decision.

Components of an Auto Home Insurance Quote

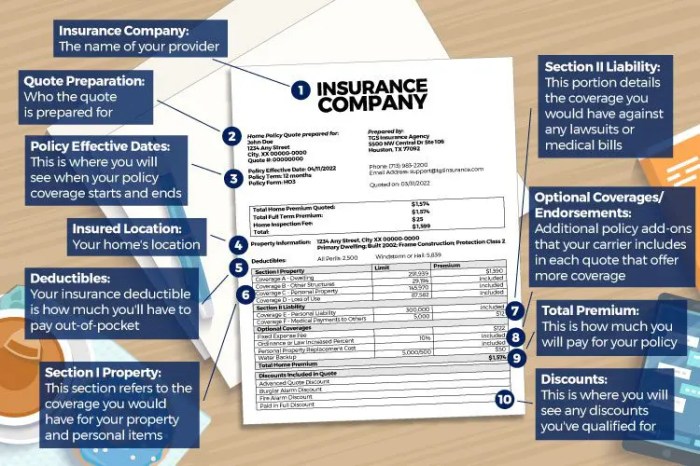

A typical auto home insurance quote will break down the estimated cost for both your auto and home insurance separately, then often present a bundled option. For each, it will detail the premium for the selected coverage level. This will include the base premium and any additional charges for specific features or coverage enhancements. For the auto portion, this might include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The home portion will detail coverage for dwelling, personal property, liability, and potentially other add-ons like flood or earthquake insurance. Finally, the quote will typically show the total premium, payment options, and any applicable discounts.

Factors Influencing Auto Home Insurance Costs

Several factors influence the cost of both your auto and home insurance, impacting the overall quote. These factors are considered individually for each and then combined to determine the final price. For auto insurance, these include your driving record (accidents, tickets), vehicle type and age, location (higher crime rates or accident frequencies can increase premiums), and the coverage levels you choose. For home insurance, factors include the location of your home (risk of natural disasters, crime rates), the age and condition of your home, the value of your belongings, and the level of security features you have installed. For example, a driver with multiple speeding tickets will likely see a higher auto premium than a driver with a clean record, and a home in a hurricane-prone area will command a higher premium than a home in a low-risk zone.

Bundled vs. Separate Auto and Home Insurance Quotes

Insurance companies frequently offer discounts for bundling auto and home insurance policies. This means purchasing both your auto and home insurance from the same provider. A bundled quote will show the total cost for both policies together, often at a reduced rate compared to purchasing them separately. The discount offered varies by company and depends on your individual risk profile. While a bundled quote can lead to significant savings, it’s important to compare the bundled price against the cost of separate policies to ensure you’re getting the best deal. Sometimes, securing the best rates for each policy individually may outweigh the discount offered for bundling. Consider the specific coverage levels and deductibles offered in each scenario to make the most informed choice.

Obtaining an Auto Home Insurance Quote

Securing an auto home insurance quote is the first step in protecting your valuable assets. Understanding the process, the necessary information, and the variations between insurer quotes will empower you to make informed decisions. This section Artikels the methods for obtaining quotes and highlights key considerations.

Online Auto Home Insurance Quote Acquisition

Obtaining an auto home insurance quote online is typically a straightforward process. Most insurers offer user-friendly websites with quote tools. These tools generally guide users through a series of questions related to their property and vehicles. The process is designed to be quick and efficient, providing a preliminary quote within minutes.

Key Information for Accurate Auto Home Insurance Quotes

Providing accurate information is crucial for receiving an accurate quote. Inaccurate information can lead to an inadequate policy or unexpected costs later. Essential details include the address of your home, the year, make, and model of your vehicles, the driving history of all listed drivers, and the desired coverage amounts. Specific details about home features, such as security systems or updated plumbing, might also impact the quote. Furthermore, providing accurate information regarding claims history will significantly affect your quote.

Variations in Quotes from Different Insurers

Insurance companies use different algorithms and assessment methods to calculate premiums. Therefore, quotes from various insurers will often vary. These variations stem from differences in risk assessment models, company profitability goals, and the specific coverage offered. For example, one insurer might weigh a driver’s age more heavily, while another might prioritize claims history. Comparing multiple quotes from different insurers is therefore strongly recommended to find the most suitable and cost-effective option.

Step-by-Step Guide for Obtaining a Quote Over the Phone

Calling an insurer directly can provide a personalized experience. Here’s a step-by-step guide:

- Initiate the Call: Contact the insurer’s customer service line.

- Provide Necessary Information: Be prepared to provide the same details needed for an online quote (address, vehicle information, driver details, coverage preferences).

- Answer Questions: The agent may ask clarifying questions to assess your risk profile.

- Receive Your Quote: The agent will provide a quote based on the information provided.

- Ask Questions: Don’t hesitate to clarify any aspects of the quote or the policy.

Analyzing Quote Details

Understanding the specifics of your auto home insurance quote is crucial to making an informed decision. This involves identifying the coverage options, comparing premiums and deductibles across different insurers, and weighing the benefits and drawbacks of each coverage level. Careful analysis ensures you get the best protection at a price that suits your budget.

Key Coverage Options in a Typical Quote

A typical auto home insurance quote will include several key coverage options. These often fall under liability coverage (protecting you financially if you cause an accident), collision coverage (covering damage to your vehicle regardless of fault), comprehensive coverage (covering damage from events other than collisions, such as theft or weather), and uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with a driver who lacks sufficient insurance). Additional options may include medical payments coverage, roadside assistance, and rental car reimbursement. The specific options and their availability will vary by insurer and state.

Comparing Deductibles and Premiums

Deductibles and premiums are inversely related. A higher deductible (the amount you pay out-of-pocket before your insurance kicks in) generally results in a lower premium (your monthly payment). Conversely, a lower deductible leads to a higher premium. Different insurers will offer various combinations of deductibles and premiums. For example, Insurer A might offer a $500 deductible with a $100 monthly premium, while Insurer B might offer a $1000 deductible with a $80 monthly premium. The best choice depends on your risk tolerance and financial situation. Someone with a larger emergency fund might opt for a higher deductible and lower premium, while someone with limited savings might prefer a lower deductible and higher premium.

Comparison of Coverage Levels and Costs

The following table illustrates a hypothetical comparison of coverage levels and associated costs from three different insurers (Insurer A, Insurer B, and Insurer C) for a standard policy. Note that these are examples and actual costs will vary significantly based on numerous factors including location, driving history, and the type of vehicle.

| Coverage Level | Insurer A | Insurer B | Insurer C |

|---|---|---|---|

| Liability ($100,000/$300,000) | $50/month | $45/month | $55/month |

| Collision ($500 deductible) | $75/month | $80/month | $70/month |

| Comprehensive ($500 deductible) | $60/month | $55/month | $65/month |

| Uninsured/Underinsured Motorist | Included | Additional $10/month | Included |

| $185 | $190 | $190 |

Benefits and Drawbacks of Various Coverage Options

Choosing the right coverage options involves understanding their benefits and drawbacks. For instance, collision coverage offers financial protection in case of an accident, regardless of fault, but it comes with a higher premium. Comprehensive coverage protects against non-collision damage, providing peace of mind, but also adds to the overall cost. Liability coverage is typically legally mandated and protects you financially if you cause harm to others, but it doesn’t cover your own vehicle damage. Uninsured/underinsured motorist coverage is vital in protecting you from drivers who lack sufficient insurance, but it’s often an optional add-on. Carefully considering your individual needs and risk tolerance is key to selecting the optimal coverage options.

End of Discussion

Obtaining the right auto home insurance quote involves careful consideration of your individual needs and a thorough understanding of the various factors affecting premiums. By diligently comparing quotes, understanding coverage options, and implementing cost-saving strategies, you can secure comprehensive protection for your home and vehicle without breaking the bank. Remember, proactive planning and informed decision-making are key to securing the best possible insurance coverage tailored to your specific circumstances.

FAQ Compilation

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How often should I review my auto home insurance policy?

It’s recommended to review your policy annually or whenever significant life changes occur (e.g., moving, buying a new car, improving home security).

Can I get an auto home insurance quote without providing my driving history?

No, your driving history is a key factor in determining your insurance rates. Insurers use this information to assess your risk profile.

What happens if I file a false claim?

Filing a false claim can lead to policy cancellation, refusal of future coverage, and even legal repercussions.