Securing the right auto and renters insurance can feel overwhelming. Navigating the complexities of coverage options, comparing prices from various providers, and understanding the factors influencing premiums requires careful consideration. This guide aims to simplify the process, providing a clear and concise overview of auto and renters insurance quotes, empowering you to make informed decisions and secure the best possible protection.

We’ll explore the key factors that determine insurance costs, including your driving history, location, credit score, and the type of vehicle you own. We’ll also compare different insurance providers and their offerings, helping you identify the best fit for your needs and budget. Finally, we’ll address common misconceptions and offer practical tips for obtaining favorable quotes and securing comprehensive coverage.

Understanding the Search Intent Behind “Auto and Renters Insurance Quotes”

The search phrase “auto and renters insurance quotes” reveals a user actively seeking pricing information for both types of insurance. However, the underlying motivations and the stage of their decision-making process can vary significantly. Understanding these nuances is crucial for effectively targeting potential customers and providing relevant information.

The diverse user needs and motivations behind this search stem from various life stages and circumstances. Some individuals may be actively seeking coverage due to a recent life event, such as buying a new car or moving into a new apartment. Others may be comparing rates to ensure they’re getting the best deal from their current provider or proactively planning for future needs. The urgency and context of the search significantly impact the user’s expectations and subsequent actions.

Stages of the Customer Journey

The search for “auto and renters insurance quotes” reflects different stages in the customer journey. These stages can range from initial awareness and research to a final purchase decision. A user in the awareness stage might be simply exploring options, while a user in the decision stage is ready to purchase a policy immediately. Understanding these stages allows for targeted messaging and optimized user experience. For example, a user in the awareness stage might benefit from informative content explaining coverage options, while a user in the decision stage would be more interested in a quick and easy quote comparison tool.

Information Users Expect

Users searching for “auto and renters insurance quotes” expect to find specific information to help them make informed decisions. This includes detailed pricing information, coverage options, and policy features. They’re also likely to be interested in comparing quotes from different insurers, reading customer reviews, and understanding the terms and conditions of each policy. Clear and concise presentation of this information is crucial for converting potential customers.

Comparison of User Search Intents

The following table illustrates the different user search intents behind the phrase “auto and renters insurance quotes,” categorizing them by urgency and motivation.

| Intent | User Profile | Information Needed | Action Taken |

|---|---|---|---|

| Immediate Need | Recent car buyer needing immediate coverage, recent move requiring renters insurance | Quick quotes, available coverage options, immediate policy purchase process | Contacts multiple insurers, purchases policy online or via phone |

| Comparison Shopping | Existing policyholder seeking better rates, individual researching options before renewal | Detailed pricing breakdown, coverage comparisons across insurers, customer reviews | Compares quotes from multiple providers, negotiates with current insurer |

| Future Planning | Young adult anticipating car purchase, individual planning a future move | General information on coverage options, average costs, policy features | Reads articles, browses websites, saves quotes for future reference |

| Problem Solving | Individual facing a claim or policy issue, needing to change insurance providers due to a life event | Information on claims process, policy cancellation options, details of different provider’s policies | Contacts current or prospective insurers, files a claim, initiates policy changes |

Competitive Landscape Analysis of Insurance Quote Websites

The online insurance market is fiercely competitive, with numerous websites offering auto and renters insurance quotes. Understanding the nuances of these platforms is crucial for consumers seeking the best value and user experience. This analysis compares three major players, highlighting their features, user experience, and overall strengths and weaknesses.

Comparison of Three Major Insurance Quote Websites

The following table compares three prominent insurance quote websites: Progressive, Geico, and Lemonade. Each website offers a unique approach to obtaining quotes, impacting the overall user experience and the features available.

| Website | Key Features | User Experience | Strengths & Weaknesses |

|---|---|---|---|

| Progressive | Name Your Price® Tool, multiple coverage options, detailed policy information, robust online account management, 24/7 customer support | Generally positive, intuitive navigation, clear presentation of information. However, some users find the Name Your Price® tool slightly complex initially. | Strengths: Comprehensive features, strong online tools, excellent customer support. Weaknesses: The Name Your Price® tool can be overwhelming for first-time users; some find the site visually cluttered. |

| Geico | Quick and easy quote process, various discounts, straightforward policy options, mobile-friendly interface, strong brand recognition | Generally positive, very streamlined and efficient quote process. However, some users find the lack of detailed information upfront slightly frustrating. | Strengths: Speed and simplicity, strong brand recognition, mobile-friendly design. Weaknesses: Less comprehensive features compared to Progressive; lack of detailed policy information upfront might deter some users. |

| Lemonade | AI-powered chatbot, quick claims process, socially conscious brand, transparent pricing, mobile-first approach | Generally positive, unique and innovative approach. However, the reliance on AI might not appeal to all users, and some find the limited policy customization options restrictive. | Strengths: Innovative technology, fast claims process, transparent pricing. Weaknesses: Limited policy customization options, reliance on AI might not be suitable for all users, less established brand recognition compared to Progressive and Geico. |

Effective and Ineffective Website Designs

Effective website designs prioritize clear navigation, concise information presentation, and a visually appealing layout. For example, Geico’s website excels in its streamlined quote process, guiding users efficiently through the necessary steps. The clear and concise language used avoids overwhelming the user with technical jargon. In contrast, websites with cluttered layouts, excessive pop-ups, or confusing navigation, like some versions of older insurance websites, negatively impact user experience. These designs can lead to frustration and abandonment of the quote process. An effective design uses visual hierarchy to guide the user’s eye to the most important information first, while an ineffective design presents information in a chaotic and disorganized manner. A strong example of an ineffective design would be a website with inconsistent font sizes and colors, making it difficult for users to read and understand the information presented.

Factors Influencing Auto and Renters Insurance Quotes

Securing affordable auto and renters insurance requires understanding the numerous factors that influence premium calculations. Insurance companies use sophisticated algorithms to assess risk, and the resulting quote reflects this evaluation. This section details the key elements that determine the cost of your insurance.

Demographic Factors and Insurance Premiums

Demographic information plays a significant role in determining insurance premiums. Age, location, and credit score are all key factors. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Conversely, older drivers with clean driving records often qualify for lower rates. Location influences premiums due to variations in crime rates, accident frequency, and the cost of repairs. Areas with high crime rates or a higher incidence of accidents will typically have higher insurance costs. Credit score is also a factor, as studies have shown a correlation between credit history and insurance claims. Individuals with poor credit scores are often considered higher-risk and may face higher premiums. For example, a 20-year-old driver in a high-crime urban area with a poor credit score will likely pay significantly more than a 50-year-old driver in a rural area with excellent credit.

Auto Insurance Cost Determinants: Vehicle, Driving History, and Coverage

Several factors related to the vehicle itself, your driving history, and the coverage options you select directly impact your auto insurance costs. The make, model, and year of your vehicle significantly influence premiums. Luxury cars or vehicles with high repair costs generally result in higher insurance premiums. Your driving history, including accidents, tickets, and claims, is a crucial factor. A clean driving record usually translates to lower premiums, while accidents and traffic violations can significantly increase costs. The type of coverage you choose also affects the price. Comprehensive and collision coverage, while offering greater protection, will typically cost more than liability-only coverage. For instance, a new sports car driven by a driver with multiple speeding tickets will command a much higher premium than an older sedan driven by a driver with a spotless record and only liability coverage.

Renters Insurance Cost Factors

While less complex than auto insurance, renters insurance premiums are still influenced by several key factors. The location of the rental property is a primary driver of cost, with higher-crime areas leading to higher premiums. The value of your belongings is another important factor; more valuable possessions require higher coverage amounts, resulting in higher premiums. The level of coverage selected will also impact the cost. Choosing a higher coverage limit for personal liability protection, for example, will increase your premium. Finally, the insurer’s risk assessment, based on factors like the age and condition of the building, will also influence your rate. A renter in a high-crime, urban area with extensive valuable possessions and high liability coverage will naturally pay more than a renter in a low-crime, suburban area with fewer possessions and lower coverage.

Best Practices for Obtaining Favorable Insurance Quotes

Securing the best possible auto and renters insurance quotes involves a strategic approach that goes beyond simply filling out online forms. By understanding the process and employing effective strategies, you can significantly reduce your premiums and find the coverage that best suits your needs. This involves careful planning, comparison shopping, and potentially, negotiation.

Step-by-Step Guide to Obtaining Optimal Insurance Quotes

This guide Artikels a systematic approach to securing the most favorable auto and renters insurance quotes. Following these steps will help you compare apples to apples and make an informed decision.

- Gather Necessary Information: Before starting, collect all relevant details, including your driver’s license, vehicle information (make, model, year), address, and details about your rental property (address, value of contents).

- Get Multiple Quotes Online: Utilize online comparison tools to obtain quotes from various insurers simultaneously. This allows for efficient comparison across different providers.

- Contact Insurers Directly: While online quotes are helpful, contacting insurers directly allows for personalized discussions and potential negotiation. This may uncover discounts or specialized programs not readily available online.

- Compare Coverage Details: Don’t just focus on price; carefully review the coverage details of each quote. Ensure the policy adequately protects your assets and meets your specific needs. Pay close attention to deductibles and coverage limits.

- Review Policy Documents: Once you’ve selected a preferred policy, thoroughly review the policy documents before signing. Understand the terms, conditions, and exclusions.

Importance of Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is crucial for finding the best value. Insurance companies use different rating factors and offer varying levels of coverage at different price points. By comparing quotes, you can identify the insurer that offers the most comprehensive coverage at the most competitive price. For example, one insurer might offer a lower premium for a similar level of coverage than another, solely based on their risk assessment models and market strategies. This comparison allows you to make an informed decision based on your specific circumstances and priorities.

Strategies for Negotiating Lower Insurance Premiums

Negotiating lower insurance premiums is possible, though it requires preparation and a clear understanding of your needs.

- Bundle Policies: Combining your auto and renters insurance with the same insurer often results in significant discounts.

- Highlight Safe Driving History: A clean driving record is a strong bargaining chip. Emphasize your years of accident-free driving and any defensive driving courses completed.

- Explore Discounts: Inquire about available discounts, such as those for good students, multiple vehicles, security systems (for renters insurance), or loyalty programs.

- Shop Around Regularly: Insurance rates fluctuate. Regularly comparing quotes can help you identify opportunities to lower your premiums over time.

- Consider Increasing Your Deductible: A higher deductible will generally result in a lower premium. Carefully weigh the financial risk of a higher deductible against the potential savings.

Tips for Consumers to Save Money on Insurance

Saving money on insurance requires proactive steps. The following tips can help you reduce your premiums.

- Maintain a Good Credit Score: A good credit score often translates to lower insurance premiums.

- Improve Your Driving Record: Avoid accidents and traffic violations to maintain a clean driving record.

- Install Security Systems: Security systems in your home can lower your renters insurance premiums.

- Pay Your Premiums on Time: Avoiding late payments can prevent additional fees and maintain a positive payment history.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums.

Illustrative Examples of Policy Coverage

Understanding the specifics of auto and renters insurance coverage is crucial for securing adequate protection. This section provides detailed descriptions of various coverage options, highlighting differences in coverage levels and associated costs through hypothetical scenarios. This will help you make informed decisions when choosing your policy.

Auto Insurance Coverage Options

Auto insurance policies typically include several types of coverage. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, or hail. Uninsured/Underinsured Motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance.

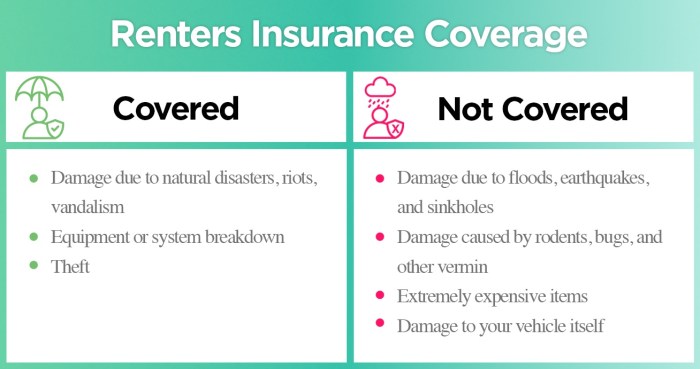

Renters Insurance Coverage Options

Renters insurance protects your personal belongings and provides liability coverage if someone is injured in your apartment. Personal property coverage reimburses you for the value of your possessions lost or damaged due to covered perils like fire, theft, or water damage. Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. Additional living expenses coverage provides temporary housing and other expenses if your apartment becomes uninhabitable due to a covered event.

Hypothetical Scenarios and Coverage Benefits

Let’s consider some scenarios to illustrate the value of different coverage options. Imagine you’re involved in a car accident and are found at fault. Liability coverage would pay for the other driver’s medical bills and vehicle repairs. If your car is damaged, collision coverage would cover the repair costs. If a tree falls on your car during a storm, comprehensive coverage would take care of the repairs. Similarly, if a fire damages your apartment and your belongings, renters insurance’s personal property coverage would help replace your lost items. If a guest slips and falls in your apartment, renters liability coverage would protect you from potential lawsuits.

Comparison of Coverage Types and Costs

The cost of insurance varies significantly based on factors like your location, driving record, credit score, and the type and amount of coverage you choose. The following table provides typical cost ranges, but these are estimates and actual costs may vary.

| Coverage Type | Description | Auto Insurance Cost Range (Annual) | Renters Insurance Cost Range (Annual) |

|---|---|---|---|

| Liability | Covers bodily injury and property damage to others | $300 – $1000 | $150 – $300 |

| Collision | Covers damage to your vehicle in an accident | $300 – $800 | N/A |

| Comprehensive | Covers damage to your vehicle from non-accident events | $100 – $400 | N/A |

| Uninsured/Underinsured Motorist | Covers injuries caused by an uninsured or underinsured driver | $100 – $300 | N/A |

| Personal Property | Covers your belongings in case of damage or theft | N/A | $100 – $300 |

| Liability | Covers legal liability for injuries or damages to others | N/A | $100 – $300 |

| Additional Living Expenses | Covers temporary housing and expenses if your home is uninhabitable | N/A | $50 – $150 |

Addressing Common Misconceptions About Insurance

Many individuals hold inaccurate beliefs about auto and renters insurance, leading to inadequate coverage or unnecessary expenses. Understanding the realities of insurance is crucial for securing appropriate protection and avoiding financial hardship in the event of an accident or loss. This section clarifies three common misconceptions and offers guidance on navigating the insurance process effectively.

Misconception: Higher Deductibles Always Mean Lower Premiums

While it’s true that choosing a higher deductible often results in a lower premium, it’s crucial to consider your financial capacity. A higher deductible means you’ll pay more out-of-pocket in the event of a claim. Carefully weigh the potential savings in premiums against the risk of a significant personal expense if you need to file a claim. For example, a $1,000 deductible might save you $50 annually on your premium, but if you have a minor accident requiring a $800 repair, you’ll still be responsible for the entire $1000 deductible. A lower deductible, while costing more upfront, offers greater financial protection. The optimal balance depends on your individual financial situation and risk tolerance.

Misconception: Renters Insurance Is Unnecessary

Many renters believe their landlord’s insurance covers their belongings. This is incorrect. Landlord insurance typically covers the building structure, not the tenant’s personal property. Renters insurance provides crucial protection for your furniture, electronics, clothing, and other possessions against theft, fire, or damage. Furthermore, it often includes liability coverage, protecting you against lawsuits if someone is injured in your apartment. The relatively low cost of renters insurance makes it a worthwhile investment, considering the potential financial devastation of losing your belongings. For instance, replacing a laptop, a television, and furniture after a fire could cost thousands of dollars. Renters insurance helps mitigate these losses.

Misconception: Comprehensive Coverage Is Always Necessary

Comprehensive coverage, which covers damage to your vehicle not caused by a collision (e.g., theft, vandalism, weather damage), is beneficial, but not always essential. Depending on the age and value of your vehicle, the cost of comprehensive coverage may outweigh the potential benefits. For an older car with low value, the cost of comprehensive coverage might not be justified, especially if you’re already carrying collision coverage and liability. Carefully assess the value of your vehicle and the cost of the comprehensive coverage to determine if it’s a worthwhile investment. A cost-benefit analysis will help you determine if the added protection is worth the increased premium.

Importance of Thorough Policy Understanding

Understanding your insurance policy is paramount. Carefully review the policy documents, paying close attention to the coverage limits, deductibles, exclusions, and any specific terms and conditions. Don’t hesitate to contact your insurance provider to clarify any uncertainties. A clear understanding of your policy prevents misunderstandings and ensures you receive the appropriate compensation in the event of a claim. Ignoring the details could lead to inadequate coverage or disputes during the claims process.

Avoiding Common Pitfalls When Choosing Insurance Coverage

To avoid pitfalls, compare quotes from multiple insurance providers. Don’t solely focus on the premium; consider the coverage provided. Ensure the coverage aligns with your needs and risk profile. Be wary of overly aggressive sales tactics and thoroughly read all policy documents before signing. Maintain accurate information about your vehicle and your living situation, as inaccurate information could invalidate your coverage.

Frequently Asked Questions

Understanding your insurance policy is key to avoiding problems. Here are some common questions and their answers:

- What is the difference between liability and collision coverage? Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for damage to your vehicle, regardless of fault.

- What does uninsured/underinsured motorist coverage protect me from? This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver.

- What is personal liability coverage in renters insurance? This protects you financially if someone is injured in your rented property or if you damage someone else’s property.

- How can I lower my auto insurance premiums? Consider factors such as safe driving history, bundling policies, increasing your deductible, and opting for a car with safety features.

- What factors affect my renters insurance premium? Location of your rental property, value of your belongings, and the level of coverage you choose all affect the cost.

Last Word

Understanding auto and renters insurance quotes is crucial for protecting your assets and financial well-being. By carefully considering the factors influencing premiums, comparing quotes from multiple insurers, and understanding your coverage options, you can secure the best possible protection at a price that fits your budget. Remember, thorough research and informed decision-making are key to finding the right insurance policy for your individual needs. Take the time to compare, understand, and choose wisely.

FAQ Compilation

Can I bundle my auto and renters insurance?

Yes, many insurers offer discounts for bundling auto and renters insurance policies. Bundling can often lead to significant savings.

How often should I review my insurance coverage?

It’s recommended to review your insurance coverage annually, or whenever there’s a significant life change (e.g., moving, buying a new car, getting married).

What happens if I’m involved in an accident and don’t have enough coverage?

If your coverage is insufficient, you may be personally liable for the costs exceeding your policy limits. This could lead to significant financial hardship.

How does my credit score affect my insurance rates?

In many states, your credit score is a factor in determining your insurance premiums. A higher credit score generally translates to lower rates.

What is the difference between liability and collision coverage?

Liability coverage pays for damages to other people’s property or injuries sustained by others in an accident you cause. Collision coverage pays for damage to your own vehicle, regardless of fault.