Navigating the world of insurance can feel like traversing a maze, especially when considering both auto and home coverage. This guide aims to illuminate the path, offering a clear understanding of how to secure the best rates for your needs. We’ll explore the factors influencing quote prices, compare different providers, and guide you through the online quote process, ultimately empowering you to make informed decisions about your insurance protection.

From understanding the typical customer profile to deciphering the intricacies of bundled versus separate policies, we’ll delve into the key aspects of obtaining auto and home insurance quotes. We’ll examine the influence of various factors, such as driving record, location, and property type, on your premium costs. The goal is to equip you with the knowledge to confidently compare offers and choose the insurance package that best suits your budget and lifestyle.

Understanding the Market for Auto and Home Insurance Quotes

The market for auto and home insurance quotes is a dynamic landscape shaped by consumer needs, insurer strategies, and technological advancements. Understanding this market requires examining the typical customer, the factors influencing their decisions, and the various ways they access quotes.

The Typical Customer Seeking Combined Auto and Home Insurance Quotes

Homeowners, particularly those with families, frequently seek combined auto and home insurance quotes. These individuals often prioritize convenience and cost savings. They are typically busy professionals or families juggling multiple responsibilities and appreciate the streamlined process of managing both insurance needs through a single provider. Younger adults starting families or older adults downsizing their homes may also be a significant segment of this market, seeking comprehensive protection at a competitive price.

Factors Influencing a Customer’s Choice of Insurer

Several key factors influence a customer’s choice of insurer when seeking combined auto and home insurance. Price is often the primary driver, with consumers actively seeking the most competitive rates. However, factors beyond price also play a crucial role. These include the insurer’s reputation for claims handling, customer service quality, policy coverage options, and the availability of discounts. A strong brand reputation and positive customer reviews can significantly influence purchase decisions. The availability of digital tools and convenient online services is also increasingly important for many consumers.

Distribution Channels for Obtaining Quotes

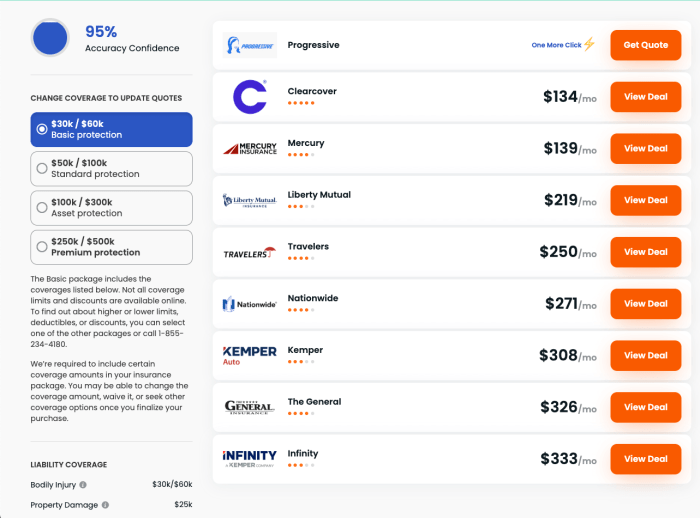

Consumers can obtain auto and home insurance quotes through various channels. Online quote comparison websites provide a convenient way to compare prices and coverage from multiple insurers simultaneously. Independent insurance agents act as intermediaries, offering quotes from several companies and providing personalized advice. Direct insurers sell policies directly to consumers through their websites or call centers, often offering competitive pricing but with potentially less personalized service. Finally, captive agents represent a single insurer, offering only that company’s products.

Comparison of Bundled vs. Separate Policies

The decision to bundle auto and home insurance or purchase separate policies involves a trade-off between convenience and potential cost savings versus the flexibility of choosing different insurers for each coverage type.

| Feature | Bundled Policies | Separate Policies |

|---|---|---|

| Cost | Often lower due to discounts | Potentially higher, but allows for individual price comparisons |

| Convenience | Simplified billing and management | More complex administration |

| Flexibility | Less flexibility in choosing insurers | Greater flexibility in selecting insurers and coverage |

| Customer Service | Single point of contact for claims | Separate contact points for each insurer |

Factors Affecting Quote Prices

Numerous factors influence the cost of auto and home insurance premiums. Understanding these factors can help consumers make informed decisions and potentially secure more favorable rates. This section will detail the key elements affecting both auto and home insurance pricing, and explore the impact of bundling these policies.

Auto Insurance Premium Factors

Several key aspects significantly impact your auto insurance premium. These include your driving record, the type of vehicle you drive, and your location.

- Driving Record: A clean driving record with no accidents or traffic violations typically results in lower premiums. Conversely, accidents, speeding tickets, or DUI convictions will significantly increase your rates. Insurance companies view a history of at-fault accidents as a higher risk, leading to increased premiums to cover potential future claims.

- Vehicle Type: The type of vehicle you insure plays a crucial role in determining your premium. Generally, more expensive vehicles, high-performance cars, and those with a history of theft or accidents command higher premiums due to higher repair costs and increased risk. Conversely, smaller, less expensive vehicles often attract lower premiums.

- Location: Your geographic location influences your auto insurance rate due to variations in crime rates, accident frequency, and the cost of repairs. Areas with high accident rates or theft will generally have higher insurance premiums than those with lower rates of incidents.

Home Insurance Premium Factors

Similar to auto insurance, several factors influence the cost of home insurance premiums. These include the location of your property, the type of property, and the level of coverage you select.

- Location: The location of your home significantly impacts your insurance costs. Properties in areas prone to natural disasters (hurricanes, earthquakes, wildfires) or high crime rates will generally have higher premiums. Insurance companies assess risk based on historical data for specific locations.

- Property Type: The type of dwelling you insure influences your premium. Larger homes, those made of more expensive materials, and those with unique architectural features might have higher premiums due to increased rebuilding costs. Older homes might also require higher premiums due to potential maintenance issues.

- Coverage: The amount of coverage you choose directly affects your premium. Higher coverage limits, such as for liability or dwelling replacement cost, will result in higher premiums. Conversely, choosing lower coverage limits will lower your premium but also reduce the financial protection you receive in the event of a claim.

Bundling Auto and Home Insurance

Bundling your auto and home insurance policies with the same insurer often leads to significant savings. Insurance companies offer discounts for bundling as it simplifies their administrative processes and reduces the risk associated with insuring multiple policies for the same customer. The discount percentage varies depending on the insurer and the specific policies being bundled.

Hypothetical Scenario: Impact of Different Factors

Let’s consider two hypothetical individuals:

Individual A: Lives in a low-risk area, drives a mid-sized sedan, has a clean driving record, and chooses standard coverage for their home and auto insurance. They bundle their policies.

Individual B: Lives in a high-risk area prone to hurricanes, drives a high-performance sports car, has several speeding tickets, and chooses high coverage limits for their home and auto insurance. They purchase separate policies.

Individual A would likely receive significantly lower premiums than Individual B due to the lower-risk profile and the benefit of bundling. The difference in premiums could be substantial, highlighting the significant impact of the various factors discussed.

Customer Experience and Satisfaction

A positive customer experience is paramount in the competitive insurance market. Securing a customer’s business often hinges not just on price, but on how easily and pleasantly they navigate the quote process. Clear, efficient communication, coupled with responsive and helpful customer service, significantly influences customer satisfaction and loyalty. Ultimately, a superior customer experience translates to increased retention and positive word-of-mouth referrals.

The clarity and conciseness of communication during the quote process are crucial. Ambiguity or jargon can lead to frustration and mistrust. A straightforward, easily understandable explanation of policy options, coverage details, and pricing is essential.

Positive and Negative Customer Experiences

Positive experiences typically involve a streamlined online quoting process with readily available information, clear explanations of policy details, and prompt, helpful responses to inquiries. For example, a customer might praise an insurer for its user-friendly website, which allows for quick comparisons of different coverage levels and immediate online chat support for clarifying questions. In contrast, negative experiences often involve lengthy wait times on the phone, confusing or incomplete information, and unhelpful or unresponsive customer service representatives. A customer might recount a frustrating experience trying to reach a representative, only to receive conflicting information about policy details. The lack of clear communication and the impersonal nature of the interaction can severely damage the customer’s perception of the insurer.

The Role of Customer Service in Influencing Satisfaction

Customer service plays a pivotal role in shaping customer satisfaction. Responsive, knowledgeable, and empathetic representatives can transform a potentially negative experience into a positive one. For instance, a customer who initially felt frustrated by a complex policy detail might change their opinion if a customer service agent patiently explains the information and answers their questions thoroughly. Conversely, unhelpful or dismissive customer service can quickly erode trust and lead to customer churn. A slow response time, unhelpful answers, or a general lack of empathy can all contribute to negative experiences. In today’s digital age, readily available online chat support and 24/7 accessibility are becoming increasingly important factors in determining customer satisfaction.

Best Practices for Improving Customer Experience

Improving the customer experience requires a multifaceted approach. The following best practices can significantly enhance customer satisfaction:

- Develop a user-friendly website with clear navigation and readily accessible information.

- Offer multiple channels for communication, including online chat, email, and phone support.

- Provide prompt and helpful responses to customer inquiries, aiming for minimal wait times.

- Use clear and concise language in all communications, avoiding technical jargon.

- Personalize the customer experience by using the customer’s name and addressing their specific needs.

- Implement a robust system for tracking and resolving customer complaints efficiently.

- Proactively solicit customer feedback and use it to improve processes and services.

- Train customer service representatives to be knowledgeable, empathetic, and solution-oriented.

Final Review

Securing affordable and comprehensive auto and home insurance requires careful planning and informed decision-making. By understanding the factors that influence quote prices, comparing different providers, and navigating the online quote process effectively, you can significantly reduce your insurance costs while ensuring adequate coverage. Remember to carefully review policy details and seek clarification from insurers when needed to ensure complete peace of mind.

FAQ Summary

What is the best time of year to get insurance quotes?

There’s no single “best” time, but shopping around periodically (e.g., annually) allows you to compare current rates and take advantage of potential discounts or promotions.

Can I get quotes without providing my personal information?

Most insurers require some personal information to generate accurate quotes, but the level of detail varies. You may be able to get a preliminary estimate with limited data, but a full quote will require more information.

What happens if I bundle my auto and home insurance, and then later need to cancel one?

The terms for cancelling bundled policies vary by insurer. Review your policy documents or contact your insurer to understand the implications of cancelling one part of the bundled coverage.

How often should I review my insurance coverage?

It’s recommended to review your insurance coverage at least annually, or whenever there are significant life changes (e.g., moving, buying a new car, getting married).