Securing your pet’s well-being often involves navigating the complexities of pet health insurance. This exploration delves into ASPCA pet health insurance, examining its plans, coverage, pricing, and customer experiences. We aim to provide a comprehensive overview, empowering you to make informed decisions about your furry friend’s healthcare.

From understanding the various coverage options and comparing them to competitors, to navigating the claims process and learning from real-life scenarios, this guide offers a practical and informative resource for pet owners considering ASPCA pet health insurance. We will also address common concerns and questions to help you make the best choice for your pet’s needs.

ASPCA Pet Health Insurance Overview

ASPCA Pet Health Insurance offers a range of plans designed to help pet owners manage the often unexpected costs associated with veterinary care. Understanding the different coverage options and the application process is crucial for making an informed decision about pet insurance. This overview will provide a comprehensive look at ASPCA’s offerings and compare them to other leading providers.

ASPCA Pet Health Insurance Plans and Details

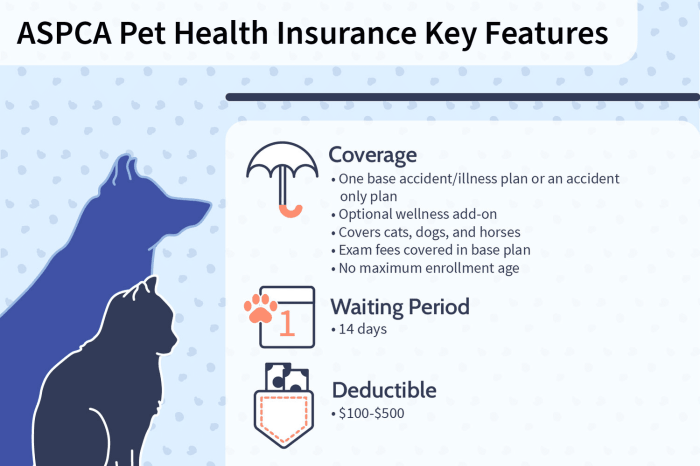

ASPCA offers several different plans, each with varying levels of coverage and cost. These plans typically cover accidents and illnesses, but specific coverage details vary. Some plans may include optional add-ons for things like wellness care or emergency care. It’s important to carefully review the policy documents to understand exactly what is and isn’t covered under each plan. The plans are designed to be flexible, catering to different budgets and pet health needs. Factors such as your pet’s breed, age, and pre-existing conditions will influence the specific coverage and premiums.

ASPCA Pet Health Insurance Application Process

Applying for ASPCA pet health insurance is generally a straightforward process. You will typically need to provide information about your pet, including their breed, age, and medical history. You will also need to select a plan that suits your needs and budget. The application process usually involves completing an online form or contacting a customer service representative. Once your application is approved, your coverage will begin, and you can start using your policy. Be sure to carefully review the policy documents to understand the terms and conditions of your coverage.

Comparison of ASPCA Pet Insurance with Other Providers

While ASPCA is a reputable provider, it’s beneficial to compare their plans with other major pet insurance companies. A direct comparison should focus on both price and the extent of coverage offered. Some competitors may offer more comprehensive coverage, while others may offer lower premiums. The best choice depends on your individual needs and priorities. Factors like reimbursement percentages, annual limits, and deductible amounts can significantly impact the overall cost and value of the policy. Researching multiple providers and comparing their plans side-by-side is recommended before making a final decision.

Comparison of Three ASPCA Plans

The following table compares three hypothetical ASPCA plans to illustrate the differences in coverage options. Remember that specific plan details and pricing may vary based on your pet’s age, breed, and location. Always refer to the ASPCA website for the most up-to-date information.

| Plan Name | Annual Maximum | Deductible | Reimbursement Percentage |

|---|---|---|---|

| Basic | $5,000 | $250 | 70% |

| Standard | $10,000 | $100 | 80% |

| Premium | $15,000 | $50 | 90% |

Understanding ASPCA Health Insurance Coverage

ASPCA pet health insurance offers various plans designed to help pet owners manage the often unpredictable costs associated with veterinary care. Understanding the specifics of your coverage is crucial for maximizing its benefits and avoiding potential claim denials. This section details the types of coverage, common exclusions, reasons for claim denials, and the claim process.

Covered Illnesses and Injuries

ASPCA pet insurance policies typically cover a wide range of illnesses and injuries. This includes accidents, such as broken bones, lacerations, and ingestion of foreign objects. It also extends to various illnesses, encompassing conditions like infections, allergies, and certain chronic diseases, depending on the chosen plan and policy details. Specific coverage details, including pre-existing conditions, vary depending on the policy selected and the pet’s age and breed. For example, a comprehensive plan might cover diagnostic testing, surgeries, hospitalization, and medications related to covered illnesses and injuries, while a more basic plan may offer coverage for accidents only. It’s vital to review your policy documents carefully to understand the exact extent of your coverage.

Exclusions and Limitations

While ASPCA pet insurance aims to provide comprehensive coverage, certain conditions and treatments are typically excluded. Common exclusions include pre-existing conditions (conditions diagnosed before the policy’s effective date), routine care (such as vaccinations and annual checkups), and elective procedures (such as cosmetic surgeries). There are often limitations on coverage for certain breeds predisposed to specific health issues, or age restrictions that may impact coverage for senior pets. Policies usually have annual and lifetime payout limits, meaning there’s a maximum amount the insurance will pay out over a year or the pet’s lifetime. Understanding these limitations helps manage expectations and avoid disappointment during claim submissions.

Common Reasons for Claim Denials

Claim denials often stem from a lack of understanding of the policy’s terms and conditions. Failing to submit the necessary documentation, such as veterinary bills and treatment records, is a frequent cause for rejection. Submitting claims after the policy’s waiting period has not elapsed can also lead to denial. Claims related to pre-existing conditions or excluded services will also be denied. Furthermore, incorrect or incomplete claim forms can cause delays or outright rejection. Finally, not adhering to the policy’s specific claim submission procedures can lead to denials.

ASPCA Pet Insurance Claim Process

The claim process generally involves several steps. A flowchart visually represents this process:

[A textual description of a flowchart is provided below, as image generation is outside the scope of this response.]

Flowchart:

1. Veterinary Visit: Your pet receives veterinary care for a covered illness or injury.

2. Gather Documentation: Obtain all necessary documentation from your veterinarian, including itemized bills and treatment records.

3. Submit Claim: Complete the claim form accurately and thoroughly, attaching all required documentation. Submit the claim via mail or online, as specified in your policy.

4. Claim Review: ASPCA reviews your claim to verify coverage and accuracy of information.

5. Claim Approval/Denial: If approved, the reimbursement will be processed. If denied, you will receive notification with the reasons for denial.

6. Reimbursement: Approved claims are reimbursed according to your policy’s terms and conditions. This reimbursement may be direct payment to the veterinary clinic or a reimbursement to you.

ASPCA Pet Insurance Pricing and Value

Understanding the cost of ASPCA pet health insurance and its potential value requires careful consideration of several factors. This section will explore how pricing varies based on pet characteristics and coverage options, and will illustrate how to assess potential cost savings compared to paying for veterinary care out-of-pocket. We will also examine factors that influence premium costs and discuss strategies for maximizing the value of your ASPCA pet insurance plan.

ASPCA pet insurance premiums are dynamically priced, reflecting the unique risk profile of each pet. Several key variables influence the final cost, resulting in a wide range of premiums depending on the individual circumstances. This makes a direct comparison across all breeds, ages, and coverage levels difficult without specific pet details, but we can explore general trends.

Cost Variations Based on Breed, Age, and Coverage Level

Generally, premium costs increase with factors that correlate to higher veterinary expenses. For example, larger breeds often require more extensive care, leading to higher premiums than smaller breeds. Older pets, with a higher likelihood of developing age-related health issues, will also command higher premiums than younger, healthier animals. Finally, the level of coverage selected significantly impacts the premium. Comprehensive plans, offering broader coverage for illnesses and accidents, naturally cost more than basic plans with limited coverage.

For instance, a young, small breed dog on a basic accident-only plan might have a significantly lower monthly premium than an older, large breed dog enrolled in a comprehensive plan that includes wellness care. These variations are based on actuarial data and risk assessment by the insurance provider.

Calculating Potential Cost Savings

Determining the potential cost savings of ASPCA pet insurance requires comparing the projected annual premium cost with the estimated cost of veterinary care without insurance. This is inherently unpredictable, as veterinary expenses can fluctuate greatly. However, we can illustrate the principle with an example.

Let’s assume a dog experiences a serious accident requiring $5,000 in veterinary bills. With a comprehensive ASPCA plan, the owner might only pay a deductible (e.g., $250) and a co-insurance percentage (e.g., 20% of the remaining costs). Their out-of-pocket expense would be significantly lower than the full $5,000. Conversely, without insurance, the owner would bear the entire cost. The difference represents the potential cost savings, which can easily outweigh the annual premium cost, particularly in the event of a major illness or accident.

Annual Premium Cost + Out-of-Pocket Expenses (with insurance) < Total Veterinary Costs (without insurance)

Factors Influencing Premium Cost

Several factors contribute to the overall cost of your ASPCA pet insurance premium. Understanding these factors allows for better informed decision-making when selecting a plan.

- Breed: Certain breeds are predisposed to specific health conditions, influencing premium costs.

- Age: Younger animals generally have lower premiums than older animals.

- Location: Veterinary costs vary geographically, affecting premium calculations.

- Coverage Level: Comprehensive plans are more expensive than basic plans.

- Deductible: A higher deductible results in a lower premium, but higher out-of-pocket costs.

- Reimbursement Percentage: A higher reimbursement percentage leads to a higher premium, but lower out-of-pocket costs.

- Pre-existing Conditions: Pre-existing conditions are generally not covered, but may influence eligibility.

Cost-Saving Strategies

Several strategies can help pet owners maximize the value and minimize the cost of their ASPCA pet insurance.

- Compare plans carefully: Evaluate different coverage levels and deductible options to find the best balance between cost and protection.

- Consider a higher deductible: Opting for a higher deductible can lower your monthly premium, but ensure you can comfortably afford the deductible in case of a claim.

- Enroll your pet early: Enrolling a young, healthy pet can result in lower premiums throughout their life.

- Maintain good pet health: Preventative care, such as regular checkups and vaccinations, can help reduce the likelihood of costly health problems.

- Bundle insurance: If you have multiple pets, explore options for bundling insurance plans to potentially receive discounts.

Customer Experiences with ASPCA Pet Insurance

Understanding the experiences of pet owners with ASPCA pet health insurance is crucial for potential customers. This section explores a range of testimonials, highlighting both positive and negative aspects of the service, claim processing, and customer service interactions. It aims to provide a balanced perspective based on available information.

Positive Customer Experiences

Many pet owners report positive experiences with ASPCA pet insurance. These positive experiences often center around the peace of mind provided by knowing their pets are financially protected in case of illness or injury. The ease of use of the online portal and the helpfulness of customer service representatives are frequently cited as key factors contributing to positive experiences. For example, one pet owner described how their dog’s unexpected surgery was fully covered, alleviating significant financial stress during a difficult time. Another owner praised the straightforward claims process, noting that their reimbursement arrived quickly and efficiently. These positive testimonials underscore the value that many customers find in the ASPCA’s pet insurance program.

Negative Customer Experiences and Challenges

While many customers report positive experiences, some have voiced concerns about specific aspects of the ASPCA pet insurance program. These concerns often involve issues with claim denials, lengthy claim processing times, and difficulties in reaching customer service. For instance, some customers have reported frustration with unclear policy language leading to unexpected denials, while others have described experiencing long wait times on the phone or via email when attempting to contact customer service. These experiences highlight the importance of carefully reviewing the policy terms and conditions and being prepared for potential delays in claim processing.

Examples of Beneficial Scenarios

ASPCA pet insurance has proven beneficial in various scenarios. One common example is coverage for unexpected illnesses or injuries requiring emergency veterinary care. The high cost of emergency veterinary treatment can quickly become overwhelming, but pet insurance can significantly reduce the financial burden. Another beneficial scenario is coverage for chronic conditions requiring ongoing treatment. For example, a pet with diabetes may require regular insulin injections and blood glucose monitoring, which can be expensive over time. ASPCA pet insurance can help offset these costs, enabling pet owners to provide the best possible care for their pets without facing significant financial strain. A final example includes coverage for preventative care, such as annual wellness exams and vaccinations.

Customer Service and Claim Processing

Customer service response times and claim processing efficiency are crucial aspects of the overall customer experience. While many customers report positive experiences with efficient claim processing, others have described longer-than-expected wait times for both phone support and email responses. The speed of claim processing can vary depending on the complexity of the claim and the amount of documentation required. Customers should be prepared for potential delays and should ensure all necessary documentation is submitted promptly to expedite the process. Generally, it’s advisable to maintain thorough records of all communication with ASPCA customer service.

Filing Complaints and Disputes

The process for filing a complaint or dispute regarding insurance coverage involves contacting ASPCA customer service directly. Many policies Artikel a specific process for appealing a denied claim, often involving submitting additional documentation or providing further clarification. It is crucial to maintain detailed records of all communications and supporting documentation related to the claim or dispute. If a resolution cannot be reached through customer service, exploring other avenues for dispute resolution, such as mediation or arbitration, may be necessary, depending on the specific terms and conditions of the policy.

Illustrative Scenarios

Understanding how ASPCA Pet Health Insurance works in practice is crucial. The following scenarios illustrate different aspects of coverage, both positive and negative, to help you understand what to expect. These are hypothetical examples, and specific coverage may vary depending on your chosen plan and policy details.

Emergency Veterinary Visit Covered

Imagine your dog, Max, a spirited Labrador, suddenly collapses after a playful romp in the park. Rushed to the nearest emergency veterinary clinic, he’s diagnosed with a life-threatening gastric torsion requiring immediate surgery. The bill totals $8,000. With ASPCA Pet Health Insurance’s comprehensive plan, Max’s owner files a claim, submitting the veterinary bills and supporting documentation. After a thorough review, ASPCA approves the claim, reimbursing 80% of the eligible expenses, totaling $6,400. The reimbursement process took approximately two weeks from submission to payment. The deductible of $250 had already been met through earlier routine care.

Veterinary Expense Not Covered

Let’s say your cat, Luna, develops a chronic skin condition requiring ongoing medication. While ASPCA Pet Health Insurance covers many illnesses and injuries, pre-existing conditions are generally excluded from coverage unless specifically noted in the policy details and the waiting period is met. If Luna’s skin condition was present before the policy’s inception, the ongoing medication costs would likely not be covered. The policy clearly states exclusions for pre-existing conditions, and the claim was denied accordingly. This highlights the importance of carefully reviewing the policy details before purchasing coverage.

Benefits of Preventative Care Coverage

Consider Chloe, a senior golden retriever. Her owner opted for ASPCA’s plan with preventative care coverage. Throughout the year, Chloe received routine checkups, vaccinations, and dental cleanings. These preventative measures identified an early stage of osteoarthritis. Early detection allowed for less invasive and more cost-effective treatment, preventing more extensive and costly procedures down the line. The preventative care coverage reimbursed a significant portion of the costs associated with these checkups and early treatment, demonstrating the long-term cost savings and health benefits of preventative care.

Hypothetical Pet’s Medical History and Plan Comparison

Let’s examine the medical history of a hypothetical cat, Whiskers. Over the course of a year, Whiskers experienced the following: a minor injury requiring stitches ($300), a routine checkup and vaccinations ($150), and a severe respiratory infection requiring hospitalization and medication ($2000).

We will compare coverage under two ASPCA plans: a basic plan with a $250 deductible and 70% reimbursement, and a comprehensive plan with a $100 deductible and 90% reimbursement.

| Expense | Basic Plan Reimbursement | Comprehensive Plan Reimbursement |

|---|---|---|

| Minor Injury | $70 (70% of $300 – $250 deductible) | $170 (90% of $300 – $100 deductible) |

| Checkup & Vaccinations | $0 (below deductible) | $45 (90% of $150 – $100 deductible) |

| Respiratory Infection | $1250 (70% of $2000 – $250 deductible) | $1710 (90% of $2000 – $100 deductible) |

| Total Reimbursement | $1320 | $1925 |

This example illustrates how choosing a more comprehensive plan can significantly increase reimbursement amounts, particularly for major illnesses. Remember that these are hypothetical examples and actual reimbursement amounts will depend on the specific policy details and the terms and conditions of the plan.

Ultimate Conclusion

Ultimately, choosing the right pet health insurance depends on individual needs and circumstances. ASPCA pet health insurance offers a viable option, but careful consideration of factors like breed, age, pre-existing conditions, and budget is crucial. By understanding the details of coverage, claims processes, and potential costs, pet owners can make informed decisions that best protect their beloved companions.

FAQ Summary

What pre-existing conditions are excluded from ASPCA pet health insurance?

Pre-existing conditions, those present before the policy’s effective date, are generally excluded. Specific exclusions vary by plan; it’s essential to review the policy details carefully.

Does ASPCA pet insurance cover preventative care?

Some ASPCA plans include coverage for preventative care, such as vaccinations and routine checkups. However, the extent of this coverage differs between plans.

What is the waiting period before coverage begins?

There’s typically a waiting period before coverage starts for certain conditions, often 14-30 days for accidents and illnesses. Preventative care may have a separate waiting period.

How do I file a claim with ASPCA pet insurance?

The claim process usually involves submitting veterinary bills and other relevant documentation online or via mail. Specific instructions are provided in the policy documents.